0001605301FALSE00016053012024-07-242024-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2024

| | | | | | | | |

| CB FINANCIAL SERVICES, INC. | |

| (Exact name of registrant as specified in its charter) | |

Commission file number: 001-36706

| | | | | | | | |

| Pennsylvania | | 51-0534721 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

100 N. Market Street, Carmichaels, PA | | 15320 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | |

| (724) 966-5041 | |

| (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| Not Applicable | |

| (Former name, former address and former fiscal year, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Common stock, par value $0.4167 per share | | CBFV | | The Nasdaq Stock Market, LLC |

| (Title of each class) | | (Trading symbol) | | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standard provided pursuant to Section 13(a) of the

Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 24, 2024, CB Financial Services, Inc. (the "Company") issued a press release announcing its financial results for the three and six months ended June 30, 2024, a copy of which is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 8.01. Other Events.

On July 24, 2024, the Company announced that its Board of Directors declared a cash dividend on the Company's outstanding shares of common stock. The dividend of $0.25 per share will be paid on or about May 31, 2024 to stockholders of record as of the close of business on May 15, 2024.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

104. Cover Page Interactive Data File (embedded in Inline XBRL)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | CB FINANCIAL SERVICES, INC. |

| | | |

| | | |

Date: July 24, 2024 | By: | /s/ Jamie L. Prah |

| | | Jamie L. Prah |

| | | Executive Vice President and Chief Financial Officer |

CB Financial Services, Inc.

Announces Second Quarter and Year-to-Date 2024 Financial Results and

Declares Quarterly Cash Dividend

WASHINGTON, PA., July 24, 2024 -- CB Financial Services, Inc. (“CB” or the “Company”) (NASDAQGM: CBFV), the holding company of Community Bank (the “Bank”), today announced its second quarter and year-to-date 2024 financial results.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | Six Months Ended |

| 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | | | | 6/30/24 | 6/30/23 |

| (Dollars in thousands, except per share data) (Unaudited) | | | | | | | | | |

| | | | | | | | | | |

| Net Income (GAAP) | $ | 2,650 | | $ | 4,196 | | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | | | | $ | 6,847 | | $ | 6,915 | |

Net Income Adjustments | 24 | | (1,000) | | (9,905) | | 29 | | 78 | | | | | (976) | | (49) | |

Adjusted Net Income (Non-GAAP) (1) | $ | 2,674 | | $ | 3,196 | | $ | 3,061 | | $ | 2,701 | | $ | 2,835 | | | | | $ | 5,871 | | $ | 6,866 | |

| | | | | | | | | | |

| Earnings per Common Share - Diluted (GAAP) | $ | 0.51 | | $ | 0.82 | | $ | 2.52 | | $ | 0.52 | | $ | 0.54 | | | | | $ | 1.33 | | $ | 1.35 | |

Adjusted Earnings per Common Share - Diluted (Non-GAAP) (1) | $ | 0.52 | | $ | 0.62 | | $ | 0.60 | | $ | 0.53 | | $ | 0.55 | | | | | $ | 1.14 | | $ | 1.34 | |

(1) Refer to Explanation of Use of Non-GAAP Financial Measures and reconciliation of adjusted net income and adjusted earnings per common share - diluted as presented later in this Press Release.

2024 Second Quarter Financial Highlights

(Comparisons to three months ended June 30, 2023 unless otherwise noted)

•Net income was $2.7 million, compared to $2.8 million. Results were impacted by the December 2023 sale of the Bank’s subsidiary insurance agency, Exchange Underwriters (“EU”), which drove decreases in noninterest income and noninterest expense.

◦Adjusted net income (Non-GAAP) was $2.7 million compared to $2.8 million.

◦Income before income tax expense was $3.2 million compared to $3.5 million.

◦Adjusted pre-provision net revenue (PPNR) (Non-GAAP) was $3.2 million compared to $4.0 million.

•Earnings per diluted common share (EPS) decreased to $0.51 from $0.54.

◦Adjusted earning per common share - diluted (Non-GAAP) was $0.52, compared to $0.55.

•Return on average assets (annualized) was 0.71%, compared to 0.79%.

◦Adjusted return on average assets (annualized) (Non-GAAP) was 0.72%, compared to 0.81%.

•Return on average equity (annualized) was 7.58%, compared to 9.38%.

◦Adjusted return on average equity (annualized) (Non-GAAP) was 7.65%, compared to 9.64%.

•Net interest margin (“NIM”) declined to 3.18% from 3.29%.

•Net interest and dividend income was $11.5 million, compared to $11.1 million.

•Noninterest income decreased to $688,000, compared to $2.3 million. The significant change in noninterest income was driven by a $1.5 million decrease in insurance commissions due to the sale of EU.

•Noninterest expense decreased to $9.0 million, compared to $9.5 million, due to decreases in compensation and benefits, intangible amortization and FDIC assessment expenses, partially offset by increases in data processing, occupancy and Pennsylvania shares tax expenses.

(Amounts at June 30, 2024; comparisons to December 31, 2023, unless otherwise noted)

•Total assets increased $103.8 million, or 7.1%, to $1.6 billion from $1.5 billion.

•Total loans decreased $31.7 million, or 2.9%, to $1.08 billion compared to $1.11 billion, and included decreases in consumer, commercial real estate and residential real estate loans of $21.3 million, $8.4 million and $5.1 million, respectively, partially offset by increases in commercial and industrial loans, other loans and construction loans of $1.1 million, $1.1 million and $922,000, respectively. The consumer loan portfolio is primarily comprised of indirect automobile loans and decreased as a result of the discontinuation of that product as of June 30, 2023. Excluding the $21.6 million decrease in indirect automobile loans, total loans decreased $10.1 million, or 0.9%. In total, $62.3 million of loans have paid off since December 31, 2023.

•Nonperforming loans to total loans was 0.17% at June 30, 2024, compared to 0.20% at December 31, 2023.

•Total deposits were $1.35 billion, an increase of $82.6 million, compared to $1.27 billion.

•Book value per share was $27.79, compared to $27.53 as of March 31, 2024 and $27.32 as of December 31, 2023.

•Tangible book value per share (Non-GAAP) was $25.83, compared to $25.52 as of March 31, 2024 and $25.23 as of December 31, 2023. The year-to-date change was due to an increase in stockholders’ equity primarily related to current period net income of $6.8 million, partially offset by a $1.6 million increase in accumulated other comprehensive loss and the payment of $2.6 million in dividends since December 31, 2023.

Management Commentary

President and CEO John H. Montgomery commented, “The first half of the year has reflected ongoing trends of net interest margin pressure due to heightened funding costs that have been driven by prevailing market rates, however, our previously announced balance sheet strategies and continued commercial loan production are contributing to stabilization and improvement in this area.

While the yield on our loan portfolio continues to improve, total loans decreased $17.6 million, or 1.6%, from March 31, 2024. Runoff in the formerly exited indirect lending portfolio of $10.2 million was partially offset by a $9.1 million increase in more profitable commercial and industrial loans. Commercial and residential real estate loans declined $11.7 million and $4.2 million, respectively, with the former largely related to the Bank’s decision to exit certain relationships along with expected asset sales and the later related to our repositioning of our residential mortgage program. Notably, asset quality remains robust, with nonperforming loans declining to $1.9 million (0.17% of total loans) from $2.2 million (0.20% of total loans) in the prior quarter.

Overall, deposit movements continued during the quarter, shifting from non-interest and lower-cost interest-bearing accounts to higher-cost time deposits. Total deposits remained relatively stable, with a slight increase, largely due to growth in our interest-bearing demand deposits and time deposits.

During the quarter, we continued progress on our strategic initiatives by implementing a new enterprise-wide loan origination system and a redesigned residential mortgage program. The loan origination system utilizes market leading technology which was carefully customized and enhanced to streamline and optimize our credit delivery process, increase transparency and communication with our clients - ensuring that we provide a best-in-class credit delivery process. Our residential mortgage program redesign was developed to provide expanded product offerings to our market, mitigate risk and generate additional sources of non-interest income through scalability.

Additionally, we completed the construction and celebrated the opening of a state-of-the-art branch office serving as a regional service center in Rostraver, PA and added a news section to our upgraded website, www.cb.bank, to provide more timely communications to our market.

Last, in our continual focus on the client experience, we created a new retail support team staffed with experienced personnel to assist our bankers as they provide a higher level of personalized service to our clients.

We firmly believe that all stakeholders benefit from the continued investment in our franchise, our commitment to our long-term plan and our focus on delivering an exceptional client experience.”

Dividend Declaration

The Company’s Board of Directors declared a $0.25 quarterly cash dividend per outstanding share of common stock, payable on or about August 30, 2024, to stockholders of record as of the close of business on August 15, 2024.

2024 Second Quarter Financial Review

Net Interest and Dividend Income

Net interest and dividend income increased $350,000, or 3.1%, to $11.5 million for the three months ended June 30, 2024 compared to $11.1 million for the three months ended June 30, 2023.

•NIM (GAAP) decreased to 3.18% for the three months ended June 30, 2024 compared to 3.29% for the three months ended June 30, 2023. Fully tax equivalent (FTE) NIM (Non-GAAP) decreased 11 basis points (“bps”) to 3.19% for the three months ended June 30, 2024 compared to 3.30% for the three months ended June 30, 2023.

•Interest and dividend income increased $3.7 million, or 24.6%, to $18.9 million for the three months ended June 30, 2024 compared to $15.2 million for the three months ended June 30, 2023.

◦Interest income on loans increased $1.2 million, or 9.3%, to $14.7 million for the three months ended June 30, 2024 compared to $13.4 million for the three months ended June 30, 2023. The average yield on loans increased 50 bps to 5.50% compared to 5.00% resulting in a $1.3 million increase in interest income on loans. The average balance of loans decreased $2.9 million to $1.076 billion from $1.079 billion, causing a $77,000 decrease in interest income on loans. The increase in loan yield has been driven by a reduction in lower yielding consumer loans due to the discontinuation of the indirect automobile loan product with the redeployment of those funds into higher yielding commercial loan products.

