UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 15F

CERTIFICATION OF A FOREIGN PRIVATE ISSUER’S

TERMINATION OF REGISTRATION OF A CLASS OF SECURITIES UNDER SECTION 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ITS TERMINATION OF

THE DUTY TO FILE REPORTS UNDER SECTION 13(a) OR SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-39308

CALLIDITAS THERAPEUTICS

AB

(Exact name of registrant as specified in its

charter)

Kungsbron 1, D5

SE-111 22 Stockholm, Sweden

Tel: +46 (0) 8 411 3005

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

American Depositary Shares,

each representing two Common Shares, quota value

SEK 0.04 per share

Common Shares, quota value SEK 0.04 per share*

(Title of each class of securities covered by

this Form)

* Not for trading, but only in connection with the registration

of the American Depositary Shares. Securities registered or to be registered pursuant to Section 12(g) of the Act.

Place an X in the appropriate box(es) to indicate the provision(s)

relied upon to terminate the duty to file reports under the Securities Exchange Act of 1934:

| Rule 12h-6(a) x |

|

Rule 12h-6(d) ¨ |

| (for equity securities) |

|

(for successor registrants) |

| |

|

| Rule 12h-6(c) ¨ |

|

Rule 12h-6(i) ¨ |

| (for debt securities) |

|

(for prior Form 15 filers) |

PART I

Item 1. Exchange Act Reporting History

| A. |

Calliditas Therapeutics AB (the “Company”) first incurred the duty to file reports under Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on June 4, 2020, the date that the Company’s Registration Statement was declared effective by the Securities and Exchange Commission (the “Commission”). Prior to September 23, 2024, the Company’s American Depositary Shares (“ADSs”), each representing two common shares of the Company, quota value SEK 0.04 per share (the “Common Shares”), were listed on The Nasdaq Global Select Market (“Nasdaq”). On September 13, 2024, the Company voluntarily filed a Form 25 with the Commission informing the Commission that the Company had determined to voluntarily delist the ADSs from listing on Nasdaq. |

| B. |

The Company has filed or submitted all reports required under Section 13(a) or Section 15(d) of the Exchange Act and the corresponding Commission rules for the 12 months preceding the filing of this Form 15F. The Company has filed at least one annual report under Section 13(a) of the Exchange Act. |

Item 2. Recent United States Market Activity

The Company’s securities were last sold in the United States

in a registered offering under the Securities Act of 1933, as amended, that was completed on June 9, 2020. On September 13, 2024, the

Company filed amendments to its Registration Statement on Form F-3 (333-265881) and its two Registration Statements on Form S-8 (Nos.

333-240126 and 333-272594) to deregister any securities that remain unsold thereon, which amendments became effective upon filing.

Item 3. Foreign Listing and Primary Trading Market

| A. |

The Common Shares trade under the symbol “CALTX” on the Nasdaq Stockholm stock exchange, which constitutes the primary trading market for such securities. |

| |

|

| B. |

The Common Shares were initially listed for trading on the Nasdaq Stockholm stock exchange on June 29, 2018, which listing has been maintained in excess of 12 months preceding the filing of this form. |

| |

|

| C. |

Approximately 58.3% of trading in the Common Shares and ADSs, considered as a single class of securities, occurred on Nasdaq Stockholm, and 37.0% of trading occurred in transactions outside of Nasdaq Stockholm in jurisdictions other than the United States during the 12 months preceding the filing of this form. The total trading volume that occurred outside the United States during the 12 months preceding the filing of this form is therefore greater than 95%. |

Item 4. Comparative Trading Volume Data

The Company’s trading volume data used to rely on Rule 12h-6(a)(4)(i)

are as follows:

A. The recent 12-month period used to meet the requirements of Rule

12h-6(a)(4)(i) is September 5, 2023 to September 4, 2024.

B. During the 12-month period beginning September 5, 2023 and ending

September 4, 2024, the average daily trading volume of the ADSs in the United States was 24,038 shares and the average daily trading volume

of the Common Shares and ADSs, considered as a single class of securities, on a worldwide basis was 522,866 shares.

