As

filed with the Securities and Exchange Commission on November 15, 2024

Registration

No. 333-__________

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Daré

Bioscience, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

20-4139823 |

| (State

or other jurisdiction of |

|

(Primary

Standard Industrial |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Classification

Code Number) |

|

Identification

No.) |

3655

Nobel Drive, Suite 260

San

Diego, California 92122

(858)

926-7655

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Sabrina

Martucci Johnson

Chief

Executive Officer

Daré

Bioscience, Inc.

3655

Nobel Drive, Suite 260

San

Diego, California 92122

(858)

926-7655

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Edwin

Astudillo, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

12275

El Camino Real, Suite 100

San

Diego, California 92130

(858)

720-8953

Approximate

date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE

REGISTRANT SHALL FILE A FURTHER AMENDMENT THAT SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE

IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE

ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

of which this prospectus forms a part filed with the Securities and Exchange Commission is effective. This preliminary prospectus is

not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale

is not permitted.

SUBJECT

TO COMPLETION, DATED NOVEMBER 15, 2024

PROSPECTUS

Daré

Bioscience, Inc.

2,750,000

Shares of Common Stock

This

prospectus relates to the resale, from time to time, of up to 2,750,000 shares of our common stock, par value $0.0001, by Lincoln

Park Capital Fund, LLC, or Lincoln Park or the selling stockholder.

The

shares of common stock to which this prospectus relates are shares that have been or may be issued to Lincoln Park

pursuant to the purchase agreement dated October 21, 2024 that we entered into with Lincoln Park, which we refer to in this prospectus

as the Purchase Agreement. See “Our Agreements with Lincoln Park” for a description of that agreement and “Selling

Stockholder” for additional information regarding Lincoln Park. The prices at which Lincoln Park may sell the shares will be determined

by the prevailing market price for the shares or in negotiated transactions.

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of shares by the selling

stockholder.

The

selling stockholder may sell or otherwise dispose of the shares of common stock described in this prospectus in a number of different

ways and at varying prices. See “Plan of Distribution” beginning on page 25 of this prospectus for more information about

how and the prices at which the selling stockholder may sell or otherwise dispose of the shares of our common stock being offered. The

selling stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended.

The

selling stockholder will pay all brokerage fees and commissions and similar expenses. We will pay all expenses (except brokerage fees

and commissions and similar expenses) relating to the registration of the shares with the Securities and Exchange Commission.

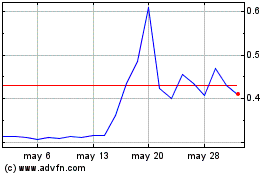

Our

common stock is listed on The Nasdaq Capital Market under the symbol “DARE.” On November 14, 2024, the last reported

sale price of our common stock was $3.57 per share.

Investing

in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully

the risks described under the caption “Risk Factors” beginning on page 8 of this prospectus, and under similar headings

in the documents incorporated by reference in this prospectus, as well as in any amendments or supplements to this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus does not contain all of the information included in the registration statement of which this prospectus forms a part. For

a more complete understanding of the offering of the securities described herein, you should refer to the registration statement, including

its exhibits. You should carefully read this prospectus, any prospectus supplement or free writing prospectus that we subsequently authorize

for use in connection with the offering of the securities described herein, the information and documents incorporated herein by reference

and the additional information under the heading “Where You Can Find More Information” before making an investment decision.

You should rely only on the information we have provided or incorporated by reference in this prospectus, or in any prospectus supplement

or free writing prospectus that we subsequently authorize for use in connection with the offering of the securities described herein.

Neither we, nor the selling stockholder, have authorized anyone to provide you with information different from that contained or incorporated

by reference in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. You should

assume that the information in this prospectus, or any related prospectus supplement or free writing prospectus, is accurate only as

of the date set forth on the cover page of any such document or any earlier date as of which such information is given, as applicable,

and that any information we have incorporated herein by reference is accurate only as of the date set forth on the cover page of any

such document containing such information or any earlier date as of which such information is given, as applicable, regardless of the

time of delivery of this prospectus, or such prospectus supplement or free writing prospectus, or any sale of a security. Our business,

financial condition, results of operations and prospects may have changed since that date.

Neither

we, nor the selling stockholder, are offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer

or sale is not permitted. We have not done anything that would permit this offering or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who

come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities

hereunder and the distribution of this prospectus outside the United States.

The

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which

this prospectus forms a part or to any document that is incorporated by reference in this prospectus were made solely for the benefit

of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements,

and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants

were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately

representing the current state of our affairs.

Unless

otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including

our general expectations and market position, market opportunity and market size, is based on information from various sources, including

peer reviewed journals, formal presentations at medical society meetings and third-parties commissioned by us or our licensors to provide

market research and analysis, and is subject to a number of assumptions and limitations. Although we are responsible for all of the disclosure

contained in this prospectus and we believe the information from industry publications and other third-party sources included in this

prospectus is reliable, such information is inherently imprecise. Information that is based on estimates, forecasts, projections, market

research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from

events and circumstances that are assumed in this information. The industry in which we operate is subject to a high degree of uncertainty

and risk due to a variety of factors, including those described in the section captioned “Risk Factors.”

To

the extent there are inconsistencies between this prospectus, any related prospectus supplement or free writing prospectus, and any documents

incorporated by reference, the document with the most recent date will control.

