0001487197

false

--12-31

Q1

0001487197

2023-01-01

2023-03-31

0001487197

2023-04-21

0001487197

2023-03-31

0001487197

2022-12-31

0001487197

2022-01-01

2022-03-31

0001487197

2021-12-31

0001487197

2022-03-31

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerAMember

2023-01-01

2023-03-31

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerAMember

2022-01-01

2022-03-31

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerBMember

2023-01-01

2023-03-31

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerBMember

2022-01-01

2022-03-31

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerCMember

2023-01-01

2023-03-31

0001487197

us-gaap:CustomerConcentrationRiskMember

BRFH:VendorMember

BRFH:ManufacturerCMember

2022-01-01

2022-03-31

0001487197

BRFH:ManufacturingAndCustomerEquipmentMember

2023-03-31

0001487197

BRFH:ManufacturingAndCustomerEquipmentMember

2022-12-31

0001487197

srt:OtherPropertyMember

2023-03-31

0001487197

srt:OtherPropertyMember

2022-12-31

0001487197

2022-01-01

2022-12-31

0001487197

2021-01-01

2021-12-31

0001487197

us-gaap:RelatedPartyMember

2022-07-31

0001487197

us-gaap:CommonStockMember

2021-12-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001487197

us-gaap:RetainedEarningsMember

2021-12-31

0001487197

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001487197

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001487197

us-gaap:CommonStockMember

2022-03-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001487197

us-gaap:RetainedEarningsMember

2022-03-31

0001487197

us-gaap:CommonStockMember

2022-12-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001487197

us-gaap:RetainedEarningsMember

2022-12-31

0001487197

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001487197

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001487197

us-gaap:CommonStockMember

2023-03-31

0001487197

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001487197

us-gaap:RetainedEarningsMember

2023-03-31

0001487197

BRFH:TwoThousandAndTwentyThreePlanMember

2023-03-31

0001487197

us-gaap:PerformanceSharesMember

2023-02-01

2023-02-28

0001487197

2023-02-01

2023-02-28

0001487197

us-gaap:PerformanceSharesMember

2023-01-01

2023-03-31

0001487197

us-gaap:PerformanceSharesMember

BRFH:TimeBasedVestingMember

2023-01-01

2023-03-31

0001487197

us-gaap:PerformanceSharesMember

BRFH:TwoThousandAndTwentyThreePlanMember

2023-04-01

2023-04-30

0001487197

us-gaap:PerformanceSharesMember

2022-12-31

0001487197

us-gaap:PerformanceSharesMember

2023-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended March 31, 2023

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from ________________ to ___________________

Commission

File Number: 001-41228

BARFRESH

FOOD GROUP INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

27-1994406 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

3600

Wilshire Blvd., Suite 1720,

Los

Angeles, California |

|

90010 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

310-598-7113

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name, former address and former fiscal year, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, $0.000001 par value |

|

BRFH |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☐ |

Smaller

reporting company ☒

Emerging

growth company ☒ |

If

an emerging growth company, indicate by the check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 13,002,603

shares as of April 21, 2023.

TABLE

OF CONTENTS

Item

1. Financial Statements.

Barfresh Food Group Inc.

Condensed Consolidated Balance Sheets

See

the accompanying notes to the condensed consolidated financial statements

Barfresh

Food Group Inc.

Condensed

Consolidated Statements of Operations

For

the three months ended March 31, 2023 and 2022

(Unaudited)

See

the accompanying notes to the condensed consolidated financial statements

Barfresh

Food Group Inc.

Condensed

Consolidated Statements of Cash Flows

For

the three months ended March 31, 2023 and 2022

(Unaudited)

See

the accompanying notes to the condensed consolidated financial statements

Barfresh

Food Group Inc.

Notes

to Condensed Consolidated Financial Statements

March

31, 2023

(Unaudited)

Note

1. Description of the Business, Basis of Presentation, and Summary of Significant Accounting Policies

Barfresh

Food Group Inc., (“we,” “us,” “our,” and the “Company”) was incorporated on February

25, 2010 in the State of Delaware. The Company is engaged in the manufacturing and distribution of ready-to-drink and ready-to-blend

beverages, particularly, smoothies, shakes and frappes.

Basis

of Presentation

The

accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial statements

have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and

applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) regarding interim financial reporting.

