FALSE000180770700018077072023-07-192023-07-190001807707us-gaap:CommonStockMember2023-07-192023-07-190001807707us-gaap:WarrantMember2023-07-192023-07-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 19, 2023

AppHarvest, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39288 | 84-5042965 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

500 Appalachian Way Morehead, KY | 40351 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (606) 653-6100

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

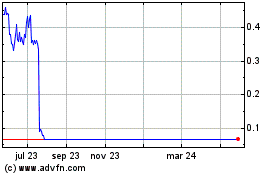

| Common Stock, $0.0001 par value per share | | APPH | | The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | APPHW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Secured Promissory Note and Loan Agreement

On July 19, 2023, AppHarvest, Inc., (the “Company”) entered into a certain Secured Promissory Note and Loan Agreement (the “Note”) with Equilibrium (as defined below), pursuant to which Equilibrium agreed to provide the Company with a loan in the principal amount of $2,690,000 (the “Bridge Loan”). The Bridge Loan shall bear interest on the unpaid principal amount thereof at a rate per annum equal to 10.0% and has a maturity date of July 24, 2023.

The Company shall utilize the proceeds of the Loan for general corporate purposes, consistent with certain cash flow forecasts and subject to certain restrictions as set forth in the Note.

The foregoing description of the Note does not purport to be complete and is qualified in its entirety by reference to the Note, a copy of which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

Certain of the transactions described in the foregoing shall be subject to approval of the Bankruptcy Court (as defined below).

Item 1.03 Bankruptcy or Receivership.

Voluntary Petitions for Bankruptcy

On July 23, 2023, the Debtors named in Exhibit 99.1 filed voluntary petitions for relief under chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) thereby commencing chapter 11 cases for the Debtors (the “Chapter 11 Cases”). The Company will continue to operate its business as a “debtor in possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. The Company is seeking approval of various “first day” motions with the Bankruptcy Court, requesting customary relief intended to enable the Company to continue its ordinary course operations and to facilitate an orderly transition of its operations. The Company intends to sell substantially all of its assets during the Chapter 11 Cases.

The Company cannot be certain that holders of the Company’s common stock will receive any payment or other distribution on account of those shares following the Chapter 11 Cases.

Additional information about the Chapter 11 Cases is available online at https://cases.stretto.com/appharvest. The information on that website is not incorporated by reference and does not constitute part of this Current Report on Form 8-K.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a

Registrant.

The information set forth above in Item 1.01 of this Current Report on Form 8-K regarding the Note is incorporated by reference herein.

Item 2.04 Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation Under an Off-

Balance Sheet Arrangement.

The commencement of the Chapter 11 Cases described in Item 1.03 above constitutes an event of default that accelerated the Company’s obligations under the following debt instruments (the “Debt Instruments”):

•that certain Credit Agreement, dated as of July 23, 2021, by and between AppHarvest Richmond Farm, LLC and Equilibrium (as amended by that certain First Amendment to Credit Agreement, dated as of July 29, 2021, that certain Second Amendment to Credit Agreement, dated as of July 29, 2022, that certain Waiver and Third Amendment to Credit Agreement, dated as of December 21, 2022, and as further amended or supplemented from time to time prior to the date hereof)

•that certain Credit Agreement, dated as of June 15, 2021, by and between AppHarvest Morehead Farm, LLC, and Rabo AgriFinance LLC (“Rabo”), (as amended by that certain First Amendment to Master Credit Agreement, dated as of March 31, 2023 and as further amended or supplemented from time to time prior to the date hereof); and

•that certain Credit Agreement, dated as of July 29, 2022, by and among Greater Nevada Credit Union (“GNCU”), AppHarvest Operations, Inc., and AppHarvest Pulaski Farm, LLC (as amended or supplemented prior to the date hereof).

The Debt Instruments provide that as a result of the Chapter 11 Cases, the principal and interest due thereunder shall be immediately due and payable. Any efforts to enforce such payment obligations under the Debt Instruments are automatically stayed as a result of the Chapter 11 Cases, and the creditors’ rights of enforcement in respect of the Debt Instruments are subject to the applicable provisions of the Bankruptcy Code.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On July 24, 2023, the Company received notice from the Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that the Staff has, in accordance with Listing Rules 5101, 5110(b), and IM-5101-1, determined that the Company’s securities will be delisted from Nasdaq based on the following factors: (i) July 23, 2023, the Company filed for protection under Chapter 11 of the U.S. Bankruptcy Code and the associated public interest concerns raised by such filing; (ii) concerns regarding, the residual equity interest of the existing listed securities holders; and (iii) concerns about the Company’s ability to sustain compliance with all requirements for continued listing on Nasdaq.

Trading of the Company’s common stock will be suspended at the opening of business on August 2, 2023 and a Form 25-NSE will be filed with the Securities and Exchange Commission (the “SEC”), which will remove the Company's securities from listing and registration on Nasdaq.

Item 7.01 Regulation FD Disclosure

On July 24, 2023, the Company issued a press release (the “Press Release”) announcing, among other things, the commencement of the Chapter 11 Cases. A copy of the Press Release is furnished as Exhibit 99.2 to this Form 8-K.

The information in this Item 7.01 of the Form 8-K, including Exhibit 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Cautionary Statements Regarding Trading in the Company’s Securities

The Company’s securityholders are cautioned that trading in the Company’s securities during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders thereof in the Company’s Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to expectations concerning matters that are not historical facts. Words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,”, “could” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “can,” “goal,” “target” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, without limitation, the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to raise additional funds during the Chapter 11 Cases; and risks associated with the Company’s business prospects, financial results and business operations. These and other factors that may affect the Company’s future business prospects, results and operations are identified and described in more detail in the Company’s filings with the SEC, including the Company’s most recent Annual Report filed on Form 10-K and the subsequently filed Quarterly Report(s) on Form 10-Q. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 8-K. Except as required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| 10.1 | | | |

| 99.1 | | | |

| 99.2 | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| AppHarvest, Inc. |

| |

| Dated: July 24, 2023 | |

| By: | /s/ Loren Eggleton |

| | Loren Eggleton |

| | Chief Financial Officer |

| | (Principal Financial Officer and Principal Accounting Officer) |

Exhibit 10.1

Execution Version

SECURED PROMISSORY NOTE AND LOAN AGREEMENT

$2,690,000 New York, New York

July 19, 2023

APPHARVEST, INC., a Delaware corporation (the “Borrower”), has requested that CEFF II APPHARVEST HOLDINGS, LLC, a Delaware Limited Liability Company (together with its successors and assigns to this Secured Promissory Note and Loan Agreement (as amended, restated, amended and restated, supplemented, waived, extended, or otherwise modified from time to time in accordance with the terms hereof, this “Note”), the “Lender”) make a Loan (as defined herein) evidenced by this Note on the date set forth in, and subject to the terms and conditions of, this Note. Certain Subsidiaries of the Borrower wish to guaranty the Borrower’s Obligations under this Note (collectively, the “Guarantors”), and are simultaneously executing the Guaranty in favor of the Lender. Capitalized terms used herein and not otherwise defined herein shall have the meanings provided in Section 18 of this Note.

1.Loan.

(a)Subject to the terms and conditions hereof, the Lender hereby agrees to provide the Borrower with a Loan on the Closing Date in the principal amount of up to $2,690,000 (the “Loan”).