Unless

the context otherwise requires, “Daré,” “Daré Bioscience,” “the Company,” “we,”

“us,” “our” and similar terms refer to Daré Bioscience, Inc. and its subsidiaries.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. This summary provides an overview of selected information and

does not contain all of the information you should consider before investing in our securities. We urge you to read this entire prospectus,

including our consolidated financial statements, notes to the consolidated financial statements, the information in the section captioned

“Risk Factors,” and other information incorporated herein by reference to our other filings with the Securities and Exchange

Commission, or SEC, or included in any applicable prospectus supplement. Investing in our securities involves a high degree of risk and

uncertainty. Therefore, carefully consider the risk factors described in this prospectus, including those incorporated herein by reference

to our most recent annual and quarterly filings with the SEC, before purchasing our securities. Each of the risk factors could adversely

affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

About

Daré Bioscience

We

are a biopharmaceutical company committed to advancing innovative products for women’s health. We are driven by a mission to identify,

develop and bring to market a diverse portfolio of differentiated therapies that prioritize women’s health and well-being, expand

treatment options, and improve outcomes, primarily in the areas of contraception, sexual health, pelvic pain, fertility, infectious disease

and menopause. Our business strategy is to in-license or otherwise acquire the rights to differentiated product candidates in our areas

of focus, some of which have existing clinical proof-of-concept data, to take those candidates through mid to late-stage clinical development

or regulatory approval, and to establish and leverage strategic collaborations to achieve commercialization. We and our wholly-owned

subsidiaries operate in one business segment.

The

first product approved by the United States Food and Drug Administration, or FDA, to emerge from our portfolio of women’s

health product candidates is XACIATO™ (clindamycin phosphate) vaginal gel 2%, or XACIATO (pronounced zah-she-AH-toe). We achieved

FDA approval of XACIATO three years after acquiring rights to the program. XACIATO was approved by the FDA in December 2021 as a single-dose

prescription medication for the treatment of bacterial vaginosis in females 12 years of age and older. In March 2022, we entered into

an agreement with an affiliate of Organon & Co., Organon International GmbH, or Organon, which became fully effective in June 2022,

whereby Organon licensed exclusive worldwide rights to develop, manufacture and commercialize XACIATO. In accordance with the license

agreement, as amended, we are no longer working on the development, manufacture or commercialization of XACIATO. Organon commenced U.S.

marketing of XACIATO in the fourth quarter of 2023 and, in January 2024, Organon announced that XACIATO was available nationwide.

Our

product pipeline includes diverse programs that target unmet needs in women’s health in the areas of contraception, sexual health,

pelvic pain, fertility, infectious disease and menopause, and aim to expand treatment options, enhance outcomes and improve ease of use

for women. We are primarily focused on progressing the development of our existing portfolio of product candidates. However, we also

explore opportunities to expand our portfolio by leveraging assets to which we hold rights or obtaining rights to new assets, with continued

focus solely on women’s health.

Our

current portfolio includes five product candidates in advanced clinical development (Phase 2-ready to Phase 3):

| ● | Ovaprene®,

a hormone-free, monthly intravaginal contraceptive; |

| ● | Sildenafil

Cream, 3.6%, a proprietary cream formulation of sildenafil for topical administration

to the female genitalia on demand for the treatment of female sexual arousal disorder (FSAD); |

| ● | DARE-HRT1,

an intravaginal ring designed to deliver both bio-identical estradiol and progesterone together,

continuously over a 28-day period, for the treatment of moderate-to-severe vasomotor symptoms,

as part of menopausal hormone therapy; |

| ● | DARE-VVA1,

a proprietary formulation of tamoxifen for intravaginal administration being developed as

a hormone-free alternative to estrogen-based therapies for the treatment of moderate-to-severe

dyspareunia, or pain during sexual intercourse, a symptom of vulvar and vaginal atrophy associated

with menopause; and |

| ● | DARE-HPV,

a proprietary, fixed-dose formulation of lopinavir and ritonavir in a soft gel vaginal insert

for the treatment of human papillomavirus (HPV)-related cervical diseases. |

Our

portfolio also includes five product candidates in Phase 1 clinical development or that we believe are Phase 1-ready:

| ● | DARE-PDM1,

a proprietary hydrogel formulation of diclofenac, a nonsteroidal anti-inflammatory drug,

for vaginal administration as a treatment for primary dysmenorrhea; |

| ● | DARE-204

and DARE-214, injectable formulations of etonogestrel designed to provide contraception

over 6-month and 12-month periods, respectively; |

| ● | DARE-FRT1,

an intravaginal ring designed to deliver bio-identical progesterone continuously for up to

14 days for luteal phase support as part of an in vitro fertilization treatment plan; and |

| ● | DARE-PTB1,

an intravaginal ring designed to deliver bio-identical progesterone continuously for up to

14 days for the prevention of preterm birth. |

In

addition, our portfolio includes five preclinical stage programs:

| ● | DARE-LARC1,

a contraceptive implant delivering levonorgestrel with a woman-centered design that has the

potential to be a long-acting, yet convenient and user-controlled contraceptive option; |

| ● | DARE-LBT,

a novel hydrogel formulation for vaginal delivery of live biotherapeutics to support vaginal

health; |

| ● | DARE-GML,

an intravaginally-delivered potential multi-target antimicrobial agent formulated with glycerol

monolaurate (GML), which has shown broad antimicrobial activity, killing bacteria and viruses; |

| ● | DARE-RH1,

a novel approach to non-hormonal contraception for both men and women by targeting the CatSper

ion channel; and |

| ● | DARE-PTB2,

a novel approach for the prevention and treatment of idiopathic preterm birth through inhibition

of a stress response protein. |

The

product candidates and potential product candidates in our portfolio will require review and approval from the FDA, or a comparable foreign

regulatory authority, prior to being marketed or sold.

Our

primary operations have consisted of research and development activities to advance our portfolio of product candidates through late-stage

clinical development and/or regulatory approval. We expect our research and development expenses will continue to represent the majority

of our operating expenses for at least the next twelve months. Until we secure additional capital to fund our operating needs, we will

focus our resources primarily on advancement of Ovaprene and Sildenafil Cream. In addition, we expect to incur significant research and

development expenses for the DARE-LARC1 and DARE-HPV programs, but we also expect such expenses will be supported, with respect to DARE-LARC1,

through at least 2026 by non-dilutive funding provided under a grant agreement we entered into in June 2021, and with respect to DARE-HPV,

through October 2026 by non-dilutive funding provided under a subaward agreement we entered into in October 2024.

