UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December 5, 2024

BURTECH ACQUISITION CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41139 |

|

86-2708752 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3529 Porter St

Washington, DC 20016

(Address of principal executive offices, including

zip code)

(202)

600-5757

Registrant’s telephone number, including

area code:

Not

Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol |

|

Name

of each exchange on

which registered |

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

BRKHU |

|

The Nasdaq Stock Market, LLC |

| Class A Common Stock, par value $0.0001 per share |

|

BRKH |

|

The Nasdaq Stock Market, LLC |

| Warrants, each exercisable for one share of Class A Common Stock for $11.50 per share |

|

BRKHW |

|

The

Nasdaq Stock Market, LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

As previously disclosed, on December 22, 2023, BurTech Acquisition

Corp. (“BurTech”), BurTech Merger Sub Inc., a Delaware corporation and a direct, wholly owned subsidiary of BurTech

(“Merger Sub”), Blaize, Inc., a Delaware corporation (“Blaize”), and for the limited purposes set

forth therein, Burkhan Capital LLC, a Delaware limited liability company and affiliate of BurTech (“Burkhan”), entered

into an Agreement and Plan of Merger (as amended on April 22, 2024, October 24, 2024 and November 21, 2024, and as may be further amended

and/or amended and restated, the “Merger Agreement”), pursuant to which Merger Sub will merge (the “Merger ”)

with and into Blaize, whereupon the separate corporate existence of Merger Sub will cease and Blaize will be the surviving company and

continue in existence as a wholly owned subsidiary of BurTech, on the terms and subject to the conditions set forth therein (collectively

with the other transactions described in the Merger Agreement, the “Business Combination”).

Attached hereto as Exhibit 99.l and incorporated into this Item 7.01

by reference is an investor presentation that will be used in making presentations to potential investors into Blaize and the post-combination

company with respect to the Business Combination.

The information in this Item 7.01 (including Exhibit 99.1) is being

furnished and shall not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in

any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Important Information About the Proposed Business Combination and

Where to Find It

In connection with the Business Combination, BurTech has filed with the Securities and Exchange Commission (the “SEC”)

a Registration Statement on Form S-4 (the “Registration Statement”), and the Registration Statement was declared effective

on December 2, 2024. BurTech has mailed a definitive proxy statement/prospectus relating to the proposed transaction to its stockholders.

This report does not contain all the information that should be considered concerning the proposed transaction and is not intended to

form the basis of any investment decision or any other decision in respect of the proposed transaction. BurTech may file other documents

regarding the proposed transaction with the SEC, and BurTech’s stockholders and other interested persons are advised to read the

definitive proxy statement/prospectus and the other documents filed in connection with the proposed transaction, as these materials contain

important information about Blaize, BurTech and the proposed transaction. The definitive proxy statement/prospectus and other relevant

materials for the proposed transaction has been mailed to stockholders of BurTech as of the record date established for voting on the

proposed transaction and the other matters to be voted upon at a meeting of BurTech’s stockholders to be held to approve the proposed

transaction and such other matters. Such stockholders are able to obtain copies of the definitive proxy statement/prospectus and other

documents filed with the SEC, without charge, at the SEC’s website at www.sec.gov, or by directing a request to BurTech Acquisition

Corp., 1300 Pennsylvania Avenue, Suite 700, New York, NY 20006, Attention: Roman Livson, Chief Financial Officer.

Participants in Solicitation

BurTech, Blaize, and their respective directors, executive officers, other members of management, and employees, under SEC rules, may

be deemed to be participants in the solicitation of proxies from BurTech’s stockholders in connection with the proposed transaction.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of BurTech’s stockholders

in connection with the proposed transaction, including the names of such persons and a description of their respective interests, is set

forth in BurTech’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Additional information

regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained

by reading the Registration Statement regarding the proposed transaction. Stockholders will be able to obtain copies of the documents

described in this paragraph that are filed with the SEC, once available, without charge at the SEC’s website at www.sec.gov, or

by directing a request to BurTech Acquisition Corp., 1300 Pennsylvania Avenue, Suite 700, New York, NY 20006, Attention: Roman Livson,

Chief Financial Officer.

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in

respect of the proposed transaction and does not constitute an offer to sell or a solicitation of an offer to buy any securities of BurTech

or Blaize, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall

be made except by means of a prospectus meeting the requirements of the Securities Act.

Cautionary Statement Regarding Forward Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Exchange Act that are based on beliefs and assumptions and on information

currently available to BurTech and Blaize including statements regarding Blaize’s business plans and growth strategies, market opportunities,

and financial prospects. In some cases, you can identify forward-looking statements by the following words: “may,” “will,”

“could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,”

“believe,” “estimate,” “predict,” “project,” “potential,” “continue,”

“ongoing,” “target,” “seek” or the negative or plural of these words, or other similar expressions

that are predictions or indicate future events or prospects, although not all forward-looking statements contain these words. Forward-looking

statements are predictions, projections and other statements about future events that are based on current expectations and assumptions

and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the

forward-looking statements in this document, including but not limited to: (i) the risk that the previously disclosed proposed business

combination (the “proposed transaction”) may not be completed in a timely manner or at all, which may adversely affect the

price of BurTech’s securities; (ii) the risk that the proposed transaction may not be completed by BurTech’s business combination

deadline and the potential failure to obtain an extension of the business combination deadline if sought by BurTech; (iii) the failure

to satisfy the conditions to the consummation of the proposed transaction, including the approval of the proposed transaction by BurTech’s

stockholders, the satisfaction of the minimum aggregate transaction proceeds amount following redemptions by BurTech’s public stockholders

and the receipt of certain governmental and regulatory approvals; (iv) the failure to obtain adequate financing to complete the proposed

transaction and to support the future working capital needs of Blaize and the combined company; (v) the effect of the pendency of the

proposed transaction on Blaize’s business relationships, performance, and business generally; (vi) risks that the proposed transaction

disrupts current plans of Blaize and potential difficulties in the retention of Blaize’s employees as a result of the proposed transaction;

(vii) the outcome of any legal proceedings that may be instituted against BurTech or Blaize related to the merger agreement and the proposed

transaction; (viii) changes to the proposed structure of the proposed transaction that may be required or appropriate as a result of applicable

laws or regulations or as a condition to obtaining regulatory approval of the proposed transaction; (ix) the ability to maintain the listing

of BurTech’s securities on Nasdaq; (x) the price of BurTech’s securities, including volatility resulting from changes in the

competitive and highly regulated industries in which Blaize operates, variations in performance across competitors, changes in laws and

regulations affecting Blaize’s business and changes in the combined capital structure; (xi) the ability to implement business plans,

forecasts, and other expectations after the completion of the proposed transaction, including the possibility of cost overruns or unanticipated

expenses in development programs, and the ability to identify and realize additional opportunities; (xii) the enforceability of Blaize’s

intellectual property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security

risks or potential breaches of data security; (xiii) the incurrence of significant expenses to remediate, or damage to Blaize’s

reputation as a result of, any defects in Blaize’s products; and (xiv) other risks and uncertainties set forth in the section entitled

“Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in BurTech’s Annual Reports on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on the website of the SEC at www.sec.gov

and other documents filed, or to be filed with the SEC by BurTech, including the Registration Statement (defined below). The foregoing

list of factors is not exhaustive. There may be additional risks that neither BurTech nor Blaize presently know or that BurTech or Blaize

currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

You should carefully consider the foregoing factors and the other risks and uncertainties described in the definitive proxy statement

filed by BurTech with the SEC, including those under “Risk Factors” therein, and other documents filed by BurTech from time

to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they

are made. Readers are cautioned not to put undue reliance on forward-looking statements, and BurTech and Blaize assume no obligation and,

except as required by law, do not intend to update or revise these forward-looking statements, whether as a result of new information,

future events, or otherwise. Neither BurTech nor Blaize gives any assurance that either BurTech or Blaize will achieve its expectations.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are

being filed herewith:

| Exhibit

No. |

|

Description |

| 99.1 |

|

Investor Presentation |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

BURTECH ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Shahal Khan |

| |

Name: |

Shahal Khan |

| |

Title: |

Chief Executive Officer |

Dated: December 5, 2024

Exhibit 99.1

Life on the Edge Copyright © 2024 Blaize. All rights reserved. Copyright © 2024 Blaize. All rights reserved.

Disclaimer 2 Copyright © 2024 Blaize. All rights reserved. About this Presentation This investor presentation (this “Presentation”) is provided for informational purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between BurTech Acquisition Corp. (“BurTech”) and Blaize, Inc. (together with its direct and indirect subsidiaries, collectively, the “Company” or “Blaize”) and for no other purpose. No representations or warranties, express or implied, are given in, or respect of, this Presentation. To the fullest extent permitted by law, in no circumstance will Blaize, BurTech or any of their respective present or former subsidiaries, shareholders, affiliates, representatives, partners, members, directors, officers, employees, advisors or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. This Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of BurTech, Blaize or the Business Combination. The information contained herein is preliminary and is subject to update, completion, revision, verification and amendment without notice, and such changes may be material. The attached material is provided to you on the understanding that as a sophisticated investor, you will understand and accept its inherent limitations, will not rely on it in making any investment decision with respect to any securities that may be issued, and will use it only for purpose of discussing with your advisors your preliminary interest in investing in BurTech or Blaize in connection with the proposed Business Combination. Important Additional Information About the Business Combination and Where to Find It This Presentation does not contain all the information that should be considered concerning the Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. In connection with the Business Combination, Blaize and BurTech have filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S - 4 (the “Registration Statement”), which contains a proxy statement/prospectus that constitutes (i) a proxy statement relating to the Business Combination in connection with BurTech’s solicitation of proxies for the vote by BurTech’s shareholders regarding the Business Combination and related matters, as described in the Registration Statement, and (ii) a prospectus relating to, among other things, the offer of the securities to be issued by BurTech in connection with the Business Combination. The Registration Statement was declared effective on December 2, 2024, and BurTech is mailing the definitive proxy statement/prospectus and other relevant documents to its shareholders as of the record date established for voting on the Business Combination. INVESTORS AND SECURITY HOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS, AND ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY OTHER RELATED DOCUMENTS FILED WITH THE SEC BY BURTECH AND BLAIZE CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT BLAIZE, BURTECH, AND THE BUSINESS COMBINATION, INCLUDING WITH RESPECT TO THE PRO FORMA IMPLIED ENTERPRISE VALUE OF THE COMBINED COMPANY. Investors and security holders may obtain free copies of the Registration Statement, proxy statement/prospectus and any amendments or supplements thereto and other related documents filed with the SEC by BurTech and Blaize (when available) through the website maintained by the SEC at www.sec.gov. These documents (when available) can also be obtained free of charge from BurTech upon written request to BurTech at: BurTech Acquisition Corp., 1300 Pennsylvania Ave NW, Suite 700, Washington, DC 20004. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY, NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE BUSINESS COMBINATION PURSUANT TO WHICH ANY SECURITIES ARE TO BE OFFERED OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. No Offer or Solicitation This Presentation is for informational purposes only and is not intended to and shall not constitute an offer to sell or exchange, or the solicitation of an offer to sell, exchange, buy or subscribe for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”), or pursuant to an exemption from the Securities Act, and otherwise in accordance with applicable law. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision.

Disclaimer (Cont’d) 3 Copyright © 2024 Blaize. All rights reserved. Cautionary Statement Regarding Forward - Looking Statements Certain statements included in this Presentation that are not historical facts are forward - looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “forecast,” “target,” and similar expressions that predict or indicate future events or trends or events that are not statements of historical matters. These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, and projections of market opportunity and the consummation of the Business Combination and related transactions. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Blaize and BurTech management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Blaize and BurTech. These forward - looking statements are subject to a number of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) the inability of the parties to successfully or timely consummate the Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company, the inability of BurTech to extend the time to complete the Business Combination, the expected benefits of the Business Combination or that the approval of the shareholders of BurTech is not obtained, that redemptions by shareholders of BurTech reduce the funds in trust or available to the combined company following the Business Combination, any of the other conditions to closing are not satisfied or that events or other circumstances give rise to the termination of the merger agreement relating to the Business Combination; (iii) changes to the structure of the Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining the necessary regulatory approvals; (iv) the ability to meet stock exchange listing standards following the consummation of the Business Combination; (v) the risk that the Business Combination disrupts current plans and operations of Blaize as a result of the announcement and consummation of the Business Combination; (vi) failure to realize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (vii) costs related to the Business Combination; (viii) changes in applicable law or regulations; (ix) the outcome of any legal proceedings that may be instituted against Blaize or BurTech; (x) the effects of competition on Blaize’s future business; (xi) the ability of BurTech or Blaize to issue equity or equity - linked securities or obtain debt financing in connection with the Business Combination or in the future; (xii) the enforceability of Blaize’s intellectual property rights, including its copyrights, patents, trademarks and trade secrets, and the potential infringement on the intellectual property rights of others; and (xiii) those factors discussed under the heading “Risk Factors” in the proxy statement/prospectus contained in the Registration Statement, and any subsequent Quarterly Reports on Form 10 - Q, and other documents filed, or to be filed, by BurTech with the SEC. If any of these risks materialize or the assumptions of Blaize and BurTech management prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be additional risks that neither Blaize nor BurTech presently know or that Blaize or BurTech currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect Blaize’s or BurTech’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Blaize and BurTech anticipate that subsequent events and developments may cause Blaize’s or BurTech’s assessments to change. However, while Blaize and BurTech may elect to update these forward - looking statements at some point in the future, Blaize and BurTech specifically disclaim any obligation to do so. Nothing in this Presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. Accordingly, undue reliance should not be placed upon the forward - looking statements. Participants in Solicitation Blaize and BurTech and their respective directors and certain of their respective executive officers, other members of management and employees, under SEC rules, may be considered participants in the solicitation of proxies with respect to the Business Combination. Information about the directors and executive officers of BurTech is included in BurTech’s Annual Report on Form 10 - K for the year ended December 31, 2023, filed with the SEC on May 7, 2024, which is available free of charge at the SEC’s website at www.sec.gov. Additional information regarding the participants in the proxy solicitation and a description of their direct interests, by security holdings or otherwise, is set forth in the Registration Statement, and the proxy statement/prospectus included therein, and other related materials to be filed with the SEC regarding the Business Combination by BurTech. Shareholders, potential investors and other interested persons should read the Registration Statement, proxy statement/prospectus and any amendments or supplements thereto and other related documents filed with the SEC by BurTech (when available) carefully before making any voting or investment decisions. These documents, when available, can be obtained free of charge from the sources indicated above. No Assurances No assurances can be given that the Business Combination will be completed on the terms or in the timeframe currently contemplated, if at all. Further, no assurances can be given that, if the Business Combination is completed, the potential benefits of the Business Combination will be realized.

Disclaimer (Cont’d) 4 Copyright © 2024 Blaize. All rights reserved. Industry and Market Data This Presentation has been prepared by BurTech and Blaize and includes market data and other statistical information from third - party sources, including independent industry publications, governmental publications and other published independent sources. Some data is also based on the estimates of BurTech and Blaize, which are derived from their review of internal sources as well as the third - party sources described above. None of BurTech, Blaize or any of their respective representatives or affiliates has independently verified the information and cannot guarantee its accuracy and completeness. Trademarks and Trade Names BurTech and Blaize own or have rights to various trademarks, service marks, trade names and copyrights that they use in connection with the operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with BurTech or Blaize, or an endorsement or sponsorship by or of BurTech or Blaize. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear without the ©, TM or SM symbols, but such references are not intended to indicate, in any way, that BurTech or Blaize or the applicable rights owner will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names.

Overview of BurTech Acquisition Corp. Leadership Shahal Khan Chairman & CEO 5 Copyright © 2024 Blaize. All rights reserved. Mr. Khan’s career as an investor, entrepreneur and social venture capitalist spans over 22 years, with investments encompassing telecoms, real estate, energy, natural resources, and technology as well as various other industrial sectors. He has been directly responsible for syndication of several billions in equity for projects as a principal through his family trust.

