UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

For

the month of: August 2024

Commission

file number: 001-38610

ALARUM

TECHNOLOGIES LTD.

(Translation

of registrant’s name into English)

30

Haarba’a Street Tel-Aviv (P.O.Box 174)

Tel-Aviv,

6473926 Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

CONTENTS

Attached

hereto and incorporated by reference herein is Alarum Technologies Ltd.’s (the “Registrant”) (i) Notice of an Annual

and Extraordinary General Meeting of Shareholders to be held on September 9, 2024, at 3:00 p.m. Israel time (the “Meeting”),

Proxy Statement and Proxy Card for the Meeting, and (ii) voting instruction form which will be sent to holders of American Depositary

Shares by The Bank of New York Mellon.

Only

shareholders of record who hold Ordinary Shares, no par value, or holders of American Depositary Shares representing Ordinary Shares,

of the Registrant at the close of business on August 8, 2024, will be entitled to notice of and to vote at the Meeting and any postponements

or adjournments thereof.

This

report on Form 6-K is incorporated by reference into the registration statements on Form S-8 (File Nos. 333-233510, 333-239249, 333-250138,

333-258744, 333-267586 and 333-274585) and Form F-3 (File Nos. 333-233724, 333-235368, 333-236030, 333-233976, 333-237629, 333-267580

and 333-274604) of the Registrant, filed with the Securities and Exchange Commission, to be a part thereof from the date on which this

report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Alarum Technologies Ltd.

(Registrant) |

| |

|

|

| Date: August 1, 2024 |

By |

/s/ Omer Weiss |

| |

Name: |

Omer Weiss |

| |

Title: |

Corporate Legal Counsel |

Exhibit 99.1

ALARUM

TECHNOLOGIES Ltd.

Notice

of Annual and Extraordinary General Meeting of shareholders

Notice is hereby given that an Annual and Extraordinary

General Meeting of Shareholders (the “Meeting”) of Alarum Technologies Ltd. (the “Company”) will

be held at the Company’s counsel’s offices, Sullivan & Worcester Tel Aviv, at 28 Haarba’a Street, Hagag Towers, North Building, 34th Floor,

Tel Aviv, Israel, on September 9, 2024, at 3:00 p.m. Israel time.

The Company is a Dual-Listed Company, as such term is

defined in the Israeli Companies Regulations (Relief for Public Companies Traded on Stock Markets Outside of Israel), 4760 – 2000.

The following matters are on the agenda for

the Meeting:

| 1. | To re-appoint PwC Israel, Certified Public Accountants, as the independent auditor of the Company, and

to authorize the Board of Directors of the Company to determine their remuneration until the next annual general meeting of the shareholders

of the Company. |

| 2. | To re-appoint Mr. Moshe Tal and Mr. Shachar Daniel, each for a three-year term as Class II directors of

the Company, until the Company’s annual general meeting of shareholders in the year 2027 and until their respective successors are

duly elected and qualified. |

| 3. | To approve a grant of Restricted Share Units to Mr. Shachar Daniel, the Company’s Chief Executive

Officer and a director. |

| 4. | To approve an annual bonus for Mr. Shachar Daniel, the Company’s Chief Executive Officer and a director,

for overachieved measurable targets in the year 2023. |

| 5. | Presentation of the Company’s financial statements and annual report for the year ended December

31, 2023. |

Our board of directors (the “Board of

Directors”) recommends that you vote in favor of the proposed resolutions, which are described in the attached proxy statement.

Shareholders of record at the close of business

on August 8, 2024 (the “Record Date”), are entitled to notice of and to vote at the Meeting, either in person or by

appointing a proxy to vote in their stead at the Meeting (as detailed below).

A form of proxy for use at the Meeting is attached

to the proxy statement, and a voting instruction form, together with a return envelope, will be sent to holders of American Depositary

Shares representing the Company’s ordinary shares, no par value (the “ADSs” and “Ordinary Shares”,

respectively). By appointing “proxies,” shareholders and ADS holders may vote at the Meeting whether or not they attend. If

a properly executed proxy in the attached form is received by the Company at least 4 hours prior to the Meeting, all of the Ordinary Shares

represented by the proxy shall be voted as indicated on the form. ADS holders should return their voting instruction form by the date

set forth therein. Subject to applicable law and the rules of the Nasdaq Stock Market, in the absence of instructions, the Ordinary Shares

represented by properly executed and received proxies will be voted “FOR” all of the proposed resolutions to be presented

at the Meeting for which the Board of Directors recommends a vote “FOR”. Shareholders and ADS holders may revoke their proxies

or voting instruction form (as applicable) at any time before the deadline for receipt of proxies or voting instruction form (as applicable)

by filing with the Company (in the case of holders of Ordinary Shares) or with the Bank of New York Mellon (in the case of holders of

ADSs) a written notice of revocation or duly executed proxy or voting instruction form (as applicable) bearing a later date.

Shareholders registered in the Company’s

shareholders register in Israel and shareholders who hold Ordinary Shares through members of the Tel Aviv Stock Exchange may also vote

through the attached proxy by completing, dating, signing and mailing the proxy to the Company’s offices no later than September

9, 2024, at 11:00 a.m. Israel time, and must also provide the Company with a copy of their identity card, passport or certification of

incorporation, as the case may be.

