Applied Therapeutics Reports Third Quarter 2023 Financial Results

09 Noviembre 2023 - 6:30AM

Applied Therapeutics, Inc. (Nasdaq: APLT), a clinical-stage

biopharmaceutical company developing a pipeline of novel drug

candidates against validated molecular targets in indications of

high unmet medical need, today reported financial results for the

third quarter ended September 30, 2023.

“We have continued to make progress across our late-stage

pipeline and have several key regulatory and clinical inflection

points expected later this quarter and in early 2024,” said

Shoshana Shendelman, PhD, Founder, Chief Executive Officer, and

Chair of the Board. “We are working expeditiously to submit our

regulatory filings for govorestat (AT-007) for the treatment of

Classic Galactosemia in both the U.S. and in Europe and look

forward to providing updates as those submissions occur. In tandem,

we are soon approaching Phase 3 readouts for our ARISE-HF Trial of

AT-001 (caficrestat) in Diabetic Cardiomyopathy (DbCM) and our

INSPIRE Trial of AT-007 trial in Sorbitol Dehydrogenase (SORD)

Deficiency, which are expected in 4Q23 and in 1Q24,

respectively.”

Recent Highlights

- On Track to Submit NDA to the U.S. FDA and MAA to the

EMA for Govorestat (AT-007) for the Treatment of Classic

Galactosemia in the Fourth Quarter of 2023. The Company is

working to submit a New Drug Application (NDA) to the United States

Food and Drug Administration (U.S. FDA) for govorestat for the

treatment of Galactosemia. As previously announced, the Company

held a successful pre-NDA meeting with the FDA regarding the

govorestat Galactosemia program. Based on discussions with the FDA,

the Company believes they are aligned with the FDA and plans to

submit an NDA for govorestat (AT-007) for the treatment of

Galactosemia in the fourth quarter of this year. Regarding

regulatory submission plans in Europe, the Company and its European

commercial partner, Advanz Pharma, expect to submit a Marketing

Authorization Application (MAA) to the European Medicines Agency

(EMA) this quarter.

- Hosted an Expert Forum on Diabetic Cardiomyopathy with

Leading Cardiologists. In November 2023, the Company

hosted a KOL discussion on Diabetic Cardiomyopathy (DbCM) led by

James Januzzi, MD, Hutter Family Professor of Medicine, Harvard

Medical School, Director, Dennis and Marilyn Barry Fellowship in

Cardiology Research, Massachusetts General Hospital Gregory Lewis,

MD, Director, Cardiopulmonary Exercise Testing Laboratory and

Section Head, Heart Failure, Massachusetts General Hospital. The

ongoing ARISE-HF Phase 3 global clinical trial is evaluating the

safety and efficacy of AT-001 (caficrestat) in improving or

preventing worsening of cardiac functional capacity in Diabetic

Cardiomyopathy (DbCM). The Company expects topline data from the

study in the fourth quarter of 2023. A replay of the webcast event

can be accessed here.

- Presented Baseline Data from Ongoing Phase 3 ARISE-HF

Study of AT-001 (caficrestat) in Diabetic Cardiomyopathy at the

2023 European Association for the Study of Diabetes Annual

Meeting. In September 2023, the Company presented baseline

data at the 2023 European Association for the Study of Diabetes

(EASD) Annual Meeting from the ongoing Phase 3 ARISE-HF study of

AT-001 (caficrestat) in DbCM. Riccardo Perfetti, MD, PhD, Chief

Medical Officer of Applied Therapeutics, presented the data in an

oral Symposium entitled Diabetic Cardiomyopathy (DbCM): a severe

complication of diabetes. The baseline data presented at EASD

showed that patients with DbCM exhibit reduced cardiac functional

capacity, resulting in decreased physical capacity, underscoring

the negative impact of DbCM on physical function and quality of

life in patients. The data supports the development of AT-001 for

the treatment of DbCM and the ongoing ARISE-HF Phase 3 global

clinical trial.

