Australian Oilseeds Holdings Limited, a Cayman Islands exempted

company (“Australian Oilseeds”, “AOI” or “Pubco”) and EDOC

Acquisition Corp., a publicly-traded special purpose acquisition

company (“EDOC”), today announced they have closed their previously

announced business combination (the “Business Combination”). The

transaction, which was approved on March 5, 2024, by EDOC

shareholders, establishes Australian Oilseeds, the largest cold

pressing oil plant in Australia and the APAC region, pressing

strictly GMO free conventional and organic oilseed, as a

publicly-traded company.

Beginning tomorrow, March 22, 2024, Australian

Oilseeds’ ordinary shares will start trading on Nasdaq under the

ticker symbol “COOT” and Australian Oilseeds’ warrants will start

trading on Nasdaq under the symbol “COOTW.” Australian Oilseeds’

CEO, Gary Seaton and the rest of the company’s current management

team are expected to remain in leadership positions. Following

listing, Mr. Seaton will ring the Nasdaq Closing Bell on March 28,

2024.

“We are thrilled to list Australian Oilseeds on

the Nasdaq, particularly at this moment of burgeoning consumer

demand for organic food ingredients globally,” said Mr. Seaton.

“With global demand for healthier, natural and

chemical-free food products, coupled with growing food

shortages, we plan to capitalize on this increased global demand

for sustainable premium cold-pressed and non-GMO products

through the recent expansion of our existing

cold-pressing capacity from 40,000 metric tons to 80,000

metric tons per annum and our current construction of a

multi-seed crushing plant at Emerald, Queensland with a

projected cold-pressing capacity of 80,000 metric tons per

annum, to market ourself as the largest cold-pressed player in

the APAC region.”

“This is an incredible milestone for the entire

Australian Oilseeds team,” added Mr. Seaton. “Upon the closing of

this transaction, and our commencing trading as a publicly traded

company, investors will have the opportunity to invest in

Australian Oilseeds’ growth and mission to become a global leader

in our market of providing chemical free non-GMO feed ingredients

into the food supply chain as we continue to provide a healthier

option for all consumers on a larger scale.”

“As we noted when the transaction was announced,

Australian Oilseeds not only produces high-demand materials in a

growing market, but also does so in a sustainable manner,” said

Kevin Chen, Chief Executive Officer of EDOC. “We are excited that

Australian Oilseeds and its team have reached this stage and

believe they are ready to accelerate their market position as a

public company.”

Advisors

ARC Group Limited served as exclusive financial

advisor to Australian Oilseeds Investments Pty Ltd, with I-Bankers

Securities, Inc. serving as financial advisor to EDOC.

Rimon P.C. acting as U.S. legal counsel

to Australian Oilseeds Investments Pty Ltd. with Stuarts

Humphries acting as local Cayman Islands counsel.

Ellenoff Grossman & Schole LLP acted as U.S.

legal counsel to EDOC, with Maples acting as Cayman Islands counsel

to EDOC and Clayton Utz acting as Australian counsel to EDOC.

About Australian Oilseeds Investments

Pty Ltd.

Australian Oilseeds Investments Pty Ltd. (the

“Company”) is an Australian proprietary company that, directly and

indirectly through its subsidiaries, is focused on the manufacture

and sale of sustainable oilseeds (e.g., seeds grown primarily for

the production of edible oils) and is committed to working with all

suppliers in the food supply chain to eliminate chemicals from the

production and manufacturing systems to supply quality products to

customers globally. The Company engages in the business of

processing, manufacture and sale of non-GMO oilseeds and organic

and non-organic food-grade oils, for the rapidly growing oilseeds

market, through sourcing materials from suppliers focused on

reducing the use of chemicals in consumables in order to supply

healthier food ingredients, vegetable oils, proteins and other

products to customers globally. The Company has expanded its

existing oil processing plant and is building an additional larger

multi-seed crushing plant in Queensland. Over the past 20

years, the Company has grown to become the largest cold pressing

oil plant in Australia and the APAC region, pressing strictly GMO

free conventional and organic oilseeds.

About EDOC Acquisition Corp.

EDOC Acquisition Corp. is a blank check company

organized for the purpose of effecting a merger, share exchange,

asset acquisition, share purchase, recapitalization,

reorganization, or other similar business combination with one or

more businesses or entities. The company is sponsored by an

extensive network of physician entrepreneurs across 30+ medical

specialties in leading medical institutions and is led by Kevin

Chen, Chief Executive Officer. In November 2020, EDOC consummated

an initial public offering of 9 million units, each unit consisting

of one Class A ordinary share, one right to receive

one-tenth (1/10th) of a Class A ordinary share, upon the

consummation by EDOC of its Business Combination and one redeemable

warrant, each warrant entitles the holder to purchase one-half

(1/2) of a Class A ordinary share at a price of $11.50 per

share.