(b)All sums advanced pursuant to this Note shall be deemed advances of the Loan and shall be evidenced by this Note, secured by the Collateral and guaranteed by the Guarantors pursuant to the Guaranty. Any amount borrowed and repaid hereunder may not be re-borrowed.

(c)The Borrower shall utilize the proceeds of the Loan for general corporate purposes, consistent with the Cash Flow Forecast; provided that in no event will proceeds of the Loan be used to pay any dividends or make any distribution on account of or redeem, retire or purchase any capital stock, to make any investments other than as necessary to operate the Borrower’s existing business in the ordinary course and consistent with the Cash Flow Forecast, to make any elective payment on any other Indebtedness for borrowed money of the Borrower or its affiliates or to prepay, repay, redeem, retire, purchase or otherwise discharge any Indebtedness, including under any Existing Credit Facility or in respect of Mechanic’s Lien Obligations or any other Indebtedness for borrowed money.

2.Certain Conditions to Making Loan. The effectiveness of this Note and the obligation of the Lender to fund the Loan requested to be made by it shall be subject to the prior or concurrent satisfaction (or waiver) of each of the conditions precedent set forth in this Section 2:

(a)the Loan Parties shall have delivered corporate resolutions, incumbency certificates, certificates of good standing and similar documents, in form and substance reasonably satisfactory to the Lender, with respect to this Note and the other Loan Documents and the transactions contemplated hereby and thereby;

(b)the Lender shall have received executed counterparts of the Guaranty, the Security Agreement, the Patent Security Agreement and the Trademark Security Agreement;

(c)the Lender shall have received the UCC-1 financing statements reasonably requested by the Lender, each in the form and substance reasonably satisfactory to the Lender;

(d)any representation or warranty by any Loan Party contained herein or in any other Loan Document shall be true and correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or

modified by materiality in the text thereof) as of such date, except to the extent that such representation or warranty expressly relates to an earlier date (in which case it shall be true and correct as of such date);

(e)no Default or Event of Default shall have occurred and be continuing or would result after giving effect to the Loan and the transactions contemplated herein;

(f)the Lender shall have received and approved the Cash Flow Forecast;

(g)the Lender (and its affiliates) shall have received payment (or, shall receive payment substantially simultaneously with the funding of the Loan on the Closing Date) of all costs, fees and expenses of the Lender’s attorneys, advisors and consultants required to be paid to the extent invoiced by 12:00 p.m. New York City time on the Closing Date; and

(h)the Lender shall have received all customary documents and information requested by the Lender prior to the Closing Date and deemed necessary by the Lender to comply with Section 326 of the U.S.A. PATRIOT Act and regulations promulgated pursuant to such law.

3.Payment of Principal. FOR VALUE RECEIVED, the Borrower promises to pay to the Lender the unpaid principal amount of the Loan, together with all accrued and unpaid interest, fees, expenses and other Obligations, on the Maturity Date.

4.Payment of Interest.

(a)Subject to the terms of this Note, the Loan shall bear interest on the unpaid principal amount thereof, from the date of the funding of the Loan until repaid, at a rate per annum equal to 10.0% (the payment of which shall be made at the time of repayment of the Loan on the Maturity Date).

(b)Accrued and unpaid interest on the Loan shall be payable in full on the Maturity Date. If any payment of any of the Obligations becomes due and payable on a day other than a Business Day, the maturity thereof will be extended to the next succeeding Business Day and, with respect to payments of principal, interest thereon shall be payable at the then applicable rate during such extension.

(c)All computations of fees and interest shall be made by the Lender on the basis of a 360-day year, in each case for the actual number of days occurring in the period for which such fees or interest are payable (including the date of disbursement but not the date of payment).

(d)Notwithstanding the foregoing, if any payment due hereunder (including, but not limited to, the entire principal balance under this Note if accelerated or otherwise matured) is not paid when due, or if any other Event of Default shall have occurred and be continuing, then the entire outstanding principal balance of this Note, together with accrued and unpaid interest, shall bear interest at a per annum rate equal to the Default Rate, from the due date of such payment to and including the date when paid, or from the occurrence of the Event of Default to and including the earlier of (i) the date on which the Obligations evidenced hereby has been repaid in full, or (ii) the date on which such Event of Default shall have been cured, as the case may be. “Default Rate” shall mean a rate of interest equal to the lesser of fifteen percent (15.0%) per annum or the maximum legal rate at the time any such interest is to be calculated.

(e)Interest at the Default Rate shall be payable upon demand.

(f)It is the intention of the parties hereto that the Lender shall conform strictly

to usury laws applicable to it. Accordingly, if the transactions contemplated hereby or by any other Loan Document would be usurious as to the Lender under laws applicable to it (including the laws of the United States of America and the State of New York or any other jurisdiction whose laws may be mandatorily applicable to the Lender notwithstanding the other provisions of this Note), then, in that event, notwithstanding anything to the contrary in this Note or any other Loan Document or any agreement entered into in connection with or as security for the Obligations, it is agreed as follows: (i) the aggregate of all consideration which constitutes interest under law applicable to the Lender that is contracted for, taken, reserved, charged or received by the Lender under this Note or any other Note Document or agreements or otherwise in connection with the Obligations shall under no circumstances exceed the maximum amount allowed by such applicable law, any excess shall be canceled automatically and if theretofore paid shall be credited by the Lender on the principal amount of the Obligations (or, to the extent that the principal amount of the Obligations shall have been or would thereby be paid in full, refunded by the Lender, as applicable, to the Borrower). If at any time and from time to time (x) the amount of interest payable to the Lender on any date shall be computed at the highest lawful rate applicable to the Lender pursuant to this Section 4(f) and (y) in respect of any subsequent interest computation period the amount of interest otherwise payable to the Lender would be less than the amount of interest payable to the Lender computed at the highest lawful rate applicable to the Lender, then the amount of interest payable to the Lender in respect of such subsequent interest computation period shall continue to be computed at the highest lawful rate applicable to the Lender until the total amount of interest payable to the Lender shall equal the total amount of interest which would have been payable to the Lender if the total amount of interest had been computed without giving effect to this Section 4(f).

5.Payments. All payments of principal and interest in respect of this Note shall be made in lawful money of the United States of America in same day funds to the Lender at the account as shall be designated in a written notice delivered by the Lender to the Borrower. Each payment made hereunder shall be credited first to interest and any premium then due and payable on the principal intended to be repaid and the remainder of such payment shall be credited to principal, and interest shall thereupon cease to accrue upon the principal so repaid. The Borrower shall make each payment required under this Note prior to 2:00 p.m. New York City time on the date when due, in immediately available funds. Any amounts received after such time on any date may, in the sole discretion of the Lender, be deemed to have been received on the next succeeding Business Day for purposes of calculating interest thereon. All payments to be made by the Borrower shall be made free and clear and without condition or deduction for any counterclaim, defense, recoupment or setoff.

6.Optional Prepayments. The Borrower shall have the right at any time and from time to time to prepay the Loan under this Note in whole (but not in part) upon two (2) Business Days’ written notice to the Lender by 1:00 p.m. New York City time (or such shorter time as the Lender may agree); provided that each such prepayment shall be in a minimum amount of $500,000. Notice of prepayment having been given as aforesaid, the principal amount specified in such notice shall become due and payable on the prepayment date specified therein in the aggregate principal amount specified therein. Any prepayment or repayment hereunder shall be accompanied by interest on the principal amount of the Note being prepaid or repaid to the date of prepayment or repayment.