We

will need to raise substantial additional capital to continue to fund our operations and execute our current business strategy. We are

also subject to a number of other risks common to biopharmaceutical companies, including, but not limited to, dependence on key employees,

reliance on third-party collaborators, service providers and suppliers, being able to develop commercially viable products in a timely

and cost-effective manner, dependence on intellectual property we own or in-license and the need to protect that intellectual property

and maintain those license agreements, uncertainty of market acceptance of products, uncertainty of third-party payor coverage, pricing

and reimbursement for products, rapid technology change, intense competition, compliance with government regulations, product liability

claims, and exposure to cybersecurity threats and incidents.

The

process of developing and obtaining regulatory approvals for prescription drug and drug/device products in the United States and in foreign

jurisdictions is inherently uncertain and requires the expenditure of substantial financial resources without any guarantee of success.

To the extent we receive regulatory approvals to market and sell our product candidates, the commercialization of any product and compliance

with subsequently applicable laws and regulations requires the expenditure of further substantial financial resources without any guarantee

of commercial success. The amount of post-approval financial resources required for commercialization and the potential revenue we may

receive from sales of any product will vary significantly depending on many factors, including whether, and the extent to which, we establish

our own sales and marketing capabilities and/or enter into and maintain commercial collaborations with third parties with established

commercialization infrastructure.

Purchase

Agreement with Lincoln Park

On

October 21, 2024, we entered into a purchase agreement with Lincoln Park, which we refer to in this prospectus as the Purchase Agreement,

pursuant to which Lincoln Park agreed to purchase from us up to an aggregate of $15,000,000 of our common stock (subject to certain limitations)

from time to time over the term of the Purchase Agreement. Also on October 21, 2024, we entered into a registration rights agreement

with Lincoln Park, which we refer to in this prospectus as the Registration Rights Agreement, pursuant to which we filed with the SEC

the registration statement of which this prospectus forms a part to register for resale under the Securities Act of 1933, as amended,

or the Securities Act, the shares of common stock that have been or may be issued to Lincoln Park under the Purchase Agreement.

We

do not have the right to commence any sales of our common stock to Lincoln Park under the Purchase Agreement until the conditions set

forth in the Purchase Agreement, all of which are outside of Lincoln Park’s control, have been satisfied, including that the SEC

has declared effective the registration statement of which this prospectus forms a part, which time we refer to in this prospectus as

the Commencement. From time to time after the Commencement, at our sole discretion, on any business day selected by us on which the closing

sale price of our common stock is not below $0.50 per share, we may direct Lincoln Park to purchase up to 30,000 shares of our common

stock (each, a “Regular Purchase”); provided that the share amount under a Regular Purchase may be increased to up to 35,000

shares or up to 40,000 shares if the closing sale price of our common stock is not below $5.00 or $7.50, respectively, on the business

day on which we initiate the purchase, subject to adjustment for any reorganization, recapitalization, non-cash dividend, stock split,

reverse stock split or other similar transaction as provided in the Purchase Agreement. However, Lincoln Park’s maximum commitment

in any single Regular Purchase may not exceed $500,000. The purchase price per share for each Regular Purchase will be the lower of (i)

the lowest sale price of our common stock on the business day on which we initiate the Regular Purchase and (ii) the average of the three

lowest closing sale prices of our common stock during the 10-business day period immediately preceding the business day on which we initiate

the Regular Purchase. In addition to Regular Purchases, we may also direct Lincoln Park to purchase other amounts of common stock as

accelerated purchases and as additional accelerated purchases, subject to limits specified in the Purchase Agreement, at a purchase price

per share calculated as specified in the Purchase Agreement, but in no case lower than the minimum price per share we stipulate in our

notice to Lincoln Park initiating these purchases. We will control the timing and amount of any sales of our common stock to Lincoln

Park.

On

October 21, 2024, in consideration for its commitment to purchase shares of our common stock under the Purchase Agreement, we issued

137,614 shares of our common stock to Lincoln Park, which we refer to in this prospectus as the “Commitment Shares.”

We

may terminate the Purchase Agreement at any time after the date of Commencement, at no penalty or cost, other than the Commitment Shares.

There are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the

Purchase Agreement or Registration Rights Agreement, other than a prohibition on our issuing, or entering into any agreement to effect

the issuance of, shares of our common stock or common stock equivalents involving a transaction that is defined in the Purchase Agreement

as a “Variable Rate Transaction.” Lincoln Park may not assign or transfer its rights and obligations under the Purchase Agreement.

As

of September 30, 2024, there were 8,546,364 shares of our common stock outstanding, excluding the Commitment Shares, of which 8,444,775

shares were held by non-affiliates. Although the Purchase Agreement provides that we may sell up to $15,000,000 of our common stock to

Lincoln Park, only 2,750,000 shares of our common stock are being offered under this prospectus, which represents the Commitment Shares

and up to 2,612,386 shares which may be issued to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares

to Lincoln Park under the Purchase Agreement. If all of the 2,750,000 shares offered by Lincoln Park under this prospectus were issued

and outstanding, such shares would represent approximately 24% of the total number of shares of our common stock outstanding and approximately

25% of the total number of outstanding shares held by non-affiliates, in each case as of September 30, 2024. Depending on the price per

share at which we sell shares to Lincoln Park under the Purchase Agreement, we may need to sell more shares to Lincoln Park than are

offered under this prospectus to receive aggregate gross proceeds equal to the $15,000,000 total commitment of Lincoln Park under the

Purchase Agreement, in which case we must first register for resale under the Securities Act additional shares of our common stock. The

number of shares ultimately offered for resale by Lincoln Park will depend upon the number of shares we elect to sell to Lincoln Park

under the Purchase Agreement. Sales of our common stock to Lincoln Park by us under the Purchase Agreement could result in substantial

dilution to our stockholders.

