Alarm.com Holdings, Inc. (Nasdaq: ALRM) (“Alarm.com”), the

leading platform for the intelligently connected property,

announced today the pricing of $425.0 million aggregate principal

amount of 2.25% Convertible Senior Notes due 2029 (the “notes”) in

a private placement (the “offering”) to persons reasonably believed

to be qualified institutional buyers pursuant to Rule 144A under

the Securities Act of 1933, as amended (the “Securities Act”).

Alarm.com has increased the size of the offering from $375.0

million to $425.0 million (or $500.0 million if the initial

purchasers’ option to purchase additional notes is exercised in

full as described in the following paragraph).

Alarm.com has also granted the initial purchasers of the notes

an option to purchase, within a 13-day period beginning on, and

including, the date on which the notes are first issued, up to an

additional $75.0 million aggregate principal amount of notes from

Alarm.com. The sale of the notes is expected to close on May 31,

2024, subject to customary closing conditions.

The notes will be general unsecured obligations of Alarm.com and

will bear interest at a rate of 2.25% per year, payable

semiannually in arrears on June 1 and December 1 of each year,

beginning on December 1, 2024. The notes will mature on June 1,

2029, unless earlier converted, redeemed or repurchased.

Alarm.com expects to use: (i) approximately $53.6 million of the

net proceeds from the offering to pay the cost of the capped call

transactions described below, (ii) approximately $75.0 million of

the net proceeds from the offering to repurchase shares of its

common stock concurrently with the pricing of the offering in

privately negotiated transactions as described below and (iii) the

remainder of the net proceeds from the offering for general

corporate purposes, which may include acquisitions or strategic

investments in complementary businesses or technologies, although

Alarm.com does not currently have any plans for any such

acquisitions or investments, other repurchases of its common stock

from time to time under its existing or any future stock repurchase

program, repurchases of its 0% convertible senior notes due 2026

(the “2026 Notes”) from time to time following the offering or the

repayment of the 2026 Notes at maturity, and working capital,

operating expenses and capital expenditures. If the initial

purchasers exercise their option to purchase additional notes,

Alarm.com expects to use a portion of the net proceeds from the

sale of the additional notes to enter into additional capped call

transactions with the option counterparties as described below and

the remainder from the sale of the additional notes for other

general corporate purposes as described above.

Additional Details for the 2.25% Convertible Senior Notes due

2029

The notes will be convertible at the option of the holders in

certain circumstances. Upon conversion, Alarm.com will pay or

deliver, as the case may be, cash, shares of Alarm.com’s common

stock or a combination of cash and shares of Alarm.com’s common

stock, at its election. The initial conversion rate is 11.4571

shares of Alarm.com’s common stock per $1,000 principal amount of

notes (equivalent to an initial conversion price of approximately

$87.28 per share of Alarm.com’s common stock, which represents a

conversion premium of approximately 30% to the last reported sale

price of Alarm.com’s common stock on the Nasdaq Global Select

Market on May 28, 2024), and will be subject to customary

anti-dilution adjustments.

Alarm.com may not redeem the notes prior to June 7, 2027.

Alarm.com may redeem for cash all or any portion of the notes

(subject to a partial redemption limitation), at its option, on or

after June 7, 2027 if the last reported sale price of Alarm.com’s

common stock has been at least 130% of the conversion price then in

effect for at least 20 trading days (whether or not consecutive)

during any 30 consecutive trading day period (including the last

trading day of such period) ending on, and including, the trading

day immediately preceding the date on which Alarm.com provides

notice of redemption at a redemption price equal to 100% of the

principal amount of the notes to be redeemed, plus accrued and

unpaid interest, if any, to, but excluding, the redemption

date.

If Alarm.com undergoes a “fundamental change” (as defined in the

indenture that will govern the notes) subject to certain conditions

and limited exceptions, holders may require Alarm.com to repurchase

for cash all or any portion of their notes at a repurchase price

equal to 100% of the principal amount of the notes to be

repurchased, plus accrued and unpaid interest, if any, to, but

excluding, the fundamental change repurchase date. In addition,

following certain corporate events that occur prior to the maturity

date of the notes or if Alarm.com delivers a notice of redemption

in respect of some or all of the notes, Alarm.com will, in certain

circumstances, increase the conversion rate of the notes for a

holder who elects to convert its notes in connection with such a

corporate event or convert its notes called (or deemed called) for

redemption during the related redemption period, as the case may

be.

Capped Call Transactions and Concurrent Share

Repurchases

In connection with the pricing of the notes, Alarm.com entered

into privately negotiated capped call transactions with one of the

initial purchasers and certain other financial institutions (the

“option counterparties”). The capped call transactions cover,

subject to customary adjustments substantially similar to those

applicable to the notes, the number of shares of Alarm.com’s common

stock initially underlying the notes. The capped call transactions

are generally expected to reduce the potential dilution to

Alarm.com’s common stock upon any conversion of notes and/or offset

any cash payments Alarm.com is required to make in excess of the

principal amount of converted notes, as the case may be, with such

reduction and/or offset subject to a cap. The cap price of the

capped call transactions will initially be $134.28 per share, which

represents a premium of 100% over the closing price of Alarm.com’s

common stock on the Nasdaq Global Select Market on May 28, 2024,

and is subject to certain adjustments under the terms of the capped

call transactions.