◦Interest income on taxable investment securities increased $1.9 million, or 199.4%, to $2.8 million for the three months ended June 30, 2024 compared to $950,000 for the three months ended June 30, 2023 driven by a 246 bp increase in average yield coupled with a $56.7 million increase in average balances. The increase in the average yield was the result of the Bank implementing a balance sheet repositioning strategy of its portfolio of available-for-sale securities during the fourth quarter of 2023. The Bank sold $69.3 million in market value of its lower yielding U.S. government agency, mortgage-backed and municipal securities with an average yield of 1.89% and purchased $69.3 million of higher yielding mortgage-backed and collateralized mortgage obligation securities with an average yield of 5.49%. The increase in volume was driven by a $74.3 million increase in the average balance of collateralized loan obligation (“CLO”) securities as the Bank executed a leverage strategy to purchase these assets funded with brokered certificates of deposits.

◦Interest income on interest-earning deposits at other banks increased $592,000, to $1.3 million for the three months ended June 30, 2024 compared to $721,000 for the three months ended June 30, 2023 driven by a $47.7 million increase in average balances, partially offset by a 19 bp decrease in the average yield. The volume increase was due in part to $30.5 million in cash received from the December 2023 sale of EU.

•Interest expense increased $3.4 million, or 82.9%, to $7.5 million for the three months ended June 30, 2024 compared to $4.1 million for the three months ended June 30, 2023.

◦Interest expense on deposits increased $3.2 million, or 83.9%, to $7.1 million for the three months ended June 30, 2024 compared to $3.8 million for the three months ended June 30, 2023. Rising market interest rates led to the repricing of interest-bearing demand and money market deposits and a shift in deposits from noninterest-bearing and interest-bearing demand deposits into money market and time deposits which resulted in a 109 bp, or 65.8%, increase in the average cost of interest-bearing deposits compared to the three months ended June 30, 2023. This accounted for a $2.8 million increase in interest expense. Additionally, interest-bearing deposit balances increased $103.6 million, or 11.1%, to $1.0 billion as of June 30, 2024 compared to $930.1 million as of June 30, 2023, accounting for a $462,000 increase in interest expense.

◦Interest expense on borrowed funds increased $163,000, or 67.6%, to $404,000 for the three months ended June 30, 2024 compared to $241,000 for the three months ended June 30, 2023. The average balance of borrowed funds increased $13.2 million due to $20.0 million of FHLB long-term advances added during the second quarter of 2023. The increase in the average balance accounted for a $158,000 increase in interest expense.

Provision for Credit Losses

The provision for credit losses recorded for the three months ended June 30, 2024 was a net recovery of $36,000. The provision for credit losses - loans was $12,000 and was primarily due to an increase in the required reserve for individually analyzed loans, partially offset by the impact of a decrease in loan balances while the provision for credit losses - unfunded commitments was a recovery of $48,000 and was due to a decrease in loss rates. This compared to a $432,000 provision for credit losses recorded for the three months ended June 30, 2023 and was required primarily due to loan growth coupled with a modeled slowdown in loan prepayment speeds.

Noninterest Income

Noninterest income decreased $1.6 million, or 69.7%, to $688,000 for the three months ended June 30, 2024, compared to $2.3 million for the three months ended June 30, 2023. This decrease resulted primarily from a $1.5 million decrease in insurance commissions as no income was recognized for the three months ended June 30, 2024 due to the December 2023 sale of EU, compared to a full quarter of income recognized for the three months ended June 30, 2023.

Noninterest Expense

Noninterest expense decreased $517,000, or 5.4%, to $9.0 million for the three months ended June 30, 2024 compared to $9.5 million for the three months ended June 30, 2023. Salaries and benefits decreased $806,000, or 15.4%, to $4.4 million primarily due to no expense related to EU recognized for the three months ended June 30, 2024 due to the December 2023 sale, compared to $823,000 of expense recognized for the three months ended June 30, 2023, partially offset by merit increases and revenue producing staff additions. Intangible amortization decreased $182,000 as a portion of the Bank’s core deposit intangible was

fully amortized in February 2024 and EU intangible amortization of $47,000 was realized during the three months ended June 30, 2023. FDIC assessment expense decreased $63,000 due to a decrease in the assessment rate. Data processing expense increased $293,000 costs associated with the implementation of a new loan origination system and financial dashboard platform. Occupancy expenses increased $151,000 due to $192,000 of environmental remediation costs related to a construction project on one of the Bank’s office location, partially offset by $42,000 of EU occupancy expenses realized during the three months ended June 30, 2023. Pennsylvania shares tax expense increased $102,000 due to a higher taxable base due to the increase in equity resulting from the sale of EU.

Statement of Financial Condition Review

Assets

Total assets increased $103.8 million, or 7.1%, to $1.56 billion at June 30, 2024, compared to $1.46 billion at December 31, 2023.

•Cash and due from banks increased $74.4 million, or 109.0%, to $142.6 million at June 30, 2024, compared to $68.2 million at December 31, 2023.

•Securities increased $61.7 million, or 29.8%, to $268.8 million at June 30, 2024, compared to $207.1 million at December 31, 2023. The securities balance was primarily impacted by the purchase of $69.8 million of CLO securities, partially offset by $6.8 million of principal repayments on amortizing securities.

Loans and Credit Quality

•Total loans decreased $31.7 million, or 2.9%, to $1.08 billion at June 30, 2024 compared to $1.11 billion at December 31, 2023. This was driven by decreases in consumer, commercial real estate and residential real estate loans of $21.3 million, $8.4 million and $5.1 million, respectively, partially offset by increases in commercial and industrial loans, other loans and construction loans of $1.1 million, $1.1 million and $922,000, respectively. The decrease in consumer loans resulted from a reduction in indirect automobile loan production due to rising market interest rates and the discontinuation of this product offering as of June 30, 2023. This portfolio is expected to continue to decline as resources are allocated and production efforts are focused on more profitable commercial products. In total, $62.3 million of loans have paid off since December 31, 2023.

•The allowance for credit losses (ACL) was $9.5 million at June 30, 2024 and $9.7 million at December 31, 2023. As a result, the ACL to total loans was 0.88% at June 30, 2024 and 0.87% at December 31, 2023. During the current year, the Company recorded a net recovery of credit losses of $73,000.

•Net charge-offs for the three months ended June 30, 2024 were $67,000, or 0.02% of average loans on an annualized basis. Net charge-offs for the three months ended June 30, 2023 were $96,000, or 0.04% of average loans on an annualized basis. Net charge-offs for the six months ended June 30, 2024 were $50,000. Net recoveries for the six months ended June 30, 2023 were $660,000 primarily due to recoveries totaling $750,000 related to a prior year $2.7 million charged-off commercial and industrial loan.

•Nonperforming loans, which include nonaccrual loans and accruing loans past due 90 days or more, were $1.9 million at June 30, 2024 and $2.2 million at December 31, 2023. Nonperforming loans to total loans ratio was 0.17% at June 30, 2024 and 0.20% at December 31, 2023.

Total liabilities increased $100.7 million, or 7.7%, to $1.4 billion at June 30, 2024 compared to $1.3 billion at December 31, 2023.

Deposits

•Total deposits increased $82.6 million to $1.35 billion as of June 30, 2024 compared to $1.27 billion at December 31, 2023. Time deposits increased $115.4 million and money market deposits increased $28.9 million while interest-bearing demand, savings and non interest-bearing demand deposits decreased $38.3 million, $15.6 million and $7.8 million, respectively. Deposit changes were primarily the result of the current interest rate environment causing a shift in deposit products to higher priced money market and time deposits. Additionally, the Bank added $63.1 million of brokered certificates of deposit during the period. Brokered certificates of deposit totaled $92.1 million as of June 30, 2024 compared to $29.0 million at December 31, 2023, all mature within three months and were utilized to fund the purchase of floating rate CLO securities. At June 30, 2024, FDIC insured deposits totaled approximately 62.6% of total deposits while an additional 15.0% of deposits were collateralized with investment securities.

Accrued Interest Payable and Other Liabilities

•Accrued interest payable and other liabilities increased $18.1 million, or 125.5%, to $32.5 million at June 30, 2024, compared to $14.4 million at December 31, 2023 primarily due to the purchase of $14.7 million of syndicated loans and $7.6 million of securities which were unsettled at the end of the period.

Stockholders’ Equity

Stockholders’ equity increased $3.0 million, or 2.1%, to $142.9 million at June 30, 2024, compared to $139.8 million at December 31, 2023. The key factor positively impacting stockholders’ equity was $6.8 million of net income for the current period, partially offset by a $1.6 million increase in accumulated other comprehensive loss and the payment of $2.6 million in dividends since December 31, 2023.

Book value per share

Book value per common share was $27.79 at June 30, 2024 compared to $27.32 at December 31, 2023, an increase of $0.47.

Tangible book value per common share (Non-GAAP) was $25.83 at June 30, 2024, compared to $25.23 at December 31, 2023, an increase of $0.60.

Refer to “Explanation of Use of Non-GAAP Financial Measures” at the end of this Press Release.

About CB Financial Services, Inc.

CB Financial Services, Inc. is the bank holding company for Community Bank, a Pennsylvania-chartered commercial bank. Community Bank operates its branch network in southwestern Pennsylvania and West Virginia. Community Bank offers a broad array of retail and commercial lending and deposit services.

For more information about CB Financial Services, Inc. and Community Bank, visit our website at www.communitybank.tv.

Statement About Forward-Looking Statements

Statements contained in this press release that are not historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 and such forward-looking statements are subject to significant risks and uncertainties. The Company intends such forward-looking statements to be covered by the safe harbor provisions contained in the Act. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, general and local economic conditions, changes in market interest rates, deposit flows, demand for loans, real estate values and competition, competitive products and pricing, the ability of our customers to make scheduled loan payments, loan delinquency rates and trends, our ability to manage the risks involved in our business, our ability to control costs and expenses, inflation, market and monetary fluctuations, changes in federal and state legislation and regulation applicable to our business, actions by our competitors, and other factors that may be disclosed in the Company’s periodic reports as filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward-looking statements except as may be required by applicable law or regulation.

