Cross Country Healthcare, Inc. (the “Company”) (Nasdaq: CCRN)

today announced financial results for its first quarter ended March

31, 2024.

SELECTED FINANCIAL INFORMATION:

Variance

Variance

Q1 2024 vs

Q1 2024 vs

Dollars are in thousands, except per share

amounts

Q1 2024

Q1 2023

Q4 2023

Revenue

$

379,174

(39)

%

(8)

%

Gross profit margin*

20.4

%

(200)

bps

(150)

bps

Net income attributable to common

stockholders

$

2,692

(91)

%

(70)

%

Diluted EPS

$

0.08

$

(0.73)

$

(0.18)

Adjusted EBITDA*

$

15,282

(71)

%

(26)

%

Adjusted EBITDA margin*

4.0

%

(440)

bps

(100)

bps

Adjusted EPS*

$

0.19

$

(0.65)

$

(0.10)

Cash flows provided by operations

$

6,011

(87)

%

(50)

%

* Represents amounts that are not

calculated in accordance with U.S. generally accepted accounting

principles (GAAP) and are referred to as non-GAAP measures. Please

refer to the accompanying discussion below of how these non-GAAP

financial measures are calculated and used under “Non-GAAP

Financial Measures” and tables reconciling these measures to the

closest GAAP measure.

First Quarter Business Highlights

- Revenue, Adjusted EBITDA, and Adjusted EPS all within guidance

ranges

- Physician Staffing and Homecare Staffing experienced

year-over-year revenue growth

- No debt outstanding as of March 31, 2024

- Repurchased approximately 300,000 shares of common stock for

$6.4 million

“Our first quarter results reflect our ability to execute in a

challenging market. We are especially pleased with the momentum we

are seeing in physician staffing, homecare, and education,” said

John A. Martins, President and Chief Executive Officer of Cross

Country Healthcare. He continued, “With near-term headwinds for

contingent nursing labor, we continue to right-size our

infrastructure while managing the business for the long-term. I am

encouraged by the prospects for growth and improved profitability

as we execute our strategy as a tech-enabled workforce solutions

provider.”

First quarter consolidated revenue was $379.2 million, a

decrease of 39% year-over-year and 8% sequentially. Consolidated

gross profit margin was 20.4%, down 200 basis points year-over-year

and 150 basis points sequentially. Net income attributable to

common stockholders was $2.7 million compared to $29.4 million in

the prior year and $9.0 million in the prior quarter. Diluted

earnings per share (EPS) was $0.08 compared to $0.81 in the prior

year and $0.26 in the prior quarter. Adjusted earnings before

interest, taxes, depreciation, and amortization (EBITDA) was $15.3

million, or 4.0% of revenue, as compared with $52.1 million, or

8.4% of revenue, in the prior year, and $20.6 million, or 5.0% of

revenue, in the prior quarter. Adjusted EPS was $0.19, compared to

$0.84 in the prior year and $0.29 in the prior quarter.

Quarterly Business Segment Highlights

Nurse and Allied Staffing

Revenue was $332.2 million, a decrease of 43% year-over-year and

10% sequentially. Contribution income was $27.2 million, a decrease

from $67.2 million year-over-year and $33.9 million sequentially.

Average field contract personnel on a full-time equivalent (FTE)

basis were 9,124 as compared with 12,518 in the prior year and

9,570 in the prior quarter. Revenue per FTE per day was $397

compared to $513 in the prior year and $414 in the prior

quarter.

Physician Staffing

Revenue was $47.0 million, an increase of 16% year-over-year and

flat sequentially. Contribution income was $3.1 million, an

increase from $1.7 million year-over-year and $1.9 million

sequentially. Total days filled were 23,785 as compared with 22,097

in the prior year and 23,578 in the prior quarter. Revenue per day

filled was $1,976 as compared with $1,829 in the prior year and

$1,988 in the prior quarter.

Cash Flow and Balance Sheet Highlights

Net cash provided by operating activities for the three months

ended March 31, 2024 was $6.0 million, as compared to $46.9 million

for the three months ended March 31, 2023 and $12.1 million for the

three months ended December 31, 2023.