Financial Results

- Cash and cash equivalents and short-term

investments totaled $37.5 million as of September 30,

2023, compared with $30.6 million at December 31, 2022.

- Research and development expenses for the

three months ended September 30, 2023 were $10.8 million, compared

to $13.1 million for the three months ended September 30, 2022. The

decrease of approximately $2.3 million was primarily related

to a decrease in clinical and pre-clinical expense of $1.8 million,

primarily due to the decrease in expense related to CROs, a

decrease in drug manufacturing and formulation costs of $0.5

million primarily due to the release of legacy accrual in the three

months ended September 30, 2023; an increase in personnel expenses

of $10,000; a decrease in stock-based compensation of $0.4 million

due to decrease in headcount which resulted in options and

restricted stock units being forfeited; and an increase in

regulatory and other expenses of $0.4 million.

- General and administrative expenses were $4.7

million for the three months ended September 30, 2023, compared to

$6.2 million for the three months ended September 30, 2022. The

decrease of approximately $1.5 million was primarily related

to an increase in legal and professional fees of $0.7 million due

to higher external legal fees; a decrease in commercial expenses of

$0.8 million related to a decrease in spend for commercial

operations and release of legacy accruals for the three months

ended September 30, 2023; a decrease in personnel expenses of $0.4

million related to a decrease in headcount; a decrease in

stock-based compensation of $0.6 million relating to options and

restricted stock units being forfeited during the current period as

well as decrease in headcount; a decrease in insurance expenses of

$0.4 million related to decreased insurance costs; and a decrease

in other expenses of $0.1 million.

- Net loss for the third quarter of 2023 was

$42.4 million, or $0.47 per basic and diluted common share,

compared to a net loss of $19.1 million, or $0.40 per basic and

diluted common share, for the third quarter 2022.

About Applied Therapeutics

Applied Therapeutics is a clinical-stage biopharmaceutical

company developing a pipeline of novel drug candidates against

validated molecular targets in indications of high unmet medical

need. The Company’s lead drug candidate, govorestat, is a novel

central nervous system penetrant Aldose Reductase Inhibitor (ARI)

for the treatment of CNS rare metabolic diseases, including

Galactosemia, SORD Deficiency, and PMM2-CDG. The Company is also

developing AT-001, a novel potent ARI, for the treatment of

Diabetic Cardiomyopathy, or DbCM, a fatal fibrosis of the heart.

The preclinical pipeline also includes AT-003, an ARI designed to

cross through the back of the eye when dosed orally, for the

treatment of Diabetic retinopathy.

To learn more, please visit

www.appliedtherapeutics.com and follow the company on Twitter

@Applied_Tx.

Forward-Looking Statements

This press release contains “forward-looking statements” that

involve substantial risks and uncertainties for purposes of the

safe harbor provided by the Private Securities Litigation Reform

Act of 1995. Any statements, other than statements of historical

fact, included in this press release regarding the strategy, future

operations, prospects, plans and objectives of management,

including words such as “may,” “will,” “expect,” “anticipate,”

“plan,” “intend,” and similar expressions (as well as other words

or expressions referencing future events, conditions or

circumstances) are forward-looking statements. These include,

without limitation, statements regarding (i) the timing of data

readouts for our ARISE-HF and INSPIRE trials, (ii) the timing of

our plans to submit an NDA and MAA for approval. Forward-looking

statements in this release involve substantial risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by the forward-looking statements,

and we, therefore cannot assure you that our plans, intentions,

expectations or strategies will be attained or achieved.