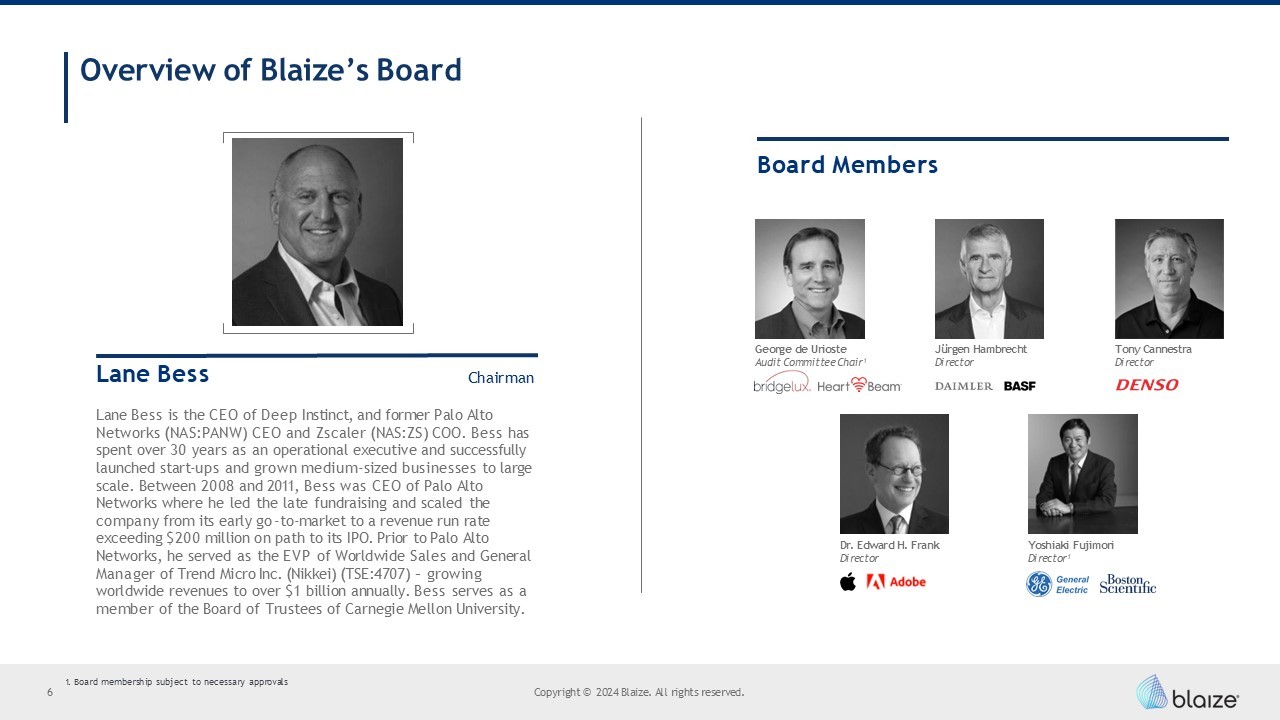

Lane Bess Chairman Lane Bess is the CEO of Deep Instinct, and former Palo Alto Networks (NAS:PANW) CEO and Zscaler (NAS:ZS) COO. Bess has spent over 30 years as an operational executive and successfully launched start - ups and grown medium - sized businesses to large scale. Between 2008 and 2011, Bess was CEO of Palo Alto Networks where he led the late fundraising and scaled the company from its early go - to - market to a revenue run rate exceeding $200 million on path to its IPO. Prior to Palo Alto Networks, he served as the EVP of Worldwide Sales and General Manager of Trend Micro Inc. (Nikkei) (TSE:4707) – growing worldwide revenues to over $1 billion annually. Bess serves as a member of the Board of Trustees of Carnegie Mellon University. Board Members Jürgen Hambrecht Director Tony Cannestra Director Dr. Edward H. Frank Director Overview of Blaize’s Board George de Urioste Audit Committee Chair 1 Yoshiaki Fujimori Director 1 1. Board membership subject to necessary approvals 6 Copyright © 2024 Blaize. All rights reserved.

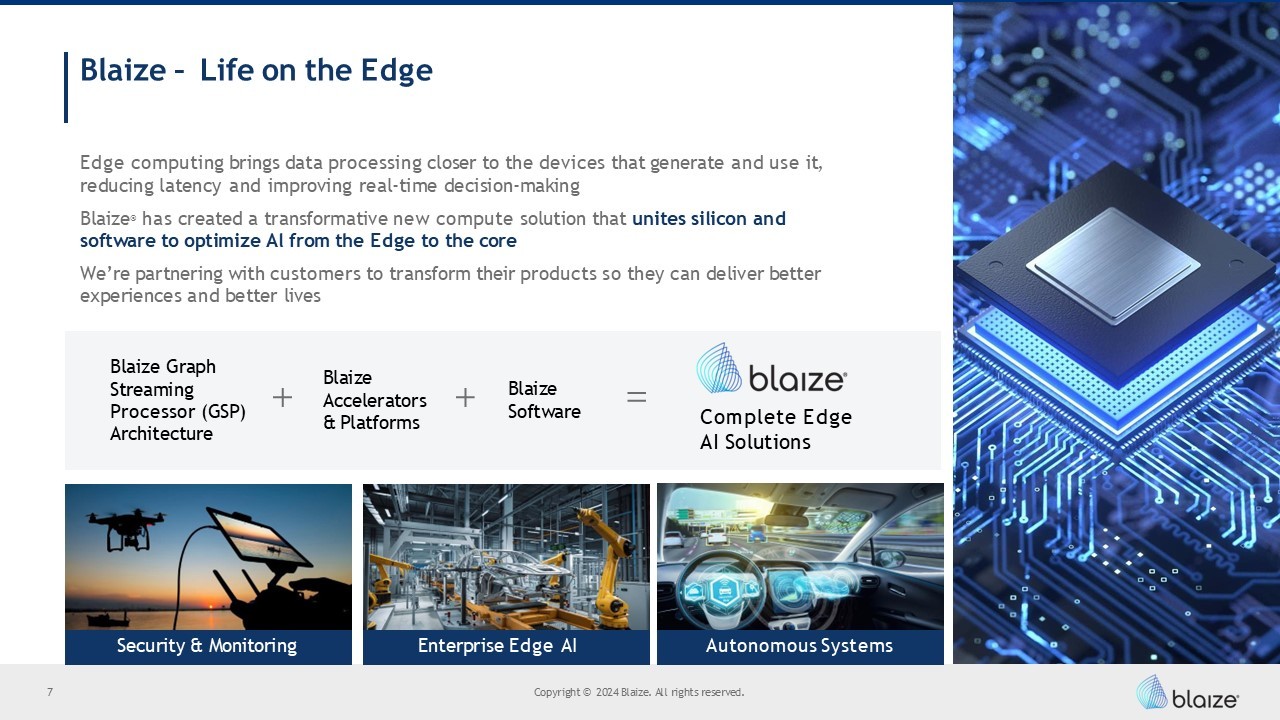

Blaize – Life on the Edge Edge computing brings data processing closer to the devices that generate and use it, reducing latency and improving real - time decision - making Blaize ® has created a transformative new compute solution that unites silicon and software to optimize Al from the Edge to the core We’re partnering with customers to transform their products so they can deliver better experiences and better lives Security & Monitoring Enterprise Edge AI Autonomous Systems Blaize Graph Streaming Processor (GSP) Architecture Blaize Accelerators & Platforms Blaize Software Complete Edge AI Solutions 7 Copyright © 2024 Blaize. All rights reserved.

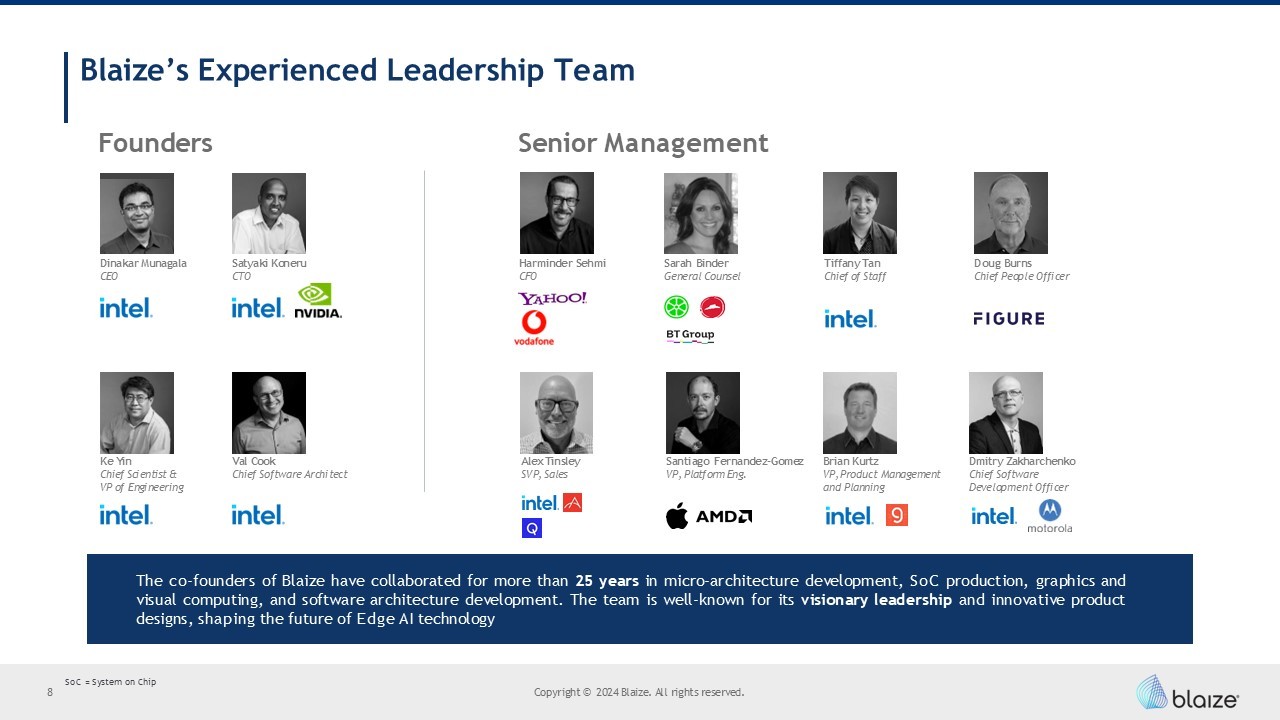

Blaize’s Experienced Leadership Team Harminder Sehmi CFO Doug Burns Chief People Officer Dmitry Zakharchenko Chief Software Development Officer Alex Tinsley SVP, Sales Tiffany Tan Chief of Staff Brian Kurtz VP, Product Management and Planning Val Cook Chief Software Architect Founders Senior Management Dinakar Munagala CEO Satyaki Koneru CTO Ke Yin Chief Scientist & VP of Engineering Santiago Fernandez - Gomez VP, Platform Eng. Sarah Binder General Counsel The co - founders of Blaize have collaborated for more than 25 years in micro - architecture development, SoC production, graphics and visual computing, and software architecture development . The team is well - known for its visionary leadership and innovative product designs, shaping the future of Edge AI technology SoC = System on Chip 8 Copyright © 2024 Blaize. All rights reserved.

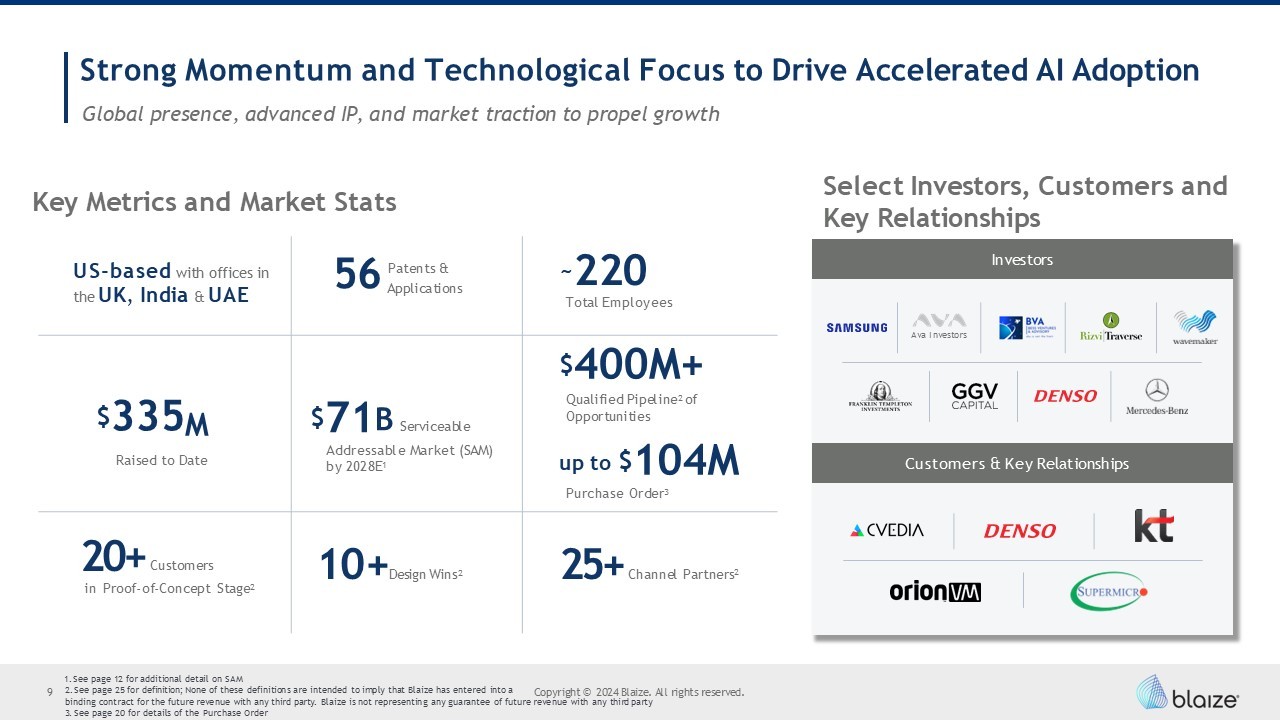

Strong Momentum and Technological Focus to Drive Accelerated AI Adoption Copyright © 2024 Blaize. All rights reserved. 9 1. See page 12 for additional detail on SAM 2. See page 25 for definition; None of these definitions are intended to imply that Blaize has entered into a binding contract for the future revenue with any third party. Blaize is not representing any guarantee of future revenue with any third party 3. See page 20 for details of the Purchase Order Key Metrics and Market Stats Customers & Key Relationships Investors Ava Investors ~ 220 Total Employees 56 Patents & Applications US - based with offices in the UK , India & UAE $ 400M+ Qualified Pipeline 2 of Opportunities up to $ 104M Purchase Order 3 $ 71 B Serviceable Addressable Market (SAM) by 2028E 1 $ 335 M Raised to Date 25+ Channel Partners 2 10+ Design Wins 2 20+ Customers in Proof - of - Concept Stage 2 Select Investors, Customers and Key Relationships Global presence, advanced IP, and market traction to propel growth

The Right Platform For The Future Of Edge AI Computing Copyright © 2024 Blaize. All rights reserved. Experienced Leadership with Blue - Chip Background 1. See page 12 for additional detail on SAM 10 2. See page 25 for definition Investment Highlights Full - Stack Hardware and Software Solution Built for AI Inference at the Edge Intuitive Flexibility for AI and Related Workflows Targeting a $71B Global Serviceable Addressable Market by 2028 1 , across Security & Monitoring, Enterprise Edge AI, and Autonomous Systems End Markets Global Footprint with Tier 1 Supply Chain Relationships Strong Traction with $400M+ Qualified Pipeline 2 of Opportunities $335M Raised to Date

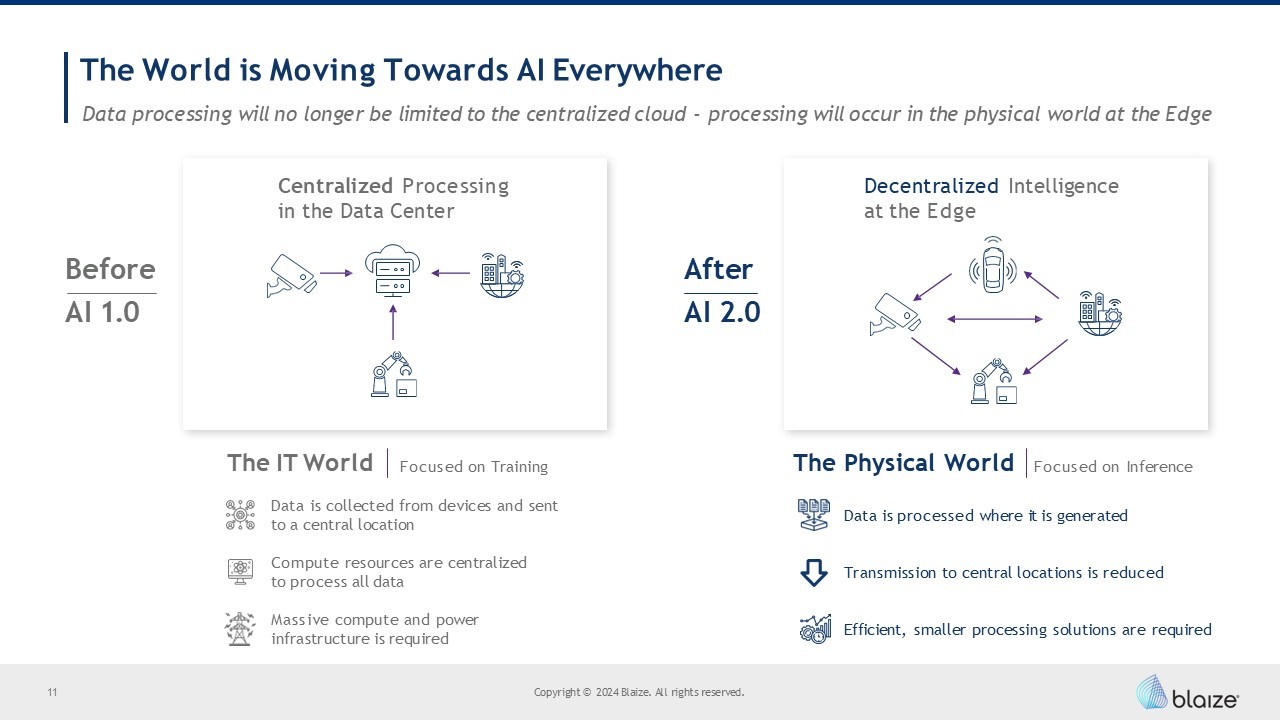

The World is Moving Towards AI Everywhere Copyright © 2024 Blaize. All rights reserved. 11 Centralized Processing in the Data Center Data processing will no longer be limited to the centralized cloud - processing will occur in the physical world at the Edge Before AI 1.0 The IT World Focused on Training Decentralized Intelligence at the Edge After AI 2.0 The Physical World Focused on Inference Data is collected from devices and sent to a central location Data is processed where it is generated Compute resources are centralized to process all data Transmission to central locations is reduced Massive compute and power infrastructure is required Efficient, smaller processing solutions are required

