As filed with the Securities and Exchange Commission on January 10, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BioXcel Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

82-1386754

(I.R.S. Employer

Identification Number)

|

|

555 Long Wharf Drive

New Haven, CT 06511

(475) 238-6837

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Vimal Mehta, Ph.D.

Chief Executive Officer

BioXcel Therapeutics, Inc.

780 East Main Street

Branford, CT 06405

(203) 643-8060

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

N. Danny Shulman

Emily Johns

Honigman LLP

1440 New York Avenue, NW Suite 200

Washington, DC 20005

(202) 844 3380

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐

|

|

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☒

|

|

|

Smaller reporting company ☒

|

|

| |

|

|

|

|

|

|

|

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 10, 2025

PROSPECTUS

BioXcel Therapeutics, Inc.

5,100,000 Shares of Common Stock

This prospectus relates to the resale by the selling stockholders named herein, or their pledgees, donees, transferees or other successors in interest, from time to time, of up to 5,100,000 shares of our common stock issuable upon exercise of warrants granted in connection with that certain (i) fourth amendment to credit agreement and guaranty dated as of March 20, 2024 and (ii) fifth amendment to credit agreement and guaranty and first amendment to fourth amendment to credit agreement and guaranty, dated as of November 21, 2024, to the credit agreement and guaranty dated as of April 19, 2022, as subsequently amended, by and among BioXcel Therapeutics, Inc., Oaktree Fund Administration, LLC as the administrative agent, and the lenders party thereto, as amended. The shares of common stock issuable upon exercise of the warrants are referred to herein as the Securities. We are registering the Securities on behalf of the selling stockholders, to be offered and sold from time to time, to satisfy certain registration rights that we have granted to the selling stockholders.

The selling stockholders may resell or dispose of the Securities, or interests therein, at fixed prices, at prevailing market prices at the time of sale or at prices negotiated with purchasers, to or through underwriters, broker-dealers, agents, or through any other means described in the section of this prospectus entitled “Plan of Distribution”. The selling stockholders will each bear their respective commissions and discounts, if any, attributable to the sale or disposition of the Securities, or interests therein, held by such selling stockholder. We will bear all costs, expenses and fees in connection with the registration of the Securities. We will not receive any of the proceeds from the sale of the Securities by the selling stockholders.

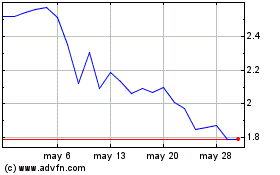

Our common stock is listed on the Nasdaq Capital Market under the symbol “BTAI.” On January 8, 2025, the last reported sale price of our common stock on the Nasdaq Capital Market was $0.386 per share.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” CONTAINED OR INCORPORATED BY REFERENCE IN THIS PROSPECTUS CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2025.

CONTENTS

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

9 |

|

|

| |

|

|

|

|

|

10 |

|

|

| |

|

|

|

|

|

11 |

|

|

| |

|

|

|

|

|

14 |

|

|

| |

|

|

|

|

|

17 |

|

|

| |

|

|

|

|

|

20 |

|

|

| |

|

|

|

|

|

20 |

|

|

| |

|

|

|

|

|

21 |

|

|

| |

|

|

|

|

|

21

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. By using a shelf registration statement, the selling stockholders may sell up to 5,100,000 shares of our common stock from time to time in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale by the selling stockholders of the Securities offered pursuant to this prospectus.

We may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective amendment, as applicable. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment, and any applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information.”

Neither we, nor the selling stockholders, have authorized anyone to provide you with any information or to make any representations other than those contained or incorporated by reference in this prospectus, any post-effective amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the selling stockholders take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. We and the selling stockholders will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, any post-effective amendment and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any post-effective amendment or any prospectus supplement may contain or incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information.

Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be incorporated by reference in this prospectus, any post-effective amendment or any prospectus supplement may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” incorporated by reference in this prospectus, any post-effective amendment and any applicable prospectus supplement. Accordingly, investors should not place undue reliance on this information.

When we refer to “BioXcel,” “we,” “our,” “us” and the “Company” in this prospectus, we mean BioXcel Therapeutics, Inc. and its consolidated subsidiaries, unless otherwise specified. When we refer to “you,” we mean the potential purchasers of the Securities.

We have proprietary rights to a number of trademarks used in this prospectus which are important to our business, including the BTI logo. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the® and™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words “anticipate,” “believe,” “can,” “continue,” “could,” “designed,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. All statements contained or incorporated by reference in this prospectus, other than statements of historical fact, are forward-looking statements, including, without limitation, statements regarding:

•

our sales strategy for IGALMI™;

•

strategy relating to, anticipated benefits from, and cost savings from our reprioritization of certain indications for BXCL501 and the deprioritization of certain other indications of BXCL501, including as a potential adjunctive treatment for major depressive disorder, as well as our BXCL701 immuno-oncology program;

•

developments relating to our SERENITY At-Home and TRANQUILITY In-Care trials;

•

our ability to extend our cash runway;

•

our plans relating to clinical trials for our product candidates;

•

our plans to research, develop and commercialize our current and future product candidates;

•

our plans to seek to enter into collaborations for the development and commercialization of certain product candidates;

•

the potential benefits of any future collaboration;

•

the timing of and our ability to obtain and maintain regulatory approvals, including 505(b)(2) regulatory approval, for our product candidates;

•

the rate and degree of market acceptance, clinical utility, number of prescribers and formulary wins of IGALMI and any product candidates for which we receive marketing approval;

•

our commercialization, marketing and manufacturing capabilities and strategy, including the potential benefits from any advertising campaigns;

•

our participation in, and any potential benefits from, events, conferences, presentations and conventions;

•

our intellectual property position and strategy;

•

our estimates regarding expenses, future revenue, capital requirements and need for additional financing;

•

potential investments in, or other strategic options for, our subsidiary, OnkosXcel Therapeutics, LLC;

•

developments relating to our competitors and our industry;

•

the impact of government laws and regulations; and

•

our relationship with BioXcel LLC.

