false

0000701288

0000701288

2024-05-28

2024-05-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 28, 2024

Atrion Corporation

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

| Delaware |

|

001-32982 |

|

63-0821819 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

One Allentown Parkway

Allen, Texas 75002 |

| (Address of principal executive offices) (Zip Code) |

| |

| (972) 390-9800 |

|

(Registrant’s telephone number, including

area code)

Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each

class |

Trading Symbol |

Name of exchange

on which registered |

| Common Stock, $0.10 par value per share |

ATRI |

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

ITEM 7.01 Regulation

FD

On May 28, 2024, Atrion Corporation, a Delaware corporation

(the “Company”) issued a press release announcing the execution of an Agreement and Plan of Merger, by and among Nordson

Corporation, an Ohio corporation (“Nordson”), Alpha Medical Merger Sub, Inc., a Delaware corporation and a wholly owned

subsidiary of Nordson and the Company. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information contained in this Item 7.01 and the

accompanying Exhibit 99.1 are furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of

1933, as amended, nor shall they be deemed incorporated by reference in any filing with the Securities and Exchange Commission (the “SEC”)

made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Cautionary Statement Regarding Forward-Looking Statements

Statements in this Current Report on Form 8-K

that are forward looking are based upon current expectations, and actual results or future events may differ materially. Therefore, the

inclusion of such forward-looking information should not be regarded as a representation by us that our objectives or plans will be achieved.

Such statements include, but are not limited to, statements regarding the financial and business impact and anticipated benefits of the

transaction, the closing of the transaction and the timing thereof, business plans and strategy, product launches and product performance

and impact. Words such as “expects,” “believes,” “anticipates,” “intends,” “should,”

“plans,” and variations of such words and similar expressions are intended to identify such forward-looking statements.

Forward-looking statements contained herein

involve numerous risks and uncertainties, including the risk factors described in Part I, Item 1A. Risk Factors in our most recent Annual

Report on Form 10-K and the specific risk factors discussed herein and in connection with forward-looking statements throughout this Current

Report on Form 8-K, and there are a number of factors that could cause actual results or future events to differ materially, including,

but not limited to, the following: the risk that the COVID-19 pandemic may again lead to material delays and cancellations of, or reduced

demand for, procedures in which our products are utilized; curtailed or delayed capital spending by hospitals and other healthcare providers;

disruption to our supply chain; closures of our facilities; delays in training; delays in gathering clinical evidence; diversion of management

and other resources to respond to the pandemic; the impact of global and regional economic and credit market conditions on healthcare

spending; the risk that the COVID-19 virus will again disrupt global economies and may cause economies in our key markets to enter prolonged

recessions; changing economic, market and business conditions; acts of war or terrorism; the effects of governmental regulation; the impact

of competition and new technologies; slower-than-anticipated introduction of new products or implementation of marketing strategies; implementation

of new manufacturing processes or implementation of new information systems; our ability to protect our intellectual property; changes

in the prices of raw materials; changes in product mix; intellectual property and product liability claims and product recalls; the ability

to attract and retain qualified personnel; the loss of, or any material reduction in sales to any significant customers; business disruptions

(including disruptions in relationships with employees, customers or suppliers) following the announcement and/or closing of the proposed

transaction; and the conditions to the completion of the proposed transaction, including the fact that the receipt of the required regulatory

approvals and clearances, may not be satisfied at all or in a timely manner; the fact that the closing of the proposed transaction may

not occur or may be delayed. In addition, assumptions relating to budgeting, marketing, product development and other management decisions

are subjective in many respects and thus susceptible to interpretations and periodic review which may cause us to alter our marketing,

capital expenditures or other budgets, which in turn may affect our results of operations and financial condition. These risks and uncertainties,

in some cases, have affected and in the future could affect our ability to implement our business strategy and may cause actual results

to differ materially from those contemplated by the statements expressed in this Current Report on Form 8-K. New risks and uncertainties

may arise from time to time and are difficult to predict. All of these factors are difficult or impossible to predict accurately and many

of them are beyond our control. As a result, readers are cautioned not to place undue reliance on any of our forward-looking statements.