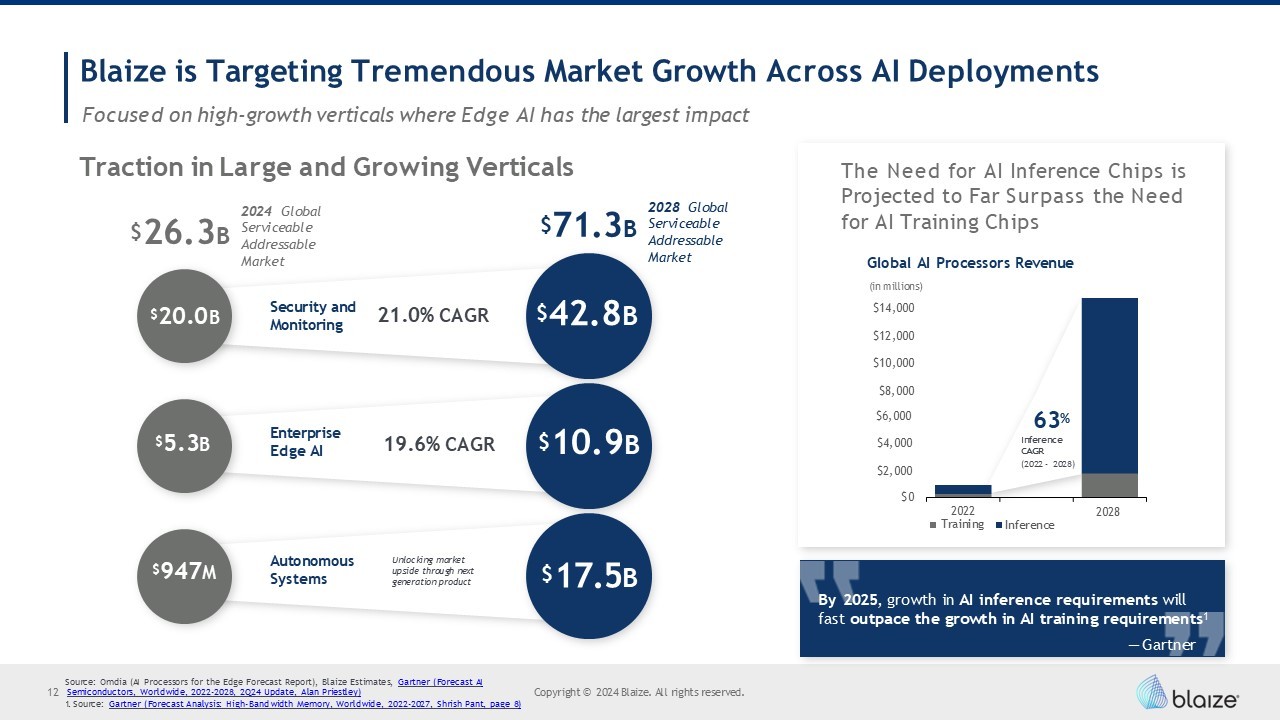

Blaize is Targeting Tremendous Market Growth Across AI Deployments Focused on high - growth verticals where Edge AI has the largest impact Copyright © 2024 Blaize. All rights reserved. Source: Omdia (AI Processors for the Edge Forecast Report), Blaize Estimates, Gartner (Forecast A I 12 Semiconductors, Worldwide, 2022 - 2028, 2Q24 Update, Alan Priestley ) 1. Source: Gartner (Forecast Analysis: High - Bandwidth Memory, Worldwide, 2022 - 2027, Shrish Pant, page 8 ) $0 $6,000 $4,000 $2,000 2028 2022 Training Inference The Need for AI Inference Chips is Projected to Far Surpass the Need for AI Training Chips Global AI Processors Revenue (in millions) $14,000 $12,000 $10,000 $8,000 63 % Inference CAGR (2022 – 2028) $ 26.3 B $ 71.3 B Enterprise Edge AI 19.6% CAGR Autonomous Systems Unlocking market upside through next generation product Security and Monitoring 21.0% CAGR $ 20.0 B $ 5.3 B $ 42.8 B $ 10.9 B $ 17.5 B 2024 Global Serviceable Addressable Market 2028 Global Serviceable Addressable Market $ 947 M By 2025 , growth in AI inference requirements will fast outpace the growth in AI training requirements 1 — Gartner Traction in Large and Growing Verticals

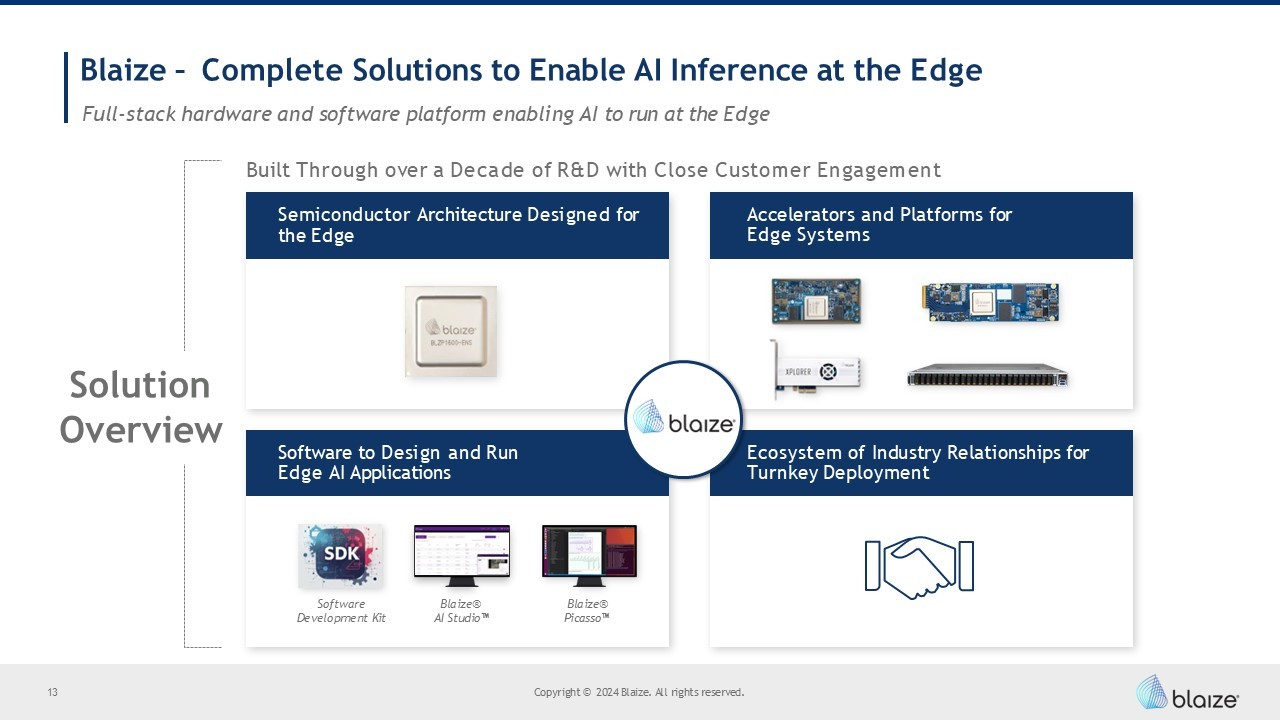

Blaize – Complete Solutions to Enable AI Inference at the Edge Full - stack hardware and software platform enabling AI to run at the Edge Built Through over a Decade of R&D with Close Customer Engagement Accelerators and Platforms for Edge Systems Ecosystem of Industry Relationships for Turnkey Deployment Semiconductor Architecture Designed for the Edge Software to Design and Run Edge AI Applications Solution Overview Blaize® AI Studio 13 Copyright © 2024 Blaize. All rights reserved. Blaize® Picasso Software Development Kit

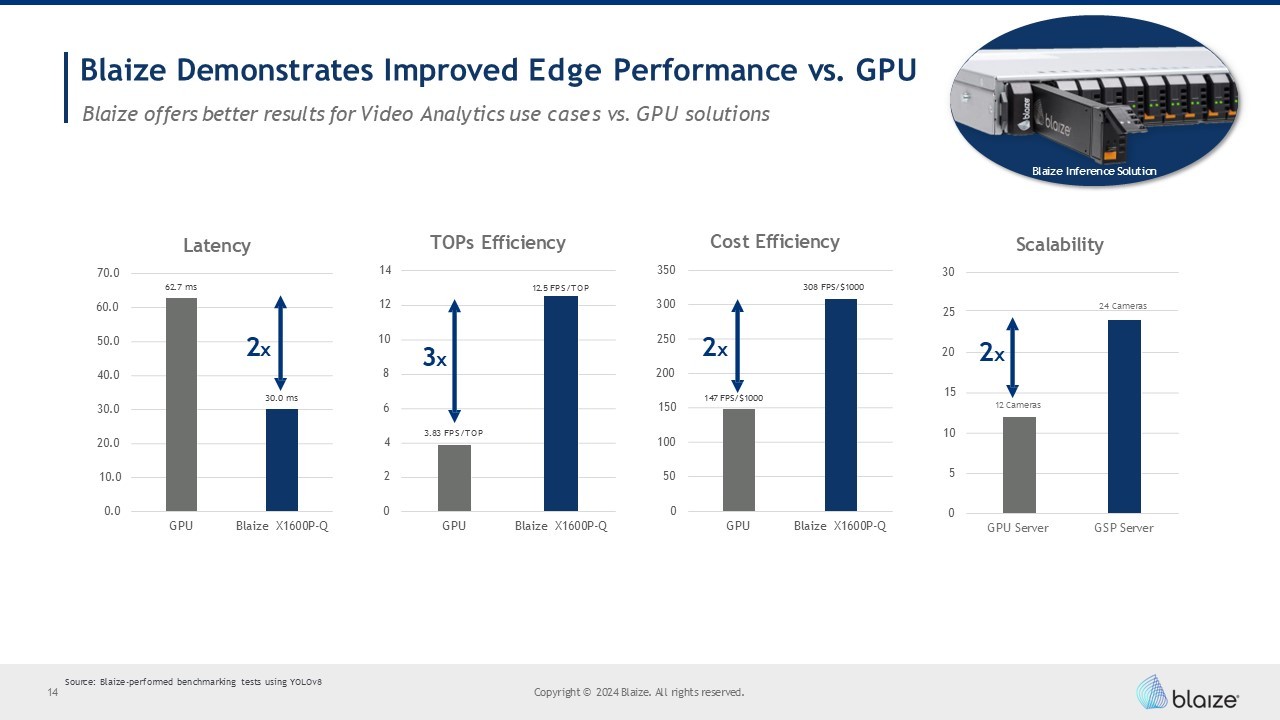

Blaize Demonstrates Improved Edge Performance vs. GPU 62.7 ms 30.0 ms 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 GPU Blaize X1600P - Q Latency 2 x 3.83 FPS/TOP 12.5 FPS/TOP 0 2 4 6 8 10 12 14 GPU Blaize X1600P - Q TOPs Efficiency 3 x 147 FPS/$1000 308 FPS/$1000 0 50 100 150 200 250 300 350 GPU Blaize X1600P - Q Cost Efficiency 2 x 12 Cameras 24 Cameras 0 5 10 15 20 25 30 GPU Server GSP Server Scalability 2 x 14 Copyright © 2024 Blaize. All rights reserved. Blaize Inference Solution Blaize offers better results for Video Analytics use cases vs. GPU solutions Source: Blaize - performed benchmarking tests using YOLOv8

• Rapidly process visual and sensor data to identify potential threats in real time • Integrated into Edge server appliance • Processing computing streams from 1 , 000 s of cameras • Integrated into VMS system compute unit • Customer behavior analysis • Incident management • Integrated in industrial PC • Enabling real - time analytics for predictive maintenance • Medical imaging • Targeting integration in vehicle alongside ECU • In - cabin monitoring • Drones and robotics • Offering high - performance, energy - efficient AI that delivers real - time insights, autonomy, and predictive analytics in demanding operational settings • Real - time data analysis • Reduce congestion issues, promote safer roads • Cost reductions • Complex vision analytics acceleration • Enable product placement and promotion optimization • Prevent unplanned downtime and unexpected expenses • Safety • Enable health professions to assess health risks using real - time Edge analytics • Improve patient care • Improve real - time obstacle detection and avoidance Blaize Products & Solutions Can Deliver Value Across a Vast Array of Applications Limited sample of Blaize applications that have been demonstrated but for which Blaize is not receiving recurring revenue Pictured devices are OEM solutions that Blaize technologies could be embedded into, but are not Blaize products Expected to address complex and unique use cases with its flexible, efficient architecture and programmability Tactical Edge / Defense Smart City Smart Retail Enterprise Edge AI Smart Manufacturing Healthcare Autonomous Vehicles Security & Monitoring Autonomous Systems Illustrative Deployments where Blaize Products Can Add Value Potential Benefits Delivered Targeting a $71B Serviceable Addressable Market 1 for Blaize by 2028 1. See page 12 for additional detail on SAM 15 Copyright © 2024 Blaize. All rights reserved.

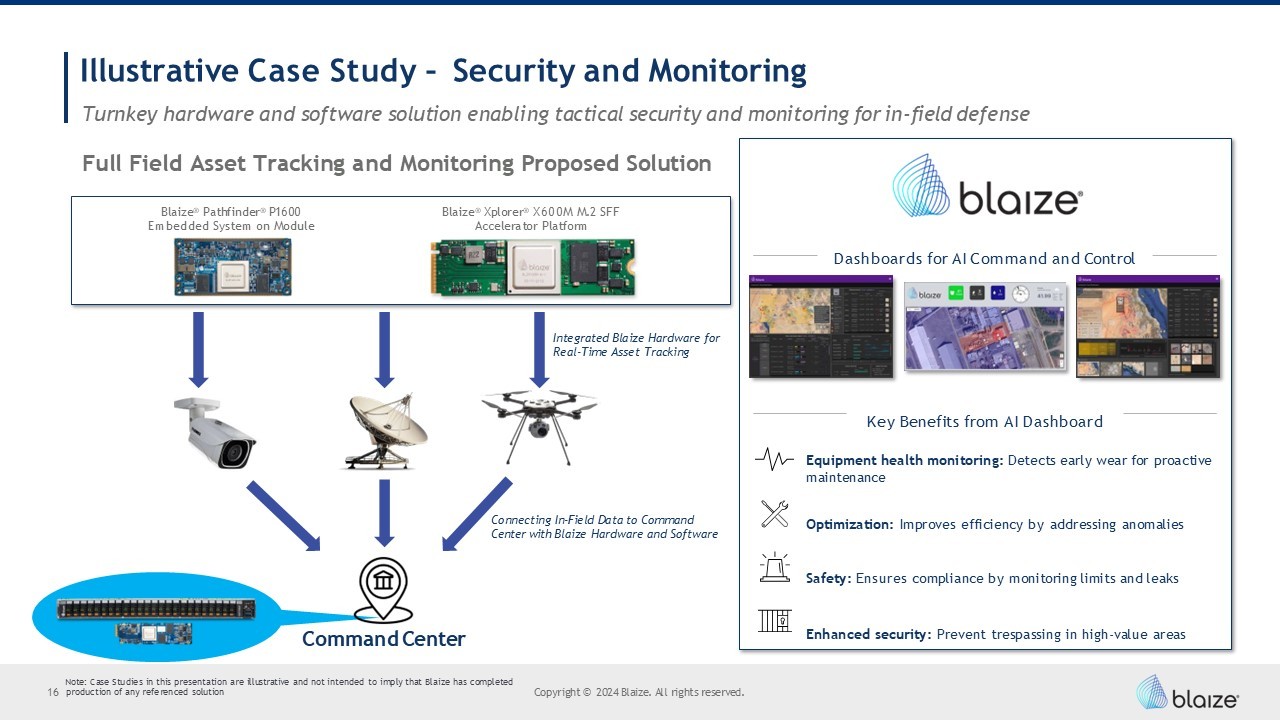

Illustrative Case Study – Security and Monitoring Turnkey hardware and software solution enabling tactical security and monitoring for in - field defense Dashboards for AI Command and Control Key Benefits from AI Dashboard Equipment health monitoring: Detects early wear for proactive maintenance Optimization: Improves efficiency by addressing anomalies Safety: Ensures compliance by monitoring limits and leaks Enhanced security: Prevent trespassing in high - value areas Integrated Blaize Hardware for Real - Time Asset Tracking Command Center Blaize ® Xplorer ® X600M M.2 SFF Accelerator Platform Blaize ® Pathfinder ® P1600 Embedded System on Module Connecting In - Field Data to Command Center with Blaize Hardware and Software Full Field Asset Tracking and Monitoring Proposed Solution Note: Case Studies in this presentation are illustrative and not intended to imply that Blaize has completed 16 production of any referenced solution Copyright © 2024 Blaize. All rights reserved.

