BigCommerce Holdings, Inc. (“BigCommerce”) (Nasdaq: BIGC), an open

SaaS, composable ecommerce platform for fast-growing and

established B2C and B2B brands and retailers, today announced

financial results for its second quarter ended June 30, 2024.

“The second quarter delivered results

consistent with our top- and bottom-line plans,” said Brent Bellm,

CEO of BigCommerce. “Revenue finished just under $82 million, up

over 8% year-over-year, with profitability exceeding our

expectations and operating cash flow of nearly $12 million. We

delivered our largest sequential growth in enterprise ARR in the

last year, with improved go-to-market spending efficiency. We

launched several notable brands and retailers on BigCommerce,

including The RealReal, Quicken, and Andertons Music Co., plus

brands like Patagonia, Melissa & Doug, and Dooney & Bourke

on Feedonomics. We see tremendous upside in the business, and these

second quarter results highlight our progress and our customers’

success using the platform.”

Second

Quarter Financial Highlights:

- Total revenue was $81.8 million, up 8% compared to the second

quarter of 2023.

- Total annual revenue run-rate (ARR) as of June 30, 2024 was

$345.8 million, up 4% compared to June 30, 2023.

- Subscription solutions revenue was $61.8 million, up 10%

compared to the second quarter of 2023.

- ARR from accounts with at least one enterprise plan

(“Enterprise Accounts”) was $253.8 million as of June 30, 2024, up

7% from June 30, 2023.

- ARR from Enterprise Accounts as a percent of total ARR was 73%

as of June 30, 2024, compared to 71% as of June 30, 2023.

- GAAP gross margin was 76%, compared

to 75% in the second quarter of 2023. Non-GAAP gross margin was

77%, compared to 77% in the second quarter of 2023.

Other Key Business Metrics

- Number of enterprise accounts was 5,961, up 1% compared to the

second quarter of 2023.

- Average revenue per account (ARPA) of enterprise accounts was

$42,576 up 7% compared to the second quarter of 2023.

- Revenue in the Americas grew by 9% compared to the second

quarter of 2023.

- Revenue in EMEA grew by 7% and

revenue in APAC grew by 9% compared to the second quarter of

2023.

Loss from Operations and Non-GAAP Operating Income

(Loss)

- GAAP loss from operations was ($13.5) million, compared to

($20.9) million in the second quarter of 2023.

- Included in GAAP loss from operations was a restructuring

charge of $2.6 million.

- Non-GAAP operating income (loss)

was $1.9 million, compared to ($3.4) million in the second quarter

of 2023.

Net Income (Loss) and Earnings Per Share

- GAAP net loss was ($11.3) million, compared to ($19.1) million

in the second quarter of 2023.

- Non-GAAP net income (loss) was $4.1 million or 5% of revenue,

compared to ($1.5) million or (2%) of revenue in the second quarter

of 2023.

- GAAP basic net loss per share was ($0.15) based on 77.5 million

shares of common stock, compared to ($0.25) based on 74.8 million

shares of common stock in the second quarter of 2023.

- Non-GAAP basic net income (loss)

per share was $0.05 based on 77.5 million shares of common stock,

compared to ($0.02) based on 74.8 million shares of common stock in

the second quarter of 2023.

Adjusted EBITDA

- Adjusted EBITDA was $3.0 million, compared to ($2.5) million in

the second quarter of 2023.

Cash

- Cash, cash equivalents, restricted cash, and marketable

securities totaled $276.9 million as of June 30, 2024.

- For the six months ended June 30, 2024, net cash provided by

operating activities was $8.3 million, compared to ($6.1) million

used in operating activities for the same period in 2023. We

reported free cash flow of $6.5 million in the six months ended

June 30, 2024.

- The Company has signed an agreement to exchange approximately

$161.2 million principal amount of its 2026 Convertible Notes in

exchange for $150.0 million Convertible Notes due in 2028. The 2028

Convertible Notes bear an annual interest rate of 7.50% with a

conversion price of $16.00.

- The Company has agreed to repurchase approximately $120.6

million principal amount of its 2026 Convertible Notes in exchange

for approximately $108.7 million of cash.

Business Highlights:

Corporate Highlights

- The company received important industry recognition in our

fiscal second quarter. For the second year in a row, BigCommerce

scored a perfect 24 out of 24 total medals in the Paradigm B2B

Combines for Digital Commerce Solutions (Enterprise and Midmarket

Editions). We performed exceptionally well in the midmarket review,

where we received more gold medals than any other platform.

- IDC recognized our B2C enterprise strength by naming us a

leader in the IDC MarketScape for Worldwide Enterprise B2C Digital

Commerce Applications. The analyst firm also named us a leader in

their MarketScapes for Worldwide Enterprise Headless Digital

Commerce Platforms and Worldwide Headless Digital Commerce

Applications for Midmarket Growth.

- Three BigCommerce customers – White Stuff, Mt. Hood Meadows,

and TradeTools – were named finalists for the MACH Alliance Impact

Awards, one of the premier award programs for headless and

composable commerce projects.