For a further list and description of these and other

important risks and uncertainties that may affect our future operations, refer to Part I, Item 1A. Risk Factors in our most recent

Annual Report on Form 10-K filed with the SEC, which we may update in Part II, Item 1A. Risk Factors in subsequent Quarterly Reports

on Form 10-Q that we will file hereafter. The forward-looking statements in this Current Report on Form 8-K are made as of the date hereof,

and we do not undertake any obligation, and disclaim any duty, to supplement, update or revise such statements, whether as a result of

subsequent events, changed expectations or otherwise, except as required by applicable law. This cautionary statement is applicable to

all forward-looking statements contained in this Current Report on Form 8-K.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This Current Report on Form 8-K does not constitute

an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the

proposed transaction, the Company plans to file a proxy statement with the SEC. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY

STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND OTHER RELEVANT DOCUMENTS

IN CONNECTION WITH THE PROPOSED TRANSACTION THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Stockholders and investors will be able

to obtain free copies of the proxy statement and other relevant materials (when they become available) and other documents filed by the

Company at the SEC’s website at www.sec.gov.

PARTICIPANTS IN THE SOLICITATION

The Company, Nordson and certain of their respective

directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders

in connection with the proposed transaction. Information regarding the Company’s directors and executive officers, including a description

of their respective direct or indirect interests, by security holdings or otherwise, will be included in the proxy statement described

above. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov or by accessing the

Investor Relations section of the Company’s website at www.atrioncorp.com. Information regarding the Company’s directors and

executive officers is contained in the sections entitled “Election of Directors” and “Securities Ownership”

included in the Company’s proxy statement for the 2024 annual meeting of stockholders, which was filed with the SEC on April 9,

2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/701288/000110465924044922/tm242747d4_def14a.htm)

and in the section entitled “Directors, Executive Officers and Corporate Governance” included in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 29, 2024 (and which is available

at https://www.sec.gov/ix?doc=/Archives/edgar/data/701288/000165495424002411/atri_10k.htm). Information regarding Nordson’s

directors and executive officers is contained in the sections entitled “Election of Directors” and “Security

Ownership of Nordson Common Shares by Certain Beneficial Owners and Management” included in Nordson’s proxy statement

for its 2024 annual meeting of stockholders, filed with the SEC on January 19, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/72331/000119312524010767/d482491ddef14a.htm),

in the section entitled “Information About Our Executive Officers” included in Nordson’s Annual Report on Form

10-K for the year ended October 31, 2023, which was filed with the SEC on December 20, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/72331/000007233123000242/ndsn-20231031.htm),

in Nordson’s Form 8-K filed on August 24, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233123000150/ndsn-20230823.htm),

in Nordson’s Form 8-K filed on January 16, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000019/ndsn-20240116.htm),

in Nordson’s Form 8-K filed on February 14, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000030/ndsn-20240214.htm),

and in Nordson’s Form 8-K filed on April 23, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000057/ndsn-20240423.htm).

To the extent holdings of Nordson securities by the directors and executive officers of Nordson have changed from the amounts of securities

of Nordson held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release, dated May 28, 2024. |

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

|

|

|

|

|

|

| |

|

|

|

|

|

ATRION CORPORATION |

| |

|

|

|

| Date: May 28, 2024 |

|

|

|

By: |

|

/s/ David A. Battat |

| |

|

|

|

|

|

David A. Battat

President and Chief Executive Officer |

| |

|

|

|

|

|

|

Exhibit 99.1

Atrion Corporation

One Allentown Parkway

Allen, TX 75002

NEWS RELEASE

FOR IMMEDIATE RELEASE

ATRION CORPORATION ENTERS INTO MERGER AGREEMENT

WITH NORDSON CORPORATION

_______________________________

Allen, TX., May 28, 2024 – Atrion Corporation (NASDAQ: ATRI), a

developer and manufacturer of products primarily for medical applications, today announced that it has entered into an agreement and plan

of merger with Nordson Corporation pursuant to which Nordson will acquire Atrion for $460 per share in cash, representing a total equity

value of approximately $815 million. The transaction enterprise value reflects a multiple of 20.2 times Atrion’s 2023 EBITDA, and

the $460 per share price represents a 15% premium to Atrion’s 90-day average daily volume-weighted average stock price.