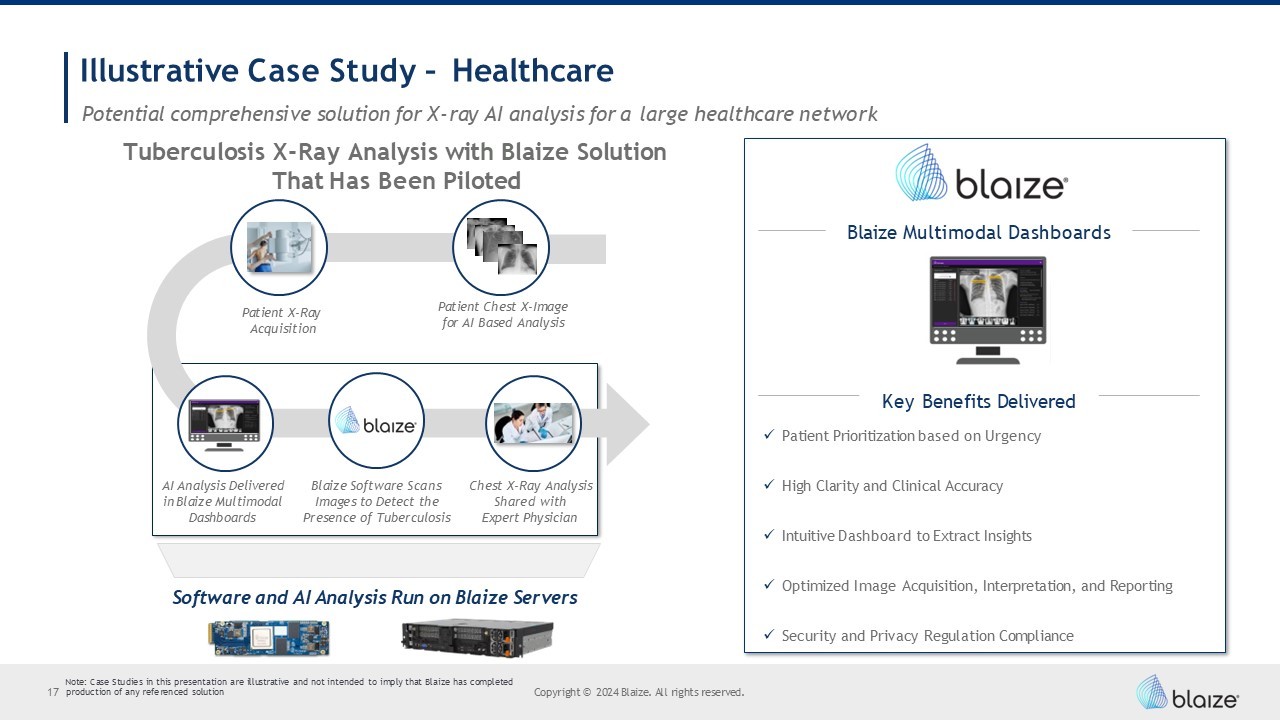

Illustrative Case Study – Healthcare Potential comprehensive solution for X - ray AI analysis for a large healthcare network Blaize Multimodal Dashboards Key Benefits Delivered x Patient Prioritization based on Urgency x High Clarity and Clinical Accuracy x Intuitive Dashboard to Extract Insights x Optimized Image Acquisition, Interpretation, and Reporting x Security and Privacy Regulation Compliance Tuberculosis X - Ray Analysis with Blaize Solution That Has Been Piloted Patient Chest X - Image for AI Based Analysis Patient X - Ray Acquisition Chest X - Ray Analysis Shared with Expert Physician AI Analysis Delivered in Blaize Multimodal Dashboards Software and AI Analysis Run on Blaize Servers Blaize Software Scans Images to Detect the Presence of Tuberculosis Note: Case Studies in this presentation are illustrative and not intended to imply that Blaize has completed 17 production of any referenced solution Copyright © 2024 Blaize. All rights reserved.

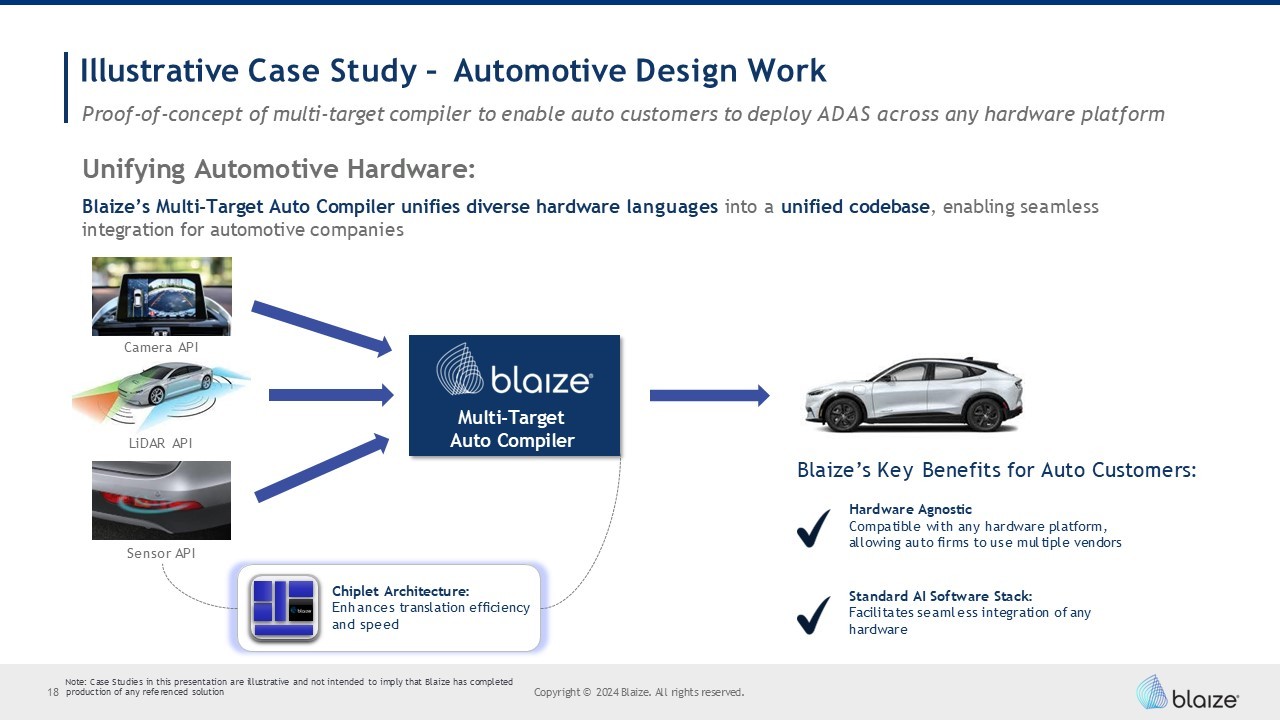

Illustrative Case Study – Automotive Design Work Proof - of - concept of multi - target compiler to enable auto customers to deploy ADAS across any hardware platform Unifying Automotive Hardware: Blaize’s Multi - Target Auto Compiler unifies diverse hardware languages into a unified codebase , enabling seamless integration for automotive companies Multi - Target Auto Compiler Chiplet Architecture: Enhances translation efficiency and speed Blaize’s Key Benefits for Auto Customers: Hardware Agnostic Compatible with any hardware platform, allowing auto firms to use multiple vendors LiDAR API Camera API Sensor API Standard AI Software Stack: Facilitates seamless integration of any hardware Note: Case Studies in this presentation are illustrative and not intended to imply that Blaize has completed 18 production of any referenced solution Copyright © 2024 Blaize. All rights reserved.

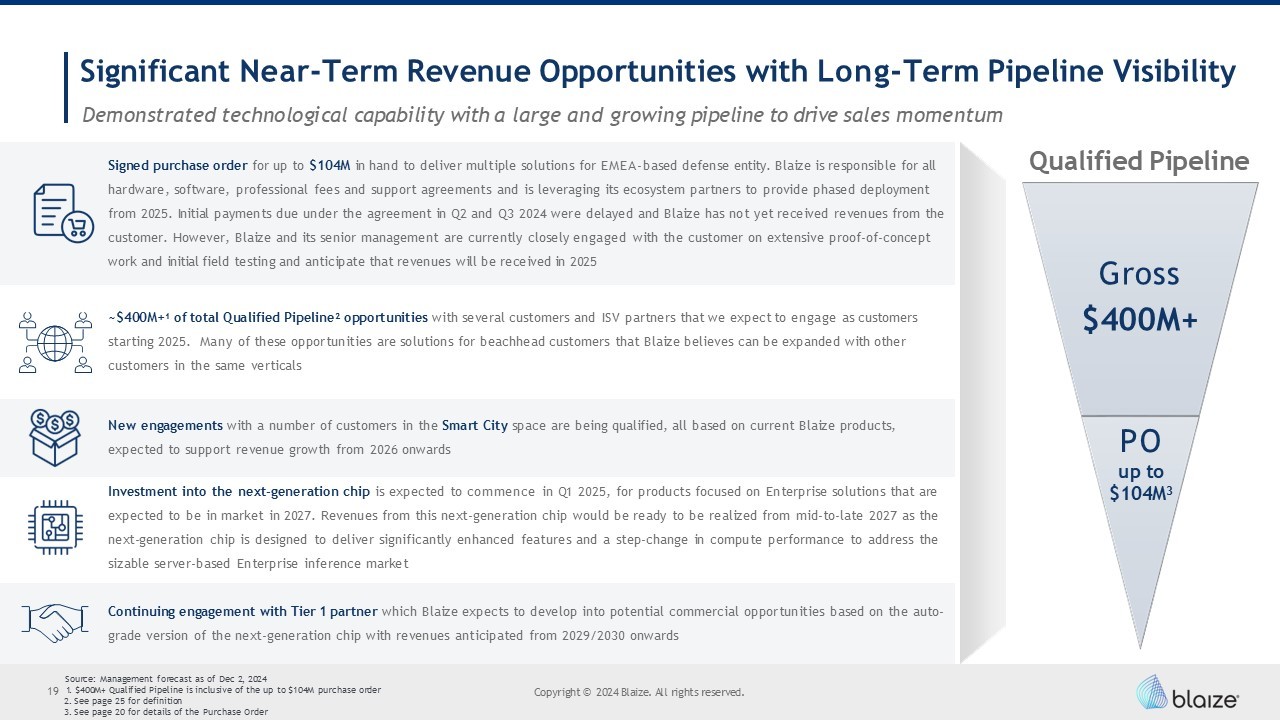

Significant Near - Term Revenue Opportunities with Long - Term Pipeline Visibility Demonstrated technological capability with a large and growing pipeline to drive sales momentum Copyright © 2024 Blaize. All rights reserved. ~$400M+ 1 of total Qualified Pipeline 2 opportunities with several customers and ISV partners that we expect to engage as customers starting 2025. Many of these opportunities are solutions for beachhead customers that Blaize believes can be expanded with other customers in the same verticals Signed purchase order for up to $104M in hand to deliver multiple solutions for EMEA - based defense entity. Blaize is responsible for all hardware, software, professional fees and support agreements and is leveraging its ecosystem partners to provide phased deployment from 2025. Initial payments due under the agreement in Q2 and Q3 2024 were delayed and Blaize has not yet received revenues from the customer. However, Blaize and its senior management are currently closely engaged with the customer on extensive proof - of - concept work and initial field testing and anticipate that revenues will be received in 2025 New engagements with a number of customers in the Smart City space are being qualified, all based on current Blaize products, expected to support revenue growth from 2026 onwards Investment into the next - generation chip is expected to commence in Q 1 2025 , for products focused on Enterprise solutions that are expected to be in market in 2027 . Revenues from this next - generation chip would be ready to be realized from mid - to - late 2027 as the next - generation chip is designed to deliver significantly enhanced features and a step - change in compute performance to address the sizable server - based Enterprise inference market Continuing engagement with Tier 1 partner which Blaize expects to develop into potential commercial opportunities based on the auto - grade version of the next - generation chip with revenues anticipated from 2029/2030 onwards Source: Management forecast as of Dec 2, 2024 19 1. $400M+ Qualified Pipeline is inclusive of the up to $104M purchase order 2. See page 25 for definition 3. See page 20 for details of the Purchase Order Qualified Pipeline Gross $400M+ PO up to $104M 3

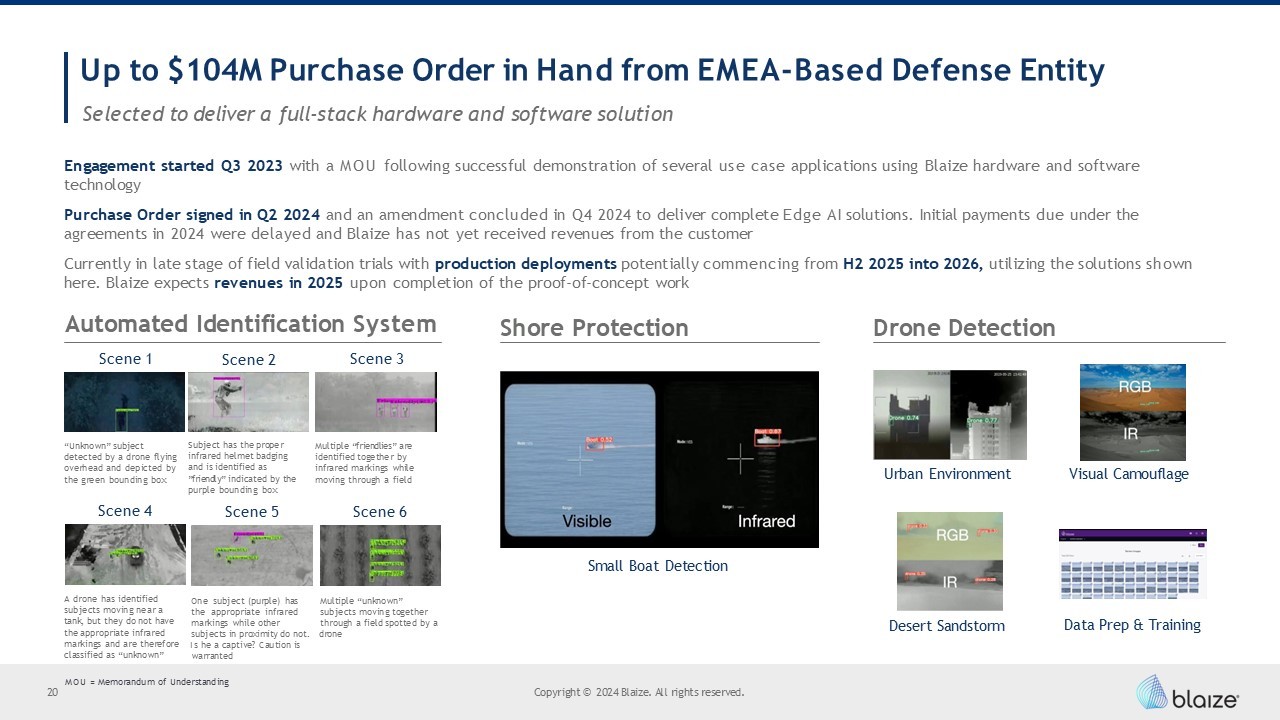

Up to $104M Purchase Order in Hand from EMEA - Based Defense Entity 20 Copyright © 2024 Blaize. All rights reserved. Automated Identification System Scene 1 Scene 2 Scene 3 “Unknown” subject detected by a drone flying overhead and depicted by the green bounding box Subject has the proper infrared helmet badging and is identified as ”friendly” indicated by the purple bounding box Scene 5 Multiple “friendlies” are identified together by infrared markings while moving through a field Scene 4 Scene 6 A drone has identified subjects moving near a tank, but they do not have the appropriate infrared markings and are therefore classified as “unknown” One subject (purple) has the appropriate infrared markings while other Multiple “unknown” subjects moving together through a field spotted by a subjects in proximity do not. drone Is he a captive? Caution is warranted Small Boat Detection Shore Protection Drone Detection Urban Environment Visual Camouflage Desert Sandstorm Data Prep & Training Selected to deliver a full - stack hardware and software solution Engagement started Q3 2023 with a MOU following successful demonstration of several use case applications using Blaize hardware and software technology Purchase Order signed in Q2 2024 and an amendment concluded in Q4 2024 to deliver complete Edge AI solutions. Initial payments due under the agreements in 2024 were delayed and Blaize has not yet received revenues from the customer Currently in late stage of field validation trials with production deployments potentially commencing from H2 2025 into 2026, utilizing the solutions shown here. Blaize expects revenues in 2025 upon completion of the proof - of - concept work MOU = Memorandum of Understanding

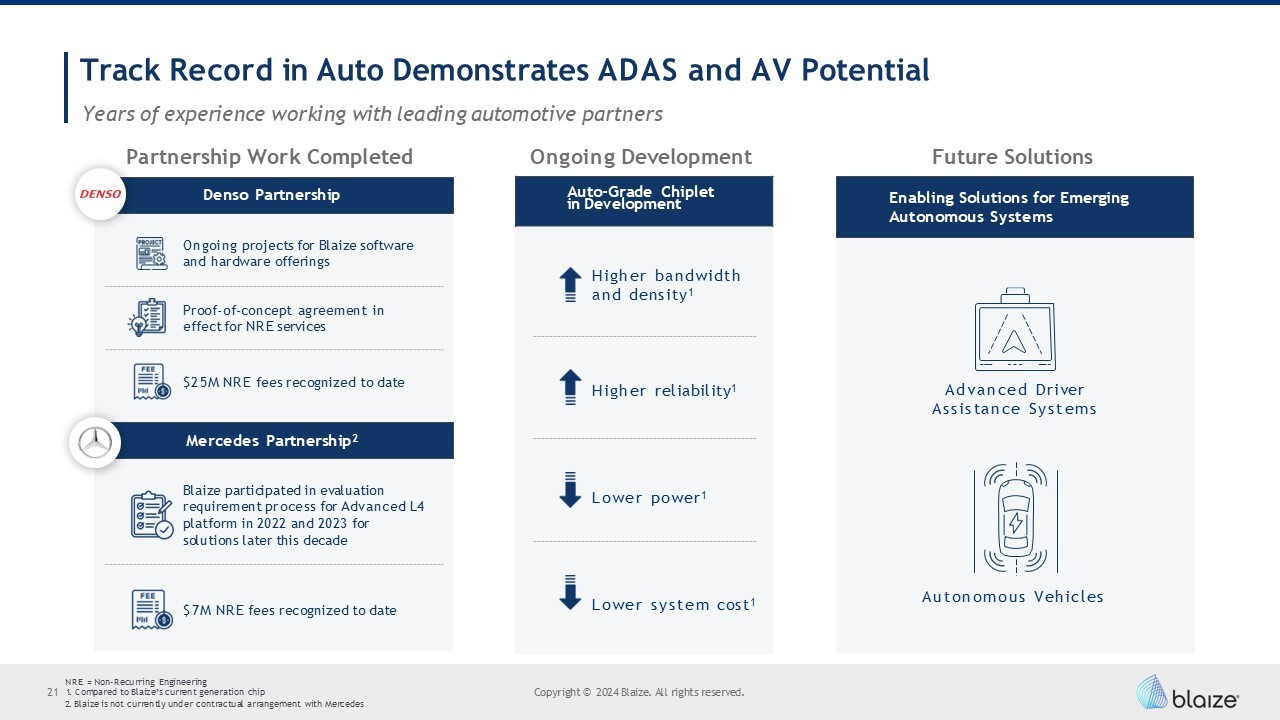

Track Record in Auto Demonstrates ADAS and AV Potential Years of experience working with leading automotive partners Copyright © 2024 Blaize. All rights reserved. NRE = Non - Recurring Engineering 21 1. Compared to Blaize’s current generation chip 2. Blaize is not currently under contractual arrangement with Mercedes Mercedes Partnership 2 $7M NRE fees recognized to date Blaize participated in evaluation requirement process for Advanced L4 platform in 2022 and 2023 for solutions later this decade Ongoing projects for Blaize software and hardware offerings Proof - of - concept agreement in effect for NRE services $25M NRE fees recognized to date Auto - Grade Chiplet in Development Higher bandwidth and density 1 Higher reliability 1 Lower power 1 Lower system cost 1 Enabling Solutions for Emerging Autonomous Systems Partnership Work Completed Ongoing Development Future Solutions Denso Partnership Advanced Driver Assistance Systems Autonomous Vehicles

