UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO RULE

13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Collective Audience, Inc.

(Name of Issuer)

Common Stock, $0.0001 par value

(Title of Class of Securities)

193939 105

(CUSIP Number)

3411 Silverside Road, Tatnall Bldg. #104

Wilmington DE 19810

Tel: (424) 732-1021

With a copy to:

Laura Anthony, Esq.

Anthony L.G., PLLC

1700 Palm Beach Lakes Blvd., Suite 820

West Palm Beach, FL 33401

(561) 514-0936

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 9, 2022

(Date of Event which Requires Filing of this

Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| ** | This constitutes a late filing due to inadvertent administrative

error. See Item 5. |

| CUSIP No. 193939 105 |

|

Schedule 13D |

|

|

| 1. |

|

Names of Reporting Persons

Abri Ventures I, LLC |

| 2. |

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) ☐ (b)

☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

Source of Funds (See Instructions)

WC |

| 5. |

|

Check if Disclosure of Legal Proceedings Is Required Pursuant

to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7. |

|

Sole Voting Power

1,613,078 (1) |

| |

8. |

|

Shared Voting Power

0 |

| |

9. |

|

Sole Dispositive Power

1,613,078 (1) |

| |

10. |

|

Shared Dispositive Power

0 |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,613,078 (1) |

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (See Instructions)

☐ |

| 13. |

|

Percent of Class Represented by Amount in Row (11)

12.23% |

| 14. |

|

Type of Reporting Person (See Instructions)

OO |

| CUSIP No. 193939 105 |

|

Schedule 13D |

|

|

| 1. |

|

Names of Reporting Persons

Abri Advisors Inc. |

| 2. |

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) ☐ (b) ☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

Source of Funds (See Instructions)

WC |

| 5. |

|

Check if Disclosure of Legal Proceedings Is Required Pursuant

to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7. |

|

Sole Voting Power

1,613,078 (1) |

| |

8. |

|

Shared Voting Power

0 |

| |

9. |

|

Sole Dispositive Power

1,613,078 (1) |

| |

10. |

|

Shared Dispositive Power

0 |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,613,078 (1) |

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (See Instructions)

☐ |

| 13. |

|

Percent of Class Represented by Amount in Row (11)

12.23% |

| 14. |

|

Type of Reporting Person (See Instructions)

CO |

| CUSIP No. 193939 105 |

|

Schedule 13D |

|

|

| 1. |

|

Names of Reporting Persons

Jeffrey Tirman |

| 2. |

|

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) ☐ (b) ☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

Source of Funds (See Instructions)

AF |

| 5. |

|

Check if Disclosure of Legal Proceedings Is Required Pursuant

to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of Organization

United Kingdom |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7. |

|

Sole Voting Power

1,613,078 (1) |

| |

8. |

|

Shared Voting Power

0 |

| |

9. |

|

Sole Dispositive Power

1,613,078 (1) |

| |

10. |

|

Shared Dispositive Power

0 |

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

1,613,078 (1) |

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (See Instructions)

☐ |

| 13. |

|

Percent of Class Represented by Amount in Row (11)

12.23% |

| 14. |

|

Type of Reporting Person (See Instructions)

IN |

| ITEM 1. |

SECURITY AND ISSUER. |

This Amendment No. 1 to Schedule 13D (“Amendment No. 1”)

amends and supplements the Schedule 13D filed on August 27, 2021 (the “Schedule 13D”), and relates to the Reporting

Persons’ beneficial ownership of shares of the common stock, par value $0.0001 per share (the “Common Stock”),

of Collective Audience Inc. (formerly known as Abri SPAC I, Inc., a Delaware corporation) (the “Issuer”). Only

those items that are hereby reported are amended; all other items reported in the Schedule 13D remain unchanged. Information given in

response to each item shall be deemed incorporated by reference in all other items, as applicable. Capitalized terms not defined in this

Amendment No. 1 have the meanings ascribed to them in the Schedule 13D. This Amendment No. 1 is being filed to reflect the transfer of

shares of Common Stock of the Issuer by the Reporting Persons that occurred on April 11, 2023 and November 2, 2023 (the “Stock Transfers”),

as well as to amend the Schedule 13D to reflect redemptions of the Issuer’s Common Stock and the issuances of shares of Common Stock

by the Issuer to third parties in connection with the Business Combination as described in Item 5 below. This filing constitutes a late

filing with respect to the filings required from the Stock Transfers, the Redemptions and the Business Combination due to administrative

error.