Shareholders who hold shares through members of

the Tel Aviv Stock Exchange and intend to vote their Ordinary Shares either in person or by proxy must deliver the Company, no later than

September 9, 2024, at 11:00 a.m. Israel time, an ownership certificate confirming their ownership of the Company’s Ordinary Shares

on the Record Date, which certificate must be approved by a recognized financial institution, as required by the Israeli Companies Regulations

(Proof of Ownership of Shares for Voting at General Meeting), 5760-2000, as amended.

Alternatively, shareholders who hold Ordinary

Shares through members of the Tel Aviv Stock Exchange may vote electronically via the electronic voting system of the Israel Securities

Authority no later than September 9, 2024, at 9:00 a.m. Israel time (six hours before the time of the Meeting). You should receive instructions

about electronic voting from the Tel Aviv Stock Exchange member through which you hold your Ordinary Shares.

ADS holders should return their proxies by the

date set forth on their voting instruction form.

If you are a beneficial owner of shares registered

in the name of a member of the Tel Aviv Stock Exchange and you wish to vote, either by appointing a proxy, or in person by attending the

Meeting, you must deliver to the Company a proof of ownership in accordance with the Israeli Companies Law, 5759-1999 and the Israeli

Companies Regulations (Proof of Ownership of Shares for Voting at General Meetings), 5760-2000. Detailed voting instructions are provided

in the proxy statement.

| |

Sincerely, |

| |

|

| |

Chen Katz |

| |

Chairman of the Board of Directors |

| |

|

| |

August 1, 2024 |

Exhibit 99.2

ALARUM TECHNOLOGIES LTD.

TEL-AVIV, ISRAEL

PROXY STATEMENT

ANNUAL AND EXTRAORDINARY

GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 9, 2024

The enclosed proxy is being solicited by the board

of directors (the “Board of Directors”) of Alarum Technologies Ltd. (the “Company”) for use at the

Company’s annual and extraordinary general meeting of shareholders (the “Meeting”) to be held on September 9,

2024, at 3:00 p.m. Israel time, or at any adjournment or postponement thereof.

Upon the receipt of a properly executed proxy

in the form enclosed, the persons named as proxies therein will vote the ordinary shares, no par value, of the Company (the “Ordinary

Shares”) covered thereby in accordance with the directions of the shareholders executing the proxy. In the absence of such directions,

and except as otherwise mentioned in this proxy statement, the Ordinary Shares represented thereby will be voted in favor of each of the

proposals described in this proxy statement.

Two or more shareholders present, personally or

by proxy, holding not less than 15% (fifteen percent) of the Company’s outstanding Ordinary Shares, shall constitute a quorum for

the Meeting. If within half an hour from the time the Meeting is convened a quorum is not present, the Meeting shall stand adjourned until

September 9, 2024, at 5:00 p.m. Israel time (the “Adjourned Meeting”). If a quorum is not present at the Adjourned Meeting

within half an hour from the time appointed for such meeting, any number of shareholders present personally or by proxy shall be deemed

a quorum and shall be entitled to deliberate and to resolve in respect of the matters for which the Meeting was convened. Abstentions

and broker non-votes are counted as Ordinary Shares present for the purpose of determining a quorum.

Pursuant to the Israeli Companies Law, 5759-1999

(the “Companies Law”), each of Proposals No. 1 and 2 described hereinafter requires the affirmative vote of shareholders

present at the Meeting, in person or by proxy, and holding Ordinary Shares of the Company amounting in the aggregate to at least a majority

of the votes actually cast by shareholders with respect to such proposals (a “Simple Majority”).

Pursuant to the Companies Law, each of Proposals

No.3 and 4 described hereinafter, requires the affirmative vote of the Company’s shareholders holding at least a majority of

the Company’s Ordinary Shares present, in person or by proxy, and voting on the matter, provided that either (i) such a majority

includes at least the majority of the votes of shareholders who are not controlling shareholders or do not have personal interest in the

approval of the transaction (abstentions will not be taken into account); or (ii) the total number of votes against such proposal among

the shareholders mentioned in clause (i) above does not exceed two percent (2%) of the total voting rights in the Company (a “Special

Majority”).

Proposal 5 will not involve a vote by the shareholders

and accordingly there is no proposed resolution.

As defined under the Companies Law, “personal

interest” means: (1) a shareholder’s personal interest in the approval of an act or a transaction of the Company, including

(i) the personal interest of any of his or her relatives (which includes for these purposes foregoing shareholder’s spouse, siblings,

parents, grandparents, descendants, and spouse’s descendants, siblings, and parents, and the spouse of any of the foregoing); (ii)

a personal interest of a corporation in which a shareholder or any of his/her aforementioned relatives serve as a director or the chief

executive officer, owns at least 5% of its issued share capital or its voting rights or has the right to appoint a director or chief executive

officer; and (iii) a personal interest of an individual voting via a power of attorney given by a third party (even if the empowering

shareholder has no personal interest), and the vote of an attorney-in-fact shall be considered a personal interest vote if the empowering

shareholder has a personal interest, and all with no regard as to whether the attorney-in-fact has voting discretion or not, but (2) excludes

a personal interest arising solely from the fact of holding shares in the Company.