Such risks and uncertainties include, without limitation, (i)

our plans to develop, market and commercialize our product

candidates, (ii) the initiation, timing, progress and results of

our current and future preclinical studies and clinical trials and

our research and development programs, (iii) our ability to take

advantage of expedited regulatory pathways for any of our product

candidates, (iv) our estimates regarding expenses, future revenue,

capital requirements and needs for additional financing, (v) our

ability to successfully acquire or license additional product

candidates on reasonable terms and advance product candidates into,

and successfully complete, clinical studies, (vi) our ability to

maintain and establish collaborations or obtain additional funding,

(vii) our ability to obtain and timing of regulatory approval of

our current and future product candidates, (viii) the anticipated

indications for our product candidates, if approved, (ix) our

expectations regarding the potential market size and the rate and

degree of market acceptance of such product candidates, (x) our

ability to fund our working capital requirements and expectations

regarding the sufficiency of our capital resources, (xi) the

implementation of our business model and strategic plans for our

business and product candidates, (xii) our intellectual property

position and the duration of our patent rights, (xiii) developments

or disputes concerning our intellectual property or other

proprietary rights, (xiv) our expectations regarding government and

third-party payor coverage and reimbursement, (xv) our ability to

compete in the markets we serve, (xvi) the impact of government

laws and regulations and liabilities thereunder, (xvii)

developments relating to our competitors and our industry, (xvii)

our ability to achieve the anticipated benefits from the agreements

entered into in connection with our partnership with Advanz Pharma

and (xiv) other factors that may impact our financial results. In

light of the significant uncertainties in these forward-looking

statements, you should not rely upon forward-looking statements as

predictions of future events. Although we believe that we have a

reasonable basis for each forward-looking statement contained in

this press release, we cannot guarantee that the future results,

levels of activity, performance or events and circumstances

reflected in the forward-looking statements will be achieved or

occur at all. Factors that may cause actual results to differ from

those expressed or implied in the forward-looking statements in

this press release are discussed in our filings with the U.S.

Securities and Exchange Commission, including the “Risk Factors”

contained therein. Except as otherwise required by law, we disclaim

any intention or obligation to update or revise any forward-looking

statements, which speak only as of the date they were made, whether

as a result of new information, future events or circumstances or

otherwise.

Contacts

Investors:Maeve Conneighton (212) 600-1902

orappliedtherapeutics@argotpartners.com

Media:media@apliedtherapeutics.com

|

Applied Therapeutics, Inc. |

|

Condensed Balance Sheets |

|

(in thousands, except share and per share

data) |

| |

| |

|

As of |

|

As of |

| |

|

September 30, |

|

December 31, |

| |

|

2023 |

|

2022 |

| |

|

(Unaudited) |

|

|

| ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

37,457 |

|

|

$ |

16,657 |

|

|

Investments |

|

|

— |

|

|

|

13,923 |

|

|

Prepaid expenses and other current assets |

|

|

7,031 |

|

|

|

6,728 |

|

|

Total current assets |

|

|

44,488 |

|

|

|

37,308 |

|

|

Operating lease right-of-use asset |

|

|

510 |

|

|

|

857 |

|

|

Security deposits and leasehold improvements |

|

|

197 |

|

|

|

198 |

|

|

TOTAL ASSETS |

|

$ |

45,195 |

|

|

$ |

38,363 |

|

| LIABILITIES AND

STOCKHOLDERS’ (DEFICIT)/EQUITY |

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

Current portion of operating lease liabilities |

|

$ |

491 |

|

|

$ |

477 |

|

|

Accounts payable |

|

|

6,005 |

|

|

|

4,534 |

|

|

Accrued expenses and other current liabilities |

|

|

12,245 |

|

|

|

14,756 |

|

|

Warrant liabilities |

|

|

36,763 |

|

|

|

13,657 |

|

|

Total current liabilities |

|

|

55,504 |

|

|

|

33,424 |

|

| NONCURRENT LIABILITIES: |

|

|

|

|

|

|

|

Noncurrent portion of operating lease liabilities |

|

|

44 |

|

|

|

414 |

|

|

Clinical holdback - long-term portion |

|

|

691 |

|

|

|

464 |

|

|

Total noncurrent liabilities |

|

|

735 |

|

|

|

878 |

|

|

Total liabilities |

|

|

56,239 |

|

|

|

34,302 |

|

| STOCKHOLDERS’

