UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND

AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 1)1

Accelerate

Diagnostics, Inc.

(Name of Issuer)

Common

Stock, par value $0.001 per share

(Title of Class of Securities)

00430H102

(CUSIP Number)

Zac Rosenberg

General Counsel & Chief Compliance Officer

Indaba Capital Management, L.P.

One Letterman Drive, Building D, Suite DM 700

San Francisco, CA 94129

(415) 680-1030

with copies to:

David Feldman

Stewart McDowell

Gibson, Dunn & Crutcher LLP

200 Park Avenue

New York, New York, 10166

(212) 351-4000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

August 8, 2024

(Date of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1.

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with

respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

CUSIP No. 00430H102

| 1 |

NAME

OF REPORTING PERSON |

|

| |

Indaba

Capital Management, L.P. |

|

| 2 |

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

|

|

(b)

x |

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

|

| 4 |

SOURCE OF FUNDS |

|

|

| |

AF |

|

|

| 5 |

CHECK BOX IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

¨ |

| |

|

|

|

| 6 |

CITIZENSHIP OR

PLACE OF ORGANIZATION |

|

| |

Delaware |

|

|

| NUMBER

OF |

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

| BENEFICIALLY |

|

|

0 |

|

| OWNED

BY |

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

2,601,841

(1) |

|

| REPORTING |

|

|

|

|

| PERSON

WITH |

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

0 |

|

| |

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

2,601,841

(1) |

|

| 11 |

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

2,601,841

(1) |

|

| 12 |

CHECK BOX IF

THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| |

|

|

| 13 |

PERCENT OF CLASS REPRESENTED

BY AMOUNT IN ROW (11) |

|

| |

9.9%

(1)(2) |

|

|

|

| 14 |

TYPE OF REPORTING

PERSON |

|

| |

IA,

PN |

|

|

| (1) | Represents shares of common stock of Accelerate Diagnostics, Inc.

(the “Issuer”) issuable upon conversion of the Issuer’s 5.00% Senior Secured

Convertible Notes due 2026 (the “New Convertible Notes”). The Reporting Persons

are prohibited from converting New Convertible Notes held by the Fund (as defined below)

to obtain beneficial ownership in excess of 9.9% of the outstanding shares of the Issuer’s

common stock. See Item 5 for additional information. |

| (2) | Based on 23,679,383 shares of the Issuer’s common stock outstanding

as of August 5, 2024, as reported on the Issuer's Form 10-Q filed with the Securities and Exchange Commission on August 8, 2024. |

CUSIP No. 00430H102

| 1 |

NAME OF REPORTING

PERSON |

|

| |

IC

GP, LLC |

|

|

| 2 |

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

|

|

(b) x |

| |

|

|

|

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

|

| 4 |

SOURCE OF FUNDS |

|

|

| |

AF |

|

|

| 5 |

CHECK BOX IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

¨ |

| |

|

|

|

| 6 |

CITIZENSHIP OR

PLACE OF ORGANIZATION |

|

| |

Delaware |

|

|

| NUMBER

OF |

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

| BENEFICIALLY |

|

|

0 |

|

| OWNED

BY |

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

2,601,841

(1) |

|

| REPORTING |

|

|

|

|

| PERSON

WITH |

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

0 |

|

| |

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

2,601,841

(1) |

|

| 11 |

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

2,601,841

(1) |

|

| 12 |

CHECK BOX IF

THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| |

|

|

| 13 |

PERCENT OF CLASS REPRESENTED

BY AMOUNT IN ROW (11) |

|

| |

9.9%

(1)(2) |

|

|

|

| 14 |

TYPE OF REPORTING

PERSON |

|

| |

OO,

HC |

|

|

| (1) | Represents shares of the Issuer’s common stock issuable upon conversion

of the Issuer’s New Convertible Notes. The Reporting Persons are prohibited from converting

New Convertible Notes held by the Fund (as defined below) to obtain beneficial ownership

in excess of 9.9% of the outstanding shares of the Issuer’s common stock. See Item

5 for additional information. |

| (2) | Based on 23,679,383 shares of the Issuer’s common stock outstanding

as of August 5, 2024, as reported on the Issuer's Form 10-Q filed with the Securities and Exchange Commission on August 8, 2024. |