7.Roll-up. Upon the occurrence of a Chapter 11 Filing, the Borrower shall use its reasonable best efforts to ensure that the Loan (including any accrued interest thereon), upon entry of a an interim DIP order, shall be (x) converted to postpetition debtor-in-possession financing loans with all of the same rights, priorities, and other terms as other loans extended by Lender after a Chapter 11 Filing to the extent that debtor-in-possession financing is provided by Lender or (y) repaid in full, to the extent that Lender does not provide debtor-in-possession financing and all debtor-in-possession financing is provided by a party other than Lender.

8.[Reserved].

9.Indemnity. The Borrower shall indemnify and hold harmless the Lender and its respective affiliates, and each such Person’s respective members, officers, directors, employees, attorneys, agents and representatives (each, an “Indemnified Person”), from and against any and all suits, actions, proceedings, claims, damages, losses, liabilities and expenses of any kind whatsoever (including reasonable attorneys’ fees and disbursements and other costs of investigation or defense, including those incurred upon any appeal but limited to the legal fees and reasonable and documented out-of-pocket costs and expenses of one legal counsel (and one local counsel in each relevant jurisdiction)) that may be instituted or asserted against or incurred by any such Indemnified Person as the result of the use of proceeds of the Loan, credit having been extended, suspended or terminated under this Note and the other Loan Documents and the administration of such credit, and in connection with or arising out of the transactions contemplated hereunder and thereunder and any actions or failures to act in connection therewith, and legal costs and expenses arising out of or incurred in connection with disputes between the Lender on the one hand and the Loan Parties on the other hand; provided that (i) the Borrower shall not be liable for any indemnification to an Indemnified Person to the extent that any such suit, action, proceeding, claim, damage, loss, liability or expense results solely from that Indemnified Person’s gross negligence, bad faith or willful misconduct as determined in a final nonappealable judgment by a court of competent jurisdiction and (ii) this Section 9 shall not apply with respect to taxes other than any taxes that represent losses, claims, damages, etc. arising from any non- tax claim. NO INDEMNIFIED PERSON SHALL BE RESPONSIBLE OR LIABLE TO ANY OTHER PARTY TO ANY LOAN DOCUMENT, ANY SUCCESSOR, ASSIGNEE OR THIRD PARTY BENEFICIARY OF SUCH PERSON OR ANY OTHER PERSON ASSERTING CLAIMS DERIVATIVELY THROUGH SUCH PARTY, FOR INDIRECT, PUNITIVE, EXEMPLARY OR CONSEQUENTIAL DAMAGES THAT MAY BE ALLEGED AS A RESULT OF CREDIT HAVING BEEN EXTENDED, SUSPENDED OR TERMINATED UNDER ANY LOAN DOCUMENT OR AS A RESULT OF ANY OTHER TRANSACTION CONTEMPLATED HEREUNDER OR THEREUNDER.

10.Taxes.

(a)All payments to the Lender by the Borrower under this Note shall be made free and clear of and without deduction or withholding for any and all taxes, duties, levies, imposts, deductions, charges or withholdings and all related liabilities (all such taxes, duties, levies, imposts, deductions, charges, withholdings and liabilities being referred to as “Taxes”) imposed by the United States of America or any other nation or jurisdiction (or any political subdivision or taxing authority of either thereof), unless such Taxes are required by applicable law to be deducted or withheld. If the Borrower shall be required by applicable law to deduct or withhold any such Taxes (as determined in the good faith discretion of the Borrower) from or in respect of any amount payable under this Note other than taxes imposed on the Lender’s overall net income, then (A) if such Tax is an Indemnified Tax, the amount payable shall be increased as may be necessary so that after making all required deductions or withholdings, (including deductions or withholdings applicable to any additional amounts paid under this Section 10(a)) the Lender receives an amount equal to the amount it would have received if no such deduction or withholding had been made, (B) the Borrower shall make such deductions or withholdings, and (C) the Borrower shall timely pay the full amount deducted or withheld to the relevant governmental entity in accordance with applicable law.

(b)If the effect of the adoption, effectiveness, phase-in or applicability after the date hereof of any law, rule or regulation (including without limitation any tax, duty, charge or withholding on or from payments due from the Borrower (but excluding Indemnified Taxes, Excluded Taxes, and taxation on or measured by the overall net income (however denominated) of the Lender or that are franchise Taxes or branch profits Taxes)), or any change therein or in the interpretation or administration thereof by any

governmental authority, central bank or comparable agency charged with the interpretation or administration thereof, is to reduce the rate of return on the capital of the Lender with respect to this Note or to increase the cost to the Lender of making or maintaining amounts available under this Note, the Borrower agrees to pay to the Lender such additional amount or amounts as will compensate the Lender on an after-tax basis for such reduction or increase.

(c)The Borrower agrees to timely pay any present or future stamp or documentary taxes or any other excise or property taxes, charges, financial institutions duties, debits taxes or similar levies which arise from any payment made by the Borrower under this Note or from the execution, delivery or registration of, or otherwise with respect to, this Note except any such Taxes that are Other Connection Taxes imposed with respect to an assignment (all such taxes, charges, duties and levies being referred to as “Other Taxes”).

(d)The Borrower shall indemnify the Lender for the full amount of Indemnified Taxes (including, without limitation, any Indemnified Taxes imposed by any jurisdiction on amounts payable by the Borrower under Section 10(a)) paid by the Lender and any penalties, interest and reasonable expenses arising from or with respect to such Indemnified Taxes, whether or not they were correctly or legally asserted, excluding taxes imposed on the Lender’s overall net income. Payment under this indemnification shall be made within 10 days after demand therefor. A certificate as to the amount of such Indemnified Taxes submitted to the Borrower by the Lender shall be conclusive evidence, absent manifest error, of the amount due from the Borrower to the Lender.

(e)The Borrower shall furnish to the Lender the original or a certified copy of a receipt evidencing any payment of Taxes made by the Borrower pursuant to this Section 10 within thirty (30) days after the date of any such payment.

(f)If the Lender becomes aware that it has received a refund of any Taxes with respect to which the Borrower has paid any amount pursuant to this Section 10, the Lender shall pay the amount of such refund (but only to the extent of indemnity payments made under this Section 10 with respect to the Taxes giving rise to such refund), net of all out-of-pocket expenses (including Taxes) of the Lender and without interest (other than any interest received from the relevant governmental authority with respect thereto), to the Borrower promptly after receipt thereof.

(g)Status of Lender.

(1)If the Lender is entitled to an exemption from or reduction of withholding Tax with respect to payments made under any Loan Document, then it shall deliver to the Borrower, at the time or times reasonably requested by the Borrower, such properly completed and executed documentation reasonably requested by the Borrower as will permit such payments to be made without withholding or at a reduced rate of withholding. In addition, the Lender, if reasonably requested by the Borrower, shall deliver such other documentation prescribed by applicable law or reasonably requested by the Borrower as will enable the Borrower to determine whether or not the Lender is subject to backup withholding or information reporting requirements. Notwithstanding anything to the contrary in the preceding two sentences, the completion, execution and submission of such documentation (other than such documentation set forth in Section 10(g)(2)) shall not be required if in the Lender’s reasonable judgment such completion, execution or submission would subject such Lender to any material unreimbursed cost or expense or would materially prejudice the legal or commercial position of such Lender.

