via NewMediaWire -- Applied UV, Inc. (NASDAQ: AUVI), a leader

in global food security, air quality, and specialty building

solutions today announced preliminary financial results for the

third quarter and nine months ended September 30, 2023, and

reiterated its previous guidance of approximately $45 million in

revenue for 2023.

Preliminary Q3 2023 Results

Applied UV expects total revenues for the third quarter of 2023

to be approximately $11.4 million, an increase of 94.8% compared to

total revenues of $5.9 million in the prior year. Gross

profit grew to approximately $2.7 million, up 216.6% from $0.8

million in the comparable period in 2022. Operating loss is

expected to be approximately $2.4 million for the third quarter of

2023, compared to an operating loss of $2.8 million for the third

quarter of 2022. Net loss is expected to be approximately $2.6

million for the third quarter of 2023, compared to a net loss of

$2.7 million for the third quarter of 2022.

Total revenues for the nine months ended September 30, 2023 are

approximately $32.9 million, an increase of 117.6% compared to

total revenues of $15.1 million in the nine months ended September

30, 2022.

Adjusted EBITDA, a non-GAAP financial measure, is defined as

Operating Profit (Loss), excluding Depreciation and Amortization,

and excluding Stock Based Compensation and Loss on Impairment of

Goodwill/Intangible Assets. Adjusted EBITDA is expected to be a

loss of $1.5 million for the third quarter of 2023, compared to a

loss of $2.1 million for the third quarter of 2022.

|

Adjusted EBITDA Non-GAAP Financial Measure |

|

|

|

|

|

|

|

2023 Q3 |

2022 Q3 |

|

|

|

|

|

|

|

|

Operating (Loss) |

|

|

($2.4 million) |

($2.8 million) |

|

Exclude: Depreciation and Amortization |

$0.7 million |

$0.5 million |

|

Exclude: Stock Based Compensation |

|

$0.2 million |

$0.2 million |

|

Adjusted EBITDA |

|

|

($1.5 million) |

($2.1 million) |

Net cash and cash equivalents as of September 30, 2023, are

approximately $1.5 million. The Company’s secured

revolving credit facility with Pinnacle Bank has approximately $1.2

million available as of September 30, 2023. Total cash and

borrowing availability is approximately $2.7 million as of

September 30, 2023. Net cash used in operating activities was

approximately $7.8 million for the nine months ended September 30,

2023. Net cash used in operating activities improved in the third

quarter when compared to the net cash used of $6.6 million for the

six months ended June 30, 2023.

The Company believes by implementing its strategic plan for

2024, including the continued realization of cost savings from the

synergies of its acquisitions completed in 2023, that it expects to

be cash flow neutral in the latter half of 2024.

“We continued to see momentum in our business in the third

quarter as we continue to benefit from the focused commercial

strategy that we implemented earlier this year to accelerate

revenue growth and establish new customer partnerships,” said Max

Munn, CEO of Applied UV. “We remain focused on delivering the

safest and most innovative air quality and specialty building

solutions and we are encouraged by our customer engagements as we

gain momentum from new products such as Airocide™ Pro and Fighter

Flex coil disinfection system. Our initiatives to improve

operational execution and efficiency, combined with our cost

reduction actions completed in the second quarter, positions us

well to drive improved operating performance and we plan to provide

more detail on our earnings call in mid-November. We remain

confident in our strategy and the long-term trends that fuel our

business.”

The expected third quarter 2023 results set out above are still

preliminary and subject to the Company’s quarter-end closing

procedures. The Company’s consolidated financial statements as of,

and for the three months ended, September 30, 2023, are

not yet available. Accordingly, the information presented herein

reflects the Company’s preliminary estimates subject to the

completion of the Company’s financial closing procedures and any

adjustments that may result from the completion of the quarterly

review of the Company’s consolidated financial statements. As a

result, these preliminary estimates may differ from the actual

results that will be reflected in the Company’s consolidated

financial statements for the third quarter when they are completed

and publicly disclosed. These preliminary estimates may change, and

those changes may be material. The Company’s expectations with

respect to its unaudited results for the period discussed above are

based upon management estimates.

The preliminary full year 2023 revenue outlook estimates

described above are based on information available to management as

of the date of this report, and as a result, these expectations

could change.

Adjusted EBITDA, a non-GAAP financial measure, is defined as

Operating Profit (Loss), excluding Depreciation and Amortization,

and excluding Stock Based Compensation and Loss on Impairment of

Goodwill/Intangible Assets. We believe Adjusted EBITDA provides

investors with useful information on period-to-period performance

as evaluated by management and comparison with our past financial

performance. We believe Adjusted EBITDA is useful in evaluating our

operating performance compared to that of other companies in our

industry, as this measure generally eliminates the effects of

certain items that may vary from company to company for reasons

unrelated to overall operating performance.

About Applied UV

Applied UV, Inc. engages in the pursuit of technologies focused

on global food security, air quality, and specialty building

solutions tailored for the commercial and hospitality sectors. More

details about Applied UV, Inc., and its subsidiaries can be found

at https://www.applieduvinc.com.

Forward-Looking Statements

The information contained herein may contain “forward‐looking

statements.” Forward‐looking statements reflect the current view

about future events. When used in this press release, the words

“anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,”

“plan,” or the negative of these terms and similar expressions, as

they relate to us or our management, identify forward‐looking

statements. Such statements include, but are not limited to,

statements contained in this press release relating to the view of

management of Applied UV concerning the Company’s preliminary third

quarter 2023 financial results, its business strategy, future

operating results and liquidity and capital resources outlook.

Forward‐looking statements are based on the Company’s current

expectations and assumptions regarding its business, the economy

and other future conditions. Because forward–looking statements

relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict.

The Company’s actual results may differ materially from those

contemplated by the forward‐looking statements. They are neither

statements of historical fact nor guarantees of assurance of future

performance. We caution you therefore against relying on any of

these forward‐looking statements. Factors or events that could

cause the Company’s actual results to differ may emerge from time

to time, and it is not possible for the Company to predict all of

them. The Company cannot guarantee future results, levels of

activity, performance, or achievements. Except as required by

applicable law, including the securities laws of the United States,

the Company does not intend to update any of the forward‐looking

statements. References and links to websites have been provided as

a convenience, and the information contained on such websites is

not incorporated by reference into this press release.

For Additional Company Information:

Applied UV, Inc. Max Munn Applied UV Founder, CEO & Director

Max.munn@applieduvinc.com

Investor Relations Contact:TraDigital IR Kevin McGrath

+1-646-418-7002 kevin@tradigitalir.com

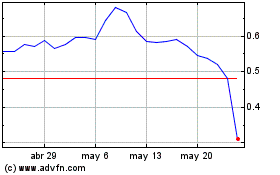

Applied UV (NASDAQ:AUVI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Applied UV (NASDAQ:AUVI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024