(DEFICIT)/EQUITY: |

|

|

|

|

|

|

|

Common stock, $0.0001 par value; 200,000,000 shares authorized as

of September 30, 2023 and December 31, 2022;

77,133,516 shares issued and outstanding as of

September 30, 2023 and 48,063,358 shares issued and

outstanding as of December 31, 2022 |

|

|

7 |

|

|

|

5 |

|

|

Preferred stock, par value $0.0001; 10,000,000 shares authorized as

of September 30, 2023 and December 31, 2022; 0

shares issued and outstanding as of September 30, 2023

and December 31, 2022 |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

419,856 |

|

|

|

352,828 |

|

|

Accumulated other comprehensive gain |

|

|

— |

|

|

|

51 |

|

|

Accumulated deficit |

|

|

(430,907 |

) |

|

|

(348,823 |

) |

|

Total stockholders' (deficit)/equity |

|

|

(11,044 |

) |

|

|

4,061 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT)/EQUITY |

|

$ |

45,195 |

|

|

$ |

38,363 |

|

|

Applied Therapeutics, Inc. |

|

Condensed Statements of Operations |

|

(in thousands, except share and per share

data) |

|

(Unaudited) |

| |

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| REVENUE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

License Revenue |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

10,660 |

|

|

$ |

— |

|

|

Total Revenue |

|

|

— |

|

|

|

— |

|

|

|

10,660 |

|

|

|

— |

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

10,785 |

|

|

$ |

13,116 |

|

|

$ |

38,602 |

|

|

$ |

43,542 |

|

|

General and administrative |

|

|

4,710 |

|

|

|

6,240 |

|

|

|

15,585 |

|

|

|

20,436 |

|

|

Total operating expenses |

|

|

15,495 |

|

|

|

19,356 |

|

|

|

54,187 |

|

|

|

63,978 |

|

| LOSS FROM OPERATIONS |

|

|

(15,495 |

) |

|

|

(19,356 |

) |

|

|

(43,527 |

) |

|

|

(63,978 |

) |

| OTHER INCOME (EXPENSE),

NET: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

392 |

|

|

|

227 |

|

|

|

1,020 |

|

|

|

414 |

|

|

Change in fair value of warrant liabilities |

|

|

(27,277 |

) |

|

|

36 |

|

|

|

(39,611 |

) |

|

|

(4,321 |

) |

|

Other income (expense): |

|

|

10 |

|

|

|

(8 |

) |

|

|

34 |

|

|

|

(194 |

) |

|

Total other income (expense), net |

|

|

(26,875 |

) |

|

|

255 |

|

|

|

(38,557 |

) |

|

|

(4,101 |

) |

| Net loss |

|

$ |

(42,370 |

) |

|

$ |

(19,101 |

) |

|

$ |

(82,084 |

) |

|

$ |

(68,079 |

) |

| Net loss attributable to

common stockholders—basic and diluted |

|

$ |

(42,370 |

) |

|

$ |

(19,101 |

) |

|

$ |

(82,084 |

) |

|

$ |

(68,079 |

) |

| Net loss per share

attributable to common stockholders—basic and diluted |

|

$ |

(0.47 |

) |

|

$ |

(0.40 |

) |

|

$ |

(1.09 |

) |

|

$ |

(2.02 |

) |

| Weighted-average common stock

outstanding—basic and diluted |

|

|

90,669,969 |

|

|

|

48,000,183 |

|

|

|

75,482,234 |

|

|

|

33,785,386 |

|

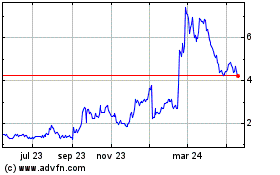

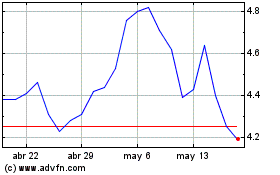

Applied Therapeutics (NASDAQ:APLT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Applied Therapeutics (NASDAQ:APLT)

Gráfica de Acción Histórica

De May 2023 a May 2024