(2)Without limiting the generality of the foregoing:

(A)the Lender shall deliver to the Borrower on or about the date on which such Lender becomes a Lender under this Agreement (and from time to time thereafter upon the reasonable request of the Borrower), executed copies of IRS Form W-9 certifying that such Lender is exempt from U.S. federal backup withholding tax; and

(B)if a payment made to the Lender under any Loan Document would be subject to U.S. federal withholding Tax imposed by FATCA if the Lender were to fail to comply with the applicable reporting requirements of FATCA (including those contained in Section 1471(b) or 1472(b) of the Code, as applicable), such Lender shall deliver to the Borrower at the time or times prescribed by law and at such time or times reasonably requested by the Borrower such documentation prescribed by applicable law (including as prescribed by Section 1471(b)(3)(C)(i) of the Code) and such additional documentation reasonably requested by the Borrower as may be necessary for the Borrower to comply with their obligations under FATCA and to determine that the Lender has complied with the Lender’s obligations under FATCA or to determine the amount, if any, to deduct and withhold from such payment. Solely for purposes of this clause (B), “FATCA” shall include any amendments made to FATCA after the date of this Agreement.

(3)The Lender agrees that if any form or certification it previously delivered expires or becomes obsolete or inaccurate in any respect, it shall update such form or certification or promptly notify the Borrower in writing of its legal inability to do so.

(h)For purposes of this Section 10, the term “applicable law” includes FATCA.

11.[Reserved].

12.Further Assurances. The Borrower agrees that it shall, at the Borrower’s expense and upon the reasonable request of the Lender, duly execute and deliver or cause to be duly executed and delivered, to the Lender, as the Lender shall direct, such further instruments and do and cause to be done such further acts as may be necessary or proper in the reasonable opinion of the Lender to carry out more effectively the provisions and purposes of this Note or any other Loan Document, including, upon the reasonable written request of the Lender and in form and substance reasonably satisfactory to the Lender, security agreements, UCC-l financing statements and other Collateral Documents confirming and perfecting the granting to the Lender, of the Liens on the Collateral to secure the Obligations.

13.Restructuring Support Agreement. The Borrower and Lender agree to each use reasonable best efforts to execute a Restructuring Support Agreement on or prior to July 23, 2023.

14.Affirmative Covenants.

The Borrower agrees that until the Obligations payable under the Loan Documents shall have been paid in full:

(a)Upon reasonable request of the Lender, the Loan Parties will permit any officer, employee, attorney or accountant or agent of the Lender or its affiliates to audit, review, make extracts from or copy, at the Borrower’s expense, any and all corporate and financial and other books and records of the Loan Parties at all times during ordinary business hours and, upon reasonable advance notice and to discuss

the Loan Parties’ affairs with any of their directors, officers, employees, attorneys, or accountants. The Borrower will permit the Lender, its affiliates, or any of its or their officers, employees, accountants, attorneys or agent, to examine and inspect any Collateral or any other property of the Loan Parties at any time during ordinary business hours and upon reasonable prior notice. Notwithstanding the foregoing, none of the Loan Parties will be required to disclose information to the Lender (or any agent or representative thereof) that is prohibited by applicable law, subject to confidentiality restrictions or is subject to attorney- client or similar privilege or constitutes attorney work product.

(b)(i) The Borrower and its Subsidiaries will comply with all requirements of applicable law, the non-compliance with which could reasonably be expected to have a Material Adverse Effect and (ii) the Borrower and its Subsidiaries will obtain, maintain in effect and comply with all permits, licenses and similar approvals necessary for the operation of its business as now or hereafter conducted, except where the failure to do so could not reasonably be expected to have a Material Adverse Effect.

(c)The Borrower and its Subsidiaries will pay or discharge, when due, (i) all taxes, assessments and governmental charges levied or imposed upon it or upon its income or profits, upon any properties of the Borrower and its Subsidiaries (including, without limitation, the Collateral) or upon or against the creation, perfection or continuance of the security interest, prior to the date on which penalties attach thereto, except in each case where the same are being contested in good faith by appropriate proceedings diligently conducted and adequate reserves in accordance with GAAP are being maintained by the Borrower or such Subsidiary, (ii) all federal, state and local taxes required to be withheld by it, and (iii) all lawful claims for labor, materials and supplies which, if unpaid, would result in a Material Adverse Effect.

(d)(i) The Borrower and each of its Subsidiaries will keep and maintain the Collateral and all of its other properties necessary or useful in its business in good condition, repair and working order (normal wear and tear excepted) other than to the extent contemplated by the Cash Flow Forecast or if the Lender is otherwise on notice, (ii) the Borrower and each of its Subsidiaries will defend the Collateral against all claims or demands of all Persons (other than Permitted Encumbrances) claiming the Collateral or any interest therein, and (iii) the Borrower and each of its Subsidiaries will keep all Collateral free and clear of all security interests, liens and encumbrances, except Permitted Encumbrances.

(e)The Borrower and its Subsidiaries will:

(1)Maintain insurance with respect to the Collateral, covering casualty, hazard, theft, malicious mischief, flood and other risks, in amounts, with endorsements and with insurers satisfactory to the Lender (it being understood that insurance maintained in a manner consistent with the ordinary business practice is satisfactory). All proceeds under each policy covering Collateral shall be payable to the Lender as a lender loss payee/mortgagee. If the Borrower fails to provide and pay for any insurance, the Lender may, at its option, but shall not be required to, procure the insurance and charge the Borrower therefor. The Borrower, upon request of the Lender, agrees to deliver to the Lender, promptly as rendered, copies of all reports made to insurance companies to the extent reasonably practicable.

(2)In addition to the insurance required under clause (e)(1) with respect to Collateral, maintain insurance with insurers reasonably satisfactory to the Lender, with respect to the properties and business of the Loan Parties, of such type (including product liability, workers’ compensation, larceny, embezzlement, or other criminal misappropriation insurance), in such amounts, and with such coverages and deductibles as are at the time of placing such insurance customary for companies similarly situated and which are available at commercially reasonable rates.

(f)The Borrower and the Loan Parties will preserve and maintain their existence and all of their rights, privileges and franchises necessary or desirable in the normal conduct of its business, except to the extent contemplated by the Cash Flow Forecast or as would not result in a Material Adverse Effect.

(g)[Reserved].

(h)No less than once per week (or as otherwise agreed with the Lender), the Borrower shall make its senior management and its advisors available at reasonable times and upon reasonable notice to the Lender to discuss the financial position, cash flows, variances, operations, sale process and general case status of the Loan Parties.

(i)The Borrower shall furnish to the Lender written notice (which may be by email from and/or to counsel) of the following within one (1) Business Day after any member of senior management or any senior officer of the Borrower obtains actual knowledge thereof: (i) any Event of Default or Default, (ii) the filing or commencement of, or any written threat or notice of intention of any person to file or commence, any material action, suit or proceeding, whether at law or in equity or by or before any governmental authority or in arbitration, against the Borrower or any of its Subsidiaries, that has a reasonable likelihood of an adverse determination against the Borrower or its Subsidiaries or (iii) any other development specific to the Borrower or any of its Subsidiaries that has had, or would reasonably be expected to have, a Material Adverse Effect.

15.Negative Covenants.

So long as the Loan or other Obligation hereunder shall remain unpaid or unsatisfied, the Borrower shall not, nor shall it permit any Loan Party to (other than transactions amongst the Borrower and its Subsidiaries in the ordinary course of business, consistent with past practice and as contemplated by the Cash Flow Forecast) without the written consent of the Lender (which may be evidenced by written approval of any amendment to the Cash Flow Forecast or any modification thereto or by exchange of emails between the parties indicating consent thereto):

(a)Directly or indirectly, by operation of law or otherwise, (i) form or acquire any Subsidiary, or (ii) merge with, consolidate with, acquire all or substantially all of the assets or Equity Interests of, or otherwise combine with or acquire, any Person.