Under

applicable rules of The Nasdaq Stock Market, in no event may we issue or sell to Lincoln Park under the Purchase Agreement more than

19.99% of the shares of our common stock outstanding immediately prior to the execution of the Purchase Agreement, which is 1,711,172

shares based on 8,555,864 shares outstanding immediately prior to the execution of the Purchase Agreement (the “Exchange Cap”),

unless (i) we obtain stockholder approval to issue shares in excess of the Exchange Cap or (ii) the average price of all applicable sales

of our common stock to Lincoln Park under the Purchase Agreement equals or exceeds $3.59 per share (which represents the lower of (A)

the official closing price of our common stock on Nasdaq immediately preceding the signing of the Purchase Agreement and (B) the average

official closing price of our common stock on Nasdaq for the five consecutive trading days ending on the trading day immediately preceding

the date of the Purchase Agreement), such that issuances and sales of common stock to Lincoln Park under the Purchase Agreement would

not be subject to the Exchange Cap under applicable Nasdaq rules. In any event, the Purchase Agreement specifically provides that we

may not issue or sell any shares of our common stock under the Purchase Agreement if such issuance or sale would breach any applicable

Nasdaq rules.

The

Purchase Agreement also prohibits us from directing Lincoln Park to purchase any shares of common stock if those shares, when aggregated

with all other shares of our common stock then beneficially owned by Lincoln Park and its affiliates, would result in Lincoln Park and

its affiliates having beneficial ownership, at any single point in time, of more than 4.99% of the then total outstanding shares of our

common stock, as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule

13d-3 thereunder, which limitation we refer to as the Beneficial Ownership Cap. Lincoln Park, upon written notice to us, may increase

the Beneficial Ownership Cap to up to 9.99%. Any increase in the Beneficial Ownership Cap will not be effective until the 61st day after

such written notice is delivered to us.

Issuances

of our common stock to Lincoln Park will not affect the rights or privileges of our existing stockholders, except that the economic and

voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares

of common stock that our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent a

smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

Additional

Information

For

additional information related to our business and operations, please refer to the annual and quarterly reports incorporated herein by

reference, as described under the caption “Incorporation of Documents by Reference” on page 27 of this prospectus.

Corporate

Information

Our

principal executive offices are located at 3655 Nobel Drive, Suite 260, San Diego, California 92122, and our telephone number at that

address is (858) 926-7655. We maintain a website at www.darebioscience.com, to which we regularly post copies of our press releases as

well as additional information about us. The information contained on, or that can be accessed through, our website is not a part of

this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Daré

Bioscience® is a registered trademark of Daré Bioscience, Inc. Ovaprene® is a registered trademark licensed to Daré

Bioscience, Inc. All brand names or trademarks appearing in this prospectus are the property of their respective holders. Use or display

by us of other parties’ trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship

with, or endorsements or sponsorship of, us by the trademark or trade dress owners.

The

Offering

This

prospectus relates to the resale by Lincoln Park Capital Fund, LLC, the selling stockholder identified in this prospectus, of shares

of our common stock, par value $0.0001 per share, as follows:

| Common

stock offered by the selling stockholder |

|

Up

to 2,750,000 shares consisting of: |

| |

|

● |

137,614

shares issued to Lincoln Park in consideration for its commitment to purchase shares of our common stock under the Purchase Agreement;

and |

| |

|

|

|

| |

|

● |

2,612,386

shares we may sell to Lincoln Park under the Purchase Agreement from time to time after the date of this prospectus. |

| Common

stock outstanding prior to this offering (which excludes the 137,614 shares issued to Lincoln Park described above) |

|

8,546,364

shares |

| |

|

|

| Common

stock to be outstanding after giving effect to the issuance of 2,750,000 shares under the Purchase Agreement registered hereunder |

|

11,296,364

shares |

| |

|

| Use

of proceeds |

|

We

will receive no proceeds from the sale of shares of common stock by Lincoln Park in this offering. We may receive up to $15,000,000

in aggregate gross proceeds under the Purchase Agreement from any sales we make to Lincoln Park pursuant to the Purchase Agreement

after the date of this prospectus. Any such proceeds we receive will be used for working capital and general corporate purposes.

See “Use of Proceeds” on page 22 of this prospectus. |

| |

|

| Risk

factors |

|

Investment

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus, as well

as the other information included in or incorporated by reference in this prospectus, for a discussion of risks you should carefully

consider before investing in our common stock.

|

| Nasdaq

Capital Market symbol |

|

“DARE” |

The

actual number of shares of our common stock outstanding after this offering will vary depending on the actual number of shares we sell

to Lincoln Park under the Purchase Agreement. The number of shares of our common stock outstanding prior to and after this offering in

the table above is based on 8,546,364 shares outstanding as of September 30, 2024 and excludes:

| ● | 137,614

shares issued to Lincoln Park on October 21, 2024 in consideration for its commitment to

purchase shares under the Purchase Agreement; |

| ● | 903,424

shares of common stock issuable upon exercise of stock options outstanding as of September

30, 2024, with a weighted-average exercise price of $14.73 per share; |

| ● | 445,661

shares of common stock reserved and available for future issuance as of September 30, 2024

under our equity incentive plans; |

| ● | 1,268,572

shares of common stock issuable upon exercise of warrants outstanding as of September 30,

2024, with a weighted-average exercise price of $7.49 per share; and |

| ● | 16,408

shares of common stock issued after September 30, 2024 pursuant to our “at the market”

offering program. |

RISK

FACTORS

Investing

in our securities involves significant risk. In addition to the other information included or incorporated by reference in this prospectus,

including the risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent

annual report on Form 10-K, as revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form

8-K that we have filed with the SEC, all of which are incorporated herein by reference (other than current reports on Form 8-K, or portions

thereof, furnished under Items 2.02 or 7.01 of Form 8-K), you should consider the risks described below before making an investment decision

with respect to the shares of our common stock in this offering. We expect to update these risks and our other risk factors from time

to time in periodic and current reports we file with the SEC in the future. Such updated risk factors will be incorporated by reference

in this prospectus. Please refer to our subsequently filed reports for additional information relating to the risks associated with investing

in our common stock. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties

not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these risks might

cause you to lose all or part of your investment.