The foregoing list sets forth some, but not all, of the factors that could affect our ability to achieve results described in any forward-looking statements. You should read this prospectus and the documents incorporated by reference herein completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Because the risk factors referred to in this prospectus and incorporated herein by reference could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you

should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this prospectus and the documents incorporated by reference herein, and particularly our forward-looking statements, by these cautionary statements.

SUMMARY

The following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you need to consider before making an investment decision. For a more complete understanding of our company, you should read and consider carefully the more detailed information included or incorporated by reference in this prospectus and any applicable prospectus supplement, including the factors described under the heading “Risk Factors” of this prospectus, as well as the information incorporated by reference from our most recent Annual Report on Form 10-K and our most recent Quarterly Reports on Form 10-Q, before making an investment decision.

Overview of the Company

BioXcel Therapeutics, Inc. is a biopharmaceutical company utilizing artificial intelligence (“AI”) approaches to develop transformative medicines in neuroscience and immuno-oncology. We are focused on utilizing cutting-edge technology and innovative research to develop high-value therapeutics aimed at transforming patients’ lives. We employ proprietary AI platforms to reduce therapeutic development costs and potentially accelerate development timelines. Our approach leverages existing approved drugs and/or clinically evaluated product candidates together with big data and proprietary machine learning algorithms to identify new therapeutic indications. We believe this differentiated approach has the potential to reduce the expense and time associated with drug development in diseases with substantial unmet medical needs.

Our most advanced neuroscience asset is BXCL501. In indications other than those approved by the United States (“U.S.”) Food and Drug Administration (“FDA”) as IGALMI™, BXCL501 is an investigational, proprietary, orally dissolving film formulation of dexmedetomidine (or “Dex”) in development for the treatment of agitation associated with psychiatric and neurological disorders. On April 6, 2022, we announced that the FDA approved IGALMI™ sublingual film for the acute treatment of agitation associated with schizophrenia or bipolar I or II disorder in adults. IGALMI is approved to be self-administrated by patients under the supervision of a health care provider. On July 6, 2022, we announced that IGALMI was commercially available in doses of 120 and 180 microgram through the Company’s third-party logistics provider and was available for order through wholesalers.

Recent Developments

Public Offering

On November 25, 2024, pursuant to an underwriting agreement (the “Underwriting Agreement”), dated as of November 22, 2024, between the Company and Canaccord Genuity LLC, as underwriter (the “Underwriter”), the Company issued (i) 5,600,000 shares of common stock, and accompanying warrants to purchase 5,600,000 shares of common stock, at a combined public offering price of $0.48 per share, and, in lieu thereof to certain investors, (ii) pre-funded warrants to purchase 9,000,000 shares of common stock, and accompanying warrants to purchase 9,000,000 shares of common stock, at a combined public offering price of $0.479 per pre-funded warrant, which equals the public offering price per share of common stock and accompanying warrant less the $0.001 exercise price per share of the pre-funded warrants, less underwriting discounts and commissions in a public offering (the “Public Offering”), pursuant to an effective shelf registration statement on Form S-3 (Registration No. 333-275261) and a related prospectus supplement filed with the Securities and Exchange Commission (the “SEC”). Each of the warrants issued in the Public Offering is subject to customary beneficial ownership limitations on exercisability, is exercisable at any time after the date of issuance of such warrant and, in the case of the accompanying warrants, will expire on the fifth anniversary of the date of issuance. Each of the accompanying warrants has an exercise price of $0.48 per underlying share of common stock.

Credit Agreement Amendment

On November 21, 2024, the Company entered into the Fifth Amendment to Credit Agreement and Guaranty and First Amendment to Fourth Amendment to Credit Agreement and Guaranty (the “Fifth Amendment”), which amended the Credit Agreement and Guaranty, dated April 19, 2022, by and among the Company, as the borrower, certain subsidiaries of the Company from time to time party thereto as subsidiary guarantors, the lenders party thereto (the “Lenders”), and Oaktree Fund Administration LLC

(“OFA”) as administrative agent (as amended by the Waiver and First Amendment to Credit Agreement and Guaranty, dated as of November 13, 2023, the Second Amendment to Credit Agreement and Guaranty and Termination of Revenue Interest Financing Agreement, dated as of December 5, 2023, the Third Amendment to Credit Agreement, dated as of February 12, 2024, and the Fourth Amendment to Credit Agreement and Guaranty, dated as of March 20, 2024 (the “Fourth Amendment”), and collectively, the “Existing Credit Agreement”).

Pursuant to the Fourth Amendment the Lenders waived the covenant that we do not receive a report and opinion from our independent registered public accounting firm that contains a “going concern” or similar qualification with respect to our financial statements for the year ended December 31, 2023. For additional information regarding the Fourth Amendment, see the summary and complete text of the Fourth Amendment included in the Company’s annual report on Form 10-K that was filed on March 22, 2024 and is incorporated herein by reference.

Pursuant to the Fifth Amendment, the Lenders and Company agreed to a number of modifications of the covenants and other terms in the Existing Credit Agreement. For additional information regarding the Fifth Amendment, see the summary and complete text of the Fifth Amendment included in the Company’s current report on Form 8-K that was filed on November 21, 2024 and is incorporated herein by reference.

Fourth Amendment Warrants

In connection with the Fourth Amendment, on March 20, 2024, the Company issued warrants to the Lenders to purchase up to 100,000 shares of common stock of the company, at an amended exercise price of $0.48 per share (the “Fourth Amendment Warrants”). The Fourth Amendment Warrants will expire on the fifth anniversary of their issuance, April 19, 2029, and may be net exercised at the holder’s election.