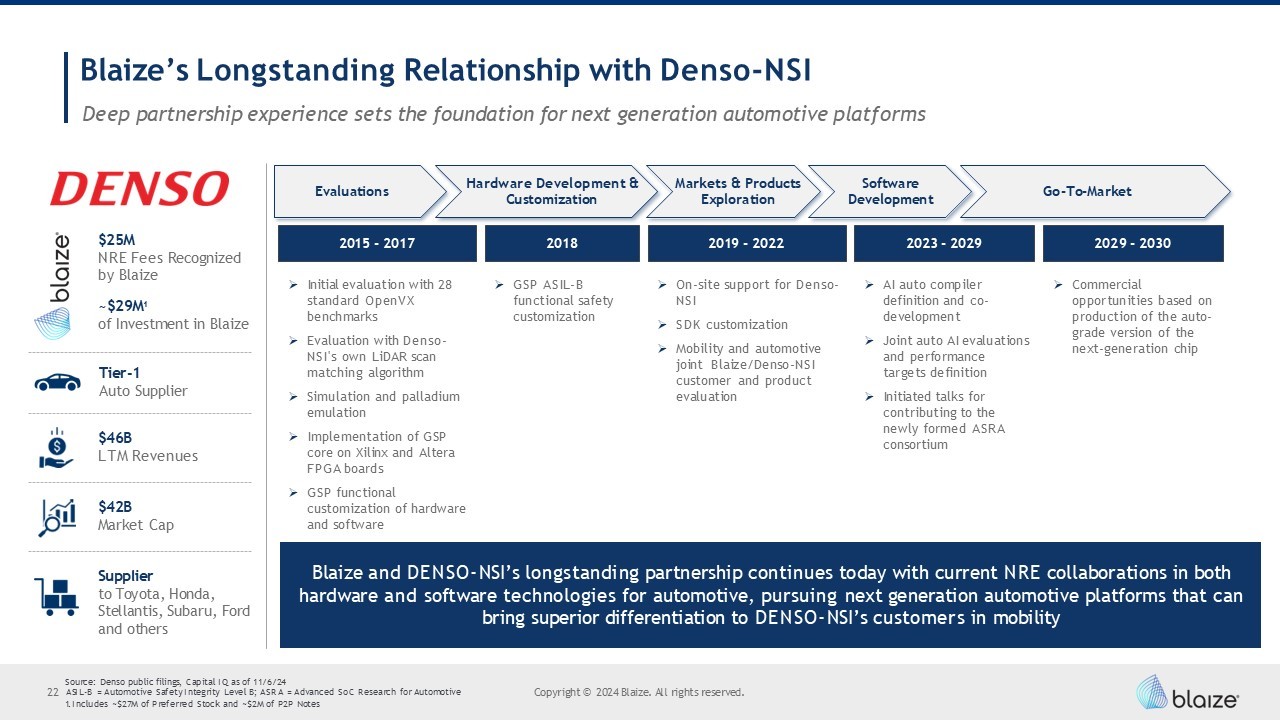

Blaize’s Longstanding Relationship with Denso - NSI Deep partnership experience sets the foundation for next generation automotive platforms Copyright © 2024 Blaize. All rights reserved. Source: Denso public filings, Capital IQ as of 11/6/24 22 ASIL - B = Automotive Safety Integrity Level B; ASRA = Advanced SoC Research for Automotive 1. Includes ~$27M of Preferred Stock and ~$2M of P2P Notes Blaize and DENSO - NSI’s longstanding partnership continues today with current NRE collaborations in both hardware and software technologies for automotive, pursuing next generation automotive platforms that can bring superior differentiation to DENSO - NSI’s customers in mobility Evaluations 2015 - 2017 » Initial evaluation with 28 standard OpenVX benchmarks » Evaluation with Denso - NSI's own LiDAR scan matching algorithm » Simulation and palladium emulation » Implementation of GSP core on Xilinx and Altera FPGA boards » GSP functional customization of hardware and software 2018 » GSP ASIL - B functional safety customization 2019 - 2022 » On - site support for Denso - NSI » SDK customization » Mobility and automotive joint Blaize/Denso - NSI customer and product evaluation 2023 - 2029 » AI auto compiler definition and co - development » Joint auto AI evaluations and performance targets definition » Initiated talks for contributing to the newly formed ASRA consortium 2029 - 2030 » Commercial opportunities based on production of the auto - grade version of the next - generation chip Go - To - Market Software Development Markets & Products Exploration Hardware Development & Customization Tier - 1 Auto Supplier $46B LTM Revenues $42B Market Cap Supplier to Toyota, Honda, Stellantis, Subaru, Ford and others $25M NRE Fees Recognized by Blaize ~$29M 1 of Investment in Blaize

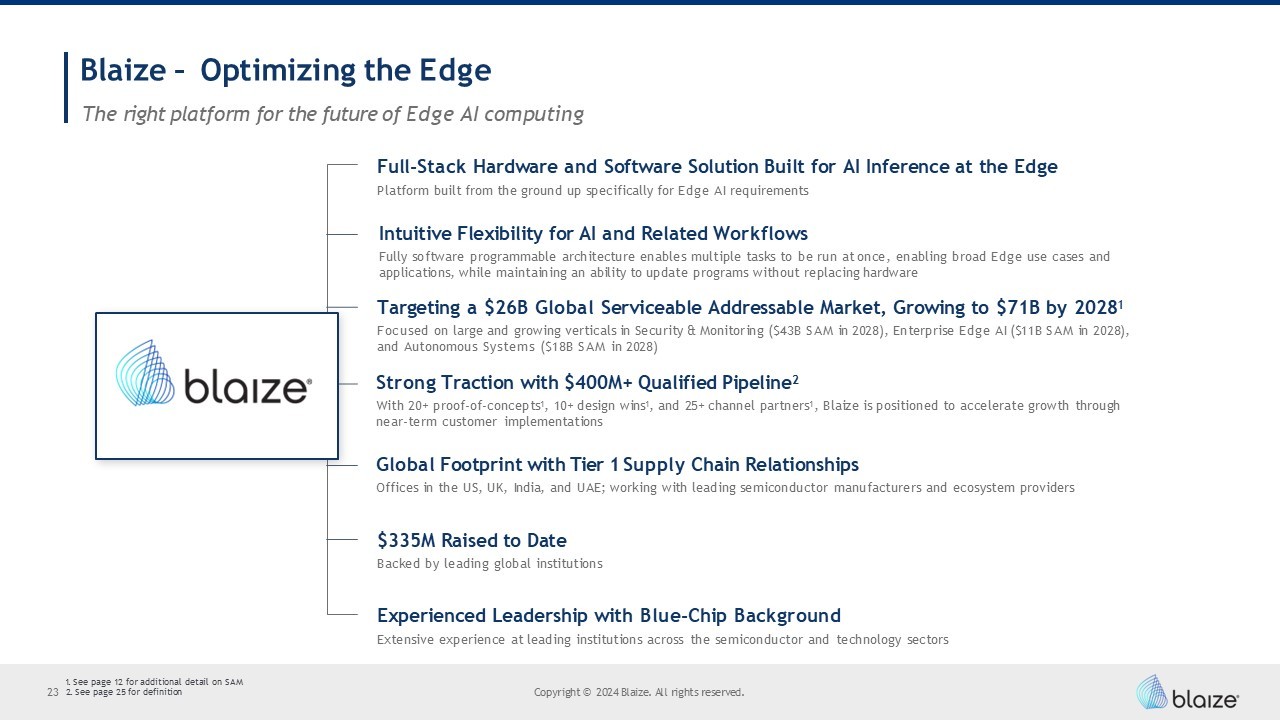

Blaize – Optimizing the Edge Copyright © 2024 Blaize. All rights reserved. 1. See page 12 for additional detail on SAM 23 2. See page 25 for definition The right platform for the future of Edge AI computing Full - Stack Hardware and Software Solution Built for AI Inference at the Edge Platform built from the ground up specifically for Edge AI requirements Intuitive Flexibility for AI and Related Workflows Fully software programmable architecture enables multiple tasks to be run at once, enabling broad Edge use cases and applications, while maintaining an ability to update programs without replacing hardware Targeting a $26B Global Serviceable Addressable Market, Growing to $71B by 2028 1 Focused on large and growing verticals in Security & Monitoring ($43B SAM in 2028), Enterprise Edge AI ($11B SAM in 2028), and Autonomous Systems ($18B SAM in 2028) Strong Traction with $400M+ Qualified Pipeline 2 With 20+ proof - of - concepts 1 , 10+ design wins 1 , and 25+ channel partners 1 , Blaize is positioned to accelerate growth through near - term customer implementations Global Footprint with Tier 1 Supply Chain Relationships Offices in the US, UK, India, and UAE; working with leading semiconductor manufacturers and ecosystem providers $335M Raised to Date Backed by leading global institutions Experienced Leadership with Blue - Chip Background Extensive experience at leading institutions across the semiconductor and technology sectors

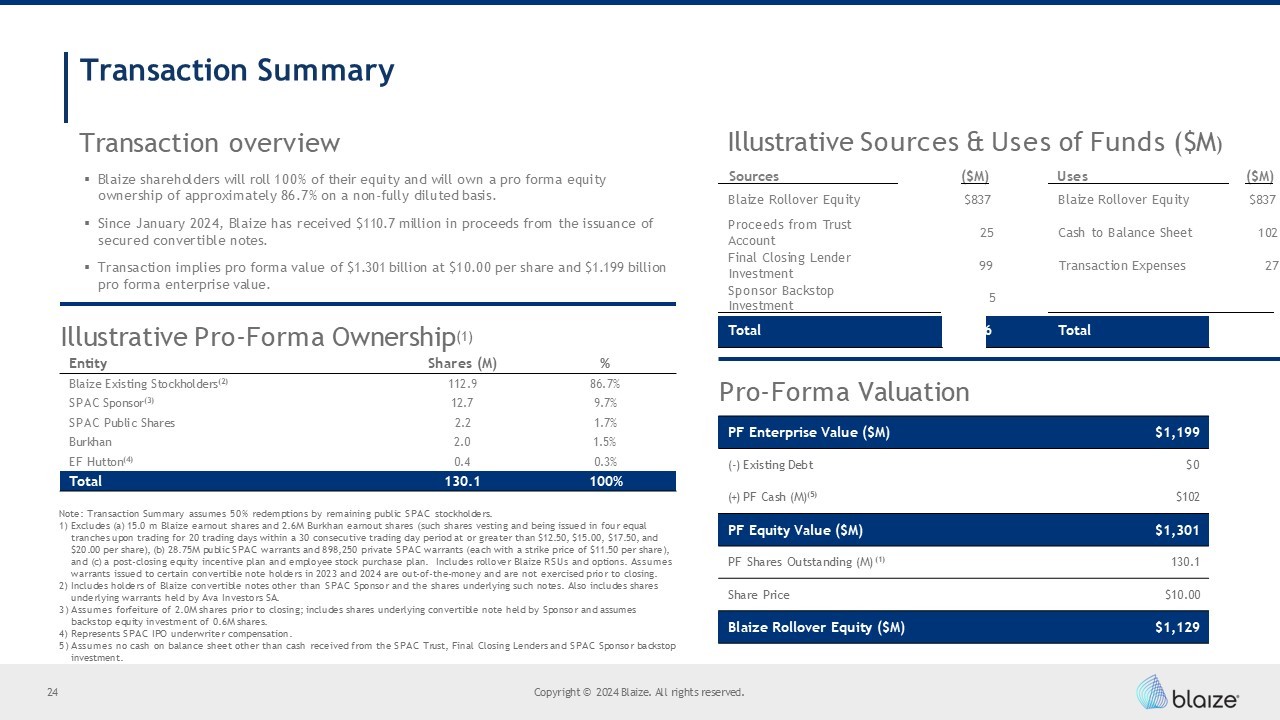

Transaction Summary Copyright © 2024 Blaize. All rights reserved. Transaction overview ▪ Blaize shareholders will roll 100% of their equity and will own a pro forma equity ownership of approximately 86.7% on a non - fully diluted basis. ▪ Since January 2024, Blaize has received $110.7 million in proceeds from the issuance of secured convertible notes. ▪ Transaction implies pro forma value of $1.301 billion at $10.00 per share and $1.199 billion pro forma enterprise value. Illustrative Pro - Forma Ownership (1) Pro - Forma Valuation Illustrative Sources & Uses of Funds ($M ) ($M) Uses ($M) Sources $837 Blaize Rollover Equity $837 Blaize Rollover Equity 102 Cash to Balance Sheet 25 Proceeds from Trust Account 27 Transaction Expenses 99 Final Closing Lender Investment 5 Sponsor Backstop Investment $966 Total $966 Total % Shares (M) Entity 86.7% 112.9 Blaize Existing Stockholders (2) 9.7% 12.7 SPAC Sponsor (3) 1.7% 2.2 SPAC Public Shares 1.5% 2.0 Burkhan 0.3% 0.4 EF Hutton (4) 100% 130.1 Total $1,199 PF Enterprise Value ($M) $0 ( - ) Existing Debt $102 (+) PF Cash (M) (5) $1,301 PF Equity Value ($M) 130.1 PF Shares Outstanding (M) (1) $10.00 Share Price $1,129 Blaize Rollover Equity ($M) Note: Transaction Summary assumes 50% redemptions by remaining public SPAC stockholders. 1) Excludes (a) 15.0 m Blaize earnout shares and 2.6M Burkhan earnout shares (such shares vesting and being issued in four equal tranches upon trading for 20 trading days within a 30 consecutive trading day period at or greater than $12.50, $15.00, $17.50, and $20.00 per share), (b) 28.75M public SPAC warrants and 898,250 private SPAC warrants (each with a strike price of $11.50 per share), and (c) a post - closing equity incentive plan and employee stock purchase plan. Includes rollover Blaize RSUs and options. Assumes warrants issued to certain convertible note holders in 2023 and 2024 are out - of - the - money and are not exercised prior to closing. 2) Includes holders of Blaize convertible notes other than SPAC Sponsor and the shares underlying such notes. Also includes shares underlying warrants held by Ava Investors SA. 3) Assumes forfeiture of 2.0M shares prior to closing; includes shares underlying convertible note held by Sponsor and assumes backstop equity investment of 0.6M shares. 4) Represents SPAC IPO underwriter compensation. 5) Assumes no cash on balance sheet other than cash received from the SPAC Trust, Final Closing Lenders and SPAC Sponsor backstop investment. 24

Definitions of Key Terms Copyright © 2024 Blaize. All rights reserved. None of these definitions are intended to imply that Blaize has entered into a binding contract for the future 25 revenue with any 3rd party. Blaize is not representing any guarantee of future revenue with any 3rd party • Design Win: A Channel Partner or End Customer has selected Blaize’s solution to be incorporated into an end product it intends to produce, and confirmed that Blaize’s solution integrates into the end product as intended • Proof - of - Concept (POC) Stage: Proposal for POC has been initiated or the POC is in progress. For Blaize the purpose of POC Stage is to provide a proof point to the potential End Customer or Channel Partner that Blaize technology has a winning value proposition and meets the customer's use case and requirements • Qualified Pipeline: Target accounts and opportunities that have been identified and vetted as potential customers for Blaize solutions. This may include a combination of Channel Partners and End Customers that could consume Blaize products • Channel Partner: An Independent Software Vendor (ISV) or Independent Hardware Vendor (IHV) with whom Blaize is working to integrate Blaize solutions into products for their end customers. IHV’s may include Original Equipment Manufacturers (OEM), Original Design Manufacturers (ODM), System Integrators or Hardware Resellers or Distributors • End Customer: The decision making entity that will choose a Blaize solution and will procure the solution either through a Blaize Channel Partner or directly from Blaize. The End Customer is either the consumer of the Blaize solution or it integrates the Blaize solution into its end product and offers it to the market

Risks 26 Copyright © 2024 Blaize. All rights reserved. We have a history of operating losses, and we may not be able to generate sufficient revenue to achieve and sustain profitability. Our recent growth rates may not be indicative of our future growth. Our independent registered public accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a going concern. Our partnerships with certain automotive OEMs and Tier - 1 suppliers are long - term in nature and we will not receive firm purchase order commitments until we deliver our auto - grade chip. Our future revenue and operating results will be harmed if we are unable to acquire new customers, retain existing customers, terminate existing customer or partnership contracts or expand sales to our existing customers. We may not be able to successfully implement our growth strategy on a timely basis or at all. Failure to effectively develop and expand our marketing and sales capabilities could harm our ability to increase our customer base and achieve broader market acceptance of our platform and products. Our sales cycle with large enterprise customers can be long and unpredictable, and our sales efforts require considerable time and expense. If we fail to maintain or grow our brand recognition, our ability to expand our customer base will be impaired and our financial condition may suffer. If we fail to offer high quality support, our business and reputation could suffer. We depend on timely supply of materials sourced from a limited number of suppliers and are directly impacted by unexpected delays or problems from our third - party manufacturers. We depend on third - party manufacturers, including Samsung Foundry and Plexus, for producing our products, and in the event of a disruption in our supply chain, any efforts to develop alternative supply sources may not be successful or may take longer to take effect than anticipated. If we fail to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform and products, and innovate and introduce new solutions in a manner that responds to our customers’ evolving needs, our business may be adversely affected. We may not be successful in driving the global deployment and customer adoption of digital offerings characterized by digital applications and solutions. If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service and customer satisfaction or adequately address competitive challenges. We may acquire or invest in companies, which may divert our management’s attention and result in additional dilution to our stockholders. We may be unable to integrate acquired businesses and technologies successfully or achieve the expected benefits of such acquisitions. We face intense competition, especially from well - established companies offering solutions and related applications. We may lack sufficient financial or other resources to maintain or improve our competitive position, which may harm our ability to add new customers, retain existing customers and grow our business.