Company Contact:

John H. Montgomery

President and Chief Executive Officer

Phone: (724) 223-8317

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CB FINANCIAL SERVICES, INC. SELECTED CONSOLIDATED FINANCIAL INFORMATION |

| (Dollars in thousands, except share and per share data) (Unaudited) | | | | | | | | |

| | | | | | | | | |

| Selected Financial Condition Data | 6/30/24 | | 3/31/24 | | 12/31/23 | | 9/30/23 | | 6/30/23 |

| Assets | | | | | | | | | |

| Cash and Due From Banks | $ | 142,600 | | | $ | 73,691 | | | $ | 68,223 | | | $ | 52,597 | | | $ | 78,093 | |

| Securities | 268,769 | | | 232,276 | | | 207,095 | | | 172,904 | | | 181,427 | |

| Loans Held for Sale | 632 | | | 200 | | | — | | | — | | | — | |

| Loans | | | | | | | | | |

| Real Estate: | | | | | | | | | |

| Residential | 342,689 | | | 346,938 | | | 347,808 | | | 346,485 | | | 338,493 | |

| Commercial | 458,724 | | | 470,430 | | | 467,154 | | | 466,910 | | | 458,614 | |

| Construction | 44,038 | | | 44,323 | | | 43,116 | | | 41,874 | | | 44,523 | |

| Commercial and Industrial | 112,395 | | | 103,313 | | | 111,278 | | | 100,873 | | | 102,266 | |

| Consumer | 90,357 | | | 100,576 | | | 111,643 | | | 122,516 | | | 134,788 | |

| Other | 30,491 | | | 30,763 | | | 29,397 | | | 23,856 | | | 22,470 | |

| Total Loans | 1,078,694 | | | 1,096,343 | | | 1,110,396 | | | 1,102,514 | | | 1,101,154 | |

| Allowance for Credit Losses | (9,527) | | | (9,582) | | | (9,707) | | | (10,848) | | | (10,666) | |

| Loans, Net | 1,069,167 | | | 1,086,761 | | | 1,100,689 | | | 1,091,666 | | | 1,090,488 | |

| | | | | | | | | |

| Premises and Equipment, Net | 20,326 | | | 19,548 | | | 19,704 | | | 18,524 | | | 18,582 | |

| Bank-Owned Life Insurance | 23,910 | | | 23,763 | | | 25,378 | | | 25,227 | | | 25,082 | |

| Goodwill | 9,732 | | | 9,732 | | | 9,732 | | | 9,732 | | | 9,732 | |

| Intangible Assets, Net | 353 | | | 617 | | | 958 | | | 2,177 | | | 2,622 | |

| Accrued Interest Receivable and Other Assets | 24,360 | | | 26,501 | | | 24,312 | | | 26,665 | | | 26,707 | |

| Total Assets | $ | 1,559,849 | | | $ | 1,473,089 | | | $ | 1,456,091 | | | $ | 1,399,492 | | | $ | 1,432,733 | |

| | | | | | | | | |

| | | | | | | | | |

| Liabilities | | | | | | | | | |

| | | | | | | | | |

| Deposits | | | | | | | | | |

| Noninterest-Bearing Demand Accounts | $ | 269,964 | | | $ | 275,182 | | | $ | 277,747 | | | $ | 305,145 | | | $ | 316,098 | |

| Interest-Bearing Demand Accounts | 324,688 | | | 323,134 | | | 362,994 | | | 357,381 | | | 374,654 | |

| Money Market Accounts | 229,998 | | | 208,375 | | | 201,074 | | | 189,187 | | | 185,814 | |

| Savings Accounts | 179,081 | | | 190,206 | | | 194,703 | | | 207,148 | | | 217,267 | |

| Time Deposits | 346,037 | | | 265,597 | | | 230,641 | | | 177,428 | | | 169,482 | |

| Total Deposits | 1,349,768 | | | 1,262,494 | | | 1,267,159 | | | 1,236,289 | | | 1,263,315 | |

| | | | | | | | | |

| | | | | | | | | |

| Other Borrowings | 34,698 | | | 34,688 | | | 34,678 | | | 34,668 | | | 34,658 | |

| Accrued Interest Payable and Other Liabilities | 32,501 | | | 34,317 | | | 14,420 | | | 13,689 | | | 18,171 | |

| Total Liabilities | 1,416,967 | | | 1,331,499 | | | 1,316,257 | | | 1,284,646 | | | 1,316,144 | |

| | | | | | | | | |

| Stockholders’ Equity | 142,882 | | | 141,590 | | | 139,834 | | | 114,846 | | | 116,589 | |

| Total Liabilities and Stockholders’ Equity | $ | 1,559,849 | | | $ | 1,473,089 | | | $ | 1,456,091 | | | $ | 1,399,492 | | | $ | 1,432,733 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (Dollars in thousands, except share and per share data) (Unaudited) | | | | | | |

| | | | | | | |

| | Three Months Ended | Six Months Ended |

| Selected Operating Data | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 6/30/24 | 6/30/23 |

| Interest and Dividend Income: | | | | | | | |

| Loans, Including Fees | $ | 14,670 | | $ | 14,838 | | $ | 14,804 | | $ | 14,049 | | $ | 13,426 | | $ | 29,508 | | $ | 25,797 | |

| Securities: | | | | | | | |

| Taxable | 2,844 | | 2,303 | | 1,164 | | 940 | | 950 | | 5,148 | | 1,914 | |

| Tax-Exempt | — | | — | | 33 | | 41 | | 42 | | — | | 83 | |

| Dividends | 27 | | 27 | | 32 | | 25 | | 25 | | 54 | | 49 | |

| Other Interest and Dividend Income | 1,398 | | 818 | | 872 | | 819 | | 760 | | 2,216 | | 1,605 | |

| Total Interest and Dividend Income | 18,939 | | 17,986 | | 16,905 | | 15,874 | | 15,203 | | 36,926 | | 29,448 | |

| Interest Expense: | | | | | | | |

| Deposits | 7,065 | | 5,991 | | 5,336 | | 4,750 | | 3,842 | | 13,056 | | 6,346 | |

| Short-Term Borrowings | — | | — | | 26 | | — | | 3 | | — | | 5 | |

| Other Borrowings | 404 | | 404 | | 407 | | 407 | | 238 | | 808 | | 393 | |

| Total Interest Expense | 7,469 | | 6,395 | | 5,769 | | 5,157 | | 4,083 | | 13,864 | | 6,744 | |

| Net Interest and Dividend Income | 11,470 | | 11,591 | | 11,136 | | 10,717 | | 11,120 | | 23,062 | | 22,704 | |

| Provision (Recovery) for Credit Losses - Loans | 12 | | (143) | | (1,147) | | 291 | | 492 | | (130) | | 572 | |

| (Recovery) Provision for Credit Losses - Unfunded Commitments | (48) | | 106 | | (273) | | 115 | | (60) | | 57 | | (60) | |

| Net Interest and Dividend Income After Net (Recovery) Provision for Credit Losses | 11,506 | | 11,628 | | 12,556 | | 10,311 | | 10,688 | | 23,135 | | 22,192 | |

| Noninterest Income: | | | | | | | |

| Service Fees | 354 | | 415 | | 460 | | 466 | | 448 | | 769 | | 892 | |

| Insurance Commissions | 1 | | 2 | | 969 | | 1,436 | | 1,511 | | 3 | | 3,434 | |

| Other Commissions | 22 | | 62 | | 60 | | 94 | | 224 | | 84 | | 368 | |

Net Gain (Loss) on Sales of Loans | 9 | | 22 | | 2 | | — | | (5) | | 30 | | (3) | |

| Net Loss on Securities | (31) | | (166) | | (9,830) | | (37) | | (100) | | (197) | | (332) | |

| Net Gain on Purchased Tax Credits | 12 | | 12 | | 7 | | 7 | | 7 | | 25 | | 14 | |

| Gain on Sale of Subsidiary | — | | — | | 24,578 | | — | | — | | — | | — | |

| Net Gain on Disposal of Premises and Equipment | — | | 274 | | — | | — | | — | | 274 | | 11 | |

| Income from Bank-Owned Life Insurance | 147 | | 148 | | 151 | | 145 | | 139 | | 295 | | 280 | |

| Net Gain on Bank-Owned Life Insurance Claims | — | | 915 | | — | | — | | 1 | | 915 | | 303 | |

| Other Income | 174 | | 232 | | 121 | | 301 | | 44 | | 406 | | 113 | |

| Total Noninterest Income | 688 | | 1,916 | | 16,518 | | 2,412 | | 2,269 | | 2,604 | | 5,080 | |

| Noninterest Expense: | | | | | | | |

| Salaries and Employee Benefits | 4,425 | | 4,576 | | 6,224 | | 5,369 | | 5,231 | | 9,001 | | 10,310 | |

| Occupancy | 940 | | 749 | | 810 | | 698 | | 789 | | 1,689 | | 1,490 | |

| Equipment | 298 | | 264 | | 298 | | 265 | | 283 | | 562 | | 501 | |

| Data Processing | 1,011 | | 692 | | 726 | | 714 | | 718 | | 1,703 | | 1,575 | |

| Federal Deposit Insurance Corporation Assessment | 161 | | 129 | | 189 | | 189 | | 224 | | 290 | | 376 | |

| Pennsylvania Shares Tax | 297 | | 297 | | 217 | | 217 | | 195 | | 595 | | 455 | |

| Contracted Services | 390 | | 281 | | 299 | | 286 | | 434 | | 671 | | 581 | |

| Legal and Professional Fees | 208 | | 212 | | 434 | | 320 | | 246 | | 420 | | 428 | |

