0001813914false0001813914cmax:WarrantsMember2023-11-092023-11-0900018139142023-11-092023-11-090001813914us-gaap:CommonClassAMember2023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 09, 2023 |

CareMax, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39391 |

85-0992224 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1000 NW 57th Court Suite 400 |

|

Miami, Florida |

|

33126 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 786 360-4768 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, par value $0.0001 per share |

|

CMAX |

|

The Nasdaq Stock Market LLC |

Warrants, each whole warrant exercisable for one share of Class A common stock, each at an exercise price of $11.50 per share |

|

CMAXW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The information contained in Item 7.01 of this Current Report on Form 8-K is incorporated by reference in this Item 2.02.

Item 7.01 Regulation FD Disclosure.

On November 9, 2023, CareMax, Inc., a Delaware corporation (the "Company"), issued a press release announcing its financial results for the third quarter ended September 30, 2023 and provided an investor presentation to accompany the press release. Copies of the press release announcing the Company's financial results and the investor presentation are furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

This information and the information contained in Exhibits 99.1 and 99.2 are furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in any such filing, regardless of any general incorporation language in the filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

November 9, 2023 |

By: |

/s/ Kevin Wirges |

|

|

|

Name: Kevin Wirges

Title: Executive Vice President, Chief Financial Officer and Treasurer |

EX-99.1

CareMax Reports Third Quarter 2023 Results

•Third Quarter Medicare Advantage Membership of 107,000, up 171% year-over-year

•Third Quarter Total Revenue of $201.8 million, up 28% year-over-year

•Reaffirming Full Year 2023 Revenue Guidance; Updating Full Year 2023 Medicare Advantage Membership and Adjusted EBITDA Guidance

Miami, FL - November 9, 2023 - CareMax, Inc. (NASDAQ: CMAX; CMAXW) (“CareMax” or the “Company”), a leading technology-enabled value-based care delivery system, today announced financial results for the third quarter ended September 30, 2023.

“Tomorrow marks one year since the acquisition of our national MSO and nearly two and a half years of rapid growth in our patient and provider base. Over that period, we experienced fluctuations in our revenue and EBITDA as we underwent numerous initiatives to integrate that membership. With significant progress made in many of those initiatives, we have increased confidence in our ability to effectively manage our members on their glidepath to risk and operate toward more consistent financial outcomes. Looking ahead, we feel well positioned to navigate the evolving utilization environment and execute on the embedded value in our platform,” said Carlos de Solo, Chief Executive Officer.

Third Quarter 2023 Results

•Total membership of 273,000, up 194% year-over-year.

•Medicare Advantage membership of 107,000, up 171% year-over-year.

•Total revenue was $201.8 million, up 28% year-over-year.

•Net loss was $103.1 million, including $80.0 million of non-cash goodwill impairment, compared to net loss of $22.1 million for the third quarter of 2022.

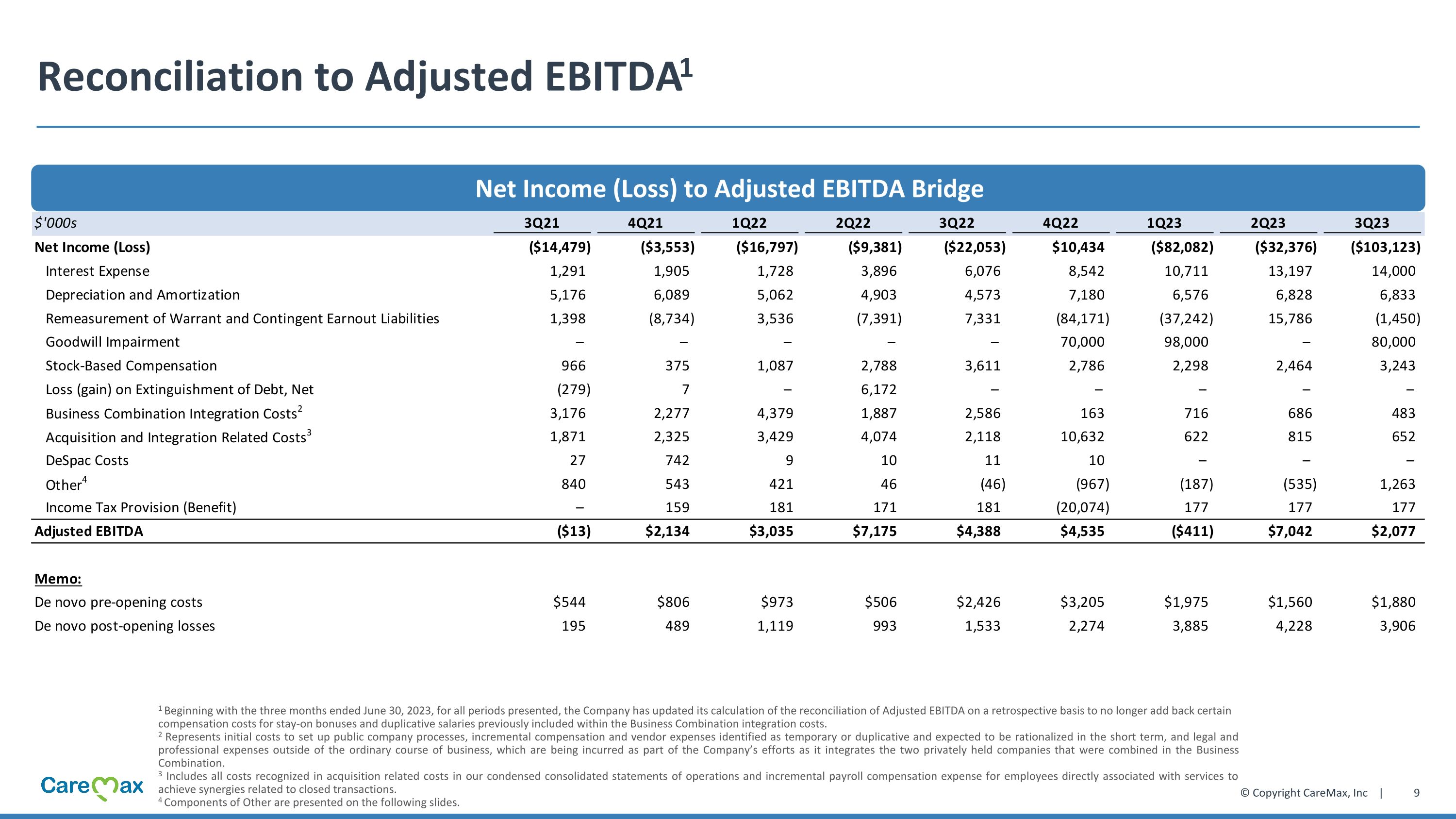

•Adjusted EBITDA was $2.1 million, compared to $4.4 million for the third quarter of 2022.1

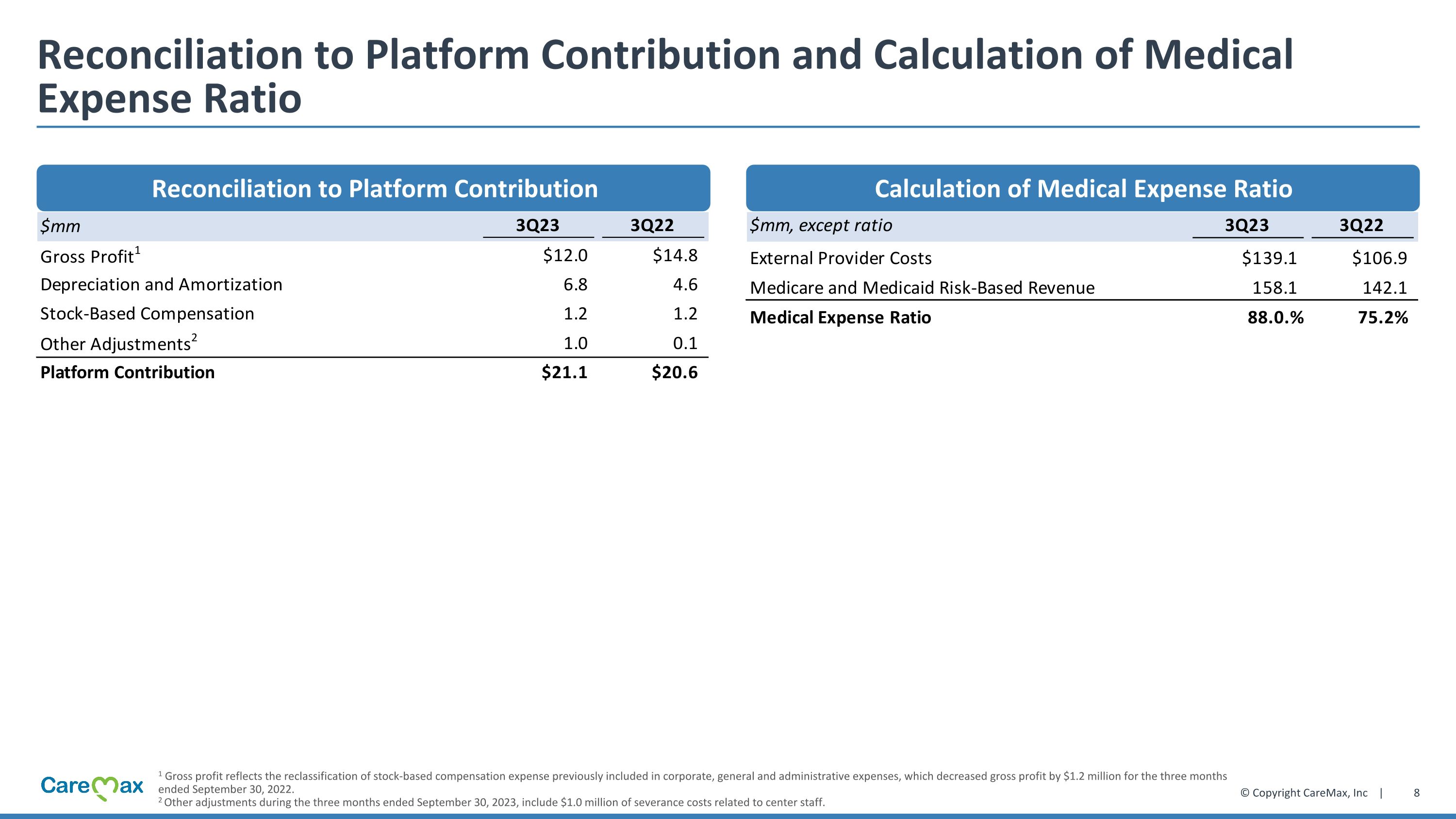

•Platform Contribution was $21.1 million, compared to $20.6 million for the third quarter of 2022.1

•Medical Expense Ratio was 88.0%, compared to 75.2% for the third quarter of 2022.

