UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-40712

Cardiol Therapeutics Inc.

(Name of registrant)

602-2265 Upper Middle Road East

Oakville, Ontario L6H 0G5

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

CARDIOL THERAPEUTICS INC. |

|

| |

(Registrant) |

|

| |

|

|

| Date: October 11, 2024 |

By: |

/s/ Chris Waddick |

|

| |

|

Name: |

Chris Waddick |

|

| |

|

Title: |

Chief Financial Officer |

Form 6-K Exhibit Index

Exhibit 99.1

Cardiol Therapeutics

Announces Exercise and Closing of Over-Allotment Option

Oakville, ON – October 11,

2024 – Cardiol Therapeutics Inc. (NASDAQ: CRDL) (TSX: CRDL) ("Cardiol" or the "Company"), a clinical-stage

life sciences company focused on the research and clinical development of anti-inflammatory and anti-fibrotic therapies for the treatment

of heart disease, is pleased to announce that, further to its successfully completed public offering of an aggregate of 8,437,500 Class

A common shares of the Company (the “Common Shares”) at a price to the public of US$1.60 per Common Share (the “Offering

Price”) for gross proceeds of US$13.5 million (the “Offering”), Canaccord Genuity has purchased an additional

1,265,625 Common Shares at the Offering Price pursuant to their exercise in full of the over-allotment option (the “Over-Allotment

Option"), for additional gross proceeds to the Company of $2,025,000 before deducting the underwriting commissions.

After giving effect

to the full exercise of the Over-Allotment Option, Cardiol sold 9,703,125 Common Shares under the Offering, for aggregate gross proceeds

of US$15,525,000.

The Company intends to use the net proceeds

from the Offering to support the clinical development of CardiolRx for the treatment of recurrent pericarditis and for general and administrative

expenses, working capital and other expenses.

Canaccord Genuity

acted as the sole bookrunner in connection with the Offering.

The Offering was

made pursuant to a U.S. registration statement on Form F-10, declared effective by the U.S. Securities and Exchange Commissions

(the "SEC") on July 16, 2024 (the "Registration Statement"), and the Company's existing Canadian

short form base shelf prospectus (the "Base Prospectus") dated July 12, 2024. A preliminary prospectus supplement

relating to the Offering was filed with the securities commission in all of the provinces and territories of Canada, except Quebec, and

with the SEC in the United States, and a final prospectus supplement relating to the Offering (the "Supplement") was

filed with the securities commissions in all of the provinces and territories of Canada, except Quebec, and with the SEC in the United

States. The Supplement and accompanying Base Prospectus contain important detailed information about the Offering.

The Supplement

and accompanying Base Prospectus can be found on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Copies of the Supplement and

accompanying Base Prospectus may also be obtained from Canaccord Genuity LLC, 1 Post Office Square, Suite 3000, Boston, Massachusetts

02109, Attn: Syndicate Department, or by email at prospectus@cgf.com.

This news release

shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any

province, state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification

under the securities laws of any such province, state or jurisdiction.

About Cardiol

Therapeutics

Cardiol Therapeutics

Inc. is a clinical-stage life sciences company focused on the research and clinical development of anti-inflammatory and anti-fibrotic

therapies for the treatment of heart disease.

Cautionary statement regarding forward-looking

information:

This news release

contains "forward-looking information" within the meaning of applicable securities laws. All statements, other than statements

of historical fact, that address activities, events, or developments that Cardiol believes, expects, or anticipates will, may, could,

or might occur in the future are "forward-looking information". Forward looking information contained herein may include, but

is not limited to statements regarding the anticipated use of proceeds from the Offering. Forward-looking information contained herein

reflects the current expectations or beliefs of Cardiol based on information currently available to it and is based on certain assumptions

and is also subject to a variety of known and unknown risks and uncertainties and other factors that could cause the actual events or

results to differ materially from any future results, performance or achievements expressed or implied by the forward looking information,

and are not (and should not be considered to be) guarantees of future performance. These risks and uncertainties and other factors include

the risks and uncertainties referred to in the Company's Annual Report on Form 20-F filed with the U.S. Securities and Exchange

Commission and Canadian securities regulators on April 1, 2024, as well as the risks and uncertainties associated with product commercialization

and clinical studies. These assumptions, risks, uncertainties, and other factors should be considered carefully, and investors should

not place undue reliance on the forward-looking information, and such information may not be appropriate for other purposes. Any forward-looking

information speaks only as of the date of this press release and, except as may be required by applicable securities laws, Cardiol disclaims

any intent or obligation to update or revise such forward-looking information, whether as a result of new information, future events,

or results, or otherwise. Investors are cautioned not to rely on these forward-looking statements and are encouraged to read the Supplement,

the accompanying Base Prospectus and the documents incorporated by reference therein.