As defined under the Companies Law, a “controlling

shareholder” is any shareholder that has the ability to direct the Company’s activities (other than by means of being

a director or office holder of the Company). A person is presumed to be a controlling shareholder if he or she holds or controls, by himself

or together with others, one half or more of any one of the “means of control” of a company; in the context of a transaction

with an interested party, a shareholder who holds 25% or more of the voting rights in the company if no other shareholder holds more than

50% of the voting rights in the company, is also presumed to be a controlling shareholder. “Means of control” is defined as

any one of the following: (i) the right to vote at a general meeting of a company, or (ii) the right to appoint directors of a company

or its chief executive officer. As of the date of this Proxy Statement, we are not aware of any controlling shareholders as defined above,

and therefore believe that, other than our directors, officers and their relatives, none of our shareholders should have a personal interest

in the proposed resolutions herein.

According to the Companies Law Regulations (exemptions

for companies whose securities are listed for trading on a stock exchange outside of Israel) 5760-2000, by signing and submitting

the attached proxy card, a shareholder declares and approves that he has no personal interest in the approval of any of the items on the

Meeting agenda that requires such declaration under the Companies Law, with the exception of a personal interest that the shareholder

positively informed the company about (as detailed in the attached proxy card).

In accordance with the Companies Law and regulations

promulgated thereunder, any shareholder of the Company holding at least one percent (1%) of the outstanding voting rights of the Company

for the Meeting may submit to the Company a proposed additional agenda item for the Meeting (and in case of a proposed additional agenda

item for nominating or removal of a director, at least five percent (5%) of the outstanding voting rights of the Company), to the Company’s

offices, or via email (contact details below), no later than August 8, 2024.

Shareholders or ADS holders wishing to express

their position on an agenda item for this Meeting may do so by submitting a written statement (a “Position Statement”)

to the Company (contact details below). Any Position Statement received will be furnished to the Securities and Exchange Commission (“SEC”)

on a Report on Form 6-K and will be made available to the public on the SEC’s website at www.sec.gov and in addition at www.magna.isa.gov.il

or https://maya.tase.co.il. Position Statements should be submitted to the Company no later than August 30, 2024. A shareholder is entitled

to contact the Company directly and receive the text of the proxy card and any Position Statement. The Board of Directors’ response

to the Position Statement will be submitted no later than September 4, 2024.

Contact details: Alarum Technologies Ltd., c/o

Mr. Shai Avnit, Chief Financial Officer or Adv. Omer Weiss, Legal Counsel, at 30 Haarba’a Street, P. O. Box 174, Israel 6473926,

e-mail addresses: shai.avnit@alarum.io; omer.weiss@alarum.io

One shareholder or more holding Ordinary Shares which reflect 5% or

more of the Company’s share capital and voting rights (that is 3,433,299 Ordinary Shares as of July 31, 2024), is entitled to examine

the proxy and voting material.

It is noted that there may be changes on the agenda

after publishing the Proxy Statement, and there may be Position Statements which can be published. Therefore, the most updated agenda

will be furnished to the SEC on a Report on Form 6-K and will be made available to the public on the SEC’s website at www.sec.gov.

PROPOSAL 1

To Re-appoint

PwC Israel, Certified Public Accountants, as the independent auditor of the Company and to authorize the board of directors of the Company

to determine their remuneration until the next annual general meeting of the shareholders of the Company

Under the Companies Law,

the appointment of an independent auditor requires the approval of the shareholders of the Company.

The Board of Directors

has authorized and approved the re-appointment of the accounting firm of PwC Israel, Certified Public Accountants (“PwC Israel”),

as the independent auditor of the Company until the next annual general meeting of the shareholders of the Company, and asks the shareholders

to authorize the Board of Directors to determine their remuneration until the next annual general meeting.

The Board of Directors

believes that the re-appointment of PwC Israel as the independent auditor of the Company is appropriate and in the best interests of the

Company and its shareholders.

For additional information

on the fees paid by the Company and its subsidiaries to PwC Israel in each of the previous two fiscal years, please see Item 16C. ‘Principal

Accountant Fees and Services’ in the Company’s annual report on Form 20-F for the year ended December 31, 2023, filed with

the SEC on March 14, 2024.

It is proposed that the

following resolution be adopted at the Meeting:

“RESOLVED, to

re-appoint PwC Israel as the independent auditor of the Company, and to authorize the Board of Directors of the Company to determine their

remuneration until the next annual general meeting of the shareholders of the Company.”

The approval of this

proposal, as described above, requires the affirmative vote of a Simple Majority.

The Board of Directors unanimously recommends

that the shareholders vote FOR the above proposal.

PROPOSAL

2

TO RE-APPOINT MR. MOSHE TAL AS A CLASS II INDEPENDENT

DIRECTOR OF THE COMPANY

AND TO RE-APPOINT MR. SHACHAR DANIEL AS A CLASS II DIRECTOR OF THE COMPANY

Background

Under the Companies Law

and the Company’s Amended Articles of Association (the “Articles”), the management of the Company’s business

is vested in the Board of Directors. The Board of Directors may exercise all powers and may take all actions that are not specifically

granted to our shareholders.