•De novo pre-opening costs and post-opening losses for the third quarter of 2023 were $5.8 million.2

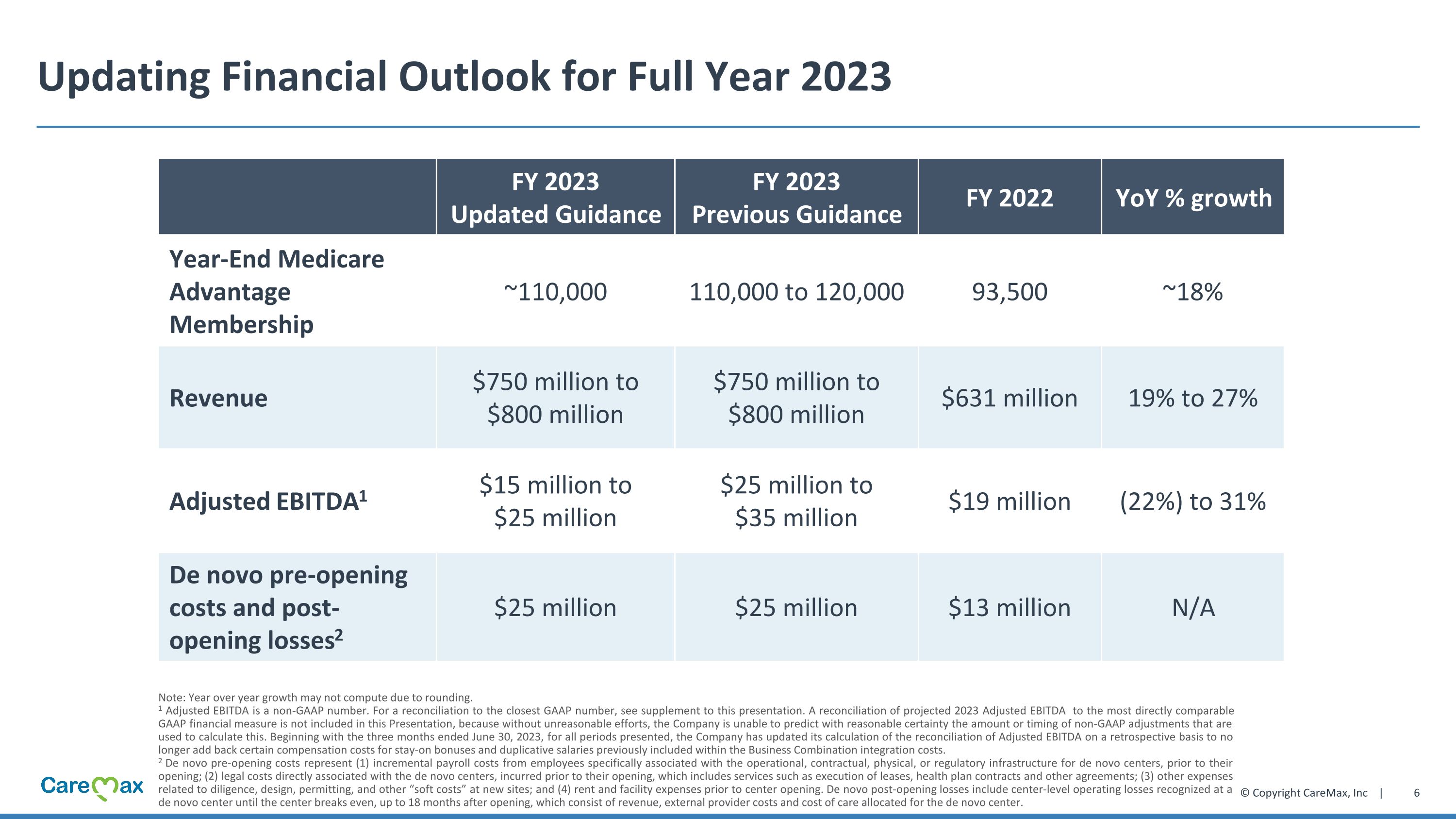

Financial Outlook for Full Year 2023

CareMax is reaffirming the following full year 2023 guidance:

•Total revenue of $750 million to $800 million, up 19% to 27% year-over-year.

•De novo pre-opening costs and post-opening losses are anticipated to be approximately $25 million in 2023.

CareMax is updating the following full year 2023 guidance:

•Year-end Medicare Advantage membership of approximately 110,000, up 18% year-over-year.

•Adjusted EBITDA of $15 million to $25 million, compared to $19.1 million for the year-ended December 31, 2022.1

1 Adjusted EBITDA and Platform Contribution are non-GAAP financial metrics. A reconciliation of non-GAAP metrics to the most directly comparable GAAP financial measures is included in the appendix to this earnings release. Beginning with the three months ended June 30, 2023, the Company has updated its calculation of Adjusted EBITDA on a retrospective basis to no longer add back certain compensation costs for stay-on bonuses and duplicative salaries previously included within the Business Combination integration costs adjustment. Adjusted EBITDA as previously reported for the third quarter of 2022 included an addback of $0.9 million for stay-on bonuses and duplicative salaries. Adjusted EBITDA as previously reported for the year ended December 31, 2022 included an addback of $2.9 million for stay-on bonuses and duplicative salaries.

2 De novo pre-opening costs represent (1) incremental payroll costs from employees specifically associated with the operational, contractual, physical, or regulatory infrastructure for de novo centers, prior to their opening; (2) legal costs directly associated with the de novo centers, incurred prior to their opening, which includes services such as execution of leases, health plan contracts and other agreements; (3) other expenses related to diligence, design, permitting, and other “soft costs” at new sites; and (4) rent and facility expenses prior to center opening. De novo post-opening losses include center-level operating losses recognized at a de novo center until the center breaks even, up to 18 months after opening, which consist of revenue, external provider costs and cost of care allocated for the de novo center.

Conference Call Details

Management will host a conference call at 8:30 am ET today to discuss the results. The conference call can be accessed by dialing (888) 330-2508 for U.S. participants, or (240) 789-2735 for international participants, and referencing conference ID 7874605. A live audio webcast as well as related presentation materials will also be available on the “Events & Presentations” section of CareMax’s investor relations website at ir.caremax.com. Following the live call, a replay will be available on the Company's website.

About CareMax

Founded in 2011, CareMax is a value-based care delivery system that utilizes a proprietary technology-enabled platform and multi-specialty, whole person health model to deliver comprehensive, preventative and coordinated care for its members. With over 200,000 Medicare Value-Based Care Members across 10 states, and fully integrated, Five-Star Quality rated health and wellness centers, CareMax is redefining healthcare across the country by reducing costs, improving overall outcomes and promoting health equity for seniors. Learn more at www.caremax.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements include statements regarding our future growth, strategy and financial performance. Words such as "anticipate," "believe," "budget," "contemplate," "continue," "could," "envision," "estimate," "expect," "guidance," "indicate," "intend," "may," "might," "plan," "possibly," "potential," "predict," "probably," "pro forma," "project," "seek," "should," "target," or "will," or the negative or other variations thereof, and similar words or phrases or comparable terminology, are intended to identify forward-looking statements. These forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this press release. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements.

Important risks and uncertainties that could cause the Company's actual results and financial condition to differ materially from those indicated in forward-looking statements include, among others, the Company’s ability to integrate acquired businesses, including the ability to implement business plans, forecasts, and other expectations after the completion of the Steward transaction; the failure to realize anticipated benefits of the Steward transaction or to realize estimated pro forma results and underlying assumptions; the impact of COVID-19 or any variant thereof or any other pandemic or epidemic on the Company's business and results of operation; the Company’s ability to attract new patients; the availability of sites for de novo centers and the costs of opening such de novo centers; changes in market or industry conditions, regulatory environment, competitive conditions, and receptivity to the Company's services; the Company's ability to continue its growth, including in new markets; changes in laws and regulations applicable to the Company's business, in particular with respect to Medicare Advantage and Medicaid; the Company's ability to maintain its relationships with health plans and other key payers; any delay, modification or cancellation of government contracts; the Company's future capital requirements and sources and uses of cash, including funds to satisfy its liquidity needs and the Company’s ability to comply with the covenants under the agreements governing its indebtedness; the Company’s ability to address the material weakness in its

internal control over financial reporting; the Company's ability to recruit and retain qualified team members and independent physicians; risks related to future acquisitions; the Company’s ability to develop and maintain proper and effective internal control over financial reporting and the impact of any prior period developments. For a detailed discussion of the risk factors that could affect the Company's actual results, please refer to the risk factors identified in the Company's reports filed with the SEC. All information provided in this press release is as of the date hereof, and the Company undertakes no duty to update or revise this information unless required by law, and forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this press release.

Use of Non-GAAP Financial Information

Certain financial information and data contained in this press release is unaudited and does not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any periodic filing, information or proxy statement, or prospectus or registration statement to be filed by the Company with the SEC. Some of the financial information and data contained in this press release, such as Adjusted EBITDA and Platform Contribution and margin thereof have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). These non-GAAP measures of financial results are not GAAP measures of our financial results or liquidity and should not be considered as an alternative to net income (loss) as a measure of financial results, cash flows from operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP. The Company believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes.

The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing the Company’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. For this reason, these non-GAAP measures may not be comparable to other companies’ similarly labeled non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results.

A reconciliation for Adjusted EBITDA and Platform Contribution to the most directly comparable GAAP financial measures is included below. A reconciliation of projected 2023 Adjusted EBITDA to the most directly comparable GAAP financial measure is not included in this press release because, without unreasonable efforts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate this. In addition, the Company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. The variability of the specified items may have a significant and unpredictable impact on the Company’s future GAAP results.