The

sale of our common stock to Lincoln Park may cause dilution and the subsequent sale of the shares of common stock acquired by Lincoln

Park, or the perception that such sales may occur, could cause the price of our common stock to fall.

On

October 21, 2024, we entered into the Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park committed to purchase up to

$15,000,000 of our common stock, and we issued the Commitment Shares. Other than the Commitment Shares, the shares of our common stock

that may be issued under the Purchase Agreement may be sold by us to Lincoln Park from time to time at our discretion over a 24-month

period commencing on the date that the conditions set forth in the Purchase Agreement are satisfied, including that the registration

statement of which this prospectus forms a part is declared effective by the SEC. The purchase price for the shares that we may sell

to Lincoln Park under the Purchase Agreement will vary based on the price of our common stock at the time we initiate the sale. Depending

on market liquidity at the time, sales of such shares may cause the trading price of our common stock to fall.

We

generally have the right to control the timing and amount of any future sales of our shares to Lincoln Park. Sales of shares of our common

stock to Lincoln Park under the Purchase Agreement, if any, will depend upon market conditions and other factors to be determined by

us. We may ultimately decide to sell to Lincoln Park all, some or none of the shares of our common stock that may be available for us

to sell pursuant to the Purchase Agreement. If and when we do sell shares to Lincoln Park, after Lincoln Park has acquired the shares,

Lincoln Park may resell all, some or none of those shares at any time or from time to time in its discretion. Therefore, sales to Lincoln

Park by us could result in substantial dilution to the interests of other holders of our common stock. Additionally, the sale of a substantial

number of shares of our common stock to Lincoln Park, or the anticipation of such sales, could make it more difficult for us to sell

equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales. See also, “The

sale of our common stock in ATM offerings may cause substantial dilution to our existing stockholders, and such sales, or the anticipation

of such sales, may cause the price of our common stock to decline,” below.

It

is not possible to predict the actual number of shares of common stock we may sell to Lincoln Park under the Purchase Agreement, or the

actual gross proceeds resulting from those sales.

Because

the purchase price per share to be paid by Lincoln Park for the shares of common stock that we may elect to sell to Lincoln Park under

the Purchase Agreement, if any, will fluctuate based on the market prices of our common stock at the time we elect to sell shares to

Lincoln Park pursuant to the Purchase Agreement, if any, it is not possible for us to predict, as of the date of this prospectus and

prior to any such sales, the number of shares of common stock that we will sell to Lincoln Park under the Purchase Agreement, the purchase

price per share that Lincoln Park will pay for shares purchased from us under the Purchase Agreement, or the aggregate gross proceeds

that we will receive from those purchases by Lincoln Park under the Purchase Agreement.

Moreover,

although the Purchase Agreement provides that we may sell up to an aggregate of $15.0 million of our common stock to Lincoln Park, only

2,750,000 shares of common stock are being registered under the Securities Act for resale by Lincoln Park under the registration

statement of which this prospectus forms a part, consisting of (i) the 137,614 Commitment Shares that we issued to Lincoln Park as consideration

for its commitment to purchase shares of our common stock under the Purchase Agreement and (ii) up to 2,612,386 shares of our common

stock that we may elect to sell to Lincoln Park, in our sole discretion, from time to time from and after the Commencement under

the Purchase Agreement.

If

after the Commencement we elect to sell to the selling stockholder all of the 2,612,386 shares of common stock being registered for resale

by Lincoln Park under this prospectus that are available for sale by us to the selling stockholder under the Purchase Agreement, depending

on the market prices of our common stock at the time of such sales, the actual gross proceeds from the sale of all such shares of common

stock by us to Lincoln Park may be substantially less than the $15.0 million total purchase commitment available to us under the Purchase

Agreement, which could materially adversely affect our liquidity.

If

it becomes necessary for us to issue and sell to Lincoln Park shares of common stock in excess of the Exchange Cap under the Purchase

Agreement in order to receive aggregate gross proceeds equal to $15.0 million under the Purchase Agreement, then for so long as the Exchange

Cap continues to apply to issuances and sales of common stock under the Purchase Agreement, we must first obtain stockholder approval

to issue shares of common stock in excess of the Exchange Cap in accordance with applicable Nasdaq listing rules. Furthermore, if we

elect to issue and sell to Lincoln Park more than the 2,612,386 shares of our common stock that we may elect to issue and sell to Lincoln

Park under the Purchase Agreement that are being registered for resale by Lincoln Park hereunder, which we have the right, but not the

obligation, to do, we must first file with the SEC one or more additional registration statements to register under the Securities Act

for resale by Lincoln Park such additional shares of our common stock we wish to sell from time to time under the Purchase Agreement,

which the SEC must declare effective, in each case before we may elect to sell any additional shares of our common stock to Lincoln Park

under the Purchase Agreement. Any issuance and sale by us under the Purchase Agreement of a substantial amount of shares of common stock

in addition to the 2,612,386 shares of common stock that we may elect to issue and sell to Lincoln Park under the Purchase Agreement

that are being registered for resale by Lincoln Park hereunder could cause additional substantial dilution to our stockholders. The number

of shares of our common stock ultimately offered for sale by Lincoln Park is dependent upon the number of shares of common stock, if

any, we ultimately sell to Lincoln Park under the Purchase Agreement, and the sale of common stock under the Purchase Agreement may cause

the trading price of our common stock to decline.