The address of the Issuer’s principal executive office is 85

Broad Street 16-079, New York, NY 10004. Information given in response to each item shall be deemed incorporated by reference in all other

items, as applicable.

| ITEM 2. |

IDENTITY AND BACKGROUND. |

(a) This Amendment No. 1 is being filed by the following persons: (i)

Abri Ventures I, LLC, a Delaware limited liability company (“Abri Ventures”), (ii) Abri Advisors Inc., a Delaware corporation,

the manager of Abri Ventures (“Abri Advisors”), and (iii) Jeffrey Tirman, the chief executive officer of Abri Advisors.

Each of the foregoing persons are sometimes individually referred to herein as a “Reporting Person” and collectively

as the “Reporting Persons.”

(b) The address of the principal place of business for each of the

Reporting Persons is: 3411 Silverside Road, Tatnall Bldg. #104, Wilmington DE 19810.

(c) Abri Ventures’ principal business is to act as the Issuer’s

sponsor. Abri Advisors is a private holding company controlled by Jeffrey Tirman for the purpose of investing in various liquid and illiquid

investments. Mr. Tirman serves as the chief executive officer of Abri Advisors which serves as the manager of Abri Ventures. Mr. Tirman

previously served as the Chief Executive Officer and Chairman of the board of directors of the Issuer and resigned those positions on

November 2, 2023.

(d) During the last five years, none of the Reporting Persons has been

convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, none of the Reporting Persons has been

a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or

is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding any violation with respect to such laws.

(f) Citizenship:

| Entities: |

|

Abri Ventures – Delaware, U.S.A.

Abri Advisors Inc. — Delaware, U.S.A. |

| |

|

|

| Individuals: |

|

Jeffrey Tirman — Switzerland |

| ITEM 4. |

PURPOSE OF TRANSACTION. |

The Reporting Persons disposed of the Securities described in Item

5 for liquidity and market purposes. Depending upon overall market conditions, other investment opportunities available to the Reporting

Persons, and the availability of Securities at prices that would make the purchase or sale of Securities desirable, the Reporting Persons

may endeavor to increase or decrease their position in the Issuer through, among other things, the purchase or sale of Securities on the

open market or in private transactions or otherwise, on such terms and at such times as the Reporting Persons may deem advisable. Except

for the above, none of the Reporting Persons has any present plan or proposal which relates to, or could result in, any of the events

referred to in paragraphs (a) through (j), inclusive, of Item 4 of Schedule 13D. However, the Reporting Persons will continue to review

the business of the Issuer and, depending upon one or more of the factors referred to above, may in the future propose that the Issuer

take one or more such actions.

| ITEM 5. |

INTEREST IN SECURITIES OF THE ISSUER. |

TOTAL OUTSTANDING SHARES. According to information set forth in the

Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 14, 2023, the number of shares

of the Issuer’s Common Stock outstanding on November 14, 2023 was 13,190,264 shares.

ABRI VENTURES. As of the date of this Amendment No. 1, the Reporting

Persons may be deemed to beneficially own, for purposes of Rule 13D-3(d)(1)(i) of the Act, an aggregate 1,613,078 shares of Common Stock

(the “Securities”), which represents approximately12.23% of the Common Stock outstanding. The Securities include

1,613,078 shares held directly by Abri Ventures. Abri Advisors is the manager of Abri Ventures. Jeffrey Tirman is the chief executive

officer of Abri Advisors and therefore has voting and investment power over the shares of Common Stock held by Abri Ventures. The Reporting

Persons did not, and do not, have the right to acquire any additional shares of Common Stock within sixty days of the date of this Amendment

No. 1.