For further information, please contact:

Trevor Burns, Investor Relations

+1-289-910-0855

trevor.burns@cardiolrx.com

Exhibit 99.2

FORM 51-102F3

MATERIAL CHANGE REPORT

Item 1 – Name and Address of Company

Cardiol Therapeutics Inc.

2265 Upper Middle Road East, Suite 602

Oakville, Ontario, L6H 0G5, Canada

Item 2 – Date of Material Change

October 9, 2024

Item 3 – News Release

Attached

as Schedule “A” are copies of the news releases relating to the material change (the “News Releases”),

which were disseminated on October 9, 2024, October 10, 2024 and October 11, 2024 through Newsfile and filed on the System

for Electronic Document Analysis and Retrieval at www.sedarplus.ca (“SEDAR+”).

Item 4 – Summary of Material Change

Cardiol Therapeutics Inc. (“Cardiol”

or the “Company”), a clinical-stage life sciences company focused on the research and clinical development of anti-inflammatory

and anti-fibrotic therapies for the treatment of heart disease, announced that it priced and subsequently completed the public offering

(the “Offering”) of 8,437,500 Class A common shares (the “Common Shares”) of the Company at

a price to the public of US$1.60 per Common Share (the “Offering Price”) for gross proceeds of US$13,500,000, before

deducting the underwriting commissions and estimated expenses incurred in connection with the Offering. The Company also issued an additional

1,265,625 Common Shares at the Offering Price pursuant to the exercise of the over-allotment option, bringing the aggregate gross proceeds

of the Offering to US$15,525,000.

Item 5 – Full Description of Material Change

Item 5.1 – Full Description of Material Change

For a full description of the material change,

please see the News Releases attached hereto as Schedule “A” which forms an integral part of this material change report.

Item 5.2 – Disclosure of Restructuring Transactions

Not applicable.

Item 6 – Reliance on Section 7.1(2) of National

Instrument 51-102

Not Applicable.

Item 7 – Omitted Information

Not Applicable.

Item 8 – Executive Officer

Chris Waddick

Chief Financial Officer

(289) 910-0850

Item

9 – Date of Report

October 11, 2024

SCHEDULE “A”

See attached news releases.

Cardiol Therapeutics Announces Pricing

of Public Offering of Common Shares

Oakville, Ontario--(Newsfile Corp. -

October 9, 2024) - Cardiol Therapeutics Inc. (NASDAQ: CRDL) (TSX: CRDL) ("Cardiol" or the "Company"),

a clinical-stage life sciences company focused on the research and clinical development of anti-inflammatory and anti-fibrotic therapies

for the treatment of heart disease, announced today the pricing of its previously announced public offering (the "Offering")

of 8,437,500 Class A common shares of the Company (the "Common Shares") at

a price to the public of US$1.60 per Common Share for gross proceeds of US$13.5 million before deducting the underwriting discounts and

commissions and estimated expenses incurred in connection with the Offering.

The Company intends to use the net proceeds from the Offering to support

the clinical development of CardiolRx for the treatment of recurrent pericarditis and for general and administrative expenses, working

capital and other expenses.

Canaccord Genuity is acting as the sole bookrunner in connection with

the Offering.

The Offering is expected to close on

or about October 10, 2024 (the "Closing Date"), subject to the satisfaction of customary closing conditions,

including the listing of the Common Shares to be issued under the Offering on the Toronto Stock Exchange (the "TSX")

and the Nasdaq Capital Market (the "Nasdaq"), receipt of any required approvals

of the TSX and Nasdaq, and the entering into of an underwriting agreement between the Company and the underwriter.