Fifth Amendment Warrants and Registration Rights Agreement

Substantially concurrently with the closing of the Public Offering, the Company issued new warrants to the Lenders to purchase up to 5.0 million shares of common stock of the Company, at an exercise price of $0.01 per share (the “Fifth Amendment Warrants”). The Fifth Amendment Warrants will expire on the seventh anniversary of their issuance, November 25, 2031, and may be net exercised at the holder’s election. Substantially concurrently with the closing of the Public Offering, the Company also entered into the Third Amended and Restated Registration Rights Agreement, dated as of November 25, 2024, by and among the Company and the Lenders. Pursuant to the Third Amended and Restated Registration Rights Agreement the Company agreed to register the shares of common stock issuable under the Fifth Amendment Warrants.

In addition, substantially concurrently with the closing of the Public Offering the Company amended and restated all warrants to purchase common stock of the Company issued to the Lenders prior to the effective date of the Fifth Amendment, to revise the exercise price thereunder to $0.48 per share (such existing warrants, as amended and restated, the “Original Warrants”). The Original Warrants provide the Lenders with the right to purchase a total of 448,150 shares of common stock of the Company.

Warrant Exercise Price Adjustment

On November 21, 2024, the exercise price of warrants to purchase 8,545,398 shares of common stock previously issued in March 2024 was reduced to $0.571 per share.

Director Appointment

On November 21, 2024, the Board of Directors of the Company (the “Board”) increased the size of the Board from six to seven directors.

On November 21, 2024, the Board appointed David Mack to the Board, effective November 21, 2024. Mr. Mack will serve as a Class I director for a term expiring at the Company’s annual meeting of stockholders to be held in 2025 and until his successor is duly elected and qualified or his earlier death, disqualification, resignation or removal. In connection with his appointment, Mr. Mack was also appointed to the Compensation Committee, effective with his commencement of service, as well as the newly formed Capital Raising Committee.

Mr. Mack is eligible to participate in the Company’s Non-Employee Director Compensation Program, which provides for annual compensation in the form of cash and equity-based awards. In addition, pursuant to the terms of the Offer Letter, Mr. Mack shall receive (i) a cash payment of $90,000, paid in monthly installments of $15,000 on the last date of each month for six months beginning November 30, 2024, with such cash amount to be accelerated in full if Mr. Mack resigns or is removed from the Board any time after four months from the effective date of his appointment and (ii) a grant of RSUs under the Company’s 2020 Incentive Award Plan to receive an aggregate of 325,077 shares of the Company’s common stock underlying the RSUs that vest in twelve equal installments on the last date of each month beginning on November 30, 2024. Following his service as a member of the Board for 12 months, he will receive compensation in accordance with the Company’s Non-Employee Director Compensation Program.

Amendments to Executive Employment Agreements

On January 7, 2025, the Company amended its executive employment agreements with three key executives: its Chief Executive Officer, Vimal Mehta, its Chief Financial Officer, Richard Steinhart, and its Chief Scientific Officer, Frank Yocca (the “Amendments”). The Amendments reduced their 2025 cash base compensation to $706,558, $289,800, and $290,500 respectively, while granting them stock options to purchase 660,000, 270,000, and 270,000 shares respectively of Company common stock at $0.4713 per share, vesting monthly over twelve months under the Company's 2020 Incentive Award Plan.

Intellectual Property Updates

The Company previously announced that it had received an issue notification from the USPTO for U.S. Patent Application No. 18/600,431, from which U.S. Patent No. 12,138,247 (the “‘431 Patent”) was issued on November 12, 2024. The ‘431 Patent claims a method of treating agitation using an oromucosal formulation of dexmedetomidine. The ‘431 Patent has an expiration date of January 12, 2043, subject to PTA, PTE and terminal disclaimers.

As of November 18, 2024, the ‘431 Patent has been accepted for listing in the FDA Approved Drug Products with Therapeutic Equivalence Evaluations (commonly known as the “Orange Book”).

Nasdaq Matters

On September 16, 2024, the Company received a letter from The Nasdaq Stock Market, LLC (“Nasdaq”) notifying us that for the last 30 consecutive business days, the bid price for the Company’s common stock, par value $0.001 per share, had closed below the $1.00 per share minimum bid price requirement for continued listing on The Nasdaq Capital Market under Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Notice”). The Bid Price Notice has no immediate effect on the listing of our common stock, which continues to trade on The Nasdaq Capital Market under the symbol “BTAI.”

In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we have a period of 180 calendar days, or until March 17, 2025 (the “Bid Price Compliance Date”), to regain compliance. To regain compliance with the Nasdaq minimum bid price requirement, the closing bid price of our common stock must be at least $1.00 per share for a minimum of 10 consecutive business days prior to the Bid Price Compliance Date. We intend to monitor the bid price of our common stock and consider available options if our common stock does not trade at a level likely to result in us regaining compliance with Nasdaq’s minimum bid price rule by the Bid Price Compliance Date.

In addition, on September 20, 2024, we received a letter from Nasdaq notifying us that for the last 30 consecutive business days prior to the date of the letter, our minimum market value of listed securities was below the minimum of $35 million required for continued listing on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(b)(2) (the “Market Value Notice”). The Market Value Notice has no immediate effect on the listing of our common stock, which continues to trade on The Nasdaq Capital Market under the symbol “BTAI.”

In accordance with Nasdaq Listing Rule 5810(c)(3)(C), we have a period of 180 calendar days, or until March 19, 2025 (the “Market Value Compliance Date”), to regain compliance. To regain compliance with the minimum market value of listed securities requirement, the market value of our common stock must meet or exceed $35.0 million for a minimum of 10 consecutive business days during the 180-day grace period ending on the Market Value Compliance Date. If we do not regain compliance with Nasdaq’s minimum

market value of listed securities requirement by the Market Value Compliance Date, we will receive written notification that its securities are subject to delisting, at which point we may appeal the delisting determination.

