Atour Lifestyle Holdings Limited (“Atour” or the “Company”)

(NASDAQ: ATAT), a leading hospitality and lifestyle company in

China, today announced its unaudited financial results for the

second quarter ended June 30, 2024.

Second

Quarter of 2024

Operational Highlights

As of June 30, 2024, there were 1,412 hotels

with a total of 161,686 hotel rooms in operation across Atour’s

hotel network, representing rapid increases of 36.6% and 34.3%

year-over-year in terms of the number of hotels and hotel rooms,

respectively. As of June 30, 2024, there were 712 manachised hotels

under development in our pipeline.

The average daily room rate4 (“ADR”) was RMB441

for the second quarter of 2024, compared with RMB475 for the same

period of 2023 and RMB430 for the first quarter of 2024.

The occupancy rate4 was 78.4% for the second

quarter of 2024, compared with 77.1% for the same period of 2023

and 73.3% for the first quarter of 2024.

The revenue per available room4 (“RevPAR”) was

RMB359 for the second quarter of 2024, compared with RMB384 for the

same period of 2023 and RMB328 for the first quarter of 2024.

The GMV5 generated from our retail business was

RMB620 million for the second quarter of 2024, representing an

increase of 157.6% year-over-year.

“Driven by the synergistic growth of our

accommodation and retail businesses, we delivered a strong

performance for the second quarter of 2024, further solidifying our

industry leadership,” said Mr. Haijun Wang, Founder, Chairman and

CEO of Atour. “Our hotel network expansion maintained its vigorous

momentum with 123 new openings in the second quarter, representing

a new quarterly record. As of the end of the second quarter, we had

a total of 1,412 hotels in operation, representing a 36.6%

year-over-year increase, which accelerates the progress toward our

goal of 2,000 premier hotels nationwide by 2025. In the second

quarter, while RevPAR declined year-over-year primarily due to a

high base effect, our occupancy rate remained solid, reaching

101.7% of 2023’s level for the same period. Additionally, our

retail business continued to deliver exceptional performance in the

second quarter, with GMV up by 157.6% year-over-year to RMB620

million, as a result of our efficient new product development and

ongoing product offering expansion.

“Looking ahead to the second half of 2024, we

will continue propelling progress with our deep understanding of

and ability to fulfill customer needs. By consistently enhancing

the ‘Chinese Experience’, we will promote comprehensive,

high-quality growth across our Group’s businesses and brand

portfolio,” concluded Mr. Wang.

Second Quarter of 2024 Unaudited Financial

Results

|

(RMB in thousands) |

|

Q2 2023 |

|

Q2 2024 |

|

|

|

|

|

|

Revenues: |

|

|

|

|

| Manachised hotels |

|

626,483 |

|

1,026,979 |

| Leased hotels |

|

219,524 |

|

180,333 |

| Retail |

|

211,648 |

|

536,734 |

| Others |

|

35,054 |

|

53,001 |

| Net

revenues |

|

1,092,709 |

|

1,797,047 |

| |

|

|

|

|

Net revenues. Our net revenues

for the second quarter of 2024 increased by 64.5% to RMB1,797

million (US$247 million) from RMB1,093 million for the same period

of 2023, mainly driven by the growth in manachised hotel and retail

businesses.

- Manachised hotels. Revenues from

our manachised hotels for the second quarter of 2024 increased by

63.9% to RMB1,027 million (US$141 million) from RMB626 million for

the same period of 2023. This increase was primarily driven by our

ongoing hotel network expansion and the rapid growth of our supply

chain business. The total number of our manachised hotels increased

from 1,001 as of June 30, 2023 to 1,382 as of June 30, 2024. RevPAR

of our manachised hotels was RMB355 for the second quarter of 2024,

compared with RMB377 for the same period of 2023.

- Leased hotels. Revenues from our

leased hotels for the second quarter of 2024 decreased by 17.9% to

RMB180 million (US$25 million) from RMB220 million for the same

period of 2023, primarily due to a decrease in the number of leased

hotels as a result of our product mix optimization, as well as a

decrease in RevPAR. RevPAR of our leased hotels was RMB503 for the

second quarter of 2024, compared with RMB537 for the same period of

2023.

- Retail. Revenues from retail for

the second quarter of 2024 increased by 153.6% to RMB537 million

(US$74 million) from RMB212 million for the same period of 2023.

This increase was driven by widespread recognition of our retail

brands and effective product innovation and development as we

successfully broadened our range of product offerings. In the

second quarter of 2024, comforters sales accounted for over 20% of

retail revenues, further accelerating the growth of our retail

business.