Investors

who buy shares at different times will likely pay different prices, and the sale of the shares of common stock acquired by Lincoln Park

could cause the price of our common stock to decline.

Pursuant

to the Purchase Agreement, we will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold

to Lincoln Park. If and when we do elect to sell shares of our common stock to Lincoln Park pursuant to the Purchase Agreement, after

Lincoln Park has acquired such shares, Lincoln Park may resell all, some or none of such shares at any time or from time to time in its

discretion and at different prices. As a result, investors who purchase shares from Lincoln Park in this offering at different times

will likely pay different prices for those shares, and so may experience different levels of dilution and in some cases substantial dilution

and different outcomes in their investment results. Investors may experience a decline in the value of the shares they purchase from

Lincoln Park in this offering as a result of future sales made by us to Lincoln Park at prices lower than the prices such investors paid

for their shares in this offering. Further, the sale of a substantial number of shares of our common stock by Lincoln Park, or anticipation

of such sales, could cause the trading price of our common stock to decline or make it more difficult for us to sell equity or equity-related

securities in the future at a time and at a price that we might otherwise desire.

We

may not have access to the full amount available under the Purchase Agreement with Lincoln Park. We may require additional financing

to sustain our operations, without which we may not be able to continue operations, and the terms of subsequent financings may adversely

impact our stockholders.

We

may direct Lincoln Park to purchase up to $15.0 million worth of shares of our common stock in a Regular Purchase from time to time under

the Purchase Agreement over a 24-month period generally in amounts up to 30,000 shares of our common stock, which may be increased to

up to 40,000 shares of our common stock depending on the closing sale price of our common stock at the time of sale, provided that Lincoln

Park’s maximum purchase obligation under any single Regular Purchase shall not exceed $500,000. Moreover, under certain circumstances

as set forth in the Purchase Agreement, we may, in our sole discretion, also direct Lincoln Park to purchase additional shares of common

stock in “accelerated purchases,” and “additional accelerated purchases” as set forth in the Purchase Agreement.

Depending

on the prevailing market price of our common stock, we may not be able to sell shares to Lincoln Park for the maximum $15.0 million over

the term of the Purchase Agreement. We will need to seek stockholder approval before issuing more than the Exchange Cap limit of 1,711,172

shares of common stock under the Purchase Agreement, unless the average price per share of common stock for all shares of common stock

sold by us to Lincoln Park under the Purchase Agreement equals or exceeds $3.59 per share (which represents the lower of (A) the official

closing price of our common stock on Nasdaq immediately preceding the signing of the Purchase Agreement and (B) the average official

closing price of our common stock on Nasdaq for the five consecutive trading days ending on the trading day immediately preceding the

date of the Purchase Agreement), such that the Exchange Cap limitation would no longer apply to issuances and sales of common stock by

us to Lincoln Park under the Purchase Agreement under applicable Nasdaq listing rules. In addition, Lincoln Park will not be required

to purchase any shares of our common stock if such sale would result in Lincoln Park’s beneficial ownership of our common stock

exceeding the Beneficial Ownership Cap. Our inability to access a portion or the full amount available under the Purchase Agreement,

in the absence of any other financing sources, could have a material adverse effect on our business.

The

extent we rely on Lincoln Park as a source of funding will depend on a number of factors including the prevailing market price of our

common stock and the extent to which we are able to raise capital from other sources. Assuming a purchase price of $4.41 per share (which

represents the closing price of our common stock on November 12, 2024), the purchase by Lincoln Park of the entire 2,612,386 shares of

common stock issuable under the Purchase Agreement being registered for resale by Lincoln Park hereunder would result in gross proceeds

to us of approximately $11.5 million. If obtaining sufficient funding from Lincoln Park were to prove unavailable or prohibitively dilutive,

we will need to secure another source of capital in order to satisfy our working capital needs. Even if we sell all $15.0 million of

shares of our common stock to Lincoln Park under the Purchase Agreement, we will need to raise substantial additional capital to continue

to fund our operations and execute our current business strategy.

If

we fail to regain and maintain compliance with the continued listing requirements of The Nasdaq Capital Market, our common stock could

be suspended and delisted, which could, among other things, limit demand for our common stock, substantially impair our ability to raise

additional capital and have an adverse effect on the market price of, and the efficiency of the trading market for, our common stock.

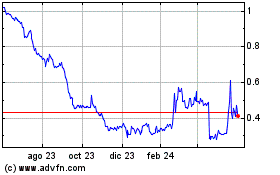

Our

common stock is listed on The Nasdaq Capital Market. On August 12, 2024, we received written notice from Nasdaq notifying us that we

do not meet the requirement in Nasdaq Listing Rule 5550(b)(2) to maintain a minimum Market Value of Listed Securities, or MVLS, of $35.0

million that is required for continued listing on The Nasdaq Capital Market. The notice has no effect at this time on the listing of

our common stock on The Nasdaq Capital Market.

We

have a period of 180 days, or until February 10, 2025, to regain compliance with the minimum MVLS rule. We will regain compliance if

at any time during the 180-day period, our MVLS closes at $35.0 million or more for a minimum of 10 consecutive business days. If we

do not regain compliance prior to February 10, 2025, Nasdaq will notify us that our securities are subject to delisting, at which time

we may appeal the delisting determination to a Nasdaq hearings panel. There can be no assurance that, if we were to appeal the delisting

determination, such an appeal would be successful.

