Clever Leaves Holdings Inc. (NASDAQ: CLVR, CLVRW) (“Clever Leaves”

or the “Company”), a global medicinal cannabis company, is

reporting financial and operating results for the fourth quarter

and full year ended December 31, 2023. All financial

information is provided in US dollars unless otherwise indicated.

“Throughout 2023, we executed on our strategic

initiatives to refine our commercial and production operations, as

well as optimize our capital efficiency and cost structure,” said

Andres Fajardo, CEO of Clever Leaves. “We continued to support

demand for our cannabinoid products in Australia and Brazil,

resulting in a 39% year-over-year increase in our cannabinoid

revenue for the full year, and we maintained progress with new

strain development.

“Reflecting our continued cost optimization

efforts, we drove year-over-year general and administrative expense

reductions of 26% for the fourth quarter and 24% for the full year.

Our year-end cash balance also improved to $6.9 million compared to

$6.5 million at the end of the third quarter, benefited by the

October 2023 sale of our remaining stake in Cansativa. Subsequent

to the end of the fourth quarter, we completed the $1.5 million

sale of our Portuguese farm assets. As we progress into 2024, we

remain focused on driving further capital preservation and

operational efficiencies.”

Fourth Quarter 2023 Summary vs. Same Year-Ago

Quarter1

- Revenue in the fourth quarter of

2023 increased 5% to $4.6 million compared to $4.4 million for the

same period in 2022. The increase was driven by an improvement in

cannabinoid segment revenues, which increased 29% to $2.0 million

compared to $1.6 million for the same period in 2022. The

year-over-year growth in cannabinoid segment revenues was largely

due to continued sales strength in Brazil and Australia.

Non-cannabinoid revenues were $2.6 million compared to $2.8 million

for the same period in 2022.

- All-in cost per gram of dry flower

was $0.55, compared to $6.76 for the same period in 2022. All-in

cost per gram in the year-ago period reflects the Company’s

significantly reduced agricultural output, along with ongoing

extraction and processing costs, at its Colombian operations. In

the fourth quarter of 2023, the Company increased its harvest to

1,693 kilograms of dry flower compared to 89 kilograms in the

year-ago quarter, with crops comprising both CBD and hemp inventory

for extraction and THC flower for export.

- Gross loss, including $4.2 million

in cost of sales (before inventory provision) and a $0.8 million

inventory provision, was $(0.3) million, compared to a $0.8 million

gross profit for the same period in 2022, which included $2.6

million in cost of sales (before inventory provision) and a $0.9

million inventory provision. Adjusted gross profit (a non-GAAP

financial measure defined and reconciled herein), which excluded

such inventory provisions, was $0.4 million compared to $1.8

million for the same period in 2022.

- Gross margin, which included such

inventory provisions, was (7.5)% compared to 19.2% for the same

period in 2022. Adjusted gross margin (a non-GAAP financial measure

defined and reconciled herein), which excluded inventory

provisions, was 9.1% compared to 40.0% for the same period in

2022.

- Operating expenses in the fourth

quarter of 2023 improved to $4.6 million compared to $8.4 million

for the same period in 2022 driven by cost-cutting measures and

$2.7 million of non-recurring restructuring expenses incurred in

the same period in 2022.

- Net loss was $5.1 million compared

to a net loss of $28.8 million for the same period in 2022. Net

loss in the fourth quarter of 2022 included a $21.2 million loss

from discontinued operations related to the Company’s wind-down

process in Portugal, along with the aforementioned $2.7 million

non-recurring restructuring expenses.

- Adjusted EBITDA (a non-GAAP

financial measure defined and reconciled herein) was flat

year-over-year at $(4.6) million.

- Cash, cash equivalents and

restricted cash were $6.9 million at December 31, 2023, compared to

$12.9 million at December 31, 2022. The decrease was primarily due

to continued working capital needs and operating losses. The

Company’s year-end cash balance reflects the $1.9 million in

proceeds received from the sale of its remaining stake in Cansativa

in October 2023. For the year ended December 31, 2023, the Company

issued and sold 253,898 shares (on a post-Reverse Share Split

basis) pursuant to its at-the-market (“ATM”) offering, for

aggregate net proceeds of $1.1 million.