Cautionary Statement Regarding Forward-Looking

Statements

The information in this press release includes

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements may be

identified by the use of words such as “estimate,” “plan,”

“project,” “forecast,” “intend,” “may,” “will,” “expect,”

“continue,” “should,” “would,” “anticipate,” “believe,” “seek,”

“target,” “predict,” “potential,” “seem,” “future,” “outlook” or

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters, but the

absence of these words does not mean that a statement is not

forward-looking. These forward-looking statements include, but are

not limited to, (1) statements regarding estimates and forecasts of

financial and performance metrics and projections of market

opportunity and market share; (2) references with respect to the

anticipated benefits of the Business Combination and the related

financing transactions and the projected future financial

performance of Pubco’s operating companies following the Business

Combination and related financing transactions; (3) changes in

the market for Pubco’s products and services and expansion plans

and opportunities; (4) Pubco’s unit economics; (5) the sources and

uses of cash of the Business Combination and the related financing

transactions; (6) the anticipated capitalization and enterprise

value of Pubco’s following the consummation of the Business

Combination and related financing transactions; (7) the projected

technological developments of Pubco and its competitors; (8)

anticipated short- and long-term customer benefits; (9) current and

future potential commercial and customer relationships; (10) the

ability to manufacture efficiently at scale; (11) anticipated

investments in research and development and the effect of these

investments and timing related to commercial product launches; and

(12) the ability of Pubco to maintain the listing of its ordinary

shares and warrants on NASDAQ. These statements are based on

various assumptions, whether or not identified in this press

release, and on the current expectations of Pubco’s and EDOC’s

management and are not predictions of actual performance.

These forward-looking statements are provided

for illustrative purposes only and are not intended to serve as,

and must not be relied on by any investor as, a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of Pubco, the

Company and EDOC. These forward-looking statements are subject to a

number of risks and uncertainties, including the inability to

recognize the anticipated benefits of the Business Combination or

the related financing transactions; the ability to maintain the

listing of Pubco’s securities on NASDAQ following the Business

Combination, including having the requisite number of shareholders;

costs related to the Business Combination and the related financing

transactions; changes in domestic and foreign business, market,

financial, political and legal conditions; risks relating to the

uncertainty of certain projected financial information; the

Company’s ability to successfully and timely develop, manufacture,

sell and expand its technology and products, including implement

its growth strategy; the Company’s ability to adequately manage any

supply chain risks, including the purchase of a sufficient supply

of critical components incorporated into its product offerings;

risks relating to the Company’s operations and business, including

information technology and cybersecurity risks, failure to

adequately forecast supply and demand, loss of key customers and

deterioration in relationships between the Company and its

employees; the Company’s ability to successfully collaborate with

business partners; demand for the Company’s current and future

offerings; risks that orders that have been placed for the

Company’s products are cancelled or modified; risks related to

increased competition; risks relating to potential disruption in

the transportation and shipping infrastructure, including trade

policies and export controls; risks that the Company is unable to

secure or protect its intellectual property; risks of product

liability or regulatory lawsuits relating to the Company’s products

and services; risks that the post-combination company experiences

difficulties managing its growth and expanding operations; the

uncertain effects of the COVID-19 pandemic and certain geopolitical

developments; the ability of the Company to execute its business

model, including market acceptance of its planned products and

services and achieving sufficient production volumes at acceptable

quality levels and prices; technological improvements by the

Company’s peers and competitors; and those risk factors discussed

in documents of Pubco and EDOC filed, or to be filed, with the SEC.

If any of these risks materialize or our assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements.

There may be additional risks that Pubco, EDOC

or the Company presently know or that Pubco, EDOC or the Company

currently believe are immaterial that could also cause actual

results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements reflect EDOC’s,

Pubco’s and the Company’s expectations, plans or forecasts of

future events and views as of the date of this press release. EDOC,

Pubco and the Company anticipate that subsequent events and

developments will cause EDOC’s, Pubco’s and the Company’s

assessments to change. However, while EDOC, Pubco and the Company

may elect to update these forward-looking statements at some point

in the future, EDOC, Pubco and the Company specifically disclaim

any obligation to do so. Readers are referred to the most recent

reports filed with the SEC by EDOC. Readers are cautioned not to

place undue reliance upon any forward-looking statements, which

speak only as of the date made, and we undertake no obligation to

update or revise the forward-looking statements, whether as a

result of new information, future events or otherwise.

Contact

Australian Oilseeds Holdings Limited126-142 Cowcumbla

StreetCootamundra New South Wales 2590Attn: Bob Wu, CFOEmail:

info@australianoilseeds.au

EDOC Acquisition Corp.7612 Main Street Fishers, Suite 200Victor,

NY 14564Attn: Kevin Chen, CEOTel: (585) 678-1198

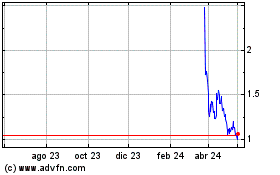

Australian Oilseeds (NASDAQ:COOT)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

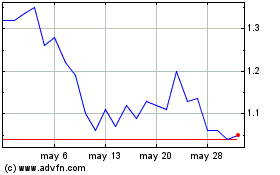

Australian Oilseeds (NASDAQ:COOT)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024