Product Highlights

- In April, the company announced over 100 new innovative

features and partner integrations as part of our first Next Big

Thing. We strengthened our customers’ ability to sell to a global

audience with new multi-geo functionality. After a successful

closed beta with over 200 participants, we soft-launched new

international enhancements for Multi-Storefront and plan to fully

launch in our third quarter of fiscal 2024 with additional

features.

- We enhanced our multi-geo selling offering by enabling brands

and retailers to offer unique checkout experiences per storefront.

Merchants in different regions now can allow shoppers to select the

storefront they want to shop at so they can have a truly local

shopping experience.

- In partnership with Fujitsu, we now have Japanese as a

supported language in the control panel for users, and as an

available language for automatic storefront translation.

- Earlier this year, we announced that BigCommerce was the first

ecommerce platform to integrate with Fastlane, PayPal’s

password-less, accelerated guest checkout solution, which speeds

shoppers through checkout and drives higher conversion rates. We

expect that this feature will become available to all of our US

customers starting in August.

- In August we will announce another exciting round of Next Big

Thing product updates and partner integrations at our BigSummit

event in Austin.

Customer

Highlights

- The RealReal, the world’s largest online

marketplace for authenticated resale luxury goods, has launched on

the BigCommerce platform. This headless implementation allows The

RealReal to fully leverage BigCommerce’s robust checkout and

shopping cart functionality by integrating with the functionality

of their existing systems in a phased, composable approach.

- Soletrader, a global premium footwear and

accessories retailer, launched a new composable website that takes

advantage of BigCommerce’s open, flexible platform to leverage

several integrations, including Storyblok for content, search &

merchandising from Algolia, marketing operations from Klaviyo and

hosted on Next.js infrastructure from Vercel.

- Andertons Music Co. launched its new website

on BigCommerce, replacing a monolithic setup with a new composable

tech stack, leveraging Stencil, Pimberly, Constructor, ShipperHQ

and Cybersource. Delivered in just six months, the new site has

enabled Andertons to improve its digital experience and release new

products and updates faster and with ease. This project was

delivered on time within 6 months.

- European luxury licorice and chocolate brand Lakrids by

Bulow successfully launched eight stores on BigCommerce,

covering eight regions including UK, US and the Nordics. The new

stores mark a shift from a headless tech stack to leveraging

BigCommerce’s out-of-the-box functionality, including Stencil and

PageBuilder, and integrations with Adyen, Voyado, Taxjar and

reviews.io.

- Quicken, the popular personal finance and

money management company, launched a new headless site on

BigCommerce with the platform serving as the order management

system for subscriptions, Contentful handling the headless

storefront, and using a hosted PayPal Braintree checkout relying on

BigCommerce’s Payments API.

- Myron Operations, a B2B seller of customizable

promotional products across electronics, apparel, food and

beverage, health and beauty, and other retail categories, launched

several new storefronts for the US, Canada, Germany, Austria,

Switzerland, France, and the UK. Notable integrations to Myron's

B2B Edition stores include Artifi, Avalara, ShipperHQ, and NetSuite

ERP, as well as PayPal Braintree and CyberSource for payments.

- Feedonomics, a BigCommerce subsidiary, also added several new

customers to its roster, including Patagonia, Melissa &

Doug, Faherty, Dooney & Bourke and

Paula's Choice.

Q3 and 2024 Financial Outlook:

For the third quarter of 2024, we currently expect:

- Total revenue between $82.0 million to $84.0 million, implying

a year-over-year growth rate of 5% to 8%.

- Non-GAAP operating income is

expected to be between $500 thousand to $1.5 million.

For the full year 2024, we currently expect:

- Total revenue between $330.2 million and $335.2 million,

translating into a year-over-year growth rate of 7% and 8%.

- Non-GAAP operating income between

$10.7 million and $13.7 million.

Our third quarter and 2024 financial outlook is based on a

number of assumptions that are subject to change and many of which

are outside our control. If actual results vary from these

assumptions, our expectations may change. There can be no assurance

that we will achieve these results.

We do not provide guidance for loss from operations , the most

directly comparable GAAP measure to Non-GAAP operating income

(loss), and similarly cannot provide a reconciliation between its

forecasted Non-GAAP operating income (loss) and Non-GAAP income

(loss) per share and these comparable GAAP measures without

unreasonable effort due to the unavailability of reliable estimates

for certain items. These items are not within our control and may

vary greatly between periods and could significantly impact future

financial results.

Conference Call Information

BigCommerce will host a conference call and webcast at 7:00 a.m.

CT (8:00 a.m. ET) on Thursday, August 1, 2024, to discuss its

financial results and business highlights. The conference call can

be accessed by dialing (833) 634-1254 from the United States and

Canada or (412) 317-6012 internationally and requesting to join the

“BigCommerce conference call.” The live webcast of the conference

call and other materials related to BigCommerce’s financial

performance can be accessed from BigCommerce’s investor relations

website at http://investors.bigcommerce.com.