During the last sixty (60) days, the Reporting Persons effected the

following transactions in the Issuer’s Common Stock:

| DATE | | |

REPORTING PERSON | |

AMOUNT | | |

PRICE | | |

TYPE OF TRANSACTION |

| April 11, 2023 | | |

Reporting Persons | |

| 75,000 | | |

$ | 10.78 | (1) | |

Private transaction |

| November 2, 2023 | | |

Reporting Persons | |

| 40,000 | | |

| $26.96 | (1) | |

Private transaction |

| (1) | Price is inferred based on the Nasdaq Official Closing Price

of the Issuer’s Common Stock as reported by Nasdaq on the trading day prior to the date reported. |

Since the filing of the Schedule 13D on August 27, 2021, the Issuer

entered into a merger agreement among the Issuer, Abri Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of the Issuer

(“Merger Sub”), Logiq, Inc., a Delaware corporation (“Logiq or “DLQ Parent”) and, DLQ, Inc.,

a Nevada corporation and wholly owned subsidiary of DLQ Parent (“DLQ”) dated September 9, 2022 (the “Merger

Agreement”). Pursuant to the terms of the Merger Agreement, the Issuer completed the business combination pursuant to the Merger

Agreement on November 2, 2023 (the “Business Combination”) and issued 11,400,000 shares of its Common Stock to DLQ Parent

as merger consideration. In addition, on December 12, 2022 stockholders holding 4,481,548 of the Issuers public shares exercised their

right to redeem such shares, on August 27, 2023 stockholders holding 570,224 of the Issuers public shares exercised their right to redeem

such shares and on October 23, 2023 stockholders holding 619,963 of the Issuer’s public shares exercised their right to redeem such

shares (collectively, the “Redemptions”).

This Amendment No. 1 is being filed to, among other things, reflect

and report such change resulting from the Business Combination and the Redemptions.

Rule 13d-2(a) under the Act provides that if any material change occurs

in the facts set forth in a reporting person’s Schedule 13D, including any material increase or decrease in the percentage of the

class beneficially owned, such reporting person promptly shall file an amendment to such Schedule 13D. Rule 13d-2(a) further provides

that an acquisition or disposition of securities in an amount equal to one percent (1%) or more of the class of securities shall be deemed

“material” for purposes of the foregoing amendment requirement. Due to inadvertent administrative error, prior to this Amendment

No. 1, the Reporting Persons failed to file four amendments to Schedule 13D, each of which was required, pursuant to Rule 13d-2(a), to

report aggregate decreases in ownership of Securities by the Reporting Persons representing one percent (1%) or more of the Securities

then outstanding (each such one-percent aggregate decrease, a “One-Percent Decrease”). The One-Percent Decreases

occurred due to the Redemptions and the completion of the Business Combination (each a “Company Offering”),

which resulted in the ownership percentage of the Securities held by the Reporting Persons to be reduced. This Amendment No. 3 is being

filed to, among other things, reflect and report such changes to such ownership percentages to the Securities held by the Reporting Persons

as a result of the Company Offerings, including the sixty (60)-day pre-amendment trading history required by Item 5(c) of Schedule 13D.

