UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 9, 2024

CAPITAL BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Maryland | 001-38671 | 52-2083046 |

(State or other jurisdiction of incorporation or organization) | (Commission file number) | (IRS Employer Identification No.) |

2275 Research Boulevard, Suite 600, Rockville, Maryland 20850

(Address of principal executive offices) (Zip Code)

(301) 468-8848

Registrant’s telephone number, including area code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☑ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | CBNK | NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On July 9, 2024, Capital Bancorp, Inc. (“CBNK” or “Capital”) received regulatory approval from the Federal Reserve Bank of Richmond, acting on delegated authority from the Board of Governors of the Federal Reserve System, for the proposed merger of Integrated Financial Holdings, Inc. (“IFH”) with and into CBNK.

The proposed mergers of CBNK and IFH and their respective bank subsidiaries remain subject to the approval of the Office of the Comptroller of the Currency, CBNK’s and IFH’s shareholders and other customary closing conditions.

Forward-Looking Statements

This Current Report on Form 8-K include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to Capital’s and IFH’s beliefs, goals, intentions, and expectations regarding the expected timing of completion of the proposed transaction; the proposed transaction and anticipated financial results; and other statements that are not historical facts.

Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” “will,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. These forward-looking statements include, without limitation, those relating to the terms, timing and closing of the proposed transaction.

Additionally, forward‐looking statements speak only as of the date they are made. Capital and IFH do not assume any duty, and do not undertake, to update such forward‐looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise, except as required by law. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in such forward-looking statements as a result of a variety of factors, many of which are beyond the control of Capital and IFH. Such statements are based upon the current beliefs and expectations of the management of Capital and IFH and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could cause actual results to differ materially include, but are not limited to, the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between Capital and IFH; the outcome of any legal proceedings that may be instituted against Capital or IFH; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated (and the risk that required regulatory approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); the ability of Capital and IFH to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of Capital; effects of the announcement, pendency or completion of the proposed transaction on the ability of IFH and Capital to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction and other factors that may affect future results of IFH and Capital; and the other factors discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Capital’s Annual Report on Form 10‐K for the year ended December 31, 2023 and in other reports Capital files with the U.S. Securities and Exchange Commission (the “SEC”).

Additional Information and Where to Find It

In connection with the proposed merger, CBNK filed with the SEC a Registration Statement on Form S-4 (File No. 333- 279900) on May 31, 2024, which was amended on June 21, 2024, and declared effective by the SEC on June 25, 2024 (as amended, the “S-4 Registration Statement”). The S-4 Registration Statement includes the joint proxy statement/prospectus, which has been mailed to CBNK’s and IFH’s shareholders.

The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS AND SECURITY HOLDERS OF IFH AND CNBK AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ THE S-4 REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS

INCLUDED WITHIN THE S-4 REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT IFH, CBNK AND THE PROPOSED MERGER. Investors and security holders are able to obtain a free copy of the S-4 Registration Statement, including the joint proxy statement/prospectus, as well as other relevant documents filed by CBNK with the SEC containing information about IFH and CBNK, without charge, at the SEC’s website (http://www.sec.gov). In addition, copies of documents filed with the SEC by CBNK will be made available free of charge in the “Investor Relations” section of CBNK’s website, https://www.capitalbankmd.com, under the heading “SEC Filings.” However, other than CBNK’s available SEC filings, the information on, or that can be accessible through, CBNK’s website does not constitute a part of, and is not incorporated by reference in, this Current Report on Form 8-K. Written requests for copies of the documents we file with the SEC should be directed to Capital Bancorp, Inc. 2275 Research Boulevard, Suite 600, Rockville, Maryland 20850, Attention: Edward Barry, CEO, telephone: 301-468-8848 or by email to ebarry@capitalbankmd.com.

Participants in Solicitation

IFH, CBNK, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed Merger under the rules of the SEC. Information regarding CBNK’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 2, 2024, and certain other documents filed by CBNK with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed merger and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of these documents may be obtained as described in the preceding paragraph.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | |

| CAPITAL BANCORP, INC. | | |

| | | |

| | | |

| Date: July 10, 2024 | By: | /s/ Jay Walker | |

| | Jay Walker | | |

| | Chief Financial Officer | | |

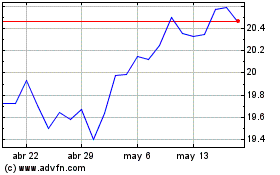

Capital Bancorp (NASDAQ:CBNK)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Capital Bancorp (NASDAQ:CBNK)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024