CUSIP No. 00430H102

| 1 |

NAME OF REPORTING

PERSON |

|

| |

Derek

C. Schrier |

|

|

| 2 |

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP |

(a) ¨ |

| |

|

|

|

(b) x |

| |

|

|

|

|

| 3 |

SEC USE ONLY |

|

|

| |

|

|

|

|

| 4 |

SOURCE OF FUNDS |

|

|

| |

AF |

|

|

| 5 |

CHECK BOX IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

¨ |

| |

|

|

|

| 6 |

CITIZENSHIP OR

PLACE OF ORGANIZATION |

|

| |

United

States of America |

|

| NUMBER

OF |

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

| BENEFICIALLY |

|

|

0 |

|

| OWNED

BY |

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

2,601,841

(1) |

|

| REPORTING |

|

|

|

|

| PERSON

WITH |

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

0 |

|

| |

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

2,601,841

(1) |

|

| 11 |

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

2,601,841

(1) |

|

| 12 |

CHECK BOX IF

THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| |

|

|

| 13 |

PERCENT OF CLASS REPRESENTED

BY AMOUNT IN ROW (11) |

|

| |

9.9%

(1)(2) |

|

|

|

| 14 |

TYPE OF REPORTING

PERSON |

|

| |

IN,

HC |

|

|

| (1) | Represents shares of the Issuer’s common stock issuable upon conversion

of the Issuer’s New Convertible Notes. The Reporting Persons are prohibited from converting

New Convertible Notes held by the Fund (as defined below) to obtain beneficial ownership

in excess of 9.9% of the outstanding shares of the Issuer’s common stock. See Item

5 for additional information. |

|

| (2) | Based on 23,679,383 shares

of the Issuer’s common stock outstanding as of August 5, 2024, as reported on the Issuer's Form 10-Q filed with the Securities and Exchange Commission on August 8, 2024. |

CUSIP No. 00430H102

AMENDMENT NO. 1 TO SCHEDULE 13D

Explanatory

Note: The following constitutes Amendment No. 1 (“Amendment No. 1”) to the initial statement on Schedule

13D filed on June 20, 2023 (the “Initial Schedule 13D”) by Indaba Capital Management, L.P. (the “Investment Manager”), IC

GP, LLC (“IC GP”) and Derek C. Schrier (collectively, “Indaba” or the “Reporting Persons”). This

Amendment No. 1 amends the Initial Schedule 13D as set forth herein (the Initial Schedule 13D as amended by this Amendment No. 1,

the “Schedule 13D”). Capitalized terms used in this Amendment No. 1 and not otherwise defined herein have the meanings

given to them in the Initial Schedule 13D.

Information given in response to each item shall be deemed incorporated

by reference in all other items, as applicable.

| Item 3. | Source

and Amount of Funds or Other Consideration |

Item 3 of the Schedule 13D is hereby amended

to add the following:

The source of the cash used to acquire New Senior

Notes (as defined below) as reported herein is the working capital of the Fund, which at any given time may include funds borrowed on

margin in the ordinary course of business and on customary terms.

| Item 4. | Purpose

of Transaction |

Item 4 of the Schedule 13D is hereby supplemented as follows:

On

August 8, 2024, the Issuer entered into a Note Purchase Agreement (the “Note Purchase Agreement”) with certain

investors named therein. Pursuant to the Note Purchase Agreement, the Fund purchased $11.5 million in aggregate principal amount of the

Issuer’s 16.00% Super-Priority Senior Secured PIK Notes due 2025 (the “New Senior Notes”) from the Issuer. Pursuant

to the Note Purchase Agreement, the Issuer agreed that holders of at least $1 million of New Senior Notes, including the Fund, would

have the right to purchase or participate in certain debt financings of the Issuer. Pursuant to the Note Purchase Agreement, the Fund,

at its request, (i) has specified information rights, (ii) the right to approve any incurrence of indebtedness by the Issuer

not permitted under the Indenture, (iii) in the event that the Common Stock were to cease to be listed on a specified exchange,

the right to appoint an observer to the special committee established by the board of directors of the Issuer to oversee the exploration

of financial strategies and strategic alternatives and (iv) the right to appoint a person to the board of directors of the Issuer

effect by, but no earlier than, March 31, 2025.

The foregoing description of the Note Purchase

Agreement does not purport to be complete and is qualified in its entirety by reference to the Note Purchase Agreement, which is incorporated

by reference as Exhibit 99.8 hereto.

The New Senior Notes were issued under an indenture

(the “Indenture”), dated as of August 8, 2024, by and between the Issuer and U.S. Bank Trust Company, National Association,

as trustee (in such capacity, the “Trustee”) and collateral agent (in such capacity, the “Collateral Agent”).

The Indenture provides that the New Senior Notes will be secured by a super-priority security interest in the same collateral that secures

the Issuer’s outstanding New Convertible Notes.