(b)Create, incur, assume or permit to exist any Indebtedness, except for Permitted

Indebtedness.

(c)Create, incur, assume or permit to exist any Lien on or with respect to any of its properties or assets (whether now owned or hereafter acquired) except for Permitted Encumbrances.

(d)Make any Restricted Payment.

(e)Other than and except with respect to Permitted Indebtedness or Permitted Encumbrances, assume, guarantee, endorse or otherwise become directly or contingently liable in connection with any obligations of any other Person (other than the Borrower or any of its Subsidiaries).

(f)Convey, sell, lease, assign, transfer or otherwise dispose of any of its property, business or assets, whether now owned or hereinafter acquired other than (i) the sale of inventory in the ordinary course of business or (ii) the sale of other property on terms acceptable to the Lender.

(g)Consent to any amendment, supplement or other modification of any of the terms or provisions contained in, or applicable to, the Existing Credit Facilities.

(h)Make any payment in respect of, or repurchase, redeem, retire or defease any, Indebtedness under the Existing Credit Facilities on any other Indebtedness for borrowed money, except for regularly scheduled payments of principal, interest and fees set forth in the Cash Flow Forecast delivered pursuant to Section 2(f) (or any amendment or modification thereto approved in writing by Lender or by exchange of emails between the parties indicating consent thereto).

(i)Make any investment in, or make loans or advances of money to, any Person (other than another Loan Party), through the direct or indirect lending of money, holding of securities or otherwise.

(j)Change its fiscal year.

(k)Directly, or knowingly indirectly, use the Loan or the proceeds of the Loan, or lend, contribute or otherwise make available the Loan or the proceeds of the Loan to any Person, to fund any activities of or business with any Person, or in any Designated Jurisdiction, that, at the time of such funding, is the subject of Sanctions, or in any other manner that will result in a violation by any Person of Sanctions.

(l)Permit (i) actual cash receipts to be less than 15.0% of the forecasted cash receipts (each calculated on a line by line basis) in the Cash Flow Forecast for the Cash Flow Forecast Test Period,

(ii) actual operating disbursements to be greater than 110.0% of the forecasted operating disbursements in the Cash Flow Forecast for such Cash Flow Forecast Test Period, (iii) actual non-operating disbursements to be greater than 115.0% of the forecasted non-operating disbursements in the Cash Flow Forecast for such Cash Flow Forecast Test Period. In connection with this clause (l), the Borrower shall deliver to the Lender a weekly variance report in form and substance satisfactory the Lender (the “Variance Report”) on the Wednesday of each calendar week comparing for each applicable Cash Flow Forecast Test Period the actual results against forecasted results under the Cash Flow Forecast, together with a written explanation of all variances greater than the permitted variance for any given Cash Flow Forecast Test Period.

(m)(i) Make any payment of any existing bonus or other non-ordinary course executive or other employee compensation, (ii) modify the terms of employment with senior management of the Borrower or any Subsidiary or (iii) enter into or make any payment under any new, existing or modified bonus or non-ordinary course executive or other employee (other than in accordance with the Cash Flow Forecast).

(n)Directly or indirectly solicit, participate in or initiate, and shall discontinue any, discussions or negotiations with any third party, and will not provide any information to or engage in any transaction with, any person or entity other than Lender (and its affiliates) concerning any debtor-in- possession financing or similar financing arrangement for Borrower or any of its Subsidiaries or affiliates; provided that, notwithstanding the foregoing or anything to the contrary herein, nothing herein requires Borrower or any of its Subsidiaries or affiliates, or any of their directors members, or officers, each in their capacity as such, to take any action or to refrain from taking any action, to the extent inconsistent with its or their fiduciary obligations under applicable law. This Section 15(n) shall survive the prepayment or repayment of the Loan under this Note unless such repayment is pursuant to a conversion of this Note into a postpetition debtor-in-possession financing loan in accordance with Section 7 hereof.

16.Events of Default; Rights and Remedies. The occurrence of any one or more of the following events (regardless of the reason therefor), without the written consent of the Lender (which may be by email between the parties or counsel), shall constitute an “Event of Default” hereunder:

(a)The Borrower (i) shall fail to make any payment of principal of, or interest on, or fees owing in respect of, the Loan or any of the other Obligations when due and payable, or (ii) shall fail to pay or reimburse the Lender for any expense reimbursable hereunder or under any other Loan Document within ten (10) Business Days following the Lender’s written demands for such reimbursement or payment.

(b)Any Loan Party shall fail to comply with any of the provisions of Section 15 of

this Note.

(c)Any Loan Party shall fail to comply with any of the provisions of Section 14 or any other provision of this Note or any of the other Loan Documents (other than any provision embodied in or covered by any other clause of this Section 16) and the same, if capable of being remedied, shall remain unremedied for five (5) Business Days after the date written notice of such Default shall have been given by the Lender to such Loan Party.

(d)a Default or breach shall occur under any agreement, document or instrument to which any Loan Party is a party other than any Existing Credit Facility or in respect of Mechanic’s Lien Obligations that is not cured within any applicable grace period therefor, and such Default or breach (i) involves the failure to make any payment when due in respect of any Indebtedness (other than the Obligations) of any Loan Party in excess of $100,000 in the aggregate, or (ii) causes, or permits any holder of such Indebtedness or a trustee to cause, Indebtedness or a portion thereof in excess of $100,000 in the aggregate to become due prior to its stated maturity or prior to its regularly scheduled dates of payment, regardless of whether such Default is waived, or such right is exercised, by such holder or trustee.

(e)Any representation or warranty herein or in any other Loan Document or in any written statement, report, financial statement or certificate made or delivered to Lender by any Loan Party is untrue or incorrect in any material respect (except that such materiality qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the text thereof) as of the date when made or deemed made.

(f)There shall commence any suit or action against the Lender by or on behalf of any Loan Party that asserts a claim or seeks a legal or equitable remedy that would have the effect of subordinating the claim or Lien of the Lender and, if such suit or action is commenced by any Person other than Borrower or any Subsidiary, officer, or employee of Borrower, such suit or action shall not have been dismissed or stayed within 10 days after service thereof on the Lender.

(g)Any provision of any Loan Document shall for any reason cease to be valid, binding and enforceable in accordance with its terms (or any Loan Party shall challenge the enforceability of any Loan Document or shall assert in writing, or engage in any action or inaction based on any such assertion, that any provision of any Loan Document has ceased to be or otherwise is not valid, binding and enforceable in accordance with its terms), or any Lien created under any Loan Document shall cease to be a valid and perfected first priority Lien (except as otherwise permitted herein) in any of the Collateral purported to be covered thereby.

(h)(x) Collateral with a fair market value of $100,000 or more are attached, seized, levied upon or subjected to a writ or distress warrant, or come within the possession of any receiver, trustee, custodian or assignee for the benefit of creditors of any Loan Party and such condition continues for 5 days or more or (y) there is a failure by the Borrower or any of its Subsidiaries to pay final judgments aggregating in excess of $100,000 (excluding amounts covered by insurance), which judgments are not paid, discharged or stayed for a period of 10 days.

