00018196152023Q2False12-3100018196152023-01-012023-06-300001819615us-gaap:CommonStockMember2023-01-012023-06-300001819615us-gaap:WarrantMember2023-01-012023-06-3000018196152023-08-10xbrli:shares00018196152023-06-30iso4217:USD00018196152022-12-3100018196152023-04-012023-06-3000018196152022-04-012022-06-3000018196152022-01-012022-06-30iso4217:USDxbrli:shares0001819615us-gaap:CommonStockMember2021-12-310001819615us-gaap:AdditionalPaidInCapitalMember2021-12-310001819615us-gaap:RetainedEarningsMember2021-12-3100018196152021-12-310001819615us-gaap:CommonStockMember2022-01-012022-03-310001819615us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-3100018196152022-01-012022-03-310001819615us-gaap:RetainedEarningsMember2022-01-012022-03-310001819615us-gaap:CommonStockMember2022-03-310001819615us-gaap:AdditionalPaidInCapitalMember2022-03-310001819615us-gaap:RetainedEarningsMember2022-03-3100018196152022-03-310001819615us-gaap:CommonStockMember2022-04-012022-06-300001819615us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001819615us-gaap:RetainedEarningsMember2022-04-012022-06-300001819615us-gaap:CommonStockMember2022-06-300001819615us-gaap:AdditionalPaidInCapitalMember2022-06-300001819615us-gaap:RetainedEarningsMember2022-06-3000018196152022-06-300001819615us-gaap:CommonStockMember2022-12-310001819615us-gaap:AdditionalPaidInCapitalMember2022-12-310001819615us-gaap:RetainedEarningsMember2022-12-310001819615us-gaap:CommonStockMember2023-01-012023-03-310001819615us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100018196152023-01-012023-03-310001819615us-gaap:RetainedEarningsMember2023-01-012023-03-310001819615us-gaap:CommonStockMember2023-03-310001819615us-gaap:AdditionalPaidInCapitalMember2023-03-310001819615us-gaap:RetainedEarningsMember2023-03-3100018196152023-03-310001819615us-gaap:CommonStockMember2023-04-012023-06-300001819615us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001819615us-gaap:RetainedEarningsMember2023-04-012023-06-300001819615us-gaap:CommonStockMember2023-06-300001819615us-gaap:AdditionalPaidInCapitalMember2023-06-300001819615us-gaap:RetainedEarningsMember2023-06-300001819615us-gaap:FairValueInputsLevel1Member2023-06-300001819615us-gaap:FairValueInputsLevel2Member2023-06-300001819615us-gaap:FairValueInputsLevel3Member2023-06-300001819615us-gaap:FairValueInputsLevel1Member2022-12-310001819615us-gaap:FairValueInputsLevel2Member2022-12-310001819615us-gaap:FairValueInputsLevel3Member2022-12-310001819615us-gaap:FairValueInputsLevel3Memberus-gaap:EquityMethodInvestmentsMember2022-12-310001819615us-gaap:FairValueInputsLevel3Memberus-gaap:EquityMethodInvestmentsMember2023-01-012023-03-310001819615us-gaap:FairValueInputsLevel3Memberus-gaap:EquityMethodInvestmentsMember2023-03-310001819615us-gaap:FairValueInputsLevel3Memberus-gaap:EquityMethodInvestmentsMember2023-04-012023-06-300001819615us-gaap:FairValueInputsLevel3Memberus-gaap:EquityMethodInvestmentsMember2023-06-300001819615us-gaap:PrivatePlacementMember2022-12-310001819615us-gaap:PrivatePlacementMember2023-01-012023-03-310001819615us-gaap:PrivatePlacementMember2023-03-310001819615us-gaap:PrivatePlacementMember2023-04-012023-06-300001819615us-gaap:PrivatePlacementMember2023-06-300001819615us-gaap:MeasurementInputRiskFreeInterestRateMember2023-06-30xbrli:pure0001819615us-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001819615us-gaap:MeasurementInputPriceVolatilityMember2023-06-300001819615us-gaap:MeasurementInputPriceVolatilityMember2022-12-310001819615us-gaap:MeasurementInputSharePriceMember2023-06-300001819615us-gaap:MeasurementInputSharePriceMember2022-12-310001819615us-gaap:MeasurementInputExercisePriceMember2023-06-300001819615us-gaap:MeasurementInputExercisePriceMember2022-12-310001819615clvr:HarvestedCannabisAndExtractsMember2023-06-300001819615clvr:HarvestedCannabisAndExtractsMember2022-12-310001819615clvr:CannabisExtractsMember2023-06-300001819615clvr:CannabisExtractsMember2022-12-310001819615clvr:OtherInventoryMember2023-06-300001819615clvr:OtherInventoryMember2022-12-310001819615us-gaap:CommonStockMemberclvr:CansativaMember2018-12-210001819615clvr:SeedFinancingRoundMemberclvr:CansativaMember2018-12-21iso4217:EURclvr:tranche0001819615clvr:CansativaMemberclvr:InvestmentTrancheOneMember2018-12-210001819615clvr:SeedFinancingRoundMemberclvr:CansativaMemberclvr:InvestmentTrancheTwoMember2018-12-210001819615clvr:SeedFinancingRoundMemberclvr:InvestmentTrancheThreeMemberclvr:CansativaMember2018-12-210001819615clvr:SeedFinancingRoundMemberclvr:CansativaMemberclvr:InvestmentTrancheOneMember2018-12-210001819615clvr:SeedFinancingRoundMemberclvr:CansativaMember2018-12-210001819615clvr:SeedFinancingRoundMemberus-gaap:PreferredStockMemberclvr:CansativaMember2018-12-21iso4217:EURxbrli:shares0001819615clvr:SeedFinancingRoundMemberclvr:CansativaMember2018-12-212018-12-210001819615clvr:SeedFinancingRoundMemberclvr:CansativaMember2019-01-012019-01-310001819615clvr:SeedFinancingRoundMemberclvr:CansativaMember2019-09-300001819615clvr:SeedFinancingRoundMemberclvr:CansativaMemberclvr:InvestmentTrancheTwoMember2020-01-012020-09-300001819615clvr:SeedFinancingRoundMemberclvr:CansativaMemberclvr:InvestmentTrancheTwoMember2020-09-300001819615clvr:SeedFinancingRoundMemberclvr:CansativaMemberclvr:CansativaEmployeeStockOwnershipPlanESOPMember2020-11-300001819615clvr:SeedFinancingRoundMemberclvr:CansativaMemberclvr:CansativaEmployeeStockOwnershipPlanESOPMember2020-12-010001819615us-gaap:PreferredStockMemberclvr:CansativaMember2021-12-310001819615clvr:SeedFinancingRoundMemberus-gaap:PreferredStockMemberclvr:CansativaMember2020-12-010001819615clvr:SeedFinancingRoundMemberus-gaap:PreferredStockMemberclvr:CansativaMember2021-12-310001819615clvr:CansativaMember2020-12-012020-12-310001819615clvr:CansativaMember2022-04-012022-04-300001819615us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMemberclvr:CansativaMember2022-04-300001819615clvr:CansativaMemberclvr:CansativaEmployeeStockOwnershipPlanESOPMember2022-04-300001819615clvr:SeedFinancingRoundMemberus-gaap:PreferredStockMemberclvr:CansativaMember2020-12-310001819615clvr:CansativaMember2022-04-300001819615clvr:CansativaMember2023-01-012023-06-300001819615clvr:CansativaMember2023-04-012023-06-300001819615clvr:CansativaMember2022-01-012022-06-300001819615clvr:HerbalBrandsIncMember2019-12-310001819615us-gaap:CustomerContractsMember2023-06-300001819615us-gaap:CustomerRelationshipsMember2023-06-300001819615us-gaap:CustomerListsMember2023-06-300001819615us-gaap:TradeNamesMember2023-06-300001819615us-gaap:CustomerContractsMember2022-12-310001819615us-gaap:CustomerRelationshipsMember2022-12-310001819615us-gaap:CustomerListsMember2022-12-310001819615us-gaap:TradeNamesMember2022-12-310001819615us-gaap:LicensingAgreementsMember2022-12-310001819615us-gaap:LicensingAgreementsMember2022-01-012022-12-310001819615clvr:MeasurementInputWeightedAverageCostOfCapitalMemberus-gaap:LicensingAgreementsMemberus-gaap:ValuationTechniqueDiscountedCashFlowMember2022-12-3100018196152022-01-012022-12-310001819615us-gaap:LandMember2023-06-300001819615us-gaap:LandMember2022-12-310001819615clvr:BuildingAndWarehouseMember2023-06-300001819615clvr:BuildingAndWarehouseMember2022-12-310001819615clvr:LaboratoryEquipmentMember2023-06-300001819615clvr:LaboratoryEquipmentMember2022-12-310001819615clvr:AgriculturalEquipmentMember2023-06-300001819615clvr:AgriculturalEquipmentMember2022-12-310001819615us-gaap:ComputerEquipmentMember2023-06-300001819615us-gaap:ComputerEquipmentMember2022-12-310001819615clvr:FurnitureAndAppliancesMember2023-06-300001819615clvr:FurnitureAndAppliancesMember2022-12-310001819615us-gaap:ConstructionInProgressMember2023-06-300001819615us-gaap:ConstructionInProgressMember2022-12-310001819615us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2023-06-300001819615us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-12-310001819615clvr:CleverLeavesPortugalUnipessoalLDAMemberclvr:PortugalDebtMemberus-gaap:ForeignLineOfCreditMember2021-01-310001819615clvr:CleverLeavesPortugalUnipessoalLDAMemberclvr:PortugalDebtMemberclvr:EuroInterbankOfferedRateEuriborMemberus-gaap:ForeignLineOfCreditMember2021-01-012021-01-310001819615clvr:CleverLeavesPortugalUnipessoalLDAMemberclvr:PortugalDebtMemberus-gaap:ForeignLineOfCreditMember2023-04-012023-06-300001819615clvr:CleverLeavesPortugalUnipessoalLDAMemberclvr:PortugalDebtMemberus-gaap:ForeignLineOfCreditMember2022-04-012022-06-300001819615clvr:CleverLeavesPortugalUnipessoalLDAMemberclvr:PortugalDebtMemberus-gaap:ForeignLineOfCreditMember2023-01-012023-06-300001819615clvr:CleverLeavesPortugalUnipessoalLDAMemberclvr:PortugalDebtMemberus-gaap:ForeignLineOfCreditMember2022-01-012022-06-300001819615clvr:CleverLeavesPortugalUnipessoalLDAMemberclvr:PortugalDebtMemberus-gaap:ForeignLineOfCreditMember2023-06-300001819615clvr:CleverLeavesPortugalUnipessoalLDAMemberclvr:PortugalDebtMemberus-gaap:ForeignLineOfCreditMember2022-12-310001819615clvr:EcomedicsSASMemberclvr:ColombiaDebtMemberus-gaap:ForeignLineOfCreditMember2023-06-30iso4217:COP0001819615clvr:EcomedicsSASMemberclvr:ColombiaDebtMembersrt:MinimumMemberus-gaap:ForeignLineOfCreditMember2023-06-300001819615clvr:EcomedicsSASMembersrt:MaximumMemberclvr:ColombiaDebtMemberus-gaap:ForeignLineOfCreditMember2023-06-300001819615clvr:EcomedicsSASMemberclvr:ColombiaDebtMemberus-gaap:ForeignLineOfCreditMember2023-01-012023-06-300001819615clvr:EcomedicsSASMemberclvr:ColombiaDebtMemberus-gaap:ForeignLineOfCreditMember2022-12-310001819615clvr:EquityDistributionAgreementMember2022-01-140001819615clvr:EquityDistributionAgreementMember2023-03-270001819615clvr:AtTheMarketMember2023-01-012023-06-300001819615clvr:AtTheMarketMember2023-04-012023-06-300001819615clvr:AtTheMarketMember2022-01-142023-06-300001819615us-gaap:WarrantMember2023-06-300001819615us-gaap:PrivatePlacementMember2023-06-300001819615us-gaap:CommonStockMembersrt:MinimumMember2023-06-300001819615us-gaap:CommonStockMember2023-01-012023-06-300001819615us-gaap:EmployeeSeveranceMember2022-12-310001819615clvr:ExitAndDisposalActivitiesMember2022-12-310001819615us-gaap:EmployeeSeveranceMember2023-01-012023-06-300001819615clvr:ExitAndDisposalActivitiesMember2023-01-012023-06-300001819615us-gaap:EmployeeSeveranceMember2023-06-300001819615clvr:ExitAndDisposalActivitiesMember2023-06-300001819615us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001819615us-gaap:EmployeeStockOptionMember2022-04-012022-06-300001819615us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001819615us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001819615us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001819615us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300001819615us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001819615us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001819615us-gaap:EmployeeStockOptionMember2023-06-300001819615us-gaap:EmployeeStockOptionMember2022-12-310001819615us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001819615clvr:RestrictedStockUnitsRSUsTimeBasedMember2022-12-310001819615clvr:RestrictedStockUnitsRSUsTimeBasedMember2023-01-012023-06-300001819615clvr:RestrictedStockUnitsRSUsTimeBasedMember2023-06-300001819615clvr:RestrictedStockUnitsRSUsMarketBasedMember2023-01-012023-06-300001819615srt:MinimumMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberclvr:RestrictedStockUnitsRSUsMarketBasedMember2023-06-300001819615us-gaap:ShareBasedCompensationAwardTrancheOneMemberclvr:RestrictedStockUnitsRSUsMarketBasedMember2023-01-012023-06-300001819615srt:MinimumMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberclvr:RestrictedStockUnitsRSUsMarketBasedMember2023-06-300001819615us-gaap:ShareBasedCompensationAwardTrancheTwoMemberclvr:RestrictedStockUnitsRSUsMarketBasedMember2023-01-012023-06-300001819615clvr:RestrictedStockUnitsRSUsMarketBasedMember2023-06-30clvr:installment0001819615clvr:RestrictedStockUnitsRSUsMarketBasedMember2022-12-31clvr:segment0001819615clvr:CannabinoidMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001819615clvr:CannabinoidMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001819615clvr:CannabinoidMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001819615clvr:CannabinoidMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001819615clvr:NonCannabinoidMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001819615clvr:NonCannabinoidMemberus-gaap:OperatingSegmentsMember2022-04-012022-06-300001819615clvr:NonCannabinoidMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001819615clvr:NonCannabinoidMemberus-gaap:OperatingSegmentsMember2022-01-012022-06-300001819615us-gaap:OperatingSegmentsMember2023-04-012023-06-300001819615us-gaap:OperatingSegmentsMember2022-04-012022-06-300001819615us-gaap:OperatingSegmentsMember2023-01-012023-06-300001819615us-gaap:OperatingSegmentsMember2022-01-012022-06-300001819615us-gaap:CorporateNonSegmentMember2023-04-012023-06-300001819615us-gaap:CorporateNonSegmentMember2022-04-012022-06-300001819615us-gaap:CorporateNonSegmentMember2023-01-012023-06-300001819615us-gaap:CorporateNonSegmentMember2022-01-012022-06-300001819615clvr:SalesChannelMassRetailMember2023-04-012023-06-300001819615clvr:SalesChannelMassRetailMember2022-04-012022-06-300001819615clvr:SalesChannelMassRetailMember2023-01-012023-06-300001819615clvr:SalesChannelMassRetailMember2022-01-012022-06-300001819615clvr:SalesChannelSpecialtyHealthAndOtherRetailMember2023-04-012023-06-300001819615clvr:SalesChannelSpecialtyHealthAndOtherRetailMember2022-04-012022-06-300001819615clvr:SalesChannelSpecialtyHealthAndOtherRetailMember2023-01-012023-06-300001819615clvr:SalesChannelSpecialtyHealthAndOtherRetailMember2022-01-012022-06-300001819615us-gaap:SalesChannelThroughIntermediaryMember2023-04-012023-06-300001819615us-gaap:SalesChannelThroughIntermediaryMember2022-04-012022-06-300001819615us-gaap:SalesChannelThroughIntermediaryMember2023-01-012023-06-300001819615us-gaap:SalesChannelThroughIntermediaryMember2022-01-012022-06-300001819615clvr:SalesChannelECommerceMember2023-04-012023-06-300001819615clvr:SalesChannelECommerceMember2022-04-012022-06-300001819615clvr:SalesChannelECommerceMember2023-01-012023-06-300001819615clvr:SalesChannelECommerceMember2022-01-012022-06-300001819615country:US2023-04-012023-06-300001819615country:US2022-04-012022-06-300001819615country:US2023-01-012023-06-300001819615country:US2022-01-012022-06-300001819615country:IL2023-04-012023-06-300001819615country:IL2022-04-012022-06-300001819615country:IL2023-01-012023-06-300001819615country:IL2022-01-012022-06-300001819615country:AU2023-04-012023-06-300001819615country:AU2022-04-012022-06-300001819615country:AU2023-01-012023-06-300001819615country:AU2022-01-012022-06-300001819615country:BR2023-04-012023-06-300001819615country:BR2022-04-012022-06-300001819615country:BR2023-01-012023-06-300001819615country:BR2022-01-012022-06-300001819615country:DE2023-04-012023-06-300001819615country:DE2022-04-012022-06-300001819615country:DE2023-01-012023-06-300001819615country:DE2022-01-012022-06-300001819615clvr:OtherCountriesNotSeparatelyDisclosedMember2023-04-012023-06-300001819615clvr:OtherCountriesNotSeparatelyDisclosedMember2022-04-012022-06-300001819615clvr:OtherCountriesNotSeparatelyDisclosedMember2023-01-012023-06-300001819615clvr:OtherCountriesNotSeparatelyDisclosedMember2022-01-012022-06-300001819615clvr:CustomerAMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-04-012023-06-300001819615clvr:CustomerAMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-04-012022-06-300001819615clvr:CustomerAMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-06-300001819615clvr:CustomerAMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-06-300001819615clvr:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310001819615clvr:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2023-01-012023-06-300001819615clvr:CustomerBMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310001819615clvr:CustomerCMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-06-300001819615us-gaap:CustomerConcentrationRiskMemberclvr:CustomerDMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310001819615us-gaap:CustomerConcentrationRiskMemberclvr:CustomerEMemberus-gaap:AccountsReceivableMember2022-01-012022-12-310001819615us-gaap:CustomerConcentrationRiskMemberclvr:CustomerFMemberus-gaap:AccountsReceivableMember2023-01-012023-06-300001819615clvr:CannabinoidMemberus-gaap:OperatingSegmentsMember2023-06-300001819615clvr:CannabinoidMemberus-gaap:OperatingSegmentsMember2022-12-310001819615clvr:NonCannabinoidMemberus-gaap:OperatingSegmentsMember2023-06-300001819615clvr:NonCannabinoidMemberus-gaap:OperatingSegmentsMember2022-12-310001819615us-gaap:WarrantMember2023-01-012023-06-300001819615us-gaap:WarrantMember2022-01-012022-06-300001819615clvr:CommonSharesEarnoutMember2023-01-012023-06-300001819615clvr:CommonSharesEarnoutMember2022-01-012022-06-300001819615us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001819615us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001819615us-gaap:RestrictedStockMember2023-01-012023-06-300001819615us-gaap:RestrictedStockMember2022-01-012022-06-300001819615srt:MinimumMember2023-06-300001819615srt:MaximumMember2023-06-300001819615clvr:PortugalOperationMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-04-012023-06-300001819615clvr:PortugalOperationMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2022-04-012022-06-300001819615clvr:PortugalOperationMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-01-012023-06-300001819615clvr:PortugalOperationMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2022-01-012022-06-300001819615us-gaap:SubsequentEventMember2023-07-012023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-39820