The Offering is being made pursuant

to a U.S. registration statement on Form F-10, declared effective by the U.S. Securities and Exchange Commissions (the "SEC")

on July 16, 2024 (the "Registration Statement"), and the Company's existing

Canadian short form base shelf prospectus (the "Base Prospectus") dated July 12,

2024. A preliminary prospectus supplement relating to the Offering has been filed with the securities commission in all of the provinces

and territories of Canada, except Quebec, and with the SEC in the United States, and a final prospectus supplement relating to the Offering

(the "Supplement") will be filed with the securities commissions in all of the

provinces and territories of Canada, except Quebec, and with the SEC in the United States. The Supplement and accompanying Base Prospectus

contain important detailed information about the Offering.

The Supplement and accompanying Base

Prospectus can be found on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Copies of the Supplement and

accompanying Base Prospectus may also be obtained from Canaccord Genuity LLC, 1 Post Office Square, Suite 3000, Boston, Massachusetts

02109, Attn: Syndicate Department, or by email at prospectus@cgf.com. Prospective investors should read the Supplement and accompanying

Base Prospectus and the other documents the Company has filed before making an investment decision.

This news release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of these securities in any province, state or jurisdiction in which such offer, solicitation

or sale would be unlawful prior to the registration or qualification under the securities laws of any such province, state or jurisdiction.

About Cardiol Therapeutics

Cardiol Therapeutics Inc. is a clinical-stage life sciences company

focused on the research and clinical development of anti-inflammatory and anti-fibrotic therapies for the treatment of heart disease.

Cautionary statement regarding forward-looking information:

This news release contains "forward-looking

information" within the meaning of applicable securities laws. All statements, other than statements of historical fact, that

address activities, events, or developments that Cardiol believes, expects, or anticipates will, may, could, or might occur in the

future are "forward-looking information". Forward looking information contained herein may include, but is not limited to

statements regarding the Offering, whether and when the Offering may close, and the anticipated use of proceeds from the Offering.

Forward-looking information contained herein reflects the current expectations or beliefs of Cardiol based on information currently

available to it and is based on certain assumptions and is also subject to a variety of known and unknown risks and uncertainties

and other factors that could cause the actual events or results to differ materially from any future results, performance or

achievements expressed or implied by the forward looking information, and are not (and should not be considered to be) guarantees of

future performance. These risks and uncertainties and other factors include the risks and uncertainties referred to in the Company's

Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission and Canadian securities regulators on

April 1, 2024, as well as the risks and uncertainties associated with product commercialization and clinical studies. These

assumptions, risks, uncertainties, and other factors should be considered carefully, and investors should not place undue reliance

on the forward-looking information, and such information may not be appropriate for other purposes. Any forward-looking information

speaks only as of the date of this press release and, except as may be required by applicable securities laws, Cardiol disclaims any

intent or obligation to update or revise such forward-looking information, whether as a result of newinformation, future events, or

results, or otherwise. Investors are cautioned not to rely on these forward-looking statements and are encouraged to read the

Supplement, the accompanying Base Prospectus and the documents incorporated by reference therein.

For further information, please contact:

Trevor Burns, Investor Relations

+1-289-910-0855

trevor.burns@cardiolrx.com

To view the source version of this press

release, please visit

https://www.newsfilecorp.com/release/226119

Cardiol Therapeutics Announces Closing of US$13.5 Million Public

Offering of Common Shares

Oakville, Ontario--(Newsfile Corp. -

October 10, 2024) - Cardiol Therapeutics Inc. (NASDAQ: CRDL) (TSX: CRDL) ("Cardiol" or the "Company"),

a clinical-stage life sciences company focused on the research and clinical development of anti-inflammatory and anti-fibrotic therapies

for the treatment of heart disease, confirmed today that it has successfully closed its previously announced public offering (the "Offering")

of 8,437,500 Class A common shares of the Company (the "Common Shares") at

a price to the public of US$1.60 per Common Share for gross proceeds of US$13.5 million, before deducting the underwriting discounts

and commissions and estimated expenses incurred in connection with the Offering.

As previously stated, the Company intends to use the net proceeds

from the Offering to support the clinical development of CardiolRx for the treatment of recurrent pericarditis and for general and administrative

expenses, working capital and other expenses.