The Company’s Articles

provide that the Company may have at least three and not more than 12 directors.

The Company’s Board of Directors currently

consists of six directors. In accordance with the Articles, the Company’s directors are divided into three classes with staggered

three-year terms. Each class of directors consists, as practically as possible, of one-third of the total number of directors constituting

the entire Board of Directors. At each annual general meeting, the appointment or re-appointment of directors following the expiration

of the term of office of the directors of that class of directors is for a term of office that expires as of the date of the third annual

general meeting following such appointment or re-appointment. Therefore, at each annual general meeting, the term of office of only one

class of directors expires. Each director holds office until the annual general meeting in which his or her term expires, unless he or

she is removed by a vote of 65% of the total voting power of the Company’s shareholders at a general meeting of the Company’s

shareholders, provided that such majority constitutes more than 50% of the Company’s issued and outstanding share capital, or upon

the occurrence of certain events, in accordance with the Companies Law and the Articles.

The Company’s directors

are divided among three classes as follows:

| |

(i) |

The Company’s Class I directors are Ms. Rakefet Remigolski and Mr. Yehuda Halfon, whose current terms expire at the Company’s 2026 annual general meeting and upon the election and qualification of their respective successors; |

| |

|

|

| |

(ii) |

The Company’s Class II directors are Mr. Shachar Daniel and Mr. Moshe Tal, whose current terms expire at the Meeting; and |

| |

|

|

| |

(iii) |

The Company’s Class III directors are Mr. Chen Katz and Mr. Avi Rubinstein, whose current terms expire at the Company’s 2025 annual general meeting and upon the election and qualification of their respective successors. |

The Company’s Board

Diversity Matrix pursuant to Nasdaq’s Rule 5605(f) is available on the Company’s website at the following address: https://d2ghdaxqb194v2.cloudfront.net/2637/192586.pdf

The Company’s Board of Directors has approved

the nomination of Mr. Daniel and Mr. Tal for re-appointment to the Company’s Board of Directors, each as a Class II director (Mr.

Tal as an independent director) at the Meeting for a three-year term and recommends that shareholders re-appoint Mr. Daniel and Mr. Tal,

each as a Class II director for a three-year term.

Mr. Daniel and Mr. Tal,

whose professional backgrounds are provided below, have each advised the Company that they are willing, able and ready to serve as a Class

II director if appointed. Additionally, in accordance with the Companies Law, Mr. Daniel and Mr. Tal, have each certified to the Company

that they meet all the requirements of the Companies Law for appointment as a director of a public company, they possess the necessary

qualifications and have sufficient time to fulfill their duties as directors of the Company, considering the size and needs of the Company.

If reappointed at the

Meeting, both Mr. Tal and Mr. Daniel will continue to benefit from the indemnification and exemption letter agreements that we previously

entered into with each of them, as well as from our directors’ and officers’ liability insurance policy, as in effect from

time to time.

In his capacity as member

of the Company’s Board of Directors, subject to his appointment, Mr. Tal will continue to be entitled to following fees: (i) an

annual fee of NIS 30,000 (approximately 1$8,000) and (ii) an attendance fee of NIS 1,500 (approximately $400) per meeting,

which amounts are less than the maximum amounts set forth in the second and third appendices of the Companies Regulations (Rules concerning

Compensation and Expenses of an External Director), 5760-2000.

Mr. Daniel, who

also serves as the Company’s Chief Executive Officer, is not compensated for his service as a member of the Board of Directors.

Set forth below is certain

biographical information regarding the background and experience of Mr. Daniel and Mr. Tal:

Mr. Shachar Daniel

Mr. Shachar Daniel is one of our co-founders

and has served as our Chief Executive Officer and director since June 2016. Prior to serving as the Chief Executive Officer of Safe-T

Data, he served as Safe-T Data’s Chief Operating Officer from November 2013. Mr. Daniel has more than 10 years of experience in

various managerial roles in operations and project management. From 2012 to 2013, he served as head of program at PrimeSense Ltd., which

was acquired by Apple Inc. for $360 million on November 24, 2013. Prior to that, and from 2009 to 2012, he was head of operations

project managers at Logic Industries Ltd., and from 2004 to 2009, he was a project manager at Elbit Systems Ltd. (Nasdaq/TASE: ESLT).

Mr. Daniel holds a B.Sc. in Industrial Engineering from the Holon Institute of Technology, Israel and an M.B.A. from the College of Management

Academic Studies, Israel and an executive post M.B.A from the Hebrew University.

Mr. Moshe Tal

Mr.

Moshe Tal has served

on our board of directors since May 2019. Since 2011, Mr. Tal serves as a partner with Shtainmetz Aminoach & Co. accounting, a CPA

(Isr.) Israeli Certified Public Accountant, Investment and Consulting. Mr. Tal is also a lecturer at the Department of Accounting at the

Reichman University (IDC Herzliya) in Israel. Mr. Tal served in the Israeli tax Authority for 13 years and has vast experience with tax

regulations and laws, both in Israel and outside of Israel. Between 2011 and 2013, Mr. Tal served as a director of Dash Ipax Holdings

Ltd. and from 2010 until 2018 as a director at Netz Group Ltd. Mr. Tal is a certified Israeli public accountant.