Clever Leaves Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| British Columbia, Canada | | Not Applicable |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

Bodega 19-B Parque Industrial Tibitoc P.H, Tocancipá - Cundinamarca, Colombia | | N/A |

| (Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code): (561) 634-7430

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

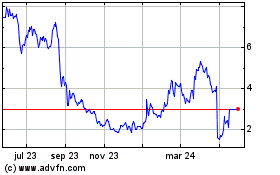

| Common shares without par value | CLVR | The Nasdaq Stock Market LLC |

| Warrants, each warrant exercisable for one common share at an exercise price of $11.50 | CLVRW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ |

| | Smaller reporting company | ☒ | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of registrant’s common shares outstanding as of August 10, 2023 was 45,726,599.

CLEVER LEAVES HOLDINGS INC.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| PART I - FINANCIAL INFORMATION | |

| ITEM 1. | | |

| Condensed Consolidated Statements of Financial Position as of June 30, 2023 and December 31, 2022 | |

| Condensed Consolidated Statements of Operations for the Three and Six months ended June 30, 2023 and 2022 | |

| Condensed Consolidated Statements of Shareholders’ Equity for the Three and Six months ended June 30, 2023 and 2022 | |

| Condensed Consolidated Statements of Cash Flows for the Six months ended June 30, 2023 and 2022 | |

| Notes to Unaudited Condensed Consolidated Financial Statements | |

| | |

| ITEM 2. | | |

| | |

| ITEM 3. | | |

| | |

| ITEM 4. | | |

| | |

| PART II - OTHER INFORMATION | |

| ITEM 1. | | |

| ITEM 1A. | Risk Factors | |

| ITEM 5. | | |

| ITEM 6. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Form 10-Q”) includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. You should not place undue reliance on such statements because they are subject to numerous risks and uncertainties which are difficult to predict and many of which are beyond our control and could cause our actual results to differ from the forward-looking statements. Forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “forecast,” “will,” “expect,” “budget,” “contemplate,” “believe,” “estimate,” “continue,” “project,” “positioned,” “strategy,” “outlook” and similar expressions. You should read statements that contain these words carefully because they:

•discuss future expectations;

•contain projections of future results of operations or financial condition; or

•state other “forward-looking” information.

All such forward-looking statements are based on our current expectations and involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. We believe it is important to communicate our expectations to our security holders. However, there may be future events that we are not able to predict accurately or over which we have no control. The risk factors and cautionary language discussed in this Part I, Item 1A, “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2022 (the “Annual Report” or “2022 Form 10-K”) provide examples of risks, contingencies, uncertainties, and events that may cause our actual results to differ materially from the expectations described by us in such forward-looking statements, including among other things:

•our ability to continue as a going concern;

•our ability to maintain the listing of our securities on Nasdaq;

•changes adversely affecting the industry in which we operate;

•our restructuring plans;

•the availability or terms of future financing;

•our ability to achieve our business strategies;

•general economic conditions, including the ongoing military conflict between Russia and Ukraine (and resulting sanctions) on the global economy, global financial markets and our business;

•regional political and economic conditions, including emerging market conditions;

•the impact and magnitude of rising energy costs;

•the impact and magnitude of inflation and currency fluctuations;

•the regulation and legalization of adult-use, recreational cannabis;

•our ability to retain our key employees; and

•other factors that are more fully discussed in Part I, Item 1A of the "2022 Form 10-K" under the heading “Risk Factors”, and those discussed in other documents we file with the SEC.

These risks could cause actual results to differ materially from those implied by the forward-looking statements contained in this Form 10-Q.

All forward-looking statements included herein attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. These forward-looking statements speak only as of the date of this Form 10-Q. Except to the extent required by applicable laws and regulations, we undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this Form 10-Q or to reflect the occurrence of unanticipated events.

This Form 10-Q contains estimates, projections and other information concerning our industry, our business, and the markets for our products. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources.

ITEM 1. FINANCIAL STATEMENTS

CLEVER LEAVES HOLDINGS INC.