Following the completion of the call through 11:59 p.m. ET on

Thursday, August 8, 2024, a telephone replay will be available by

dialing (877) 344-7529 from the United States, (855) 669-9658 from

Canada or (412) 317-0088 internationally with conference ID

1402022. A webcast replay will also be available at

http://investors.bigcommerce.com for 12 months.

About BigCommerceBigCommerce (Nasdaq: BIGC) is

a leading open SaaS and composable ecommerce platform that empowers

brands and retailers of all sizes to build, innovate and grow their

businesses online. BigCommerce provides its customers sophisticated

enterprise-grade functionality, customization and performance with

simplicity and ease-of-use. Tens of thousands of B2C and B2B

companies across 150 countries and numerous industries rely on

BigCommerce, including Burrow, Coldwater Creek, Francesca’s, Harvey

Nichols, King Arthur Baking Co., MKM Building Supplies, United Aqua

Group and Uplift Desk. For more information, please visit

www.bigcommerce.com or follow us on X and LinkedIn.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. In some cases, you can identify forward-looking statements

by terms such as “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “outlook,” “may,” “might,” “plan,” “project,” “will,”

“would,” “should,” “could,” “can,” “predict,” “potential,”

“strategy, “target,” “explore,” “continue,” or the negative of

these terms, and similar expressions intended to identify

forward-looking statements. However, not all forward-looking

statements contain these identifying words. These statements may

relate to our market size and growth strategy, our estimated and

projected costs, margins, revenue, expenditures and customer and

financial growth rates, our Q3 and fiscal 2024 financial outlook,

our plans and objectives for future operations, growth, initiatives

or strategies. By their nature, these statements are subject to

numerous uncertainties and risks, including factors beyond our

control, that could cause actual results, performance or

achievement to differ materially and adversely from those

anticipated or implied in the forward-looking statements. These

assumptions, uncertainties and risks include that, among others,

our business would be harmed by any decline in new customers,

renewals or upgrades, our limited operating history makes it

difficult to evaluate our prospects and future results of

operations, we operate in competitive markets, we may not be able

to sustain our revenue growth rate in the future, our business

would be harmed by any significant interruptions, delays or outages

in services from our platform or certain social media platforms,

and a cybersecurity-related attack, significant data breach or

disruption of the information technology systems or networks could

negatively affect our business. Additional risks and uncertainties

that could cause actual outcomes and results to differ materially

from those contemplated by the forward-looking statements are

included under the caption “Risk Factors” and elsewhere in our

filings with the Securities and Exchange Commission (the “SEC”),

including our Annual Report on Form 10-K for the year ended

December 31, 2023 and the future quarterly and current reports that

we file with the SEC. Forward-looking statements speak only as of

the date the statements are made and are based on information

available to BigCommerce at the time those statements are made

and/or management's good faith belief as of that time with respect

to future events. BigCommerce assumes no obligation to update

forward-looking statements to reflect events or circumstances after

the date they were made, except as required by law.

Use of Non-GAAP Financial Measures

We have provided in this press release certain financial

information that has not been prepared in accordance with generally

accepted accounting principles in the United States (“GAAP”). Our

management uses these Non-GAAP financial measures internally in

analyzing our financial results and believes that use of these

Non-GAAP financial measures is useful to investors as an additional

tool to evaluate ongoing operating results and trends and in

comparing our financial results with other companies in our

industry, many of which present similar Non-GAAP financial

measures. Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable financial

measures prepared in accordance with GAAP and should be read only

in conjunction with our consolidated financial statements prepared

in accordance with GAAP. A reconciliation of our historical

Non-GAAP financial measures to the most directly comparable GAAP

measures has been provided in the financial statement tables

included in this press release, and investors are encouraged to

review these reconciliations.

Annual Revenue Run-Rate

We calculate annual revenue run-rate (“ARR”) at the end of each

month as the sum of: (1) contractual monthly recurring revenue at

the end of the period, which includes platform subscription fees,

invoiced growth adjustments, feed management subscription fees,

recurring professional services revenue, and other recurring

revenue, multiplied by twelve to prospectively annualize recurring

revenue, and (2) the sum of the trailing twelve-month non-recurring

and variable revenue, which includes one-time partner integrations,

one-time fees, payments revenue share, and any other revenue that

is non-recurring and variable.

Enterprise Account Metrics

To measure the effectiveness of our ability to execute against

our growth strategy, particularly within the mid-market and

enterprise business segments, we calculate ARR attributable to

Enterprise Accounts. We define Enterprise Accounts as accounts with

at least one unique Enterprise plan subscription or an enterprise

level feed management subscription (collectively “Enterprise

Accounts”). These accounts may have more than one Enterprise plan

or a combination of Enterprise plans and Essentials plans.

Average Revenue Per Account

We calculate average revenue per account (ARPA) for accounts in

the Enterprise cohort at the end of a period by including

customer-billed revenue and an allocation of partner and services

revenue, where applicable. We allocate partner revenue, where

applicable, primarily based on each customer’s share of GMV

processed through that partner’s solution. For partner revenue that

is not directly linked to customer usage of a partner’s solution,

we allocate such revenue based on each customer’s share of total

platform GMV. Each account’s partner revenue allocation is

calculated by taking the account’s trailing twelve-month partner

revenue, then dividing by twelve to create a monthly average to

apply to the applicable period in order to normalize ARPA for

seasonality.