| Advertising | 78 | | 129 | | 158 | | 114 | | 75 | | 206 | | 154 | |

| Other Real Estate Owned (Income) | 37 | | (23) | | (36) | | (8) | | (35) | | 14 | | (72) | |

| Amortization of Intangible Assets | 264 | | 341 | | 430 | | 445 | | 446 | | 605 | | 891 | |

| | | | | | | |

| | | | | | | |

| Other Expense | 875 | | 781 | | 1,016 | | 878 | | 895 | | 1,656 | | 1,841 | |

| Total Noninterest Expense | 8,984 | | 8,428 | | 10,765 | | 9,487 | | 9,501 | | 17,412 | | 18,530 | |

| Income Before Income Tax Expense | 3,210 | | 5,116 | | 18,309 | | 3,236 | | 3,456 | | 8,327 | | 8,742 | |

| Income Tax Expense | 560 | | 920 | | 5,343 | | 564 | | 699 | | 1,480 | | 1,827 | |

| Net Income | $ | 2,650 | | $ | 4,196 | | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 6,847 | | $ | 6,915 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Six Months Ended | |

| Per Common Share Data | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 6/30/24 | 6/30/23 | | |

| Dividends Per Common Share | $ | 0.25 | | $ | 0.25 | | $ | 0.25 | | $ | 0.25 | | $ | 0.25 | | $ | 0.50 | | $ | 0.50 | | | |

| Earnings Per Common Share - Basic | 0.52 | | 0.82 | | 2.53 | | 0.52 | | 0.54 | | 1.33 | | 1.35 | | | |

| Earnings Per Common Share - Diluted | 0.51 | | 0.82 | | 2.52 | | 0.52 | | 0.54 | | 1.33 | | 1.35 | | | |

| | | | | | | | | |

| Weighted Average Common Shares Outstanding - Basic | 5,142,139 | | 5,129,903 | | 5,119,184 | | 5,115,026 | | 5,111,987 | | 5,136,021 | | 5,110,799 | | | |

| Weighted Average Common Shares Outstanding - Diluted | 5,152,657 | | 5,142,286 | | 5,135,997 | | 5,126,546 | | 5,116,134 | | 5,151,188 | | 5,118,396 | | | |

| | | | | | | | | | | | | | | | | |

| 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 |

| Common Shares Outstanding | 5,141,911 | | 5,142,901 | | 5,118,713 | | 5,120,678 | | 5,111,678 | |

| Book Value Per Common Share | $ | 27.79 | | $ | 27.53 | | $ | 27.32 | | $ | 22.43 | | $ | 22.81 | |

Tangible Book Value per Common Share (1) | 25.83 | | 25.52 | | 25.23 | | 20.10 | | 20.39 | |

| Stockholders’ Equity to Assets | 9.2 | % | 9.6 | % | 9.6 | % | 8.2 | % | 8.1 | % |

Tangible Common Equity to Tangible Assets (1) | 8.6 | | 9.0 | | 8.9 | | 7.4 | | 7.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Six Months Ended | |

Selected Financial Ratios (2) | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 6/30/24 | 6/30/23 | | |

| Return on Average Assets | 0.71 | % | 1.17 | % | 3.62 | % | 0.75 | % | 0.79 | % | 0.93 | % | 1.00 | % | | |

| Return on Average Equity | 7.58 | | 12.03 | | 44.99 | | 9.03 | | 9.38 | | 9.80 | | 11.98 | | | |

| Average Interest-Earning Assets to Average Interest-Bearing Liabilities | 135.69 | | 137.07 | | 138.67 | | 139.65 | | 142.28 | | 136.36 | | 144.88 | | | |

| Average Equity to Average Assets | 9.36 | | 9.72 | | 8.04 | | 8.32 | | 8.38 | | 9.54 | | 8.33 | | | |

| Net Interest Rate Spread | 2.44 | | 2.67 | | 2.56 | | 2.54 | | 2.78 | | 2.55 | | 2.95 | | | |

Net Interest Rate Spread (FTE) (1) | 2.46 | | 2.68 | | 2.57 | | 2.55 | | 2.79 | | 2.56 | | 2.96 | | | |

| Net Interest Margin | 3.18 | | 3.36 | | 3.19 | | 3.13 | | 3.29 | | 3.27 | | 3.40 | | | |

Net Interest Margin (FTE) (1) | 3.19 | | 3.37 | | 3.21 | | 3.14 | | 3.30 | | 3.28 | | 3.41 | | | |

Net Charge-Offs (Recoveries) to Average Loans | 0.02 | | (0.01) | | — | | 0.04 | | 0.04 | | 0.01 | | (0.12) | | | |

| Efficiency Ratio | 73.89 | | 62.40 | | 38.93 | | 72.26 | | 70.96 | | 67.84 | | 66.69 | | | |

| | | | | | | | | | | | | | | | | | |

| Asset Quality Ratios | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | |

| Allowance for Credit Losses to Total Loans | 0.88 | % | 0.87 | % | 0.87 | % | 0.98 | % | 0.97 | % | |

| | | | | | |

Allowance for Credit Losses to Nonperforming Loans (3) | 513.03 | | 437.73 | | 433.35 | | 330.13 | | 260.46 | | |

Delinquent and Nonaccrual Loans to Total Loans (4) | 0.53 | | 0.63 | | 0.62 | | 0.73 | | 0.68 | | |

Nonperforming Loans to Total Loans (3) | 0.17 | | 0.20 | | 0.20 | | 0.30 | | 0.37 | | |

Nonperforming Assets to Total Assets (5) | 0.13 | | 0.15 | | 0.16 | | 0.23 | | 0.30 | | |

| | | | | | | | | | | | | | | | | | |

Capital Ratios (6) | 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | |

| Common Equity Tier 1 Capital (to Risk Weighted Assets) | 14.62 | % | 14.50 | % | 13.64 | % | 12.77 | % | 12.54 | % | |

| Tier 1 Capital (to Risk Weighted Assets) | 14.62 | | 14.50 | | 13.64 | | 12.77 | | 12.54 | | |

| Total Capital (to Risk Weighted Assets) | 15.61 | | 15.51 | | 14.61 | | 13.90 | | 13.64 | | |

| Tier 1 Leverage (to Adjusted Total Assets) | 9.98 | | 10.28 | | 10.19 | | 9.37 | | 9.26 | | |

(1) Refer to Explanation of Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure.

(2) Interim period ratios are calculated on an annualized basis.

(3) Nonperforming loans consist of all nonaccrual loans and accruing loans that are 90 days or more past due.

(4) Delinquent loans consist of accruing loans that are 30 days or more past due.

(5) Nonperforming assets consist of nonperforming loans and other real estate owned.

(6) Capital ratios are for Community Bank only.

Certain items previously reported may have been reclassified to conform with the current reporting period’s format.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE BALANCES AND YIELDS |

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 |

| Average Balance | Interest and Dividends | Yield / Cost (1) | | Average Balance | Interest and Dividends | Yield / Cost (1) | | Average Balance | Interest and Dividends | Yield / Cost (1) | | Average Balance | Interest and Dividends | Yield / Cost (1) | | Average Balance | Interest and Dividends | Yield / Cost (1) |

| (Dollars in thousands) (Unaudited) | | | | | | | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | | | | |

| Interest-Earning Assets: | | | | | | | | | | | | | | | | | | | |

Loans, Net (2) | $ | 1,076,455 | | $ | 14,711 | | 5.50 | % | | $ | 1,087,889 | | $ | 14,877 | | 5.50 | % | | $ | 1,098,284 | | $ | 14,840 | | 5.36 | % | | $ | 1,088,691 | | $ | 14,081 | | 5.13 | % | | $ | 1,079,399 | | $ | 13,450 | | 5.00 | % |

| Debt Securities | | | | | | | | | | | | | | | | | | | |

| Taxable | 266,021 | | 2,844 | | 4.28 | | | 235,800 | | 2,303 | | 3.91 | | | 206,702 | | 1,164 | | 2.25 | | | 204,848 | | 940 | | 1.84 | | | 209,292 | | 950 | | 1.82 | |

| Tax-Exempt | — | | — | | — | | | — | | — | | — | | | 4,833 | | 42 | | 3.48 | | | 6,013 | | 52 | | 3.46 | | | 6,180 | | 53 | | 3.43 | |

| Equity Securities | 2,693 | | 27 | | 4.01 | | | 2,693 | | 27 | | 4.01 | | | 2,693 | | 32 | | 4.75 | | | 2,693 | | 25 | | 3.71 | | | 2,693 | | 25 | | 3.71 | |

| Interest-Earning Deposits at Banks | 101,277 | | 1,313 | | 5.19 | | | 58,887 | | 733 | | 4.98 | | | 67,450 | | 808 | | 4.79 | | | 52,466 | | 750 | | 5.72 | | | 53,582 | | 721 | | 5.38 | |

| Other Interest-Earning Assets | 3,154 | | 85 | | 10.84 | | | 3,235 | | 85 | | 10.57 | | | 3,387 | | 64 | | 7.50 | | | 3,292 | | 69 | | 8.32 | | | 2,783 | | 39 | | 5.62 | |

| Total Interest-Earning Assets | 1,449,600 | | 18,980 | | 5.27 | | | 1,388,504 | | 18,025 | | 5.22 | | | 1,383,349 | | 16,950 | | 4.86 | | | 1,358,003 | | 15,917 | | 4.65 | | | 1,353,929 | | 15,238 | | 4.51 | |

| Noninterest-Earning Assets | 53,564 | | | | | 54,910 | | | | | 38,464 | | | | | 52,885 | | | | | 52,812 | | | |

| Total Assets | $ | 1,503,164 | | | | | $ | 1,443,414 | | | | | $ | 1,421,813 | | | | | $ | 1,410,888 | | | | | $ | 1,406,741 | | | |