Canaccord Genuity acted as the sole bookrunner in connection with

the Offering.

The Offering was made pursuant to a

U.S. registration statement on Form F-10, declared effective by the U.S. Securities and Exchange Commissions (the "SEC")

on July 16, 2024 (the "Registration Statement"), and the Company's existing

Canadian short form base shelf prospectus (the "Base Prospectus") dated July 12,

2024. A preliminary prospectus supplement relating to the Offering was filed with the securities commission in all of the provinces and

territories of Canada, except Quebec, and with the SEC in the United States, and a final prospectus supplement relating to the Offering

(the "Supplement") was filed with the securities commissions in all of the provinces

and territories of Canada, except Quebec, and with the SEC in the United States. The Supplement and accompanying Base Prospectus contain

important detailed information about the Offering.

The Supplement and accompanying Base

Prospectus can be found on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Copies of the Supplement and accompanying

Base Prospectus may also be obtained from Canaccord Genuity LLC, 1 Post Office Square, Suite 3000, Boston, Massachusetts 02109,

Attn: Syndicate Department, or by email at prospectus@cgf.com.

This news release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of these securities in any province, state or jurisdiction in which such offer, solicitation

or sale would be unlawful prior to the registration or qualification under the securities laws of any such province, state or jurisdiction.

About Cardiol Therapeutics

Cardiol Therapeutics Inc. is a clinical-stage life sciences company

focused on the research and clinical development of anti-inflammatory and anti-fibrotic therapies for the treatment of heart disease.

Cautionary statement regarding forward-looking information:

This news release contains "forward-looking

information" within the meaning of applicable securities laws. All statements, other than statements of historical fact, that

address activities, events, or developments that Cardiol believes, expects, or anticipates will, may, could, or might occur in the

future are "forward-looking information". Forward looking information contained herein may include, but is not limited to

statements regarding the anticipated use of proceeds from the Offering. Forward-looking information contained herein reflects the

current expectations or beliefs of Cardiol based on information currently available to it and is based on certain assumptions and is

also subject to a variety of known and unknown risks and uncertainties and other factors that could cause the actual events or

results to differ materially from any future results, performance or achievements expressed or implied by the forward looking

information, and are not (and should not be considered to be) guarantees of future performance. These risks and uncertainties and

other factors include the risks and uncertainties referred to in the Company's Annual Report on Form 20-F filed with the U.S.

Securities and Exchange Commission and Canadian securities regulators on April 1, 2024, as well as the risks and uncertainties

associated with product commercialization and clinical studies. These assumptions, risks, uncertainties, and other factors should be

considered carefully, and investors should not place undue reliance on the forward-looking information, and such information may not

be appropriate for other purposes. Any forward-looking information speaks only as of the date of this press release and, except as

may be required by applicable securities laws, Cardiol disclaims any intent or obligation to update or revise such forward-looking

information, whether as a result of new information, future events, or results, or otherwise. Investors are cautioned not to rely on

these forward-looking statements and are encouraged to read the Supplement, the accompanying Base Prospectus and the documents

incorporated by reference therein.

For further information, please contact:

Trevor Burns, Investor Relations

+1-289-910-0855

trevor.burns@cardiolrx.com

To view the source version of this press

release, please visit

https://www.newsfilecorp.com/release/226257

Cardiol Therapeutics Announces Exercise and

Closing of Over-Allotment Option

Oakville, Ontario--(Newsfile Corp.

- October 11, 2024) - Cardiol Therapeutics Inc. (NASDAQ: CRDL) (TSX: CRDL) ("Cardiol" or the

"Company"), a clinical-stage life sciences company focused on the research and clinical development of

anti-inflammatory and anti-fibrotic therapies for the treatment of heart disease, is pleased to announce that, further to its

successfully completed public offering of an aggregate of 8,437,500 Class A common shares of the Company (the "Common

Shares") at a price to the public of US$1.60 per Common Share (the "Offering

Price") for gross proceeds of US$13.5 million (the "Offering"),

Canaccord Genuity has purchased an additional 1,265,625 Common Shares at the Offering Price pursuant to their exercise in full of

the over-allotment option (the "Over-Allotment Option"), for additional gross

proceeds to the Company of $2,025,000 before deducting the underwriting commissions.

