false

0001720893

0001720893

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 14, 2024

BioXcel

Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-38410 |

|

82-1386754 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

555

Long Wharf Drive

New

Haven, CT 06511

(Address of principal executive offices, including

Zip Code)

(475)

238-6837

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common

Stock, par value $0.001 |

|

BTAI |

|

The Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition. |

On November 14, 2024,

BioXcel Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for the three and

nine months ended September 30, 2024 and provided a business update. A copy of the Company’s press release is furnished

as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information disclosed

under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into any registration

statement or other document pursuant to the Securities Act of 1933, as amended, except as expressly set forth in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: November 14, 2024 |

BIOXCEL THERAPEUTICS, INC. |

| |

|

| |

/s/ Richard Steinhart |

| |

By: Richard Steinhart |

| |

Title: Chief Financial Officer |

Exhibit 99.1

BioXcel

Therapeutics Reports Third Quarter 2024 Financial Results

Advancing

two pivotal Phase 3 trials of BXCL501 for acute treatment of agitation associated with bipolar disorders,

schizophrenia, and Alzheimer’s dementia

Conference

call set for 8:00 a.m. ET today

NEW

HAVEN, Conn., Nov. 14, 2024 — BioXcel Therapeutics, Inc. (Nasdaq: BTAI), a biopharmaceutical company utilizing artificial

intelligence to develop transformative medicines in neuroscience, today announced its financial

results for the third quarter of 2024.

“Our

focus continues to be the clinical development of BXCL501,” said Vimal Mehta, Ph.D., CEO of BioXcel Therapeutics. “We

are advancing our SERENITY At-Home trial to pursue the near-term growth opportunity for treating acute agitation associated with bipolar

disorders or schizophrenia in the outpatient setting. At the same time, we are progressing with our TRANQUILITY In-Care trial planning

for Alzheimer’s-associated agitation. We are driven by the needs of patients, caregivers, and healthcare providers, as well as the

market-expansion potential of our lead neuroscience asset.”

BXCL501 Pivotal Phase 3 Trials

| · | First

patient randomized in SERENITY At-Home trial of BXCL501 for acute treatment of agitation

associated with bipolar disorders or schizophrenia |

| o | The Company announced trial initiation on September 5, 2024, with an expected trial duration of 9 to 12 months. |

| · | Received

FDA feedback on protocol for TRANQUILITY In-Care trial of BXCL501 for agitation associated

with Alzheimer’s dementia |

| o | The Company submitted its protocol to the FDA on September 5, 2024. |

BXCL501 Investigator-Sponsored Trials

| · | Announced

U.S. Department of Defense grant to University of North Carolina at Chapel Hill to

fund Phase 2a efficacy and safety trial of BXCL501 for treatment of acute stress disorder |

| o | Enrollment expected to commence in H1 2025 |

| o | Marks second externally funded stress-related trial |

Patent Portfolio

The

Company continues to strengthen its intellectual property portfolio for IGALMI™ (dexmedetomidine) sublingual film.

| · | The Company currently has 12 listed patents for IGALMI in the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations

(Orange Book) with expiration dates between 2037 and 2043. |

| · | Recently received an issued patent (U.S. Patent No. 12,138,247) for IGALMI from U.S. Patent and Trademark Office. The patent has an

expiration date of January 12, 2043, and is expected to be eligible for listing in the Orange Book. |

Third Quarter 2024 Financial Results

Net

Revenue: Net revenue from IGALMI was $214 thousand for the third quarter of 2024, compared to $341

thousand for the same period in 2023. The decrease in sales was primarily due to the timing of re-orders from existing customers.

Net revenue of $1.9 million for the nine months ended September 30, 2024 increased 89% compared to $1.0 million for same period in 2023.

The increase in new customer acquisitions and increased sales activity reflects rising utilization.

Cost

of Goods Sold: Cost of goods sold for the three months ended September 30, 2024 and 2023, were $1.2 million and $512 thousand,

respectively. Cost of goods sold is related to the costs to produce, package, and deliver IGALMITM to customers, as well as

costs related to excess or obsolete inventory. The increase in Cost of goods sold for the three months ended September 30, 2024 is the

result of higher charges for reserves for excess or obsolete inventory compared to the same period in 2023. Charges for reserves for excess

or obsolete inventory were $1.2 million and $495 thousand in the three months ended September 30, 2024 and 2023, respectively.