- No shares were sold pursuant to the

ATM offering during the three months ended December 31, 2023.

________________________1 Due to the cessation

of the Company’s production operations in Portugal, as well as the

ongoing wind-down process for these operations, Clever Leaves has

determined that these operations meet the "discontinued operations"

criteria as of March 31, 2023, in accordance with Accounting

Standards Codification (ASC) 205, Presentation of Financial

Statements. As a result, the Company’s Consolidated Balance Sheets

and Consolidated Statements of Operations, and the notes to the

Consolidated Financial Statements, have been restated for all

periods presented to reflect the discontinuation of these

operations in accordance with ASC 205. For additional detail on

this presentation, please refer to the Company’s Form 10-K for the

fiscal period ended December 31, 2023.

Fajardo continued: “Within our commercial

strategy, we have driven both extract and flower sales in

Australia, as well as expanded extract sales in Brazil with our

approved products under RDC 327. Alongside this traction, however,

we have continued to experience variability related to the timing

and issuance of Brazilian quotas, along with order stoppages in

Israel resulting from the current geopolitical conflict. We are

continuing to work toward developing inroads to the European

markets, adapting to an evolving regulatory structure in Germany

and our early pathways to the United Kingdom. Most recently, we

announced a partnership with an award-winning Dutch seed bank,

Paradise Seeds, to develop and register high performance cannabis

cultivars at our Colombian facilities.

“We have also maintained our steadfast

commitment to strengthening our cannabinoid portfolio and broader

operational infrastructure. As we announced earlier this year,

Clever Leaves was granted Australian GMP certification for cannabis

products by Australia’s Therapeutic Goods Administration, which

authorizes us to manufacture cannabis products for Australian

patients and adds to our significant library of global GMP

certifications. Significantly, the recent sale of our farm assets

in Portugal marked the completion of our wind-down process in the

country, allowing us to focus on further streamlining our Colombian

production.

“Our strategy remains focused on our core set of

international cannabinoid markets, our Colombian production

efficiencies, and our efforts to preserve and improve cash

liquidity. We will maintain our work on each of these fronts as we

navigate a constantly evolving global operating environment.”

Full Year 2023 Summary vs.

2022

- Revenue increased 6% to $17.4

million compared to $16.4 million in 2022. Cannabinoid revenue

increased 39% to $6.6 million compared to $4.7 million, and

non-cannabinoid revenue was $10.9 million compared to $11.7

million.

- All-in cost per gram of dry flower

was $0.75 compared to $0.36 in 2022. The increase was primarily

driven by the Company’s significantly reduced agricultural output

in Colombia in the prior year through the first quarter of 2023,

along with changes in cultivation techniques to improve flower

quality and organoleptic properties. Cost per gram during the year

also reflects more stringent market and regulatory requirements,

along with ongoing extraction and processing costs at the Company’s

Colombian operations.

- Gross profit was $6.6 million,

which included a $1.4 million inventory provision, compared to $7.2

million in 2022, which included a $2.0 million inventory provision.

Adjusted gross profit, which excluded such inventory provisions,

was $7.9 million compared to $9.2 million in 2022.

- Gross margin, which included such

inventory provision of $1.4 million, was 37.6% compared to 44.0% in

2022, which included such inventory provision of $2.0 million.

Adjusted gross margin, which excluded such inventory provisions,

was 45.4% compared to 56.3% in 2022.

- Operating expenses improved to

$22.2 million compared to $54.1 million in 2022. Operating expenses

in the prior year included a $19.0 million intangible asset

impairment charge the Company recorded on its cannabis-related

licenses in Colombia during the third quarter of 2022, along with

$6.4 million in restructuring expenses.

- Net loss was $17.9 million compared

to a net loss of $66.2 million in 2022. Net loss in 2023 includes a

$3.7 million loss on investment related to the fourth quarter sale

of the Company’s remaining Cansativa stake. Net loss in the prior

year included the aforementioned $19.0 million intangible asset

impairment charge and $6.4 million in restructuring expenses, along

with a $6.9 million gain on investment related to the sale of

Cansativa shares to an unrelated third-party and revaluation of the

Company's retained interest of the shares held as of December 31,

2022.