Adjusted EBITDA

We define Adjusted EBITDA as our net loss, excluding the impact

of stock-based compensation expense and related payroll tax costs,

amortization of intangible assets, acquisition related costs,

restructuring charges, depreciation, interest income, interest

expense, other expense, and our provision or benefit for income

taxes.

Acquisition related costs include contingent compensation

arrangements entered into in connection with acquisitions and

achieved earnout related to an acquisition.

Restructuring charges include employee notice period expenses

and severance payments, lease or contract termination costs, asset

impairments, one-time services, and other costs relating to

significant items that are nonrecurring or unusual.

Depreciation includes depreciation expenses related to the

Company's fixed assets.

The most directly comparable GAAP measure is net loss.

Non-GAAP Operating Income (Loss)

We define Non-GAAP Operating Income (Loss) as our GAAP Loss from

operations, excluding the impact of stock-based compensation

expense and related payroll tax costs, third party

acquisition-related costs, and other acquisition related expenses,

including contingent compensation arrangements entered into in

connection with acquisitions, amortization of acquisition-related

intangible assets, and restructuring charges. The most directly

comparable GAAP measure is our loss from operations.

Non-GAAP Net Income (Loss)

We define Non-GAAP Net Income (Loss) as our GAAP net loss,

excluding the impact of stock-based compensation expense and

related payroll tax costs, third party acquisition-related costs,

and other acquisition related expenses, including contingent

compensation arrangements entered into in connection with

acquisitions, amortization of acquisition-related intangible

assets, and restructuring charges. The most directly comparable

GAAP measure is our net loss.

Non-GAAP Basic Net Income (Loss) per Share

We define Non-GAAP Basic Net Income (Loss) per Share as our

Non-GAAP income (loss), defined above, divided by our basic and

diluted GAAP weighted average shares outstanding. The most directly

comparable GAAP measure is our basic net loss per share.

Free Cash Flow

We define Free Cash flow as our GAAP cash flow provided by (used

in) operating activities less our GAAP purchases of property and

equipment (Capital Expenditures). The most directly comparable GAAP

measure is our cash flow provided by (used in) operating

activities.

| Media

Relations Contact |

Investor

Relations Contact |

| Brad Hem |

Tyler Duncan |

| PR@BigCommerce.com |

InvestorRelations@BigCommerce.com |

|

Consolidated Balance Sheets(in thousands) |

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

(unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

133,088 |

|

|

|

71,719 |

|

| Restricted cash |

|

|

1,120 |

|

|

|

1,126 |

|

| Marketable securities |

|

|

142,712 |

|

|

|

198,415 |

|

| Accounts receivable, net |

|

|

45,054 |

|

|

|

37,713 |

|

| Prepaid expenses and other

assets, net |

|

|

24,688 |

|

|

|

24,733 |

|

| Deferred commissions |

|

|

9,119 |

|

|

|

8,280 |

|

| Total current

assets |

|

|

355,781 |

|

|

|

341,986 |

|

| Property and equipment, net |

|

|

9,975 |

|

|

|

10,233 |

|

| Operating lease,

right-of-use-assets |

|

|

3,647 |

|

|

|

4,405 |

|

| Prepaid expenses, net of current

portion |

|

|

2,633 |

|

|

|

1,240 |

|

| Deferred commissions, net of

current portion |

|

|

6,408 |

|

|

|

7,056 |

|

| Intangible assets, net |

|

|

22,133 |

|

|

|

27,052 |

|

| Goodwill |

|

|

51,927 |

|

|

|

52,086 |

|

| Total

assets |

|

$ |

452,504 |

|

|

$ |

444,058 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

| Accounts payable |

|

$ |

6,686 |

|

|

$ |

7,982 |

|

| Accrued liabilities |

|

|

3,596 |

|

|

|

2,652 |

|

| Deferred revenue |

|

|

42,417 |

|

|

|

32,242 |

|

| Current portion of debt |

|

|

417 |

|

|

|

547 |

|

| Current portion of operating

lease liabilities |

|

|

2,424 |

|

|

|

2,542 |

|

| Other current liabilities |

|

|

23,289 |

|

|

|

24,785 |

|

| Total current

liabilities |

|

|

78,829 |

|

|

|

70,750 |

|

| Long-term portion of debt |

|

|

340,468 |

|

|

|

339,614 |

|

| Operating lease liabilities, net

of current portion |

|

|

6,393 |

|

|

|

7,610 |

|

| Other long-term liabilities, net

of current portion |

|

|

703 |

|

|

|

551 |

|

| Total

liabilities |

|

|

426,393 |

|

|

|

418,525 |

|

| Stockholders’