Risks (continued) 27 Copyright © 2024 Blaize. All rights reserved. We may need to reduce or change our pricing model to remain competitive. If we fail to adapt and respond effectively to rapidly changing technology, evolving industry standards, and changing customer needs or preferences, our platform and products may become less competitive. The estimates of market opportunity and forecasts of market growth included in this proxy statement/prospectus may prove to be inaccurate. Even if the market in which we compete achieves the forecasted growth, our business could fail to grow at similar rates, if at all. We anticipate that our operations will continue to increase in complexity as we grow, which will create management challenges. We depend on our senior management team and the loss of one or more key employees or an inability to attract and retain highly skilled employees may adversely affect our business. If we are unable to hire, retain and motivate qualified personnel, our business will suffer. If we are unable to maintain our corporate culture as we grow, we could lose the innovation, teamwork, passion and focus on execution that we believe contribute to our success, and our business may be harmed. If our software or hardware contains serious errors or defects, we may lose revenue and market acceptance and may incur costs to defend or settle claims with our customers. We process proprietary, confidential and personal information of our employees, as well as employees of our customers and third parties with which we do business, in addition to any personal information that may be uploaded to our services by our customers, which may subject us to certain laws regarding their privacy and security of such personal information. If we fail to comply with applicable laws or if the security of this information is compromised or is otherwise accessed without authorization, our reputation may be harmed and we may be exposed to liability and loss of business. We currently, and may in the future, use and develop AI, machine learning and automated decision - making technologies throughout our business, which may expose us to certain regulatory and other risks that could adversely affect our results of operations and financial condition. We depend on third - party data hosting and transmission services. Increases in cost, interruptions in service, latency or poor service from our third - party data center providers could impair the delivery of our platform, which could result in customer dissatisfaction, damage to our reputation, loss of customers, limited growth and reduction in revenue. We rely on third - party proprietary and open source software for our platform. Our inability to obtain third - party licenses for such software, or obtain them on favorable terms, or any errors, bugs, defects or failures caused by such software could adversely affect our business, results of operations and financial condition. Our use of open source software could subject us to possible litigation or cause us to subject our platform or products to unwanted open source license conditions that could negatively impact our sales. We rely on computer hardware, purchased or leased, and software licensed from and services rendered by third parties in order to run our business. Our growth depends in part on the success of our strategic relationships with third parties. We could incur substantial costs in protecting or defending our proprietary rights. Failure to adequately protect our rights could impair our competitive position and we could lose valuable assets, experience reduced revenue and incur costly litigation.

Risks (continued) 28 Copyright © 2024 Blaize. All rights reserved. If we fail to execute invention assignment agreements with our employees and contractors involved in the development of intellectual property or are unable to protect the confidentiality of our trade secrets, the value of our products and our business and competitive position could be harmed. We are subject to financial and economic sanctions, export controls and similar laws, and non - compliance with such laws can subject us to administrative, civil, and criminal fines and penalties, collateral consequences, remedial measures and legal expenses, all of which could adversely affect our business, results of operations, financial condition and reputation. Blaize conducts, and New Blaize will conduct, a portion of its business with third - party ecosystem partners to provide defensive solutions that incorporate our products to various foreign and domestic government agencies, which are subject to unique risks. We are subject to anti - corruption, anti - bribery, anti - money laundering and similar laws. Non - compliance with such laws can subject us to criminal and/or civil liability and harm our business. We are exposed to fluctuations in currency exchange rates, which could negatively affect our operating results. Our insurance costs may increase significantly, we may be unable to obtain the same level of insurance coverage and our insurance coverage may not be adequate to cover all possible losses we may suffer. Our ability to use our net operating losses and certain other attributes may be subject to certain limitations. Changes to applicable tax laws and regulations or exposure to additional income tax liabilities could affect our business and future profitability. We may be subject to additional obligations to collect and remit sales tax and other taxes. We may be subject to tax liability for past sales, which could harm our business.

Copyright © 2024 Blaize. All rights reserved. Copyright © 2024 Blaize. All rights reserved. 29 Appendix: Blaize’s Technology Innovations

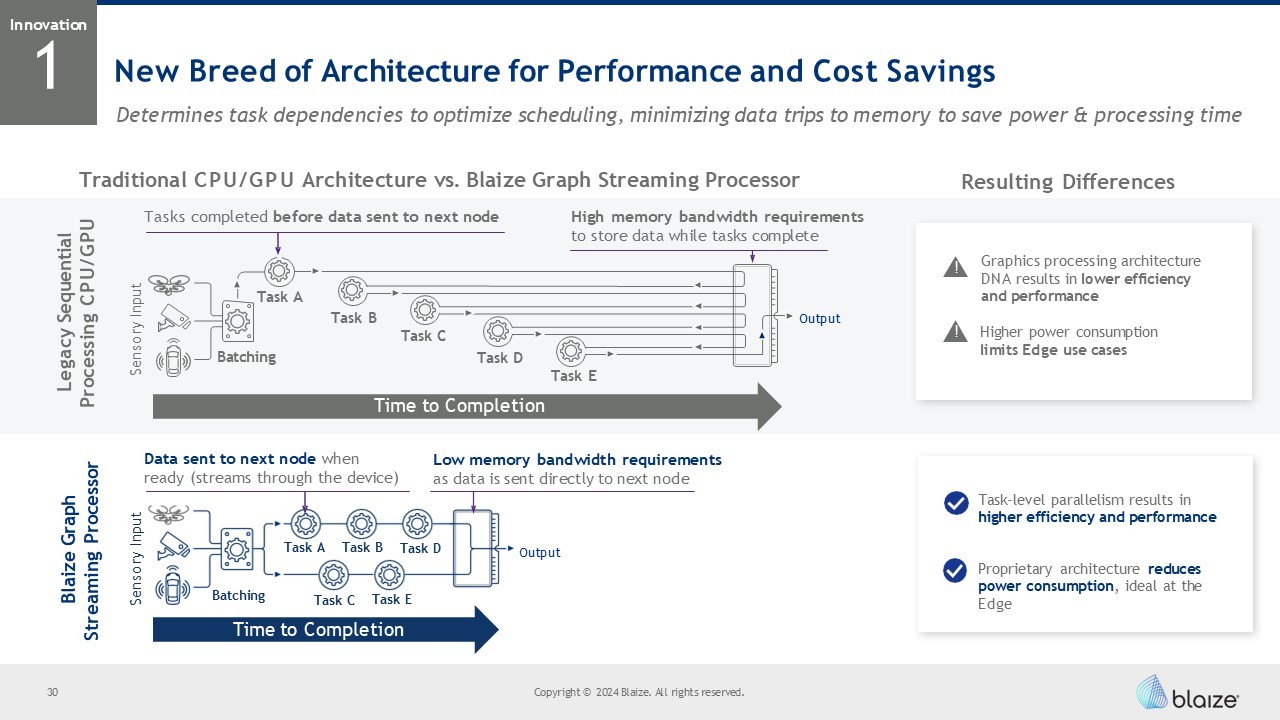

Legacy Sequential Processing CPU/GPU Tasks completed before data sent to next node High memory bandwidth requirements to store data while tasks complete Low memory bandwidth requirements as data is sent directly to next node Data sent to next node when ready (streams through the device) Output 1 Innovation Blaize Graph Streaming Processor Sensory Input Task A Batching Task B Task C Task D Task E Time to Completion Batching Task A Task B Task D Task C Task E Time to Completion Resulting Differences Output Sensory Input Graphics processing architecture DNA results in lower efficiency and performance ! ! Higher power consumption limits Edge use cases Task - level parallelism results in higher efficiency and performance Proprietary architecture reduces power consumption , ideal at the Edge Traditional CPU/GPU Architecture vs. Blaize Graph Streaming Processor 30 Copyright © 2024 Blaize. All rights reserved. New Breed of Architecture for Performance and Cost Savings Determines task dependencies to optimize scheduling, minimizing data trips to memory to save power & processing time

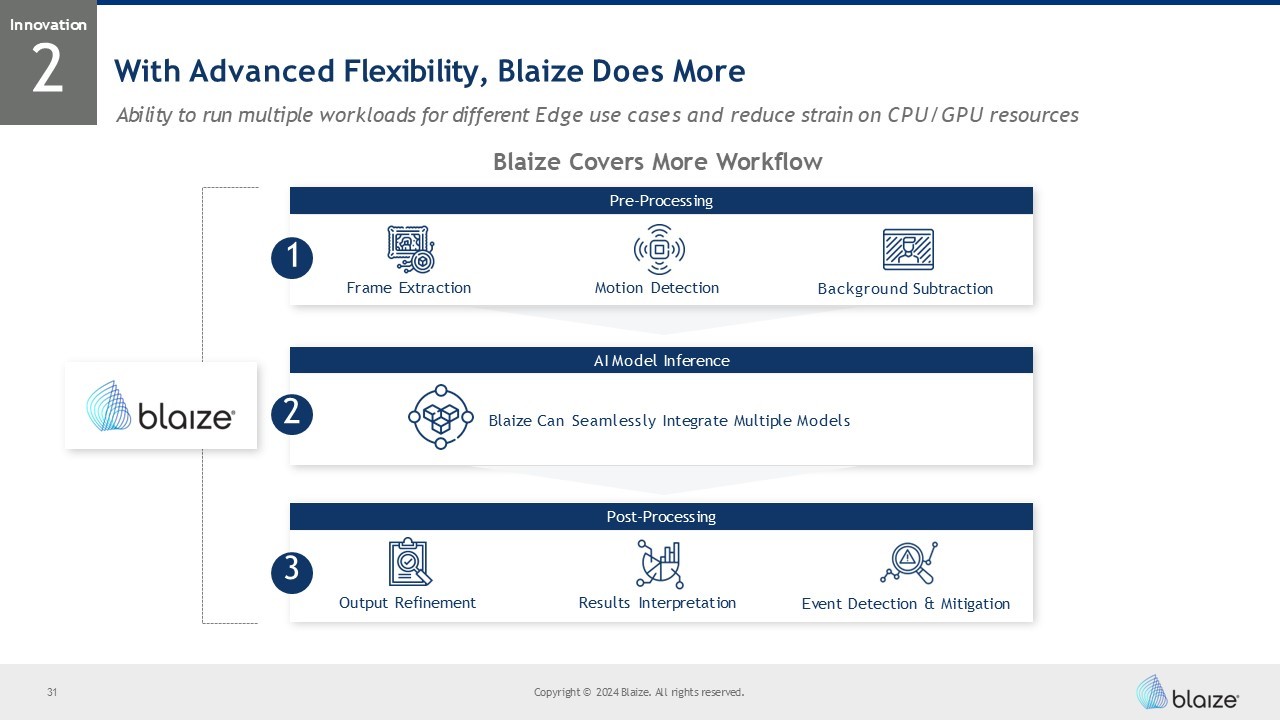

With Advanced Flexibility, Blaize Does More Ability to run multiple workloads for different Edge use cases and reduce strain on CPU/GPU resources Blaize Covers More Workflow 2 Innovation Pre - Processing AI Model Inference Post - Processing Frame Extraction Motion Detection Background Subtraction Blaize Can Seamlessly Integrate Multiple Models Output Refinement Results Interpretation Event Detection & Mitigation 1 2 3 31 Copyright © 2024 Blaize. All rights reserved.

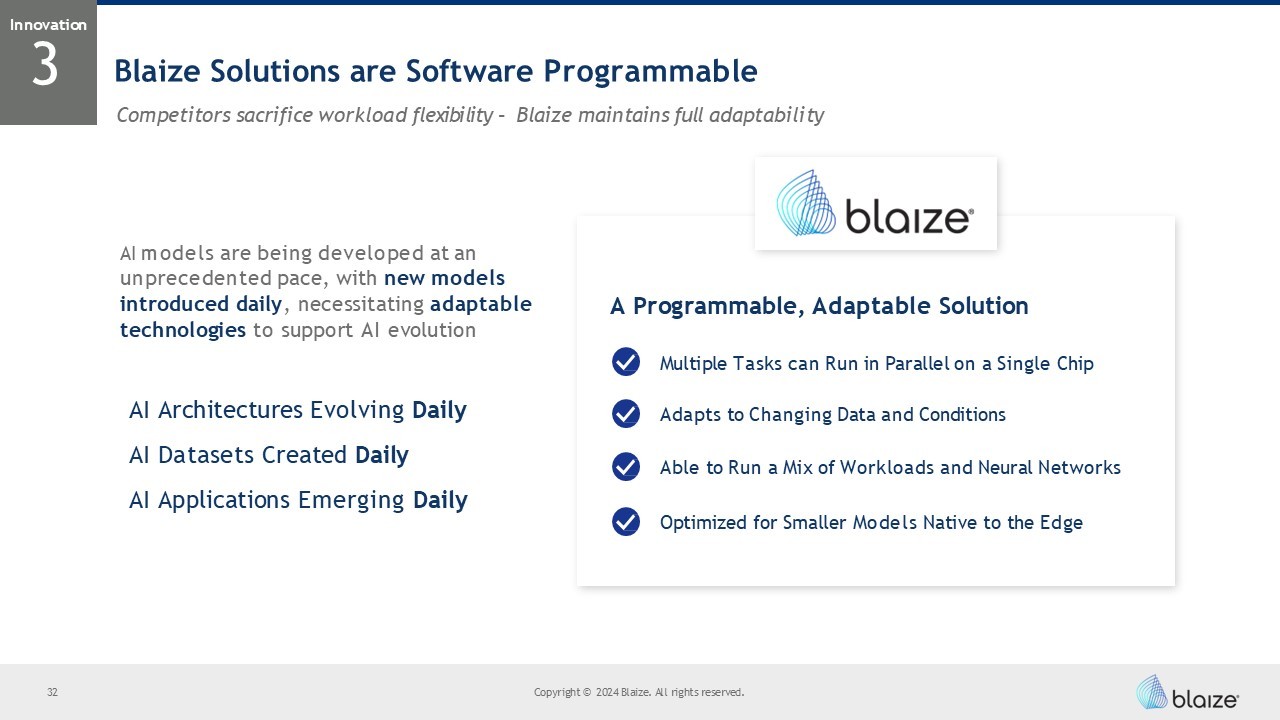

Multiple Tasks can Run in Parallel on a Single Chip Adapts to Changing Data and Conditions Able to Run a Mix of Workloads and Neural Networks AI models are being developed at an unprecedented pace, with new models introduced daily , necessitating adaptable technologies to support AI evolution A Programmable, Adaptable Solution AI Architectures Evolving Daily AI Datasets Created Daily AI Applications Emerging Daily Optimized for Smaller Models Native to the Edge 3 32 Copyright © 2024 Blaize. All rights reserved. Innovation Blaize Solutions are Software Programmable Competitors sacrifice workload flexibility – Blaize maintains full adaptability