There

are many factors that affect the trading price of our common stock, and many of those factors are outside of our control. We intend to

actively monitor our MVLS and may, if appropriate, consider implementing available options to regain compliance with the minimum MVLS

rule. There can be no assurance that we will be able to regain compliance with such rule or that we will be able to satisfy all other

continued listing requirements of The Nasdaq Capital Market and maintain the listing of our common stock on The Nasdaq Capital Market

even if we regain compliance with the minimum MVLS rule. For example, until we regained compliance on July 18, 2024, we were not in compliance

with the continued listing standard commonly referred to as the minimum bid price rule since July 19, 2023.

The

suspension or delisting of our common stock, for whatever reason, could, among other things, substantially impair our ability to raise

additional capital; result in the loss of interest from institutional investors, the loss of confidence in our company by investors and

employees, and in fewer financing, strategic and business development opportunities; and result in potential breaches of agreements under

which we made representations or covenants relating to our compliance with applicable listing requirements. Claims related to any such

breaches, with or without merit, could result in costly litigation, significant liabilities and diversion of our management’s time

and attention and could have a material adverse effect on our financial condition, business and results of operations. In addition, the

suspension or delisting of our common stock, for whatever reason, may materially impair our stockholders’ ability to buy and sell

shares of our common stock and could have an adverse effect on the market price of, and the efficiency of the trading market for, our

common stock.

The

sale of our common stock in ATM offerings may cause substantial dilution to our existing stockholders, and such sales, or the anticipation

of such sales, may cause the price of our common stock to decline.

We

have used at-the-market, or ATM, offerings to fund a significant portion of our operations in prior years, and we may continue to use

ATM offerings to raise additional capital in the future. For example, in 2021, we sold an aggregate of approximately 3.0 million shares

of our common stock in ATM offerings. We sold substantially fewer shares in ATM offerings in 2022 and 2023 and to-date in 2024, however,

we may sell significant amounts of shares in ATM offerings again in the future. While sales of shares of our common stock in ATM offerings

may enable us to raise capital at a lower cost compared with other types of equity financing transactions; such sales may result in substantial

dilution to our existing stockholders, and such sales, or the anticipation of such sales, may cause the trading price of our common stock

to decline.

Our

management will have broad discretion over the use of the net proceeds, if any, from sales of shares of our common stock to Lincoln Park,

you may not agree with how we use the proceeds and the proceeds may not be used effectively.

This

prospectus relates to shares of our common stock that may be offered and sold from time to time by Lincoln Park. We will not receive

any proceeds upon the sale of shares by Lincoln Park. However, we may receive gross proceeds of up to $15.0 million from the sale of

shares under the Purchase Agreement to Lincoln Park. The anticipated use of net proceeds from the sale of our common stock to Lincoln

Park under the Purchase Agreement represents our intentions based upon our current plans and business conditions. Because we have not

designated the amount of net proceeds from the sale of shares under the Purchase Agreement to be used for any particular purpose, our

management will have broad discretion as to the use of the net proceeds from our sale of shares of common stock to Lincoln Park. Accordingly,

you will be relying on the judgment of our management with regard to the use of those net proceeds, and you will not have the opportunity,

as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that, pending their

use, we may invest those net proceeds in a way that does not yield a favorable, or any, return for us. Further, our management may use

the net proceeds for corporate purposes that may not improve our financial condition or market value. The failure of our management to

use such funds effectively could have a material adverse effect on our business, financial condition, operating results and cash flows.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference in this prospectus contain or incorporate by reference forward-looking statements

that involve substantial risks and uncertainties. All statements, other than statements of historical fact, including statements regarding

our strategy, future operations, future financial position, projected revenue, funding and expenses, prospects, plans and objectives

of management, are forward-looking statements. Forward-looking statements, in some cases, can be identified by terms such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “design,”

“intend,” “expect,” “could,” “plan,” “potential,” “predict,”

“seek,” “pursue,” “should,” “would,” “contemplate,” “project,”

“target,” “tend to,” or the negative version of these words and similar expressions.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements,

including those factors described under the headings “Risk Factors” of this prospectus and in our Annual Report on Form 10-K

for the year ended December 31, 2023 and in our subsequent Quarterly Reports on Form 10-Q, all of which are incorporated herein by reference,

as may be updated or superseded by the risks and uncertainties described under similar headings in the other documents that are filed

after the date hereof and incorporated by reference into this prospectus. Given these uncertainties, you should not place undue reliance

on any forward-looking statement. The following factors are among those that may cause such differences:

● Inability

to raise additional capital, under favorable terms or at all, to fund our operating needs and continue as a going concern;

● The

number and scope of product development programs we pursue;

● Difficulties

or delays in commencement or completion, or the termination or suspension, of our current or planned clinical or preclinical studies;

● Clinical

trial outcomes and results of preclinical development;

● Failure

to complete development of our product candidates or submit and obtain FDA or foreign

regulatory authority approval for our product candidates on projected timelines or budgets, or at all;

● Challenges

and delays in obtaining timely supplies of our product candidates, including their components as well as the finished product, in the

quantities needed in accordance with current good manufacturing practices, our specifications and other applicable requirements;

● The

performance of third parties on which we rely to conduct nonclinical studies and clinical trials of our product candidates;

● Our

failure, or a failure of a strategic collaborator, to successfully commercialize our product candidates, if approved, or our failure

to otherwise monetize our portfolio programs and assets;

● Termination

by a collaborator of our respective out-license agreements for commercialization of XACIATO and Ovaprene®, or, in the case of Ovaprene, a decision by the collaborator not to make the license grant fully effective

following its review of the results of the ongoing pivotal clinical trial of Ovaprene;

●

The timing and amount of future royalty, milestone or other payments to us, if any, under our out-license agreement for Ovaprene, and

of upside-sharing milestone payments from XOMA (US) LLC under our traditional and synthetic royalty purchase agreements, if any;

● The

performance of third parties on which we rely to commercialize, or assist us in commercializing, XACIATO and any future product;