equity |

|

|

|

|

|

|

| Common stock |

|

|

7 |

|

|

|

7 |

|

| Additional paid-in capital |

|

|

638,586 |

|

|

|

620,021 |

|

| Accumulated other comprehensive

gain (loss) |

|

|

(177 |

) |

|

|

163 |

|

| Accumulated deficit |

|

|

(612,305 |

) |

|

|

(594,658 |

) |

| Total stockholders’

equity |

|

|

26,111 |

|

|

|

25,533 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

452,504 |

|

|

$ |

444,058 |

|

| |

|

|

|

|

|

|

|

|

|

Consolidated Statements of Operations(in

thousands, except per share amounts)(unaudited) |

|

|

|

|

|

For the three months endedJune 30, |

|

|

For the six months endedJune 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

| Cost of revenue (1) |

|

|

19,811 |

|

|

|

18,756 |

|

|

|

38,250 |

|

|

|

36,202 |

|

| Gross profit |

|

|

62,018 |

|

|

|

56,687 |

|

|

|

123,939 |

|

|

|

110,998 |

|

| Operating expenses: (1) |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing |

|

|

34,425 |

|

|

|

35,593 |

|

|

|

66,857 |

|

|

|

69,645 |

|

| Research and development |

|

|

20,287 |

|

|

|

21,403 |

|

|

|

40,275 |

|

|

|

42,248 |

|

| General and administrative |

|

|

15,436 |

|

|

|

14,428 |

|

|

|

30,365 |

|

|

|

30,922 |

|

| Amortization of intangible

assets |

|

|

2,452 |

|

|

|

2,033 |

|

|

|

4,919 |

|

|

|

4,066 |

|

| Acquisition related costs |

|

|

334 |

|

|

|

4,125 |

|

|

|

667 |

|

|

|

8,250 |

|

| Restructuring charges |

|

|

2,572 |

|

|

|

0 |

|

|

|

2,572 |

|

|

|

420 |

|

| Total operating expenses |

|

|

75,506 |

|

|

|

77,582 |

|

|

|

145,655 |

|

|

|

155,551 |

|

| Loss from operations |

|

|

(13,488 |

) |

|

|

(20,895 |

) |

|

|

(21,716 |

) |

|

|

(44,553 |

) |

| Interest income |

|

|

3,196 |

|

|

|

2,825 |

|

|

|

6,374 |

|

|

|

5,251 |

|

| Interest expense |

|

|

(720 |

) |

|

|

(722 |

) |

|

|

(1,440 |

) |

|

|

(1,444 |

) |

| Other expense |

|

|

(111 |

) |

|

|

(63 |

) |

|

|

(443 |

) |

|

|

(32 |

) |

| Loss before provision for income

taxes |

|

|

(11,123 |

) |

|

|

(18,855 |

) |

|

|

(17,225 |

) |

|

|

(40,778 |

) |

| Provision for income taxes |

|

|

(132 |

) |

|

|

(210 |

) |

|

|

(422 |

) |

|

|

(407 |

) |

| Net loss |

|

$ |

(11,255 |

) |

|

$ |

(19,065 |

) |

|

$ |

(17,647 |

) |

|

$ |

(41,185 |

) |

| Basic net loss per share |

|

$ |

(0.15 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.55 |

) |

| Shares used to compute basic net

loss per share |

|

|

77,456 |

|

|

|

74,790 |

|

|

|

77,041 |

|

|

|

74,468 |

|

| |

|

|

|

|

|

|

|

|

|

|

(1) Amounts include stock-based compensation expense and

associated payroll tax costs, as follows:

| |

|

For the three months endedJune 30, |

|

|

For the six months endedJune 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Cost of revenue |