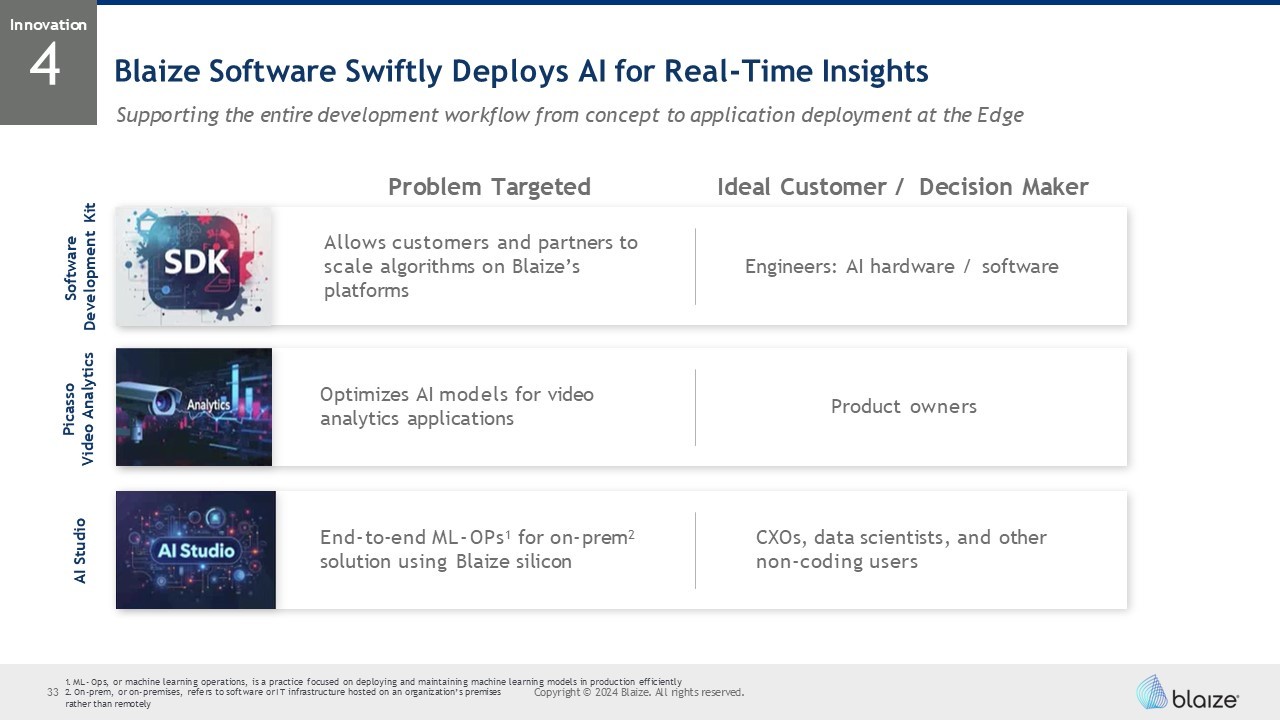

1. ML - Ops, or machine learning operations, is a practice focused on deploying and maintaining machine learning models in production efficiently 33 2. On - prem, or on - premises, refers to software or IT infrastructure hosted on an organization’s premises Copyright © 2024 Blaize. All rights reserved. Allows customers and partners to scale algorithms on Blaize’s platforms Engineers: AI hardware / software Optimizes AI models for video analytics applications Product owners End - to - end ML - OPs 1 for on - prem 2 solution using Blaize silicon CXOs, data scientists, and other non - coding users AI Studio Picasso Video Analytics Software Development Kit Blaize Software Swiftly Deploys AI for Real - Time Insights Supporting the entire development workflow from concept to application deployment at the Edge Problem Targeted Ideal Customer / Decision Maker 4 rather than remotely Innovation

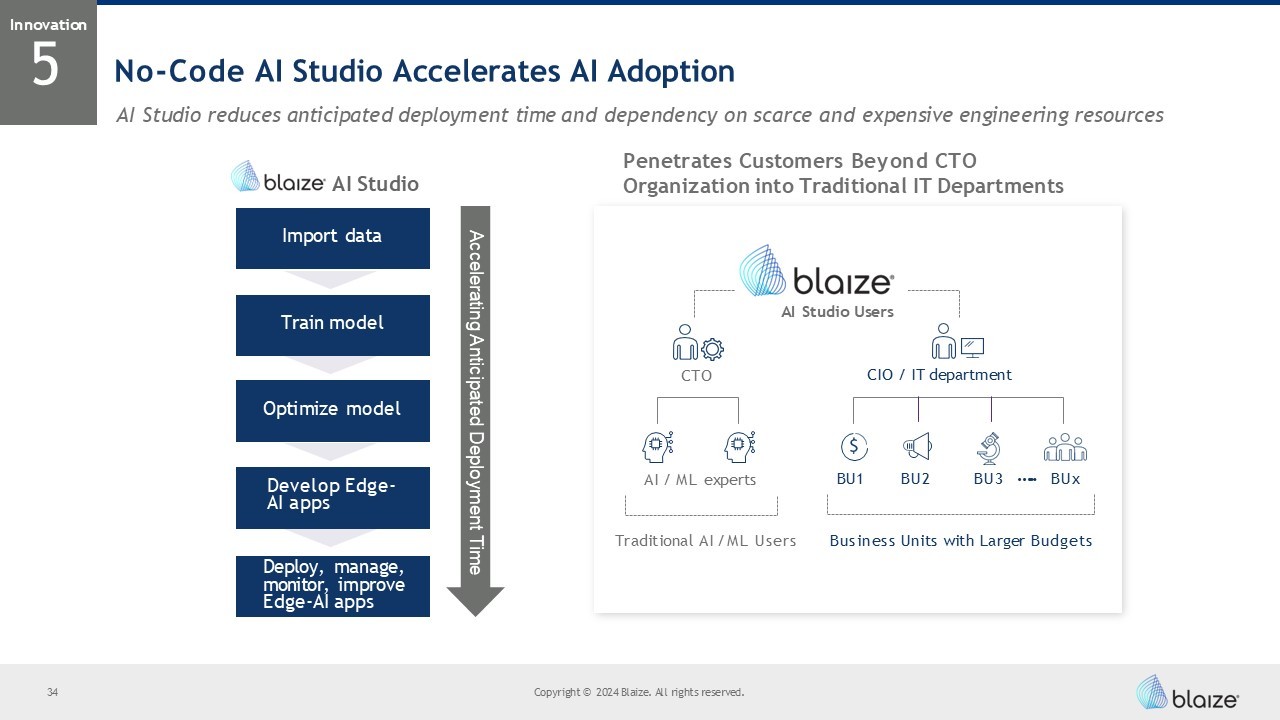

No - Code AI Studio Accelerates AI Adoption AI Studio reduces anticipated deployment time and dependency on scarce and expensive engineering resources 5 Innovation Penetrates Customers Beyond CTO Organization into Traditional IT Departments CTO CIO / IT department AI Studio Users AI / ML experts Traditional AI /ML Users Business Units with Larger Budgets BU1 BU2 BU3 BUx ….. Import data Train model Optimize model Develop Edge - AI apps Deploy, manage, monitor, improve Edge - AI apps AI Studio Accelerating Anticipated Deployment Time 34 Copyright © 2024 Blaize. All rights reserved.

Copyright © 2024 Blaize. All rights reserved. Copyright © 2024 Blaize. All rights reserved. 35 Appendix: Market, Product, and Business

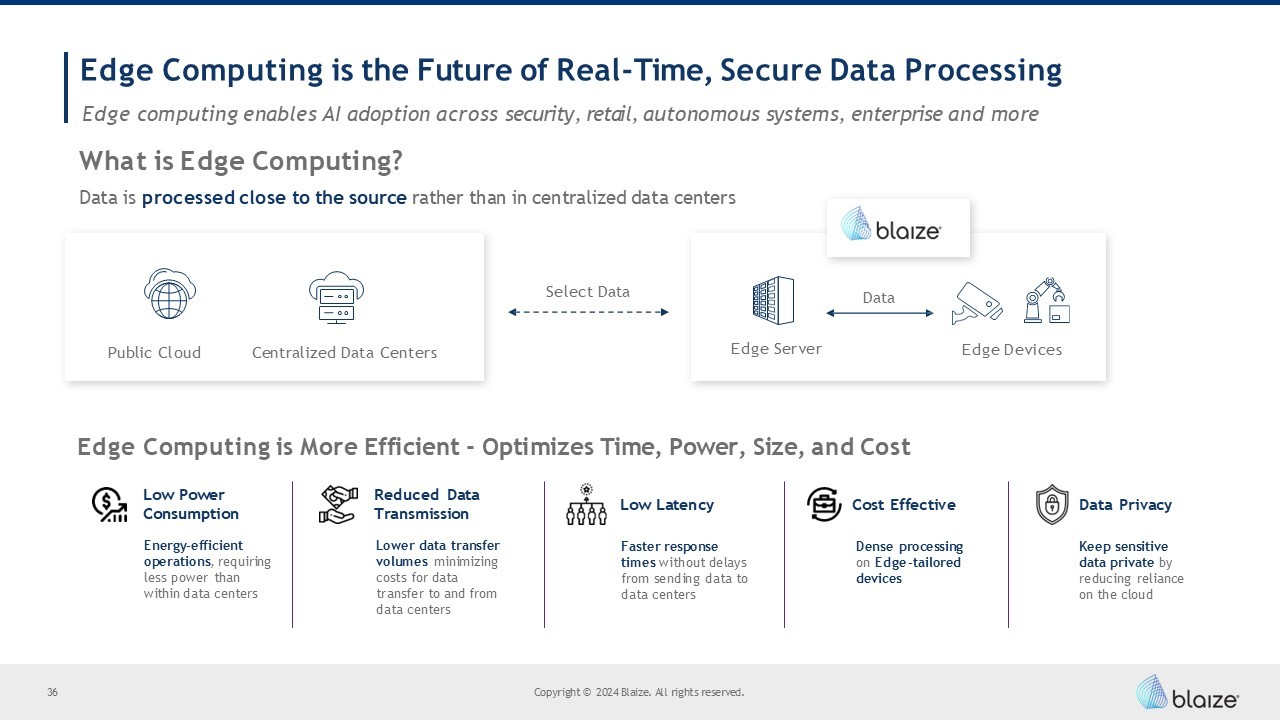

Edge Computing is the Future of Real - Time, Secure Data Processing Low Power Consumption Energy - efficient operations , requiring less power than within data centers Reduced Data Transmission Lower data transfer volumes minimizing costs for data transfer to and from data centers Cost Effective Dense processing on Edge - tailored devices Data Privacy Select Data Data Edge Computing is More Efficient - Optimizes Time, Power, Size, and Cost Edge Devices Edge computing enables AI adoption across security, retail, autonomous systems, enterprise and more What is Edge Computing? Data is processed close to the source rather than in centralized data centers Public Cloud Centralized Data Centers Keep sensitive data private by reducing reliance on the cloud Low Latency Faster response times without delays from sending data to data centers Edge Server 36 Copyright © 2024 Blaize. All rights reserved.

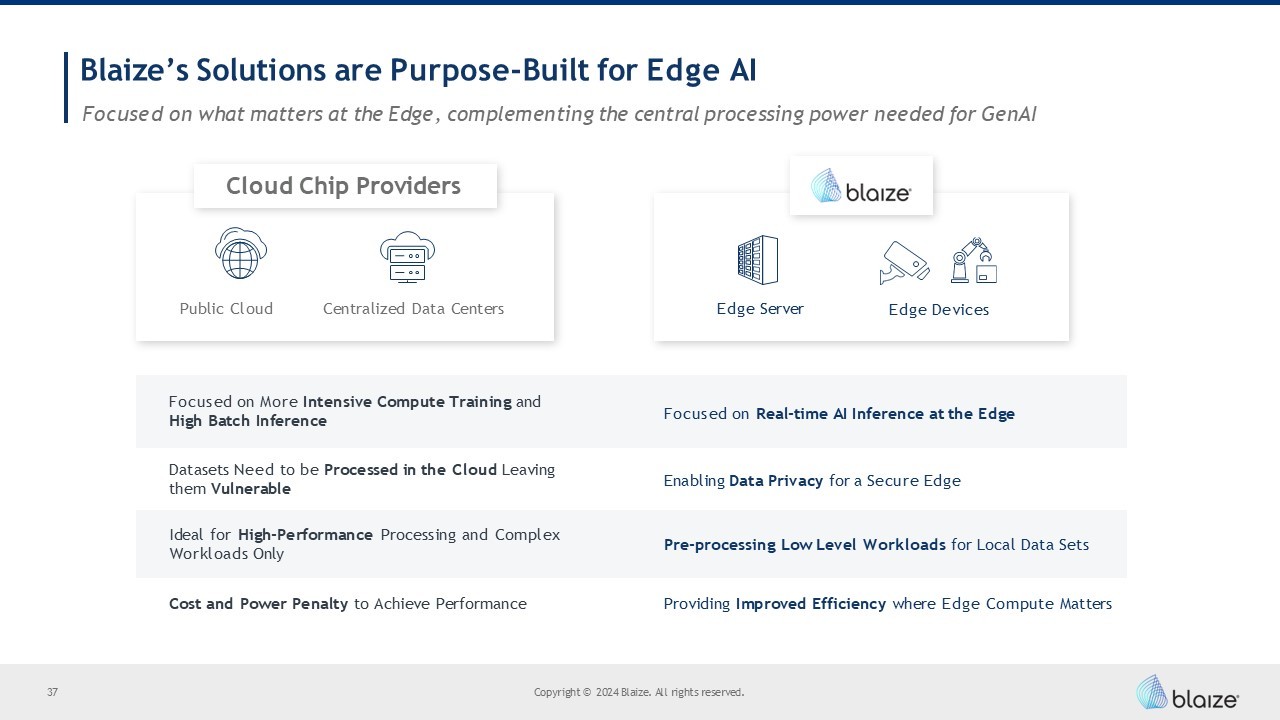

Blaize’s Solutions are Purpose - Built for Edge AI Edge Devices Edge Server Public Cloud Centralized Data Centers Focused on what matters at the Edge, complementing the central processing power needed for GenAI Cloud Chip Providers Providing Improved Efficiency where Edge Compute Matters Focused on More Intensive Compute Training and High Batch Inference 37 Copyright © 2024 Blaize. All rights reserved. Focused on Real - time AI Inference at the Edge Datasets Need to be Processed in the Cloud Leaving them Vulnerable Enabling Data Privacy for a Secure Edge Ideal for High - Performance Processing and Complex Workloads Only Pre - processing Low Level Workloads for Local Data Sets Cost and Power Penalty to Achieve Performance

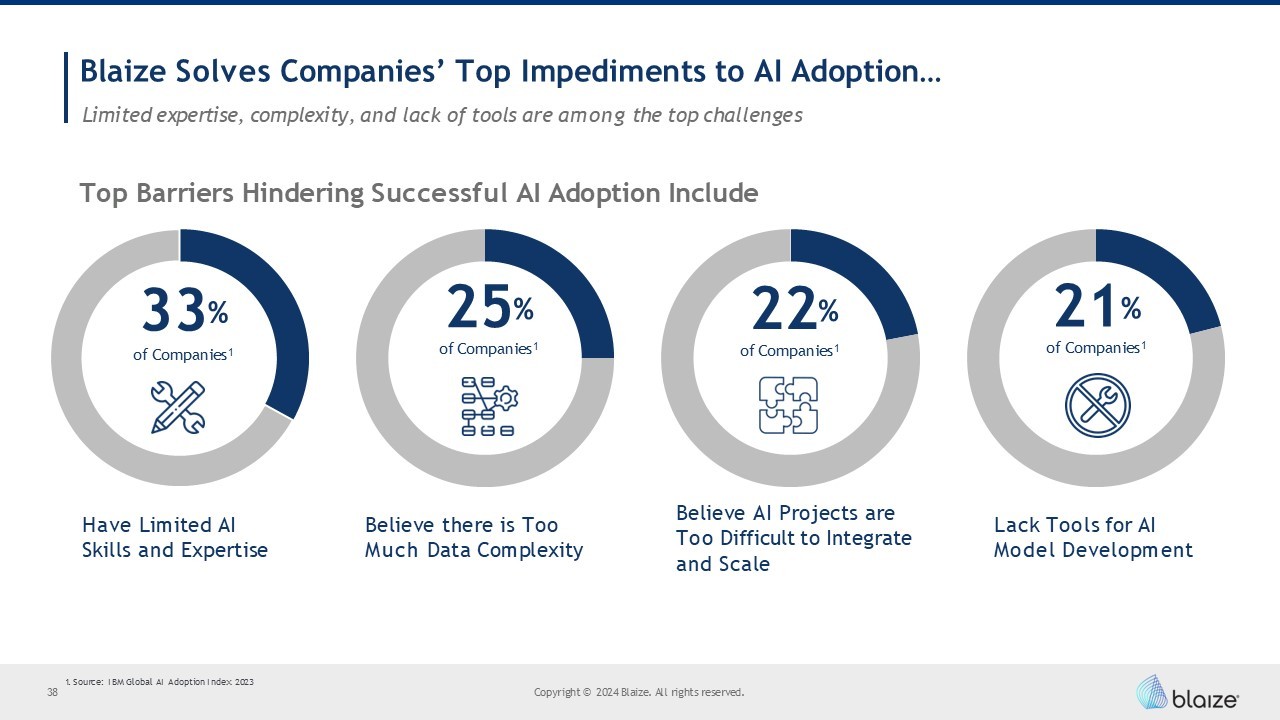

Blaize Solves Companies’ Top Impediments to AI Adoption… Limited expertise, complexity, and lack of tools are among the top challenges Top Barriers Hindering Successful AI Adoption Include Have Limited AI Skills and Expertise Believe there is Too Much Data Complexity Believe AI Projects are Too Difficult to Integrate and Scale Lack Tools for AI Model Development 38 Copyright © 2024 Blaize. All rights reserved. 33 % of Companies 1 25 % of Companies 1 22 % of Companies 1 21 % of Companies 1 1. Source: IBM Global AI Adoption Index 2023