Condensed Consolidated Statements of Financial Position

(Amounts in thousands of U.S. Dollars, except share and per share data)

(Unaudited) | | | | | | | | | | | | | | | | | |

| | | As of | | As of |

| Note | | June 30, 2023 | | December 31, 2022 |

Assets | | | | | |

| Current: | | | | | |

| Cash and cash equivalents | | | $ | 5,077 | | | $ | 12,449 | |

| Restricted cash | | | 64 | | | 439 | |

| Accounts receivable, net | | | 2,590 | | | 2,252 | |

| Prepaids, deposits and other receivables | 6 | | 3,207 | | | 2,708 | |

| | | | | |

| Inventories, net | 5 | | 7,470 | | | 8,399 | |

| Total current assets | | | 18,408 | | | 26,247 | |

| | | | | | |

| Investment – Cansativa | 7 | | 5,777 | | | 5,679 | |

Property, plant and equipment, net of accumulated depreciation of $7,990 and $7,120 for June 30, 2023 and December 31, 2022, respectively | 9 | | 13,094 | | | 13,963 | |

| Assets held for sale - Land | | | 1,500 | | | 1,500 | |

| Intangible assets, net | 8 | | 2,987 | | | 3,354 | |

| | | | | |

| Operating lease right-of-use assets, net | 18 | | 981 | | | 1,303 | |

| Other non-current assets | | | 84 | | | 52 | |

Total Assets | | | $ | 42,831 | | | $ | 52,098 | |

| | | | | | |

Liabilities | | | | | |

| Current: | | | | | |

| Accounts payable | | | $ | 2,300 | | | $ | 2,299 | |

| Accrued expenses and other current liabilities | | | 3,115 | | | 4,238 | |

| | | | | |

| Loans and borrowings, current portion | 10 | | 471 | | | 465 | |

| Warrant liability | | | 168 | | | 113 | |

| Operating lease liabilities, current portion | 18 | | 663 | | | 1,239 | |

| Deferred revenue | | | 845 | | | 1,072 | |

| Total current liabilities | | | 7,562 | | | 9,426 | |

| | | | | |

| Loans and borrowing — long-term | 10 | | 908 | | | 1,065 | |

| | | | | |

| Operating lease liabilities — long-term | 18 | | 389 | | | 1,087 | |

| | | | | |

| Other long-term liabilities | | | 24 | | | 112 | |

Total Liabilities | | | $ | 8,883 | | | $ | 11,690 | |

| | | | | | |

| Contingencies and commitments | | | | | |

| | | | | |

Shareholders’ equity | | | | | |

Preferred shares, without par value, unlimited shares authorized, nil shares issued and outstanding for each of June 30, 2023 and December 31, 2022 | | | — | | | — | |

Common shares, without par value, unlimited shares authorized: 45,704,459 and 43,636,783 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | 11 | | — | | | — | |

| Additional paid-in capital | | | 222,530 | | | 221,313 | |

| Accumulated deficit | | | (188,582) | | | (180,905) | |

Total shareholders' equity | | | 33,948 | | | 40,408 | |

Total liabilities and shareholders' equity | | | $ | 42,831 | | | $ | 52,098 | |

| | | | | |

| | | | | |

See accompanying notes to the condensed consolidated financial statements

CLEVER LEAVES HOLDINGS INC.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Amounts in thousands of U.S. Dollars, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Six Months Ended June 30, |

| Note | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue, net | 16 | | $ | 4,981 | | | $ | 4,100 | | | $ | 8,959 | | | $ | 9,141 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Cost of sales | | | (2,255) | | | (1,619) | | | (3,999) | | | (4,067) | |

| Gross profit | | | 2,726 | | | 2,481 | | | 4,960 | | | 5,074 | |

| | | | | | | | | |

| Expenses | | | | | | | | | |

| General and administrative | 12 | | 4,805 | | | 6,424 | | | 10,172 | | | 13,422 | |

| Sales and marketing | | | 469 | | | 728 | | | 1,018 | | | 1,461 | |

| Research and development | | | 403 | | | 359 | | | 615 | | | 771 | |

| Restructuring expenses | 13 | | — | | | — | | | — | | | 3,842 | |

| | | | | | | | | |

| Depreciation and amortization | | | 224 | | | 318 | | | 460 | | | 644 | |

| Total expenses | | | 5,901 | | | 7,829 | | | 12,265 | | | 20,140 | |

| | | | | | | | | |

| Loss from operations | | | (3,175) | | | (5,348) | | | (7,305) | | | (15,066) | |

| | | | | | | | | |

| Other Expense (Income), net | | | | | | | | | |

| Interest and amortization of debt issuance cost | | | 35 | | | 645 | | | 18 | | | 2,754 | |

| Loss (Gain) on remeasurement of warrant liability | 11 | | 11 | | | (1,323) | | | 55 | | | (1,813) | |

| Gain on investment | 7 | | — | | | (6,851) | | | — | | | (6,851) | |

| Loss on debt extinguishment, net | 10 | | — | | | — | | | — | | | 2,263 | |

| | | | | | | | | |

| Foreign exchange loss | | | 67 | | | 264 | | | 22 | | | 475 | |

| Other (income) expense, net | | | (27) | | | 61 | | | 12 | | | 9 | |

| Total other expenses (income), net | | | 86 | | | (7,204) | | | 107 | | | (3,163) | |

| | | | | | | | | |

| Loss (income) before income taxes and equity investment loss | | | $ | (3,261) | | | $ | 1,856 | | | $ | (7,412) | | | $ | (11,903) | |

| Equity investment share of loss | | | — | | | — | | | — | | | 64 | |

| Loss (income) from continuing operations | | | $ | (3,261) | | | $ | 1,856 | | | $ | (7,412) | | | $ | (11,968) | |

| Loss from discontinued operations | | | (334) | | | (2,902) | | | (264) | | | (5,218) | |

| Net loss | | | $ | (3,595) | | | $ | (1,046) | | | $ | (7,676) | | | $ | (17,186) | |

| Net loss per share: | | | | | | | | | |

| Basic and diluted from continuing operations | 17 | | $ | (0.07) | | | $ | 0.05 | | | $ | (0.17) | | | $ | (0.35) | |

| Basic and diluted from discontinued operations | | | (0.01) | | | (0.08) | | | (0.01) | | | (0.16) | |

| Net loss per share | | | $ | (0.08) | | | $ | (0.03) | | | $ | (0.18) | | | $ | (0.51) | |

| Weighted-average common shares outstanding: | | | 44,866,179 | | | 39,559,793 | | | 44,387,392 | | | 33,792,261 | |

| Basic and diluted | 17 | | (0.08) | | | (0.03) | | | (0.18) | | | (0.51) | |

| | | | | | | | | |

See accompanying notes to the condensed consolidated financial statements.

CLEVER LEAVES HOLDINGS INC.

Condensed Consolidated Statements of Shareholders’ Equity

(Amounts in thousands of U.S. Dollars, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total Shareholders’ Equity |

| | Shares | | Amount | | Amount | | Amount | | Amount |

| Balance at December 31, 2021 | | 26,605,797 | | $ | — | | | $ | 187,510 | | | $ | (114,740) | | | $ | 72,770 | |

| Issuance of common shares, gross | | 11,047,567 | | | — | | | 23,400 | | | — | | | 23,400 | |

| Issuance of common shares upon vesting RSUs | | 247,453 | | | — | | | — | | | — | | | — | |

| Stock option exercise | | 116,112 | | | — | | | 22 | | | — | | | 22 | |

| Stock-based compensation expense | | — | | | — | | | 500 | | | — | | | 500 | |

| Equity issuance costs | | — | | | — | | | (1,177) | | | — | | | (1,177) | |

| Beneficial conversion feature of Convertible Note | | | | — | | | 1,749 | | | — | | | 1,749 | |

| Conversion of Convertible Note to common shares | | 607,000 | | — | | | 1,324 | | | — | | | 1,324 | |

| Net loss | | — | | | — | | | — | | | (16,140) | | | (16,140) | |

| Balance at March 31, 2022 | | 38,623,929 | | $ | — | | | $ | 213,328 | | | $ | (130,880) | | | $ | 82,448 | |

| Issuance of common shares upon vesting RSUs | | 39,898 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | |

| Stock option exercise | | 35,582 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | |

| Stock-based compensation expense | | — | | | — | | | 1,148 | | | — | | | 1,148 | |

| Conversion of Convertible Note to common shares | | 900,000 | | | — | | | 2,039 | | | — | | | 2,039 | |

| Net loss | | — | | | — | | | — | | | (1,046) | | | (1,046) | |

| Balance at June 30, 2022 | | 39,599,409 | | $ | — | | | $ | 216,515 | | | $ | (131,926) | | | $ | 84,589 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Note |

Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total Shareholders’ Equity |

| | Shares | | Amount | | Amount | | Amount | | Amount |

| Balance at December 31, 2022 | | 43,636,783 | | | $ | — | | | $ | 221,313 | | | $ | (180,905) | | | $ | 40,408 | |

| Issuance of common shares upon vesting RSUs | | 370,489 | | | — | | | — | | | — | | | — | |

| Stock-based compensation expense | | — | | | — | | | 468 | | | — | | | 468 | |

| Equity issuance costs | | — | | | — | | | (25) | | | — | | | (25) | |

| Net loss | | — | | | — | | | — | | | (4,081) | | | (4,081) | |

| Balance at March 31, 2023 | | 44,007,272 | | | $ | — | | | $ | 221,756 | | | $ | (184,986) | | | $ | 36,770 | |

| Issuance of common shares upon vesting RSUs | 14 | 137,614 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | |

| Stock-based compensation expense | 12 | — | | | — | | | 433 | | | — | | | 433 | |

| Issuance of common stock - gross | | 1,559,573 | | | — | | | 438 | | | — | | | 438 | |

| Equity issuance costs | | — | | | $ | — | | | (97) | | | $ | — | | | (97) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net loss | | | | | | | | (3,595) | | | (3,595) | |

| Balance at June 30, 2023 | | 45,704,459 | | | $ | — | | | $ | 222,530 | | | $ | (188,582) | | | $ | 33,948 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

See accompanying notes to the condensed consolidated financial statements.