- Adjusted EBITDA (a non-GAAP

financial measure defined and reconciled herein) improved to

$(12.4) million compared to $(16.3) million in 2022.

Sale of Non-Cannabinoid Herbal Brands

BusinessOn March 21, 2024, Clever Leaves and a wholly

owned Company subsidiary, NS US Holdings, Inc. (the “Seller”),

entered into a stock purchase agreement with KAC Investments LLC

(the “Buyer”). Pursuant to this agreement, the Company sold its

non-cannabinoid business segment, comprising the Company’s wholly

owned subsidiary, Herbal Brands, Inc. ("HBI”).

The sale transaction was completed on March 21,

2024 for a purchase price of $8.02 million, comprising $7.02

million in cash paid on the closing date and the issuance of a

senior secured promissory note and security agreement in the

original principal amount of $1.00 million (the “Note and Security

Agreement”).

The Note and Security Agreement was issued by

the Buyer in favor of the Seller and accrues interest at seven and

one-half percent (7.50%) per annum. Interest is payable quarterly,

in cash, until the March 21, 2025 maturity date. The Seller also

expects to receive $0.19 million in additional proceeds related to

the sale of HBI’s manufacturing equipment, which preceded the March

21 transaction closing date.

Fajardo concluded: “Through completing this

transaction, we aim to focus our operations solely on our

cannabinoid business, as well as point our ongoing capital and cost

optimization initiatives in this direction. We would like to thank

Joe Jacober and the entire HBI team for their significant

contributions and years of partnership with Clever Leaves, and we

wish them all the best in their next endeavors.”

For more details on the transaction and

associated payment terms, please refer to the Company’s related

disclosure on Form 8-K, filed on March 27, 2024.

About Clever Leaves Holdings

Inc.Clever Leaves is a global medical cannabis company.

Its operations in Colombia produce EU GMP cannabinoid active

pharmaceutical ingredients (API) and finished products in flower

and extract form to a growing base of B2B customers around the

globe. Clever Leaves aims to disrupt the traditional cannabis

production industry by leveraging environmentally sustainable,

ESG-friendly, industrial-scale and low-cost production methods,

with the world’s most stringent pharmaceutical quality

certifications. Clever Leaves announces material information to the

public through a variety of means, including filings with the U.S.

Securities and Exchange Commission (the “SEC”), press releases,

public conference calls, and its website

(https://cleverleaves.com). Clever Leaves uses these channels, as

well as social media, including its Twitter account

(@clever_leaves), and its LinkedIn page

(https://www.linkedin.com/company/clever-leaves), to communicate

with investors and the public about Clever Leaves, its products,

and other matters. Therefore, Clever Leaves encourages investors,

the media, and others interested in Clever Leaves to review the

information it makes public in these locations, as such information

could be deemed to be material information. Information on or that

can be accessed through Clever Leaves’ websites or these social

media channels is not part of this release, and references to

Clever Leaves’ website addresses and social media channels are

inactive textual references only.