C. During the 12-month period beginning September 5, 2023 and ending

September 4, 2024, the average daily trading volume of the ADSs in the United States represented 4.6% of the average daily trading volume

of the Common Shares and ADSs, considered as a single class of securities, on a worldwide basis.

D. On September 13, 2024, the Company filed a Form 25 with the Commission

to delist its ADSs from the Nasdaq Global Select Market. At such time, for the preceding 12-month period, the average daily trading volume

of the ADSs in the United States represented 4.6% of the average daily trading volume of the Common Shares and ADSs, considered as a single

class of securities, on a worldwide basis.

E. On September 2, 2024, the Company notified Citibank, N.A. that it

intends to terminate its ADS facility. At such time, for the preceding 12-month period, the average daily trading volume of the ADSs in

the United States represented 4.6% of the average daily trading volume of the Common Shares and ADSs, considered as a single class of

securities, on a worldwide basis.

F. The Company used trading data from the Nasdaq Stockholm, The Nasdaq

Stock Market and FactSet to determine whether it meets the requirements of Rule 12h-6. The Company used the sources for trading volume

information that it viewed as likely to have reliable information.

Item 5. Alternative Record Holder Information

Not applicable.

Item 6. Debt Securities

Not applicable.

Item 7. Notice Requirement

| A. |

As required by Rule 12h-6(h), the Company published a notice disclosing its intent to terminate its duty to file reports under section 13(a) and section 15(d) of the Exchange Act by means of a press release on September 3, 2024. |

| B. |

The notice was disseminated in the United States via press release and was also published on the Company’s website and filed as Exhibit 99.1 to the Form 6-K filed by the Company on September 3, 2024. |

Item 8. Prior Form 15 Filers

Not applicable.

PART II

Item 9. Rule 12g3-2(b) Exemption

The Company has published the information required by Rule 12g3-2(b)(1)(iii)

on its Internet Web site at: https://www.calliditas.se/en/.

PART III

Item 10. Exhibits

The press release issued by the Company on September 3, 2024 is incorporated

herein by reference to Exhibit 99.1 of the Form 6-K filed by the Company on September 3, 2024.

Item 11. Undertakings

The undersigned issuer hereby undertakes to withdraw this Form 15F

if, at any time before the effectiveness of its termination of reporting under Rule 12h-6, it has actual knowledge of information that

causes it reasonably to believe that, at the time of filing the Form 15F:

| |

(1) |

The average daily trading volume of its subject class of securities in the United States exceeded 5 percent of the average daily trading volume of that class of securities on a worldwide basis for the same recent 12-month period that the issuer used for purposes of Rule 12h-6(a)(4)(i); |

| |

|

|

| |

(2) |

Its subject class of securities was held of record by 300 or more United States residents or 300 or more persons worldwide, if proceeding under Rule 12h-6(a)(4)(ii) or Rule 12h-6(c); or |

| |

(3) |

It otherwise did not qualify for termination of its Exchange Act reporting obligations under Rule 12h-6. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

Calliditas Therapeutics AB has duly authorized the undersigned person to sign on its behalf this certification on Form 15F. In so doing,

Calliditas Therapeutics AB certifies that, as represented on this Form, it has complied with all of the conditions set forth in Rule 12h-6

for terminating its registration under Section 12(g) of the Exchange Act, or its duty to file reports under Section 13(a) or Section 15(d)

of the Exchange Act, or both.

| |

CALLITIDAS THERAPEUTCS AB |

| |

|

|

| |

By: |

/s/ Renée Aguiar-Lucander |

| |

Name: |

Renée Aguiar-Lucander |

| |

Title: |

Chief Executive Officer |

EXHIBIT INDEX

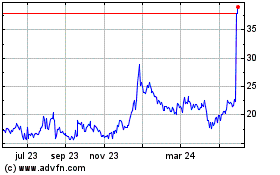

Calliditas Therapeutics AB (NASDAQ:CALT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

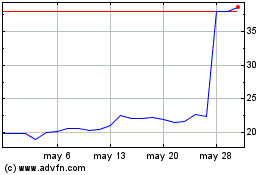

Calliditas Therapeutics AB (NASDAQ:CALT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025