On December 30, 2024, we filed a proxy statement with the SEC related to a special meeting of our stockholders regarding an amendment to our Amended and Restated Certificate of Incorporation, as amended to effect a reverse split of our outstanding common stock.

Our Corporate Information

We filed a certificate of amendment to our amended and restated certificate of incorporation with the Secretary of State of Delaware on June 10, 2024 to increase the number of authorized shares of the Company’s common stock from 100,000,000 to 200,000,000. Our principal executive offices are located at 555 Long Wharf Drive, New Haven, Connecticut 06511, and our telephone number is (475) 238-6837. Our website address is www.bioxceltherapeutics.com. The information contained in, or accessible through, our website does not constitute a part of this prospectus.

THE OFFERING

5,100,000 shares of our common stock, issuable upon the exercise of (i) the Fifth Amendment Warrants granted in connection with the Fifth Amendment, and (ii) the Fourth Amendment Warrants granted in connection with the Fourth Amendment.

The selling stockholders will each determine when and how they will sell the Securities offered in this prospectus, as described in the “Plan of Distribution.”

Terms of the Fifth Amendment Warrants and the Fourth Amendment Warrants

Each Fifth Amendment Warrant entitles the holder to purchase one share of common stock, subject to any adjustments, at an exercise price of $0.01 per share. The Fifth Amendment Warrants will expire on November 25, 2031 and may be net exercised at the holder’s election.

Each Fourth Amendment Warrant entitles the holder to purchase one share of common stock, subject to any adjustments, at an exercise price of $0.48 per share (subject to adjustments provided in the terms of the Fourth Amendment Warrants). The Fourth Amendment Warrants will expire on April 19, 2029 and may be net exercised at the holder’s election.

We will not receive any proceeds from the sale of the Securities by the selling stockholders in this offering. See “Use of Proceeds.”

See the section under the heading “Risk Factors” in this prospectus and the other information included in, or incorporated by reference into, this prospectus or any prospectus supplement for a discussion of certain factors you should carefully consider before deciding to invest in shares of our common stock.

Nasdaq Capital Market symbol

“BTAI”

RISK FACTORS

Investment in the Securities offered pursuant to this prospectus and any applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference herein from our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q, and our recently filed Current Reports on Form 8-K, as well as any subsequent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such Securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered Securities.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the Securities covered by this prospectus and any accompanying prospectus supplement. All proceeds from the sale of the Securities will be for the respective accounts of the selling stockholders named herein. We will bear all other costs, fees and expenses incurred in effecting the registration of the Securities covered by this prospectus and any accompanying prospectus supplement, including, without limitation, all registration and filing fees, Nasdaq listing fees and fees and expenses of our counsel and our accountants, in accordance with the terms of the Third Amended and Restated Registration Rights Agreement entered into by and among the Company and the selling stockholders in connection with the Credit Agreement. Each selling stockholder will each pay any discounts, commissions, and fees of underwriters, selling brokers, dealer managers or similar securities industry professionals incurred by such selling stockholder in disposing of the Securities covered by this prospectus.

SELLING STOCKHOLDERS

We have prepared this prospectus to allow the selling stockholders or their pledgees, donees, transferees or other successors in interest, to sell or otherwise dispose of, from time to time, up to 5,100,000 shares of our common stock issuable upon (i) the exercise of the Fifth Amendment Warrants, and (ii) the exercise of the Fourth Amendment Warrants.

We are registering the above-referenced Securities to permit the selling stockholders and their donees, pledgees, transferees or other successors in interest that receive Securities after the date of this prospectus to resell or otherwise dispose of the Securities in the manner contemplated under “Plan of Distribution” below.

In connection with certain registration rights that we granted to the selling stockholders pursuant to the Third Amended and Restated Registration Rights Agreement, we filed with the SEC a Registration Statement on Form S-3, of which this prospectus forms a part, with respect to the resale or other disposition of the Securities offered by this prospectus from time to time on Nasdaq, in privately negotiated transactions or otherwise.

The following table sets forth the names of each of the selling stockholders and the aggregate number of Securities that the selling stockholders may offer and sell pursuant to this prospectus, as well as other information regarding the beneficial ownership (as determined under Section 13(d) of the Exchange Act and the rules and regulations thereunder) of the shares of common stock of the Company held by the selling stockholder.

The selling stockholders may sell some, all or none of the Securities. We do not know how long the selling stockholders will hold the Securities before selling them, and we currently have no agreements, arrangements or understandings with any selling stockholder regarding the sale or other disposition of any of the Securities. The Securities may be offered and sold from time to time by the selling stockholders pursuant to this prospectus. The information below assumes the offer and sale of all Securities beneficially owned by the selling stockholders and available for sale under this prospectus and assumes no further acquisitions or dispositions of Securities by the selling stockholders. The information set forth below is based upon information obtained from the selling stockholders and upon information in our possession regarding the original issuance of the Fourth Amendment Warrants and the Fifth Amendment Warrants. The percentages of shares owned after the offering are based on 49,628,948 shares of common stock outstanding as of December 17, 2024.