CLEVER LEAVES HOLDINGS INC.

Condensed Consolidated Statements of Cash Flows

(Amounts in thousands of U.S. Dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, | | | | | | | | | | | | | | | | | | | | | |

| | | 2023 | | 2022 | | | | | | | | | | | | | | | | | | | | | |

Cash Flow from Operating Activities: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss from continuing operations | | (7,412) | | | (11,968) | | | | | | | | | | | | | | | | | | | | | | |

| Loss from discontinued operations | | (264) | | | (5,218) | | | | | | | | | | | | | | | | | | | | | | |

| Net loss | | (7,676) | | | (17,186) | | | | | | | | | | | | | | | | | | | | | | |

| Adjustments to reconcile to net cash used in operating activities: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | 1,242 | | | 1,984 | | | | | | | | | | | | | | | | | | | | | | |

| Amortization of debt discount and debt issuance cost | | — | | | 1,949 | | | | | | | | | | | | | | | | | | | | | | |

| Inventory provision | 5 | 326 | | | 2,126 | | | | | | | | | | | | | | | | | | | | | | |

| Restructuring and related costs | 13 | — | | | 3,430 | | | | | | | | | | | | | | | | | | | | | | |

| (Gain) loss on remeasurement of warrant liability | 11 | 55 | | | (1,813) | | | | | | | | | | | | | | | | | | | | | | |

| Loss on disposal of fixed assets | | 72 | | | — | | | | | | | | | | | | | | | | | | | | | | |

| Non-cash lease expense | 18 | 322 | | | 155 | | | | | | | | | | | | | | | | | | | | | | |

| Foreign exchange loss | | 22 | | | 652 | | | | | | | | | | | | | | | | | | | | | | |

| Stock-based compensation expense | 14 | 901 | | | 1,648 | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity investment share of loss | | — | | | 64 | | | | | | | | | | | | | | | | | | | | | | |

| Gain on investment | 7 | — | | | (6,851) | | | | | | | | | | | | | | | | | | | | | | |

| Loss on debt extinguishment, net | 10 | — | | | 2,263 | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Other non-cash expense, net | | — | | | 600 | | | | | | | | | | | | | | | | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Increase) decrease in accounts receivable | | (338) | | | (1,169) | | | | | | | | | | | | | | | | | | | | | | |

| (Increase) in prepaid expenses | 6 | (499) | | | (1,014) | | | | | | | | | | | | | | | | | | | | | | |

| Decrease (increase) in other receivables and other non-current assets | | (34) | | | 178 | | | | | | | | | | | | | | | | | | | | | | |

| (Decrease) in lease liability | 18 | (614) | | | — | | | | | | | | | | | | | | | | | | | | | | |

| (Increase) decrease in inventory | | 602 | | | (3,458) | | | | | | | | | | | | | | | | | | | | | | |

| (Decrease) in accounts payable and other current liabilities | | (2,059) | | | (1,957) | | | | | | | | | | | | | | | | | | | | | | |

| (Decrease) increase in accrued and other non-current liabilities | | (86) | | | (185) | | | | | | | | | | | | | | | | | | | | | | |

| Net cash used in operating activities | | (7,764) | | | (18,584) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Cash Flow from Investing Activities: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Purchase of property, plant and equipment | | (79) | | | (1,601) | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from partial sale of equity method of investment | | — | | | 2,498 | | | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by (used in) investing activities | | (79) | | | 897 | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Cash Flow from Financing Activities: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Repayment of debt | 10 | (257) | | | (22,665) | | | | | | | | | | | | | | | | | | | | | | |

| Other borrowings | | — | | | 73 | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from issuance of shares | 11 | 438 | | | 23,400 | | | | | | | | | | | | | | | | | | | | | | |

| Equity issuance costs | 11 | (123) | | | (1,177) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock option exercise | | — | | | 22 | | | | | | | | | | | | | | | | | | | | | | |

| Net cash (used in) provided by financing activities | | 58 | | | (347) | | | | | | | | | | | | | | | | | | | | | | |

| Effect of exchange rate changes on cash, cash equivalents & restricted cash | | 38 | | | (202) | | | | | | | | | | | | | | | | | | | | | | |

| Decrease in cash, cash equivalents & restricted cash | | (7,747) | | | (18,236) | | | | | | | | | | | | | | | | | | | | | | |

Cash, cash equivalents & restricted cash, beginning of period (a) | | 12,888 | | | 37,699 | | | | | | | | | | | | | | | | | | | | | | |

Cash, cash equivalents & restricted cash, end of period (a) | | 5,141 | | | 19,463 | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

(a) These amounts include restricted cash of $64 and $454 as of June 30, 2023 and June 30, 2022, respectively, which are comprised primarily of cash on deposits for certain lease arrangements.

See accompanying notes to the condensed consolidated financial statements.

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

1. CORPORATE INFORMATION

Clever Leaves Holdings Inc., (the “Company”) is a multi-national U.S. based holding company focused on cannabinoids. In addition to the cannabinoid business, the Company is also engaged in the non-cannabinoid business of nutraceutical and other natural remedies and wellness products. The Company is incorporated under the Business Corporations Act of British Columbia, Canada.

The mailing address of the Company's principal executive office is Bodega 19-B Parque Industrial Tibitoc P.H, Tocancipá - Cundinamarca, Colombia.

2. BASIS OF PRESENTATION

The accompanying interim condensed consolidated financial statements (“Financial Statements”) are unaudited. These Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial statements and with the instructions to Form 10-Q and Article 10 of regulation S-X. Accordingly, they do not include all disclosures required for annual financial statements. These Financial Statements reflect all adjustments, which, in the opinion of the management, are necessary for a fair presentation of the results for the interim periods presented. All significant intercompany transactions and balances have been eliminated. All adjustments were of a normal recurring nature. Interim results are not necessarily indicative of results to be expected for the full year.

The Financial Statements include the accounts of the Company and its wholly owned subsidiaries. Company’s subsidiaries and respective ownership percentage has not changed from the year ended December 31, 2022.

Discontinued Operations

During the fiscal year 2022, the Company undertook various strategic initiatives aimed at reducing costs, improving organizational efficiency, and optimizing its business model. As part of these initiatives, the Company implemented several restructuring activities.

Additionally, in December 2022, the Company made the decision to shut down its Portugal operations in order to preserve cash. In January 2023, the Company further approved the wind-down of its entire Portuguese operations to enhance operating margin and focus solely on cannabis cultivation and production in Colombia. As part of this restructuring plan, the Company has completed the cessation of its Portuguese flower cultivation, post-harvest processes, and manufacturing activities and is expected to fully shut down the remainder of its operations by the end of the second quarter of 2023. Subsequently, the post harvest facility has been sold and preparations are currently underway for the sale process of the farm land with the objective of concluding the sale during the fiscal year ending December 31, 2023.

Considering the nature and extent of the restructuring activities undertaken, in accordance with Accounting Standards Codification (ASC) 205, Presentation of Financial Statements, the Company has determined that these operations meet the "discontinued operations" criteria as of June 30, 2023. As a result, the condensed consolidated statements of financial position, the condensed consolidated statements of operations, the condensed consolidated statements of cash flows, and the notes to the consolidated financial statements have been restated for all periods presented to reflect the discontinuation of these operations in accordance with ASC 205.