| Liabilities and Stockholders' Equity: | | | | | | | | | | | | | | | | | | | |

| Interest-Bearing Liabilities: | | | | | | | | | | | | | | | | | | | |

| Interest-Bearing Demand Accounts | $ | 325,069 | | $ | 1,858 | | 2.30 | % | | $ | 334,880 | | $ | 1,794 | | 2.15 | % | | $ | 362,018 | | $ | 1,965 | | 2.15 | % | | $ | 363,997 | | $ | 2,003 | | 2.18 | % | | $ | 354,497 | | $ | 1,582 | | 1.79 | % |

| Money Market Accounts | 214,690 | | 1,646 | | 3.08 | | | 203,867 | | 1,514 | | 2.99 | | | 205,060 | | 1,441 | | 2.79 | | | 187,012 | | 1,141 | | 2.42 | | | 194,565 | | 1,033 | | 2.13 | |

| Savings Accounts | 184,944 | | 52 | | 0.11 | | | 191,444 | | 59 | | 0.12 | | | 200,737 | | 57 | | 0.11 | | | 212,909 | | 54 | | 0.10 | | | 225,175 | | 53 | | 0.09 | |

| Time Deposits | 308,956 | | 3,509 | | 4.57 | | | 248,118 | | 2,624 | | 4.25 | | | 193,188 | | 1,873 | | 3.85 | | | 173,832 | | 1,552 | | 3.54 | | | 155,867 | | 1,174 | | 3.02 | |

| Total Interest-Bearing Deposits | 1,033,659 | | 7,065 | | 2.75 | | | 978,309 | | 5,991 | | 2.46 | | | 961,003 | | 5,336 | | 2.20 | | | 937,750 | | 4,750 | | 2.01 | | | 930,104 | | 3,842 | | 1.66 | |

| Short-Term Borrowings | 2 | | — | | — | | | — | | — | | — | | | 1,902 | | 26 | | 5.42 | | | — | | — | | — | | | 480 | | 3 | | 2.51 | |

| Other Borrowings | 34,692 | | 404 | | 4.68 | | | 34,682 | | 404 | | 4.69 | | | 34,673 | | 407 | | 4.66 | | | 34,662 | | 407 | | 4.66 | | | 21,026 | | 238 | | 4.54 | |

| Total Interest-Bearing Liabilities | 1,068,353 | | 7,469 | | 2.81 | | | 1,012,991 | | 6,395 | | 2.54 | | | 997,578 | | 5,769 | | 2.29 | | | 972,412 | | 5,157 | | 2.10 | | | 951,610 | | 4,083 | | 1.72 | |

| Noninterest-Bearing Demand Deposits | 272,280 | | | | | 278,691 | | | | | 305,789 | | | | | 312,016 | | | | | 326,262 | | | |

Total Funding and Cost of Funds | 1,340,633 | | | 2.24 | | | 1,291,682 | | | 1.99 | | | 1,303,367 | | | 1.76 | | | 1,284,428 | | | 1.59 | | | 1,277,872 | | | 1.28 | |

| Other Liabilities | 21,867 | | | | | 11,441 | | | | | 4,119 | | | | | 9,025 | | | | | 10,920 | | | |

| Total Liabilities | 1,362,500 | | | | | 1,303,123 | | | | | 1,307,486 | | | | | 1,293,453 | | | | | 1,288,792 | | | |

| Stockholders' Equity | 140,664 | | | | | 140,291 | | | | | 114,327 | | | | | 117,435 | | | | | 117,949 | | | |

| Total Liabilities and Stockholders' Equity | $ | 1,503,164 | | | | | $ | 1,443,414 | | | | | $ | 1,421,813 | | | | | $ | 1,410,888 | | | | | $ | 1,406,741 | | | |

Net Interest Income (FTE) (Non-GAAP) (3) | | $ | 11,511 | | | | | $ | 11,630 | | | | | $ | 11,181 | | | | | $ | 10,760 | | | | | $ | 11,155 | | |

Net Interest-Earning Assets (4) | 381,247 | | | | | 375,513 | | | | | 385,771 | | | | | 385,591 | | | | | 402,319 | | | |

Net Interest Rate Spread (FTE) (Non-GAAP) (3) (5) | | | 2.46 | % | | | | 2.68 | % | | | | 2.57 | % | | | | 2.55 | % | | | | 2.79 | % |

Net Interest Margin (GAAP) (6) | | | 3.18 | | | | | 3.36 | | | | | 3.19 | | | | | 3.13 | | | | | 3.29 | |

Net Interest Margin (FTE) (Non-GAAP) (3)(6) | | | 3.19 | | | | | 3.37 | | | | | 3.21 | | | | | 3.14 | | | | | 3.30 | |

| | | | | | | | | | | | | | | | | | | |

(1) Annualized based on three months ended results.

(2) Net of the allowance for credit losses and includes nonaccrual loans with a zero yield and Loans Held for Sale if applicable.

(3) Refer to Explanation and Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure.

(4) Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

(5) Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(6) Net interest margin represents annualized net interest income divided by average total interest-earning assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE BALANCES AND YIELDS |

| | | | | | | | | | | |

| Six Months Ended |

| June 30, 2024 | | June 30, 2023 |

| Average Balance | | Interest and Dividends | | Yield /Cost (1) | | Average Balance | | Interest and Dividends | | Yield / Cost (1) |

| (Dollars in thousands) (Unaudited) | | | | | | | | | | | |

| Assets: | | | | | | | | | | | |

| Interest-Earning Assets: | | | | | | | | | | | |

Loans, Net (2) | $ | 1,082,172 | | | $ | 29,586 | | | 5.50 | % | | $ | 1,060,092 | | | $ | 25,840 | | | 4.92 | % |

| Debt Securities | | | | | | | | | | | |

| Taxable | 250,912 | | | 5,148 | | | 4.10 | | | 211,213 | | | 1,914 | | | 1.81 | |

| Exempt From Federal Tax | — | | | — | | | — | | | 6,225 | | | 105 | | | 3.37 | |

| Marketable Equity Securities | 2,693 | | | 54 | | | 4.01 | | | 2,693 | | | 49 | | | 3.64 | |

| Interest-Earning Deposits at Banks | 80,082 | | | 2,045 | | | 5.11 | | | 64,455 | | | 1,526 | | | 4.74 | |

| Other Interest-Earning Assets | 3,195 | | | 171 | | | 10.76 | | | 2,709 | | | 79 | | | 5.88 | |

| Total Interest-Earning Assets | 1,419,054 | | | 37,004 | | | 5.24 | | | 1,347,387 | | | 29,513 | | | 4.42 | |

| Noninterest-Earning Assets | 54,141 | | | | | | | 50,159 | | | | | |

| Total Assets | $ | 1,473,195 | | | | | | | $ | 1,397,546 | | | | | |

| | | | | | | | | | | |

| Liabilities and Stockholders' Equity: | | | | | | | | | | | |

| Interest-Bearing Liabilities: | | | | | | | | | | | |

| Interest-Bearing Demand Accounts | $ | 329,974 | | | $ | 3,653 | | | 2.23 | % | | $ | 344,965 | | | $ | 2,773 | | | 1.62 | % |

| Savings Accounts | 188,194 | | | 111 | | | 0.12 | | | 233,689 | | | 90 | | | 0.08 | |

| Money Market Accounts | 209,279 | | | 3,159 | | | 3.04 | | | 203,952 | | | 1,972 | | | 1.95 | |

| Time Deposits | 278,538 | | | 6,133 | | | 4.43 | | | 128,659 | | | 1,511 | | | 2.37 | |

| Total Interest-Bearing Deposits | 1,005,985 | | | 13,056 | | | 2.61 | | | 911,265 | | | 6,346 | | | 1.40 | |

| Short-Term Borrowings | 1 | | | — | | | — | | | 910 | | | 5 | | | 1.11 | |

| Other Borrowings | 34,687 | | | 808 | | | 4.68 | | | 17,850 | | | 393 | | | 4.44 | |

| Total Interest-Bearing Liabilities | 1,040,673 | | | 13,864 | | | 2.68 | | | 930,025 | | | 6,744 | | | 1.46 | |

| Noninterest-Bearing Demand Deposits | 275,485 | | | | | | | 344,203 | | | | | |

Total Funding and Cost of Funds | 1,316,158 | | | | | 2.12 | | | 1,274,228 | | | | | 1.07 | |

| Other Liabilities | 16,559 | | | | | | | 6,959 | | | | | |

| Total Liabilities | 1,332,717 | | | | | | | 1,281,187 | | | | | |

| Stockholders' Equity | 140,478 | | | | | | | 116,359 | | | | | |

| Total Liabilities and Stockholders' Equity | $ | 1,473,195 | | | | | | | $ | 1,397,546 | | | | | |

Net Interest Income (FTE) (Non-GAAP) (3) | | | 23,140 | | | | | | | 22,769 | | | |

Net Interest-Earning Assets (4) | 378,381 | | | | | | | 417,362 | | | | | |

Net Interest Rate Spread (FTE) (Non-GAAP) (3)(5) | | | | | 2.56 | % | | | | | | 2.96 | % |

Net Interest Margin (FTE) (Non-GAAP) (3)(6) | | | | | 3.28 | | | | | | | 3.41 | |

| | | | | | | | | | | |

(1) Annualized based on six months ended results.

(2) Net of the allowance for credit losses and includes nonaccrual loans with a zero yield and Loans Held for Sale if applicable.

(3) Refer to Explanation and Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure.

(4) Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

(5) Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(6) Net interest margin represents annualized net interest income divided by average total interest-earning assets.

