false

0001768224

0001768224

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): November 7, 2024

ARCTURUS THERAPEUTICS

HOLDINGS INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-38942 |

|

32-0595345 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

10628 Science Center

Drive, Suite 250

San Diego, California 92121

(Address of principal

executive offices)

Registrant’s

telephone number, including area code: (858) 900-2660

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, par value $0.001 per share |

|

ARCT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Conditions.

On November 7, 2024, Arcturus Therapeutics

Holdings Inc. (the “Company” or “Arcturus”) issued a press release, a copy of which is furnished herewith as Exhibit

99.1, announcing the Company’s financial results for the quarter ended September 30, 2024 and providing a corporate update (the

“Press Release”).

The information contained in Item 2.02 of

this Current Report on Form 8-K, including the Press Release, shall not be deemed “filed” for the purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section or Sections 11 and 12(a)(2) of

the Securities Act of 1933, as amended. In addition, this information shall not be deemed incorporated by reference into any of the Company’s

filings with the Securities and Exchange Commission (the “SEC”), except as shall be expressly set forth by specific reference

in any such filing.

Cautionary Note Regarding Forward-Looking

Statements

This Current Report on Form 8-K, and the Press

Release, contain forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided

by the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact included in this current

report, and the Press Release are forward-looking statements, including those regarding strategy, future operations, the likelihood of success and continued advancement

of the Company’s pipeline (including ARCT-032 and ARCT-810) and partnered programs (including the COVID-19 and flu programs partnered

with CSL Seqirus), the likelihood and extent of commercialization of KOSTAIVE and the timing thereof, the continued clinical development

of the rare disease programs, the interim Phase 2 proof-of-concept clinical data and the timing therefor, the likelihood and timing of

European Marketing Authorization application approval for KOSTAIVE and of a milestone payment from CSL related thereto, the planned transfer

of the CF manufacturing process to ARCALIS and timing thereof, the anticipated enrollment in the Phase 2 clinical program for ARCT-810,

the anticipated enrollment in the Phase 2 clinical program for ARCT-032, that preclinical or clinical data will be predictive of future

clinical results, the likelihood and timing of clinical study updates, the likelihood of and timing for approval of Meiji Seika Pharma’s

application to amend approval for KOSTAIVE to include domestic manufacturing sites in Japan, Meiji Seika Pharma’s plans to begin

selling Japan-produced KOSTAIVE and the timing thereof, the likelihood or timing of collection of accounts receivables including expected

future milestone and other payments from CSL, its current cash position and expected cash burn and runway, and the impact of general business

and economic conditions. Arcturus may not actually achieve the plans, carry out the intentions or meet the expectations or projections

disclosed in any forward-looking statements such as the foregoing and you should not place undue reliance on such forward-looking statements.

These statements are only current predictions or expectations, and are subject to known and unknown risks, uncertainties, and other factors

that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different

from those anticipated by the forward-looking statements, including those discussed under the heading "Risk Factors" in Arcturus’

most recent Annual Report on Form 10-K, and in subsequent filings with, or submissions to, the SEC, which are available on the SEC’s

website at www.sec.gov. Except as otherwise required by law, Arcturus disclaims any intention or obligation to update or revise any forward-looking

statements, which speak only as of the date they were made, whether as a result of new information, future events or circumstances or

otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Arcturus Therapeutics Holdings Inc. |

| Date: November 7, 2024 |

|

| |

|

|

| |

By: |

/s/ Joseph E. Payne |

| |

Name: |

Joseph E. Payne |

| |

Title: |

Chief Executive Officer |

Arcturus Therapeutics Announces Third Quarter

2024 Financial Update and Pipeline Progress

Cystic Fibrosis and OTC Deficiency Phase 2 studies

on track for POC data in first half of 2025

$25 Million commercial milestone achieved with

first sale of KOSTAIVE® in Japan

KOSTAIVE® European CHMP opinion expected

December

Positive results from multiple Phase 3 studies

support KOSTAIVE® U.S. BLA filing in H1 2025

Superior 12-month durability results from Phase

3 study of KOSTAIVE® published in The Lancet Infectious Diseases

Positive Phase 3 results showed KOSTAIVE®

XBB.1.5. met all four primary study objectives and key secondary objectives

Investor conference call at 4:30 p.m. ET today

SAN DIEGO--(BUSINESSWIRE)--November 7, 2024--

Arcturus Therapeutics Holdings Inc. (the “Company”, “Arcturus”, Nasdaq: ARCT), a commercial messenger RNA medicines

company focused on the development of infectious disease vaccines and opportunities within liver and respiratory rare diseases, today

announced its financial results for the third quarter ended September 30, 2024, and provided corporate updates.