The proposed transaction was unanimously approved by the Boards of Directors

of Atrion and Nordson.

David Battat, President and CEO of Atrion said, “The multiple of

over twenty times Atrion’s 2023 EBITDA reflects the substantial value of the business my co-workers have worked so hard to build.

I am immensely proud of our team, and I believe Nordson is a great home to continue to grow our business and to advance our people and

products.”

Completion of the proposed transaction is expected in the third quarter

of 2024, subject to the satisfaction of customary closing conditions, including the receipt of customary regulatory clearances and approvals.

Three of Atrion’s largest stockholders, holding approximately 22% of Atrion’s outstanding shares, have entered into voting

and support agreements with Nordson under which they have agreed, on customary terms and conditions, to vote all their Atrion shares in

favor of the proposed transaction.

Truist Securities is acting as the exclusive financial advisor to Atrion

on the transaction, and A&O Shearman is acting as legal counsel to Atrion.

Transaction Details

Under the terms of the merger agreement, a wholly owned subsidiary of

Nordson will merge into Atrion, with Atrion as the surviving corporation, and each outstanding share of Atrion common stock will be converted

into the right to receive $460 per share. The merger is subject to the satisfaction of customary closing conditions, including the approval

of the holders of a majority of the outstanding shares of Atrion’s common stock.

About Atrion Corporation

Atrion Corporation develops and manufactures products primarily for medical

applications. Atrion’s website is www.atrioncorp.com.

Forward-Looking Statements

Statements in this press release that are forward

looking are based upon current expectations, and actual results or future events may differ materially. Therefore, the inclusion of such

forward-looking information should not be regarded as a representation by us that our objectives or plans will be achieved. Such statements

include, but are not limited to, statements regarding the financial and business impact and anticipated benefits of the transaction, the

closing of the transaction and the timing thereof, business plans and strategy, product launches and product performance and impact. Words

such as “expects,” “believes,” “anticipates,” “intends,” “should,” “plans,”

and variations of such words and similar expressions are intended to identify such forward-looking statements.

Forward-looking statements contained herein involve

numerous risks and uncertainties, including the risk factors described in Part I, Item 1A. Risk Factors in our most recent Annual Report

on Form 10-K and the specific risk factors discussed herein and in connection with forward-looking statements throughout this press release,

and there are a number of factors that could cause actual results or future events to differ materially, including, but not limited to,

the following: the risk that the COVID-19 pandemic may again lead to material delays and cancellations of, or reduced demand for, procedures

in which our products are utilized; curtailed or delayed capital spending by hospitals and other healthcare providers; disruption to our

supply chain; closures of our facilities; delays in training; delays in gathering clinical evidence; diversion of management and other

resources to respond to the pandemic; the impact of global and regional economic and credit market conditions on healthcare spending;

the risk that the COVID-19 virus will again disrupt global economies and may cause economies in our key markets to enter prolonged recessions;

changing economic, market and business conditions; acts of war or terrorism; the effects of governmental regulation; the impact of competition

and new technologies; slower-than-anticipated introduction of new products or implementation of marketing strategies; implementation of

new manufacturing processes or implementation of new information systems; our ability to protect our intellectual property; changes in

the prices of raw materials; changes in product mix; intellectual property and product liability claims and product recalls; the ability

to attract and retain qualified personnel; the loss of, or any material reduction in sales to any significant customers; business disruptions

(including disruptions in relationships with employees, customers or suppliers) following the announcement and/or closing of the proposed

transaction; and the conditions to the completion of the proposed transaction, including the fact that the receipt of the required regulatory

approvals and clearances, may not be satisfied at all or in a timely manner; the fact that the closing of the proposed transaction may

not occur or may be delayed. In addition, assumptions relating to budgeting, marketing, product development and other management decisions

are subjective in many respects and thus susceptible to interpretations and periodic review which may cause us to alter our marketing,

capital expenditures or other budgets, which in turn may affect our results of operations and financial condition. These risks and uncertainties,

in some cases, have affected and in the future could affect our ability to implement our business strategy and may cause actual results

to differ materially from those contemplated by the statements expressed in this press release. New risks and uncertainties may arise

from time to time and are difficult to predict. All of these factors are difficult or impossible to predict accurately and many of them

are beyond our control. As a result, readers are cautioned not to place undue reliance on any of our forward-looking statements.