(i)Any Loan Party or any Subsidiary thereof institutes or consents to the institution of any proceeding under any Debtor Relief Law; or applies for or consents to the appointment of any receiver, trustee, custodian, conservator, liquidator, rehabilitator or similar officer for it or for all or any part of its property; or any receiver, trustee, custodian, conservator, liquidator, rehabilitator or similar officer is appointed without the application or consent of such Person and the appointment continues undischarged or unstayed for 45 calendar days; or any proceeding under any Debtor Relief Law relating to any such Person or to all or any part of its property is instituted without the consent of such Person and continues undismissed or unstayed for 45 calendar days, or an order for relief is entered in any such proceeding.

If any Event of Default shall have occurred and be continuing, then the Lender may, upon written notice to the Borrower: (i) declare all or any portion of the Obligations, including all or any portion of the Loan, to be forthwith due and payable and (ii) exercise any rights and remedies under the Loan Documents or at law or in equity; provided that upon the occurrence of an Event of Default under Section 16(i) above, the unpaid principal amount of the Loan and all interest and other premiums, amounts and Obligations under the Loan Documents shall automatically become due and payable without further action of the Lender. Upon the occurrence of an Event of Default and the exercise by the Lender of its rights and remedies under this Note and the other Loan Documents pursuant to clause (ii) above, each Loan Party shall assist the Lender in effecting a sale or other disposition of the Collateral upon such terms as are designed to maximize the proceeds obtainable from such sale or other disposition.

Except as otherwise provided for in this Note or by applicable law, the Borrower waives:

(a) presentment, demand and protest and notice of presentment, dishonor, notice of intent to accelerate, notice of acceleration, protest, Default, nonpayment, maturity, release, compromise, settlement, extension or renewal of any or all commercial paper, accounts, contract rights, documents, instruments, chattel paper and guaranties at any time held by the Lender on which the Borrower may in any way be liable, and hereby ratifies and confirms whatever the Lender may do in this regard; (b) all rights to notice and a hearing prior to the Lender taking possession or control of, or Lender’s replevy, attachment or levy upon, the Collateral or any bond or security that might be required by any court prior to allowing Lender to exercise any of its remedies; and (c) the benefit of all valuation, appraisal, marshaling and exemption laws.

To the extent permitted by law, the Lender’s sole duty with respect to the custody, safekeeping and physical preservation of the Collateral in its possession, under section 9-207 of the Uniform Commercial Code or otherwise, shall be to deal with it in the same manner as the Lender deals with similar securities and property for its own account, the Lender’s duty of care with respect to Collateral in the custody or possession of a bailee or other third person shall be deemed fulfilled if the Lender exercises reasonable care in the selection of the bailee or other third person, and the Lender need not otherwise preserve, protect, insure or care for any Collateral, and the Lender shall not be obligated to preserve any rights any Loan Party may have against prior parties.

Any amount or payment received by the Lender from any Loan Party or from the proceeds of Collateral following (i) any acceleration of the Obligations under this Note or (ii) at the direction of the Lender after any Event of Default, shall be applied to the Obligations as determined by the Lender and once paid in full, any excess shall be paid to the Borrower or as otherwise required by applicable law.

17.[Reserved].

18.Definitions. The following terms used in this Note shall have the following meanings (and any of such terms may, unless the context otherwise requires, be used in the singular or the plural depending on the reference):

“APB” shall have the meaning given such term in Section 21(b) of this Note.

“ATI” shall mean Appharvest Technology, Inc., a Delaware corporation.

“Borrower” shall have the meaning given such term in the recital to this Note.

“Business Day” shall mean any day other than a Saturday, Sunday or legal holiday under the laws of the State of New York or any other day on which banking institutions located in the State of New York are authorized or required by law or other governmental action to close.

“Cash Flow Forecast” shall mean the cash flow forecast and budget of the Borrower, its Subsidiaries and affiliates on a consolidated basis in form satisfactory to the Lender (which shall include supporting details of farm-level cash flows).

“Cash Flow Forecast Test Period” shall mean with respect to any Variance Report, the one- week period ending on the Saturday of the week immediately preceding the date on which the Variance Report is required to be delivered under Section 15(l).

“Chapter 11 Filing” shall mean filings under Chapter 11 of the United States Bankruptcy Code by the Borrower and its Subsidiaries.

“Closing Date” shall mean the Business Day when each of the conditions applicable to the funding of the Loan and listed in Section 2 of this Note shall have been satisfied or waived in a manner satisfactory to the Lender.

“Code” shall mean the Internal Revenue Code of 1986, as amended.

“Collateral” shall mean all of the “Collateral” referred to in the Collateral Documents and all the other property that is or is intended under the terms of the Collateral Documents to be subject to Liens in favor of the Lender.

“Collateral Documents” shall mean the Security Agreement, the Patent Security Agreement, the Trademark Security Agreement, and each agreement entered into pursuant to Section 12 hereof and all similar agreements entered into guaranteeing payment of, or granting a Lien upon property as security for payment of, the Obligations, including the Guaranty.

“Debtor Relief Law” shall mean the Bankruptcy Code of the United States, and all other liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, receivership, insolvency, reorganization, or similar debtor relief Laws of the United States or other applicable jurisdictions from time to time in effect and affecting the rights of creditors generally.

“Default” shall mean an event which, with the giving of notice or the lapse of time or both, would constitute an Event of Default.

“Default Rate” shall have the meaning given such term in Section 4. (d) of this Note.

“Designated Jurisdiction” shall mean any country or territory that is the target of a

Sanction.

“Disqualified Capital Stock” shall mean any Equity Interest which, by its terms (or by the terms of any security into which it is convertible or for which it is exchangeable), or upon the happening of any event, (a) matures (excluding any maturity as the result of an optional redemption by the issuer thereof) or is mandatorily redeemable for any consideration other than solely an Equity Interest in such Person (which would not otherwise constitute Disqualified Capital Stock), pursuant to a sinking fund obligation or otherwise, or is redeemable at the option of the holder thereof for any consideration other than solely an Equity Interest in such Person (which would not otherwise constitute Disqualified Capital Stock) at the option of the holder thereof, in whole or in part on or prior to the date that is 181 days after the earlier of the Maturity Date and payment in full of the Obligations, (b) is convertible into or exchangeable (unless at the sole option of the issuer thereof) for (i) debt securities or (ii) any Equity Interests referred to in (a) above, or (c) contains any repurchase obligation on or prior to the date that is 181 days after the earlier of the Maturity Date and payment in full of the Obligations.

“Dollars” or “$” shall mean lawful currency of the United States of America.

“Equity Interests” shall mean, with respect to any Person, all of the shares of capital stock of (or other ownership or profit interests in) such Person, all of the warrants, options or other rights for the purchase or acquisition from such Person of shares of capital stock of (or other ownership or profit interests in) such Person, all of the securities convertible into or exchangeable for shares of capital stock of (or other ownership or profit interests in) such Person or warrants, rights or options for the purchase or acquisition from such Person of such shares (or such other interests), and all of the other ownership or profit interests in such Person (including partnership, member or trust interests therein), whether voting or nonvoting, and whether or not such shares, warrants, options, rights or other interests are outstanding on any date of determination.

“Event of Default” shall have the meaning given such term in Section 16 of this Note.