Please refer to Note 19, "Discontinued Operations," for further details regarding the discontinued businesses. The discussion in the notes to these financial statements, unless otherwise noted, pertains solely to the Company's continuing operations.

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

Going Concern

These interim condensed financial statements have been prepared in accordance with U.S. GAAP, which assumes that the Company will be able to meet its obligations and continue its operations for the next twelve months from the date of issue.

As shown in the accompanying interim condensed financial statements, the Company had an accumulated deficit as of June 30, 2023, as well as operating losses and negative cash flows from operations since inception and expects to continue to incur net losses for the foreseeable future until such time that it can generate significant revenue from the sale of its available inventories.

At June 30, 2023, the Company had cash and cash equivalents of $5,077. As of June 30, 2023, the Company’s current working capital, anticipated operating expenses and net losses, and the uncertainties surrounding its ability to raise additional capital as needed, raise substantial doubt as to whether existing cash and cash equivalents will be sufficient to meet its obligations as they come due within twelve months from the date the consolidated financial statements were issued. The consolidated financial statements do not include any adjustments for the recovery and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The Company’s ability to execute its operating plans through 2023 and beyond depends on its ability to obtain additional funding, which may include several initiatives such as raising capital, reducing working capital, and monetizing non-core assets, to meet planned growth requirements and to fund future operations, which may not be available on acceptable terms, or at all.

Principles of Consolidation

The Financial Statements include the accounts of the Company and its consolidated subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Company's significant accounting policies are disclosed in its audited consolidated financial statements for the year ended December 31, 2022, included in the Annual Report. Except as noted below, there have been no other changes in the Company's significant accounting policies as discussed in the Annual Report.

Use of Accounting Estimates

The preparation of these Financial Statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported and disclosed in the Financial Statements and accompanying notes in the reported period. These estimates include, but are not limited to, allowance for doubtful accounts, inventory valuation, determination of fair value of stock-based awards and estimate of incremental borrowing rate for determining the present value of future lease payments, intangible assets, useful lives of property and equipment, revenue recognition and income taxes and related tax asset valuation allowances. While the significant estimates made by management in the preparation of the consolidated financial statements are reasonable, prudent, and evaluated on an ongoing basis, actual results may differ materially from those estimates.

Recently Adopted Accounting Pronouncements

ASU No. 2016-13- Credit Losses on Financial Instruments (Topic 326)

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). ASU 2016-13 replaces the existing incurred loss impairment model with a forward-looking expected credit loss model which will result in earlier recognition of credit losses for certain financial instruments and financial assets. For trade receivables, we are required to estimate lifetime expected credit losses. ASU 2016-13 is effective for the Company’s fiscal year beginning January 1, 2023. We have adopted the provisions of Accounting Standards

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

Update (ASU) No. 2016-13, Credit Losses on Financial Instruments (Topic 326). After careful consideration and analysis, we have determined that the adoption of this pronouncement has not had a material impact on our financial reporting. Therefore, our financial statements and disclosures have not been significantly affected by the adoption of this standard.

4. FAIR VALUE MEASUREMENTS

The following table provides the fair value measurement hierarchy of the Company’s assets and liabilities, except for those assets and liabilities that are short term in nature and approximate the fair values, as of the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| | | | | | | | |

| As of June 30, 2023 | | | | | | | | |

| Assets: | | | | | | | | |

| Investment – Cansativa | | — | | | — | | | 5,777 | | | 5,777 | |

| Total Assets | | $ | — | | | $ | — | | | $ | 5,777 | | | $ | 5,777 | |

| Liabilities: | | | | | | | | |

| Loans and borrowings | | — | | | 1,379 | | | — | | | 1,379 | |

| Warrant liability | | — | | | — | | | 168 | | | 168 | |

| | | | | | | | |

| Total Liabilities | | $ | — | | | $ | 1,379 | | | $ | 168 | | | $ | 1,547 | |

| | | | | | | | |

| As of December 31, 2022 | | | | | | | | |

| Assets: | | | | | | | | |

| Investment – Cansativa | | — | | | — | | | 5,679 | | | 5,679 | |

| Total Assets | | $ | — | | | $ | — | | | $ | 5,679 | | | $ | 5,679 | |

| Liabilities: | | | | | | | | |

| Loans and borrowings | | — | | | 1,530 | | | — | | | 1,530 | |

| Warrant liability | | — | | | — | | | 113 | | | 113 | |

| Total Liabilities | | $ | — | | | $ | 1,530 | | | $ | 113 | | | $ | 1,643 | |

Investment – Cansativa

Our investment in Cansativa's equity securities does not have a “readily determinable fair value,” or is not traded in a verifiable public market. The Company accounted for this investment under ASC 321, Investments - Equity Securities. The Company used the practical expedient available under ASU 2016-01, the cost method investment which presents and carries this investment using the alternative measurement method which is cost minus impairment, if any, plus or minus changes resulting from observable price changes in “orderly transactions,” as defined in ASC 321, for the identical or a similar investment of the same issuer. The Company periodically reviews the investments for other than temporary declines in fair value below cost and more frequently when events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. As of June 30, 2023, the carrying value of its cost method investments were recoverable in all material respects. For more information, refer to Note 7 to our Financial Statements for the six months ended June 30, 2023.

The following table provides a summary of changes in fair value of the Company’s level 3 investments for the six months ended June 30, 2023:

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

| | | | | |

| Level 3 |

| Balance, December 31, 2022 | $ | 5,679 | |

| Change in value due to foreign exchange gain | 74 | |

| Balance, March 31, 2023 | $ | 5,753 | |

| |

| Change in value due to foreign exchange gain | $ | 24 | |

| Balance, June 30, 2023 | $ | 5,777 | |

During the six months ended June 30, 2023, there were no transfers between fair value measurement levels.

The change in fair value of warrant liabilities related to private warrants during the six months ended June 30, 2023, is as follows:

| | | | | |

| Private Placement Warrants: | Total Warrant Liability |

| Warrant liability at December 31, 2022 | $ | 113 | |

| Change in fair value of warrant liability | 44 | |

| Warrant liabilities at March 31, 2023 | $ | 157 | |

| Change in fair value of warrant liability | 11 | |

| Warrant liabilities at June 30, 2023 | $ | 168 | |

| |

| |

The Company determined the fair value of its private warrants using the Monte Carlo simulation model. The following assumptions were used to determine the fair value of the Private Warrants as of June 30, 2023 and December 31, 2022:

| | | | | | | | | | | |

| As of |

| June 30,

2023 | | December 31,

2022 |

| Risk-free interest rate | 4.69% | | 4.23% |

| Expected volatility | 145% | | 105% |

| Share Price | $0.20 | | $0.31 |

| Exercise Price | $11.50 | | $11.50 |

| Expiration date | December 18, 2025 | | December 18, 2025 |

•The risk-free interest rate assumptions are based on U.S. dollar zero curve derived from swap rates at the valuation date, with a term to maturity matching the remaining term of warrants.

•The expected volatility assumptions are based on average of historical volatility based on comparable industry volatilities of public warrants.

5. INVENTORIES, NET

Inventories are comprised of the following items as of the periods presented:

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| Raw materials | $ | 1,063 | | | $ | 1,204 | |

Work in progress – harvested cannabis and extracts | 141 | | | 21 | |

Finished goods – cannabis extracts | 5,806 | | | 6,703 | |

Finished goods – other | 460 | | | 471 | |

Total | $ | 7,470 | | | $ | 8,399 | |

During the three and six months ended June 30, 2023 the Company recorded inventory provisions for approximately $205 and $326, respectively, to cost of sales to write-down obsolete inventories. During the three and six months ended June 30, 2022, the Company recorded inventory provisions for approximately $236 and $548, respectively, to cost of sales to write-down

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

obsolete inventory.