During the first quarter, the Company repurchased a total of 0.3

million shares of the Company’s common stock for an aggregate price

of $6.4 million, at an average market price of $20.51 per share. As

of March 31, 2024, the Company had 34.3 million unrestricted shares

outstanding and $70.9 million remaining for share repurchase.

As of March 31, 2024, the Company had $5.2 million in cash and

cash equivalents with no debt outstanding. There were no borrowings

drawn under its revolving senior secured asset-based credit

facility (ABL). As of March 31, 2024, borrowing base availability

under the ABL was $200.1 million, with $186.3 million of

availability net of $13.8 million of letters of credit.

Outlook for Second Quarter 2024

The guidance below applies to management’s expectations for the

second quarter of 2024.

Q2 2024 Range

Year-over-Year

Sequential

Change

Change

Revenue

$330 million - $340 million

(39)% - (37)%

(13)% - (10)%

Adjusted EBITDA*

$10.0 million - $15.0 million

(77)% - (66)%

(35)% - (2)%

Adjusted EPS*

$0.10 - $0.20

$(0.59) - $(0.49)

$(0.09) - $0.01

* Refer to discussion of non-GAAP

financial measures and reconciliation tables below.

The above estimates are based on current management expectations

and, as such, are forward-looking and actual results may differ

materially. The above ranges do not include the potential impact of

any future divestitures, mergers, acquisitions, or other business

combinations, changes in debt structure, or future significant

share repurchases.

INVITATION TO CONFERENCE CALL

The Company will hold its quarterly conference call on

Wednesday, May 1, 2024, at 5:00 P.M. Eastern Time to discuss its

first quarter 2024 financial results. This call will be webcast

live and can be accessed at the Company’s website at

ir.crosscountry.com or by dialing 888-566-1290 from anywhere in the

U.S. or by dialing 773-799-3776 from non-U.S. locations - Passcode:

Cross Country. A replay of the webcast will be available from May

1st through May 15th on the Company’s website and a replay of the

conference call will be available by telephone by calling

800-835-8067 from anywhere in the U.S. or 203-369-3354 from

non-U.S. locations - Passcode: 5204.

ABOUT CROSS COUNTRY HEALTHCARE

Cross Country Healthcare, Inc. is a market-leading, tech-enabled

workforce solutions and advisory firm with 38 years of industry

experience and insight. We help clients tackle complex

labor-related challenges and achieve high-quality outcomes, while

reducing complexity and improving visibility through data-driven

insights. Diversity, equality, and inclusion is at the heart of the

organization’s overall corporate social responsibility program, and

closely aligned with our core values to create a better future for

its people, communities, and its stockholders.

Copies of this and other press releases, as well as additional

information about the Company, can be accessed online at

ir.crosscountry.com. Stockholders and prospective investors can

also register to automatically receive the Company’s press

releases, filings with the Securities and Exchange Commission

(SEC), and other notices by e-mail.

NON-GAAP FINANCIAL MEASURES

This press release and the accompanying financial statement

tables reference non-GAAP financial measures, such as gross profit

margin, adjusted EBITDA, and adjusted EPS. Such non-GAAP financial

measures are provided as additional information and should not be

considered substitutes for, or superior to, financial measures

calculated in accordance with GAAP. Such non-GAAP financial

measures are provided for consistency and comparability to prior

year results; furthermore, management believes such non-GAAP

financial measures are useful to investors when evaluating the

Company’s performance, as such non-GAAP financial measures exclude

certain items that management believes are not indicative of the

Company’s future operating performance. Pro forma measures, if

applicable, are adjusted to include the results of our

acquisitions, and exclude the results of divestments, as if the

transactions occurred in the beginning of the periods mentioned.

Such non-GAAP financial measures may differ materially from the

non-GAAP financial measures used by other companies. The financial

statement tables that accompany this press release include a

reconciliation of each non-GAAP financial measure to the most

directly comparable GAAP financial measure and a more detailed

discussion of each financial measure; as such, the financial

statement tables should be read in conjunction with the

presentation of these non-GAAP financial measures.