Certain information and footnote disclosures normally included in the financial statements prepared in accordance with GAAP have been

condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed consolidated financial statements should

be read in conjunction with the audited consolidated financial statements for the fiscal year ended December 31, 2022 included in the

Company’s Annual Report on Form 10-K, as filed with the SEC on March 2, 2023. In management’s opinion, the unaudited interim

condensed consolidated financial statements reflect all adjustments, which are of a normal and recurring nature, that are necessary for

a fair presentation of financial results for the interim periods presented. Operating results for any quarter are not necessarily indicative

of the results for the full fiscal year.

Principles

of Consolidation

The

consolidated financial statements include the financial statements of the Company and our wholly owned subsidiaries, Barfresh Inc. and

Barfresh Corporation Inc. (formerly known as Smoothie, Inc.). All inter-company balances and transactions among the companies have been

eliminated upon consolidation.

Use

of Estimates

The

preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities in the balance sheets and revenues and expenses during the years reported. Actual results may differ

from these estimates.

Vendor

Concentrations

The

Company is exposed to supply risk as a result of concentrations in its vendor base resulting from the use of a limited number of contract

manufacturers. Purchases from the Company’s significant contract manufacturers as a percentage of all finished goods purchased

were as follows:

Schedule

of Company’s Contract Manufacturers of Finished Goods

| | |

For the three months ended March 31, | |

| | |

2023 | | |

2022 | |

| Manufacturer A | |

| 49 | % | |

| 31 | % |

| Manufacturer B | |

| 46 | % | |

| 0 | % |

| Manufacturer C | |

| 0 | % | |

| 59 | % |

Summary

of Significant Accounting Policies

There

have been no changes to our significant accounting policies described in our Annual Report on Form 10-K for the year ended December 31,

2022, as filed with the SEC on March 2, 2023 that have had a material impact on our condensed consolidated financial statements and related

notes.

Fair

Value Measurement and Financial Instruments

Financial

Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements

and Disclosures (“ASC 820”), that requires the valuation of assets and liabilities permitted to be either recorded or

disclosed at fair value based on a hierarchy of available inputs as follows:

Level

1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or

liabilities;

Level

2 – Quoted prices for similar assets and liabilities in active markets, quoted prices for identical assets and liabilities in markets

that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability;

and

Level

3 – Prices or valuation techniques that require inputs that are both significant to the fair value and unobservable (i.e., supported

by little or no market activity).

The

Company’s financial instruments consist of cash, restricted cash, accounts receivable and accounts payable. The carrying value

of the Company’s financial instruments approximates their fair value.

Restricted

Cash

At

each of March 31, 2023 and December 31, 2022, the Company had approximately $211,000 in restricted cash related to a co-packing agreement.

Accounts

Receivable and Allowances

Accounts receivable are recorded and carried at the original invoiced amount

less allowances for credits and for any potential uncollectible amounts due to credit losses. We make estimates of the expected credit

and collectability trends for the allowance for credit losses based on our assessment of various factors, including historical experience,

the age of the accounts receivable balances, credit quality of our customers, current economic conditions, and other factors that may

affect our ability to collect from our customers. Expected credit losses are recorded as general and administrative expenses on our condensed

consolidated statements of operations. As

of March 31, 2023 and December 31, 2022, there was no allowance for doubtful accounts.

Other

Receivables

Other

receivables consist of amounts due from vendors for materials acquired on their behalf for use in manufacturing the Company’s products,

vendor rebates and freight claims.

Revenue

Recognition

In

accordance with ASC 606, Revenue from Contracts with Customers, revenue is recognized when a customer obtains ownership of promised goods.

The amount of revenue recognized reflects the consideration to which the Company expects to be entitled to receive in exchange for these

goods. The Company applies the following five steps:

| |

1) |

Identify

the contract with a customer |

| |

|

|

| |

|

A

contract with a customer exists when (I) the Company enters into an enforceable contract with a customer that defines each party’s

rights, (ii) the contract has commercial substance and, (iii) the Company determines that collection of substantially all consideration

for goods or services that are transferred is probable. For the Company, the contract is the approved sales order, which may also

be supplemented by other agreements that formalize various terms and conditions with customers. |

| |

| |

2) |

Identify

the performance obligation in the contract |

| |

|

|

| |

|

Performance

obligations promised in a contract are identified based on the goods or services that will be transferred to the customer. For the