|

SELLING STOCKHOLDER

|

|

|

SHARES

BENEFICIALLY

OWNED PRIOR TO

THE OFFERING(5)

|

|

|

SHARES

BEING

OFFERED

HEREBY(6)

|

|

|

SHARES BENEFICIALLY

OWNED AFTER THE

OFFERING

|

|

| |

NUMBER OF

SHARES

|

|

|

PERCENTAGE

|

|

|

Oaktree-TCDRS Strategic Credit, LLC(1)(2)

|

|

|

|

|

56,172 |

|

|

|

|

|

52,581 |

|

|

|

|

|

3,591 |

|

|

|

|

|

* |

|

|

|

Oaktree-Forrest Multi-Strategy, LLC(1)(2)

|

|

|

|

|

45,330 |

|

|

|

|

|

42,432 |

|

|

|

|

|

2,898 |

|

|

|

|

|

* |

|

|

|

Oaktree-TBMR Strategic Credit Fund C, LLC(1)(2)

|

|

|

|

|

27,350 |

|

|

|

|

|

25,602 |

|

|

|

|

|

1,748 |

|

|

|

|

|

* |

|

|

|

Oaktree-TBMR Strategic Credit Fund F, LLC(1)(2)

|

|

|

|

|

42,824 |

|

|

|

|

|

40,086 |

|

|

|

|

|

2,738 |

|

|

|

|

|

* |

|

|

|

Oaktree-TBMR Strategic Credit Fund G, LLC(1)(2)

|

|

|

|

|

69,954 |

|

|

|

|

|

65,484 |

|

|

|

|

|

4,470 |

|

|

|

|

|

* |

|

|

|

Oaktree-TSE 16 Strategic Credit, LLC(1)(2)

|

|

|

|

|

70,280 |

|

|

|

|

|

65,790 |

|

|

|

|

|

4,490 |

|

|

|

|

|

* |

|

|

|

INPRS Strategic Credit Holdings, LLC(1)(2)

|

|

|

|

|

21,464 |

|

|

|

|

|

20,094 |

|

|

|

|

|

1,370 |

|

|

|

|

|

* |

|

|

|

Oaktree Specialty Lending Corporation(1)(3)

|

|

|

|

|

511,146 |

|

|

|

|

|

478,482 |

|

|

|

|

|

32,664 |

|

|

|

|

|

* |

|

|

|

Oaktree Strategic Credit Fund(1)(3)

|

|

|

|

|

243,587 |

|

|

|

|

|

228,021 |

|

|

|

|

|

15,566 |

|

|

|

|

|

* |

|

|

|

Oaktree GCP Fund Delaware Holdings, L.P.(1)(2)

|

|

|

|

|

31,163 |

|

|

|

|

|

29,172 |

|

|

|

|

|

1,991 |

|

|

|

|

|

* |

|

|

|

Oaktree Diversified Income Fund Inc.(1)(3)

|

|

|

|

|

68,211 |

|

|

|

|

|

63,852 |

|

|

|

|

|

4,359 |

|

|

|

|

|

* |

|

|

|

Oaktree AZ Strategic Lending Fund, L.P.(1)(2)

|

|

|

|

|

399,784 |

|

|

|

|

|

374,238 |

|

|

|

|

|

25,546 |

|

|

|

|

|

* |

|

|

|

Oaktree LSL Fund Holdings EURRC S.à.r.l(1)(2)

|

|

|

|

|

811,992 |

|

|

|

|

|

760,104 |

|

|

|

|

|

51,888 |

|

|

|

|

|

* |

|

|

|

Oaktree LSL Fund Delaware Holdings EURRC, L.P.(1)(2)

|

|

|

|

|

324,818 |

|

|

|

|

|

304,062 |

|

|

|

|

|

20,756 |

|

|

|

|

|

* |

|

|

|

Q Boost Holding LLC(4)

|

|

|

|

|

2,724,075 |

|

|

|

|

|

2,550,000 |

|

|

|

|

|

174,075 |

|

|

|

|

|

* |

|

|

*

Less than 1%.

(1)

The principal business address and address for notice of the selling stockholder is 333 S. Grand Avenue, 28th Fl., Los Angeles, California, 90071.

(2)

Oaktree Capital Management, L.P. acts as investment adviser to the selling stockholder.

(3)

Oaktree Fund Advisors, LLC acts as investment adviser to the selling stockholder.

(4)

Q Boost Holding LLC is an entity affiliated with Qatar Investment Authority. The principal business address and address for notice of the selling stockholder is c/o Qatar Investment Authority, Ooredoo Tower (Building 14), Al Dafna Street (Street 801), Al Dafna (Zone 61), Doha, Qatar.

(5)

Consists of shares of common stock issuable upon exercise of the Original Warrants, the Fourth Amendment Warrant and the Fifth Amendment Warrants.

(6)

Consists solely of shares of common stock issuable upon exercise of the Fourth Amendment Warrants and the Fifth Amendment Warrants.

Relationship with the Selling Stockholders

We and the selling stockholders are party to the Credit Agreement, the Third Amended and Restated Registration Rights Agreement, the Original Warrants, the Fourth Amendment Warrants and the Fifth Amendment Warrants. During the last three years, we and the selling stockholders were also party to the RIFA, which was terminated in December 2023.

Credit Agreement and RIFA

For additional information regarding the Credit Agreement and the RIFA, refer to Note 9 to our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023, filed with the SEC on November 14, 2023, our Current Report on Form 8-K, filed with the SEC on December 6, 2023 and our Current Report on Form 8-K, filed with the SEC on November 21, 2024, all which reports are incorporated by reference herein.

Third Amended and Restated Registration Rights Agreement

Pursuant to the Third Amended and Restated Registration Rights Agreement, dated November 25, 2024, we agreed to prepare and file with the SEC: (1) a registration statement on Form S-3 for the resale of the shares issuable upon the exercise of the Fourth Amendment Warrants and the Fifth Amendment Warrants granted to the selling stockholders and, subject to certain exceptions, use reasonable best efforts to keep the registration statement of which this prospectus forms a part effective under the Securities Act until the earlier of (i) the 30-month anniversary of the Closing Date (as defined therein), (ii) a Change of Control (as defined therein) and (iii) such time as there are no Registrable Securities (as defined therein) remaining or issuable upon exercise of the Fourth Amendment Warrants and the Fifth Amendment Warrants; and (2) a registration statement on Form S-3 for the resale of the shares issuable upon the exercise of the Fourth Amendment Warrants and the Fifth Amendment Warrants granted to the selling stockholders and, subject to certain exceptions, use reasonable best efforts to keep the registration statement of which this prospectus forms a part effective under the Securities Act until the earlier of (i) the 30-month anniversary of the Effective Date, (ii) a Change of Control and (iii) such time as there are no Registrable Securities remaining or issuable upon exercise of the Fourth Amendment Warrants and the Fifth Amendment Warrants.