“I am thrilled about the approval of KOSTAIVE®

for the COVID-19 JN.1 strain in Japan and for the continued success of the STARR® platform in multiple Phase 3 trials, underscoring

CSL and Arcturus’ commitment to deliver disruptive technologies for protection against respiratory viral diseases,” said Joseph

Payne, President & CEO of Arcturus Therapeutics. “I am pleased that both of our flagship mRNA therapeutic programs, ARCT-032

and ARCT-810, are on track for interim Phase 2 proof-of-concept clinical data in the first half of 2025. These studies allow us to evaluate

lung function improvement in individuals with cystic fibrosis, and meaningful biomarker changes in individuals with OTC deficiency.”

“I am happy to report our first commercial

milestone achieved from our CSL partnership for the first commercial sale of KOSTAIVE in Japan,” said Andy Sassine, Chief Financial

Officer of Arcturus. “We anticipate another milestone related to potential European approval in the first quarter of 2025. I am

also happy to announce that Arcturus is planning to transfer our cystic fibrosis manufacturing process technology to ARCALIS.”

Recent Corporate Highlights

| · | In September, Arcturus received clearance of an Investigational New Drug application from the U.S. Food

and Drug Administration (FDA), enabling the Company to initiate a Phase 2 multiple ascending dose study to evaluate the safety, tolerability

and efficacy of ARCT-032 in people with cystic fibrosis (CF). |

| o | The Phase 2 study is screening individuals with CF who do not qualify for, or benefit from, CFTR modulator

medicines due to dysfunctional or absent CFTR protein and/or drug intolerance. |

| o | The Company remains on track to share ARCT-032 Phase 2 proof-of-concept (POC) interim data in 1H25. |

| · | In August, the Company announced the expansion of the Phase 2 clinical program of ARCT-810, an mRNA therapeutic

to potentially treat ornithine transcarbamylase (OTC) deficiency, into the United States. |

| o | This open-label multiple-dose study (NCT06488313) evaluating pharmacodynamics and safety is currently

enrolling adults and adolescents requiring clinical management for OTC deficiency. |

| o | The placebo-controlled Phase 2 European study has completed the dosing phase (N = 8; 0.3 mg/kg) in OTC

deficient individuals. |

| o | The Company remains on track to share ARCT-810 Phase 2 POC interim data from both U.S. and European studies

in 1H25. |

| · | Meiji Seika Pharma, CSL’s exclusive partner in Japan, began KOSTAIVE commercial sales in September

2024. This event triggered a $25 million commercial milestone associated with the first sale of KOSTAIVE® in Japan. |

| · | In September, the Company, along with partners CSL and Meiji, announced new 12-month post vaccination

data for KOSTAIVE at OPTIONS XII for the Control of Influenza conference. |

| o | The results of a head-to-head study demonstrated that KOSTAIVE maintained superior immunogenicity compared

to the conventional mRNA vaccine COMIRNATY® for up to one year against Wuhan-Hu-1, Omicron BA.4/5 and certain other variants, and

at one-sixth the dose of the comparator (5 μg vs 30 μg, respectively). The results were published in The Lancet Infectious Disease. |

| o | Additional Phase 3 data presented by CSL, Meiji and Arcturus show that bivalent KOSTAIVE, ARCT-2301, induced

superior immunogenicity over conventional bivalent mRNA vaccine COMIRNATY® that persists against key variants up to six months post

vaccination. |

| · | Earlier this year, CSL Seqirus’s partner Meiji Seika Pharma announced that it submitted a partial

change application for an amendment to the manufacturing and marketing approval of KOSTAIVE® to include manufacturing sites in Japan,

including ARCALIS, Inc., Arcturus’ manufacturing joint venture in Japan. When approved, Meiji Seika Pharma will begin selling domestically

produced KOSTAIVE® this season. |

| · | The Company announced the results of a Phase 3 study which demonstrated the added value of an updated