- Others. Revenues from others for

the second quarter of 2024 increased by 51.2% to RMB53 million

(US$7 million) from RMB35 million for the same period of 2023. This

increase was driven by our fast-growing membership business.

| |

Q2 2023 |

|

Q2 2024 |

| (RMB in thousands) |

|

|

| Operating costs and

expenses: |

|

|

|

Hotel operating costs |

(509,513 |

) |

|

(775,753 |

) |

|

Retail costs |

(107,560 |

) |

|

(265,003 |

) |

|

Other operating costs |

(13,261 |

) |

|

(9,918 |

) |

|

Selling and marketing expenses |

(94,400 |

) |

|

(224,607 |

) |

|

General and administrative expenses |

(73,450 |

) |

|

(91,488 |

) |

|

Technology and development expenses |

(17,831 |

) |

|

(32,952 |

) |

|

Total operating costs and expenses |

(816,015 |

) |

|

(1,399,721 |

) |

|

|

|

|

|

|

|

Operating costs and expenses

for the second quarter of 2024 were RMB1,400 million (US$193

million), including RMB24 million share-based compensation

expenses, compared with RMB816 million, including RMB10 million

share-based compensation expenses for the same period of 2023.

- Hotel operating costs for the

second quarter of 2024 were RMB776 million (US$107 million),

compared with RMB510 million for the same period of 2023. This

increase was mainly due to the increase in variable costs, such as

supply chain costs, associated with our ongoing hotel network

expansion. Hotel operating costs accounted for 64.3% of manachised

and leased hotels’ revenues for the second quarter of 2024,

compared with 60.2% for the same period of 2023. This increase was

due to a decrease in RevPAR attributable to the high base effect in

the same period of 2023, as well as an increased share of revenue

generated by the lower-margin supply chain business.

- Retail costs for the second quarter

of 2024 were RMB265 million (US$36 million), compared with RMB108

million for the same period of 2023. This increase was associated

with the rapid growth of our retail business. Retail costs

accounted for 49.4% of retail revenues for the second quarter of

2024, compared with 50.8% for the same period of 2023. This

decrease was attributable to an increasing contribution from

higher-margin online sales.

- Other operating costs for the

second quarter of 2024 were RMB10 million (US$1.4 million),

compared with RMB13 million for the same period of 2023.

- Selling and marketing expenses for

the second quarter of 2024 were RMB225 million (US$31 million),

compared with RMB94 million for the same period of 2023. This

increase was mainly due to our enhanced investment in brand

recognition and the effective development of online channels,

aligned with the growth of our retail business. Selling and

marketing expenses accounted for 12.5% of net revenues for the

second quarter of 2024, compared with 8.6% for the same period of

2023.

- General and administrative expenses

for the second quarter of 2024 were RMB91 million (US$13 million),

including RMB15 million share-based compensation expenses, compared

with RMB73 million, including RMB9 million share-based compensation

expenses for the same period of 2023. Excluding the share-based

compensation expenses, this increase was primarily due to an

increase in labor costs. General and administrative expenses,

excluding share-based compensation expenses, accounted for 4.2% of

net revenues for the second quarter of 2024, compared with 5.9% for

the same period of 2023.

- Technology and development expenses

for the second quarter of 2024 were RMB33 million (US$5 million),

compared with RMB18 million for the same period of 2023. This

increase was mainly attributable to our increased investments in

technology systems and infrastructure to support our expanding

hotel network and retail business and improve customer experience.

Technology and development expenses accounted for 1.8% of net

revenues for the second quarter of 2024, compared with 1.6% for the

same period of 2023.

Other operating income

(expenses), net for the second quarter of 2024 was

RMB6 million (US$0.8 million) expenses, compared with RMB30 million

income for the same period of 2023. This decrease was primarily due

to the decrease in government subsidies.

Income from operations for the

second quarter of 2024 was RMB391 million (US$54 million), compared

with RMB307 million for the same period of 2023.

Income tax expense for the

second quarter of 2024 was RMB110 million (US$15 million), compared

with RMB79 million for the same period of 2023.

Net income for the second

quarter of 2024 was RMB304 million (US$42 million), representing an

increase of 27.1% year-over-year compared with RMB239 million for

the same period of 2023.

Adjusted net income (non-GAAP)

for the second quarter of 2024 was RMB328 million (US$45 million),

representing an increase of 31.6% year-over-year compared with

RMB249 million for the same period of 2023.

Basic and diluted income

per share/American depositary share (ADS). For the

second quarter of 2024, basic income per share was RMB0.73

(US$0.10), and diluted income per share was RMB0.73 (US$0.10).

Basic income per ADS for the second quarter of 2024 was RMB2.20

(US$0.30), and diluted income per ADS was RMB2.19 (US$0.30).

