0001832332false00018323322024-11-082024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 08, 2024 |

Aveanna Healthcare Holdings Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40362 |

81-4717209 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

400 Interstate North Parkway SE |

|

Atlanta, Georgia |

|

30339 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 770 441-1580 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

AVAH |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On November 8, 2024, Aveanna Healthcare Holdings Inc. (the "Company", "we", "us", or "our") made available a financial presentation to investors. A copy of the presentation is attached hereto as Exhibit 99.1 and incorporated by reference in this Item 7.01. A copy of the presentation is also available on our website at ir.aveanna.com.

Use of our Website and Social Media to Distribute Material Company Information

We use our website as a channel of distribution for important Company information. We routinely post on our website important information, including press releases, investor presentations and financial information, which may be accessed by clicking on the “Investors” section of www.aveanna.com. We also use our website to expedite public access to time-critical information regarding our Company in advance of or in lieu of distributing a press release or a filing with the SEC disclosing the same information. Therefore, investors should look to the “Investors” section of our website for important and time-critical information. Visitors to our website can also register to receive automatic e-mail and other notifications alerting them when certain new information is made available on our website. Information contained on, or accessible through, our website is not a part of and is not incorporated by reference in this Current Report on Form 8-K.

The information contained in this Item 7.01, including in Exhibit 99.1 attached hereto, is “furnished” and not “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference in another filing under the Exchange Act or the Securities Act, except to the extent such other filing specifically incorporates such information by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

AVEANNA HEALTHCARE HOLDINGS INC. |

|

|

|

|

Date: |

November 8, 2024 |

By: |

/s/ Matthew Buckhalter |

|

|

|

Matthew Buckhalter

Chief Financial Officer

(Principal Financial Officer) |

Investor Presentation November 2024 Exhibit 99.1

Disclaimers and Forward-Looking Statements This investor presentation (this "presentation“) and any oral statements made in connection with this presentation are for information purposes only and do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other securities of Aveanna Healthcare Holdings Inc. (including its consolidated subsidiaries, "Aveanna," the "Company," "we," "us" or "our"). The information contained herein does not purport to be all inclusive. The data contained herein has been derived from various internal and external sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of such information. Any data on past performance contained herein is not an indication as to future performance. Except as required by applicable law, Aveanna assumes no obligation to update the information in this presentation. Nothing herein shall be deemed to constitute investment, legal, tax, financial, accounting or other advice. This presentation is not intended for distribution to, or use by, any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. No representation or warranty (whether express or implied) has been made by Aveanna with respect to the matters set forth in this presentation. Cautionary Note Regarding Forward-Looking Statements Certain matters discussed in this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements (other than statements of historical facts) in this presentation regarding our prospects, plans, financial position, business strategy, expected financial and operational results, and any other future events may constitute forward-looking statements. Forward-looking statements generally can be identified by the use of terminology such as “believe,” “expect,” “anticipate,” “design,” “would,” “could,” “intend,” “plan,” “estimate,” “seek,” “will,” “may,” “should,” “predict,” “project,” “potential,” “continue” or the negatives of these terms or variations of them or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate in these circumstances. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. Forward-looking statements involve a number of risks and uncertainties that may cause actual results to differ materially from those expressed or implied by such forward-looking statements, such as our ability to successfully execute our growth strategy, including through organic growth and the completion of acquisitions, effective integration of the companies we acquire, unexpected costs of acquisitions and dispositions, the possibility that expected cost synergies may not materialize as expected, the failure of Aveanna or the companies we acquire to perform as expected, estimation inaccuracies in revenue recognition, our ability to drive margin leverage through lower costs, unexpected increases in SG&A and other expenses, changes in reimbursement, changes in government regulations, changes in Aveanna’s relationships with referral sources, increased competition for Aveanna’s services or wage inflation, the failure to retain or attract employees, changes in the interpretation of government regulations or discretionary determinations made by government officials, uncertainties regarding the outcome of rate discussions with managed care organizations and our ability to effectively collect our cash from these organizations, changes in the case-mix of our patients, as well as the payor mix and payment methodologies, legal proceedings, claims or governmental inquiries, our ability to effectively collect and submit data required under Electronic Visit Verification regulations, our ability to comply with the terms and conditions of the CMS Review Choice Demonstration program, our ability to effectively implement and transition to new electronic medical record systems or billing and collection systems, a failure to maintain the security and functionality of our information systems or to defend against or otherwise prevent a cybersecurity attack or breach, changes in tax rates, our substantial indebtedness, the impact of adverse weather, and other risks set forth under the heading “Risk Factors” in Aveanna’s Annual Report on Form 10-K for its 2023 fiscal year filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2024, which is available at www.sec.gov, as well as under similar headings in Aveanna’s subsequently filed Quarterly Reports on Form 10-Q and other filings with the SEC. In addition, these forward-looking statements necessarily depend upon assumptions, estimates and dates that may prove to be incorrect or imprecise. Accordingly, forward-looking statements included in this presentation do not purport to be predictions of future events or circumstances, and actual results may differ materially from those expressed by forward-looking statements. All forward-looking statements speak only as of the date made, and Aveanna undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Industry and Market Data Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Aveanna has not independently verified the information and data obtained from third party sources and cannot assure you of such data’s accuracy or completeness. Management estimates are derived from publicly available information released by third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. Any industry forecasts are based on data (including third-party data), models and experience of various professionals and are based on various assumptions, all of which are subject to change without notice. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate, and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Cautionary Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. Non-GAAP Financial Measures This presentation includes various performance indicators and non-GAAP financial measures that we use to help us evaluate our business, identify trends affecting our business, formulate business plans, and make strategic decisions. EBITDA, Adjusted EBITDA, Free Cash Flow, and pro forma presentations of the foregoing are financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Reconciliations of such non-GAAP measures to their nearest comparable GAAP measures can be found in the Appendix to this presentation. Any non-GAAP financial measures used in this presentation are in addition to, and not meant to be considered superior to, or a substitute for, the Company’s financial statements prepared in accordance with GAAP. Additional information with respect to Aveanna is contained in its filings with the SEC and is available at the SEC's website, www.sec.gov, and on Aveanna's website, www.aveanna.com