Non-GAAP Financial MeasuresIn

this press release, Clever Leaves refers to certain non-GAAP

financial measures including Adjusted EBITDA, Adjusted Gross Profit

and Adjusted Gross Margin. Adjusted EBITDA, Adjusted Gross Profit

and Adjusted Gross Margin do not have standardized meanings

prescribed by GAAP and are therefore unlikely to be comparable to

similar measures presented by other companies. Adjusted EBITDA is

defined as income/loss from continuing operations before interest,

taxes, depreciation and amortization, share-based compensation

expense, restructuring expenses, foreign exchange gain/loss,

gains/losses on the early extinguishment of debt, gain/loss on

remeasurement of warrant liability, equity investment share of

gain/loss, other expense/income and income/loss from discontinued

operations. Adjusted Gross Profit (and the related Adjusted Gross

Margin measure) is defined as gross profit excluding inventory

provision. Adjusted EBITDA, Adjusted Gross Profit and Adjusted

Gross Margin also exclude the impact of certain non-recurring items

that are not directly attributable to the underlying operating

performance. Clever Leaves considers Adjusted EBITDA, Adjusted

Gross Profit and Adjusted Gross Margin to be meaningful indicators

of the performance of its core business. Adjusted EBITDA, Adjusted

Gross Profit and Adjusted Gross Margin should neither be considered

in isolation nor as a substitute for the financial measures

prepared in accordance with U.S. GAAP. For reconciliations of

Adjusted EBITDA, Adjusted Gross Profit and Adjusted Gross Margin to

the most directly comparable U.S. GAAP measures, see the relevant

schedules provided with this press release. We have not provided or

reconciled the non-GAAP forward-looking information to their

corresponding GAAP measures because the exact amounts for these

items are not currently determinable without unreasonable efforts

but may be significant.

Forward-Looking Statements This

press release includes certain statements that are not historical

facts but are forward-looking statements for purposes of the safe

harbor provisions under the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

are accompanied by words such as “aim,” “anticipate,” “believe,”

“can,” “continue,” “could,” “estimate,” “evolve,” “expect,”

“forecast,” “future,” “guidance,” “intend,” “may,” “opportunity,”

“outlook,” “pipeline,” “plan,” “predict,” “potential,” “projected,”

“seek,” “seem,” “should,” “will,” “would” and similar expressions

(or the negative versions of such words or expressions) that

predict or indicate future events or trends or that are not

statements of historical matters. Such forward-looking statements

are subject to risks and uncertainties, which could cause actual

results to differ from the forward-looking statements. Important

factors that may affect actual results or the achievability of the

Company’s expectations include, but are not limited to: (i) our

ability to continue as a going concern; (ii) our ability to

maintain the listing of our securities on Nasdaq; (iii) our ability

to implement our restructuring initiatives; (iv) expectations with

respect to future operating and financial performance and growth,

including if or when Clever Leaves will become profitable; (v)

Clever Leaves’ ability to execute its business plans and strategy

and to receive regulatory approvals (including its goals in its

five key markets and goals to expand in Australia and the United

Kingdom); (vi) Clever Leaves’ ability to capitalize on expected

market opportunities, including the timing and extent to which

cannabis is legalized in various jurisdictions; (vii) global

economic and business conditions, including recent economic

sanctions against Russia and their effects on the global economy;

(viii) geopolitical events (including the ongoing military conflict

between Russia and Ukraine as well as the war between Israel and

Hamas), natural disasters, acts of God and pandemics, including the

economic and operational disruptions; (ix) regulatory developments

in key markets for the Company's products, including international

regulatory agency coordination and increased quality standards

imposed by certain health regulatory agencies, and failure to

otherwise comply with laws and regulations; (x) uncertainty with

respect to the requirements applicable to certain cannabis products

as well as the permissibility of sample shipments, and other risks

and uncertainties; (xi) consumer, legislative, and regulatory

sentiment or perception regarding Clever Leaves’ products; (xii)

lack of regulatory approval and market acceptance of Clever Leaves’

new products which may impede its ability to successfully

commercialize its products; (xiii) the extent to which Clever

Leaves’ is able to monetize its existing THC market quota within

Colombia; (xiv) demand for Clever Leaves’ products and Clever

Leaves’ ability to meet demand for its products and negotiate

agreements with existing and new customers; (xv) developing product

enhancements and formulations with commercial value and appeal;

(xvi) product liability claims exposure; (xvii) lack of a history

and experience operating a business on a large scale and across

multiple jurisdictions; (xviii) limited experience operating as a

public company; (xix) changes in currency exchange rates and

interest rates; (xx) weather and agricultural conditions and their

impact on the Company’s cultivation and construction plans, (xxi)

Clever Leaves’ ability to hire and retain skilled personnel in the

jurisdictions where it operates; (xxii) Clever Leaves’ ability to

remediate material weaknesses in its internal control cover

financial reporting and to develop and maintain effective internal

and disclosure controls; (xxiii) potential litigation; (xxiv)

access to additional financing; and (xxv) completion of our

construction initiatives on time and on budget. The foregoing list

of factors is not exclusive. Additional information concerning

certain of these and other risk factors is contained in Clever

Leaves’ most recent filings with the SEC. All subsequent written

and oral forward-looking statements concerning Clever Leaves and

attributable to Clever Leaves or any person acting on its behalf

are expressly qualified in their entirety by the cautionary

statements above. Readers are cautioned not to place undue reliance

upon any forward-looking statements, which speak only as of the

date made. Clever Leaves expressly disclaims any obligations or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in its expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based.