EBITDA (non-GAAP) for the

second quarter of 2024 was RMB419 million (US$58 million),

representing an increase of 25.3% compared with RMB334 million for

the same period of 2023.

Adjusted EBITDA (non-GAAP) for

the second quarter of 2024 was RMB443 million (US$61 million),

representing an increase of 28.6% compared with RMB344 million for

the same period of 2023.

Cash flows. Operating cash

inflow for the second quarter of 2024 was RMB577 million (US$79

million). Investing cash outflow for the second quarter of 2024 was

RMB306 million (US$42 million). There were no cash flows from

financing activities for the second quarter of 2024.

Cash and cash equivalents and restricted

cash. As of June 30, 2024, the Company had a total balance

of cash and cash equivalents and restricted cash of RMB3.3 billion

(US$457 million).

Debt financing. As of June 30,

2024, the Company had total outstanding borrowings of RMB92 million

(US$13 million), and the unutilized credit facility available to

the Company was RMB450 million.

Outlook

For the full year of 2024, the Company currently expects total

net revenues to increase by 48% to 52% compared with full-year

2023.

This outlook is based on current market conditions and the

Company’s preliminary estimates, which are subject to changes.

__________________________________1 Adjusted net

income (non-GAAP) is defined as net income excluding share-based

compensation expenses.2 EBITDA (non-GAAP) is defined as earnings

before interest expense, interest income, income tax expense and

depreciation and amortization.3 Adjusted EBITDA (non-GAAP) is

defined as EBITDA excluding share-based compensation expenses.4

Excludes hotel rooms that were previously requisitioned by the

government for quarantine needs in response to the COVID-19

outbreak or otherwise became unavailable due to temporary hotel

closures. In the second quarter of 2024, no hotels were

requisitioned for quarantine needs. ADR and RevPAR are calculated

based on tax-inclusive room rates.“ADR” refers to the average daily

room rate, which means room revenue divided by the number of rooms

in use for a given period;“Occupancy rate” refers to the number of

rooms in use divided by the number of available rooms for a given

period;“RevPAR” refers to revenue per available room, which is

calculated by total revenues during a period divided by the number

of available rooms of our hotels during the same period.5 “GMV”

refers to gross merchandise value, which is the total value of

confirmed orders placed and paid for by our end customers with us

or our franchisees, as the case may be, and sold as part of our

retail business, where the ordered products have been dispatched,

regardless of whether they are delivered or returned, calculated

based on the prices of the ordered products net of any discounts

offered to our end customers.

Conference Call

The Company will host a conference call at 7:00

AM U.S. Eastern time on Thursday, August 29, 2023 (or 7:00 PM

Beijing/Hong Kong time on the same day).

A live webcast of the conference call will be

available on the Company’s investor relations website

at https://ir.yaduo.com, and a replay of the webcast will be

available following the session.

For participants who wish to join the conference

call via telephone, please pre-register using the link provided

below. Upon registration, each participant will receive a set of

participant dial-in numbers and a personal PIN to join the

conference call.

Details for the conference call are as follows:

Event Title: Atour Second Quarter 2024 Earnings Conference Call

Pre-registration

Link: https://register.vevent.com/register/BIbfa7010eae7841bcbc827b0194809f7c

Use of Non-GAAP Financial Measures

To supplement the Company’s unaudited

consolidated financial results presented in accordance with U.S.

Generally-Accepted Accounting Principles (“GAAP”), the Company uses

the following non-GAAP measures defined as non-GAAP financial

measures by the U.S. Securities and Exchange Commission: adjusted

net income, which is defined as net income excluding share-based

compensation expenses; EBITDA, which is defined as earnings before

interest expense, interest income, income tax expense and

depreciation and amortization; adjusted EBITDA, which is defined as

EBITDA excluding share-based compensation expenses. The

presentation of these non-GAAP financial measures is not intended

to be considered in isolation or as a substitute for the financial

information prepared and presented in accordance with U.S. GAAP.

For more information on these non-GAAP financial measures, please

see the table captioned “Reconciliations of GAAP and non-GAAP

results” set forth at the end of this release.