Debbie Stewart�Principal Accounting Officer Jeff Shaner Chief Executive Officer CEO of Aveanna since 2023 Instrumental in formation of Aveanna Healthcare Chief Operating Officer of Aveanna Healthcare since 2017 Chief Operating Officer of PSA Healthcare since 2015 Former SVP, President of Operations of Gentiva Health Services Former President of Gentiva Health �Services’ Hospice Division CFO of Aveanna since 2023 Integral to Aveanna’s financial structure �since inception Senior Vice President of Finance for Aveanna Healthcare since 2016 Leads the Company’s Investor Relations Group Former Vice President of Finance of �PSA Healthcare since 2015 Principal Accounting Officer of Aveanna since 2023 Vice President of Accounting and Controller of Aveanna since 2021 Leads the Company’s Accounting, Tax, SEC Reporting and Internal Audit teams Former Assurance Senior Manager of Ernst & Young Certified Public Accountant since 2009 Matt Buckhalter�Chief Financial Officer Leadership Presenters

~ Aveanna Overview 2024 Guidance(1) Key Operating Statistics ~$2.0b Revenue 31.4%�Gross Margin(2) $168m+�Adjusted EBITDA 327 �Locations 33 States 26,500 Caregivers 41m Homecare Hours(3) 62 Preferred Payors ___________________________ 1. Consistent with prior practice, we are not providing guidance on net income, or a reconciliation of Adjusted EBITDA thereto, at this time due to the volatility of certain required inputs that are not available without unreasonable efforts, including future fair value adjustments associated with our interest rate derivatives. 2. Q3 2024 Gross Margin 3. Q3 YTD 2024 PDS Hours annualized 4. Q3 YTD 2024 Payor mix ($ in millions) 7.6% CAGR By The Numbers Payor Mix4 2020 – 2024 Revenue Growth National Footprint No single payor contributes more than 11% of total revenue