COVID-19 vaccine (ARCT-2303) containing the Omicron XBB.1.5 variant. The study supports co-administration of KOSTAIVE with licensed influenza

vaccines. |

| o | ARCT-2303 demonstrated superior immune response versus ARCT-154 as measured by neutralizing antibodies

against Omicron XBB.1.5.6 in terms of GMT ratio and SCR difference. |

| o | Co-administration of ARCT-2303 and cell-based quadrivalent influenza vaccine (QIV; FLUCELVAX®, CSL)

showed noninferior immune response vs standalone QIV administration. |

| o | Co-administration of ARCT-2303 and QIV showed noninferior immune response vs standalone ARCT-2303 administration. |

| o | Co-administration of ARCT-2303 and adjuvanted QIV (FLUAD®, CSL) in older adults showed similar responses

vs standalone administration of ARCT-2303 and adjuvanted QIV. |

Financial Results for the three months ended September 30,

2024

Revenues in conjunction with strategic alliances and collaborations:

Arcturus’ primary revenue streams include license fees, consulting

and related technology transfer fees, reservation fees and collaborative payments received from research and development arrangements

with pharmaceutical and biotechnology partners. For the three months ended September 30, 2024, we reported revenue of $41.7 million, a

slight decrease of $3.5 million from the $45.2 million reported in the same period in 2023. The decline was mostly attributable to a lower

milestone achievement from the CSL agreement during the third quarter of 2024. This decrease was offset by revenue recognized from a supply

agreement related to the commercial production of KOSTAIVE® and an increase in revenue from the BARDA agreement during the three months

ended September 30, 2024.

Revenue decreased by $6.4 million during the nine months ended September

30, 2024, as compared to the same period in 2023. The decrease was due to lower CSL revenue resulting from the timing and value of milestone

achievements. This was offset by increased BARDA revenue due to progress of the pandemic flu program.

Operating expenses:

Total operating expenses for the three months ended September

30, 2024, were $52.4 million compared with $64.5 million for the three months ended September 30, 2023. Total

operating expenses for the nine months ended September 30, 2024, were $191.8 million compared with $195.9 million for

the nine months ended September 30, 2023.

Research and development expenses:

Research and development expenses consist primarily of external manufacturing

costs, in vivo research studies and clinical trials performed by contract research organizations, clinical and regulatory

consultants, personnel-related expenses, facility-related expenses and laboratory supplies related to conducting research and development

activities. Research and development expenses were $39.1 million for the three months ended September 30, 2024, compared

with $51.1 million for the three months ended September 30, 2023. Research and development expenses were $151.4 million for

the nine months ended September 30, 2024, compared with $155.5 million for the nine months ended September 30, 2023.

The decreases in research and development expenses were primarily driven by a decrease in manufacturing costs for the Covid program. The

decrease was partially offset by an increase in clinical trial costs for the Covid and Flu programs.

General and Administrative Expenses:

General and administrative expenses primarily consist of salaries and

related benefits for executive, administrative, legal and accounting functions and professional service fees for legal and accounting

services as well as other general and administrative expenses. General and administrative expenses were $13.3 million and $40.4

million for the three and nine months ended September 30, 2024, respectively, compared with $13.4 million and $40.4

million for the comparable periods in the prior year. These expenses remained relatively consistent between the two periods. The

Company expects that general and administrative expenses will remain relatively consistent over the next fiscal year with the current

pipeline.

Net Loss:

For the three months ended September 30, 2024, Arcturus reported

a net loss of approximately $6.9 million, or ($0.26) per diluted share, compared with a net loss of $16.2 million, or ($0.61)

per diluted share in the three months ended September 30, 2023. For the nine months ended September 30, 2024, Arcturus reported

a net loss of approximately $50.9 million, or ($1.89) per diluted share, compared with a net loss of $18.0 million, or ($0.68)

per diluted share in the nine months ended September 30, 2023.

Cash Position and Balance Sheet:

Cash, cash equivalents and restricted cash were $294.1 million as

of September 30, 2024, and $348.9 million on December 31, 2023. Arcturus achieved a total of approximately $462.1

million in upfront payments and milestones from CSL as of September 30, 2024, and expects to continue to receive future milestone

payments from CSL supporting the ongoing development of the COVID and flu programs and three additional vaccine programs by CSL. Based

on the current pipeline and programs, the cash runway is expected to extend through the first quarter of fiscal year 2027.

Earnings Call: Thursday, November 7, 2024 @

4:30 pm ET

| · | Domestic: 1-800-274-8461 |

| · | International: 1-203-518-9814 |

| · | Webcast: https://viavid.webcasts.com/starthere.jsp?ei=1690364&tp_key=aa4eb0ba02 |

About Arcturus

Founded in 2013 and based in San Diego, California,

Arcturus Therapeutics Holdings Inc. (Nasdaq: ARCT) is a commercial mRNA medicines and vaccines company with enabling technologies: (i)

LUNAR® lipid-mediated delivery, (ii) STARR® mRNA Technology (sa-mRNA) and (iii) mRNA drug substance along with drug product manufacturing

expertise. Arcturus developed KOSTAIVE®, the first self-amplifying messenger RNA (sa-mRNA) COVID vaccine in the world to be approved.