Research

and Development (R&D) Expenses: R&D expenses were $5.1 million for the third quarter of 2024, compared to $19.6 million for

the same period in 2023. The decreased expenses were primarily due to decreased clinical trial expenses, professional fees, as well as

personnel and related costs resulting from the Company’s reprioritization in August 2023 and reduction in force in May 2024.

Selling,

General and Administrative (SG&A) Expenses: SG&A expenses were $7.7 million for the third quarter of 2024, compared

to $24.3 million for the same period in 2023. The decreased expenses were primarily due to decreased personnel and related costs resulting

from the Company’s reprioritization in August 2023 and reduction in force in May 2024, as well as decreased professional fees and

commercial expenses.

Net

Loss: BioXcel Therapeutics had a net loss of $13.7 million for the third quarter of 2024, compared to a net loss of $50.5 million

for the same period in 2023. The Company used $16.3 million in operating cash during the third quarter of 2024.

Cash

and cash equivalents totaled $40.4 million as of September 30, 2024.

Conference Call and Webcast

BioXcel

Therapeutics will host a conference call and webcast today, November 14, 2024, at 8:00 a.m. ET to discuss its third quarter 2024 financial

results. To access the call, please dial 877-407-5795 or 201-689-8722. A live webcast

will be available on the Investors section of the corporate website, bioxceltherapeutics.com and a replay will be available for

90 days.

BioXcel

Therapeutics may use its website as a distribution channel of material information about the Company. Financial and other important information

regarding the Company is routinely posted on and accessible through the Investors sections of its website at bioxceltherapeutics.com.

In addition, you may sign up to automatically receive email alerts and other information about the Company by visiting the “Email

Alerts” option under the News/Events section of the Investors & Media website section and submitting your email address.

About

IGALMI™ (dexmedetomidine) sublingual film

INDICATION

IGALMI™

(dexmedetomidine) sublingual film is a prescription medicine, administered under the supervision of a health care provider, that is placed

under the tongue or behind the lower lip and is used for the acute treatment of agitation associated with schizophrenia and bipolar disorder

I or II in adults. The safety and effectiveness of IGALMI has not been studied beyond 24 hours from the first dose. It is not known if

IGALMI is safe and effective in children.

IMPORTANT

SAFETY INFORMATION

IGALMI

can cause serious side effects, including:

| · | Decreased blood pressure, low blood pressure upon standing, and slower than normal heart rate, which may be more likely in patients

with low blood volume, diabetes, chronic high blood pressure, and older patients. IGALMI is taken under the supervision of a healthcare

provider who will monitor vital signs (like blood pressure and heart rate) and alertness after IGALMI is administered to help prevent

falling or fainting. Patients should be adequately hydrated and sit or lie down after taking IGALMI and instructed to tell their healthcare

provider if they feel dizzy, lightheaded, or faint. |

| · | Heart rhythm changes (QT interval prolongation). IGALMI should not be given to patients with an abnormal heart rhythm, a history

of an irregular heartbeat, slow heart rate, low potassium, low magnesium, or taking other drugs that could affect heart rhythm. Taking

IGALMI with a history of abnormal heart rhythm can increase the risk of torsades de pointes and sudden death. Patients should be instructed

to tell their healthcare provider immediately if they feel faint or have heart palpitations. |

| · | Sleepiness/drowsiness. Patients should not perform activities requiring mental alertness, such as driving or operating hazardous

machinery, for at least 8 hours after taking IGALMI. |

| · | Withdrawal reactions, tolerance, and decreased response/efficacy. IGALMI was not studied for longer than 24 hours after the

first dose. Physical dependence, withdrawal symptoms (e.g., nausea, vomiting, agitation), and decreased response to IGALMI may occur if

IGALMI is used longer than 24 hours. |

The

most common side effects of IGALMI in clinical studies were sleepiness or drowsiness, a prickling or tingling sensation or

numbness of the mouth, dizziness, dry mouth, low blood pressure, and low blood pressure upon standing.

These

are not all the possible side effects of IGALMI. Patients should speak with their healthcare provider for medical advice about side effects.

Patients

should tell their healthcare provider about their medical history, including if they suffer from any known heart problems,

low potassium, low magnesium, low blood pressure, low heart rate, diabetes, high blood pressure, history of fainting, or liver impairment.