We have also agreed, among other things, to indemnify the selling stockholders, their officers, directors, members, employees and agents, successors and assigns, and each other person, if any, who controls such selling stockholders from certain liabilities and to pay all reasonable fees and expenses (except legal fees of more than one counsel to the selling stockholders and excluding discounts, commissions and fees of underwriters, selling brokers, dealer managers or similar securities industry professionals) incurred by us in connection with the registration of the ordinary shares held by the selling stockholders.

Fourth Amendment Warrants

The Fourth Amendment Warrants are exercisable at any time until April 19, 2029 and entitle the selling stockholders to purchase an aggregate of 100,000 shares of our common stock at an exercise price per share of $0.48 per share, subject to certain adjustments.

Fifth Amendment Warrants

The Fifth Amendment Warrants are exercisable at any time until November 25, 2031 and entitle the selling stockholders to purchase an aggregate of 5,000,000 shares of our common stock at an exercise price per share of $0.01 per share, subject to certain adjustments.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is not complete and may not contain all the information you should consider before investing in our capital stock. This description is summarized from, and qualified in its entirety by reference to, our first amendment to our amended and restated certificate of incorporation, which has been publicly filed with the SEC. See “Where You Can Find More Information; Incorporation by Reference.”

Our authorized capital stock consists of:

•

200,000,000 shares of common stock, $0.001 par value; and

•

10,000,000 shares of preferred stock, $0.001 par value.

Common Stock

We are authorized to issue up to a total of 200,000,000 shares of common stock, par value $0.001 per share. Holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of our stockholders. Holders of our common stock have no cumulative voting rights. Further, holders of our common stock have no preemptive or conversion rights or other subscription rights.

Upon our liquidation, dissolution or winding-up, holders of our common stock are entitled to share in all assets remaining after payment of all liabilities and the liquidation preferences of any of our outstanding shares of preferred stock. Subject to preferences that may be applicable to any outstanding shares of preferred stock, holders of our common stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of our assets which are legally available. Such dividends, if any, are payable in cash, in property or in shares of capital stock.

The holders of one-third of the voting power of our issued and outstanding capital stock, represented in person or by proxy, are necessary to constitute a quorum for the transaction of business at any meeting. If a quorum is present, an action by stockholders entitled to vote on a matter is approved if the number of votes cast in favor of the action exceeds the number of votes cast in opposition to the action unless a different vote is required by law, the charter, the by-laws or, with respect to a class or series of preferred stock, the terms of any resolution or resolutions adopted by the board of directors. Pursuant to our charter, the election of directors requires a plurality of the votes cast by the stockholders present in person or represented by proxy at the meeting and entitled to vote thereon.

Transfer Agent

The Transfer Agent and Registrar for our common stock is Equiniti Trust Company, LLC (formerly American Stock Transfer and Trust Company).

Dividend

We have never paid or declared any cash dividends on our common stock, and we do not anticipate paying any cash dividends on our common stock in the foreseeable future. We intend to retain all available funds and any future earnings to fund the development and expansion of our business. Any future determination to pay dividends will be at the discretion of our board of directors and will depend upon a number of factors, including our results of operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors that our board of directors deems relevant.

Preferred Stock

Our board of directors has the authority, without further action by the stockholders, to issue up to 10,000,000 shares of preferred stock in one or more series and to fix the designations, powers, preferences, privileges, and relative participating, optional, or special rights as well as the qualifications, limitations, or restrictions of the preferred stock, including dividend rights, conversion rights, voting rights, terms of redemption, and liquidation preferences, any or all of which may be greater than the rights of the common stock. Our board of directors, without stockholder approval, can issue convertible preferred stock with voting,

conversion, or other rights that could adversely affect the voting power and other rights of the holders of common stock. Preferred stock could be issued quickly with terms calculated to delay or prevent a change of control or make removal of management more difficult. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of our common stock, and may adversely affect the voting and other rights of the holders of common stock.

Anti-Takeover Effects of Certain Provisions of our Charter and Bylaws and the DGCL

Delaware Law

We are governed by the provisions of Section 203 of the Delaware General Corporation Law. In general, Section 203 prohibits a publicly traded Delaware corporation from engaging in a business combination with an interested stockholder for a period of three years after the date of the transaction in which the person became an interested stockholder, unless the business combination is approved in a prescribed manner. A business combination includes mergers, asset sales or other transactions resulting in a financial benefit to the stockholder. An interested stockholder is a person who, together with affiliates and associates, owns (or within three years, did own) 15% or more of the corporation’s voting stock, subject to certain exceptions. The statute could have the effect of delaying, deferring or preventing a change in control of our Company.

Classified Board of Directors

Our charter provides that our Board is divided into three classes, with the classes as nearly equal in number as possible and each class serving three-year staggered terms. Directors may only be removed from our board of directors for cause and only by the affirmative vote of holders of a majority of the voting power of all then-outstanding shares of capital stock of the Company entitled to vote generally in the election of directors, voting together as a single class. These provisions may have the effect of deferring, delaying or discouraging hostile takeovers, or changes in control of us or our management.

Board of Directors Vacancies

Our charter and bylaws authorize only our board of directors to fill vacant directorships. In addition, the number of directors constituting our board of directors may be set only by resolution of the majority of the incumbent directors.