In connection with establishing their initial hedges of the

capped call transactions, Alarm.com expects that the option

counterparties or their respective affiliates will enter into

various derivative transactions with respect to Alarm.com’s common

stock and/or purchase shares of Alarm.com’s common stock

concurrently with or shortly after the pricing of the notes. This

activity could increase (or reduce the size of any decrease in) the

market price of Alarm.com’s common stock or the notes at that

time.

In addition, the option counterparties or their respective

affiliates may modify their hedge positions by entering into or

unwinding various derivatives with respect to Alarm.com’s common

stock and/or purchasing or selling Alarm.com’s common stock or

other securities of Alarm.com in secondary market transactions

following the pricing of the notes and prior to the maturity of the

notes (and are likely to do so during any observation period

related to a conversion of notes or, to the extent Alarm.com

exercises the relevant election under the capped call transactions,

following any repurchase or redemption of the notes). This activity

could also cause or avoid an increase or a decrease in the market

price of Alarm.com’s common stock or the notes, which could affect

the ability of a holder of notes to convert the notes and, to the

extent the activity occurs during any observation period related to

a conversion of notes, this could affect the number of shares, if

any, and value of the consideration that a holder of notes will

receive upon conversion of its notes.

As discussed above, Alarm.com intends to use approximately $75.0

million of the net proceeds from the offering to repurchase shares

of its common stock. Alarm.com expects to repurchase such shares

from purchasers of notes in privately negotiated transactions with

or through one of the initial purchasers or its affiliate

concurrently with the pricing of the offering (the “share

repurchases”), at a purchase price per share of Alarm.com’s common

stock equal to the closing price per share of Alarm.com’s common

stock on May 28, 2024, which was $67.14 per share. These share

repurchases could increase, or reduce the size of any decrease in,

the market price of Alarm.com's common stock, including

concurrently with the pricing of the notes, and could have resulted

in a higher effective conversion price for the notes. This press

release is not an offer to repurchase Alarm.com's common stock, and

the offering of the notes is not contingent upon the repurchase of

Alarm.com's common stock.

The notes and any shares of Alarm.com’s common stock issuable

upon conversion of the notes have not been and will not be

registered under the Securities Act, any state securities laws or

the securities laws of any other jurisdiction, and unless so

registered, may not be offered or sold in the United States absent

registration or an applicable exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

and other applicable securities laws.

This press release is neither an offer to sell nor a

solicitation of an offer to buy any of these securities nor shall

there be any sale of these securities in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful

prior to the registration or qualification thereof under the

securities laws of any such state or jurisdiction.

About Alarm.com

Alarm.com is the leading platform for the intelligently

connected property. Millions of consumers and businesses depend on

Alarm.com’s technology to manage and control their property from

anywhere. Our platform integrates with a growing variety of

Internet of Things (IoT) devices through our apps and interfaces.

Our security, video, access control, intelligent automation, energy

management, and wellness solutions are available through our

network of thousands of professional service providers in North

America and around the globe.

Forward-Looking Statements

This press release contains “forward-looking” statements that

involve risks and uncertainties regarding, among other things, the

offering, including statements concerning the expected closing of

the offering, the capped call transactions and the share

repurchases, the anticipated use of proceeds from the proposed

offering, the timing or amount of any repurchases or repayment of

our 2026 Notes or any repurchases of shares of our common stock,

including the share repurchases, and the potential impact of the

foregoing or related transactions on dilution to holders of our

common stock and the market price of our common stock, the trading

price of the notes or the conversion price of the notes. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual events to

differ materially from Alarm.com’s plans. These risks include, but

are not limited to, market risks, trends and conditions, our

ability to complete the proposed offering on the expected terms, or

at all, whether we will be able to satisfy closing conditions

related to the proposed offering, any of which could differ or

change based upon market conditions or for other reasons, and those

risks included in the section titled “Risk Factors” in Alarm.com’s

Securities and Exchange Commission (“SEC”) filings and reports,

including its Quarterly Report on Form 10-Q for the quarter ended

March 31, 2024 and other filings that Alarm.com makes from time to

time with the SEC, which are available on the SEC’s website at

www.sec.gov. All forward-looking statements contained in this press

release speak only as of the date on which they were made.

Alarm.com undertakes no obligation to update such statements to

reflect events that occur or circumstances that exist after the

date on which they were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240528852395/en/

Investor & Media Relations: Matthew Zartman Alarm.com

ir@alarm.com

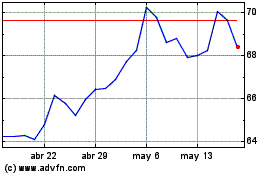

Alarm com (NASDAQ:ALRM)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Alarm com (NASDAQ:ALRM)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025