| EVENT DATE | |

SHARES (REDEEMED)/ISSUED | | |

COMPANY

SHARES

OUTSTANDING | | |

REPORTING PERSONS | |

AMOUNT

BENEFICIALLY

OWNED | | |

PERCENT OF

CLASS | | |

CHANGE IN

PERCENT OF

CLASS FROM

PREVIOUS | |

| 12/9/2022 | |

| (4,481,548) (redeemed) | | |

| 2,980,450 | | |

Reporting Persons | |

| 1,728,078 | | |

| 57.98 | % | |

| 34.82 | % |

| 8/27/2023 | |

| (570,224) (redeemed) | | |

| 2,410,226 | | |

Reporting Persons | |

| 1,728,078 | | |

| 71.70 | % | |

| 13.72 | % |

| 4/11/2023 | |

| (75,000) (transferred) | | |

| 2,410,226 | | |

Reporting Persons | |

| 1,653,078 | | |

| 68.59 | % | |

| (3.11 | )% |

| 10/23/2023 | |

| (619,963) (redeemed) | | |

| 1,790,263 | | |

Reporting Persons | |

| 1,653,078 | | |

| 92.34 | % | |

| 23.75 | % |

| 11/2/2023 | |

| 11,400,000 (issued) | | |

| 13,190,263 | | |

Reporting Persons | |

| 1,613,078 | | |

| 12.23 | % | |

| (80.11 | )% |

The share totals and ownership percentages reported by the Reporting

Persons in this Amendment No. 1 are reflective of the Redemptions, shares of Common Stock issued in the Business Combination and disposition

of shares of Common Stock disclosed above in this Item 5.

| ITEM 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER. |

The responses to Items 3, 4 and 5 are incorporated by reference into

Item 6.

Joint Filing Agreement

Pursuant to Rule 13d-1(k) promulgated under the Exchange Act, the Reporting

Persons have entered into a Joint Filing Agreement, a copy of which is filed hereto as Exhibit 99.1, with respect to the joint filing

of this Schedule 13D and any amendment or amendments thereto.

Securities Subscription Agreement between the Issuer and Abri Ventures

In connection with the organization of the Issuer, 1,437,500 shares

of Common Stock were purchased by Abri Ventures for the amount of $25,000 pursuant to the Securities Subscription Agreement between the

Issuer and Abri Ventures, dated April 12, 2021 (the “Securities Subscription Agreement”). The description of the Securities

Subscription Agreement is qualified in its entirety by reference to the full text of such agreement, a copy of which is filed as an exhibit

hereto.

Insider Letters

On August 9, 2021, the Issuer entered into a letter agreement with

the Issuer’s directors, officers and senior advisors (collectively, the “Insiders”) and a Letter Agreement, dated

August 9, 2021, by and between the Company and the Company’s Abri Ventures, Abri Ventures I, LLC (collectively the “Letter

Agreements”). Pursuant to the Letter Agreements, the Insiders and Abri Ventures have each agreed that if the Issuer seeks shareholder

approval of a proposed business combination it will vote all shares held by it in favor of such proposed business combination.

Pursuant to the Letter Agreements, the Insiders and Abri Ventures

have each agreed not to transfer, assign or sell any of their Founder Shares until: (i) with respect to 50% of the Founder Shares, the

earlier of (x) twelve months after the date of the consummation of an initial business combination (or up to 18 months if the company

extends its time to consummate a public offering by 2 three-month extension periods) or (y) the date on which the closing price of the

Issuer’s Common Stock equals or exceeds $12.00 per share (as adjusted for stock splits, stock dividends, reorganizations and recapitalizations)

for any 20 trading days within any 30-trading day period commencing after an initial business combination and (ii) with respect to the

remaining 50% of the Founder Shares, twelve months after the date of the consummation of an initial business combination, except to certain

permitted transferees and under certain circumstances as described in the Final Prospectus. In addition, during the period commencing

from August 9, 2021, and ending 180 days after such date, Abri Ventures, and each Insider shall not, subject to the terms of the Letter

Agreements, (i) sell, offer to sell, contract or agree to sell, hypothecate, pledge, grant any option to purchase or otherwise dispose

of or agree to dispose of, directly or indirectly, or establish or increase a put equivalent position or liquidate or decrease a call

equivalent position within the meaning of Section 16 of the Securities Exchange Act of 1934 with respect to any Units, shares of Common

Stock (including, but not limited to, Founder Shares), Warrants or any securities convertible into, or exercisable, or exchangeable for,

shares of Common Stock owned by it, him or her, (ii) enter into any swap or other arrangement that transfers to another, in whole or

in part, any of the economic consequences of ownership of any Units, shares of Common Stock (including, but not limited to, the Founder

Shares), Warrants or any securities convertible into, or exercisable, or exchangeable for, shares of Common Stock owned by it, him or

her, whether any such transaction is to be settled by delivery of such securities, in cash or otherwise, or (iii) publicly announce any

intention to effect any transaction specified in clause (i) or (ii).