The New Senior Notes will mature on December 31,

2025, and will bear interest at a rate of 16.00% per annum, payable in kind. Interest on the New Senior Notes will be payable by the

Issuer quarterly in arrears on the last business day of each March, June, September and December, beginning on September 30,

2024.

CUSIP No. 00430H102

The Indenture contains customary events of default,

including, but not limited to, non-payment of principal or interest, breach of certain covenants in the Indenture, defaults under or

failure to pay certain other indebtedness and certain events of bankruptcy, insolvency, and reorganization. If an event of default (other

than certain events of bankruptcy, insolvency or reorganization involving the Issuer) occurs and is continuing, the Trustee, by notice

to the Issuer, or the holders of the Notes representing at least a majority in aggregate principal amount of the outstanding Notes, by

notice to the Issuer and the Trustee, may declare 100% of the principal, the premium (including the Exit Premium (as defined below)),

and all accrued and unpaid interest on all of the then outstanding Notes to be due and payable immediately. Upon the occurrence of certain

events of bankruptcy, insolvency or reorganization involving the Issuer, 100% of the principal, the premium (including the Exit Premium),

and all accrued and unpaid interest on all of the then outstanding Notes will automatically become immediately due and payable. Upon

the occurrence of a change of control, the Issuer will be required to make an offer to repurchase all or any portion of the outstanding

Notes at a price in cash equal to 100% of the aggregate principal amount of the Notes repurchased, plus the premium (including the Exit

Premium), and all accrued and unpaid interest to, but excluding, the date or repurchase. Upon the occurrence of any repayment (including

in connection with a change of control or an asset sale) or redemption or acceleration upon any event of default, the Issuer is required

to pay the investors a fee equal to a certain percentage of the aggregate principal amount of the Notes then outstanding plus accrued

and unpaid interest thereon, which fee shall be equal to 30.00% if any such event occurs on or prior to June 30, 2025 and equal

to 42.50% if any such event occurs on July 1, 2025 and thereafter (the “Exit Premium”).

The Indenture also contains various affirmative,

negative and financial covenants that, among other things, may restrict the ability of the Issuer and its subsidiaries to incur additional

indebtedness, create certain liens, merge or consolidate with another entity, pay dividends or repurchase stock, and sell all or substantially

all of their assets.

The foregoing description of the Indenture does

not purport to be complete and is qualified in its entirety by reference to the Indenture, which is incorporated by reference as Exhibit 99.9

hereto.

The Issuer entered into an intercreditor agreement (the “Intercreditor Agreement”) with the Collateral Agent and with the

collateral agent for the New Convertible Notes, pursuant to which the collateral agent for the Convertible Notes subordinated the security

interest of the New Convertible Notes to the security interest of the New Senior Notes.

The foregoing description of the Intercreditor

Agreement does not purport to be complete and is qualified in its entirety by reference to the Intercreditor Agreement, which is incorporated

by reference as Exhibit 99.10 hereto.

The Issuer entered into a Security Agreement

(the “Security Agreement”) with the Collateral Agent. Pursuant to the Security Agreement, the Issuer granted the Collateral

Agent a security interest in certain of its assets, including but not limited to certain accounts, equipment, fixtures and intellectual

property, in order to secure the payment and performance of all of the Obligations, as defined in the Indenture.

In connection with the Security Agreement, the

Issuer and Collateral Agent also entered into a Patent Security Agreement (the “Patent Security Agreement”) and a Trademark

Security Agreement (the “Trademark Security Agreement and, together with the Patent Security Agreement, the “IP Security

Agreements”). Pursuant to the IP Security Agreements, the Issuer granted the Collateral Agent a security interest in the Patent

Collateral and Trademark Collateral, as defined therein.

The foregoing description of the Security Agreement

does not purport to be complete and is qualified in its entirety by reference to the Security Agreement, which is incorporated by reference

as Exhibit 99.11 hereto.

| Item 5. | Interest

in Securities of the Issuer |

Item 5(a) – (e) of the Schedule

13D is hereby amended and restated as follows:

(a) – (b) The responses of

the Reporting Persons to Rows (7) through (13) of the cover pages of this Schedule 13D are incorporated herein by

reference. The percentages set forth in this Item 5 are based on 23,679,383 shares of Common Stock of the Issuer outstanding as of

August 5, 2024, as reported on the Issuer's Form 10-Q filed with the Securities and Exchange Commission on August 8, 2024. Pursuant

to Rule 13d-3 of the rules and regulations promulgated by the SEC pursuant to the Act, and giving effect to the Beneficial