The Company believes that EBITDA is widely used

by other companies in the hospitality industry and may be used by

investors as a measure of the financial performance. Given the

significant investments that the Company has made in leasehold

improvements and other fixed assets of leased hotels, depreciation

and amortization comprises a significant portion of the Company’s

cost structure. The Company believes that EBITDA will provide

investors with a useful tool for comparability between periods

because it eliminates depreciation and amortization attributable to

capital expenditures. Adjusted net income and adjusted EBITDA

provide meaningful supplemental information regarding the Company’s

performance by excluding share-based compensation expenses, as the

investors can better understand the Company’s performance and

compare business trends among different reporting periods on a

consistent basis, excluding share-based compensation expenses,

which are not expected to result in cash payment. The Company

believes that both management and investors benefit from referring

to these non-GAAP financial measures in assessing the Company’s

performance and when planning and forecasting future periods. These

non-GAAP financial measures also facilitate management’s internal

comparisons to the Company’s historical performance. The Company

believes these non-GAAP financial measures are also useful to

investors in allowing for greater transparency with respect to

supplemental information used regularly by Company management in

financial and operational decision-making. The accompanying tables

provide more details on the reconciliations between GAAP financial

measures that are most directly comparable to non-GAAP financial

measures.

The use of these non-GAAP measures has certain

limitations, as the excluded items have been and will be incurred,

and are not reflected in the presentation of these non-GAAP

measures. Each of these items should also be considered in the

overall evaluation of the results. The Company compensates for

these limitations by providing the disclosure of the relevant items

both in its reconciliations to the U.S. GAAP financial measures and

in its consolidated financial statements, all of which should be

considered when evaluating the performance of the Company.

In addition, these measures may not be

comparable to similarly titled measures utilized by other

companies, as these companies may not calculate these measures in

the same manner as the Company does.

About Atour Lifestyle Holdings Limited

Atour Lifestyle Holdings Limited (NASDAQ: ATAT)

is a leading hospitality and lifestyle company in China, with a

distinct portfolio of lifestyle hotel brands. Atour is the leading

upper midscale hotel chain in China and is the first Chinese hotel

chain to develop scenario-based retail business. Atour is committed

to bringing innovations to China’s hospitality industry and

building new lifestyle brands around hotel offerings.

For more information, please visit

https://ir.yaduo.com.

Investor Relations Contact

Atour Lifestyle Holdings LimitedEmail: ir@yaduo.com

Piacente Financial CommunicationsEmail: Atour@tpg-ir.comTel:

+86-10-6508-0677

—Financial Tables and Operational Data

Follow—

|

ATOUR LIFESTYLE HOLDINGS LIMITED UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS |

|

(All amounts in thousands, except share data and per share

data, or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

As of |

|

As of |

|

|

|

December 31, |

|

June 30, |

|

|

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

USD1 |

| Assets |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

2,840,807 |

|

3,322,879 |

|

457,243 |

| Short-term investments |

|

751,794 |

|

1,008,571 |

|

138,784 |

| Accounts receivable |

|

162,101 |

|

165,286 |

|

22,744 |

| Prepayments and other current

assets |

|

251,900 |

|

264,441 |

|

36,388 |

| Amounts due from related

parties |

|

115,900 |

|

123,460 |

|

16,989 |

| Inventories |

|

119,078 |

|

160,889 |

|

22,139 |

| Total current

assets |

|

4,241,580 |

|

5,045,526 |

|

694,287 |

| Non-current

assets |

|

|

|

|

|

|

| Restricted cash |

|

946 |

|

1,106 |

|

152 |

| Contract costs |

|

98,220 |

|

111,507 |

|

15,344 |

| Property and equipment,

net |

|

266,120 |

|

262,381 |

|

36,105 |

| Operating lease right-of-use

assets |

|

1,712,580 |

|

1,559,106 |

|

214,540 |

| Intangible assets, net |

|

4,247 |

|

3,957 |

|

545 |

| Goodwill |

|

17,446 |

|

17,446 |

|

2,401 |

| Other assets |

|

100,939 |

|

90,960 |

|

12,517 |

| Deferred tax assets |

|

144,947 |

|

193,091 |

|

26,570 |

| Total non-current

assets |

|

2,345,445 |

|

2,239,554 |

|

308,174 |

| Total

assets |

|

6,587,025 |

|

7,285,080 |

|

1,002,461 |

|

|

|

|

|

|

|

|

| Liabilities and

shareholders’ equity |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

| Operating lease liabilities,

current |

|

295,721 |

|

310,466 |

|

42,722 |

| Accounts payable |

|

594,545 |

|

669,883 |

|

92,179 |

| Deferred revenue, current |

|

406,066 |

|

437,106 |

|

60,148 |

| Salary and welfare

payable |

|

189,823 |

|

179,166 |

|

24,654 |

| Accrued expenses and other

payables |

|

684,391 |

|

742,120 |

|

102,118 |

| Income taxes payable |

|

136,201 |

|

106,381 |

|

14,639 |

| Short-term borrowings |

|

70,000 |

|

90,000 |

|

12,384 |

| Amounts due to related

parties |

|

1,104 |

|

2,932 |

|

403 |

| Total current

liabilities |

|

2,377,851 |

|

2,538,054 |

|

349,247 |

| Non-current

liabilities |

|

|

|

|

|

|

| Operating lease liabilities,

non-current |

|

1,583,178 |

|

1,422,930 |

|

195,802 |

| Deferred revenue,

non-current |

|

369,455 |

|

433,037 |

|

59,588 |

| Long-term borrowings,

non-current portion |

|

2,000 |

|

2,000 |

|

275 |

|

Other non-current liabilities |

|

194,452 |

|

227,198 |

|

31,263 |

| Total non-current

liabilities |

|

2,149,085 |

|

2,085,165 |

|

286,928 |

| Total

liabilities |

|

4,526,936 |

|

4,623,219 |

|

636,175 |

__________________________________

1 Translations of balances in the consolidated

financial statements from RMB into US$ for the second quarter of

2024 and as of June 30, 2024 are solely for readers’ convenience

and were calculated at the rate of US$1.00=RMB 7.2672, representing

the exchange rate set forth in the H.10 statistical release of the

Federal Reserve Board on June 28, 2024.

|

ATOUR LIFESTYLE HOLDINGS LIMITED UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS |

|

(All amounts in thousands, except share data and per share

data, or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

As of |

|

As of |

|

|

|

December 31, |

|

June 30, |

|

|

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

USD1 |

| Shareholders’

equity |

|

|

|

|

|

|

|

Class A ordinary shares |

|

244 |

|

|

258 |

|

|

36 |

|

|

Class B ordinary shares |

|

56 |

|

|

56 |

|

|

8 |

|

|

Additional paid in capital |

|

1,555,773 |

|

|

1,582,786 |

|

|

217,799 |

|

| Retained earnings |

|

507,226 |

|

|

1,068,036 |

|

|

146,967 |

|

| Accumulated other

comprehensive income |

|

4,769 |

|

|

17,900 |

|

|

2,463 |

|

| Total

equity attributable to shareholders of the

Company |

|

2,068,068 |

|

|

2,669,036 |

|

|

367,273 |

|

| Non-controlling interests |

|

(7,979 |

) |

|

(7,175 |

) |

|

(987 |

) |

| Total

shareholders’ equity |

|

2,060,089 |

|

|

2,661,861 |

|

|

366,286 |

|

| Commitments and

contingencies |

|

- |

|

|

- |

|

|

- |

|

| Total liabilities and

shareholders’ equity |

|

6,587,025 |

|

|

7,285,080 |

|

|

1,002,461 |

|

|

ATOUR LIFESTYLE HOLDINGS LIMITED UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