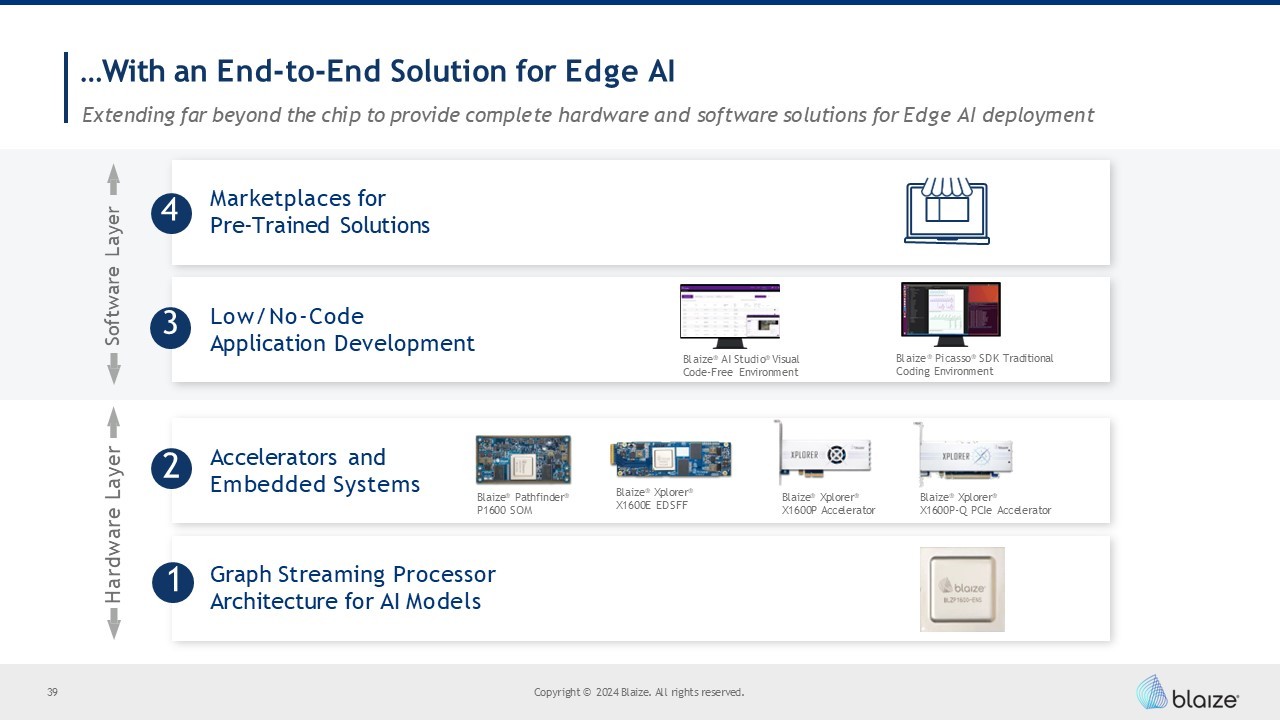

Accelerators and Embedded Systems …With an End - to - End Solution for Edge AI Extending far beyond the chip to provide complete hardware and software solutions for Edge AI deployment Marketplaces for Pre - Trained Solutions Low/No - Code Application Development Graph Streaming Processor Architecture for AI Models Blaize ® Pathfinder ® P1600 SOM Blaize ® Xplorer ® X1600E EDSFF Blaize ® Xplorer ® X1600P Accelerator Blaize ® AI Studio ® Visual Code - Free Environment Blaize ® Picasso ® SDK Traditional Coding Environment Blaize ® Xplorer ® X1600P - Q PCIe Accelerator 2 3 Software Layer 1 4 Hardware Layer 39 Copyright © 2024 Blaize. All rights reserved.

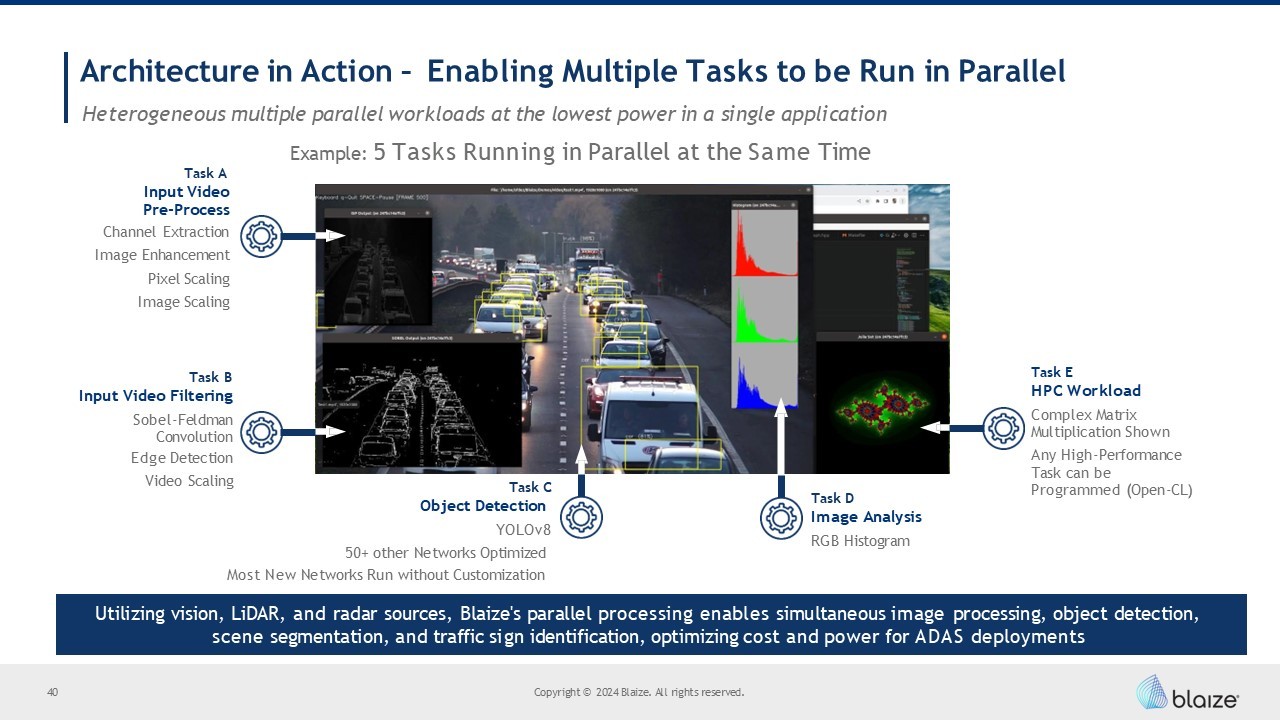

Architecture in Action – Enabling Multiple Tasks to be Run in Parallel Task B Input Video Filtering Sobel - Feldman Convolution Edge Detection Video Scaling Task C Object Detection YOLOv8 50+ other Networks Optimized Most New Networks Run without Customization Task D Image Analysis RGB Histogram Task E HPC Workload Complex Matrix Multiplication Shown Any High - Performance Task can be Programmed (Open - CL) Heterogeneous multiple parallel workloads at the lowest power in a single application Example: 5 Tasks Running in Parallel at the Same Time Task A Input Video Pre - Process Channel Extraction Image Enhancement Pixel Scaling Image Scaling 40 Copyright © 2024 Blaize. All rights reserved. Utilizing vision, LiDAR, and radar sources, Blaize's parallel processing enables simultaneous image processing, object detection, scene segmentation, and traffic sign identification, optimizing cost and power for ADAS deployments

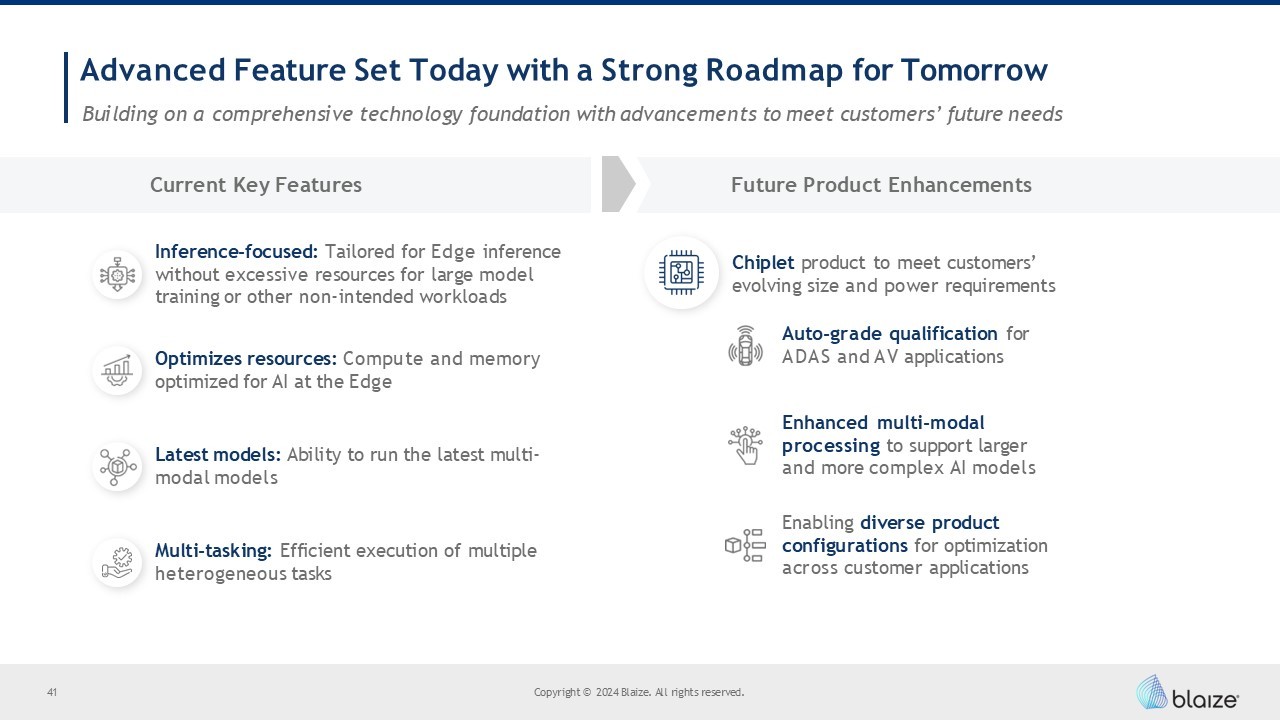

Advanced Feature Set Today with a Strong Roadmap for Tomorrow Building on a comprehensive technology foundation with advancements to meet customers’ future needs Latest models: Ability to run the latest multi - modal models Multi - tasking: Efficient execution of multiple heterogeneous tasks Optimizes resources: Compute and memory optimized for AI at the Edge Inference - focused: Tailored for Edge inference without excessive resources for large model training or other non - intended workloads Chiplet product to meet customers’ evolving size and power requirements Auto - grade qualification for ADAS and AV applications Enhanced multi - modal processing to support larger and more complex AI models Enabling diverse product configurations for optimization across customer applications Future Product Enhancements Current Key Features 41 Copyright © 2024 Blaize. All rights reserved.

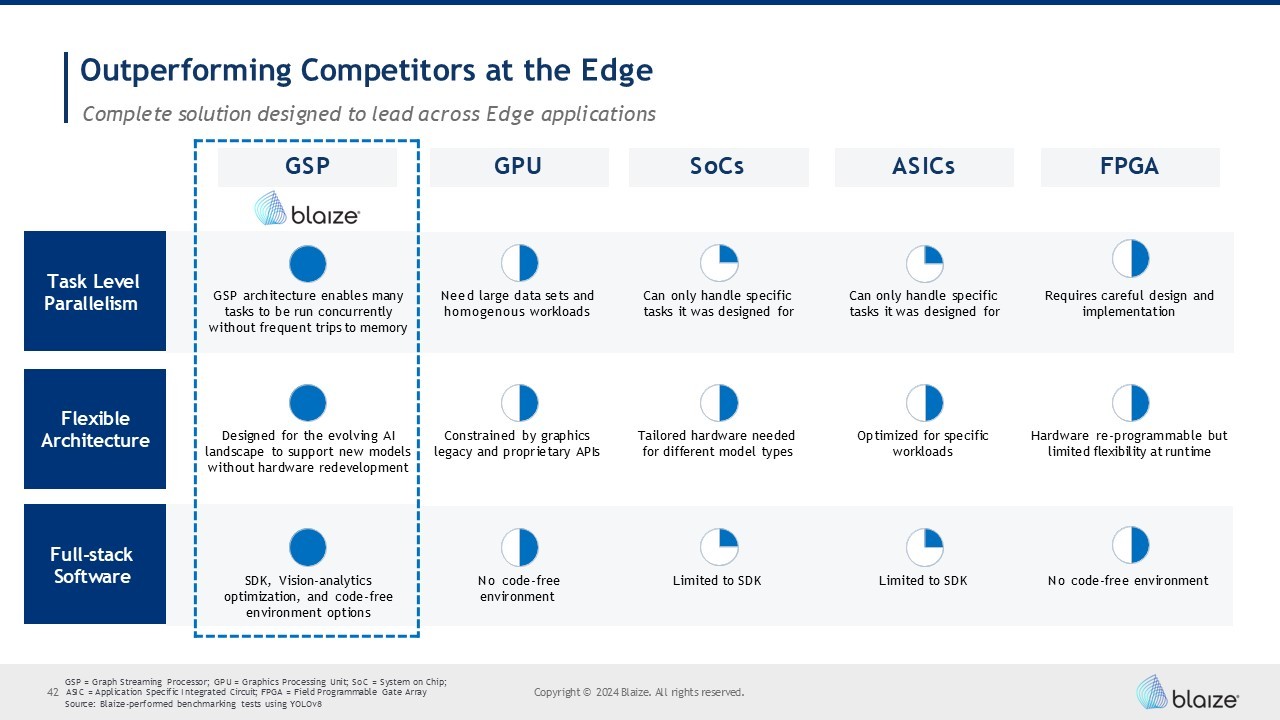

Copyright © 2024 Blaize. All rights reserved. GSP = Graph Streaming Processor; GPU = Graphics Processing Unit; SoC = System on Chip; 42 ASIC = Application Specific Integrated Circuit; FPGA = Field Programmable Gate Array Complete solution designed to lead across Edge applications GPU SoCs ASICs FPGA GSP Need large data sets and Can only handle specific Can only handle specific Requires careful design and homogenous workloads tasks it was designed for tasks it was designed for implementation GSP architecture enables many tasks to be run concurrently without frequent trips to memory Task Level Parallelism Constrained by graphics Tailored hardware needed Optimized for specific Hardware re - programmable but legacy and proprietary APIs for different model types workloads limited flexibility at runtime Designed for the evolving AI landscape to support new models without hardware redevelopment Flexible Architecture No code - free Limited to SDK Limited to SDK No code - free environment environment SDK, Vision - analytics optimization, and code - free environment options Full - stack Software Outperforming Competitors at the Edge Source: Blaize - performed benchmarking tests using YOLOv8

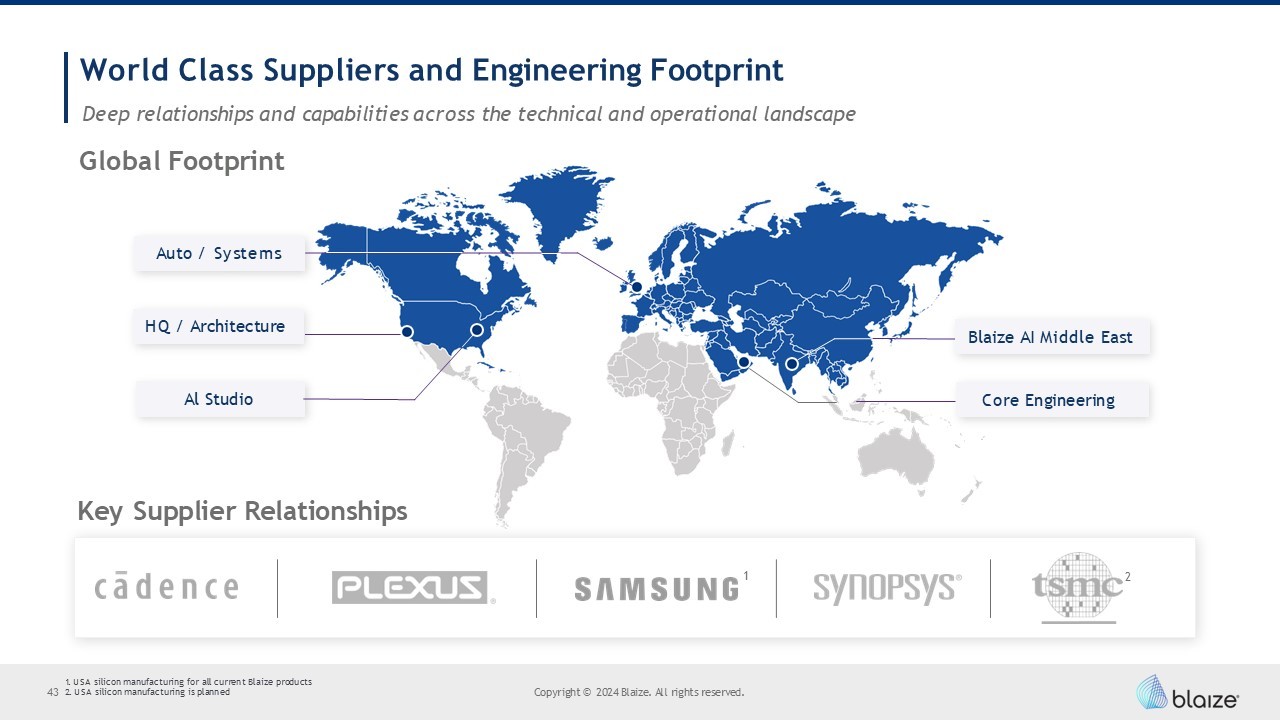

Auto / Systems HQ / Architecture Al Studio Core Engineering World Class Suppliers and Engineering Footprint Key Supplier Relationships Deep relationships and capabilities across the technical and operational landscape Global Footprint 43 2. USA silicon manufacturing is planned Copyright © 2024 Blaize. All rights reserved. Blaize AI Middle East 1 2 1. USA silicon manufacturing for all current Blaize products

Copyright © 2024 Blaize. All rights reserved. 44 www.blaize.com

BurTech Acquisition (NASDAQ:BRKHW)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

BurTech Acquisition (NASDAQ:BRKHW)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024