CAREMAX, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30,

2023 |

|

|

December 31,

2022 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

32,264 |

|

|

$ |

41,626 |

|

Accounts receivable, net |

|

|

139,573 |

|

|

|

151,036 |

|

Risk settlement receivables |

|

|

251 |

|

|

|

707 |

|

Related party receivables |

|

|

754 |

|

|

|

— |

|

Other current assets |

|

|

3,820 |

|

|

|

3,968 |

|

Total Current Assets |

|

|

176,662 |

|

|

|

197,336 |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

27,837 |

|

|

|

21,006 |

|

Operating lease right-of-use assets |

|

|

130,826 |

|

|

|

108,937 |

|

Goodwill, net |

|

|

522,643 |

|

|

|

700,643 |

|

Intangible assets, net |

|

|

106,889 |

|

|

|

123,585 |

|

Deferred debt issuance costs |

|

|

896 |

|

|

|

1,685 |

|

Other assets |

|

|

92,363 |

|

|

|

17,550 |

|

Total Assets |

|

$ |

1,058,117 |

|

|

$ |

1,170,743 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

9,345 |

|

|

$ |

7,687 |

|

Accrued expenses |

|

|

14,999 |

|

|

|

16,854 |

|

Risk settlement liabilities |

|

|

21,934 |

|

|

|

14,171 |

|

Related party liabilities |

|

|

47 |

|

|

|

1,777 |

|

Related party debt, net |

|

|

34,517 |

|

|

|

30,277 |

|

Current portion of third-party debt, net |

|

|

355 |

|

|

|

253 |

|

Current portion of operating lease liabilities |

|

|

8,555 |

|

|

|

5,512 |

|

Other current liabilities |

|

|

8,589 |

|

|

|

790 |

|

Total Current Liabilities |

|

|

98,341 |

|

|

|

77,322 |

|

Derivative warrant liabilities |

|

|

983 |

|

|

|

3,974 |

|

Long-term debt, net |

|

|

302,612 |

|

|

|

230,725 |

|

Long-term operating lease liabilities |

|

|

117,668 |

|

|

|

96,539 |

|

Contingent earnout liability |

|

|

— |

|

|

|

134,561 |

|

Other liabilities |

|

|

13,897 |

|

|

|

8,075 |

|

Total Liabilities |

|

|

533,501 |

|

|

|

551,196 |

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Preferred stock (1,000,000 shares authorized; one share issued and outstanding as of September 30, 2023 and December 31, 2022) |

|

|

— |

|

|

|

— |

|

Class A common stock ($0.0001 par value; 250,000,000 shares authorized; 112,096,998 and 111,332,584 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively) |

|

|

11 |

|

|

|

11 |

|

Additional paid-in-capital |

|

|

779,776 |

|

|

|

657,126 |

|

Accumulated deficit |

|

|

(255,171 |

) |

|

|

(37,590 |

) |

Total Stockholders' Equity |

|

|

524,616 |

|

|

|

619,547 |

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity |

|

$ |

1,058,117 |

|

|

$ |

1,170,743 |

|

CAREMAX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

Medicare risk-based revenue |

$ |

134,105 |

|

|

$ |

122,267 |

|

|

$ |

411,184 |

|

|

$ |

373,677 |

|

Medicaid risk-based revenue |

|

23,950 |

|

|

|

19,852 |

|

|

|

79,630 |

|

|

|

59,914 |

|

Government value-based care revenue |

|

28,067 |

|

|

|

— |

|

|

|

60,284 |

|

|

|

— |

|

Other revenue |

|

15,721 |

|

|

|

15,551 |

|

|

|

48,169 |

|

|

|

33,278 |

|

Total revenue |

|

201,843 |

|

|

|

157,670 |

|

|

|

599,267 |

|

|

|

466,869 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

External provider costs |

|

139,139 |

|

|

|

106,900 |

|

|

|

406,807 |

|

|

|

320,104 |

|

Cost of care |

|

43,826 |

|

|

|

30,213 |

|

|

|

122,645 |

|

|

|

87,925 |

|

Sales and marketing |

|

3,501 |

|

|

|

2,355 |

|

|

|

10,593 |

|

|

|

7,955 |

|

Corporate, general and administrative |

|

19,282 |

|

|

|

21,687 |

|

|

|

64,021 |

|

|

|

58,728 |

|

Depreciation and amortization |

|

6,833 |

|

|

|

4,573 |

|

|

|

20,237 |

|

|

|

14,538 |

|

Goodwill impairment |

|

80,000 |

|

|

|

— |

|

|

|

178,000 |

|

|

|

— |

|

Acquisition related costs |

|

34 |

|

|

|

494 |

|

|

|

108 |

|

|

|

3,549 |

|

Total operating expenses |

|

292,615 |

|

|

|

166,222 |

|

|

|

802,412 |

|

|

|

492,799 |

|

Operating loss |

|

(90,772 |

) |

|

|

(8,552 |

) |

|

|

(203,145 |

) |

|

|

(25,930 |

) |

Nonoperating income (expense) |

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(14,000 |

) |

|

|

(6,088 |

) |

|

|

(37,908 |

) |

|

|

(11,712 |

) |

Change in fair value of derivative warrant liabilities |

|

1,450 |

|

|

|

(7,331 |

) |

|

|

2,991 |

|

|

|

(3,476 |

) |

Gain on remeasurement of contingent earnout liabilities |

|

— |

|

|

|

— |

|

|

|

19,916 |

|

|

|

— |

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,172 |

) |

Other income (expense), net |

|

376 |

|

|

|

99 |

|

|

|

1,097 |

|

|

|

(408 |

) |

|

|

(12,174 |

) |

|

|

(13,320 |

) |

|

|

(13,904 |

) |

|

|

(21,768 |

) |

Loss before income tax |

|

(102,946 |

) |

|

|

(21,872 |

) |

|

|

(217,049 |

) |

|

|

(47,698 |

) |

Income tax expense |

|

(177 |

) |

|

|

(181 |

) |

|

|

(532 |

) |

|

|

(532 |

) |

Net loss |

$ |

(103,123 |

) |

|

$ |

(22,053 |

) |

|

$ |

(217,581 |

) |

|

$ |

(48,230 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average basic shares outstanding |