Company, this consists of the delivery of frozen beverages, which provide immediate benefit to the customer. |

| |

|

|

| |

3) |

Determine

the transaction price |

| |

|

|

| |

|

The

transaction price is determined based on the consideration to which the Company will be entitled in exchange for transferring goods

and is generally stated on the approved sales order. Variable consideration, which typically includes rebates or discounts, are estimated

utilizing the most likely amount method. Provisions for refunds are generally provided for in the period the related sales are recorded,

based on management’s assessment of historical and projected trends. |

| |

|

|

| |

4) |

Allocate

the transaction price to performance obligations in the contract

Since

the Company’s contracts contain a single performance obligation, delivery of frozen beverages, the transaction price is allocated

to that single performance obligation. |

| |

5) |

Recognize

revenue when or as the Company satisfies a performance obligation |

| |

|

|

| |

|

The

Company recognizes revenue from the sale of frozen beverages when title and risk of loss

passes and the customer accepts the goods, which generally occurs at the time of delivery

to a customer warehouse. Customer sales incentives such as volume-based rebates or discounts

are treated as a reduction of sales at the time the sale is recognized. Shipping and handling

costs are treated as fulfilment costs and presented in distribution, selling and administrative

costs.

Payments

that are received before performance obligations are recorded are shown as current liabilities. |

| |

|

|

| |

|

The

Company evaluated the requirement to disaggregate revenue and concluded that substantially all of its revenue comes from a single

product, frozen beverages. |

Storage

and Shipping Costs

Storage

and outbound freight costs are included in selling, marketing and distribution expense. For the three months ending March 31, 2023 and

2022, storage and outbound freight totaled approximately $311,000 and $386,000, respectively.

Research

and Development

Expenditures

for research activities relating to product development and improvement are charged to expense as incurred. The Company incurred approximately

$21,000 and $31,000, in research and development expense for the three months ending March 31, 2023 and 2022, respectively.

Loss

Per Share

For

the three months ended March 31, 2023 and 2022 common stock equivalents have not been included in the calculation of net loss per share

as their effect is anti-dilutive as a result of losses incurred.

Reclassifications

Certain

reclassifications have been made to the 2022 financial statements to conform to the 2023 presentation, namely the presentation of selling

and marketing expense apart from general and administrative expense in the consolidated statement of operations, the reclassification

of materials shipping to cost of revenue, and the presentation of the components of cash used in operations.

Recent

Pronouncements

From

time to time, new accounting pronouncements are issued that we adopt as of the specified effective date. We have not determined if the

impact of recently issued standards that are not yet effective will have an impact on our results of operations and financial position.

Note

2. Inventory

Inventory

consists of the following:

Schedule

of Inventory

| | |

March 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Raw materials | |

$ | 49,000 | | |

$ | 65,000 | |

| Finished goods | |

| 1,006,000 | | |

| 983,000 | |

| Inventory, net | |

$ | 1,055,000 | | |

$ | 1,048,000 | |

Note

3. Property Plant and Equipment

Property

and equipment, net consist of the following:

Schedule

of Property and Equipment, Net

| | |

March 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Manufacturing and customer equipment | |

$ | 3,637,000 | | |

$ | 3,637,000 | |

| Other property | |

| 69,000 | | |

| 69,000 | |

| Property and equipment, gross | |

| 3,706,000 | | |

| 3,706,000 | |

| Less: accumulated depreciation | |

| (3,409,000 | ) | |

| (3,317,000 | ) |

| Property and equipment, net of depreciation | |

$ | 297,000 | | |

$ | 389,000 | |

Depreciation

expense related to these assets was approximately $92,000 and $145,000 for the three months ended March 31, 2023 and 2022, respectively.

Depreciation expense in cost of revenue was $4,000 for the three months ended March 31, 2023. There was no depreciation expense in cost

of revenue for the three months ended March 31, 2022.

Note

4. Commitments and Contingencies

Lease

Commitments

The

Company leases office space under a non-cancellable operating lease which expired on March 31, 2023, and was extended through June 30,

2023. The Company’s periodic lease cost was approximately $20,000 for each of the three months ended March 31, 2023 and 2022.

Legal

Proceedings

Schreiber

Dispute

The

Company’s products are produced to its specifications through several contract manufacturers. One of the Company’s contract

manufacturers (the “Manufacturer”) provided approximately 52% and 42% of the Company’s products in the years ended

December 31, 2022 and 2021, respectively, under a Supply Agreement with an initial term through September 2025.

Over

the course of 2022, the Company experienced numerous quality issues with the case packaging utilized by the Manufacturer. In addition,

in July of 2022, the Company began receiving customer complaints about the texture of the Company’s smoothie products produced

by the Manufacturer. In response, the Company withdrew product from the market and destroyed on-hand inventory, withholding $499,000

in payments due to the Manufacturer.