It is proposed that the

following separate resolutions be adopted at the Meeting:

“RESOLVED, to

re-appoint Mr. Shachar Daniel as a Class II director of the Company for a term of three years that expires at the third annual general

meeting of shareholders following such re-appointment and until he ceases to serve in her office in accordance with the provisions of

the Company’s Amended Articles of Association or any law, whichever is the earlier.”

“RESOLVED, to appoint Mr. Moshe Tal as

a Class II independent director of the Company for a term of three years that expires at the third annual general meeting of shareholders

following such election and until he ceases to serve in his office in accordance with the provisions of the Company’s Amended Articles

of Association or any law, whichever is the earlier.

The re-appointment of

each of Mr. Daniel and Mr. Tal, respectively, as a Class II director, as mentioned above, requires the affirmative vote of a Simple Majority.

The Board of Directors unanimously recommends

a vote “FOR” the above proposals.

| 1 | All USD amounts are based on an exchange rate of USD 1: NIS

3.733, on July 29, 2024. |

PROPOSAL

3

to

approve a grant of RESTRICTED sHARE UNITS to Mr. SHACHAR DANIEL, the COMPANY’S CHIEF EXECUTIVE OFFICER AND A DIRECTOR

On July 14, 2024, and on July 16, 2024 (the “Date

of Grant”), the Compensation Committee and the Board of Directors, respectively, approved and recommended that the Company’s

shareholders approve, a grant of Restricted Share Units (“RSUs”) to Mr. Shachar Daniel, the Company’s Chief Executive

Officer and a director, under the Company’s Amended and Restated Global Incentive Plan (the “Global Incentive Plan”).

The recommended grant consists of RSUs

equivalent to approximately 19,999 ADSs (equal to 199,992 RSUs), to be granted to Mr. Daniel (the “Grant of RSUs to Mr.

Daniel”). The value of the Grant of RSUs to Mr. Daniel and its terms are in line with the Company’s Compensation

Policy (the “Compensation Policy”). The value of the proposed Grant of RSUs to Mr. Daniel, amounts to a total of

approximately $286,000 (approximately NIS 1,067,000). According to the Compensation Policy, the Company’s Chief Executive

Officer is entitled to an annual long-term component of his remuneration of up to approximately $576,000 (NIS 2,150,000).

Together with Ordinary Shares equivalent to 7,500 ADSs (75,000 Ordinary Shares) that resulted from the issuance of previously granted

RSUs, and the outstanding RSUs and options to purchase Ordinary Shares equivalent to approximately 84,903 ADSs (849,027 Ordinary Shares)

of the Company (an aggregate of 92,403 ADSs or 924,027 Ordinary Shares), granted to Mr. Daniel in aggregate in the past, Mr. Daniel’s

holdings will be equal to approximately 1.4% of the Company’s issued and outstanding share capital on a fully diluted basis as of

July 31, 2024.

The Grant of RSUs to Mr. Daniel is subject to a standard

vesting of three years, as follows (the “Vesting Schedule”): (i) Ordinary Shares equivalent to approximately 3,333

ADSs (33,332 of the RSUs granted) will vest on January 19, 2024 (the “First Installment”); and (ii) Ordinary Shares

equivalent to approximately 1,667 ADSs (16,666 of the granted RSUs) will vest each quarter for 10 quarters, following the First Installment.

The RSUs are granted in accordance with the capital

gain track of Section 102 of the Israeli Income Tax Ordinance, 1961.

In making its recommendation with regard to the

approval of the Grant of RSUs to Mr. Daniel, the Compensation Committee and the Board of Directors each have considered all relevant considerations

and discussed all matters required under the Companies Law and the regulations promulgated thereunder and also considered, inter alia:

(i) the factors included in the Compensation Policy, including, the position, responsibilities, background and experience of Mr. Daniel;

(ii) that the Grant of RSUs to Mr. Daniel reflects a fair and reasonable value for the Mr. Daniel’s contribution and achievements

as the Company’s Chief Executive Officer; (iii) that the Grant of RSUs to Mr. Daniel is in accordance with the Compensation Policy;

(iv) Mr. Daniel’s significant contribution to the Company’s business progress and achievements; and (v) that the Grant of RSUs to Mr.

Daniel is reasonable and fair under the circumstances. It is hereby clarified that the Vesting Schedule may be accelerated upon the occurrence

of special events, as defined in the Compensation Policy.

The shareholders of the

Company are requested to adopt the following resolution:

“RESOLVED, to

grant Mr. Shachar Daniel RSUs, as set forth in the Proxy Statement.”

The approval of this

proposal, as described above, requires the affirmative vote of a Special Majority.

The Board of Directors unanimously recommends a vote FOR on the

above proposal.