|

112,085,154 |

|

|

|

87,408,605 |

|

|

|

111,704,585 |

|

|

|

87,415,801 |

|

Weighted-average diluted shares outstanding |

|

112,085,154 |

|

|

|

87,408,605 |

|

|

|

111,704,585 |

|

|

|

87,415,801 |

|

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.92 |

) |

|

$ |

(0.25 |

) |

|

$ |

(1.95 |

) |

|

$ |

(0.55 |

) |

Diluted |

$ |

(0.92 |

) |

|

$ |

(0.25 |

) |

|

$ |

(1.95 |

) |

|

$ |

(0.55 |

) |

CAREMAX, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

Net loss |

|

$ |

(217,581 |

) |

|

$ |

(48,230 |

) |

Adjustments to reconcile net loss to cash and cash equivalents: |

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

20,237 |

|

|

|

14,538 |

|

Amortization of debt issuance costs and discounts |

|

|

6,422 |

|

|

|

1,093 |

|

Stock-based compensation expense |

|

|

8,004 |

|

|

|

7,486 |

|

Income tax provision |

|

|

532 |

|

|

|

532 |

|

Change in fair value of derivative warrant liabilities |

|

|

(2,991 |

) |

|

|

3,476 |

|

Gain on remeasurement of contingent earnout liabilities |

|

|

(19,916 |

) |

|

|

— |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

6,172 |

|

Payment-in-kind interest expense |

|

|

8,643 |

|

|

|

3,038 |

|

Provision for credit losses |

|

|

382 |

|

|

|

— |

|

Goodwill impairment |

|

|

178,000 |

|

|

|

— |

|

Amortization of right-of-use assets |

|

|

8,872 |

|

|

|

— |

|

Other non-cash, net |

|

|

1,140 |

|

|

|

(774 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

2,121 |

|

|

|

(43,109 |

) |

Other current assets |

|

|

148 |

|

|

|

(69 |

) |

Risk settlement receivables and liabilities |

|

|

11,020 |

|

|

|

(144 |

) |

Other assets |

|

|

(74,024 |

) |

|

|

(1,037 |

) |

Operating lease liabilities |

|

|

(4,390 |

) |

|

|

— |

|

Accounts payable |

|

|

(410 |

) |

|

|

9,291 |

|

Accrued expenses |

|

|

(1,855 |

) |

|

|

6,705 |

|

Related party receivables and payables |

|

|

(1,212 |

) |

|

|

— |

|

Other liabilities |

|

|

14,414 |

|

|

|

1,222 |

|

Net cash used in operating activities |

|

|

(62,446 |

) |

|

|

(39,811 |

) |

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(8,007 |

) |

|

|

(4,862 |

) |

Return of cash held in escrow |

|

|

— |

|

|

|

785 |

|

Acquisition of businesses, net of cash acquired |

|

|

— |

|

|

|

(892 |

) |

Net cash used in investing activities |

|

|

(8,007 |

) |

|

|

(4,969 |

) |

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

Proceeds from borrowings |

|

|

62,000 |

|

|

|

184,000 |

|

Principal payments of debt |

|

|

(189 |

) |

|

|

(121,926 |

) |

Payments of debt issuance costs |

|

|

(720 |

) |

|

|

(6,456 |

) |

Collateral for letters of credit |

|

|

— |

|

|

|

(5,439 |

) |

Net cash provided by financing activities |

|

|

61,091 |

|

|

|

50,179 |

|

|

|

|

|

|

|

|

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS |

|

|

(9,361 |

) |

|

|

5,399 |

|

Cash and cash equivalents - beginning of period |

|

|

41,626 |

|

|

|

47,917 |

|

CASH AND CASH EQUIVALENTS - END OF PERIOD |

|

$ |

32,264 |

|

|

$ |

53,315 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

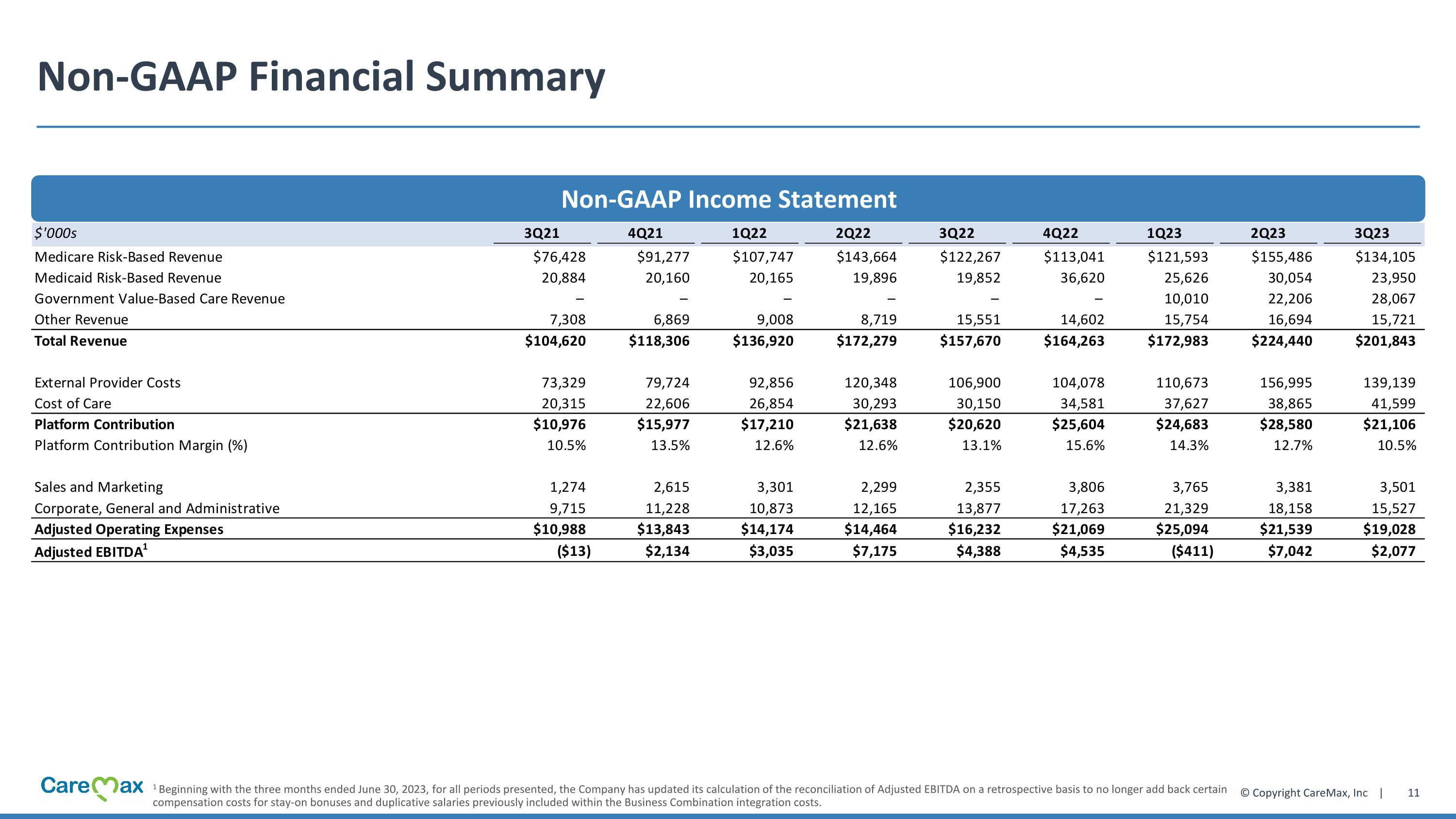

Non-GAAP Financial Summary |

Three Months Ended |

|

(in thousands) |

Sep 30, 2021 |

|

Dec 31, 2021 |

|

Mar 31, 2022 |

|

Jun 30, 2022 |

|

Sep 30, 2022 |

|

Dec 31, 2022 |

|

Mar 31, 2023 |

|

Jun 30,

2023 |

|

Sep 30, 2023 |

|

Medicare risk-based revenue |

$ |

76,428 |

|

$ |

91,277 |

|

$ |

107,747 |

|

$ |

143,664 |

|

$ |

122,267 |

|

$ |

113,041 |

|

$ |

121,593 |

|

$ |

155,486 |

|

$ |

134,105 |

|

Medicaid risk-based revenue |

|

20,884 |

|

|

20,160 |

|

|

20,165 |

|

|

19,896 |

|

|

19,852 |

|

|

36,620 |

|

|

25,626 |

|

|

30,054 |

|

|

23,950 |

|

Government value-based care revenue |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

10,010 |

|

|

22,206 |

|

|

28,067 |

|

Other revenue |

|

7,308 |

|

|

6,869 |

|

|

9,008 |

|

|

8,719 |

|

|

15,551 |

|

|

14,602 |

|

|

15,754 |

|

|

16,694 |

|

|

15,721 |

|

Total revenue |

|

104,620 |

|

|

118,306 |

|

|

136,920 |

|

|

172,279 |

|

|

157,670 |

|

|

164,263 |

|

|

172,983 |

|

|

224,440 |

|

|

201,843 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

External provider costs |

|

73,329 |

|

|

79,724 |

|

|

92,856 |

|

|

120,348 |

|

|

106,900 |

|

|

104,078 |

|

|

110,673 |

|

|

156,995 |

|

|

139,139 |

|

Cost of care |

|

20,315 |

|

|

22,606 |

|

|

26,854 |

|

|

30,293 |

|

|

30,150 |

|

|

34,581 |

|

|

37,627 |

|

|

38,865 |

|

|

41,599 |

|

Platform contribution |

|

10,976 |

|

|

15,977 |

|

|

17,210 |

|

|

21,638 |

|

|

20,620 |

|

|

25,604 |

|

|

24,683 |

|

|

28,580 |

|

|

21,106 |

|

Platform contribution margin (%) |

|

10.5 |

% |

|

13.5 |

% |

|

12.6 |

% |

|

12.6 |

% |

|

13.1 |

% |

|

15.6 |

% |

|

14.3 |

% |

|

12.7 |

% |

|

10.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

1,274 |

|

|

2,615 |

|

|

3,301 |

|

|

2,299 |

|

|

2,355 |

|

|

3,806 |

|

|

3,765 |

|

|

3,381 |

|

|

3,501 |

|

Corporate, general and administrative |

|

9,715 |

|

|

11,228 |

|

|

10,873 |

|

|

12,165 |

|

|

13,877 |

|

|

17,263 |

|

|

21,329 |

|

|

18,158 |

|

|

15,527 |

|

Adjusted operating expenses |

|

10,988 |

|

|

13,843 |

|

|

14,174 |

|

|

14,464 |

|

|

16,232 |

|

|

21,069 |

|

|

25,094 |

|

|

21,539 |

|

|

19,028 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

(13 |

) |

$ |

2,134 |

|

$ |

3,035 |

|

$ |

7,175 |

|

$ |

4,388 |

|

$ |

4,535 |

|

$ |

(411 |

) |

$ |

7,042 |

|

$ |

2,077 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation to Adjusted EBITDA |

Three Months Ended |

|

(in thousands) |

Sep 30, 2021 |

|

Dec 31, 2021 |

|

Mar 31, 2022 |

|

Jun 30, 2022 |

|

Sep 30, 2022 |

|

Dec 31, 2022 |

|

Mar 31, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2023 |

|

Net Income (loss) |

$ |

(14,479 |

) |

$ |

(3,553 |

) |

$ |

(16,797 |

) |

$ |

(9,381 |

) |

$ |

(22,053 |

) |

$ |

10,434 |

|

$ |

(82,082 |

) |

$ |

(32,376 |

) |

$ |

(103,123 |

) |

Interest expense |

|

1,291 |

|

|

1,905 |

|

|

1,728 |

|

|

3,896 |

|

|

6,076 |

|

|

8,542 |

|

|

10,711 |

|

|

13,197 |

|

|

14,000 |

|

Depreciation and amortization |

|

5,176 |

|

|

6,089 |

|

|

5,062 |

|

|

4,903 |

|

|

4,573 |

|

|

7,180 |

|

|

6,576 |

|

|

6,828 |

|

|

6,833 |

|

Remeasurement of warrant and contingent earnout liabilities |

|

1,398 |

|

|

(8,734 |

) |

|

3,536 |

|

|

(7,391 |

) |

|

7,331 |

|

|

(84,171 |

) |

|

(37,242 |

) |

|

15,786 |

|

|

(1,450 |

) |

Goodwill impairment |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

70,000 |

|

|

98,000 |

|

|

— |

|

|

80,000 |

|

Stock-based compensation |

|

966 |

|

|

375 |

|

|

1,087 |

|

|

2,788 |

|

|

3,611 |

|

|

2,786 |

|

|

2,298 |

|

|

2,464 |

|

|

3,243 |

|

Loss (gain) on extinguishment of debt, net |

|

(279 |

) |

|

7 |

|

|

— |

|

|

6,172 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Business Combination integration costs (1) |

|

3,176 |

|

|

2,277 |

|

|

4,379 |

|

|

1,887 |

|

|

2,586 |

|

|

163 |

|

|

716 |

|

|

686 |

|

|

483 |

|

Acquisition and integration related costs (2) |

|

1,871 |

|

|

2,325 |

|

|

3,429 |

|

|

4,074 |

|

|

2,118 |

|

|

10,632 |

|

|

622 |

|

|

815 |

|

|

652 |

|

DeSpac costs |

|

27 |

|

|

742 |

|

|

9 |

|

|

10 |

|

|

11 |

|

|

10 |

|

|

— |

|

|

— |

|

|

— |

|

Other (3) |

|

840 |

|

|

543 |

|

|

421 |

|

|

46 |

|

|

(46 |

) |

|

(967 |

) |

|

(187 |

) |

|

(535 |

) |

|

1,263 |

|

Income tax provision (benefit) |

|

— |

|

|

159 |

|

|

181 |

|

|

171 |

|

|

181 |

|

|

(20,074 |

) |

|

177 |

|

|

177 |

|

|

177 |

|

Adjusted EBITDA |

$ |

(13 |

) |

$ |

2,134 |

|

$ |

3,035 |

|

$ |

7,175 |

|

$ |

4,388 |

|

$ |

4,535 |

|

$ |

(411 |

) |

$ |

7,042 |

|

$ |

2,077 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Memo: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