The

Company attempted to resolve the issues based on the contractual procedures described in the Supply Agreement. However, on November 4,

2022, in response to a formal proposal of alternate resolutions, the Company received notification from the Manufacturer that it was

denying any responsibility for the defective manufacture of the product. In response, on November 10, 2022, the Company filed a complaint

in the United States District Court for the Central District of California, Western Division (the “Complaint”), claiming

that the Manufacturer had not met its obligations under the Supply Agreement, and seeking economic damages. In response, the Manufacturer

terminated the Supply Agreement. On January 20, 2023, the Company filed a voluntary dismissal of the Complaint which allows the parties

to reach a potential resolution outside of the court system. However, if the parties are once again unable to come to an agreement, the

Company has the right to refile the Complaint in California State Court.

Due

to the uncertainties surrounding the claim, the Company is not able to predict either the outcome or a range of reasonably possible recoveries

that could result from its actions against the Manufacturer, and no gain contingencies have been recorded. The disruption in its supply

resulting from the dispute has and will continue to adversely impact its results of operations and cash flow until a suitable resolution

is reached or new sources of reliable supply at sufficient volume can be identified and developed, the timing of which is uncertain.

Other

legal matters

From

time to time, various lawsuits and legal proceedings may arise in the ordinary course of business. However, litigation is subject to

inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are

currently the defendant in one legal proceeding for an amount less than $100,000. Our legal counsel and management believe the probability

of a material unfavorable outcome is remote.

Note

5. Stockholders’ Equity

The

following are changes in stockholders’ equity for the three months ended March 31, 2022 and 2023:

Schedule of Changes in Stockholders' Equity

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

paid in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| Balance December 31, 2021 | |

| 12,905,112 | | |

$ | - | | |

$ | 60,341,000 | | |

$ | (52,165,000 | ) | |

$ | 8,176,000 | |

| Shares issued for warrant exercise | |

| 986 | | |

| - | | |

| 5,000 | | |

| - | | |

| 5,000 | |

| Equity-based compensation | |

| - | | |

| - | | |

| 28,000 | | |

| - | | |

| 28,000 | |

| Issuance of stock and options for services | |

| 13,801 | | |

| - | | |

| 98,000 | | |

| - | | |

| 98,000 | |

| Cash settlement of equity-based compensation | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (895,000 | ) | |

| (895,000 | ) |

| Balance March 31, 2022 | |

| 12,919,899 | | |

$ | - | | |

$ | 60,472,000 | | |

$ | (53,060,000 | ) | |

$ | 7,412,000 | |

| | |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

paid in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Total | |

| Balance December 31, 2022 | |

| 12,934,741 | | |

$ | - | | |

$ | 60,905,000 | | |

$ | (58,384,000 | ) | |

$ | 2,521,000 | |

| Beginning balance | |

| 12,934,741 | | |

$ | - | | |

$ | 60,905,000 | | |

$ | (58,384,000 | ) | |

$ | 2,521,000 | |

| Equity-based compensation | |

| 35,659 | | |

| - | | |

| 175,000 | | |

| - | | |

| 175,000 | |

| Cash settlement of equity-based compensation | |

| - | | |

| - | | |

| (24,000 | ) | |

| - | | |

| (24,000 | ) |

| Issuance of stock and options for services | |

| 32,203 | | |

| - | | |

| 83,000 | | |

| - | | |

| 83,000 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (910,000 | ) | |

$ | (910,000 | ) |

| Balance March 31, 2023 | |

| 13,002,603 | | |

$ | - | | |

$ | 61,139,000 | | |

$ | (59,294,000 | ) | |

| 1,845,000 | |

| Ending balance | |

| 13,002,603 | | |

$ | - | | |

$ | 61,139,000 | | |

$ | (59,294,000 | ) | |

| 1,845,000 | |

Warrants

During

the three months ended March 31, 2023, 684,639 warrants at a weighted average exercise price of $5.85 per share expired.

Equity

Incentive Plan

Through

2022, the Company issued equity awards under the 2015 Equity Incentive Plan (the “2015 Plan”) and outside the Plan. In March

2023, the Board of Directors adopted the 2023 Equity Incentive Plan (the “2023 Plan”), reserving 650,000 shares for future

issuance, and discontinuing further grants under the 2015 Plan.