PROPOSAL

4

TO APPROVE AN ANNUAL BONUS FOR MR. SHACHAR

DANIEL, THE COMPANY’S CHIEF EXECUTIVE OFFICER AND A DIRECTOR, for OVERACHIEVED measurable

targets in the year of 2023

Background

Under the Companies Law

and the Israeli Securities Authority’s position statements, arrangements concerning compensation of a company’s chief executive

officer and a director, not in accordance with the terms of the Compensation Policy, require the approval by the Compensation Committee,

the Board of Directors and the Company’s shareholders, in a Special Majority (as defined above).

Mr. Shachar Daniel has

been one of our co-founders and has served as our Chief Executive Officer and a director since June 2016.

Annual Bonus

On December 27, 2022,

and on December 29, 2022, the Compensation Committee and the Board of Directors, respectively, approved measurable targets for Mr.

Daniel for the year 2023 (the “Measurable Targets”).

According to the Compensation

Policy, the maximum annual bonus for the Company’s Chief Executive Director for meeting the Measurable Targets is equal to 12 monthly

salaries.

On March 11, 2024 and on

March 13, 2024, the Compensation Committee and the Board of Directors, respectively, approved: (1) that Mr. Daniel had met the Measurable

Targets; (2) to pay Mr. Daniel an annual bonus in accordance with the Compensation Policy for meeting the Measurable Targets; and (3)

to pay Mr. Daniel, subject to the approval of the Company’s shareholders, an additional amount of approximately $76,000 ( NIS 283,889)

as an annual bonus, which exceeds the maximum amounts specified in the Compensation Policy and for overachieving the Measurable Targets

(the “Additional Annual Bonus”).

In making their recommendation

regarding the approval of the Additional Annual Bonus for Mr. Shachar Daniel, the Compensation Committee and the Board of Directors each

considered all relevant matters and discussed all matters required under the Companies Law and the regulations promulgated thereunder,

and have also considered, among other things: (i) the Measurable Targets set forth for Mr. Daniel; (ii) Mr. Daniel meeting

the Measurable Targets; and (iii) Mr. Daniel’s over achievements of his set targets as the Company’s Chief Executive Officer.

The shareholders of the

Company are requested to adopt the following resolutions:

“RESOLVED, to approve an Annual Bonus

for Mr. Shachar Daniel, the Company’s Chief Executive Officer and a director, as set forth in this Proxy Statement.”

The approval of this

proposal, as described above, requires the affirmative vote of a Special Majority

The Board of

Directors unanimously recommends a vote FOR on the above proposal.

PROPOSAL 5

PRESENTATION OF THE COMPANY’S FINANCIAL

STATEMENTS AND

ANNUAL REPORT FOR THE YEAR ENDED DECEMBER 31, 2023

Pursuant to the Companies Law, the Company is

required to present the Company’s financial statements and annual report for the year ended December 31, 2023, to the Company’s

shareholders. The Company’s financial statements and annual report for the year ended December 31, 2023, filed on Form 20-F with

the SEC on March 14, 2024, are available on the SEC’s website at the following address:

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001725332/000121390024022367/ea0201426-20f_alarum.htm

and on the Israel Securities Authority distribution

website at the following address:

https://maya.tase.co.il/reports/details/1579562/1/0

At the Meeting, shareholders will have an opportunity

to review, ask questions and comment on the Company’s audited consolidated financial statements and annual report for the year ended

December 31, 2023.

This agenda proposal will not involve a vote by

the shareholders, and accordingly there is no proposed resolution.

Your vote is important! Shareholders

are urged to complete and return their proxies promptly in order to, among other things, ensure action by a quorum and to avoid the expense

of additional solicitation. If the accompanying proxy is properly executed and returned in time for voting, and a choice is specified,

the shares represented thereby will be voted as indicated thereon. EXCEPT AS MENTIONED OTHERWISE IN THIS PROXY STATEMENT, IF NO SPECIFICATION

IS MADE, THE PROXY WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT. Shareholders who hold shares of

the Company through members of the TASE and who wish to participate in the Meeting, in person or by proxy, are required to deliver proof

of ownership to the Company, in accordance with the Israeli Companies Regulations (Proof of Ownership of a Share for Purposes of Voting

at General Meetings), 5760-2000. Such shareholders wishing to vote by proxy are requested to attach their proof of ownership to the enclosed

proxy.

Proxies and all other applicable materials

should be sent to the Company’s office at 30 Haarba’a Street, P. O. Box 174, Tel-Aviv 6473926, Israel.

ADDITIONAL INFORMATION

The Company is subject to the informational requirements

of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), as applicable to foreign private issuers.

Accordingly, the Company files reports and other information with the SEC. All documents which the Company will file on the SEC’s

EDGAR system will be available for retrieval on the SEC’s website at http://www.sec.gov. As a Dual Company (as defined in the

Israeli Companies Regulations (Concessions for Public Companies Traded on Stock Markets Outside of Israel), 5760- 2000), the Company also

files reports with the Israel Securities Authority. Such reports can be viewed on the Israel Securities Authority distribution website

at http://www.magna.isa.gov.il and the TASE website at http://www.maya.tase.co.il.