|

$ |

1,028 |

|

|

$ |

1,290 |

|

|

$ |

1,684 |

|

|

$ |

2,479 |

|

| Sales and marketing |

|

|

3,138 |

|

|

|

3,566 |

|

|

|

5,005 |

|

|

|

6,433 |

|

| Research and development |

|

|

3,273 |

|

|

|

3,943 |

|

|

|

6,749 |

|

|

|

7,446 |

|

| General and administrative |

|

|

2,582 |

|

|

|

2,573 |

|

|

|

5,174 |

|

|

|

5,652 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Cash Flows(in

thousands)(unaudited) |

|

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from operating

activities |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(11,255 |

) |

|

$ |

(19,065 |

) |

|

$ |

(17,647 |

) |

|

$ |

(41,185 |

) |

| Adjustments to reconcile net loss

to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization

expense |

|

3,512 |

|

|

|

2,940 |

|

|

|

6,998 |

|

|

|

5,844 |

|

| Amortization of discount on

debt |

|

497 |

|

|

|

494 |

|

|

|

994 |

|

|

|

987 |

|

| Stock-based compensation

expense |

|

10,009 |

|

|

|

11,290 |

|

|

|

18,397 |

|

|

|

21,777 |

|

| Provision for expected credit

losses |

|

850 |

|

|

|

433 |

|

|

|

1,713 |

|

|

|

1,508 |

|

| Other |

|

(37 |

) |

|

|

0 |

|

|

|

(37 |

) |

|

|

0 |

|

| Changes in operating assets and

liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Accounts receivable |

|

(6,790 |

) |

|

|

6,425 |

|

|

|

(9,378 |

) |

|

|

(1,760 |

) |

| Prepaid expenses |

|

3,935 |

|

|

|

751 |

|

|

|

(1,025 |

) |

|

|

(3,484 |

) |

| Deferred commissions |

|

(402 |

) |

|

|

(821 |

) |

|

|

(191 |

) |

|

|

(772 |

) |

| Accounts payable |

|

(356 |

) |

|

|

(1,023 |

) |

|

|

(1,245 |

) |

|

|

(528 |

) |

| Accrued and other

liabilities |

|

4,168 |

|

|

|

7,027 |

|

|

|

(433 |

) |

|

|

2,105 |

|

| Deferred revenue |

|

7,607 |

|

|

|

6,292 |

|

|

|

10,175 |

|

|

|

9,415 |

|

| Net cash provided by (used in)

operating activities |

|

11,738 |

|

|

|

14,743 |

|

|

|

8,321 |

|

|

|

(6,093 |

) |

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

|

|

| Cash paid for acquisition |

|

(100 |

) |

|

0 |

|

|

|

(100 |

) |

|

0 |

|

| Purchase of property and

equipment |

|

(1,064 |

) |

|

|

(1,017 |

) |

|

|

(1,870 |

) |

|

|

(2,080 |

) |

| Maturity of marketable

securities |

|

62,525 |

|

|

|

83,643 |

|

|

|

91,965 |

|

|

|

123,072 |

|

| Purchase of marketable

securities |

|

(1,037 |

) |

|

|

(85,351 |

) |

|

|

(36,602 |

) |

|

|

(133,394 |

) |

| Net cash provided by (used in)

investing activities |

|

60,324 |

|

|

|

(2,725 |

) |

|

|

53,393 |

|

|

|

(12,402 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from exercise of stock

options |

|

271 |

|

|

|

1,156 |

|

|

|

1,245 |

|

|

|

2,245 |

|

| Taxes paid related to net share

settlement of stock options |

|

0 |

|

|

|

(811 |

) |

|

|

(1,325 |

) |

|

|

(2,230 |

) |

| Proceeds from financing

obligation |

|

0 |

|

|

|

1,081 |

|

|

|

0 |

|

|

|

1,081 |

|

| Repayment of debt |

|

(137 |

) |

|

|

0 |

|

|

|

(271 |

) |

|

|

0 |

|

| Net cash provided by (used in)

financing activities |

|

134 |

|

|

|

1,426 |

|

|

|

(351 |

) |

|

|

1,096 |

|

| Net change in cash and cash

equivalents and restricted cash |

|

72,196 |

|

|

|

13,444 |

|

|

|

61,363 |

|

|

|

(17,399 |

) |

| Cash and cash equivalents and

restricted cash, beginning of period |

|

62,012 |

|

|

|

62,187 |

|

|

|

72,845 |

|

|

|

93,030 |

|

| Cash and cash equivalents and

restricted cash, end of period |

$ |

134,208 |

|

|

$ |

75,631 |

|

|

$ |

134,208 |

|

|

$ |

75,631 |

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

|

|

|

|

|

| Cash paid for interest |

$ |

6 |

|

|

$ |

0 |

|

|

$ |

445 |

|

|

$ |

431 |

|

| Cash paid for taxes |

$ |

42 |

|

|

$ |

60 |

|

|

$ |

182 |

|

|

$ |

212 |

|

| Noncash investing and

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

| Capital additions, accrued but

not paid |

$ |

117 |

|

|

$ |

125 |

|

|

$ |

117 |

|

|

$ |

190 |

|

| Fair value of shares issued as

consideration for acquisition |

$ |

248 |

|

|

$ |

0 |

|

|

$ |

248 |

|

|

$ |

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disaggregated Revenue:

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

| (in

thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Subscription solutions |

|

$ |

61,796 |

|

|

$ |

56,135 |

|

|

$ |

122,755 |

|

|

$ |

109,943 |

|

| Partner and services |

|

|

20,033 |

|

|

|

19,308 |

|

|

|

39,434 |

|

|

|

37,257 |

|

| Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue by geographic region:

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

| (in

thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas – United States |

|

$ |

62,428 |

|

|

$ |

57,546 |

|

|

$ |

123,567 |

|

|

$ |

112,355 |

|

| Americas – other (1) |

|

|

3,777 |

|

|

|

3,422 |

|

|

|

7,552 |

|

|

|

6,773 |

|

| EMEA |

|

|

9,281 |

|

|

|

8,649 |

|

|

|

18,473 |

|

|

|

16,633 |

|

| APAC |

|

|

6,343 |

|

|

|

5,826 |

|

|

|

12,597 |

|

|

|

11,439 |

|

| Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Americas-other revenue includes revenue from North and South

America, other than the United States.