De novo pre-opening costs |

$ |

544 |

|

$ |

806 |

|

$ |

973 |

|

$ |

506 |

|

$ |

2,426 |

|

$ |

3,205 |

|

$ |

1,975 |

|

$ |

1,560 |

|

$ |

1,880 |

|

De novo post-opening costs |

|

195 |

|

|

489 |

|

|

1,119 |

|

|

993 |

|

|

1,533 |

|

|

2,274 |

|

|

3,885 |

|

|

4,228 |

|

|

3,906 |

|

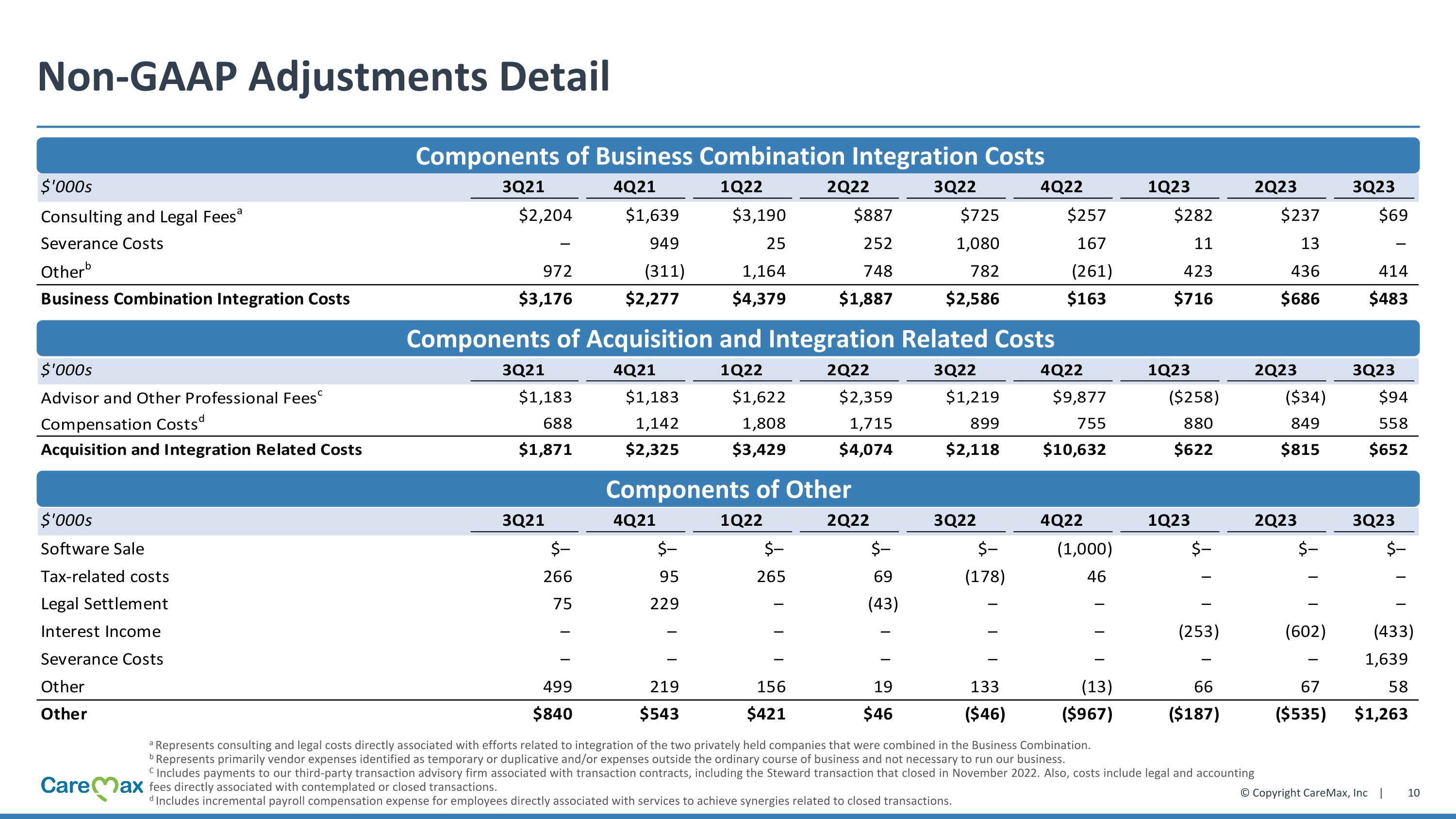

(1)Represents initial costs to set up public company processes, incremental vendor expenses identified as temporary or duplicative and expected to be rationalized in the short term, and legal and professional expenses outside of the ordinary course of business, which are being incurred as part of the Company’s efforts as it integrates the two privately held companies that were combined in the Business Combination. Significant components of Business Combination integration costs were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

(in thousands) |

Sep 30, 2021 |

|

Dec 31, 2021 |

|

Mar 31, 2022 |

|

Jun 30, 2022 |

|

Sep 30, 2022 |

|

Dec 31, 2022 |

|

Mar 31, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2023 |

|

Consulting and legal fees (a) |

$ |

2,204 |

|

$ |

1,639 |

|

$ |

3,190 |

|

$ |

887 |

|

$ |

725 |

|

$ |

257 |

|

$ |

282 |

|

$ |

237 |

|

$ |

69 |

|

Severance costs |

|

— |

|

|

949 |

|

|

25 |

|

|

252 |

|

|

1,080 |

|

|

167 |

|

|

11 |

|

|

13 |

|

|

— |

|

Other (b) |

|

972 |

|

|

(311 |

) |

|

1,164 |

|

|

748 |

|

|

782 |

|

|

(261 |

) |

|

423 |

|

|

436 |

|

|

414 |

|

|

$ |

3,176 |

|

$ |

2,277 |

|

$ |

4,379 |

|

$ |

1,887 |

|

$ |

2,586 |

|

$ |

163 |

|

$ |

716 |

|

$ |

686 |

|

$ |

483 |

|

(a) Represents consulting and legal costs directly associated with efforts related to integration of the two privately held companies that were combined in the Business Combination.

(b) Represents primarily vendor expenses identified as temporary or duplicative and/or expenses outside the ordinary course of business and not necessary to run the Company's business.

(2)Includes all costs recognized in acquisition related costs in our condensed consolidated statements of operations and incremental payroll compensation expense for employees directly associated with services to achieve synergies related to closed transactions. Significant components of acquisition and integration related costs were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

(in thousands) |

Sep 30, 2021 |

|

Dec 31, 2021 |

|

Mar 31, 2022 |

|

Jun 30, 2022 |

|

Sep 30, 2022 |

|

Dec 31, 2022 |

|

Mar 31, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2023 |

|

Advisor and other professional fees (a) |

$ |

1,183 |

|

$ |

1,183 |

|

$ |

1,622 |

|

$ |

2,359 |

|

$ |

1,219 |

|

$ |

9,877 |

|

$ |

(258 |

) |

$ |

(34 |

) |

$ |

94 |

|

Compensation costs (b) |

|

688 |

|

|

1,142 |

|

|

1,808 |

|

|

1,715 |

|

|

899 |

|

|

755 |

|

|

880 |

|

|

849 |

|

|

558 |

|

|

$ |

1,871 |

|

$ |

2,325 |

|

$ |

3,429 |

|

$ |

4,074 |

|

$ |

2,118 |

|

$ |

10,632 |

|

$ |

622 |

|

$ |

815 |

|

$ |

652 |

|

(a) Includes payments to our third-party transaction advisory firm associated with transaction contracts, including the Steward transaction that closed in November 2022. Also, costs include legal and accounting fees directly associated with contemplated or closed transactions.

(b) Includes incremental payroll compensation expense for employees directly associated with services to achieve synergies related to closed transactions.

(3)Components of other were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

(in thousands) |

Sep 30, 2021 |

|

Dec 31, 2021 |

|

Mar 31, 2022 |

|

Jun 30, 2022 |

|

Sep 30, 2022 |

|

Dec 31, 2022 |

|

Mar 31, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2023 |

|

Software sale |

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

(1,000 |

) |

$ |

— |

|

$ |

— |

|

$ |

— |

|

Tax-related costs |

|

266 |

|

|

95 |

|

|

265 |

|

|

69 |

|

|

(178 |

) |

|

46 |

|

|

— |

|

|

— |

|

|

— |

|

Legal settlement |

|

75 |

|

|

229 |

|

|

— |

|

|

(43 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Interest income |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(253 |

) |

|

(602 |

) |

|

(433 |

) |

Severance costs |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,639 |

|

Other |

|

499 |

|

|

219 |

|

|

156 |

|

|

19 |

|

|

133 |

|

|

(13 |

) |

|

66 |

|

|

67 |

|

|

58 |

|

|

$ |

840 |

|

$ |

543 |

|

$ |

421 |

|

$ |

46 |

|

$ |

(46 |

) |

$ |

(967 |

) |

$ |

(187 |

) |

$ |

(535 |

) |

$ |

1,263 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Operating Metrics |

Sep 30, 2021 |

|

Dec 31, 2021 |

|

Mar 31, 2022 |

|

Jun 30, 2022 |

|

Sep 30, 2022 |

|

Dec 31, 2022 |

|

Mar 31, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2023 |

|

Centers |

|

40 |

|

|

45 |

|

|

48 |

|

|

48 |

|

|

51 |

|

|

62 |

|

|

62 |

|

|

62 |

|

|

62 |

|

Markets |

|

3 |

|

|

4 |

|

|

6 |

|

|

6 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

7 |

|

|

7 |

|

Patients (MCREM)* |

|

40,400 |

|

|

50,100 |

|

|

50,600 |

|

|

54,000 |

|

|

57,400 |

|

|

221,500 |

|

|

225,100 |

|

|

226,500 |

|

|

228,700 |

|

Patients in value-based care arrangements (MCREM) |

|

87.2 |

% |

|

79.3 |

% |

|

79.8 |

% |

|

81.0 |

% |

|

78.2 |

% |

|

97.6 |

% |

|

99.0 |

% |

|

99.4 |

% |

|

98.8 |

% |

Platform Contribution ($, millions) |

$ |

11.0 |

|

$ |

16.0 |

|

$ |

17.2 |

|

$ |

21.6 |

|

$ |

20.6 |

|

$ |

25.6 |

|

$ |

24.7 |

|

$ |

28.6 |

|

$ |

21.1 |

|

* MCREM defined as Medicare Equivalent Members, which assumes the level of support received by a Medicare patient is equivalent to that received by three Medicaid or Commercial patients. |

|

|

|

Reconciliation to Platform Contribution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