As a foreign private issuer, the Company is exempt

from the rules under the Exchange Act prescribing certain disclosure and procedural requirements for proxy solicitations. In addition,

the Company is not required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as

promptly as other companies incorporated in states within the United States whose securities are registered under the Exchange Act. The

Notice of the Annual and Extraordinary General Meeting of Shareholders and the proxy statement have been prepared in accordance with applicable

disclosure requirements in the State of Israel.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED

IN THIS PROXY STATEMENT OR THE INFORMATION FURNISHED TO YOU IN CONNECTION WITH THIS PROXY STATEMENT WHEN VOTING ON THE MATTERS SUBMITTED

TO SHAREHOLDER APPROVAL HEREUNDER. THE COMPANY HAS NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION THAT IS DIFFERENT FROM WHAT IS

CONTAINED IN THIS DOCUMENT. THIS PROXY STATEMENT IS DATED AUGUST 1, 2024. UNLESS OTHERWISE STATED HEREIN, YOU SHOULD NOT ASSUME THAT THE

INFORMATION CONTAINED IN THIS DOCUMENT IS ACCURATE AS OF ANY DATE OTHER THAN AUGUST 1, 2024, AND THE DISCLOSURE OF THIS DOCUMENT TO SHAREHOLDERS

SHOULD NOT CREATE ANY IMPLICATION TO THE CONTRARY.

| |

By Order of the Board of Directors |

| |

|

| |

Alarum Technologies Ltd. |

| |

Chen Katz, Chairman of the Board of Directors |

Exhibit 99.3

ALARUM TECHNOLOGIES LTD.

PROXY CARD

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD

OF DIRECTORS

The undersigned hereby appoints, Mr. Shachar

Daniel, Chief Executive Officer and a director of the Company, Mr. Shai Avnit, Chief Financial Officer of the Company, and each of them,

agents and proxies of the undersigned, with full power of substitution to each of them, to represent and to vote on behalf of the undersigned

all the Ordinary Shares of Alarum Technologies Ltd. (the “Company”) which the undersigned is entitled to vote at the

Annual and Extraordinary General Meeting of Shareholders (the “Meeting”) to be held at the Company’s counsel’s

offices, Sullivan & Worcester Tel Aviv, at 28 Haarba’a, Hagag Towers, North Building, 34th floor, Tel Aviv, Israel, on September 9, 2024, at 3:00 p.m.

Israel time, and at any adjournments or postponements thereof, upon the following matters, which are more fully described in the Notice

of Annual and Extraordinary General Meeting of Shareholders and proxy statement relating to the Meeting.

This Proxy, when properly executed, will be voted

in the manner directed herein by the undersigned. If no direction is made with respect to any matter, this Proxy Card will be voted FOR

such matter. Any and all proxies heretofore given by the undersigned are hereby revoked.

(Continued and to be signed on the reverse

side)

ALARUM TECHNOLOGIES LTD.

ANNUAL AND EXTRAORDINARY GENERAL MEETING OF

SHAREHOLDERS

Date of Meeting: September 9, 2024

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED

ENVELOPE. PLEASE

MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE ☒

| 1. |

To re-appoint PwC Israel as the independent auditor of the Company and to authorize the Board of Directors of the Company to determine their remuneration, until the next annual general meeting of the Company’s shareholders. |

| |

☐ |

FOR |

☐ |

AGAINST |

☐ |

ABSTAIN |

| 2. |

|

| 2a |

To re-appoint Mr. Moshe Tal as a Class II independent director of the Company for a term of three years that expires at the third annual general meeting of the Company’s shareholders following such re-election and until he ceases to serve in her office in accordance with the provisions of the Company’s Amended Articles of Association or any law, whichever is the earlier. |

| |

☐ |

FOR |

☐ |

AGAINST |

☐ |

ABSTAIN |

| 2b |

To re-appoint Mr. Shachar Daniel as Class II director of the Company for a term of three years that expires at the third annual general meeting of the Company’s shareholders following such election and until he ceases to serve in his office in accordance with the provisions of the Company’s Amended Articles of Association or any law, whichever is the earlier. |

| |

☐ |

FOR |

☐ |

AGAINST |

☐ |

ABSTAIN |

| 3. | To

approve a grant of RSUs to Mr. Shachar Daniel, the Company’s Chief Executive Officer and a director. |

| |

☐ |

FOR |

☐ |

AGAINST |

☐ |

ABSTAIN |

| 4. | To approve an annual bonus for Mr. Shachar Daniel, the

Company’s Chief Executive Officer and a director, for overachieving measurable targets in the year 2023. |

| |

☐ |

FOR |

☐ |

AGAINST |

☐ |

ABSTAIN |

PLEASE NOTE: By signing and submitting this proxy card, you declare

that you are not a controlling shareholder of the Company (as defined in the Israeli Companies Law 5759-1999) (the “Companies

Law”), and that you have no personal interest in the approval of any of the items that are proposed for approval at the 2024 annual

and extraordinary general meeting of shareholders, which require such declaration under the Companies Law, except as notified to the Company

via Email to Mr. Shai Avnit, e-mail address: shai.avnit@alarum.io.

In their discretion, the proxies are authorized

to vote upon such other matters as may properly come before the Meeting or any adjournment or postponement thereof.

| |

|

|

|

|

| NAME |

|

SIGNATURE |

|

DATE |

| |

|

|

|

|

| |

|

|

|

|

| NAME |

|

SIGNATURE |

|

DATE |

Please sign exactly as your name appears on this

proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, trustee or guardian, please give

full title as such. If the signed is a corporation, please sign full corporate name by duly authorized officer, giving full title as

such. If signer is a partnership, please sign in partnership name by authorized person.