|

Reconciliation of GAAP to Non-GAAP Results(in

thousands, except per share amounts)(unaudited) |

| |

|

Reconciliation of loss from operations to Non-GAAP

operating income (loss): |

|

|

| |

|

Three months endedJune 30, |

|

|

Six months ended June 30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

$ |

(13,488 |

) |

|

$ |

(20,895 |

) |

|

$ |

(21,716 |

) |

|

$ |

(44,553 |

) |

|

| Plus: stock-based compensation

expense and associated payroll tax costs |

|

|

10,021 |

|

|

|

11,372 |

|

|

|

18,612 |

|

|

|

22,010 |

|

|

| Amortization of intangible

assets |

|

|

2,452 |

|

|

|

2,033 |

|

|

|

4,919 |

|

|

|

4,066 |

|

|

| Acquisition related costs |

|

|

334 |

|

|

|

4,125 |

|

|

|

667 |

|

|

|

8,250 |

|

|

| Restructuring charges |

|

|

2,572 |

|

|

|

0 |

|

|

|

2,572 |

|

|

|

420 |

|

|

| Non-GAAP operating income

(loss) |

|

$ |

1,891 |

|

|

$ |

(3,365 |

) |

|

$ |

5,054 |

|

|

$ |

(9,807 |

) |

|

| Non-GAAP operating income (loss)

as a percentage of revenue |

|

|

2.3 |

|

% |

|

(4.5 |

) |

% |

|

3.1 |

|

% |

|

(6.7 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of net loss and basic net loss per share

to Non-GAAP net income (loss) and Non-GAAP net income (loss) per

share:

| |

|

Three months endedJune 30, |

|

|

Six months ended June 30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(11,255 |

) |

|

$ |

(19,065 |

) |

|

$ |

(17,647 |

) |

|

$ |

(41,185 |

) |

|

| Plus: stock-based compensation

expense and associated payroll tax costs |

|

|

10,021 |

|

|

|

11,372 |

|

|

|

18,612 |

|

|

|

22,010 |

|

|

| Amortization of intangible

assets |

|

|

2,452 |

|

|

|

2,033 |

|

|

|

4,919 |

|

|

|

4,066 |

|

|

| Acquisition related costs |

|

|

334 |

|

|

|

4,125 |

|

|

|

667 |

|

|

|

8,250 |

|

|

| Restructuring charges |

|

|

2,572 |

|

|

|

0 |

|

|

|

2,572 |

|

|

|

420 |

|

|

| Non-GAAP net income (loss) |

|

$ |

4,124 |

|

|

$ |

(1,535 |

) |

|

$ |

9,123 |

|

|

$ |

(6,439 |

) |

|

| Basic net loss per share |

|

$ |

(0.15 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.55 |

) |

|

| Non-GAAP basic net income (loss)

per share |

|

$ |

0.05 |

|

|

$ |

(0.02 |

) |

|

$ |

0.12 |

|

|

$ |

(0.09 |

) |

|

| Non-GAAP diluted net income per

share (1) |

|

$ |

0.05 |

|

|

|

|

|

$ |

0.12 |

|

|

|

|

|

| Shares used to compute basic

Non-GAAP net income (loss) per share |

|

|

77,456 |

|

|

|

74,790 |

|

|

|

77,041 |

|

|

|

74,468 |

|

|

| Shares used to compute diluted

Non-GAAP net income (loss) per share (1) |

|

|

79,291 |

|

|

|

|

|

|

79,085 |

|

|

|

|

|

| Non-GAAP net income (loss) as a

percentage of revenue |

|

|

5.0 |

|

% |

|

(2.0 |

) |

% |

|

5.6 |

|

% |

|

(4.4 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Due to Non-GAAP net income (loss) for the three and six

months ended June 30, 2023, there are no common shares added

to calculate Non-GAAP diluted net income per share because the

effect would be anti-dilutive.

Reconciliation of net loss to adjusted

EBITDA:

| |

|

Three months endedJune 30, |

|

|

Six months ended June 30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(11,255 |

) |

|

$ |

(19,065 |

) |

|

$ |

(17,647 |

) |

|

$ |

(41,185 |

) |

|

| Plus: stock-based compensation

expense and associated payroll tax costs |

|

|

10,021 |

|

|

|

11,372 |

|

|

|

18,612 |

|

|

|

22,010 |

|

|

| Amortization of intangible

assets |

|

|

2,452 |

|

|

|

2,033 |

|

|

|

4,919 |

|

|

|

4,066 |

|

|

| Acquisition related costs |

|

|

334 |

|

|

|

4,125 |

|

|

|

667 |

|

|

|

8,250 |

|

|

| Restructuring charges |

|

|

2,572 |

|

|

|

0 |

|

|

|

2,572 |

|

|

|

420 |

|

|

| Depreciation |

|

|

1,060 |

|

|

|

906 |

|

|

|

2,079 |

|

|

|

1,778 |

|

|

| Interest income |

|

|

(3,196 |

) |

|

|

(2,825 |

) |

|

|

(6,374 |

) |

|

|

(5,251 |

) |

|

| Interest expense |

|

|

720 |

|

|

|

722 |

|

|

|

1,440 |

|

|

|

1,444 |

|

|

| Other expenses |

|

|

111 |

|

|

|

63 |

|

|

|

443 |

|

|

|

32 |

|

|

| Provision for income taxes |

|

|

132 |

|

|

|

210 |

|

|

|

422 |

|

|

|

407 |

|

|

| Adjusted EBITDA |

|

$ |

2,951 |

|

|

$ |

(2,459 |

) |

|

$ |

7,133 |

|

|

$ |

(8,029 |

) |

|

| Adjusted EBITDA as a percentage

of revenue |

|

|

3.6 |

|

% |

|

(3.3 |

) |

% |

|

4.4 |

|

% |

|

(5.5 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of cost of revenue to Non-GAAP cost of