6. PREPAID, DEPOSITS AND OTHER RECEIVABLES

Prepaid and advances are comprised of the following items as of the periods presented:

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| Prepaid expenses | $ | 1,155 | | | $ | 590 | |

| Indirect tax receivables | 1,981 | | | 2,007 | |

| Deposits | 52 | | | 51 | |

| Other receivable and advances | 19 | | | 60 | |

Total | $ | 3,207 | | | $ | 2,708 | |

Prepaid expenses and deposits represent amounts paid upfront to vendors for director and officer's insurance, security deposits and supplies.

7. INVESTMENTS

Cansativa

On December 21, 2018, the Company, through its subsidiary Northern Swan Deutschland Holdings, Inc., entered into a seed investment agreement with the existing stockholders of Cansativa GmbH (“Cansativa”), a German limited liability company primarily focused on the import and sale of cannabis products for medical use and related supplements and nutraceuticals. Prior to the Company’s investment, Cansativa’s registered and fully paid-in share capital amounted to 26,318 common shares. Under the investment agreement, the Company has agreed with the existing stockholders to invest up to EUR 7,000 in Cansativa in three separate tranches of, respectively, EUR 1,000, EUR 3,000 and up to a further EUR 3,000. The first EUR 1,000 (specifically, EUR 999.92, approximately $1,075, or “Seed Financing Round”) was invested in Cansativa to subscribe for 3,096 newly issued preferred voting shares at EUR 322.97 per preferred share, and as cash contributions from the Company to Cansativa. The seed EUR 322.97 per share price was based on a fully diluted pre-money valuation for Cansativa of EUR 8,500, and the increase of Cansativa’s registered share capital by the 3,096 preferred shares in the Seed Financing Round provided the Company with 10.53% of the total equity ownership of Cansativa. The Company paid the seed investment subscription by, first, an initial nominal payment of EUR 3.1, (i.e., EUR 1.00 per share) upon signing the investment agreement to demonstrate the Company’s intent to invest, and the remainder of EUR 996.82 was settled in January 2019 to officially close the investment deal after certain closing conditions have been met by the existing stockholders and Cansativa. The Company accounted for its investment in Cansativa using the equity accounting method, due to the Company's significant influence, in accordance with ASC 323, Investments — Equity Method and Joint Ventures.

The Company recorded its investment in Cansativa at the cost basis of an aggregated amount of EUR 999.92, approximately $1,075, which is comprised of EUR 3.10 for the initial nominal amount of the Seed Financing Round and EUR 996.82 for the remaining Seed Financing Round (i.e., Capital Reserve Payment), with no transaction costs.

In accordance with the seed investment agreement, in September 2019, the Company made an additional investment of approximately EUR 650, or approximately $722, for 2,138 shares in Cansativa, thereby increasing its equity ownership to 16.6% of the book value of Cansativa’s net assets of approximately EUR 1,233, and approximately EUR 1,122 of equity method goodwill as Cansativa was still in the process of getting the licenses and expanding its operations. As of September 30, 2020, the balance of Tranche 2 option expired un-exercised and as a result the Company recognized a loss on investment of approximately $370 in its Statement of Operations and Comprehensive Loss and the carrying value of the Tranche 2 option was reduced to nil.

In December 2020, Cansativa allocated shares of its common stock to a newly installed employee-stock ownership plan (“ESOP”). As a result of the ESOP installment, the Company’s equity ownership of Cansativa, on a fully-diluted basis, decreased from 16.59% to 15.80% of the book value of Cansativa’s net assets. Additionally, Cansativa raised additional capital through the issuance of Series A preferred stock (“Cansativa Series A Shares”) to a third-party investor at a per share price of

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

EUR 543.31. As a result of the Series A Share issuance, the Company’s equity ownership of Cansativa, on a fully diluted basis, decreased from 15.80% to 14.22% of the book value of Cansativa’s net assets. The Company accounted for the transaction as a proportionate sale of ownership share and recognized a gain of approximately $211 in its consolidated statement of operations within loss on investments line. This change did not impact the equity method classification.

In April 2022, the Company sold 1,586 shares in Cansativa to an unrelated third-party for approximately EUR 2,300.

Additionally Cansativa issued 10,184 series B and 992 ESOP shares. As a result, the Company's equity ownership of Cansativa, on a fully diluted basis, decreased from 14.22% to 7.6% of the book value of Cansativa's net assets. Furthermore, the Company relinquished the board seat, indicating that the Company's influence was no longer "significant", to which the equity method of accounting was applicable. The Company started to account for this investment under ASC 321, Investments – Equity Securities. The Company utilized the practical expedient under ASC 321 as the investment does not qualify for the practical expedient under ASC 820 and there is no readily determinable fair value for these privately held shares of Cansativa on a recurring basis.

At the time of the sale, the Company compared the transaction value of the shares sold to the carrying value of shares sold and recognized a gain of $1,983. Immediately following the sale, the Company then remeasured its retained interest which resulted in an additional gain of $4,868. No gain or loss on investments was recorded in other income in the Consolidated Statements of Operations during the three and six months ended June 30, 2023. Using the measurement alternative, as defined in ASC 321, the Company will remeasure the value of its retained interest if and when additional sales of Cansativa shares occur with third parties. For the six months ended June 30, 2023 and 2022, the Company’s share of net losses from the investment were $nil and $64, respectively.

8. INTANGIBLE ASSETS, NET

As part of the Herbal Brand acquisition in 2019, the Company acquired finite-lived intangible assets with a gross value of approximately $7,091. During the three months ended June 30, 2023 and 2022 the Company recorded $175 and $191, respectively, of amortization related to its finite-lived intangible assets. During the six months ended June 30, 2023 and 2022 the Company recorded $366 and $382, respectively, of amortization related to its finite-lived intangible assets.The following tables present details of the Company’s total intangible assets as of June 30, 2023 and December 31, 2022. The value of product formulation intangible asset is included in the value of Brand: | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2023 |

| | Gross

Carrying

Amount | | Accumulated

Amortization | | Net

Carrying

Amount | | Weighted-

Average

Useful Life

(in Years) |

Finite-lived intangible assets: | | | | | | | |

| Customer contracts | $ | 925 | | | $ | 925 | | | $ | — | | | 0.0 |

| Customer relationships | 1,000 | | | 745 | | | 255 | | | 2.8 |

| Customer list | 650 | | | 542 | | | 107 | | | 0.8 |

| Trade name | 4,516 | | | 1,891 | | | 2,625 | | | 5.8 |

| Total finite-lived intangible assets | $ | 7,091 | | | $ | 4,103 | | | $ | 2,987 | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2022 |

| | Gross

Carrying

Amount | | Accumulated

Amortization | | Net

Carrying

Amount | | Weighted-

Average

Useful Life

(in Years) |

Finite-lived intangible assets: | | | | | | | |

| Customer contracts | $ | 925 | | | $ | 925 | | | $ | — | | | 0.0 |

| Customer relationships | 1,000 | | | 669 | | | 331 | | | 3.0 |

| Customer list | 650 | | | 478 | | | 172 | | | 1.3 |

| Trade name | 4,516 | | | 1,665 | | | 2,851 | | | 6.3 |

| Total finite-lived intangible assets | $ | 7,091 | | | $ | 3,737 | | | $ | 3,354 | | | |

| | | | | | | | |

Indefinite-lived intangible assets: | | | | | | | |

| Licenses | $ | 19,000 | | | N/A | | $ | 19,000 | | | |

| Impairment Charge | $ | (19,000) | | | N/A | | $ | (19,000) | | | |

| Total indefinite-lived intangible assets | $ | — | | | | | $ | — | | | |

| | | | | | | |

| Total intangible assets | $ | 7,091 | | | $ | 3,737 | | | $ | 3,354 | | | |

Annual Impairment Testing

In accordance with ASC Topic 350, “Intangibles – Goodwill and Other,” the Company performs its annual impairment test as

of December 31 of each year. As part of the review, the Company has performed a qualitative assessment to determine whether indicators of impairment existed, along with considering, among other factors, the financial performance, industry conditions, as well as microeconomic developments. The Company also reviews intangibles for impairment whenever events or changes in circumstances indicate that the carrying value of its intangibles may not be recoverable. After the close of each interim quarter,

management assesses whether any indicators of impairment exist requiring the Company to perform an interim goodwill and other intangible assets impairment analysis.