In addition, forward-looking adjusted EBITDA and adjusted EPS

for fiscal 2024 exclude potential charges or gains that may be

recorded during the fiscal year, including among other things, the

potential impact of any future divestitures, mergers, acquisitions,

or other business combinations, changes in debt structure, or

future significant share repurchases. We have not attempted to

provide reconciliations of such forward-looking non-GAAP earnings

guidance to the comparable GAAP measure, as permitted by Item

10(e)(1)(i)(B) of Regulation S-K, because the impact and timing of

these potential charges or gains is inherently uncertain and

difficult to predict and is unavailable without unreasonable

efforts. In addition, the Company believes such reconciliations

would imply a degree of precision and certainty that could be

confusing to investors. Such items could have a substantial impact

on GAAP measures of our financial performance.

FORWARD-LOOKING STATEMENTS

In addition to historical information, this press release

contains statements relating to our future results (including

certain projections and business trends) that are “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, Section 21E of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), and the Private Securities

Litigation Reform Act of 1995, and are subject to the “safe harbor”

created by those sections. Forward-looking statements consist of

statements that are predictive in nature and/or depend upon or

refer to future events. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “estimates,” “suggests,” “appears,”

“seeks,” “will,” “could,” and variations of such words and similar

expressions are intended to identify forward-looking statements.

These statements involve known and unknown risks, uncertainties,

and other factors that may cause our actual results and performance

to be materially different from any future results or performance

expressed or implied by these forward-looking statements. These

factors include, but are not limited to, the following: the overall

macroeconomic environment, including increased inflation and

interest rates, demand for the healthcare services we provide, both

nationally and in the regions in which we operate, our ability to

attract and retain qualified nurses, physicians, and other

healthcare personnel, costs and availability of short-term housing

for our travel healthcare professionals, the functioning of our

information systems, the effect of cyber security risks and cyber

incidents on our business, the effect of existing or future

government regulation and federal and state legislative and

enforcement initiatives on our business, including data privacy and

protection laws, social, ethical, and security issues relating to

the use of artificial intelligence, our customers’ ability to pay

us for our services, our ability to successfully implement our

acquisition and development strategies, including our ability to

successfully integrate acquired businesses and realize synergies

from such acquisitions, the effect of liabilities and other claims

asserted against us, the effect of competition in the markets we

serve, our ability to successfully defend the Company, its

subsidiaries, and its officers and directors on the merits of any

lawsuit or determine its potential liability, if any, and other

factors, including, without limitation, the risk factors set forth

in Item 1A. “Risk Factors” in the Company’s Annual Report on Form

10-K for the year ended December 31, 2023, as filed and updated in

our Quarterly Reports on Form 10-Q and other filings with the SEC.

You should consult any further disclosures that the Company makes

on related subjects in its filings with the SEC.

Although we believe that these statements are based upon

reasonable assumptions, we cannot guarantee future results and

readers are cautioned not to place undue reliance on these

forward-looking statements, which reflect management’s opinions

only as of the date of this press release. There can be no

assurance that (i) we have correctly measured or identified all of

the factors affecting our business or the extent of these factors’

likely impact, (ii) the available information with respect to these

factors on which such analysis is based is complete or accurate,

(iii) such analysis is correct, or (iv) our strategy, which is

based in part on this analysis, will be successful. Except as may

be required by law, the Company undertakes no obligation to update

or revise forward-looking statements. All references to “the

Company,” “we,” “us,” “our,” or “Cross Country” in this press

release mean Cross Country Healthcare, Inc. and its consolidated

subsidiaries.

Cross Country Healthcare,

Inc.

Consolidated Statements of

Operations

(Unaudited, amounts in

thousands, except per share data)

Three Months Ended

March 31,

March 31,

December 31,

2024

2023

2023

Revenue from services

$

379,174

$

622,707

$

414,035

Operating expenses:

Direct operating expenses

301,877

483,284

323,546

Selling, general and administrative

expenses

63,252

84,260

67,566

Bad debt expense

1,290

4,908

4,165

Depreciation and amortization

4,642

4,904

4,471

Restructuring costs

938

429

863

Legal and other losses

3,650

1,125

—

Impairment charges

604

—

—

Total operating expenses

376,253

578,910

400,611

Income from operations

2,921

43,797

13,424

Other expenses (income):