Clever Leaves Investor

Inquiries:Cody Slach or Jackie KeshnerGateway Group,

Inc.+1-949-574-3860CLVR@gateway-grp.com

|

|

|

CLEVER LEAVES HOLDINGS INC. |

|

Consolidated Statements of Financial Position |

|

(Amounts in thousands of U.S. Dollars, except share and per share

data) |

|

|

|

|

(Audited) |

|

|

December 31, 2023 |

|

December 31, 2022 |

|

Assets |

|

|

|

|

Current: |

|

|

|

|

Cash and cash equivalents |

$ |

6,831 |

|

|

$ |

12,449 |

|

|

Restricted cash |

|

70 |

|

|

|

439 |

|

|

Accounts receivable, net |

|

907 |

|

|

|

2,252 |

|

|

Prepaids, deposits and other receivables |

|

1,649 |

|

|

|

2,708 |

|

|

Inventories, net |

|

4,483 |

|

|

|

8,399 |

|

|

Total current assets |

|

13,940 |

|

|

|

26,247 |

|

|

|

|

|

|

|

Investment – Cansativa |

|

- |

|

|

|

5,679 |

|

|

Property, plant and equipment, net |

|

12,321 |

|

|

|

13,963 |

|

|

Asset held for sale - Land |

|

1,500 |

|

|

|

1,500 |

|

|

Intangible assets, net |

|

2,653 |

|

|

|

3,354 |

|

|

Operating lease right-of-use assets, net |

|

829 |

|

|

|

1,303 |

|

|

Other non-current assets |

|

- |

|

|

|

52 |

|

|

Total Assets |

$ |

31,243 |

|

|

$ |

52,098 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

Current: |

|

|

|

|

Accounts payable |

|

2,063 |

|

|

|

2,299 |

|

|

Accrued expenses and other current liabilities |

|

2,844 |

|

|

|

4,238 |

|

|

Loans and borrowings, current portion |

|

498 |

|

|

|

465 |

|

|

Warrant liability |

|

- |

|

|

|

113 |

|

|

Operating lease liabilities, current portion |

|

386 |

|

|

|

1,239 |

|

|

Deferred revenue |

|

20 |

|

|

|

1,072 |

|

|

Total current liabilities |

$ |

5,811 |

|

|

$ |

9,426 |

|

|

Loans and borrowings |

|

720 |

|

|

|

1,065 |

|

|

Operating lease liabilities - Long-term |

|

483 |

|

|

|

1,087 |

|

|

Other long-term liabilities |

|

12 |

|

|

|

112 |

|

|

Total Liabilities |

$ |

7,026 |

|

|

$ |

11,690 |

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

|

|

Additional paid-in capital |

|

223,021 |

|

|

|

221,313 |

|

|

Accumulated deficit |

|

(198,804 |

) |

|

|

(180,905 |

) |

|

Total shareholders' equity |

|

24,217 |

|

|

|

40,408 |

|

|

Total liabilities and shareholders' equity |

$ |

31,243 |

|

|

$ |

52,098 |

|

|

|

|

|

|

|

CLEVER LEAVES HOLDINGS INC. |

|

Consolidated Statements of Operations and Comprehensive

Loss |

|

(Amounts in thousands of U.S. Dollars, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

(Audited) |

|

|

|

For the three months endedDecember 31, |

|

For the twelve months endedDecember 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue, net |

|

$ |

4,638 |

|

|

$ |

4,402 |

|

|

$ |

17,417 |

|

|

$ |

16,410 |

|

|

Cost of sales |

|

|

(4,984 |

) |

|

|

(3,558 |

) |

|

|

(10,861 |

) |

|

|

(9,193 |

) |

|

Gross Profit |

|

|

(346 |

) |

|

|

844 |

|

|

|

6,556 |

|

|

|

7,217 |

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

General and administrative |

|

|

3,666 |

|

|

|

4,965 |

|

|

|

17,993 |

|

|

|

23,830 |

|

|

Sales and marketing |

|

|

436 |

|

|

|

(178 |

) |

|

|

2,036 |

|

|

|

1,897 |

|

|

Research and development |

|

|

233 |

|

|

|

605 |

|

|

|

1,140 |

|

|

|

1,719 |

|

|

Restructuring expenses |

|

|

- |

|

|

|

2,688 |

|

|

|

- |

|

|

|

6,449 |

|

|

Intangible asset impairment |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