(in millions) |

Sep 30, 2021 |

|

Dec 31, 2021 |

|

Mar 31, 2022 |

|

Jun 30, 2022 |

|

Sep 30, 2022 |

|

Dec 31, 2022 |

|

Mar 31, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2023 |

|

Gross profit (a) |

$ |

4.5 |

|

$ |

9.6 |

|

$ |

11.2 |

|

$ |

15.4 |

|

$ |

14.8 |

|

$ |

17.2 |

|

$ |

17.1 |

|

$ |

20.4 |

|

$ |

12.0 |

|

Depreciation and amortization |

|

5.2 |

|

|

6.1 |

|

|

5.1 |

|

|

4.9 |

|

|

4.6 |

|

|

7.2 |

|

|

6.6 |

|

|

6.8 |

|

|

6.8 |

|

Stock-based compensation |

|

— |

|

|

0.1 |

|

|

0.4 |

|

|

1.3 |

|

|

1.2 |

|

|

1.2 |

|

|

1.0 |

|

|

1.3 |

|

|

1.2 |

|

Other adjustments (b) |

|

1.3 |

|

|

0.2 |

|

|

0.5 |

|

|

0.1 |

|

|

0.1 |

|

|

— |

|

|

— |

|

|

— |

|

|

1.0 |

|

Platform Contribution |

$ |

11.0 |

|

$ |

16.0 |

|

$ |

17.2 |

|

$ |

21.6 |

|

$ |

20.6 |

|

$ |

25.6 |

|

$ |

24.7 |

|

$ |

28.6 |

|

$ |

21.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Gross profit reflects the reclassification of stock-based compensation expense previously included in corporate, general and administrative expenses, which decreased gross profit by $0.1 million during the three months ended December 31, 2021, $0.4 million during the three months ended March 31, 2022, $1.3 million during the three months ended June 30, 2022, $1.2 million during the three months ended September 30, 2022, and $1.2 million during the three months ended December 31, 2022. |

|

(b) Other adjustments include incremental costs related to post-Business Combination integration initiatives and other one-time center-level costs. Other adjustments reflected during the three months ended September 30, 2021 include $0.6 million of incremental costs relating to one-time operational projects and $0.3 million of non-cash true-up of deferred rent expense. Other adjustments reflected during the three months ended March 31, 2022 include $0.3 million of costs for a pilot project regarding outsourcing and during the three months ended September 30, 2023 include $1.0 million of severance costs related to center staff. |

|

Calculation of the Medical Expense Ratio

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

(in thousands, except ratio) |

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

External provider costs |

$ |

139,139 |

|

$ |

106,900 |

|

|

$ |

406,807 |

|

$ |

320,104 |

|

Medicare and Medicaid risk-based revenue |

|

158,055 |

|

|

142,119 |

|

|

|

490,814 |

|

|

433,591 |

|

Medical Expense Ratio |

|

88.0 |

% |

|

75.2 |

% |

|

|

82.9 |

% |

|

73.8 |

% |

Investor Relations

Roger Ou

SVP of Finance and Investor Relations

CareMaxInvestorRelations@caremax.com

Media

Conchita Topinka

Conchita@thinkbsg.com

Third Quarter 2023 Earnings Presentation November 9, 2023 EX-99.2

Disclaimer Presentation This presentation (“Presentation”) is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments, of CareMax, Inc. (“CareMax” or the “Company”) or any of its affiliates. The information contained herein does not purport to be all-inclusive. The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. CareMax assumes no obligation to update any information in this Presentation, except as required by law. Projections This Presentation contains projected financial information. Such projected financial information constitutes forward-looking information, is for illustrative purposes only and should not be relied upon as indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the projected financial information. See “Forward Looking Statements” paragraph below. Actual results may differ materially from the results contemplated by the projected financial information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved. The independent registered public accounting firm of CareMax has not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and, accordingly, has not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. Forward-Looking Statements This Presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements include statements regarding our future growth and strategy and future financial results. Words such as "anticipate," "believe," "budget," "contemplate," "continue," "could," "envision," "estimate," "expect," "guidance," "indicate," "intend," "may," "might," "plan," "possibly," "potential," "predict," "probably," “pro-forma,” "project," "seek," "should," "target," or "will," or the negative or other variations thereof, and similar words or phrases or comparable terminology, are intended to identify forward-looking statements. These forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this Presentation. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important risks and uncertainties that could cause the Company's actual results and financial condition to differ materially from those indicated in forward-looking statements include, among others, the Company’s ability to integrate acquired businesses, including the ability to implement business plans, forecasts, and other expectations after the completion of the Steward transaction; the failure to realize anticipated benefits of the Steward transaction or to realize estimated pro forma results and underlying assumptions; the impact of COVID-19 or any variant thereof or any other pandemic or epidemic on the Company's business and results of operation; the Company’s ability to attract new patients; the availability of sites for de novo centers and the costs of opening such de novo centers; changes in market or industry conditions, regulatory environment, competitive conditions, and receptivity to the Company's services; the Company's ability to continue its growth, including in new markets; changes in laws and regulations applicable to the Company's business, in particular with respect to Medicare Advantage and Medicaid; the Company's ability to maintain its relationships with health plans and other key payers; any delay, modification or cancellation of government contracts; the Company's future capital requirements and sources and uses of cash, including funds to satisfy its liquidity needs and the Company’s ability to comply with the covenants under the agreements governing its indebtedness; the Company’s ability to address the material weaknesses in its internal control over financial reporting; the Company's ability to recruit and retain qualified team members and independent physicians; risks related to future acquisitions; the Company’s ability to develop and maintain proper and effective internal control over financial reporting; and the impact of any prior period developments. For a detailed discussion of the risk factors that could affect the Company's actual results, please refer to the risk factors identified in the Company's reports filed with the SEC. All information provided in this Presentation is as of the date hereof, and the Company undertakes no duty to update or revise this information unless required by law, and forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this Presentation. Use of Non-GAAP Financial Information Certain financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any periodic filing, information or proxy statement, or prospectus or registration statement to be filed by the Company with the SEC. Some of the financial information and data contained in this Presentation, such as Adjusted EBITDA and Platform Contribution and margin thereof have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). These non-GAAP measures of financial results are not GAAP measures of our financial results or liquidity and should not be considered as an alternative to net income (loss) as a measure of financial results, cash flows from operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP. The Company believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company’s management uses these non-GAAP measures for trend analyses and for budgeting and planning purposes. The Company believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing the Company’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. For this reason, these non-GAAP measures may not be comparable to other companies’ similarly labeled non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. You should review the Company’s audited financial statements, which have been filed by the Company with the SEC. A reconciliation for Adjusted EBITDA and Platform Contribution to the most directly comparable GAAP financial measures is included in this Presentation. A reconciliation of projected 2023 Adjusted EBITDA to the most directly comparable GAAP financial measure is not included in this Presentation because, without unreasonable efforts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate this. In addition, the Company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. The variability of the specified items may have a significant and unpredictable impact on the Company’s future GAAP results.

CareMax is Driven by a Mission to Deliver Best-in-Class Care ~107K Medicare Advantage Members 63 CareMax Medical Centers1 5-Stars CMS Quality Rating3 ~273K Total Members2 10 States1 1 CareMax medical centers and number of states as of October 31, 2023. 2 Membership as of September 30, 2023. 3 Centers for Medicare & Medicaid Services 2022 Star rating across CareMax centers as of year-end 2022. Who We Are A value-based care delivery system that utilizes a technology-enabled platform and multi-specialty, whole person health model to deliver comprehensive, preventative and coordinated care for our members. Vision Transforming care to end disparity and create a sustainable healthcare system. Mission To improve lives through kindness, compassion, and better health.