Melia and Mom Heather Valerie JAR to think through and build out Aveanna's Transformative Homecare Platform Preferred Payor Partnerships Government Affairs Strategy Scaled National Platform Technology and Data Driven Results Reduction in Total Cost of Care Our advanced homecare platform positions us to improve outcomes with data-driven results and introduce �value-based agreements that deliver exceptional value to our partners. Improved Clinical Outcomes

Aveanna's Transformative Homecare Platform PDS Preferred Payors 22 2024 2023 Projected 14 7 State Rate Increases 19 Home Health Episodic Mix >70% 2024 2023 Value-based Agreements 8 5 2024 2023 Projected 2023 Projected 2024 Projected 10+ 62% 2022 2022 2022 2022 3 13 ~70% 2023 resulted in substantial progress as demonstrated by key performance metrics. (1) ___________________________ 1. See Disclaimers and Forward-looking Statements slide.

Melia and Mom Heather Valerie Our future opportunity will continue to provide enhanced value that is driven �by our significant investment in our value-based national homecare platform. Aveanna's Transformative Homecare Platform Value-based Organic Growth Risk-based Growth Core Organic Growth Scaled national platform drives growth Payor partnerships underpinned by shared value creation Government �agencies shifting programs and reimbursement to homecare Data and outcomes that define value and savings Capitating risk and population health �management Strategic tuck-in acquisitions that strengthen our offerings to key �payor and �government �partners M&A 3 – 4% 2 – 3% 1 – 2% 1 – 1.5% 1 – 1.5% 7 – 10% ___________________________ 1. See Disclaimers and Forward-looking Statements slide. Long-term Growth Rate (1)

Valerie Melia and Mom Heather Aveanna Business Segments

Private Duty Services Segment Financial Highlights Key Operating Statistics $1,617m Net Revenue1 26% – 28%�Gross Margin2 3% – 5%�Organic Growth Rate3 228 Locations 27 States 38,000 Patients on �Service ~47% % of PP Volume Preferred Payors 21 Preferred Payor Partnerships underpinned by �enhanced rates and value-based agreements Defined Government Affairs Strategy in every state Scaled National Recruiting Platform to accelerate caregiver hiring Technology and Data Driven Outcomes that support value-based agreements Strategic M&A tuck in opportunities in key states ___________________________ 1. Q3 YTD 2024 Annualized revenue. 2. Management’s target for gross margin percentages over time. 3. Management’s target for total organic revenue growth rate over time. One Nurse – One Patient Full Time & Per Diem Caregivers Paid by the Hour Longer Length of Stay Patient Demand Exceeds Caregiver Supply Services Delivered in the Comfort of the Patient's Home By The Numbers Key Items

Medical Solutions Segment Financial Highlights Key Operating Statistics States we deliver to Patients on �Service Preferred Payors $172m Net Revenue1 41% – 44%�Gross Margin2 8% – 10%�Organic Growth Rate3 37 30,000 3 Nutritional Support – �Enteral Product, Equipment and Supplies Provided to Pediatric, Adult, and Geriatric Patients 24-hour Clinical Support Longer Length of Stay Leading National Enteral Provider ___________________________ 1. Q3 YTD 2024 Annualized revenue. 2. Management’s target for gross margin percentages over time. 3. Management’s target for total organic revenue growth rate over time. Preferred Payor Contracts provide in-network patient support at favorable rates Enhanced AMS Model driving need to refine our �payor network with focus on preferred payors Nationally Scaled Enteral Provider Strong Patient Demand drives growth trends Symbiotic relationship with PDN services Key Items By The Numbers 2 – 3 Years Avg. Case Length Rate / UPS ~$460

Home Health & Hospice Segment Financial Highlights Key Operating Statistics Locations States Patients on Service Episodic Mix Preferred Payors $218m Net Revenue1 48% – 50%�Gross Margin2 5% – 7%�Organic Growth Rate3 83 15 13,500 38 Home Health Geriatric Patient Population Intermittent Services Shorter Length of Stay Value-based Care Component RN, PT, OT, SLP, SW and HHA Hospice Geriatric Patient Population Per Diem Reimbursement End-of-life Care / Support ___________________________ 1. Q3 YTD 2024 Annualized revenue. 2. Management’s target for gross margin percentages over time. 3. Management’s target for total organic revenue growth rate over time. >70% HH Preferred Payors defined as episodic agreements Caregiver Capacity aligned with preferred payors Episodic Payor Agreements and Value-based Payments driven by CMS Star Ratings Organic growth initiatives that support the preferred payor strategy By The Numbers Key Items