Interest expense

462

3,690

586

Other income, net

(1,230

)

(12

)

(131

)

Income before income taxes

3,689

40,119

12,969

Income tax expense

997

10,683

3,931

Net income attributable to common

stockholders

$

2,692

$

29,436

$

9,038

Net income per share attributable to

common stockholders - Basic

$

0.08

$

0.82

$

0.26

Net income per share attributable to

common stockholders - Diluted

$

0.08

$

0.81

$

0.26

Weighted average common shares

outstanding:

Basic

34,216

35,864

34,481

Diluted

34,597

36,560

34,685

Cross Country Healthcare,

Inc.

Reconciliation of Non-GAAP

Financial Measures

(Unaudited, amounts in

thousands, except per share data)

Three Months Ended

March 31,

March 31,

December 31,

2024

2023

2023

Adjusted EBITDA:a

Net income attributable to common

stockholders

$

2,692

$

29,436

$

9,038

Interest expense

462

3,690

586

Income tax expense

997

10,683

3,931

Depreciation and amortization

4,642

4,904

4,471

Acquisition and integration-related

benefits

—

(18

)

—

Restructuring costsb

938

429

863

Legal and other lossesc

3,650

1,125

—

Impairment chargesd

604

—

—

Loss on disposal of fixed assets

—

—

44

Loss on lease termination

—

8

—

Other income, net

(1,230

)

(20

)

(175

)

Equity compensation

1,198

1,775

1,166

System conversion costse

1,329

129

668

Adjusted EBITDAa

$

15,282

$

52,141

$

20,592

Adjusted EBITDA margina

4.0

%

8.4

%

5.0

%

Adjusted EPS:f

Numerator:

Net income attributable to common

stockholders

$

2,692

$

29,436

$

9,038

Non-GAAP adjustments - pretax:

Acquisition and integration-related

benefits

—

(18

)

—

Restructuring costsb

938

429

863

Legal and other lossesc

3,650

1,125

—

Impairment chargesd

604

—

—

Other income, net

(1,115

)

—

—

System conversion costse

1,329

129

668

Tax impact of non-GAAP adjustments

(1,405

)

(427

)

(400

)

Adjusted net income attributable to common

stockholders - non-GAAP

$

6,693

$

30,674

$

10,169

Denominator:

Weighted average common shares - basic,

GAAP

34,216

35,864

34,481

Dilutive impact of share-based

payments

381

696

204

Adjusted weighted average common shares -

diluted, non-GAAP

34,597

36,560

34,685

Reconciliation:

Diluted EPS, GAAP

$

0.08

$

0.81

$

0.26

Non-GAAP adjustments - pretax:

Restructuring costsb

0.02

0.01

0.02

Legal and other lossesc

0.10

0.03

—

Impairment chargesd

0.02

—

—

Other income, net

(0.03

)

—

—

System conversion costse

0.04

—

0.03

Tax impact of non-GAAP adjustments

(0.04

)

(0.01

)

(0.02

)

Adjusted EPS, non-GAAPf

$

0.19

$

0.84

$

0.29

Cross Country Healthcare,

Inc.

Consolidated Balance

Sheets

(Unaudited, amounts in

thousands)

March 31,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

5,242

$

17,094

Accounts receivable, net

357,458

372,352

Income taxes receivable

6,326

6,898

Prepaid expenses

7,616

7,681

Insurance recovery receivable

8,815

9,097

Other current assets

1,861

2,031

Total current assets

387,318

415,153

Property and equipment, net

28,200

27,339

Operating lease right-of-use assets

1,831

2,599

Goodwill

135,430

135,430

Other intangible assets, net

51,742

54,468

Deferred tax assets

6,805

5,954

Insurance recovery receivable

23,120

25,714

Cloud computing

7,209

5,987

Other assets

6,784

6,673

Total assets

$

648,439

$

679,317

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable and accrued expenses

$

68,921

$

85,333

Accrued compensation and benefits

51,606

52,297

Operating lease liabilities

2,362

2,604

Earnout liability

4,100

6,794

Other current liabilities

1,453

1,559

Total current liabilities

128,442

148,587

Operating lease liabilities

2,130

2,663

Accrued claims

34,299

34,853

Earnout liability

—

5,000

Uncertain tax positions

11,339

10,603

Other liabilities

4,039

4,218

Total liabilities

180,249

205,924

Commitments and contingencies

Stockholders’ equity:

Common stock

4

4

Additional paid-in capital

228,525

236,417

Accumulated other comprehensive loss

(1,388

)

(1,385

)

Retained earnings

241,049

238,357

Total stockholders’ equity

468,190

473,393

Total liabilities and stockholders’

equity

$

648,439

$

679,317

Cross Country Healthcare,

Inc.