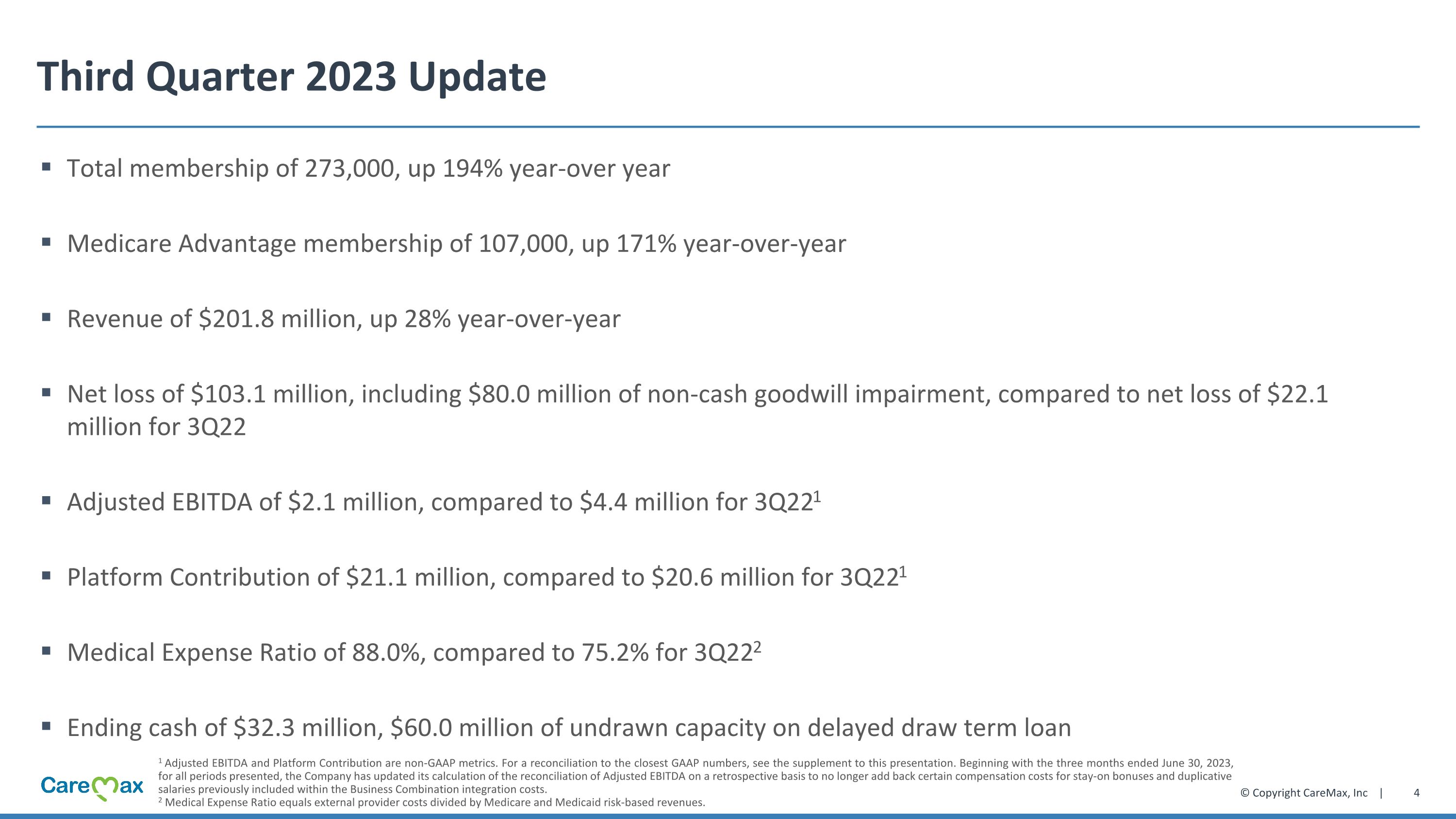

Third Quarter 2023 Update Total membership of 273,000, up 194% year-over year Medicare Advantage membership of 107,000, up 171% year-over-year Revenue of $201.8 million, up 28% year-over-year Net loss of $103.1 million, including $80.0 million of non-cash goodwill impairment, compared to net loss of $22.1 million for 3Q22 Adjusted EBITDA of $2.1 million, compared to $4.4 million for 3Q221 Platform Contribution of $21.1 million, compared to $20.6 million for 3Q221 Medical Expense Ratio of 88.0%, compared to 75.2% for 3Q222 Ending cash of $32.3 million, $60.0 million of undrawn capacity on delayed draw term loan 1 Adjusted EBITDA and Platform Contribution are non-GAAP metrics. For a reconciliation to the closest GAAP numbers, see the supplement to this presentation. Beginning with the three months ended June 30, 2023, for all periods presented, the Company has updated its calculation of the reconciliation of Adjusted EBITDA on a retrospective basis to no longer add back certain compensation costs for stay-on bonuses and duplicative salaries previously included within the Business Combination integration costs. 2 Medical Expense Ratio equals external provider costs divided by Medicare and Medicaid risk-based revenues.

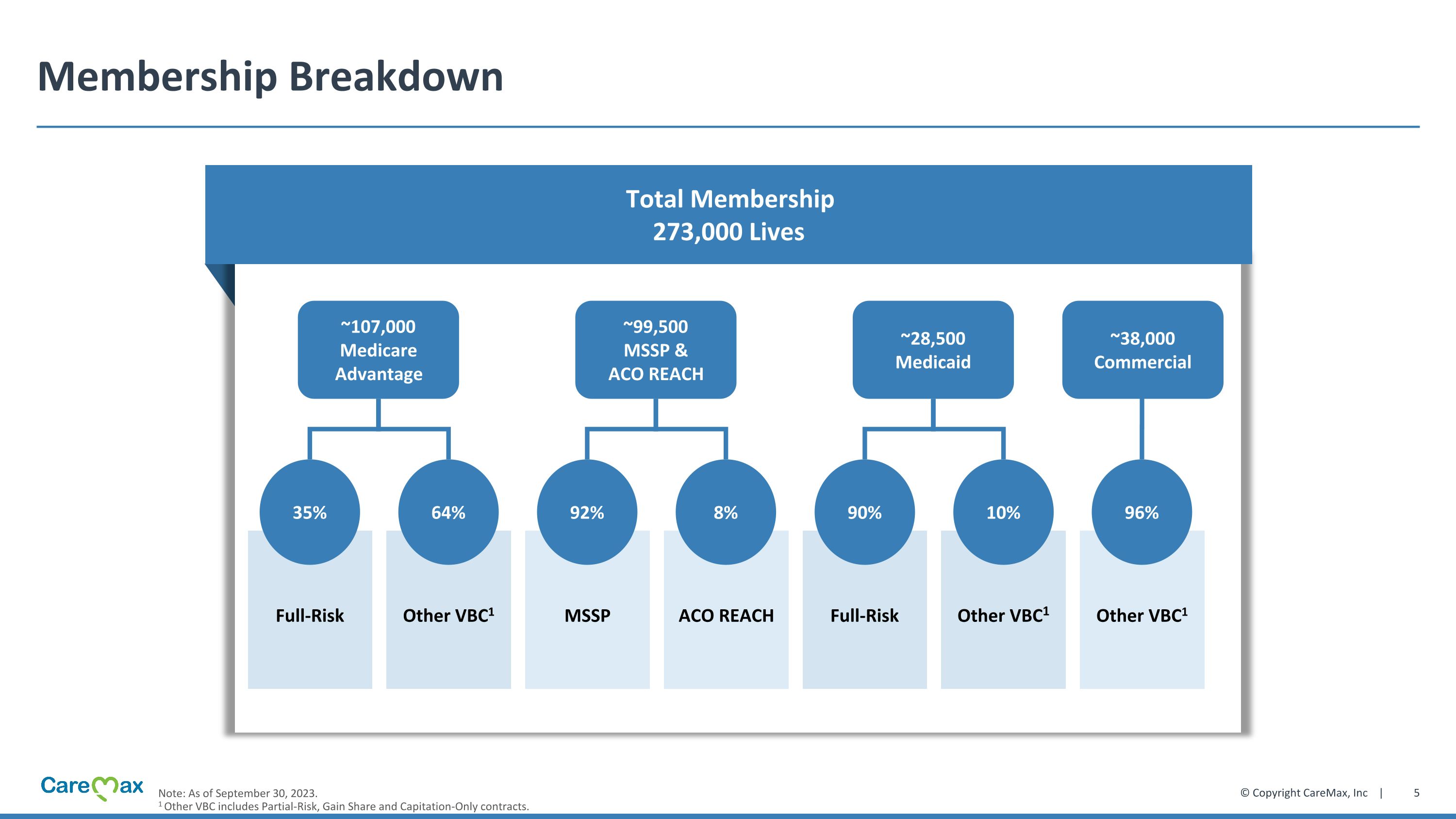

Membership Breakdown Total Membership 273,000 Lives ~107,000 Medicare Advantage Full-Risk 35% Other VBC1 64% ~28,500 Medicaid Other VBC1 96% ~38,000 Commercial Full-Risk 90% Other VBC1 10% ~99,500 MSSP & ACO REACH MSSP 92% ACO REACH 8% Note: As of September 30, 2023. 1 Other VBC includes Partial-Risk, Gain Share and Capitation-Only contracts.

Updating Financial Outlook for Full Year 2023 Note: Year over year growth may not compute due to rounding. 1 Adjusted EBITDA is a non-GAAP number. For a reconciliation to the closest GAAP number, see supplement to this presentation. A reconciliation of projected 2023 Adjusted EBITDA to the most directly comparable GAAP financial measure is not included in this Presentation, because without unreasonable efforts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate this. Beginning with the three months ended June 30, 2023, for all periods presented, the Company has updated its calculation of the reconciliation of Adjusted EBITDA on a retrospective basis to no longer add back certain compensation costs for stay-on bonuses and duplicative salaries previously included within the Business Combination integration costs. 2 De novo pre-opening costs represent (1) incremental payroll costs from employees specifically associated with the operational, contractual, physical, or regulatory infrastructure for de novo centers, prior to their opening; (2) legal costs directly associated with the de novo centers, incurred prior to their opening, which includes services such as execution of leases, health plan contracts and other agreements; (3) other expenses related to diligence, design, permitting, and other “soft costs” at new sites; and (4) rent and facility expenses prior to center opening. De novo post-opening losses include center-level operating losses recognized at a de novo center until the center breaks even, up to 18 months after opening, which consist of revenue, external provider costs and cost of care allocated for the de novo center. FY 2023 Updated Guidance FY 2023 Previous Guidance FY 2022 YoY % growth Year-End Medicare Advantage Membership ~110,000 110,000 to 120,000 93,500 ~18% Revenue $750 million to $800 million $750 million to $800 million $631 million 19% to 27% Adjusted EBITDA1 $15 million to $25 million $25 million to $35 million $19 million (22%) to 31% De novo pre-opening costs and post-opening losses2 $25 million $25 million $13 million N/A

Third Quarter 2023 Financial Supplement

Reconciliation to Platform Contribution and Calculation of Medical Expense Ratio 1 Gross profit reflects the reclassification of stock-based compensation expense previously included in corporate, general and administrative expenses, which decreased gross profit by $1.2 million for the three months ended September 30, 2022. 2 Other adjustments during the three months ended September 30, 2023, include $1.0 million of severance costs related to center staff. Reconciliation to Platform Contribution Calculation of Medical Expense Ratio

Reconciliation to Adjusted EBITDA1 Net Income (Loss) to Adjusted EBITDA Bridge 1 Beginning with the three months ended June 30, 2023, for all periods presented, the Company has updated its calculation of the reconciliation of Adjusted EBITDA on a retrospective basis to no longer add back certain compensation costs for stay-on bonuses and duplicative salaries previously included within the Business Combination integration costs. 2 Represents initial costs to set up public company processes, incremental compensation and vendor expenses identified as temporary or duplicative and expected to be rationalized in the short term, and legal and professional expenses outside of the ordinary course of business, which are being incurred as part of the Company’s efforts as it integrates the two privately held companies that were combined in the Business Combination. 3 Includes all costs recognized in acquisition related costs in our condensed consolidated statements of operations and incremental payroll compensation expense for employees directly associated with services to achieve synergies related to closed transactions. 4 Components of Other are presented on the following slides.