Scaled Platform Built for Driving Growth and Enhancing Value

Fragmented Home Care Markets Support Sustainable Growth $20bn �Legacy Pediatric Focus Personal Care $18.0bn Annual U.S.�Healthcare Spend�$4.5tn Therapy $6.0bn Enteral Nutrition $3.0bn Therapy $7.0bn Private Duty �Nursing $10.0bn Hospice $23.0bn $99bn �Addressable �Adult �Opportunity TAM annual growth from 2023-2028 $119bn ~4% Untapped PDN demand with only a fraction of children and adults getting needed care Family caregiver program expansion Expanding insurance coverage for Medicaid beneficiaries Our Market Opportunity Home Health $58.0bn ___________________________ Source: 2022 Third party consulting report, management estimates.

Q3 2024 Financial Performance: Summary Results PDS Q3 2024 revenue growth of 6.4% from Q3 2023, driven by 10.5 million hours of care or 3.8% YOY volume increase MS Q3 2024 revenue growth of 12.6% from Q3 2023, driven by strong rate improvement of 8.1% HHH Q3 2024 gross margin percentage growth of 6.0% from Q3 2023, driven by strong episodic mix and caregiver utilization Q3 2024 demonstrated continued focus on optimization across Aveanna’s overhead platform and preferred payor strategy 2024 Operating Cash Flow of positive $19.2m and Free Cash Flow of positive $16.7m (2) $ in millions Q3 2023 Q3 2024 Y/Y%� Change Revenue $478.0 $509.0 6.5% Gross Margin $147.3 $159.7 8.4% Adjusted EBITDA(1) $36.2 $47.8 32.2% 30.8% 31.4% 27.2% 26.8% 47.9% 53.9% 43.2% 45.6% Gross Margin % ___________________________ 1. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation to the most comparable GAAP measure 2. Free Cash Flow is a non-GAAP financial measure. See Appendix for a reconciliation to the most comparable GAAP measure Consolidated Results Key Highlights Revenue and Gross Margin % by Segment $ in millions

Financial Performance: Capital Structure Liquidity of over $284.6m, comprised of the following: $78.5m cash on balance sheet $168.2m revolver availability $37.9m securitization availability Undrawn revolver at the end of Q3 $32m in outstanding letters of credit at the end of Q3 Total variable rate debt of $1,480m, consisting of: First Lien: $895m (S + 3.75%) Second Lien: $415m (S + 7.00%) Securitization: $170m (S + 3.15%) Interest rate hedges in place: $520m notional interest rate swap (expires �June 2026) $880m notional, 3% interest rate cap (expires February 2027) ___________________________ 1. Free Cash Flow is a non-GAAP financial measure. See Appendix for a reconciliation to the most comparable GAAP measure FY 2023 free cash flow of $12.5m(1) 2024 cash provided by operating activities of $19.2m 2024 free cash flow of $16.7m(1) Goal to drive positive operating cash flow FY 2024 Liquidity Cash Flow Indebtedness and Hedging

Path Forward:�Strategic and Operational Focus �on Driving Shareholder Value Value-based Growth Enhanced Capital Structure Core Organic Growth

Appendix

Reconciliation of Net Loss to Adjusted EBITDA ___________________________ 1-7: Please see our earnings release posted on November 7, 2024 for further description of the nature of these items

Reconciliation of Net Cash (Used in) Provided by Operating Activities to Free Cash Flow

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

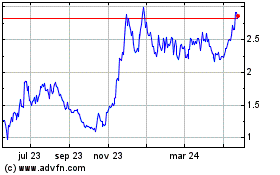

Aveanna Healthcare (NASDAQ:AVAH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

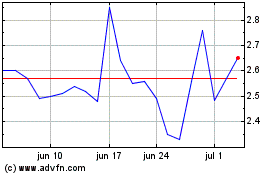

Aveanna Healthcare (NASDAQ:AVAH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024