They should also tell their healthcare provider if they are pregnant or breastfeeding or take any medicines, including prescription and

over-the-counter medicines, vitamins, and herbal supplements. Patients should especially tell their healthcare provider if they take any

drugs that lower blood pressure, change heart rate, or take anesthetics, sedatives, hypnotics, and opioids.

Everyone

is encouraged to report negative side effects of prescription drugs to the FDA. Visit www.fda.gov/medwatch or

call 1-800-FDA-1088. You can also contact BioXcel Therapeutics, Inc. at 1-833-201- 1088 or medinfo@bioxceltherapeutics.com.

Please

see full Prescribing Information.

About BXCL501

Outside of its approved indication by the

U.S. Food and Drug Administration as IGALMI™ (dexmedetomidine) sublingual film, BXCL501 is an investigational proprietary, orally

dissolving film formulation of dexmedetomidine, a selective alpha-2 adrenergic receptor agonist. BXCL501 is under investigation by BioXcel

Therapeutics for the acute treatment of agitation associated with Alzheimer’s dementia and for the acute treatment of agitation

associated with bipolar I or II disorder or schizophrenia in the at-home setting. The safety and efficacy of BXCL501 for these investigational

uses have not been established. BXCL501 has been granted Breakthrough Therapy designation by the FDA for the acute treatment of agitation

associated with dementia and Fast Track designation for the acute treatment of agitation associated with schizophrenia, bipolar disorders,

and dementia.

About BioXcel Therapeutics, Inc.

BioXcel Therapeutics, Inc. (Nasdaq: BTAI) is a biopharmaceutical company utilizing artificial intelligence to develop transformative

medicines in neuroscience. Its wholly owned subsidiary, OnkosXcel Therapeutics, is focused on the development of medicines in immuno-oncology.

The Company’s drug re-innovation approach leverages existing approved drugs and/or clinically validated product candidates together

with big data and proprietary machine learning algorithms to identify new therapeutic indications. For more information, please visit bioxceltherapeutics.com.

Forward-Looking Statements

This

press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements

contained in this press release other than statements of historical fact should be considered forward-looking statements, including,

without limitation, statements related to: the Company’s planned advancement of its TRANQUILITY and SERENITY trials and the trial

designs thereof; potential market opportunity for BXCL501; the potential for the results from the Company’s completed, ongoing

and proposed clinical trials to support regulatory approvals for its product candidates; the Company’s current patent applications

and potential Orange Book listings. When used herein, words including “anticipate,” “believe,” “can,”

“continue,” “could,” “designed,” “estimate,” “expect,” “forecast,”

“goal,” “intend,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “target,” “will,” “would” and

similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or

expressions. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance

or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. All forward-looking

statements are based upon the Company’s current expectations and various assumptions. The Company believes there is a reasonable

basis for its expectations and beliefs, but they are inherently uncertain. The Company may not realize its expectations, and its beliefs

may not prove correct. Actual results could differ materially from those described or implied by such forward-looking statements as a

result of various important factors, including, without limitation: its limited operating history; its incurrence of significant losses;

its need for substantial additional funding and ability to raise capital when needed; the impact of the reprioritization; its significant

indebtedness, ability to comply with covenant obligations and potential payment obligations related to such indebtedness and other contractual

obligations; the Company has identified conditions and events that raise substantial doubt about its ability to continue as a going concern;

its limited experience in drug discovery and drug development; risks related to the TRANQUILITY program; its dependence on the success

and commercialization of IGALMI™, BXCL501, BXCL502, BXCL701 and BXCL702 and other product candidates; the number of episodes of

agitation and the size of the Company’s total addressable market may be overestimated, and approval that the Company may obtain

may be based on a narrower definition of the patient population; its lack of experience in marketing and selling drug products; the risk

that IGALMI or the Company’s product candidates may not be accepted by physicians or the medical community in general; the Company

still faces extensive and ongoing regulatory requirements and obligations for IGALMI; the failure of preliminary data from its clinical

studies to predict final study results; failure of its early clinical studies or preclinical studies to predict future clinical studies;

its ability to receive regulatory approval for its product candidates; its ability to enroll patients in its clinical trials; undesirable