|

(All amounts in thousands, except share data and per share

data, or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

USD1 |

|

RMB |

|

RMB |

|

USD1 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Manachised hotels |

|

626,483 |

|

|

1,026,979 |

|

|

141,317 |

|

|

1,073,281 |

|

|

1,863,090 |

|

|

256,370 |

|

|

Leased hotels |

|

219,524 |

|

|

180,333 |

|

|

24,815 |

|

|

406,834 |

|

|

348,382 |

|

|

47,939 |

|

|

Retail |

|

211,648 |

|

|

536,734 |

|

|

73,857 |

|

|

324,581 |

|

|

953,325 |

|

|

131,182 |

|

|

Others |

|

35,054 |

|

|

53,001 |

|

|

7,293 |

|

|

61,949 |

|

|

100,543 |

|

|

13,835 |

|

| Net

revenues |

|

1,092,709 |

|

|

1,797,047 |

|

|

247,282 |

|

|

1,866,645 |

|

|

3,265,340 |

|

|

449,326 |

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotel operating costs |

|

(509,513 |

) |

|

(775,753 |

) |

|

(106,747 |

) |

|

(891,145 |

) |

|

(1,437,922 |

) |

|

(197,865 |

) |

|

Retail costs |

|

(107,560 |

) |

|

(265,003 |

) |

|

(36,466 |

) |

|

(169,077 |

) |

|

(471,106 |

) |

|

(64,826 |

) |

|

Other operating costs |

|

(13,261 |

) |

|

(9,918 |

) |

|

(1,365 |

) |

|

(23,398 |

) |

|

(19,744 |

) |

|

(2,717 |

) |

| Selling and marketing

expenses |

|

(94,400 |

) |

|

(224,607 |

) |

|

(30,907 |

) |

|

(150,409 |

) |

|

(399,318 |

) |

|

(54,948 |

) |

| General and administrative

expenses |

|

(73,450 |

) |

|

(91,488 |

) |

|

(12,589 |

) |

|

(266,654 |

) |

|

(168,143 |

) |

|

(23,137 |

) |

| Technology and development

expenses |

|

(17,831 |

) |

|

(32,952 |

) |

|

(4,534 |

) |

|

(34,621 |

) |

|

(57,133 |

) |

|

(7,862 |

) |

| Total operating costs

and expenses |

|

(816,015 |

) |

|

(1,399,721 |

) |

|

(192,608 |

) |

|

(1,535,304 |

) |

|

(2,553,366 |

) |

|

(351,355 |

) |

| Other operating income

(expenses), net |

|

29,948 |

|

|

(5,943 |

) |

|

(818 |

) |

|

37,178 |

|

|

4,066 |

|

|

560 |

|

| Income from

operations |

|

306,642 |

|

|

391,383 |

|

|

53,856 |

|

|

368,519 |

|

|

716,040 |

|

|

98,531 |

|

| Interest income |

|

7,513 |

|

|

12,396 |

|

|

1,706 |

|

|

12,356 |

|

|

25,915 |

|

|

3,566 |

|

| Gain from short-term

investments |

|

8,968 |

|

|

10,945 |

|

|

1,506 |

|

|

14,322 |

|

|

20,537 |

|

|

2,826 |

|

| Interest expense |

|

(1,676 |

) |

|

(854 |

) |

|

(118 |

) |

|

(3,603 |

) |

|

(1,527 |

) |

|

(210 |

) |

| Other expenses, net |

|

(3,522 |

) |

|

(85 |

) |

|

(12 |

) |

|

(2,971 |

) |

|

(551 |

) |

|

(76 |

) |

| Income before income

tax |

|

317,925 |

|

|

413,785 |

|

|

56,938 |

|

|

388,623 |

|

|

760,414 |

|

|

104,637 |

|

| Income tax expense |

|

(78,770 |

) |

|

(109,879 |

) |

|

(15,120 |

) |

|

(131,396 |

) |

|

(198,800 |

) |

|

(27,356 |

) |

| Net

income |

|

239,155 |

|

|

303,906 |

|

|

41,818 |

|

|

257,227 |

|

|

561,614 |

|

|

77,281 |

|

| Less: net income attributable

to non-controlling interests |

|

965 |

|

|

254 |

|

|

35 |

|

|

1,162 |

|

|

804 |

|

|

111 |

|

| Net income

attributable to the Company |

|

238,190 |

|

|

303,652 |

|

|

41,783 |

|

|

256,065 |

|

|

560,810 |

|

|

77,170 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

239,155 |

|

|

303,906 |

|

|

41,818 |

|

|

257,227 |

|

|

561,614 |

|

|

77,281 |

|

| Other comprehensive

income |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustments, net of nil income taxes |

|

25,072 |

|

|

5,622 |

|

|

774 |

|

|

22,992 |

|

|

13,131 |

|

|

1,807 |

|

| Other comprehensive

income, net of income taxes |

|

25,072 |

|

|

5,622 |

|

|

774 |

|

|

22,992 |

|

|

13,131 |

|

|

1,807 |

|

| Total comprehensive

income |

|

264,227 |

|

|

309,528 |

|

|

42,592 |

|

|

280,219 |

|

|

574,745 |

|

|

79,088 |

|

| Comprehensive income

attributable to non-controlling interests |

|

965 |

|

|

254 |

|

|

35 |

|

|

1,162 |

|

|

804 |

|

|

111 |

|

| Comprehensive income

attributable to the Company |

|

263,262 |

|

|

309,274 |

|

|

42,557 |

|

|

279,057 |

|

|

573,941 |

|

|

78,977 |

|

| Net income per ordinary

share |

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

0.59 |

|

|

0.73 |

|

|

0.10 |

|

|

0.64 |

|

|

1.36 |

|

|

0.19 |

|

| —Diluted |

|

0.57 |

|

|

0.73 |

|

|

0.10 |

|

|

0.62 |

|

|

1.35 |

|

|

0.19 |

|

| Weighted average ordinary

shares used in calculating net income per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

402,763,517 |

|

|

413,244,101 |

|

|

413,244,101 |

|

|

398,389,853 |

|

|

413,042,603 |

|

|

413,042,603 |

|

| —Diluted |

|

414,773,664 |

|

|

416,487,748 |

|

|

416,487,748 |

|

|

413,553,602 |

|

|

416,300,958 |

|

|

416,300,958 |

|

|

ATOUR LIFESTYLE HOLDINGS LIMITED UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