Explanation of Use of Non-GAAP Financial Measures

In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), we use, and this Press Release contains or references, certain Non-GAAP financial measures. We believe these Non-GAAP financial measures provide useful information in understanding our underlying results of operations or financial position and our business and performance trends as they facilitate comparisons with the performance of other companies in the financial services industry. Non-GAAP adjusted items impacting the Company's financial performance are identified to assist investors in providing a complete understanding of factors and trends affecting the Company’s business and in analyzing the Company’s operating results on the same basis as that applied by management. Although we believe that these Non-GAAP financial measures enhance the understanding of our business and performance, they should not be considered an alternative to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with similar Non-GAAP measures which may be presented by other companies. Where Non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found herein.

| | | | | | | | | | | | | | | | | |

| 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 |

| (Dollars in thousands, except share and per share data) (Unaudited) | | | | | |

| | | | | |

Total Assets (GAAP) | $ | 1,559,849 | | $ | 1,473,089 | | $ | 1,456,091 | | $ | 1,399,492 | | $ | 1,432,733 | |

| Goodwill and Intangible Assets, Net | (10,085) | | (10,349) | | (10,690) | | (11,909) | | (12,354) | |

| Tangible Assets (Non-GAAP) (Numerator) | $ | 1,549,764 | | $ | 1,462,740 | | $ | 1,445,401 | | $ | 1,387,583 | | $ | 1,420,379 | |

| Stockholders' Equity (GAAP) | $ | 142,882 | | $ | 141,590 | | $ | 139,834 | | $ | 114,846 | | $ | 116,589 | |

| Goodwill and Intangible Assets, Net | (10,085) | | (10,349) | | (10,690) | | (11,909) | | (12,354) | |

| Tangible Common Equity or Tangible Book Value (Non-GAAP) (Denominator) | $ | 132,797 | | $ | 131,241 | | $ | 129,144 | | $ | 102,937 | | $ | 104,235 | |

| Stockholders’ Equity to Assets (GAAP) | 9.2 | % | 9.6 | % | 9.6 | % | 8.2 | % | 8.1 | % |

| Tangible Common Equity to Tangible Assets (Non-GAAP) | 8.6 | % | 9.0 | % | 8.9 | % | 7.4 | % | 7.3 | % |

| Common Shares Outstanding (Denominator) | 5,141,911 | | 5,142,901 | | 5,118,713 | | 5,120,678 | | 5,111,678 | |

| Book Value per Common Share (GAAP) | $ | 27.79 | | $ | 27.53 | | $ | 27.32 | | $ | 22.43 | | $ | 22.81 | |

| Tangible Book Value per Common Share (Non-GAAP) | $ | 25.83 | | $ | 25.52 | | $ | 25.23 | | $ | 20.10 | | $ | 20.39 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Six Months Ended | |

| 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 6/30/24 | 6/30/23 | |

| (Dollars in thousands) (Unaudited) | | | | | | | | |

| | | | | | | | |

| Net Income (GAAP) | $ | 2,650 | | $ | 4,196 | | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 6,847 | | $ | 6,915 | | |

| Amortization of Intangible Assets, Net | 264 | | 341 | | 430 | | 445 | | 446 | | 605 | | 891 | | |

| | | | | | | | |

| Adjusted Net Income (Non-GAAP) (Numerator) | $ | 2,914 | | $ | 4,537 | | $ | 13,396 | | $ | 3,117 | | $ | 3,203 | | $ | 7,452 | | $ | 7,806 | | |

| Annualization Factor | 4.02 | | 4.02 | | 3.97 | | 3.97 | | 4.01 | | 2.01 | | 2.02 | | |

| Average Stockholders' Equity (GAAP) | $ | 140,664 | | $ | 140,291 | | $ | 114,327 | | $ | 117,435 | | $ | 117,949 | | $ | 140,478 | | $ | 116,359 | | |

| Average Goodwill and Intangible Assets, Net | (10,242) | | (10,553) | | (11,829) | | (12,185) | | (12,626) | | (10,398) | | (12,852) | | |

| Average Tangible Common Equity (Non-GAAP) (Denominator) | $ | 130,422 | | $ | 129,738 | | $ | 102,498 | | $ | 105,250 | | $ | 105,323 | | $ | 130,080 | | $ | 103,507 | | |

| Return on Average Equity (GAAP) | 7.58 | % | 12.03 | % | 44.99 | % | 9.03 | % | 9.38 | % | 9.80 | % | 11.98 | % | |

| Return on Average Tangible Common Equity (Non-GAAP) | 8.99 | % | 14.07 | % | 51.85 | % | 11.75 | % | 12.20 | % | 11.52 | % | 15.21 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Six Months Ended | | |

| 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 6/30/24 | 6/30/23 | | | |

| (Dollars in thousands) (Unaudited) | | | | | | | | | | |

| | | | | | | | | | |

| Interest Income (GAAP) | $ | 18,939 | | $ | 17,986 | | $ | 16,905 | | $ | 15,874 | | $ | 15,203 | | $ | 36,926 | | $ | 29,448 | | | | |

| Adjustment to FTE Basis | 41 | | 39 | | 45 | | 43 | | 35 | | 78 | | 65 | | | | |

| Interest Income (FTE) (Non-GAAP) | 18,980 | | 18,025 | | 16,950 | | 15,917 | | 15,238 | | 37,004 | | 29,513 | | | | |

| Interest Expense (GAAP) | 7,469 | | 6,395 | | 5,769 | | 5,157 | | 4,083 | | 13,864 | | 6,744 | | | | |

| Net Interest Income (FTE) (Non-GAAP) | $ | 11,511 | | $ | 11,630 | | $ | 11,181 | | $ | 10,760 | | $ | 11,155 | | $ | 23,140 | | $ | 22,769 | | | | |

| | | | | | | | | | |

| Net Interest Rate Spread (GAAP) | 2.44 | % | 2.67 | % | 2.56 | % | 2.54 | % | 2.78 | % | 2.55 | % | 2.95 | % | | | |

| Adjustment to FTE Basis | 0.02 | | 0.01 | | 0.01 | | 0.01 | | 0.01 | | 0.01 | | 0.01 | | | | |

| Net Interest Rate Spread (FTE) (Non-GAAP) | 2.46 | % | 2.68 | % | 2.57 | % | 2.55 | % | 2.79 | % | 2.56 | % | 2.96 | % | | | |

| | | | | | | | | | |

| Net Interest Margin (GAAP) | 3.18 | % | 3.36 | % | 3.19 | % | 3.13 | % | 3.29 | % | 3.27 | % | 3.40 | % | | | |

| Adjustment to FTE Basis | 0.01 | | 0.01 | | 0.02 | | 0.01 | | 0.01 | | 0.01 | | 0.01 | | | | |

| Net Interest Margin (FTE) (Non-GAAP) | 3.19 | % | 3.37 | % | 3.21 | % | 3.14 | % | 3.30 | % | 3.28 | % | 3.41 | % | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Six Months Ended |

| 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 6/30/24 | 6/30/23 |

| (Dollars in thousands) (Unaudited) | | | | | | | |

| | | | | | | |

| Income Before Income Tax Expense (GAAP) | $ | 3,210 | | $ | 5,116 | | $ | 18,309 | | $ | 3,236 | | $ | 3,456 | | $ | 8,327 | | $ | 8,742 | |

| Net (Recovery) Provision for Credit Losses | (36) | | (37) | | (1,420) | | 406 | | 432 | | (73) | | 512 | |

| Adjustments | | | | | | | |

| Net Loss on Securities | 31 | | 166 | | 9,830 | | 37 | | 100 | | 197 | | 332 | |

| Gain on Sale of Subsidiary | — | | — | | (24,578) | | — | | — | | — | | — | |

| Net Gain on Disposal of Premises and Equipment | — | | (274) | | — | | — | | — | | (274) | | (11) | |

| Net Gain on Bank-Owned Life Insurance Claims | — | | (915) | | — | | — | | (1) | | $ | (915) | | $ | (303) | |

| Adjusted PPNR (Non-GAAP) (Numerator) | $ | 3,205 | | $ | 4,056 | | $ | 2,141 | | $ | 3,679 | | $ | 3,987 | | $ | 7,262 | | $ | 9,272 | |

| Annualization Factor | 4.02 | | 4.02 | | 3.97 | | 3.97 | | 4.01 | | 2.01 | | 2.02 | |

| Average Assets (Denominator) | $ | 1,503,164 | | $ | 1,443,414 | | $ | 1,421,813 | | $ | 1,410,888 | | $ | 1,406,741 | | $ | 1,473,195 | | $ | 1,397,546 | |

| Adjusted PPNR Return on Average Assets (Non-GAAP) | 0.86 | % | 1.13 | % | 0.60 | % | 1.04 | % | 1.14 | % | 0.99 | % | 1.34 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Six Months Ended |

| 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 6/30/24 | 6/30/23 |

| (Dollars in thousands, except share and per share data) (Unaudited) | | | | | | | |

| | | | | | | |

| Net Income (GAAP) | $ | 2,650 | | $ | 4,196 | | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 6,847 | | $ | 6,915 | |

| | | | | | | |

| Adjustments | | | | | | | |

| Net Loss on Securities | 31 | | 166 | | 9,830 | | 37 | | 100 | | 197 | | 332 | |

| Gain on Sale of Subsidiary | — | | — | | (24,578) | | — | | — | | — | | — | |

| Net Gain on Disposal of Premises and Equipment | — | | (274) | | — | | — | | — | | (274) | | (11) | |

| Net Gain on Bank-Owned Life Insurance Claims | — | | (915) | | — | | — | | (1) | | (915) | | (303) | |

| Tax effect | (7) | | 23 | | 4,843 | | (8) | | (21) | | 16 | | (67) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted Net Income (Non-GAAP) | $ | 2,674 | | $ | 3,196 | | $ | 3,061 | | $ | 2,701 | | $ | 2,835 | | $ | 5,871 | | $ | 6,866 | |

| Weighted-Average Diluted Common Shares and Common Stock Equivalents Outstanding | 5,152,657 | | 5,142,286 | | 5,135,997 | | 5,126,546 | | 5,116,134 | | 5,151,188 | | 5,118,396 | |

| Earnings per Common Share - Diluted (GAAP) | $ | 0.51 | | $ | 0.82 | | $ | 2.52 | | $ | 0.52 | | $ | 0.54 | | $ | 1.33 | | $ | 1.35 | |

| Adjusted Earnings per Common Share - Diluted (Non-GAAP) | $ | 0.52 | | $ | 0.62 | | $ | 0.60 | | $ | 0.53 | | $ | 0.55 | | $ | 1.14 | | $ | 1.34 | |