As

of March 31, 2023, the Company has $227,000 of total unrecognized share-based compensation expense relative to unvested options, stock

awards and stock units, which is expected to be recognized over the remaining weighted average period of 1.8 years.

Stock

Options

The

following is a summary of stock option activity for the three months ended March 31, 2023:

Summary of Stock Options Activity

| | |

Number of Options | | |

Weighted

average

exercise price

per share | | |

Remaining

term in years | |

| Outstanding on December 31, 2022 | |

| 682,939 | | |

$ | 7.30 | | |

| 3.2 | |

| Issued | |

| 20,891 | | |

$ | 1.62 | | |

| 8.0 | |

| Cancelled/expired | |

| (4,000 | ) | |

$ | 5.65 | | |

| | |

| Outstanding on March 31, 2023 | |

| 699,830 | | |

$ | 7.14 | | |

| 3.1 | |

| | |

| | | |

| | | |

| | |

| Exercisable, March 31, 2023 | |

| 638,110 | | |

$ | 7.26 | | |

| 2.8 | |

The

fair value of the options issued was calculated using the Black-Scholes option pricing model, based on the following:

Summary of Fair Value of Options Using Black-Sholes Option Pricing Model

| | |

2023 | |

| Expected term (in years) | |

| 8.0 | |

| Expected volatility | |

| 84.4 | % |

| Risk-free interest rate | |

| 3.5 | % |

| Expected dividends | |

$ | - | |

| Weighted average grant date fair value per share | |

$ | 1.31 | |

Restricted

Stock

The

following is a summary of restricted stock award and restricted stock unit activity for the three months ended March 31, 2023:

Summary

of Restricted Stock Award and Restricted Stock Unit Activity

| | |

Number of

shares | | |

Weighted

average grant

date fair value | |

| Unvested at January 1, 2023 | |

| 41,923 | | |

$ | 4.92 | |

| Granted | |

| 5,000 | | |

$ | 1.25 | |

| Vested | |

| (4,386 | ) | |

$ | 5.06 | |

| Forfeited | |

| (4,054 | ) | |

$ | 5.39 | |

| Unvested at March 31, 2023 | |

| 38,483 | | |

$ | 4.37 | |

Performance

Stock Units

During

2022, the Company issued performance share units (“PSUs”) that represented shares potentially issuable based upon Company

and individual performance in 2022.

The

following table summarizes the activity for the Company’s unvested PSUs for the three months ended March 31, 2023:

Summary

of Performance Stock Unit Activity

| | |

Number of shares | | |

Weighted

average grant

date fair value | |

| Unvested at January 1, 2023 | |

| 17,678 | | |

$ | 4.50 | |

| Cash settled | |

| (17,678 | ) | |

$ | 4.50 | |

| Granted | |

| 71,265 | | |

$ | 1.36 | |

| Vested | |

| (45,251 | ) | |

$ | 1.36 | |

| Unvested at March 31, 2023 | |

| 26,014 | | |

$ | 1.36 | |

In

February 2023, the unvested awards issued for individual performance and outstanding at January 1, 2023 were modified to cash-settle

the original grant-date fair value of approximately $80,000,

resulting in incremental compensation of $56,000

after considering the $24,000 fair value of the vested shares at the date of the modification. Additionally, the Company performance

targets were modified to allow approximately 71,000

PSU to vest, with an additional time-based vesting requirement for approximately 26,000

of the PSU. Because the awards did not vest based on the original terms, the modification was considered a new grant, resulting in

$64,000

in compensation expense in the three-months ended March 31, 2023.

The

Company adopted a 2023 PSU program in April 2023, granting approximately 172,000 PSUs at target performance. The results for the three-month

period ended March 31, 2023 include $67,000 in stock-based compensation expense as management determined that the service inception date

preceded the grant date.

Note

6. Income Taxes

ASC

740 requires a valuation allowance to reduce the deferred tax assets reported if, based on the weight of evidence, it is more than likely

than not that some portion or all the deferred tax assets will not be recognized. Accordingly, at this time the Company has placed a

valuation allowance on all tax assets. As of March 31, 2023, the estimated effective tax rate for the 2023 was zero.

There

are open statutes of limitations for taxing authorities in federal and state jurisdictions to audit our tax returns from 2018 through

the current period. Our policy is to account for income tax related interest and penalties in income tax expense in the statement of

operations.

For

the three months ended March 31, 2023 and 2022, the Company did not incur any interest and penalties associated with tax positions. As

of March 31, 2023, the Company did not have any significant unrecognized uncertain tax positions.