(In thousands of RMB, except share data and per share data,

or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

USD1 |

|

RMB |

|

RMB |

|

USD1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash generated from operating activities |

|

519,908 |

|

|

576,641 |

|

|

79,347 |

|

|

881,565 |

|

|

719,877 |

|

|

99,061 |

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Payment for purchases of

property and equipment |

|

(9,791 |

) |

|

(20,136 |

) |

|

(2,771 |

) |

|

(27,410 |

) |

|

(32,751 |

) |

|

(4,507 |

) |

| Payment for purchases of

intangible assets |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

(282 |

) |

|

(39 |

) |

| Payment for purchases of

short-term investments |

|

(2,003,860 |

) |

|

(4,578,000 |

) |

|

(629,953 |

) |

|

(3,332,210 |

) |

|

(7,242,000 |

) |

|

(996,532 |

) |

| Proceeds from maturities of

short-term investments |

|

2,162,234 |

|

|

4,291,899 |

|

|

590,585 |

|

|

3,494,694 |

|

|

7,005,760 |

|

|

964,025 |

|

| Net cash generated

from (used in) investing activities |

|

148,583 |

|

|

(306,237 |

) |

|

(42,139 |

) |

|

135,074 |

|

|

(269,273 |

) |

|

(37,053 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from borrowings |

|

- |

|

|

- |

|

|

- |

|

|

40,000 |

|

|

20,000 |

|

|

2,752 |

|

| Repayment of borrowings |

|

(140,130 |

) |

|

- |

|

|

- |

|

|

(141,110 |

) |

|

- |

|

|

- |

|

| Net cash (used in)

generated from financing activities |

|

(140,130 |

) |

|

- |

|

|

- |

|

|

(101,110 |

) |

|

20,000 |

|

|

2,752 |

|

| Effect of exchange rate

changes on cash and cash equivalents and restricted cash |

|

25,072 |

|

|

4,227 |

|

|

582 |

|

|

23,670 |

|

|

11,628 |

|

|

1,600 |

|

| Net increase in cash

and cash equivalents and restricted cash |

|

553,433 |

|

|

274,631 |

|

|

37,790 |

|

|

939,199 |

|

|

482,232 |

|

|

66,360 |

|

| Cash and cash equivalents and

restricted cash at the beginning of the period |

|

1,975,873 |

|

|

3,049,354 |

|

|

419,605 |

|

|

1,590,107 |

|

|

2,841,753 |

|

|

391,038 |

|

| Cash and cash

equivalents and restricted cash at the end of the

period |

|

2,529,306 |

|

|

3,323,985 |

|

|

457,395 |

|

|

2,529,306 |

|

|

3,323,985 |

|

|

457,398 |

|

|

ATOUR LIFESTYLE HOLDINGS LIMITED UNAUDITED RECONCILIATION

OF GAAP AND NON-GAAP RESULTS |

|

(In thousands of RMB, except share data and per share data,

or otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

USD1 |

|

RMB |

|

RMB |

|

USD1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (GAAP) |

|

239,155 |

|

|

303,906 |

|

|

41,818 |

|

|

257,227 |

|

|

561,614 |

|

|

77,281 |

|

| Share-based compensation

expenses, net of tax effect of nil2 |

|

9,998 |

|

|

23,885 |

|

|

3,287 |

|

|

151,578 |

|

|

27,027 |

|

|

3,719 |

|

| Adjusted net income

(non-GAAP) |

|

249,153 |

|

|

327,791 |

|

|

45,105 |

|

|

408,805 |

|

|

588,641 |

|

|

81,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

|

|

RMB |

|

RMB |

|

USD1 |

|

RMB |

|

RMB |

|

USD1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(GAAP) |

|

239,155 |

|

|

303,906 |

|

|

41,818 |

|

|

257,227 |

|

|

561,614 |

|

|

77,281 |

|

| Interest income |

|

(7,513 |

) |

|

(12,396 |

) |

|

(1,706 |

) |

|

(12,356 |

) |

|

(25,915 |

) |

|

(3,566 |

) |

| Interest expense |

|

1,676 |

|

|

854 |

|

|

118 |

|

|

3,603 |

|

|

1,527 |

|

|

210 |

|

| Income tax expense |

|

78,770 |

|

|

109,879 |

|

|

15,120 |

|

|

131,396 |

|

|

198,800 |

|

|

27,356 |

|

| Depreciation and

amortization |

|

22,289 |

|

|

16,690 |

|

|

2,297 |

|

|

44,186 |

|

|

33,839 |

|

|

4,656 |

|

| EBITDA

(non-GAAP) |

|

334,377 |

|

|

418,933 |

|

|

57,647 |

|

|

424,056 |

|

|

769,865 |

|

|

105,937 |

|

| Share-based compensation

expenses |

|

9,998 |

|

|

23,885 |

|

|

3,287 |

|

|

151,578 |

|

|

27,027 |

|

|

3,719 |

|

| Adjusted EBITDA

(non-GAAP) |

|

344,375 |

|

|

442,818 |

|

|

60,934 |

|

|

575,634 |

|

|

796,892 |

|

|

109,656 |

|

__________________________________2 The

share-based compensation expenses were recorded at entities in PRC.