| Net Income (GAAP) (Numerator) | $ | 2,650 | | $ | 4,196 | | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 6,847 | | $ | 6,915 | |

| Annualization Factor | 4.02 | | 4.02 | | 3.97 | | 3.97 | | 4.01 | | 2.01 | | 2.02 | |

| Average Assets (Denominator) | 1,503,164 | | 1,443,414 | | 1,421,813 | | 1,410,888 | | 1,406,741 | | 1,473,195 | | 1,397,546 | |

| Return on Average Assets (GAAP) | 0.71 | % | 1.17 | % | 3.62 | % | 0.75 | % | 0.79 | % | 0.93 | % | 1.00 | % |

| Adjusted Net Income (Non-GAAP) (Numerator) | $ | 2,674 | | $ | 3,196 | | $ | 3,061 | | $ | 2,701 | | $ | 2,835 | | $ | 5,871 | | $ | 6,866 | |

| Annualization Factor | 4.02 | | 4.02 | | 3.97 | | 3.97 | | 4.01 | | 2.01 | | 2.02 | |

| Average Assets (Denominator) | 1,503,164 | | 1,443,414 | | 1,421,813 | | 1,410,888 | | 1,406,741 | | 1,473,195 | | 1,397,546 | |

| Adjusted Return on Average Assets (Non-GAAP) | 0.72 | % | 0.89 | % | 0.85 | % | 0.76 | % | 0.81 | % | 0.80 | % | 0.99 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Six Months Ended | |

| 6/30/24 | 3/31/24 | 12/31/23 | 9/30/23 | 6/30/23 | 6/30/24 | 6/30/23 | | |

| (Dollars in thousands) (Unaudited) | | | | | | | | | |

| | | | | | | | | |

| Net Income (GAAP) (Numerator) | $ | 2,650 | | $ | 4,196 | | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 6,847 | | $ | 6,915 | | | |

| Annualization Factor | 4.02 | | 4.02 | | 3.97 | | 3.97 | | 4.01 | | 2.01 | | 2.02 | | | |

| Average Equity (GAAP) (Denominator) | 140,664 | | 140,291 | | 114,327 | | 117,435 | | 117,949 | | 140,478 | | 116,359 | | | |

| Return on Average Equity (GAAP) | 7.58 | % | 12.03 | % | 44.99 | % | 9.03 | % | 9.38 | % | 9.80 | % | 11.98 | % | | |

| Adjusted Net Income (Non-GAAP) (Numerator) | $ | 2,674 | | $ | 3,196 | | $ | 3,061 | | $ | 2,701 | | $ | 2,835 | | $ | 5,871 | | $ | 6,866 | | | |

| Annualization Factor | 4.02 | | 4.02 | | 3.97 | | 3.97 | | 4.01 | | 2.01 | | 2.02 | | | |

| Average Equity (GAAP) (Denominator) | 140,664 | | 140,291 | | 114,327 | | 117,435 | | 117,949 | | 140,478 | | 116,359 | | | |

| Adjusted Return on Average Equity (Non-GAAP) | 7.65 | % | 9.16 | % | 10.62 | % | 9.12 | % | 9.64 | % | 8.40 | % | 11.90 | % | | |

The Q2 2024 Investor Presentation should be read in conjunction with the Earnings Release furnished in Exhibit 99.1 to Form 8K filed with the SEC on July 24, 2024.

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 2 Forward-Looking Statements and Non-GAAP Financial Measures Statements contained in this investor presentation that are not historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 and such forward-looking statements are subject to significant risks and uncertainties. The Company intends such forward-looking statements to be covered by the safe harbor provisions contained in the Act. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, general and local economic conditions, changes in market interest rates, deposit flows, demand for loans, real estate values and competition, competitive products and pricing, the ability of our clients to make scheduled loan payments, loan delinquency rates and trends, our ability to manage the risks involved in our business, our ability to control costs and expenses, inflation, market and monetary fluctuations, changes in federal and state legislation and regulation applicable to our business, actions by our competitors, and other factors that may be disclosed in the Company’s periodic reports as filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward-looking statements except as may be required by applicable law or regulation. Explanation of Use of Non-GAAP Financial Measures In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), we use, and this investor presentation may contain or reference, certain non-GAAP financial measures. We believe these non-GAAP financial measures provide useful information in understanding our underlying results of operations or financial position and our business and performance trends as they facilitate comparisons with the performance of other companies in the financial services industry. Non-GAAP adjusted items impacting the Company's financial performance are identified to assist investors in providing a complete understanding of factors and trends affecting the Company’s business and in analyzing the Company’s operating results on the same basis as that applied by management. Although we believe that these non-GAAP financial measures enhance the understanding of our business and performance, they should not be considered an alternative to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with similar non-GAAP measures which may be presented by other companies. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found within the referenced earnings release.

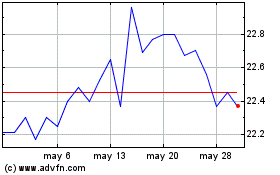

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 3 CB Financial Services, Inc. - Corporate Overview • Holding Company for Community Bank (Carmichaels, PA), serving the community since 1901 • Community Bank operates 12 full-service branch offices and two loan production offices in southwestern Pennsylvania and northern West Virginia. • NASDAQ: CBFV Trading Highlights CBFV Share Price $22.66 Shares Outstanding 5.1M Market Cap $120.1M Total Stockholders' Equity $142.9M Book Value per Common Share $27.79 Tangible Book Value per Common Share $25.83 Price to Book Value 0.82x Price to Tangible Book Value 0.88x P/E LTM (LTM EPS of $4.37) 5.19x ◦ All daily trading information/multiples as of July 22, 2024 ◦ All other financial information as of June 30, 2024 Washington Waynesburg Moundsville Canonsburg Uniontown

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 4 Meet CB Financial Services Our Mission Statement "We partner with individuals, businesses and communities to realize their dreams, protect their financial futures and improve their lives" Our Core Values 1. Take care of Each Other 2. Always do the Right Thing 3. Be a Great Teammate 4. Work Hard to Achieve Our Goals 5. Give and Expect Mutual Respect 6. Enjoy Life Everyday 7. Be Positive 8. Have a Sense of Urgency "With a differentiated model and approach to risk management, our Operational Goals for 2024 are improving efficiencies and client experience." Strategic Initiatives p Continue investment in technology to support the client experience p Solidify Commercial Banking team and enhance loan origination processes p Rollout new consumer loan products including FHA mortgages, securities- based lending program and an advanced suite of treasury management products Diversified Business Model

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 5 2024 Macro Outlook Item Comment Deposits Market interest rates remain elevated resulting in increased deposit costs and changing deposit mix; Corporate wide initiatives to retain deposits in place Loans Focal area with new talent in place, continuing to opportunistically push for growth in the face of headwinds stemming from moderating economic conditions Net Interest Margin Stabilization is expected as deposit repricing slows and the Bank continues to focus on attracting core non/low interest bearing deposits to mitigate compression. Noninterest expense Upward bias as we attract top talent and continue to invest in technology to generate efficiencies and enhance client experience Expectations for the balance of 2024 are marked by 'Uncertainty' as potential future interest rate changes by the Federal Reserve and industry-specific developments exert a resulting mixed impact on CB

Q2 2024 Financial Highlights

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 7 Q2 2024 Highlights Earnings (for the three months ended June 30, 2024 unless otherwise noted) • Solid earnings. Net income was $2.7 million, with diluted earnings per share of $0.51. Pre-provision net revenue (PPNR) (non-GAAP) was $3.2 million. • Margin compression. Net interest income was $11.5 million, a decrease of 1.0% from Q1 2024 and an increase of 3.1% from Q2 2023. Net interest margin was 3.18%, down 18 bps from Q1 2024 and 11 bps from Q2 2023. • Positive returns. Return on average tangible common equity (non-GAAP) was 8.99% for Q2 2024, compared 12.20% in Q2 2023. • Diversified revenue sources. Noninterest income represents 3.5% of operating revenues. Balance Sheet & Asset Quality (as of June 30, 2024 unless otherwise noted) • Steady loan portfolio. Net loans ($1.07 billion) decreased 1.6% from March 31, 2024 and 2.9% from December 31, 2023 driven by exit of indirect lending. • Strong deposit base. Deposits ($1.35 billion) increased 6.9% from March 31, 2024 and 6.5% from December 31, 2023. • High concentration of core deposits. Core deposits (non-time) were 74% of total deposits at June 30, 2024. • Limited wholesale funding. Borrowings to total assets was 2.2% and brokered deposits to total assets was 5.9% at June 30, 2024. • Strong credit quality. Nonperforming loans to total loans was 0.17% and nonperforming assets to total assets was 0.13% as of June 30, 2024. Annualized net charge-offs to average loans for the current quarter was 0.02%. Liquidity and Capital Strength (as of June 30, 2024 unless otherwise noted) • Significant available liquidity. Cash on deposit was $142.6 million and available borrowing capacity was $603.7 million. Available liquidity covers 337% of uninsured/non-collateralized deposits. • Low-risk deposit base. Insured/collateralized deposits account for 77.6% of total deposits. • Well-capitalized. The Bank's Tier 1 Leverage ratio was 9.98% at June 30, 2024, compared to 10.19% at December 31, 2023. • Increasing shareholder value. TBV per common share (non-GAAP) was $25.83 at June 30, 2024, compared to $25.23 at December 31, 2023. • Stock Repurchase Plan. Attractive way to return capital to shareholders.