Segment Datag

(Unaudited, amounts in

thousands)

Three Months Ended

Year-over-Year

Sequential

March 31,

% of

March 31,

% of

December 31,

% of

% change

% change

2024

Total

2023

Total

2023

Total

Fav (Unfav)

Fav (Unfav)

Revenue from services:

Nurse and Allied Staffing

$

332,186

88

%

$

582,302

94

%

$

367,155

89

%

(43

)%

(10

)%

Physician Staffing

46,988

12

%

40,405

6

%

46,880

11

%

16

%

—

%

$

379,174

100

%

$

622,707

100

%

$

414,035

100

%

(39

)%

(8

)%

Contribution income:h

Nurse and Allied Staffing

$

27,183

$

67,169

$

33,901

(60

)%

(20

)%

Physician Staffing

3,138

1,724

1,947

82

%

61

%

30,321

68,893

35,848

(56

)%

(15

)%

Corporate overheadi

17,566

18,656

17,090

6

%

(3

)%

Depreciation and amortization

4,642

4,904

4,471

5

%

(4

)%

Restructuring costsb

938

429

863

(119

)%

(9

)%

Legal and other lossesc

3,650

1,125

—

(224

)%

(100

)%

Impairment chargesd

604

—

—

(100

)%

(100

)%

Other benefits

—

(18

)

—

(100

)%

—

%

Income from operations

$

2,921

$

43,797

$

13,424

(93

)%

(78

)%

Other benefits include acquisition and

integration-related benefits.

Cross Country Healthcare,

Inc.

Summary Condensed Consolidated

Statements of Cash Flows

(Unaudited, amounts in

thousands)

Three Months Ended

March 31,

March 31,

December 31,

2024

2023

2023

Net cash provided by operating

activities

$

6,011

$

46,865

$

12,074

Net cash used in investing activities

(2,210

)

(3,496

)

(2,875

)

Net cash used in financing activities

(15,653

)

(46,681

)

(6,416

)

Effect of exchange rate changes on

cash

—

(1

)

10

Change in cash and cash equivalents

(11,852

)

(3,313

)

2,793

Cash and cash equivalents at beginning of

period

17,094

3,604

14,301

Cash and cash equivalents at end of

period

$

5,242

$

291

$

17,094

Cross Country Healthcare,

Inc.

Other Financial Data

(Unaudited)

Three Months Ended

March 31,

March 31,

December 31,

2024

2023

2023

Revenue from services

$

379,174

$

622,707

$

414,035

Less: Direct operating expenses

301,877

483,284

323,546

Gross profit

$

77,297

$

139,423

$

90,489

Consolidated gross profit marginj

20.4

%

22.4

%

21.9

%

Nurse and Allied

Staffing statistical data:

FTEsk

9,124

12,518

9,570

Average Nurse and Allied Staffing revenue

per FTE per dayl

$

397

$

513

$

414

Physician Staffing

statistical data:

Days filledm

23,785

22,097

23,578

Revenue per day filledn

$

1,976

$

1,829

$

1,988

(a)

Adjusted EBITDA, a non-GAAP financial

measure, is defined as net income (loss) attributable to common

stockholders before interest expense, income tax expense (benefit),

depreciation and amortization, acquisition and integration-related

(benefits) costs, restructuring (benefits) costs, legal and other

losses, impairment charges, gain or loss on derivative, loss on

early extinguishment of debt, gain or loss on disposal of fixed

assets, gain or loss on lease termination, gain or loss on sale of

business, other expense (income), net, equity compensation, and

system conversion costs. Adjusted EBITDA is not and should not be

considered a measure of financial performance under GAAP.