“Excluded Taxes” shall mean any of the following Taxes imposed on or with respect to the Lender or required to be withheld or deducted from a payment to the Lender, (a) Taxes imposed on or measured by net income (however denominated), franchise Taxes, and branch profits Taxes, in each case,

(i) imposed as a result of such Lender being organized under the laws of, or having its principal office located in, the jurisdiction imposing such Tax (or any political subdivision thereof) or (ii) that are Other Connection Taxes, (b) federal withholding Taxes imposed on amounts payable to or for the account of the Lender with respect to an applicable interest in the Loan pursuant to a law in effect on the date on which the Lender acquires such interest in the Loan except to the extent that, pursuant to Section 10, amounts with respect to such Taxes were payable to the Lender’s assignor immediately before the Lender became a party hereto, (c) Taxes attributable to the Lender’s failure to provide the Borrower with the tax documentation described in Section 10 hereof, and (d) any withholding Taxes imposed under FATCA.

“Existing Credit Facilities” shall mean the Richmond Facility, the Morehead Facility and the GNCU Facility.

“FATCA” shall mean Sections 1471 through 1474 of the Code, as of the date of this Note (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreements entered into pursuant to Section 1471(b)(1) of the Code and any fiscal or regulatory legislation, rules or practices adopted pursuant to any intergovernmental agreement, treaty or convention among governmental authorities entered into in connection with the implementation of the foregoing.

“GAAP” shall mean generally accepted accounting principles in the United States of

America.

“GNCU Facility” shall mean the credit facility governed by that certain Loan Agreement by and among AppHarvest Pulaski Farm, LLC, AppHarvest Operations, Inc., and Greater Nevada Credit Union, dated as of July 29, 2022 (as amended or supplemented prior to the date hereof) in the aggregate principal amount of $50,000,000.00.

“Guarantor” shall have the meaning given such term in the recital to this Note.

“Guaranty” shall mean the Guaranty, dated as of the date hereof, made by the Guarantors in favor of the Lender.

“Indebtedness” shall mean, as to any Person at a particular time, without duplication, all of the following, whether or not included as indebtedness or liabilities in accordance with GAAP: (i) all obligations of such Person for borrowed money and all obligations of such Person evidenced by bonds, debentures, notes, loan agreements or other similar instruments; (ii) the maximum amount of all direct or contingent obligations of such Person arising under letters of credit (including standby and commercial), bankers’ acceptances, bank guaranties, surety bonds and similar instruments; (iii) net obligations of such Person under any swap contract; (iv) all obligations of such Person to pay the deferred purchase price of property or services (other than trade accounts payable in the ordinary course of business and not past due for more than 90 days after the date on which such trade account was created); (v) indebtedness (excluding prepaid interest thereon paid prior to the date hereof) secured by a Lien on property owned or being purchased by such Person (including indebtedness arising under conditional sales or other title retention agreements), whether or not such indebtedness shall have been assumed by such Person or is limited in recourse; provided that, if such indebtedness is limited in recourse, then the amount of such indebtedness for purposes of this Agreement will not exceed the fair market value of such property; (vi) all obligations with respect to capitalized leases and synthetic lease obligations of such Person and all synthetic debt of such Person; (vii) all Disqualified Capital Stock; and (viii) all guarantees of such Person in respect of any of the foregoing.

For all purposes hereof, the Indebtedness of any Person shall include the Indebtedness of any partnership or joint venture (other than a joint venture that is itself a corporation or limited liability company) in which such Person is a general partner or a joint venturer, unless such Indebtedness is expressly made non-recourse to such Person. Indebtedness shall also be deemed to include obligations under any receivables, factoring, warehouse, securitization or similar facilities.

“Indemnified Person” shall have the meaning given such term in Section 9 of this Note.

“Indemnified Taxes” shall mean (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of the Borrower under any Loan Document and (b) to the extent not otherwise described in (a), Other Taxes.

“Lien” shall mean any mortgage or deed of trust, pledge, hypothecation, assignment, deposit arrangement, lien (statutory or otherwise), charge, claim, security interest, easement or encumbrance, or preference, priority or other security agreement or preferential arrangement of any kind or nature whatsoever (including any lease or any financing lease having substantially the same economic effect as any of the foregoing, and the filing of, or agreement to give, any financing statement perfecting a security interest under the Uniform Commercial Code or comparable law of any jurisdiction), whether or not filed, recorded or otherwise perfected or effective under applicable law.

“Loan” shall have the meaning given such term in Section 1.

“Loan Documents” shall mean the Note, the Collateral Documents, the Guaranty and all other agreements, instruments, documents and certificates executed and delivered to, or in favor of the Lender in connection with this Note. Any reference in this Note or any other Loan Document to a Loan Document shall include all appendices, exhibits or schedules thereto, and all amendments, restatements, amendments and restatements supplements or other modifications thereto, and shall refer to such Loan Document as the same may be in effect at all times such reference becomes operative.

“Loan Party” shall mean the Borrower and any Guarantor.

“Material Adverse Effect” shall mean a material adverse effect on (i) the operations, business, assets, properties or financial condition of any of the Loan Parties, (ii) the ability of the Loan Parties to perform payment or other material obligations under any Loan Document, (iii) the legality, validity or enforceability of this Note or any other Loan Document, (iv) the rights and remedies of the Lender under any Loan Document, or (v) the validity, perfection or priority of a Lien in favor of the Lender on any of the Collateral; provided that none of the events existing on the Closing Date or relating to a Chapter 11 Filing shall be deemed to have a Material Adverse Effect.

“Maturity Date” shall mean 5:00 p.m. New York City time on July 24, 2023.

“Mechanic’s Lien Obligations” shall mean the mechanic’s lien claims arising under the laws of Kentucky or otherwise against property of the Loan Parties arising from any agreement or obligation by or between Dalsem Greenhouse Technology B.V. or any of its affiliates, on the one hand, and any of the Loans Parties or their subsidiaries, on the other hand.

“Morehead Facility” shall mean the credit facility governed by that certain Credit Agreement by and between AppHarvest Morehead Farm, LLC and Rabo AgriFinance LLC, dated as of June 15, 2021 (as amended by that certain First Amendment to Master Credit Agreement, dated as of March 31, 2023 and as further amended or supplemented from time to time prior to the date hereof) in the aggregate principal amount of $45,941,435.41.

“Note” shall have the meaning given such term in the recital to this Note.

“Obligations” shall mean any and all loans, advances, debts, principal, interest on the loans, liabilities and all other obligations for the performance of covenants, tasks or duties or for payment of monetary amounts (whether or not such performance is then required or contingent, due or to become due, now existing or hereafter incurred, or such amounts are liquidated or determinable) owing by Borrower to the Lender arising under the Note or any of the other Loan Documents, and all covenants and duties regarding such amounts, of any kind or nature, present or future, arising under the Note or any of the other Loan Documents. This term includes all principal, interest, fees, charges, expenses, attorneys’ fees and any other sum chargeable to Borrower under the Note or any of the other Loan Documents.

“OFAC” shall mean the Office of Foreign Assets Control of the United States Department

of the Treasury.

“Other Connection Taxes” shall mean, with respect to the Lender, Taxes imposed as a result of a present or former connection between the Lender and the jurisdiction imposing such Tax (other than connections arising from the Lender having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in any Loan

or Loan Document).

“Other Taxes” shall have the meaning given such term in Section 10 of this Note.

“Patent Security Agreement” shall mean the Patent Security Agreement, dated the date hereof, between ATI and the Lender.