After giving effect to the full exercise of the Over-Allotment Option,

Cardiol sold 9,703,125 Common Shares under the Offering, for aggregate gross proceeds of US$15,525,000.

The Company intends to use the net proceeds from the Offering to support

the clinical development of CardiolRx for the treatment of recurrent pericarditis and for general and administrative expenses, working

capital and other expenses.

Canaccord Genuity acted as the sole bookrunner in connection with

the Offering.

The Offering was made pursuant to a

U.S. registration statement on Form F-10, declared effective by the U.S. Securities and Exchange Commissions (the "SEC")

on July 16, 2024 (the "Registration Statement"), and the Company's existing

Canadian short form base shelf prospectus (the "Base Prospectus") dated July 12,

2024. A preliminary prospectus supplement relating to the Offering was filed with the securities commission in all of the provinces and

territories of Canada, except Quebec, and with the SEC in the United States, and a final prospectus supplement relating to the Offering

(the "Supplement") was filed with the securities commissions in all of the provinces

and territories of Canada, except Quebec, and with the SEC in the United States. The Supplement and accompanying Base Prospectus contain

important detailed information about the Offering.

The Supplement and accompanying Base

Prospectus can be found on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Copies of the Supplement and accompanying

Base Prospectus may also be obtained from Canaccord Genuity LLC, 1 Post Office Square, Suite 3000, Boston, Massachusetts 02109,

Attn: Syndicate Department, or by email at prospectus@cgf.com.

This news release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of these securities in any province, state or jurisdiction in which such offer, solicitation

or sale would be unlawful prior to the registration or qualification under the securities laws of any such province, state or jurisdiction.

About Cardiol Therapeutics

Cardiol Therapeutics Inc. is a clinical-stage life sciences company

focused on the research and clinical development of anti-inflammatory and anti-fibrotic therapies for the treatment of heart disease.

Cautionary statement regarding forward-looking information:

This news release contains "forward-looking

information" within the meaning of applicable securities laws. All statements, other than statements of historical fact, that

address activities, events, or developments that Cardiol believes, expects, or anticipates will, may, could, or might occur in the

future are "forward-looking information". Forward looking information contained herein may include, but is not limited to

statements regarding the anticipated use of proceeds from the Offering. Forward-looking information contained herein reflects the

current expectations or beliefs of Cardiol based on information currently available to it and is based on certain assumptions and is

also subject to a variety of known and unknown risks and uncertainties and other factors that could cause the actual events or

results to differ materially from any future results, performance or achievements expressed or implied by the forward looking

information, and are not (and should not be considered to be) guarantees of future performance. These risks and uncertainties and

other factors include the risks and uncertainties referred to in the Company's Annual Report on Form 20-F filed with the U.S.

Securities and Exchange Commission and Canadian securities regulators on April 1, 2024, as well as the risks and uncertainties

associated with product commercialization and clinical studies. These assumptions, risks, uncertainties, and other factors should be

considered carefully, and investors should not place undue reliance on the forward-looking information, and such information may not

be appropriate for other purposes. Any forward-looking information speaks only as of the date of this press release and, except as

may be required by applicable securities laws, Cardiol disclaims any intent or obligation to update or revise such forward-looking

information, whether as a result of new information, future events, or results, or otherwise. Investors are cautioned not to rely on

these forward-looking statements and are encouraged to read the Supplement, the accompanying Base Prospectus and the documents

incorporated by reference therein.

For further information, please contact:

Trevor Burns, Investor Relations

+1-289-910-0855

trevor.burns@cardiolrx.com

To view the source version of this press

release, please visit

https://www.newsfilecorp.com/release/226366

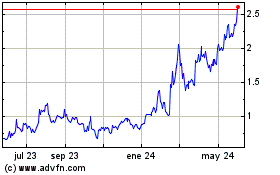

Cardiol Therapeutics (NASDAQ:CRDL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

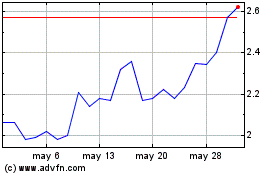

Cardiol Therapeutics (NASDAQ:CRDL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024