The Letter Agreements provide exceptions pursuant to which the Insiders

or Abri Ventures can transfer Founder Shares to certain permitted transferees as further described in the Letter Agreement. Under the

Letter Agreements, neither the Private Placement Units nor the securities underlying such units may be transferred (except to certain

permitted transferees) until 30 days after the consummation of the initial business combination.

Under the Letter Agreements, the Insiders and Abri Ventures also agreed

that they will not propose any amendment to the Issuer’s Amended and Restated Certificate of Incorporation that would affect the

substance or timing of the Issuer’s obligation to redeem the shares of Common Stock underlying the units sold in the Issuer’s

IPO if the Issuer does not complete a business combination within 18 months from the closing of its IPO unless the Issuer provides its

public shareholders with the opportunity to redeem their shares upon approval of any such amendment.

Under the Letter Agreements, the Insiders and Abri Ventures agreed

to waive, with respect to any shares of the Common Stock held by them, any redemption rights they may have in connection with the consummation

of a business transaction, including, without limitation, any such rights available in the context of a shareholder vote to approve such

business transaction or in the context of a tender offer made by the Issuer to purchase shares of the Common Stock.

Abri Ventures also agreed that in the event of the liquidation of the

Trust Account of the Issuer (as defined in the Letter Agreement), it will indemnify and hold harmless the Issuer against any and all loss,

liability, claims, damage and expense whatsoever which the Issuer may become subject as a result of any claim by any third party for services

rendered or products sold to the Issuer, or by any prospective target business with which the Issuer has entered into a letter of intent,

confidentiality or other similar agreement for a business combination, but only to the extent necessary to ensure that such loss, liability,

claim, damage or expense does not reduce the amount of funds in the Trust Account to below (i) $10.00 per public share or (ii) such lesser

amount per public share held in the Trust Account as of the date of the liquidation of the Trust Account, due to reductions in value of

the trust assets, in each case net of the amount of interest which may be withdrawn to pay taxes; provided that such indemnity shall not

apply if such third party or prospective target business executes an agreement waiving any claims against the Trust Account.

The description of the Letter Agreements are qualified in its entirety

by reference to the full text of such agreement, copies of which are filed as an exhibit hereto.

Private Placement Units Purchase Agreement

On August 9, 2021, simultaneously with the closing of the Issuer’s

IPO, Abri Ventures acquired 276,250 private placement units (the “Private Placement Units”) at a purchase price of $10.00

per Private Placement Unit, pursuant to a Private Placement Units Purchase Agreement (the “Private Placement Units Purchase Agreement”).

On August 23, 2021, simultaneously with the closing of the underwriter exercising its OA Option, Abri Ventures acquired an additional

18,348 Private Placement Units at a purchase price of $10.00 per Private Placement Unit, pursuant to a Private Placement Units Purchase

Agreement. Each Private Placement Unit consists of one share of Common Stock and one warrant (the “Warrants”), each

Warrant entitling the holder to purchase one share of Common Stock at $11.50 per share. The Warrants will become exercisable on the later

of the completion of the Issuer’s initial business combination or 12 months from the closing of the Issuer’s IPO. The Public

Warrants will expire five years after the completion of the Issuer’s initial business combination or earlier upon redemption or

liquidation.

The Private Placement Units and the underlying securities are subject

to a lock up provision, which provides that such securities shall not be transferable, saleable or assignable until 30 days after the

consummation of the Issuer’s initial business combination, subject to certain limited exceptions as described in the Letter Agreement.