Ownership Limitation, the Reporting Persons may be deemed to beneficially own 2,601,841 shares of Common Stock issuable upon

conversion of the New Convertible Notes, which shares of Common Stock may be deemed to be beneficially owned by each of the

Investment Manager, IC GP and Mr. Schrier. Without giving effect to the Beneficial Ownership Limitation, the Reporting

Persons would be entitled to receive an additional 743,412 shares of Common Stock issuable upon the conversion of the New

Convertible Notes as of the date hereof. The number of shares of Common Stock issuable upon conversion of the New Convertible Notes

reflect the Issuer’s 1-for-10 reverse stock split, which was effective July 11, 2023 (the “Reverse Stock

Split”) and increases in the principal amount of New Convertible Notes outstanding as a result of the payment of interest in

kind in accordance with the terms of the indenture for the New Convertible Notes.

CUSIP No. 00430H102

The securities of the Issuer beneficially owned

by the Reporting Persons are directly held by Indaba Capital Fund, L.P. (the “Fund”), a private investment fund for which

the Investment Manager serves as investment manager. Pursuant to an Investment Management Agreement, the Fund and its general partner

have delegated all voting and investment power over the securities of the Issuer directly held by the Fund to the Investment Manager.

As a result, each of the Investment Manager, IC GP, as the general partner of Investment Manager, and Mr. Schrier, as Managing

Member of IC GP, may be deemed to exercise voting and investment power over the securities of the Issuer directly held by the Fund. The

Fund specifically disclaims beneficial ownership of the securities of the Issuer directly held by it by virtue of its inability to vote

or dispose of such securities as a result of such delegation to the Investment Manager.

| (c) | There were no transactions in the shares of

Common Stock effected by the Reporting Persons on behalf of the Fund during the past sixty

days. |

| Item 6. | Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Item 6 of the Schedule 13D is hereby supplemented

to add the following:

On

August 8, 2024, the Reporting Persons and the Issuer entered into a Note Purchase Agreement as defined and described

in Item 4 above and incorporated by reference as Exhibit 99.8 hereto. The Note Purchase Agreement and the responses to Items 3 and

4 are incorporated herein by reference.

| Item 7. | Material

to Be Filed As Exhibits |

Item 7 of the Schedule 13D is hereby supplemented

to add the following Exhibits:

| Exhibit |

Description

|

| 99.8 |

Note Purchase Agreement, dated August 8,

2024, between the Issuer and certain purchasers of New Senior Notes, including the Fund (filed as Exhibit 10.1 to the Issuer’s

Current Report on Form 8-K filed on August 8, 2024).

|

| 99.9 |

Indenture for the New Senior Notes, dated

as of August 8, 2024, between the Issuer and the trustee for the New Senior Notes, including the form of New Senior Note (filed

as Exhibit 4.1 to the Issuer’s Current Report on Form 8-K filed on August 8, 2024).

|

CUSIP No. 00430H102

| 99.10 |

Form of Intercreditor Agreement, dated

as of August 8, 2024, between the Issuer and the collateral agent and the trustee for the New Convertible Notes (filed as Exhibit 10.2

to the Issuer’s Current Report on Form 8-K filed on August 8, 2024).

|

| 99.11 |

Security

Agreement, dated as of August 8, 2024, between the Issuer and the Collateral Agent (filed as Exhibit 10.3 to the Issuer’s

Current Report on Form 8-K filed on August 8, 2024). |

CUSIP No. 00430H102

SIGNATURES

After reasonable inquiry and to the best of his or its knowledge

and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: August 12, 2024

| |

INDABA

CAPITAL MANAGEMENT, L.P. |

| |

|

| |

|

| |

By: |

IC GP, LLC, its general partner |

| |

|

| |

|

| |

By: |

/s/ Derek C. Schrier |

| |

|

Name: |

Derek C. Schrier |

| |

|

Title: |

Managing Member |

| |

IC

GP, LLC |

| |

|

| |

|

| |

By: |

/s/ Derek C. Schrier |

| |

|

Name: |

Derek C. Schrier |

| |

|

Title: |

Managing Member |

| |

|

| |

|

| |

DEREK

C. SCHRIER |

| |

|

| |

|

| |

By: |

/s/ Derek C. Schrier |

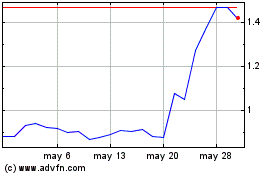

Accelerate Diagnostics (NASDAQ:AXDX)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Accelerate Diagnostics (NASDAQ:AXDX)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024