Management presents Adjusted EBITDA because it believes that

Adjusted EBITDA is a useful supplement to net income attributable

to common stockholders as an indicator of operating performance.

Management uses Adjusted EBITDA for planning purposes and as one

performance measure in its incentive programs for certain members

of its management team. Adjusted EBITDA, as defined, closely

matches the operating measure as defined by the Company's credit

facilities. Adjusted EBITDA Margin is calculated by dividing

Adjusted EBITDA by the Company's consolidated revenue.

(b)

Restructuring costs were primarily

comprised of employee termination costs, lease-related exit costs,

and reorganization costs as part of planned cost savings

initiatives.

(c)

Includes legal costs and other settlement

charges as presented on the consolidated statements of operations,

as well as losses pertaining to matters outside the normal course

of operations.

(d)

Impairment charges of $0.6 million for the

three months ended March 31, 2024 were related to right-of-use

assets and related property in connection with vacated leases in

the first quarter of 2024.

(e)

System conversion costs include enterprise

resource planning system costs related to the upgrading and

integrating of our middle and back-office platforms, with certain

development costs capitalized and amortized in accordance with the

Company’s policies, and applicant tracking system costs related to

the Company’s project to replace its legacy system supporting its

travel nurse staffing business.

(f)

Adjusted EPS, a non-GAAP financial

measure, is defined as net income (loss) attributable to common

stockholders per diluted share before the diluted EPS impact of

acquisition and integration-related (benefits) costs, restructuring

(benefits) costs, legal and other losses, impairment charges, gain

or loss on derivative, loss on early extinguishment of debt, gain

or loss on sale of business, system conversion costs, and

nonrecurring income tax adjustments. Adjusted EPS is not and should

not be considered a measure of financial performance under GAAP.

Management presents Adjusted EPS because it believes that Adjusted

EPS is a useful supplement to its reported EPS as an indicator of

operating performance. Management believes Adjusted EPS provides a

more useful comparison of the Company’s underlying business

performance from period to period and is more representative of the

future earnings capacity of the Company than EPS. Quarterly

non-GAAP adjustment may vary due to rounding.

(g)

Segment data is provided in accordance

with the Segment Reporting Topic of the Financial Accounting

Standards Board Accounting Standards Codification.

(h)

Contribution income is defined as income

(loss) from operations before depreciation and amortization,

acquisition and integration-related (benefits) costs, restructuring

(benefits) costs, legal and other losses, impairment charges, and

corporate overhead. Contribution income is a financial measure used

by management when assessing segment performance.

(i)

Corporate overhead includes unallocated

executive leadership and other centralized corporate functional

support costs such as finance, IT, legal, human resources, and

marketing, as well as public company expenses and Company-wide

projects (initiatives).

(j)

Gross profit is defined as revenue from

services less direct operating expenses. The Company’s gross profit

excludes allocated depreciation and amortization expense. Gross

profit margin is calculated by dividing gross profit by revenue

from services.

(k)

FTEs represent the average number of Nurse

and Allied Staffing contract personnel on a full-time equivalent

basis.

(l)

Average revenue per FTE per day is

calculated by dividing Nurse and Allied Staffing revenue, excluding

permanent placement, per FTE by the number of days worked in the

respective periods.

(m)

Days filled is calculated by dividing the

total hours invoiced during the period, including an estimate for

the impact of accrued revenue, by 8 hours.

(n)

Revenue per day filled is calculated by

dividing revenue as reported by days filled for the period

presented.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430440141/en/

Cross Country Healthcare, Inc. William J. Burns, Executive Vice

President & Chief Financial Officer 561-237-2555

wburns@crosscountry.com

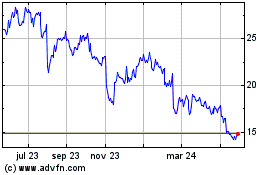

Cross Country Health (NASDAQ:CCRN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

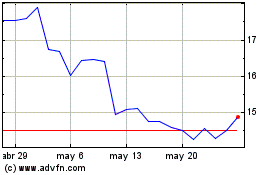

Cross Country Health (NASDAQ:CCRN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025