Note

7. Liquidity

During

the three months ended March 31, 2023, the Company used cash for operations of $1,242,000. The Company has a history of operating losses

and negative cash flow, which were expected to improve with growth, offset by working capital required to achieve such growth. As described

more fully in Note 4, the dispute and subsequent contract termination with the Manufacturer has resulted in uncertainty around our ability

to procure product, which in turn may inhibit our ability to achieve positive cash flow. Additionally, management has considered that

dispute resolution, including litigation, is costly and will require the outlay of cash.

However,

as of March 31, 2023, the Company has $1,777,000 of cash and restricted cash and even though management has identified certain indicators,

these indicators do not raise substantial doubt regarding the Company’s ability to continue as a going concern. However, management

cannot predict, with certainty, the outcome of its potential actions to generate liquidity, including the availability of additional

financing, or whether such actions would generate the expected liquidity as planned.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The

following discussion should be read in conjunction with the financial information included elsewhere in this Quarterly Report on Form

10-Q (this “Report”), including our unaudited condensed consolidated financial statements and the related notes and with

our audited consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December

31, 2022, as filed with the SEC on March 2, 2023, and other reports that we file with the SEC from time to time.

References

in this Quarterly Report on Form 10-Q to “us”, “we”, “our” and similar terms refer to Barfresh Food

Group Inc.

Cautionary

Note Regarding Forward-Looking Statements

This

discussion includes forward-looking statements, as that term is defined in the federal securities laws, based upon current expectations

that involve risks and uncertainties, such as plans, objectives, expectations, and intentions. Actual results and the timing of events

could differ materially from those anticipated in these forward-looking statements as a result of a number of factors. Words such as

“anticipate”, “estimate”, “plan”, “continuing”, “ongoing”, “expect”,

“believe”, “intend”, “may”, “will”, “should”, “could” and similar

expressions are used to identify forward-looking statements.

We

caution you that these statements are not guarantees of future performance or events and are subject to a number of uncertainties, risks

and other influences, many of which are beyond our control, which may influence the accuracy of the statements and the projections upon

which the statements are based. Any one or more of these uncertainties, risks and other influences could materially affect our results

of operations and whether forward-looking statements made by us ultimately prove to be accurate. Our actual results, performance and

achievements could differ materially from those expressed or implied in these forward-looking statements. We undertake no obligation

to publicly update or revise any forward-looking statements, whether from new information, future events or otherwise.

Critical

Accounting Policies

Our

consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States

of America (“GAAP”).

Results

of Operations

Results

of Operation for Three Months Ended March 31, 2023 as Compared to the Three Months Ended March 31, 2022

Revenue

and cost of revenue

Revenue

decreased $435,000, or 17%, from $2,526,000 in 2022 to $2,091,000 in 2023. The decline in revenue was due to limited supply due to our

product withdrawal resulting from the quality complaints with product purchased from the Manufacturer. We anticipate that our revenues

will be adversely impacted as a result of the dispute unless and until new sources of reliable supply at sufficient volume can be identified

and developed, the timing of which is uncertain.

Cost

of revenue for 2023 was $1,236,000 as compared to $1,762,000 in 2022. Our gross profit was $855,000 (41%) and $764,000 (30%) for 2023

and 2022, respectively. Cost of revenue declined as a result of the 17% decrease in revenue, partially offset by lower costs relative

to revenue on the smoothie carton product, resulting in the 1,100-basis point gross margin improvement.

Selling,

marketing and distribution expense

Our

operations were primarily directed towards increasing sales and expanding our distribution network.

| | |

Three months ended

March 31, | | |

Three months ended

March 31, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

Change | | |

Percent | |

| Sales and marketing | |

$ | 356,000 | | |

$ | 289,000 | | |

$ | 67,000 | | |

| 23 | % |

| Storage and outbound freight | |

| 311,000 | | |

| 386,000 | | |

| (75,000 | ) | |

| -19 | % |

| | |

$ | 667,000 | | |

$ | 675,000 | | |

$ | (8,000 | ) | |

| -1 | % |

Selling,

marketing and distribution expense decreased approximately $8,000 (1%) from approximately $675,000 in 2022 to $667,000 in 2023.

Sales

and marketing expense increased approximately $67,000 (23%) from approximately $289,000 in 2022 to $356,000 in 2023. The increase in

sales and marketing expense was primarily the result of the retention of outside service providers to assist with sales and initiatives,

including, beginning in the third quarter of 2022, brokers specializing in the school market. Additionally, the Company increased its

product sampling and advertising in conjunction with the launch of its smoothie carton product.