“Permitted Encumbrances” shall mean the following encumbrances: (a) Liens for taxes or assessments or other governmental charges (i) not yet due and payable, (ii) that are being contested in good faith by appropriate proceedings diligently conducted and adequate reserves with respect thereto are maintained on the books of the applicable Person in accordance with GAAP, or (iii) the nonpayment of which is required by the Bankruptcy Code; (b) pledges or deposits of money securing statutory obligations under workmen’s compensation, unemployment insurance, social security or public liability laws or similar legislation (excluding Liens under ERISA); (c) carriers’, warehousemen’s, suppliers’ or other similar possessory liens arising in the ordinary course of business which secure obligations that (i) (A) are not overdue, and (B) individually or together with all other Permitted Encumbrances outstanding on any date of determination, would not reasonably be expected to result in a Material Adverse Effect, or (ii) are being contested in good faith by appropriate proceedings diligently conducted and adequate reserves with respect thereto are maintained on the books of the applicable Person in accordance with GAAP; (d) deposits securing, or in lieu of, surety, appeal or customs bonds in proceedings to which any Loan Party is a party;

(e) zoning restrictions, easements, licenses, or easements and rights-of-way in favor of utility companies and government authorities so long as the same do not materially impair the use, value, or marketability of such real estate; (f) the Lender’s Liens, (g) Liens existing on the Closing Date (other than the Liens described in clause (h)) and (h) Liens securing the obligations under the Existing Credit Facilities.

“Permitted Indebtedness” shall mean: (a) current Indebtedness incurred in the ordinary course of business for inventory, supplies, equipment, services, taxes or labor, in each case, as contemplated by the Cash Flow Forecast; (b) Indebtedness arising under this Note and the other Loan Documents; (c) the obligations under the Existing Credit Facilities or in respect of the Mechanic’s Lien Obligations, each as in effect as of the date hereof and any interest accrued or accruing thereon; (d) deferred taxes and other expenses incurred in the ordinary course of business and (e) any Indebtedness existing on the Closing Date that, to the extent in excess of $1,000,000 is disclosed on Schedule 1 (other than Indebtedness under clause (c)).

“Person” shall mean any individual, sole proprietorship, partnership, joint venture, trust, unincorporated organization, association, corporation, limited liability company, institution, public benefit corporation, other entity or government (whether federal, state, county, city, municipal, local, foreign, or otherwise, including any instrumentality, division, agency, body or department thereof).

“Related Parties” shall mean, with respect to any specified Person, such Person’s affiliates and the respective managers, administrators, trustees, partners, investors, directors, officers, employees, agents, advisors, sub-advisors or other representatives of such Person and such Person’s affiliates.

“Restricted Payment” shall mean any dividend or other distribution (whether in cash, securities or other property) with respect to any capital stock or other Equity Interest of any Person or any of its Subsidiaries, or any payment (whether in cash, securities or other property), including any sinking fund or similar deposit, on account of the purchase, redemption, retirement, defeasance, acquisition, cancellation or termination of any such capital stock or other Equity Interest, or on account of any return of capital to any Person’s stockholders, partners or members (or the equivalent of any thereof), or any option, warrant or other right to acquire any such dividend or other distribution or payment.

“Richmond Facility” shall mean the credit facility governed by that certain Credit Agreement by and between AppHarvest Richmond Farm, LLC, as Borrower, and CEFF II AppHarvest Holdings, LLC, as Lender, dated as of July 23, 2021 (as amended by that certain First Amendment to Credit Agreement, dated as of July 29, 2021, that certain Second Amendment to Credit Agreement, dated as of July 29, 2022, that certain Waiver and Third Amendment to Credit Agreement, dated as of December 21, 2022, and as further amended or supplemented from time to time prior to the date hereof), in the aggregate principal amount of $66,252,138.27.

“Sanction” shall mean any sanction administered or enforced by the United States Government (including, without limitation, OFAC), the United Nations Security Council, the European Union, Her Majesty’s Treasury or other relevant sanctions authority.

“Security Agreement” shall mean the Security Agreement, dated the date hereof, among the Borrower, the Guarantors and the Lender.

“Subsidiary” of a Person shall mean a corporation, partnership, joint venture, limited liability company or other business entity of which fifty percent (50%) or more of the shares of securities or other interests having ordinary voting power for the election of directors or other governing body (other than securities or interests having such power only by reason of the happening of a contingency) are at the time beneficially owned, or the management of which is otherwise controlled, directly, or indirectly through one or more intermediaries, or both, by such Person. Unless otherwise specified, all references herein to a “Subsidiary” or to “Subsidiaries” shall refer to a Subsidiary or Subsidiaries of the Borrower.

“Taxes” shall have the meaning given such term in Section 10 of this Note.

“Trademark Security Agreement” shall mean the Trademark Security Agreement, dated the date hereof, among the Borrower, ATI and the Lender.

“U.S.A. PATRIOT Act” shall mean the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Public Law 107-56 (signed into law on October 26, 2001).

“Variance Report” shall have the meaning given such term in Section 15(l) of this Note.

19.Representations and Warranties. The Borrower represents as to itself and each of the other Loan Parties as follows:

(a)the Borrower and each of the Loan Parties are duly formed and/or organized and validly existing under the laws of their jurisdictions of incorporation or formation;

(b)the execution and delivery of this Note by Borrower and the other Loan Documents by the Loan Parties (as applicable) and the performance by the Borrower of the Borrower’s obligations hereunder and by the Loan Parties under the other Loan Documents (as applicable) are within their corporate powers, have been duly authorized by all necessary corporate action of each Loan Party, have received all necessary bankruptcy, insolvency or governmental approvals, and do not and will not contravene or conflict with any provisions of applicable material law or of the a Loan Party’s corporate charter or by-laws or of any agreements binding upon or applicable to the Borrower or any of its Subsidiaries or any of their properties;

(c)this Note and each other Loan Document is the legal, valid and binding obligation, enforceable against the Loan Parties in accordance with its terms subject to applicable bankruptcy,

insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally, and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law;

(d)the Borrower and the Loan Parties have good and marketable title to, or valid leasehold interests in, all of its material property and assets, including all material Collateral; none of the properties and assets of the Borrower and its Subsidiaries are subject to any Liens other than Permitted Encumbrances;

(e)no written statement furnished by or on behalf of the Borrower and its Subsidiaries to the Lender pursuant to the terms of this Note (other than any projections, the Cash Flow Forecast, estimates and information of a general economic nature or general industry nature), contains any untrue statement of a material fact individually, with respect to the Collateral or otherwise when taken as a whole, or omits to state a material fact necessary to make the statements contained herein or therein not materially misleading in light of all of the circumstances under which they were made;

(f)the Liens granted to the Lender pursuant to the Collateral Documents will at all times to the extent required thereby be fully perfected Liens in and to the Collateral described therein, subject, as to priority, only to Permitted Encumbrances;

(g)no action, claim, lawsuit, demand, investigation or proceeding is now pending or, to the knowledge of the Borrower, threatened against the Borrower or its Subsidiaries before any governmental authority or before any arbitrator or panel of arbitrators that challenges the rights or powers of the Borrower or its Subsidiaries to enter into or perform any of its obligations under the Loan Documents to which it is a party, or the validity or enforceability of any Loan Document or any action taken thereunder;

(h)each Loan Party is in compliance in all material respects with the requirements of all laws and regulations and all orders, writs, injunctions and decrees applicable to it or to its properties, except in such instances in which such requirement of law or regulation or order, writ, injunction or decree is being contested in good faith by appropriate proceedings diligently conducted;

(i)no Loan Party is required to be registered under the Investment Company Act of 1940, as amended;