Arcturus has an ongoing global collaboration for innovative mRNA vaccines with CSL Seqirus, and a joint venture in Japan, ARCALIS, focused

on the manufacture of mRNA vaccines and therapeutics. Arcturus' pipeline includes RNA therapeutic candidates to potentially treat ornithine

transcarbamylase (OTC) deficiency and cystic fibrosis (CF), along with its partnered mRNA vaccine programs for SARS-CoV-2 (COVID-19) and

influenza. Arcturus' versatile RNA therapeutics platforms can be applied toward multiple types of nucleic acid medicines including messenger

RNA, small interfering RNA, circular RNA, antisense RNA, self-amplifying RNA, DNA, and gene editing therapeutics. Arcturus' technologies

are covered by its extensive patent portfolio (over 400 patents and patent applications in the U.S., Europe, Japan, China, and other countries).

For more information, visit www.ArcturusRx.com. In addition, please connect with us on Twitter and LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements

that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform

Act of 1995. Any statements, other than statements of historical fact included in this press release, are forward-looking statements,

including those regarding strategy, future operations, the likelihood of success and continued advancement of the Company’s pipeline

(including ARCT-032 and ARCT-810) and partnered programs (including the COVID-19 and flu programs partnered with CSL Seqirus), the likelihood

and extent of commercialization of KOSTAIVE and the timing thereof, the continued clinical development of the rare disease programs, the

interim Phase 2 proof-of-concept clinical data and the timing therefor, the likelihood and timing of European Marketing Authorization

application approval for KOSTAIVE and of a milestone payment from CSL related thereto, the planned transfer of the CF manufacturing process

to ARCALIS and timing thereof, the anticipated enrollment in the Phase 2 clinical program for ARCT-810, the anticipated enrollment in

the Phase 2 clinical program for ARCT-032, that preclinical or clinical data will be predictive of future clinical results, the likelihood

and timing of clinical study updates, the likelihood of and timing for approval of Meiji Seika Pharma’s application to amend approval

for KOSTAIVE to include domestic manufacturing sites in Japan, Meiji Seika Pharma’s plans to begin selling Japan-produced KOSTAIVE

and the timing thereof, the likelihood or timing of collection of accounts receivables including expected future milestone and other payments

from CSL, its current cash position and expected cash burn and runway, and the impact of general business and economic conditions. Arcturus

may not actually achieve the plans, carry out the intentions or meet the expectations or projections disclosed in any forward-looking

statements such as the foregoing and you should not place undue reliance on such forward-looking statements. These statements are only

current predictions or expectations, and are subject to known and unknown risks, uncertainties, and other factors that may cause our or

our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated

by the forward-looking statements, including those discussed under the heading "Risk Factors" in Arcturus’ most recent

Annual Report on Form 10-K, and in subsequent filings with, or submissions to, the SEC, which are available on the SEC’s website

at www.sec.gov. Except as otherwise required by law, Arcturus disclaims any intention or obligation to update or revise any forward-looking

statements, which speak only as of the date they were made, whether as a result of new information, future events or circumstances or

otherwise.

Trademark Acknowledgements

The Arcturus logo and other trademarks of Arcturus

appearing in this announcement, including LUNAR® and STARR®, are the property of Arcturus. All other trademarks, services marks,

and trade names in this announcement are the property of their respective owners.