For a further list and description of these and other

important risks and uncertainties that may affect our future operations, refer to Part I, Item 1A. Risk Factors in our most recent

Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), which we may update in Part II,

Item 1A. Risk Factors in subsequent Quarterly Reports on Form 10-Q that we will file hereafter. The forward-looking statements

in this press release are made as of the date hereof, and we do not undertake any obligation, and disclaim any duty, to supplement, update

or revise such statements, whether as a result of subsequent events, changed expectations or otherwise, except as required by applicable

law. This cautionary statement is applicable to all forward-looking statements contained in this press release.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This press release does not constitute an offer to

sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed

transaction, Atrion plans to file a proxy statement with the SEC. STOCKHOLDERS OF ATRION ARE URGED TO READ THE PROXY STATEMENT (INCLUDING

ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND OTHER RELEVANT DOCUMENTS IN CONNECTION

WITH THE PROPOSED TRANSACTION THAT ATRION WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Stockholders and investors will be able to obtain free copies

of the proxy statement and other relevant materials (when they become available) and other documents filed by Atrion at the SEC’s

website at www.sec.gov.

PARTICIPANTS IN THE SOLICITATION

Atrion, Nordson and certain of their respective directors and executive

officers may be deemed to be participants in the solicitation of proxies from Atrion’s stockholders in connection with the proposed

transaction. Information regarding Atrion’s directors and executive officers, including a description of their respective direct

or indirect interests, by security holdings or otherwise, will be included in the proxy statement described above. These documents (when

available) may be obtained free of charge from the SEC’s website at www.sec.gov or by accessing the Investor Relations section of

Atrion’s website at www.atrioncorp.com. Information regarding Atrion’s directors and executive officers is contained in the

sections entitled “Election of Directors” and “Securities Ownership” included in Atrion’s

proxy statement for the 2024 annual meeting of stockholders, which was filed with the SEC on April 9, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/701288/000110465924044922/tm242747d4_def14a.htm)

and in the section entitled “Directors, Executive Officers and Corporate Governance” included in Atrion’s Annual

Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 29, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/701288/000165495424002411/atri_10k.htm).

Information regarding Nordson’s directors and executive officers is contained in the sections entitled “Election of

Directors” and “Security Ownership of Nordson Common Shares by Certain Beneficial Owners and Management” included

in Nordson’s proxy statement for its 2024 annual meeting of stockholders, filed with the SEC on January 19, 2024 (and which is available

at https://www.sec.gov/ix?doc=/Archives/edgar/data/72331/000119312524010767/d482491ddef14a.htm), in the section entitled “Information

About Our Executive Officers” included in Nordson’s Annual Report on Form 10-K for the year ended October 31, 2023, which

was filed with the SEC on December 20, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/72331/000007233123000242/ndsn-20231031.htm),

in Nordson’s Form 8-K filed on August 24, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233123000150/ndsn-20230823.htm),

in Nordson’s Form 8-K filed on January 16, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000019/ndsn-20240116.htm),

in Nordson’s Form 8-K filed on February 14, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000030/ndsn-20240214.htm),

and in Nordson’s Form 8-K filed on April 23, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000057/ndsn-20240423.htm).

To the extent holdings of Nordson securities by the directors and executive officers of Nordson have changed from the amounts of securities

of Nordson held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

Vice President and Chief Financial Officer

(972) 390-9800

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

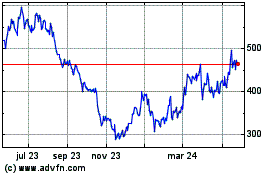

ATRION (NASDAQ:ATRI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

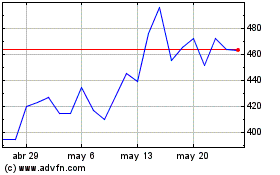

ATRION (NASDAQ:ATRI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024