The summary of such Private Placement Units Purchase Agreement contained

herein is qualified in its entirety by reference to the full text of such agreement, a copy of which is filed as an exhibit hereto.

Registration and Shareholder Rights Agreement

On August 9, 2021, in connection with the Issuer’s IPO, the Issuer

and the Insiders entered into a registration rights agreement (the “Registration Rights Agreement”), pursuant to which the

Holders (as defined therein) are entitled to request that the Issuer register certain of its securities held by them for sale under the

Securities Act and to have the securities covered thereby registered for resale pursuant to Rule 415 under the Securities Act. In addition,

the Holders have the right to include their securities in other registration statements filed by the Issuer.

The summary of the Registration Rights Agreement contained herein is

qualified in its entirety by reference to the full text of such agreement, a copy of which is filed as an exhibit hereto.

| ITEM 7. |

|

MATERIAL TO BE FILED AS EXHIBITS. |

| |

|

|

| Exhibit 99.1 |

|

Joint Filing Agreement, as required by Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, as amended (incorporated by reference to Exhibit 99.1 to the Schedule 13D filed by the Report Persons with the SEC on August 27, 2021). |

| |

|

|

| Exhibit 99.2 |

|

Securities Subscription Agreement, dated April 12, 2021, between the Issuer and Abri Ventures (incorporated by reference to Exhibit 10.9 to the Registration Statement on Form S-1 filed by the Issuer with the SEC on June 25, 2021). |

| |

|

|

| Exhibit 99.3.1 |

|

Letter Agreement, dated August 9, 2021, among the Issuer, its officers and directors, (incorporated by reference to Exhibit 10.1.1 to the Current Report on Form 8-K filed by the Issuer with the SEC on August 13, 2021). |

| |

|

|

| Exhibit 99.3.2 |

|

Letter Agreement, dated August 9, 2021, between the Issuer and Abri Ventures, Abri Ventures I, LLC, (incorporated by reference to Exhibit 10.1.2 to the Current Report on Form 8-K filed by the Issuer with the SEC on August 13, 2021). |

| |

|

|

| Exhibit 99.4 |

|

Private Placement Units Purchase Agreement, dated August 9, 2021, by and between the Issuer and Abri Ventures (incorporated by reference to Exhibit 10.6 to the Current Report on Form 8-K filed by the Issuer with the SEC on August 13, 2021). |

| |

|

|

| Exhibit 99.5 |

|

Registration Rights Agreement, dated August 9, 2021, between the Issuer and certain other security holders named therein (incorporated by reference to Exhibit 10.3 to the Current Report on Form 8-K filed by the Issuer with the SEC on August 13, 2021). |

SIGNATURES

After reasonable inquiry and to the best of its knowledge and belief,

the undersigned certifies that the information set forth in this Statement is true, complete and correct.

Dated: December 13, 2023

| |

ABRI VENTURES I, LLC |

| |

|

|

| |

By: |

Abri Advisors Inc., Manager of Abri Ventures I, LLC |

| |

|

|

| |

|

/s/ Jeffrey Tirman |

| |

|

Jeffrey Tirman, Chief Executive Officer |

| |

|

| |

ABRI ADVISORS INC. |

| |

|

| |

By: |

/s/ Jeffrey Tirman |

| |

|

Jeffrey Tirman, Chief Executive Officer |

| |

|

|

| |

|

JEFFREY TIRMAN |

| |

|

|

| |

By: |

/s/ Jeffrey Tirman |

| |

|

Jeffrey Tirman |

10

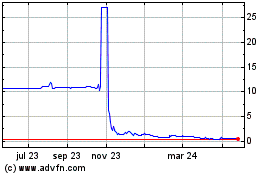

Collective Audience (NASDAQ:CAUD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

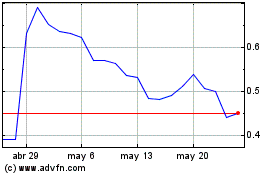

Collective Audience (NASDAQ:CAUD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024