19,000 |

|

|

Depreciation and amortization |

|

|

231 |

|

|

|

291 |

|

|

|

981 |

|

|

|

1,241 |

|

|

Total expenses |

|

|

4,566 |

|

|

|

8,371 |

|

|

|

22,150 |

|

|

|

54,136 |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(4,912 |

) |

|

|

(7,527 |

) |

|

|

(15,594 |

) |

|

|

(46,919 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other Expense (Income), Net |

|

|

|

|

|

|

|

|

|

Interest expense and amortization of debt issuance cost |

|

|

23 |

|

|

|

(24 |

) |

|

|

46 |

|

|

|

2,672 |

|

|

Gain on remeasurement of warrant liability |

|

|

(108 |

) |

|

|

(83 |

) |

|

|

(113 |

) |

|

|

(2,092 |

) |

|

Loss (Gain) on investment |

|

|

33 |

|

|

|

- |

|

|

|

3,738 |

|

|

|

(6,851 |

) |

|

Loss on debt extinguishment, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,263 |

|

|

Foreign exchange loss |

|

|

136 |

|

|

|

(181 |

) |

|

|

433 |

|

|

|

963 |

|

|

Other expense, net |

|

|

50 |

|

|

|

109 |

|

|

|

31 |

|

|

|

220 |

|

|

Total other expenses (income), net |

|

|

134 |

|

|

|

(179 |

) |

|

|

4,135 |

|

|

|

(2,825 |

) |

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes and equity investment

loss |

|

|

(5,046 |

) |

|

|

(7,348 |

) |

|

|

(19,729 |

) |

|

|

(44,094 |

) |

|

Equity investment share of loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

64 |

|

|

Income tax provision |

|

|

68 |

|

|

|

296 |

|

|

|

68 |

|

|

|

296 |

|

|

Deferred Income Tax recovery |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(6,650 |

) |

|

Loss from continuing operations |

|

|

(5,114 |

) |

|

|

(7,644 |

) |

|

|

(19,797 |

) |

|

|

(37,804 |

) |

|

Income (Loss) from discontinued operations |

|

|

29 |

|

|

|

(21,172 |

) |

|

|

1,898 |

|

|

|

(28,361 |

) |

|

Net loss |

|

$ |

(5,085 |

) |

|

$ |

(28,816 |

) |

|

|

(17,899 |

) |

|

$ |

(66,165 |

) |

|

Net loss attributable to non-controlling interest |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

Net loss attributable to Clever Leaves Holdings Inc. common

shareholders |

|

$ |

(5,085 |

) |

|

$ |

(28,816 |

) |

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

Basic and diluted from continuing operations |

|

$ |

(2.96 |

) |

|

$ |

(5.26 |

) |

|

$ |

(12.63 |

) |

|

$ |

(29.54 |

) |

|

Basic and diluted from discontinued operations |

|

$ |

0.02 |

|

|

$ |

(14.56 |

) |

|

$ |

1.21 |

|

|

$ |

(22.16 |

) |

|

Net loss per share |

|

$ |

(2.95 |

) |

|

$ |

(19.82 |

) |

|

$ |

(11.42 |

) |

|

$ |

(51.70 |

) |

|

Weighted-average common shares outstanding - basic and

diluted |

|

|

1,726,215 |

|

|

|

1,453,751 |

|

|

|

1,567,601 |

|

|

|

1,279,746 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLEVER LEAVES HOLDINGS INC. |