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 8 Financial Highlights Change ($000s except per share) Q2 2024 Q1 2024 Q2 2023 Balance Sheet Total Loans (Net Allowance) $ 1,069,167 $ (17,594) $ (21,321) Total Deposits 1,349,768 87,274 86,453 Income Statement Net Interest Income 11,470 (121) 350 (Recovery) Provision for Credit Losses (36) 1 (468) Noninterest Income (excl Net Gain (Loss) on Investment Securities) 719 (1,363) (1,650) Net Gain (Loss) on Investment Securities (31) 135 (69) Noninterest Expense 8,984 556 (517) Income Tax Expense 560 (360) (139) Net Income 2,650 (1,546) (107) Performance Ratios Earnings Per Share, Diluted $ 0.51 $ (0.30) $ (0.02) Net Interest Margin(1) 3.18 % (0.18) % (0.11) % ROAA(1) 0.71 % (0.46) % (0.08) % ROATCE(1)(2) 8.99 % (5.08) % (3.21) % NCOs/Average Loans(1) 0.02 % 0.03 % (0.02) % Tangible Book Value per Share(2) $ 25.83 $ 0.31 $ 5.43 Tangible Equity Ratio (TCE / TA)(2) 8.57 % (0.40) % 1.23 % Capital Ratios (Bank Only) Tier 1 Leverage 9.98 % (0.30) % 0.72 % Common Equity Tier 1 Capital 14.62 % 0.12 % 2.08 % Tier 1 Capital 14.62 % 0.12 % 2.08 % Total Risk-Based Capital 15.61 % 0.11 % 1.97 % Q2 2024 Results Overview (1) Annualized (2) Non-GAAP Calculation in Press Release (3) Comparisons are to Q1 2024 unless otherwise noted Quarterly Highlights(3) Balance Sheet: • Loans decreased $17.6 million. • Deposits increased $87.3 million. • Tangible book value per share (non-GAAP) was $25.83. Earnings and Capital: • Net income was $2.7 million and diluted EPS was $0.51. • Net interest margin(1) was down 18 bps to 3.18% resulting from increase in deposit costs. • Noninterest income declined primarily due to non-recurring BOLI claim and gain on sale/leaseback transaction recorded during Q1 2024. • Noninterest expense increased 6.6% due to costs associated with technology investments (loan origination system and financial dashboard platform)and environmental remediation related to branch improvement project. • Effective Tax Rate was 17.4%. • Tier 1 Leverage ratio was 9.98%.

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 9 Financial Trends - Balance Sheet Total Net LoansTotal Assets Total Deposits Total Stockholders' Equity in m ill io ns $1,433 $1,399 $1,456 $1,473 $1,560 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 $1,300 $1,400 $1,500 $1,600 in m ill io ns $1,090 $1,092 $1,101 $1,087 $1,069 Net Loans Yield on Loans 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 $800 $1,000 $1,200 4.50% 5.00% 5.50% 6.00% in m ill io ns $1,263 $1,236 $1,267 $1,262 $1,350 Total Deposits Cost of Interest Bearing Deposits 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 $1,100 $1,200 $1,300 $1,400 1.50% 2.00% 2.50% 3.00% in m ill io ns $117 $115 $140 $142 $143 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 $75 $100 $125 $150

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 10 Financial Trends - Earnings and Profitability Net Income / PPNR (non-GAAP) Earnings Per Share (EPS) in th ou sa nd s $2,757 $2,672 $12,966 $4,196 $2,650 $3,888 $3,642 $16,889 $5,079 $3,174 Net Income PPNR Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $— $5,000 $10,000 $15,000 $20,000 $0.54 $0.52 $2.52 $0.82 $0.51 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $— $1.00 $2.00 $3.00 Annualized Return on Average Equity (ROAE) 9.38% 9.03% 44.99% 12.03% 7.58% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 —% 20.00% 40.00% 60.00% Annualized Return on Average Assets (ROAA) 0.79% 0.75% 3.62% 1.17% 0.71% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 —% 1.00% 2.00% 3.00% 4.00%

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 11 Financial Trends - Earnings and Profitability Total Revenue Highlights - Noninterest Income Efficiency Ratio $11,120 $10,717 $11,136 $11,591 $11,470 $2,269 $2,412 $16,518 $1,916 $688 Net Interest Income Noninterest Income Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $— $5,000 $10,000 $15,000 71.0% 72.3% 38.9% 62.4% 73.9% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 20.0% 40.0% 60.0% 80.0% Net Interest Margin (NIM) (non-GAAP) 4.51% 4.65% 4.86% 5.22% 5.27% 3.30% 3.14% 3.21% 3.37% 3.19% 1.72% 2.10% 2.29% 2.54% 2.81% Yield on Earning Assets Net Interest Margin (FTE) Cost of Funds Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% • Prior to the sale of Exchange Underwriters ("EU"), noninterest income for Q2, Q3 and Q4 2023 included insurance commissions of $1.5 million, $1.4 million and $969,000 respectively. • Sale of EU resulted in a gain of $24.6 million in Q4 2023. • Securities losses totaled $9.8 million in Q4 2023 primarily resulting from a portfolio restructuring. • Q1 2024 included a $915,000 gain on bank-owned life insurance and a $274,000 gain on a sales leaseback transaction.

Deposit Composition / Characteristics

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 13 Deposit Mix and Cost 20.0% 24.1% 17.0% 13.3% 25.6% Non-Interest Bearing Demand Interest Bearing Demand Money Market Accounts Savings Accounts Time Deposits Deposit Mix Cost of Interest-Bearing Deposits 1.66% 2.01% 2.20% 2.46% 2.75% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 —% 1.00% 2.00% 3.00% Deposit Composition (in millions) 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 NIB Demand $ 316.1 $ 305.1 $ 277.7 $ 275.2 $ 270.0 IB Demand $ 374.7 $ 357.4 $ 363.0 $ 323.1 $ 324.7 Money Market $ 185.8 $ 189.2 $ 201.1 $ 208.4 $ 230.0 Savings Accounts $ 217.3 $ 207.1 $ 194.7 $ 190.2 $ 179.1 Time Deposits $ 169.5 $ 177.4 $ 230.6 $ 265.6 $ 346.0 Total Deposits $ 1,263.4 $ 1,236.2 $ 1,267.1 $ 1,262.5 $ 1,349.8 Highlights • Deposits increased $82.6 million, or 6.5%, from December 31, 2023. • Time deposits included $92.1 million of brokered CDs at June 30, 2024, compared to $29.0 million at December 31, 2023. • Mix shifting to higher-cost money market and time deposits. • Retaining deposits through short-term certificate offering at a cost favorable to alternative funding sources. • Cost of interest-bearing deposits was 2.75% for Q2 2024, compared to 2.46% for Q1 2024 and 1.66% for Q2 2023. Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 —% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% Noninterest- Bearing Interest- Bearing Money Market Accounts Savings Accounts Time Deposits $— $100,000 $200,000 $300,000 $400,000 25.0% 24.7% 21.9% 21.8% 20.0% 29.7% 28.9% 28.6% 25.6% 24.1% 14.7% 15.3% 15.9% 16.5% 17.0% 17.2% 16.7% 15.4% 15.1% 13.3% 13.4% 14.4% 18.2% 21.0% 25.6% Noninterest-Bearing Interest-Bearing Money Market Accounts Savings Accounts Time Deposits 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 14 Secure Deposit Base • In total, 77.6% of client deposits (non- brokered) are FDIC insured or collateralized with investment securities as of June 30, 2024. • Uninsured client deposits consist of business & retail deposits of 15.6% and 6.9% of total deposits, respectively. • At June 30, 2024, client deposits consisted of 57.7% retail, 27.7% business, and 14.6% public funds. • CB is focused on providing opportunities for uninsured depositors to move funds to alternate products, providing benefit to both clients and the Bank. FDIC Insured, 62.6% Collateralized, 15.0% Uninsured, 22.4% Source: Company information as of 6/30/2024

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 15 Strong Liquidity Position $3,903 2.3% $3,334 2.0% $52,369 31.0% $98,984 58.6% $7,979 4.7% $2,391 1.4% Government Agency Municipal MBS's CMO's Corporate Debt Marketable Equity Cash $142.6 million Investments $97.6 million Fed Capacity $88.1 millionFHLB Capacity $465.6 million Other Capacity $50.0 million Available Liquidity of $844.0 million Highlights Source: Company information as of 6/30/2024 • Cash & Cash Equivalents totaled $142.6 million, or 9.1% of total assets. • Investment Securities totaled $268.8 million, with $171.1 million utilized as collateral for public fund deposits. All securities are classified as available-for-sale and marked to market. • Total borrowings totaled $34.7 million, or 2.2% of total assets and included $20.0 million in FHLB borrowings and $14.7 million in subordinated debt. • The Bank has $603.7 million in available borrowing capacity (FED, FHLB, Other). • Available liquidity covers 337% of uninsured/ non-collateralized deposits.

Loan Composition / Characteristics

CB Financial Services, Inc. (Nasdaq: CBFV) July 2024 Page 17 Loan Portfolio Composition Commercial & Industrial 10% Real Estate- Construction 4% Real Estate- Commercial 43% Real Estate- Residential 32% Consumer 8% Other 3% As of 6/30/2024 Loan Portfolio Detail dollars in millions 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 YoY Growth Annualized YTD Real Estate - Residential $ 338.5 $ 346.5 $ 347.8 $ 346.9 $ 342.7 1.2% (3.0)% Real Estate - Commercial 458.6 466.9 467.2 470.4 458.7 —% (3.6)% Real Estate - Construction 44.5 41.9 43.1 44.3 44.0 (1.1)% 4.2% Commercial & Industrial 102.3 100.9 111.3 103.3 112.4 9.9% 2.0% Consumer 134.8 122.5 111.6 100.6 90.4 (32.9)% (38.4)% Other 22.5 23.9 29.4 30.8 30.5 35.6% 7.4% Total Loans $ 1,101.2 $ 1,102.6 $ 1,110.4 $ 1,096.3 $ 1,078.7 (2.0)% (5.8)% Highlights • Loans decreased $31.5 million, or 2.9%, from December 31, 2023 due primarily from exit of indirect lending. • Year-to-date loan production totaled $64.0 million while loans paid off totaled $62.3 million. • No loans are currently in deferral. • CB continues to focus on disciplined pricing and credit quality standards. • CB remains committed to hiring and retaining experienced commercial bankers.