side effects caused by the Company’s product candidates; its novel approach to the discovery and development of product candidates

based on EvolverAI; the significant influence of and dependence on BioXcel LLC; its exposure to patent infringement lawsuits; its reliance

on third parties; its ability to comply with the extensive regulations applicable to it; impacts from data breaches or cyber-attacks,

if any; risks associated with the increased scrutiny relating to environmental, social and governance (ESG) matters; risks associated

with federal, state or foreign health care “fraud and abuse” laws; and its ability to commercialize its product candidates,

as well as the important factors discussed under the caption “Risk Factors” in its Quarterly Report on Form 10-Q for the

quarterly period ended September 30, 2024, as such factors may be updated from time to time in its other filings with the SEC, which

are accessible on the SEC’s website at www.sec.gov and the Investors section of the Company’s website at www.bioxceltherapeutics.com.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements

made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release.

While the Company may elect to update such forward-looking statements at some point in the future, except as required by law, it disclaims

any obligation to do so, even if subsequent events cause our views to change. These forward-looking statements should not be relied upon

as representing the Company’s views as of any date subsequent to the date of this press release.

Contact Information

Corporate/Investors

BioXcel

Therapeutics

Erik Kopp

1.203.494.7062

Media

Russo Partners

David Schull

1.858.717.2310

Source: BioXcel Therapeutics, Inc.

IGALMI™

is a trademark of BioXcel Therapeutics, Inc.

BioXcel

Therapeutics, Inc.

Statements of Operations

(Unaudited, in thousands, except per share amounts)

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Product revenues | |

$ | 214 | | |

$ | 341 | | |

$ | 1,900 | | |

$ | 1,004 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 1,170 | | |

| 512 | | |

| 1,311 | | |

| 546 | |

| Research and development | |

| 5,101 | | |

| 19,619 | | |

| 24,534 | | |

| 74,392 | |

| Selling, general and administrative | |

| 7,683 | | |

| 24,344 | | |

| 30,398 | | |

| 73,810 | |

| Restructuring costs | |

| 1,553 | | |

| 4,163 | | |

| 2,409 | | |

| 4,163 | |

| Total operating expenses | |

| 15,507 | | |

| 48,638 | | |

| 58,652 | | |

| 152,911 | |

| Loss from operations | |

| (15,293 | ) | |

| (48,297 | ) | |

| (56,752 | ) | |

| (151,907 | ) |

| Other (income) expense | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| 3,790 | | |

| 3,252 | | |

| 11,097 | | |

| 9,879 | |

| Interest income | |

| (616 | ) | |

| (1,068 | ) | |

| (2,234 | ) | |

| (4,703 | ) |

| Other (income) expense, net | |

| (4,817 | ) | |

| 5 | | |

| (16,875 | ) | |

| (286 | ) |

| Net loss and comprehensive loss | |

$ | (13,650 | ) | |

$ | (50,486 | ) | |

$ | (48,740 | ) | |

$ | (156,797 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and diluted | |

$ | (0.32 | ) | |

$ | (1.72 | ) | |

$ | (1.29 | ) | |

$ | (5.40 | ) |

| Weighted average shares outstanding - basic and diluted | |

| 42,390 | | |

| 29,268 | | |

| 37,853 | | |

| 29,026 | |

Condensed Balance Sheets

(Unaudited, in thousands)

| | |

September 30, | | |

December 31, | |

|

|

|

|

|

|

|

|

| | |

2024 | | |

2023 | |

|

|

|

|

|

|

|

|

| Cash and cash equivalents | |

$ | 40,387 | | |

$ | 65,221 | |

|

|

|

|

|

|

|

|

| Total assets | |

$ | 48,892 | | |

$ | 73,702 | |

|

|

|

|

|

|

|

|

| Total liabilities | |

$ | 134,525 | | |

$ | 130,210 | |

|

|

|

|

|

|

|

|

| Total stockholders' equity (deficit) | |

$ | (85,633 | ) | |

$ | (56,508 | ) |

|

|

|

|

|

|

|

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

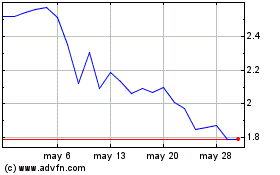

BioXcel Therapeutics (NASDAQ:BTAI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

BioXcel Therapeutics (NASDAQ:BTAI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024