Storage

and outbound freight expense decreased approximately $75,000 (19%) from approximately $386,000 in 2022 to $311,000 in 2023. The decrease

was the result of the 17% decrease in revenue and distribution efficiencies.

General

and administrative expense

| | |

Three months ended March 31, | | |

Three months ended March 31, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

Change | | |

Percent | |

| Personnel costs | |

$ | 489,000 | | |

$ | 309,000 | | |

$ | 180,000 | | |

| 58 | % |

| Stock based compensation | |

| 209,000 | | |

| 85,000 | | |

| 124,000 | | |

| 146 | % |

| Legal, professional and consulting fees | |

| 115,000 | | |

| 161,000 | | |

| (46,000 | ) | |

| -29 | % |

| Director fees paid in cash | |

| 25,000 | | |

| 25,000 | | |

| - | | |

| 0 | % |

| Research and development | |

| 21,000 | | |

| 31,000 | | |

| (10,000 | ) | |

| -32 | % |

| Other general and administrative expenses | |

| 135,000 | | |

| 212,000 | | |

| (77,000 | ) | |

| -36 | % |

| | |

$ | 994,000 | | |

$ | 823,000 | | |

$ | 171,000 | | |

| 21 | % |

General

and administrative expense increased approximately $171,000 (21%) from approximately $823,000 in 2022 to $994,000 in 2023.

Personnel

cost represents the cost of employees including salaries, bonuses, employee benefits and employment taxes and continues to be our largest

cost. Personnel cost increased by approximately $180,000 (58%) from approximately $309,000 to $489,000 and stock-based compensation increased

by approximately $124,000 (146%) from $85,000 to $209,000. The increase in personnel cost and stock-based compensation resulted primarily

from modification of our 2022 performance stock unit program, with partial cash settlement.

Legal,

professional, and consulting fees decreased approximately $46,000 (29%) from approximately $161,000 in 2022 to $115,000 in 2023. The

decrease was primarily due to a reduction in temporary labor, partially offsetting the increase in personnel costs.

Research

and development expense decreased approximately $10,000 (32%) from approximately $31,000 in 2022 to $21,000 in 2023 as a result of vendor

credits related to development activities.

Other

expense decreased approximately $77,000 (36%) from approximately $212,000 in 2022 to $135,000 in 2023. In 2022, we incurred approximately

$102,000 in one-time costs related to the uplist of our common stock to the NASDAQ Stock Market. In 2023, we incurred approximately $25,000

in inventory disposal costs related to our dispute with the Manufacturer.

Net

loss

We

had net losses of approximately $910,000 and $895,000 for the three-month periods ended March 31, 2023 and 2022, respectively. The increase

of approximately $15,000, was the result of the aforementioned changes in revenue, cost and expenses.

Liquidity

and Capital Resources

As

of March 31, 2023, we had working capital of $1,250,000 compared with $1,801,000 at December 31, 2022. The decrease in working capital

is primarily due to the operating loss for the three months ended March 31, 2023.

During

the three months ended March 31, 2023, we used $1,242,000 in operations.

The

impact of COVID-19 on the Company is constantly evolving. The direct impact to our operations had begun to take effect at the close of

the first quarter ended March 31, 2020. Specifically, our business was impacted by dining bans targeted at restaurants to reduce the

size of public gatherings. Such bans precluded our single serve products from being served at those establishments for a number of weeks,

and in some instances, resulted in abandoned product launches. Furthermore, many school districts closed regular attendance for a period

of time thereby disrupting sales of product into that channel. More recently, we have experienced a disruption in the supply chain for

manufacturing our products due to COVID-19. The developments surrounding COVID-19 remain fluid and dynamic, and consequently, will require

the Company to continue to monitor news headlines from government and health officials, as well as the business community.

On

June 1, 2021, the Company completed a private placement of 1,282,051 shares of its common stock at $4.68 per share, resulting in gross

proceeds of $6,000,000. In addition, holders of debt converted a total of $399,000 in principal and $234,000 in interest into 133,991

shares of common stock and debt in the amount of $840,000 was retired, leaving the Company with no debt.

Our

liquidity needs will depend on how quickly we are able to profitably ramp up sales, as well as our ability to control and reduce variable

operating expenses, and to continue to control and reduce fixed overhead expense. Our recent business developments with the Manufacturer

impact our supply chain and will result in increased legal cost and are expected to have a negative impact on our financial position,

results of operations and cash flow.