revenue:

| |

|

Three months endedJune 30, |

|

|

Six months ended June 30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

$ |

19,811 |

|

|

$ |

18,756 |

|

|

$ |

38,250 |

|

|

$ |

36,202 |

|

|

| Less: stock-based compensation

expense and associated payroll tax costs |

|

|

1,028 |

|

|

|

1,290 |

|

|

|

1,684 |

|

|

|

2,479 |

|

|

| Non-GAAP cost of revenue |

|

$ |

18,783 |

|

|

$ |

17,466 |

|

|

$ |

36,566 |

|

|

$ |

33,723 |

|

|

| As a percentage of revenue |

|

|

23.0 |

|

% |

|

23.2 |

|

% |

|

22.5 |

|

% |

|

22.9 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of sales and marketing expense to

Non-GAAP sales and marketing expense:

| |

|

Three months endedJune 30, |

|

|

Six months ended June 30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing |

|

$ |

34,425 |

|

|

$ |

35,593 |

|

|

$ |

66,857 |

|

|

$ |

69,645 |

|

|

| Less: stock-based compensation

expense and associated payroll tax costs |

|

|

3,138 |

|

|

|

3,566 |

|

|

|

5,005 |

|

|

|

6,433 |

|

|

| Non-GAAP sales and

marketing |

|

$ |

31,287 |

|

|

$ |

32,027 |

|

|

$ |

61,852 |

|

|

$ |

63,212 |

|

|

| As a percentage of

revenue |

|

|

38.2 |

|

% |

|

42.5 |

|

% |

|

38.1 |

|

% |

|

42.9 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of research and development expense to

Non-GAAP research and development expense:

| |

|

Three months endedJune 30, |

|

|

Six months ended June 30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

$ |

20,287 |

|

|

$ |

21,403 |

|

|

$ |

40,275 |

|

|

$ |

42,248 |

|

|

| Less: stock-based compensation

expense and associated payroll tax costs |

|

|

3,273 |

|

|

|

3,943 |

|

|

|

6,749 |

|

|

|

7,446 |

|

|

| Non-GAAP research and

development |

|

$ |

17,014 |

|

|

$ |

17,460 |

|

|

$ |

33,526 |

|

|

$ |

34,802 |

|

|

| As a percentage of

revenue |

|

|

20.8 |

|

% |

|

23.1 |

|

% |

|

20.7 |

|

% |

|

23.6 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of general and administrative expense to

Non-GAAP general and administrative expense:

| |

|

Three months endedJune 30, |

|

|

Six months ended June 30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

81,829 |

|

|

$ |

75,443 |

|

|

$ |

162,189 |

|

|

$ |

147,200 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| General &

administrative |

|

$ |

15,436 |

|

|

$ |

14,428 |

|

|

$ |

30,365 |

|

|

$ |

30,922 |

|

|

| Less: stock-based compensation

expense and associated payroll tax costs |

|

|

2,582 |

|

|

|

2,573 |

|

|

|

5,174 |

|

|

|

5,652 |

|

|

| Non-GAAP general &

administrative |

|

$ |

12,854 |

|

|

$ |

11,855 |

|

|

$ |

25,191 |

|

|

$ |

25,270 |

|

|

| As a percentage of

revenue |

|

|

15.7 |

|

% |

|

15.7 |

|

% |

|

15.5 |

|

% |

|

17.2 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of net cash provided by (used in)

operating activities to free cash flow:

| |

|

Three months endedJune 30, |

|

|

Six months ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| (in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities |

|

$ |

11,738 |

|

|

$ |

14,743 |

|

|

$ |

8,321 |

|

|

$ |

(6,093 |

) |

| Purchases of property and

equipment |

|

|

(1,064 |

) |

|

|

(1,017 |

) |

|

|

(1,870 |

) |

|

|

(2,080 |

) |

| Free cash flow |

|

$ |

10,674 |

|

|

$ |

13,726 |

|

|

$ |

6,451 |

|

|

$ |

(8,173 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

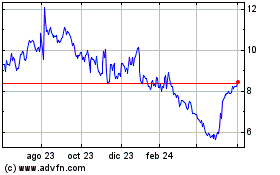

BigCommerce (NASDAQ:BIGC)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

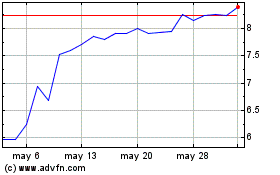

BigCommerce (NASDAQ:BIGC)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024