Amended Annual Report (10-k/a)

15 Marzo 2023 - 2:02PM

Edgar (US Regulatory)

true

0001624322

0001624322

2022-12-31

2022-12-31

0001624322

2022-06-30

0001624322

2023-02-22

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

| |

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2022

--12-31FY2022

or

| |

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 001-38447

BUSINESS FIRST BANCSHARES, INC.

(Exact name of registrant as specified in its charter)

|

Louisiana

|

|

20-5340628

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification Number)

|

| |

|

|

|

500 Laurel Street, Suite 101

Baton Rouge, Louisiana

|

|

70801

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

| |

|

|

|

(225) 248-7600

(Registrant’s telephone number, including area code)

|

Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $1.00 per share

|

BFST

|

Nasdaq Global Select Market

|

Securities registered under Section 12(g) of the Exchange Act: None

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes ☐ No ☒

|

| |

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes ☐ No ☒

|

| |

|

|

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes ☒ No ☐

|

| |

|

|

Indicate by check mark whether the registrant has submitted electronically every Interactive Date File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

|

Yes ☒ No ☐

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☒

|

| |

|

|

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

| |

|

|

|

| |

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

| |

|

|

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

|

☒

|

| |

|

|

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

|

☐

|

| |

|

|

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

|

☐

|

| |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

Yes ☐ No ☒

|

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $449.8 million.

Note.—If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

As of February 22, 2023, there were 25,110,313 outstanding shares of the registrant’s common stock, $1.00 par value per share.

Document Incorporated By Reference:

Portions of the registrant’s Definitive Proxy Statement relating to the 2023 Annual Meeting of Shareholders are incorporated by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such Definitive Proxy Statement, or an Amended Annual Report on Form 10-K/A containing such Part III information, will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2022.

EXPLANATORY NOTE

This Amendment No. 1 to the Annual Report on Form 10-K of Business First Bancshares, Inc. (the “Company”) for the year ended December 31, 2022 as filed with the Securities and Exchange Commission on March 2, 2023 (the “Original Form 10-K”), is being filed for the sole purpose of including an amendment to the 2017 Equity Incentive Plan (the “2017 Equity Incentive Plan”) as an exhibit, which was inadvertently omitted from the Original Form 10-K.

Except as otherwise expressly noted herein, this Amendment No. 1 does not modify or update in any way the financial position, results of operations, cash flows or other disclosures in, or exhibits to, the Original Form 10-K, nor does it reflect events occurring after the filing of the Original Form 10-K. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Form 10-K.

PART IV

ITEM 15. Exhibits and Financial Statement Schedules.

|

(a)

|

List of documents filed as part of this Report

|

The following financial statements are included in Item 8 of the Original Form 10-K:

Report of Independent Registered Public Accounting Firm FORVIS, LLP (formerly Dixon Hughes Goodman LLP) PCAOB Firm ID No. 686 Fort Worth, TX

Consolidated Balance Sheets

Consolidated Statements of Income

Consolidated Statements of Comprehensive Income

Consolidated Statements of Changes in Shareholders’ Equity

Consolidated Statements of Cash Flows

Notes to Consolidated Financial Statements

| |

(2)

|

Financial Statement Schedules

|

Financial statement schedules are omitted either because they are not required or are not applicable, or because the required information is shown in the financial statements or notes thereto.

|

Number

|

Description

|

| |

|

|

2.1

|

|

| |

|

|

2.2

|

|

| |

|

|

3.1

|

|

| |

|

|

3.2

|

|

| |

|

|

4.1

|

|

|

4.2

|

|

| |

|

|

4.3

|

|

| |

|

|

10.1 +

|

|

| |

|

|

10.3 +

|

|

| |

|

|

10.4 +

|

|

| |

|

|

10.7 +

|

|

| |

|

|

10.8 +

|

|

| |

|

|

10.9 +

|

|

| |

|

|

10.10 +

|

|

| |

|

|

10.11 +

|

|

| |

|

|

10.12 +

|

|

| |

|

|

10.13 +

|

|

| |

|

|

10.14 +

|

|

| |

|

|

10.15 +

|

|

| |

|

|

10.16 +

|

|

|

10.17 +

|

|

| |

|

|

10.18

|

|

| |

|

|

10.19 +

|

|

| |

|

|

10.20 +

|

|

| |

|

|

21.1

|

|

| |

|

|

23.1

|

|

| |

|

|

24.1

|

|

| |

|

|

31.1

|

|

| |

|

|

31.2

|

|

| |

|

|

32.1

|

|

| |

|

|

101.INS

|

Inline XBRL Instance Document (included in the Original Form 10-K).

|

| |

|

|

101.SCH

|

Inline XBRL Taxonomy Extension Schema Document (included in the Original Form 10-K).

|

| |

|

|

101.CAL

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document (included in the Original Form 10-K).

|

| |

|

|

101.DEF

|

Inline XBRL Taxonomy Extension Definition Linkbase Document (included in the Original Form 10-K).

|

| |

|

|

101.LAB

|

Inline XBRL Taxonomy Extension Label Linkbase Document (included in the Original Form 10-K).

|

| |

|

|

101.PRE

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document (included in the Original Form 10-K).

|

| |

|

|

104

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101)*

|

| |

|

|

*

|

Filed herewith.

|

|

+

|

Represents a management contract or a compensatory plan or arrangement.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BUSINESS FIRST BANCSHARES, INC.

|

|

| |

|

|

|

| |

|

|

|

|

March 15, 2023

|

By:

|

/s/ David R. Melville, III

|

|

| |

|

David R. Melville, III

|

|

| |

|

President and Chief Executive Officer

|

|

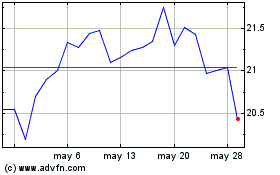

Business First Bancshares (NASDAQ:BFST)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Business First Bancshares (NASDAQ:BFST)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024