IR and Media Contacts

Arcturus Therapeutics

Neda Safarzadeh

VP, Head of IR/PR/Marketing

(858) 900-2682

IR@ArcturusRx.com

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

September 30,

2024 | |

December 31,

2023 |

| (in thousands, except par value information) | |

| (unaudited) | | |

| | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 237,178 | | |

$ | 292,005 | |

| Restricted cash | |

| 55,000 | | |

| 55,000 | |

| Accounts receivable | |

| 30,199 | | |

| 32,064 | |

| Prepaid expenses and other current assets | |

| 8,444 | | |

| 7,521 | |

| Total current assets | |

| 330,821 | | |

| 386,590 | |

| Property and equipment, net | |

| 10,350 | | |

| 12,427 | |

| Operating lease right-of-use assets, net | |

| 27,598 | | |

| 28,500 | |

| Non-current restricted cash | |

| 1,885 | | |

| 1,885 | |

| Total assets | |

$ | 370,654 | | |

$ | 429,402 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 10,131 | | |

$ | 5,279 | |

| Accrued liabilities | |

| 32,396 | | |

| 31,881 | |

| Deferred revenue | |

| 26,936 | | |

| 44,829 | |

| Total current liabilities | |

| 69,463 | | |

| 81,989 | |

| Deferred revenue, net of current portion | |

| 13,338 | | |

| 42,496 | |

| Operating lease liability, net of current portion | |

| 25,987 | | |

| 25,907 | |

| Other non-current liabilities | |

| — | | |

| 497 | |

| Total liabilities | |

| 108,788 | | |

| 150,889 | |

| Stockholders’ equity | |

| | | |

| | |

Common stock, $0.001 par value; 60,000 shares authorized; issued and

outstanding shares were 27,084 at September 30, 2024 and 26,828 at December 31, 2023 | |

| 27 | | |

| 27 | |

| Additional paid-in capital | |

| 680,641 | | |

| 646,352 | |

| Accumulated deficit | |

| (418,802 | ) | |

| (367,866 | ) |

| Total stockholders’ equity | |

| 261,866 | | |

| 278,513 | |

| Total liabilities and stockholders’ equity | |

$ | 370,654 | | |

$ | 429,402 | |

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

(unaudited)

| | |

Three Months Ended | |

Nine Months Ended |

| | |

September 30, | |

September 30, |

| (in thousands, except per share data) | |

2024 | |

2023 | |

2024 | |

2023 |

| Revenue: | |

| |

| |

| |

|

| Collaboration revenue | |

$ | 38,815 | | |

$ | 43,376 | | |

$ | 117,389 | | |

$ | 132,670 | |

| Grant revenue | |

| 2,858 | | |

| 1,764 | | |

| 12,155 | | |

| 3,274 | |

| Total revenue | |

| 41,673 | | |

| 45,140 | | |

| 129,544 | | |

| 135,944 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development, net | |

| 39,134 | | |

| 51,077 | | |

| 151,376 | | |

| 155,513 | |

| General and administrative | |

| 13,276 | | |

| 13,377 | | |

| 40,443 | | |

| 40,364 | |

| Total operating expenses | |

| 52,410 | | |

| 64,454 | | |

| 191,819 | | |

| 195,877 | |

| Loss from operations | |

| (10,737 | ) | |

| (19,314 | ) | |

| (62,275 | ) | |

| (59,933 | ) |

| (Loss) gain from foreign currency | |

| (201 | ) | |

| 4 | | |

| (642 | ) | |

| (175 | ) |

| Gain on debt extinguishment | |

| — | | |

| — | | |

| — | | |

| 33,953 | |

| Finance income, net | |

| 3,818 | | |

| 3,981 | | |

| 11,981 | | |

| 9,710 | |

| Net loss before income taxes | |

| (7,120 | ) | |

| (15,329 | ) | |

| (50,936 | ) | |

| (16,445 | ) |

| Provision for income taxes | |

| (217 | ) | |

| 893 | | |

| — | | |

| 1,573 | |

| Net loss | |

$ | (6,903 | ) | |

$ | (16,222 | ) | |

$ | (50,936 | ) | |

$ | (18,018 | ) |

| Net loss per share, basic and diluted | |

$ | (0.26 | ) | |

$ | (0.61 | ) | |

$ | (1.89 | ) | |

$ | (0.68 | ) |

| Weighted-average shares outstanding, basic and diluted | |

| 27,062 | | |

| 26,574 | | |

| 26,970 | | |

| 26,559 | |

| Comprehensive loss: | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (6,903 | ) | |

$ | (16,222 | ) | |

$ | (50,936 | ) | |

$ | (18,018 | ) |

| Comprehensive loss | |

$ | (6,903 | ) | |

$ | (16,222 | ) | |

$ | (50,936 | ) | |

$ | (18,018 | ) |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

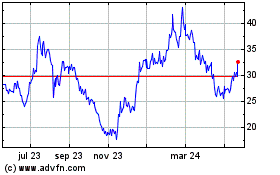

Arcturus Therapeutics (NASDAQ:ARCT)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

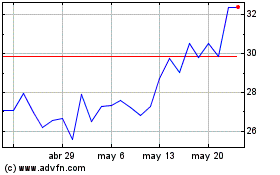

Arcturus Therapeutics (NASDAQ:ARCT)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025