|

Consolidated Statements of Cash Flows |

|

(Amounts in thousands of U.S. Dollars) |

|

(Audited) |

|

|

|

|

|

|

|

For the Twelve months ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

Cash Flow from Operating Activities: |

|

|

|

|

Loss from continuing operations |

$ |

(19,797 |

) |

|

$ |

(37,804 |

) |

|

Gain (Loss) from discontinued operations |

|

1,898 |

|

|

|

(28,361 |

) |

|

Net loss |

$ |

(17,899 |

) |

|

$ |

(66,165 |

) |

|

Adjustments to reconcile to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

|

2,374 |

|

|

|

3,672 |

|

|

Amortization of debt discount and debt issuance cost |

|

- |

|

|

|

1,949 |

|

|

Gain on sale of fixed assets |

|

(2,862 |

) |

|

|

- |

|

|

Inventory provision |

|

1,359 |

|

|

|

4,736 |

|

|

Restructuring and related costs |

|

- |

|

|

|

25,809 |

|

|

Gain on remeasurement of warrant liability |

|

(113 |

) |

|

|

(2,092 |

) |

|

Intangible asset Impairment |

|

- |

|

|

|

19,000 |

|

|

Deferred Tax Recovery |

|

- |

|

|

|

(6,650 |

) |

|

Foreign exchange loss |

|

468 |

|

|

|

1,129 |

|

|

Share-based compensation expense |

|

818 |

|

|

|

2,343 |

|

|

Amortization of right of use assets |

|

474 |

|

|

|

- |

|

|

Loss on equity method investment, net |

|

- |

|

|

|

64 |

|

|

Loss/(gain) on investment |

|

3,738 |

|

|

|

(6,851 |

) |

|

Loss on debt extinguishment, net |

|

- |

|

|

|

2,263 |

|

|

Other non-cash expense, net |

|

- |

|

|

|

727 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Decrease (Increase) in accounts receivable |

|

1,345 |

|

|

|

(278 |

) |

|

Decrease in prepaid expenses & other receivables |

|

809 |

|

|

|

190 |

|

|

Decrease in other receivable and other non-current assets |

|

52 |

|

|

|

538 |

|

|

(Decrease) in lease liability |

|

(588 |

) |

|

|

- |

|

|

Decrease (Increase) in inventory |

|

2,556 |

|

|

|

(4,453 |

) |

|

(Decrease) in accounts payable and other current liabilities |

|

(2,886 |

) |

|

|

(4,749 |

) |

|

(Decrease) in deferred revenue |

|

(1,052 |

) |

|

|

- |

|

|

(Decrease) in accrued and other non-current liabilities |

|

(101 |

) |

|

|

(248 |

) |

|

Net cash used in operating activities |

|

(11,508 |

) |

|

|

(29,066 |

) |

|

Cash Flow from Investing Activities: |

|

|

|

|

Proceeds from sale of assets |

|

2,862 |

|

|

|

- |

|

|

Purchase of property, plant and equipment |

|

(31 |

) |

|

|

(1,306 |

) |

|

Proceeds from sale of investments |

|

1,863 |

|

|

|

2,498 |

|

|

Net cash provided by investing activities |

|

4,694 |

|

|

|

1,192 |

|

|

Cash Flow From Financing Activities: |

|

|

|

|

Repayment of debt |

|

(484 |

) |

|

|

(23,131 |

) |

|

Other borrowings |

|

- |

|

|

|

73 |

|

|

Proceeds from issuance of shares |

|

1,339 |

|

|

|

27,686 |

|

|

Equity issuance costs |

|

(199 |

) |

|

|

(1,361 |

) |

|

Stock option exercise |

|

- |

|

|

|

22 |

|

|

Net cash provided by financing activities |

$ |

656 |

|

|

$ |

3,289 |

|

|

Effect of exchange rate changes on cash, cash equivalents &

restricted cash |

|

171 |

|

|

|

(226 |

) |

|

Decrease in cash, cash equivalents & restricted cash |

$ |

(5,987 |

) |

|

$ |

(24,811 |

) |

|

Cash, cash equivalents & restricted cash, beginning of

period |

|

12,888 |

|

|

|

37,699 |

|

|

Cash, cash equivalents & restricted cash, end of

period |

$ |

6,901 |

|

|

$ |

12,888 |

|

|

|

|

|

|

|

CLEVER LEAVES HOLDINGS INC. |

|

Adjusted EBITDA Reconciliation (Non-GAAP

Measure) |

|

(Amounts in thousands of U.S. Dollars) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net Loss |