Share-based compensation expenses were non-deductible expenses in

PRC. Therefore, there is no tax impact for share-based compensation

expenses adjustment for non-GAAP financial measures.

Key Operating Data

| |

Number of Hotels |

|

Number of Rooms |

|

|

Opened in Q2

2024 |

Closed in Q2

2024 |

As of June

30,

2024 |

|

As of June

30,

2024 |

| Manachised hotels |

123 |

12 |

1,382 |

|

157,225 |

| Leased hotels |

- |

1 |

30 |

|

4,461 |

| Total |

123 |

13 |

1,412 |

|

161,686 |

| Brand |

Positioning |

As of June 30, 2024 |

|

Properties |

Rooms |

|

Manachised |

Leased |

|

|

A.T. House |

Luxury |

- |

1 |

214 |

| Atour S |

Upscale |

66 |

5 |

10,421 |

| ZHOTEL |

Upscale |

1 |

- |

52 |

| Atour |

Upper midscale |

1,040 |

23 |

122,944 |

| Atour X |

Upper midscale |

153 |

- |

16,440 |

| Atour Light |

Midscale |

122 |

1 |

11,615 |

| Total |

|

1,382 |

30 |

161,686 |

|

|

All Hotels in Operation |

|

|

Three

Months EndedJune 30,

2023 |

|

Three

Months EndedMarch 31,

2024 |

|

Three

Months EndedJune 30,

2024 |

| |

|

|

|

|

|

| Occupancy rate3 (in

percentage) |

|

|

|

|

|

|

Manachised hotels |

76.8% |

|

73.1% |

|

78.2% |

|

Leased hotels |

83.0% |

|

79.3% |

|

83.7% |

|

All hotels |

77.1% |

|

73.3% |

|

78.4% |

| |

|

|

|

|

|

|

ADR3 (in RMB) |

|

|

|

|

|

|

Manachised hotels |

468.1 |

|

426.0 |

|

436.4 |

|

Leased hotels |

611.5 |

|

541.6 |

|

573.0 |

|

All hotels |

474.8 |

|

430.0 |

|

440.6 |

| |

|

|

|

|

|

|

RevPAR3 (in RMB) |

|

|

|

|

|

|

Manachised hotels |

376.6 |

|

323.7 |

|

354.5 |

|

Leased hotels |

536.8 |

|

455.2 |

|

503.3 |

|

All hotels |

383.6 |

|

327.9 |

|

358.7 |

|

|

Hotels in Operation for More Than 18 Months in Q2

20244 |

| |

Number of hotels |

|

Same-hotel Occupancy3(in

percentage) |

|

Same-hotel ADR3(in

RMB) |

|

Same-hotel RevPAR3(in

RMB) |

| |

Q2 2023 |

|

Q2 2024 |

|

Q2 2023 |

Q2 2024 |

|

Q2 2023 |

|

Q2 2024 |

|

Q2 2023 |

|

Q2 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manachised hotels |

859 |

|

859 |

|

77.9 |

% |

|

80.1 |

% |

|

471.3 |

|

445.5 |

|

384.6 |

|

370.8 |

|

Leased hotels |

30 |

|

30 |

|

83.1 |

% |

|

83.7 |

% |

|

613.7 |

|

572.8 |

|

540.0 |

|

503.1 |

|

All hotels |

889 |

|

889 |

|

78.1 |

% |

|

80.3 |

% |

|

477.8 |

|

451.1 |

|

391.3 |

|

376.5 |

__________________________________3 Excludes

hotel rooms that were previously requisitioned by the government

for quarantine needs in response to the COVID-19 outbreak or

otherwise became unavailable due to temporary hotel closures. In

the second quarter of 2024, no hotels were requisitioned for

quarantine needs. ADR and RevPAR are calculated based on

tax-inclusive room rates.4 For any given quarter, we define

“same-hotel” to be a hotel that has operated for a minimum of 18

calendar months as of the 15th day (inclusive) of any month within

that quarter. The OCC, ADR and RevPAR presented above represent

such metrics generated by “same hotels” in the second quarter of

2024, compared to the corresponding metrics generated by these

“same hotels” during the same period in 2023.

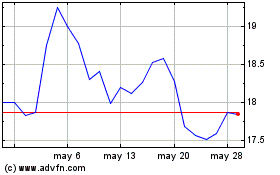

Atour Lifestyle (NASDAQ:ATAT)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Atour Lifestyle (NASDAQ:ATAT)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024