Non-GAAP Adjustments Detail a Represents consulting and legal costs directly associated with efforts related to integration of the two privately held companies that were combined in the Business Combination. b Represents primarily vendor expenses identified as temporary or duplicative and/or expenses outside the ordinary course of business and not necessary to run our business. C Includes payments to our third-party transaction advisory firm associated with transaction contracts, including the Steward transaction that closed in November 2022. Also, costs include legal and accounting fees directly associated with contemplated or closed transactions. d Includes incremental payroll compensation expense for employees directly associated with services to achieve synergies related to closed transactions. Components of Business Combination Integration Costs Components of Acquisition and Integration Related Costs Components of Other

Non-GAAP Financial Summary 1 Beginning with the three months ended June 30, 2023, for all periods presented, the Company has updated its calculation of the reconciliation of Adjusted EBITDA on a retrospective basis to no longer add back certain compensation costs for stay-on bonuses and duplicative salaries previously included within the Business Combination integration costs. Non-GAAP Income Statement

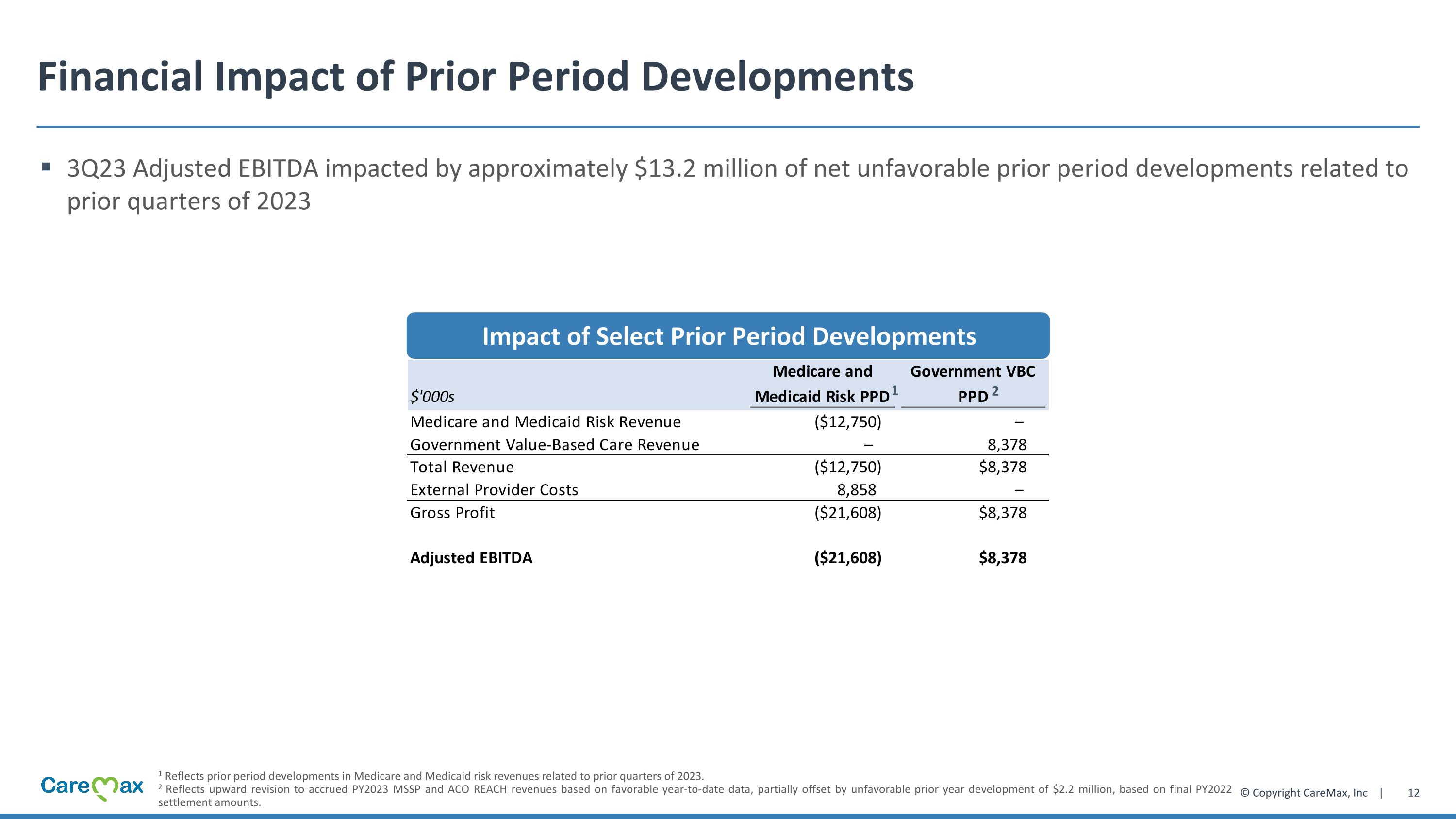

Financial Impact of Prior Period Developments 1 Reflects prior period developments in Medicare and Medicaid risk revenues related to prior quarters of 2023. 2 Reflects upward revision to accrued PY2023 MSSP and ACO REACH revenues based on favorable year-to-date data, partially offset by unfavorable prior year development of $2.2 million, based on final PY2022 settlement amounts. Impact of Select Prior Period Developments 3Q23 Adjusted EBITDA impacted by approximately $13.2 million of net unfavorable prior period developments related to prior quarters of 2023 1 2

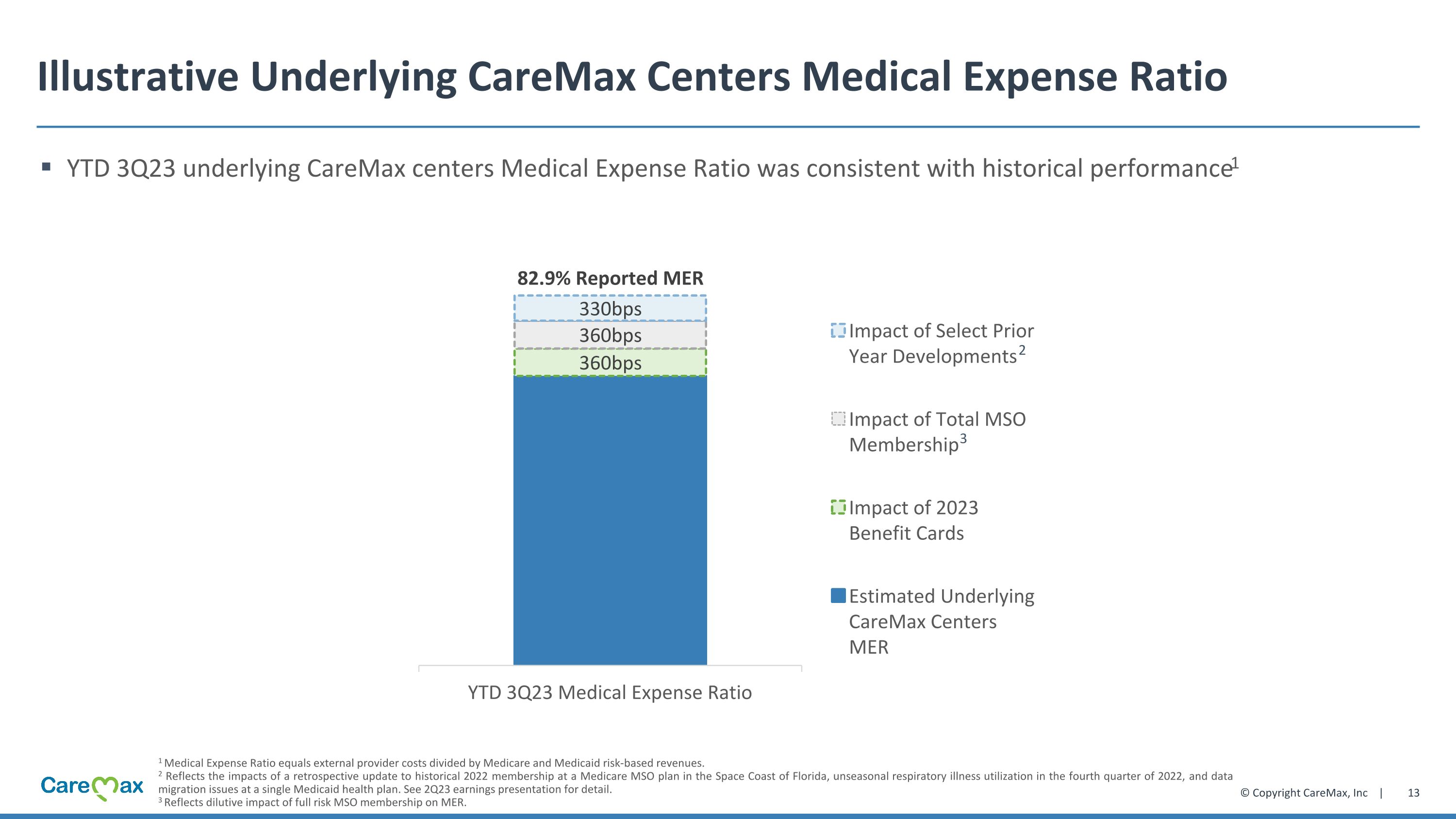

Illustrative Underlying CareMax Centers Medical Expense Ratio 1 Medical Expense Ratio equals external provider costs divided by Medicare and Medicaid risk-based revenues. 2 Reflects the impacts of a retrospective update to historical 2022 membership at a Medicare MSO plan in the Space Coast of Florida, unseasonal respiratory illness utilization in the fourth quarter of 2022, and data migration issues at a single Medicaid health plan. See 2Q23 earnings presentation for detail. 3 Reflects dilutive impact of full risk MSO membership on MER. YTD 3Q23 underlying CareMax centers Medical Expense Ratio was consistent with historical performance1 2 3