Our

operations to date have been financed by the sale of securities, the issuance of convertible debt and the issuance of short-term debt,

including related party advances. If we are unable to generate sufficient cash flow from operations with the capital raised we will be

required to raise additional funds either in the form of equity or in the form of debt. There are no assurances that we will be able

to generate the necessary capital to carry out our current plan of operations.

Off-Balance

Sheet Arrangements

We

have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition,

changes in financial condition, revenues or expense, results of operations, liquidity, capital expenditures or capital resources that

are material to stockholders.

Item

3. Quantitative and Qualitative Disclosures About Market Risk.

Not

required because we are a smaller reporting company.

Item

4. Controls and Procedures.

Evaluation

of Disclosure Controls and Procedures

Under

the supervision and with the participation of our management, including our Chief Executive Officer and our Chief Financial Officer,

we conducted an evaluation of our disclosure controls and procedures, as such term is defined under Securities and Exchange Act of 1934

Rule 13(a)-15(e). Disclosure controls and procedures are designed to provide reasonable assurance that the information required to be

disclosed in the reports that we file or submit under the Exchange Act has been appropriately recorded, processed, summarized and reported

on a timely basis and are effective in ensuring that such information is accumulated and communicated to the Company’s management,

as appropriate to allow timely decisions regarding required disclosure. Based on this evaluation, our Chief Executive Officer and our

Chief Financial Officer concluded that as of March 31, 2023, our disclosure controls and procedures are not effective.

Management

has identified the following material weaknesses in our internal control over financial reporting:

Management

has concluded that there is a material weakness due to the control environment. The control environment is impacted due to the company’s

inadequate segregation of duties, including information technology control activities.

Since

the assessment of the effectiveness of our internal control over financial reporting did identify material weaknesses, management considers

its internal control over financial reporting to be ineffective.

In

an effort to remediate the identified material weakness and enhance our internal control over financial reporting, we have hired additional

personnel to help ensure that we are able to properly implement internal control procedures.

Management

believes that the material weakness set forth above did not have an effect on our financial results.

Changes

in Internal Control over Financial Reporting

None

PART

II- OTHER INFORMATION

Item

1. Legal Proceedings.

As

described in Note 4, the Company has an on-going dispute with the Manufacturer, the outcome of which cannot be predicted at this time.

From

time to time, various lawsuits and legal proceedings may arise in the ordinary course of business. However, litigation is subject to

inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business. We are

currently the defendant in one legal proceeding for an amount less than $100,000. Our legal counsel and management believe a material

unfavorable outcome to be remote.

Item

1A. Risk Factors.

Not

required because we are a smaller reporting company.

Item

2. Unregistered Sales of Equity Securities and Use of Proceeds

During

the quarter ended March 31, 2023, the Company issued 32,203 shares of common stock for services valued at $83,000. The Company relied

upon the exemption from registration contained in Rule 506(b) and Section 4(a)(2) of the Securities Act, and corresponding provisions

of state securities laws, on the basis that (i) offers were made to a limited number of persons, (ii) each offer was made through direct

communication with the offerees by the Company, (iii) each of the offerees, which included an officer and two directors of the Company,

had the requisite sophistication and financial ability to bear risks of investing in the Company’s common stock, (iv) the Company

provided disclosure to the offerees, and (v) there was no general solicitation and no commission or remuneration was paid in connection

with the offers.

Item

3. Defaults Upon Senior Securities.

None.

Item

4. Mine Safety Disclosures.

Not

applicable.

Item

5. Other Information.

None.

Item

6. Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

BARFRESH

FOOD GROUP INC. |

| |

|

|

| Date:

April 27, 2023 |

By: |

/s/

Riccardo Delle Coste |

| |

|

Riccardo

Delle Coste

Chief

Executive Officer

(Principal

Executive Officer) |

| |

|

|

| Date:

April 27, 2023 |

By: |

/s/

Lisa Roger |

| |

|

Chief

Financial Officer

(Principal

Financial Officer) |

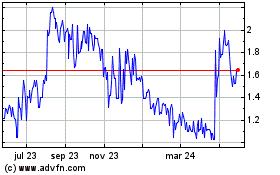

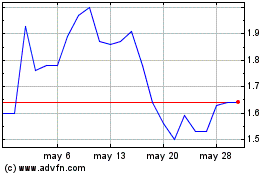

Barfresh Food (NASDAQ:BRFH)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Barfresh Food (NASDAQ:BRFH)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024