Exhibit 99.4

Annual and Extraordinary General Meeting of Shareholders of Alarum Technologies Ltd. Date: September 9, 2024 See Voting Instruction On Reverse Side. Please make your marks like this: Use pen only Agenda Please Sign Here Please Date Above Please Sign Here Please Date Above Please separate carefully at the perforation and return just this portion in the envelope provided. Authorized Signatures - This section must be completed for your instructions to be executed. EVENT # CLIENT # Annual and Extraordinary General Meeting of Shareholders of Alarum Technologies Ltd. to be Held on September 9, 2024 for Holders as of August 8, 2024 All votes must be received by 12:00 p.m. E.T. on September 3, 2024 For additional information, please visit: http://alarum.io/general - meetings/ Copyright © 2024 Mediant Communications Inc. All Rights Reserved PROXY TABULATOR FOR ALARUM TECHNOLOGIES LTD. P.O. BOX 8016 CARY, NC 27512 - 9903 1 . To re - appoint PwC Israel as the independent auditor of the Company and to authorize the Board of Directors of the Company to determine their remuneration, until the next annual general meeting of the Company’s shareholders . 2. 2 a To re - appoint Mr . Moshe Tal as a Class II independent director of the Company for a term of three years that expires at the third annual general meeting of the Company’s shareholders following such re - election and until he ceases to serve in her office in accordance with the provisions of the Company’s Amended Articles of Association or any law, whichever is the earlier . 2 b To re - appoint Mr . Shachar Daniel as Class II director of the Company for a term of three years that expires at the third annual general meeting of the Company’s shareholders following such election and until he ceases to serve in his office in accordance with the provisions of the Company’s Amended Articles of Association or any law, whichever is the earlier . 3. To approve a grant of RSUs to Mr . Shachar Daniel, the Company’s Chief Executive Officer and a director . 4. To approve an annual bonus for Mr . Shachar Daniel, the Company’s Chief Executive Officer and a director, for overachieving measurable targets in the year 2023 . For Against Abstain MAIL • Mark, sign and date your Voting Instruction Form. • Detach your Voting Instruction Form. • Return your Voting Instruction Form in the post - age - paid envelope provided. INTERNET Go To adrproxy@bnymellon.com • Cast your vote online. • View Meeting Documents. OR

Alarum Technologies Ltd. Instructions to The Bank of New York Mellon, as Depositary (Must be received prior to 12:00 p.m. E.T. on September 3, 2024) The undersigned registered owner of American Depositary Shares hereby requests and instructs The Bank of New York Mellon, as Depositary, to endeavor, in so far as practicable, to vote or cause to be voted the amount of Shares or other Deposited Securities represented by such Shares of Alarum Technologies Ltd . (the “Company”) registered in the name of the undersigned on the books of the Depositary as of the close of business on August 8 , 2024 , at the Annual and Extraordinary General Meeting of Shareholders of the Company, to be held on September 9 , 2024 at 3 : 00 p . m . (Israel time) , at the Company’s counsels’ offices at 28 Ha’Arbaa Street, Hagag Tower, North Building, 34 th floor, Tel Aviv, Israel, or at any adjournment thereof, in respect to the resolutions specified on the reverse side, which are more fully described in the Notice of Annual and Extraordinary General Meeting of Shareholders and proxy statement relating to the Meeting . NOTE: 1. Please direct the Depositary how it is to vote by placing “X” in the appropriate box opposite each agenda item . 2. This Proxy, when properly executed, will be voted in the manner directed herein by the undersigned . If no direction is made with respect to any matter, this Proxy will be voted FOR such matter . Any and all proxies heretofore given by the undersigned are hereby revoked . 3. By signing and submitting this proxy card, you declare that you are not a controlling shareholder of Alarum Technologies Ltd . (as defined in the Israeli Companies Law 5759 - 1999 ) (the “Companies Law”), and that you have no personal interest in the approval of any of the items that are proposed for approval at the 2024 annual and extraordinary general meeting of shareholders, which require such declaration under the Companies Law, except as notified to Alarum Technologies Ltd . via Email to Mr . Shai Avnit, e - mail address : shai . avnit@alarum . io The board of directors (the “Board of Directors”) recommends voting in favor of the proposed resolutions. (Continued and to be marked, dated and signed, on the reverse side) PROXY TABULATOR FOR ALARUM TECHNOLOGIES LTD P.O. BOX 8016 CARY, NC 27512 - 9903

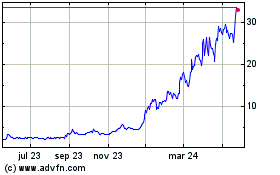

Alarum Technologies (NASDAQ:ALAR)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

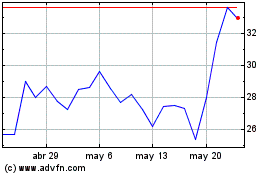

Alarum Technologies (NASDAQ:ALAR)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025