Stockholder Action; Special Meeting of Stockholders

Our charter and bylaws provide that our stockholders may not take action by written consent. Our charter and bylaws further provide that special meetings of our stockholders may be called by a majority of the board of directors, the Chief Executive Officer, or the Chairman of the board of directors.

Advance Notice Requirements for Stockholder Proposals and Director Nominations

Our bylaws provide that stockholders seeking to bring business before our annual meeting of stockholders, including to nominate candidates for election as directors at our annual meeting of stockholders, must provide timely notice of their intent in writing. To be timely, a stockholder’s notice must be delivered to the Secretary at our principal executive offices not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, or if no annual meeting was held in the preceding year, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which a public announcement of the date of such meeting is first made by us. These provisions may preclude our stockholders from bringing matters before our annual meeting of stockholders or from making nominations for directors at our annual meeting of stockholders.

Authorized but Unissued Shares

Our authorized but unissued shares of common stock and preferred stock are available for future issuance without stockholder approval and may be utilized for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued and unreserved common stock and preferred stock could render more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise.

PLAN OF DISTRIBUTION

The selling stockholders, including their pledgees, donees, transferees, distributees, beneficiaries or other successors in interest, may from time to time offer some or all of the Securities by this prospectus. We will not receive any of the proceeds from the sale of the Securities covered by this prospectus by the selling stockholders. The selling stockholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. We will bear all fees and expenses incident to our obligation to register the Securities covered by this prospectus.

The selling stockholders may each sell all or a portion of the Securities beneficially owned by it and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the Securities are sold through underwriters or broker-dealers, the selling stockholders will each be responsible for underwriting discounts or commissions or agent’s commissions in connection with the Securities held by such selling stockholders. The Securities may be sold on any national securities exchange or quotation service on which the Securities may be listed or quoted at the time of sale, in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over-the-counter market and in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at privately negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions.

The selling stockholders may use any one or more of the following methods when disposing of Securities or interests therein:

•

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•

block trades in which the broker-dealer will attempt to sell the Securities as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•

an over-the-counter distribution;

•

an exchange distribution in accordance with the rules of the applicable exchange;

•

privately negotiated transactions;

•

short sales effected after the effective date of the registration statement of which this prospectus is a part;

•

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•

in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents;

•

through trading plans entered into by the selling stockholders pursuant to Rule 10b5-1 under the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans;

•

through firm-commitment underwritten public offerings;

•

a combination of any such methods of sale; or

•

any other method permitted pursuant to applicable law.

The selling stockholders may each, from time to time, pledge or grant a security interest in some or all of the Securities owned and, if any selling stockholder defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the Securities, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of the selling stockholders to include the pledgee, transferee, or other successors in interest as the selling stockholders under this prospectus. The selling stockholders also may transfer the

Securities in other circumstances, in which case the transferees, pledgees or other successors in interest will be the beneficial owners for purposes of this prospectus.

In connection with the sale of Securities, or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions it assumes. The selling stockholders may also sell Securities short and deliver the Securities to close out any such short positions, or loan or pledge the Securities to broker-dealers that in turn may sell these Securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of Securities offered by this prospectus, which Securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Broker-dealers engaged by the selling stockholders may arrange for other broker-dealers to participate in sales. If the selling stockholders effect certain transactions by selling Securities to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from such selling stockholders or commissions from purchasers of the Securities for whom they may act as agent or to whom they may sell as principal. Such commissions will be in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction will not be in excess of a customary brokerage commission in compliance with applicable rules of the Financial Industry Regulatory Authority, or FINRA, and in the case of a principal transaction, a markup or markdown in compliance with applicable FINRA rules.

The aggregate proceeds to the selling stockholders from the sale of the Securities offered will be the purchase price of the Securities less discounts or commissions, if any. The selling stockholders reserve the right to accept and, together with their respective agents from time to time, to reject, in whole or in part, any proposed purchase of Securities to be made directly or through agents. The selling stockholders also may resell all or a portion of the Securities in open market transactions in reliance upon Rule 144 under the Securities Act, rather than under this prospectus, provided that each meets the criteria and conforms to the requirements of that rule.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the Securities, or interests therein, may be deemed to be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the Securities may be underwriting discounts and commissions under the Securities Act. If selling securities pursuant to this prospectus, the selling stockholders are subject to the prospectus delivery requirements of the Securities Act.

To the extent required pursuant to Rule 424(b) under the Securities Act, the Securities to be sold, the names of the selling stockholders, the purchase price and public offering price, the names of any agents, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of some states, if applicable, the Securities may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the Securities may not be sold unless they have been registered or qualified for sale, or an exemption from registration or qualification requirements is available and the selling stockholder complies with such exemption’s requirements.

The selling stockholders and any other person participating in a sale of the Securities registered under this prospectus will be subject to applicable provisions of the Exchange Act, and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the Securities by the selling stockholders and any other participating person.

All of the foregoing may affect the marketability of the Securities and the ability of any person or entity to engage in market-making activities with respect to the Securities. In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling

stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. We have agreed to indemnify the selling stockholders against certain liabilities, including certain liabilities under the Securities Act, the Exchange Act or other federal or state law. We and the selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the Securities against certain liabilities, including liabilities arising under the Securities Act.

LEGAL MATTERS

Honigman LLP will pass upon certain legal matters relating to the issuance and sale of the common stock offered hereby on behalf of BioXcel Therapeutics, Inc.

EXPERTS

The consolidated financial statements of BioXcel Therapeutics, Inc. appearing in BioXcel Therapeutics, Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2023, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon (which contains an explanatory paragraph describing conditions that raise substantial doubt about the Company’s ability to continue as a going concern as described in Note 2 to the consolidated financial statements), included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our web site address is https://www.bioxceltherapeutics.com/. The information contained in, or accessible through, our web site, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

INCORPORATION BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information.

Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

•

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 22, 2024.