Impairment Testing - Finite-Lived Intangibles

In conjunction with the 2022 annual impairment testing, the Company reviewed finite-lived intangible assets for impairment. In performing such review, the Company makes judgments about the recoverability of purchased finite lived intangible assets whenever events or changes in circumstances indicate that an impairment may exist. The Company recognizes an impairment if the carrying amount of the long-lived asset group exceeds the Company’s estimate of the asset group’s undiscounted future cash flows. For the six months ended June 30 2023, no impairment was recognized related to the carrying value of any of the Company's finite lived intangible assets. The Company will perform an impairment test at fiscal year ending December 31, 2023.

Impairment Testing - Indefinite-Lived Intangibles

In 2022, due to the continued decline in the Company’s stock price and the projected revenues falling behind target, the Company performed an interim impairment assessment on its indefinite-lived intangible assets, consisting of cannabis related licenses for its Colombian operations. Significant assumptions used in the impairment analysis include financial projections of free cash flow (including assumptions about revenue projections, regulations, operating margins, capital requirements and income taxes), long-term growth rates for determining terminal value beyond the discretely forecasted periods and discount rates. Utilizing a discounted cash flow model with a weighted average cost of capital (“WACC”) of 24%, the Company performed the assessment and recognized an impairment charge of $19,000 along with the related deferred tax liability write-off of $6,650 for the year ended December 31, 2022. As a result of this recognition in 2022, no indefinite-lived intangible assets exist as of June 30, 2023.

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

Amortization Expense

The following table reflects the estimated future amortization expense for each period presented for the Company’s finite-lived intangible assets as of June 30, 2023:

| | | | | |

| Estimated

Amortization

Expense |

| 2023 | $ | 336 | |

| 2024 | 585 | |

| 2025 | 541 | |

| 2026 | 482 | |

| 2027 | 452 | |

| Thereafter | 591 | |

| Total | $ | 2,987 | |

9. PROPERTY, PLANT AND EQUIPMENT, NET

Property, plant and equipment, net consisted of the following:

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| Land | $ | 1,806 | | | $ | 1,806 | |

| Building & warehouse | 7,736 | | | 7,658 | |

| Laboratory equipment | 6,426 | | | 6,416 | |

| Agricultural equipment | 1,480 | | | 1,477 | |

| Computer equipment | 1,397 | | | 1,397 | |

| Furniture & appliances | 785 | | | 785 | |

| Construction in progress | 130 | | | 240 | |

| Other | 1,324 | | | 1,304 | |

| Property, plant and equipment, gross | 21,084 | | | 21,083 | |

| Less: accumulated depreciation | (7,990) | | | (7,120) | |

| Property, plant and equipment, net | $ | 13,094 | | | $ | 13,963 | |

10. DEBT

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

Loans and borrowings, current portion | $ | 471 | | | $ | 465 | |

| Loans and borrowings, non-current portion | 908 | | | 1,065 | |

Total debt | $ | 1,379 | | | $ | 1,530 | |

Portugal Debt

In January 2021, Clever Leaves Portugal Unipessoal LDA borrowed €1,000 ($1,213) (the "Portugal Debt"), from a local lender (the "Portugal Lender") under the terms of its credit line agreement. The Portugal Debt pays interest quarterly at a rate of Euribor plus 3.0 percentage points. For the three months ended June 30, 2023 and 2022, the company recognized interest expense of approximately €10 ($11) and €7 ($8), respectively, and repaid principal of approximately €63 ($68) and €63 ($67),

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

respectively, of the Portugal Debt in accordance with the terms of the loan agreement. For the six months ended June 30, 2023 and 2022, the company recognized interest expense of approximately €20 ($21) and €15 ($17), respectively, and repaid principal of approximately €125 ($134) and €125 ($137), respectively, of the Portugal Debt in accordance with the terms of the loan agreement. As of June 30, 2023 and December 31, 2022, the outstanding principal balance of the Portugal Debt was €625 ($671) and €875 ($1,076), respectively.

Colombia Debt

Ecomedics S.A.S. has entered into loan agreements with multiple local lenders (collectively, the "Colombia Debt"), under which the Company borrowed approximately COP$5,305,800 ($1,295) of mainly working capital loans. The working capital loans are secured by mortgage of our farm land in Colombia as collateral. These loans bear interest at a range of 10.96% to 12.25% per annum denominated in Colombian pesos. The first payment of the principal and interest will be repaid six months after receiving the loan. After the first payment, the principal and interest will be repaid semi-annually. For the period ended June 30, 2023 and December 31, 2022, the outstanding principal balance was approximately COP$3,390,173 ($708) and COP$3,471,576 ($725), respectively.

11. CAPITAL STOCK

Common Shares

As of June 30, 2023 and December 31, 2022, a total of 45,704,459 and 43,636,783 common shares were issued and outstanding, respectively. The increase in outstanding shares was primarily the result of shares issued under the ATM. See Equity Distribution Agreement disclosed below.

Equity Distribution Agreement

On January 14, 2022, the Company entered into an Equity Distribution Agreement (the “Equity Distribution Agreement”) with Canaccord Genuity LLC, as sales agent (the “Agent”). Under the terms of the Equity Distribution Agreement, the Company may issue and sell its common shares, without par value, having an aggregate offering price of up to $50,000 from time to time through the Agent. The issuance and sale of the common shares under the Equity Distribution Agreement have been made, and any such future sales will be made, pursuant to the Company’s effective registration statement on Form S-3 (File No. 333-262183), which includes an “at-the-market” (“ATM”) offering prospectus supplement (the "Prospectus Supplement"), as amended from time to time.

Following the filing of the 2022 Form 10-K, we are subject to the limitations under General Instruction I.B.6. of Form S-3. As such, we filed Amendment No. 3 to the Prospectus Supplement, updating our proposed maximum offering amount based on the aggregate market value of our outstanding common shares held by non-affiliates as of March 27, 2023. On such date our public float was $22,548, which is calculated based on 40,996,523 of our common shares outstanding held by non-affiliates at a price of $0.55 per share. This calculation of our public float reduced our proposed offering amount to up to $7,516. If our public float increases such that we may sell additional amounts under the Equity Distribution Agreement and the Prospectus Supplement, we will file another amendment to the Prospectus Supplement prior to making additional sales.

For the three and six months ended June 30, 2023, 1,559,573 shares and 1,559,573 shares, respectively were sold for total gross proceeds of $438 pursuant to the ATM offering and $123 of equity issuance costs.

As of June 30, 2023, the Company had issued and sold 11,047,567 shares pursuant to the ATM offering, for aggregate net proceeds of $22,223, which consisted of gross proceeds of $23,400 and $1,177 of equity issuance costs.

Warrants

As of June 30, 2023, the Company had 12,877,361 of its public warrants classified as a component of equity and 4,900,000 of its private warrants recognized as liability. Each warrant entitles the holder to purchase one common share at an exercise price

CLEVER LEAVES HOLDINGS INC.

Notes to the Unaudited Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars, except share and per share amounts and where otherwise noted)

of $11.50 per share commencing 30 days after the closing of the Business Combination and will expire on December 18, 2025, at 5:00 p.m., New York City time, or earlier upon redemption. Once the warrants are exercisable, the Company may redeem the outstanding public warrants at a price of $0.01 per warrant if the last reported sales price of the Company’s common shares equals or exceeds $18.00 per share (as adjusted for share splits, share capitalizations, reorganizations, recapitalizations and the like) for any 20 trading days within a 30 trading day period ending on the third trading day prior to the date on which the Company will send the notice of redemption to the warrant holders. The private warrants were issued in the same form as the public warrants, but they (i) are not redeemable by the Company and (ii) may be exercised for cash or on a cashless basis at the holder’s option, in either case as long as they are held by the initial purchasers or their permitted transferees (as defined in the warrant agreement). Once a private warrant is transferred to a holder other than an affiliate or permitted transferee, it is treated as a public warrant for all purposes. The terms of the warrants may be amended in a manner that may be adverse to holders with the approval of the holders of at least a majority 50.1% of the then outstanding warrants.

In accordance to ASC 815, certain provisions of private warrants that do not meet the criteria for equity treatment are recorded as liabilities with the offset to additional paid-in capital and are measured at fair value at inception and at each reporting period in accordance with ASC 820, Fair Value Measurement, with changes in fair value recognized in the statement of operations and comprehensive loss in the period of change.