|

(5,085 |

) |

|

(28,816 |

) |

|

(17,899 |

) |

|

(66,165 |

) |

|

Loss (Income) from discontinued operations |

|

(30 |

) |

|

21,172 |

|

|

(1,898 |

) |

|

28,361 |

|

|

Gain on remeasurement of warrant liability |

|

(108 |

) |

|

(83 |

) |

|

(113 |

) |

|

(2,092 |

) |

|

Share-based compensation |

|

(136 |

) |

|

(263 |

) |

|

818 |

|

|

2,343 |

|

|

Restructuring expenses |

|

- |

|

|

2,688 |

|

|

- |

|

|

6,449 |

|

|

Depreciation and amortization |

|

441 |

|

|

534 |

|

|

2,374 |

|

|

2,856 |

|

|

Interest expense and amortization of debt issuance costs |

|

23 |

|

|

(24 |

) |

|

46 |

|

|

2,672 |

|

|

Foreign exchange loss (gain) |

|

137 |

|

|

(181 |

) |

|

433 |

|

|

963 |

|

|

Loss/(gain) on investments |

|

33 |

|

|

- |

|

|

3,738 |

|

|

(6,851 |

) |

|

Intangible Asset Impairment |

|

- |

|

|

- |

|

|

- |

|

|

19,000 |

|

|

Deferred Tax recovery |

|

- |

|

|

- |

|

|

- |

|

|

(6,650 |

) |

|

Loss on debt extinguishment, net |

|

- |

|

|

- |

|

|

- |

|

|

2,263 |

|

|

Equity investment share of loss |

|

- |

|

|

- |

|

|

- |

|

|

64 |

|

|

Other expense, net |

|

50 |

|

|

109 |

|

|

31 |

|

|

220 |

|

|

Income tax provision |

|

68 |

|

|

296 |

|

|

68 |

|

|

296 |

|

|

Adjusted EBITDA (Non-GAAP Measure) |

|

(4,607 |

) |

|

(4,568 |

) |

|

(12,402 |

) |

|

(16,271 |

) |

|

|

|

|

|

|

|

|

|

|

|

CLEVER LEAVES HOLDINGS INC. |

|

Adjusted Gross Profit Reconciliation (Non-GAAP

Measure) |

|

(Amounts in thousands of U.S. Dollars) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

|

$ |

4,638 |

|

|

$ |

4,402 |

|

|

$ |

17,417 |

|

|

$ |

16,410 |

|

|

Cost of sales, before inventory provision |

|

|

(4,216 |

) |

|

|

(2,643 |

) |

|

|

(9,502 |

) |

|

|

(7,175 |

) |

|

Inventory provision |

|

|

(768 |

) |

|

|

(915 |

) |

|

|

(1,359 |

) |

|

|

(2,018 |

) |

|

Gross (loss) profit |

|

$ |

(346 |

) |

|

$ |

844 |

|

|

$ |

6,556 |

|

|

$ |

7,217 |

|

|

Inventory provision |

|

|

(768 |

) |

|

|

(915 |

) |

|

|

(1,359 |

) |

|

|

(2,018 |

) |

|

Adjusted Gross Profit (Non-GAAP Measure) |

|

$ |

422 |

|

|

$ |

1,759 |

|

|

$ |

7,915 |

|

|

$ |

9,235 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit Margin (%) |

|

|

-7.5 |

% |

|

|

19.2 |

% |

|

|

37.6 |

% |

|

|

44.0 |

% |

|

Adjusted Gross Profit Margin (Non-GAAP Measure) (%) |

|

|

9.1 |

% |

|

|

40.0 |

% |

|

|

45.4 |

% |

|

|

56.3 |

% |

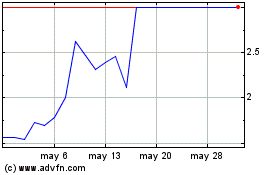

Clever Leaves (NASDAQ:CLVR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Clever Leaves (NASDAQ:CLVR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025