•

•

Our Current Reports on Form 8-K, filed with the SEC on March 25, 2024, April 10, 2024, April 22, 2024, June 12, 2024, June 25, 2024, July 17, 2024, September 5, 2024, September 9, 2024, September 19, 2024, September 20, 2024, October 9, 2024, November 21, 2024, November 25, 2024, and January 8, 2024.

•

•

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, prior to the termination of this offering, including all such documents we may file with the SEC after the date of filing of this registration statement and prior to the effectiveness of this registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following address:

BioXcel Therapeutics, Inc.

555 Long Wharf Drive

New Haven, CT 06511

(475) 238-6837

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any accompanying prospectus supplement.

5,100,000 Shares of Common Stock

PROSPECTUS

, 2025

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following is an estimate of the expenses (all of which are to be paid by the registrant) that we may incur in connection with the securities being registered hereby.

| |

SEC registration fee

|

|

|

|

$ |

330 |

|

|

| |

Printing expenses

|

|

|

|

$ |

10,000 |

|

|

| |

Legal fees and expenses

|

|

|

|

$ |

30,000 |

|

|

| |

Accounting fees and expenses

|

|

|

|

$ |

30,000 |

|

|

| |

Miscellaneous

|

|

|

|

$ |

4,670 |

|

|

| |

Total

|

|

|

|

$ |

75,000 |

|

|

Item 15. Indemnification of Directors and Officers

Section 102 of the General Corporation Law of the State of Delaware, or the DGCL, permits a corporation to eliminate the personal liability of directors of a corporation to the corporation or its stockholders for monetary damages for a breach of fiduciary duty as a director, except where the director breached his duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit. Our charter provides that no director of the Company shall be personally liable to it or its stockholders for monetary damages for any breach of fiduciary duty as a director, notwithstanding any provision of law imposing such liability, except to the extent that the DGCL prohibits the elimination or limitation of liability of directors for breaches of fiduciary duty.

Section 145 of the DGCL provides that a corporation has the power to indemnify a director, officer, employee, or agent of the corporation, or a person serving at the request of the corporation for another corporation, partnership, joint venture, trust or other enterprise in related capacities against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with an action, suit or proceeding to which he was or is a party or is threatened to be made a party to any threatened, ending or completed action, suit or proceeding by reason of such position, if such person acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful, except that, in the case of actions brought by or in the right of the corporation, no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or other adjudicating court determines that, despite the adjudication of liability but in view of all of the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Section 145 further authorizes a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation or enterprise, against any liability asserted against such person and incurred by such person in any such capacity, or arising out of his or her status as such, whether or not the corporation would otherwise have the power to indemnify him or her under Section 145.

Any underwriting agreement or distribution agreement that the registrant enters into with any underwriters or agents involved in the offering or sale of any securities registered hereby may require such underwriters or dealers to indemnify the registrant, some or all of its directors and officers and its controlling persons, if any, for specified liabilities, which may include liabilities under the Securities Act of 1933, as amended.

Our charter and bylaws provide for indemnification and advancement of expenses to our directors and officers to the fullest extent permitted by the DGCL. We will indemnify each person who was or is a party or threatened to be made a party to any threatened, pending or completed action, suit or proceeding (other than an action by or in the right of the Company) by reason of the fact that he or she is or was, or has agreed to become, a director or officer, or is or was serving, or has agreed to serve, at our request as a director, officer, partner, employee or trustee of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other enterprise (all such persons being referred to as an “Indemnitee”), or by reason of any action alleged to have been taken or omitted in such capacity, against all expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding and any appeal therefrom, if such Indemnitee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, our best interests, and, with respect to any criminal action or proceeding, he or she had no reasonable cause to believe his or her conduct was unlawful. Our charter and bylaws provide that we will indemnify any Indemnitee who was or is a party to an action or suit by or in the right of the Company to procure a judgment in the Company’s favor by reason of the fact that the Indemnitee is or was, or has agreed to become, a director or officer, or is or was serving, or has agreed to serve, at our request as a director, officer, partner, employee or trustee of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other enterprise, or by reason of any action alleged to have been taken or omitted in such capacity, against all expenses (including attorneys’ fees) and, to the extent permitted by law, amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding, and any appeal therefrom, if the Indemnitee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the Company’s best interests, except that no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to the Company, unless a court determines that, despite such adjudication but in view of all of the circumstances, he or she is entitled to indemnification of such expenses. Notwithstanding the foregoing, to the extent that any Indemnitee has been successful, on the merits or otherwise, he or she will be indemnified by the Company against all expenses (including attorneys’ fees) actually and reasonably incurred in connection therewith. Expenses must be advanced to an Indemnitee under certain circumstances. The limitation of liability and indemnification provisions in our charter and bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against our directors and officers, even though such an action, if successful, might otherwise benefit us and our stockholders. However, these provisions do not limit or eliminate our rights, or those of any stockholder, to seek non-monetary relief such as injunction or rescission in the event of a breach of a director’s duty of care. These provisions will not alter the liability of directors under federal securities laws.

We have entered into separate indemnification agreements with each of our directors and executive officers. Each indemnification agreement provides, among other things, for indemnification to the fullest extent permitted by law and our charter and bylaws any and all expenses, judgments, fines, penalties and amounts paid in settlement of any claim. The indemnification agreements provide for the advancement or payment of all expenses to the indemnitee and for the reimbursement to us if it is found that such indemnitee is not entitled to such indemnification under applicable law and our charter and bylaws.

We maintain a general liability insurance policy that covers certain liabilities of our directors and officers arising out of claims based on acts or omissions in their capacities as our directors or officers.

Item 16. Exhibits

| |

Exhibit

Number

|

|

|

Description

|

|

| |

4.1

|

|

|

|

|

| |

4.2

|

|

|

|

|

| |