● Difficulties

with maintaining existing collaborations relating to the development and/or commercialization of our product candidates, or establishing

new ones on a timely basis or on acceptable terms, or at all;

● The

terms and conditions of any future strategic collaborations relating to our product candidates;

● The

degree of market acceptance that XACIATO and any future product achieves;

● Coverage

and reimbursement levels for XACIATO and any future product by government health care programs, private health insurance companies and

other third-party payors;

● Our

loss of, or inability to attract, key personnel;

● A

change in the FDA’s prior determination that the Center for Devices and Radiological Health would lead the review of a premarket

approval application for potential marketing approval of Ovaprene;

● A

change in regulatory requirements for our product candidates, including the development pathway pursuant to Section 505(b)(2) of the

Federal Food, Drug, and Cosmetic Act, or the FDA’s 505(b)(2) pathway;

● Unfavorable

differences between preliminary, interim or topline clinical study data reported by us and final study results;

● Communication

from the FDA or another regulatory authority, including a complete response letter, that such agency does not accept or agree with our

assumptions, estimates, calculations, conclusions or analyses of clinical or nonclinical study data regarding a product candidate, or

that such agency interprets or weighs the importance of study data differently than we have in a manner that negatively impacts the candidate’s

prospects for regulatory approval in a timely manner, or at all;

● Failure

to select product candidates that capitalize on the most scientifically, clinically or commercially promising or profitable indications

or therapeutic areas within women’s health including due to our limited financial resources;

● Loss

or impairment of our in-licensed rights to develop and commercialize XACIATO and our product candidates;

● The

timing and amount of our payment and other obligations under our in-license and acquisition agreements for XACIATO and our product candidates;

● Developments

by our competitors that make XACIATO, or any potential product we develop, less competitive or obsolete;

● Unfavorable

or unanticipated macroeconomic factors, geopolitical events or conflicts, public health emergencies, or natural disasters;

● Weak

interest in women’s health relative to other healthcare sectors from the investment community or from pharmaceutical companies

and other potential development and commercialization collaborators;

● Cyber-attacks,

security breaches or similar events compromising our technology systems and data, our financial resources and other assets, or the technology

systems and data of third parties on which we rely;

● Difficulty

in introducing branded products in a market made up of generic products;

● Inability

to adequately protect or enforce our, or our licensor’s, intellectual property rights;

● Lack

of patent protection for the active ingredients in XACIATO and certain of our product candidates that expose them to competition from

other formulations using the same active ingredients;

● Higher

risk of failure associated with product candidates in preclinical stages of development that may lead investors to assign them little

to no value and make these assets difficult to fund;

● Dependence

on grants and other financial awards from governmental entities and private foundations to advance the development of several of our

product candidates;

● Disputes

or other developments concerning our intellectual property rights;

● Actual

and anticipated fluctuations in our quarterly or annual operating results or results that differ from investors’ expectations for

such results;

● Price

and volume fluctuations in the stock market, and in our stock in particular, which could cause investors to experience losses and subject

us to securities class-action litigation;

● Failure

to maintain the listing of our common stock on The Nasdaq Capital Market or another nationally recognized exchange;

● Development

of safety, efficacy or quality concerns related to our product or product candidates (or third-party products or product candidates that

share similar characteristics or drug substances), whether or not scientifically justified, leading to delays in or discontinuation of

product development, product recalls or withdrawals, diminished sales, and/or other significant negative consequences;

● Product

liability claims or governmental investigations;

● Changes

in government laws and regulations in the United States and other jurisdictions, including laws and regulations governing the research,

development, approval, clearance, manufacturing, supply, distribution, pricing and/or marketing of our products, product candidates and

related intellectual property, health care information and data privacy and security laws, transparency laws and fraud and abuse laws,

and the enforcement thereof affecting our business; and

● Increased

costs as a result of operating as a public company, and substantial time devoted by our management to compliance initiatives and corporate

governance practices.

In

addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These

statements are based upon information available to us as of the date they are made, and while we believe such information forms a reasonable

basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have

conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain

and investors are cautioned not to unduly rely upon these statements.

Investors

are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this prospectus or the date

of the document incorporated by reference in this prospectus. We do not undertake any obligation to publicly update any forward-looking

statement to reflect events or circumstances after the date on which any statement is made or to reflect the occurrence of unanticipated

events, except as required by law.

OUR

AGREEMENTS WITH LINCOLN PARK

Overview

On

October 21, 2024, we entered into the Purchase Agreement and the Registration Rights Agreement with Lincoln Park. Pursuant to the terms

of the Purchase Agreement, Lincoln Park has agreed to purchase from us up to $15,000,000 of our common stock (subject to certain limitations)

from time to time during the 24-month term of the Purchase Agreement. Pursuant to the terms of the Registration Rights Agreement, we

filed with the SEC the registration statement of which this prospectus forms a part to register for resale under the Securities Act shares

that have been or may be issued to Lincoln Park under the Purchase Agreement.

We

do not have the right to commence sales of our shares of common stock to Lincoln Park under the Purchase Agreement until the Commencement

has occurred, which is the time at which all of the conditions set forth in the Purchase Agreement, all of which are outside of Lincoln

Park’s control, have been satisfied, including that the SEC has declared effective the registration statement of which this prospectus

forms a part. On or after the Commencement, from time to time, at our sole discretion, we may direct Lincoln Park to purchase shares

of our common stock in amounts of up to 30,000 shares on any single business day as a Regular Purchase. The amount of a Regular Purchase

may be increased to up to 40,000 shares depending on the market price of our common stock at the time we initiate the sale, subject to

a maximum commitment by Lincoln Park of $500,000 per single Regular Purchase. In addition, at our discretion, Lincoln Park has committed

to purchase other “accelerated amounts” and/or “additional accelerated amounts” under certain circumstances.

The purchase price per share sold in any Regular Purchase will be the lower of (i) the lowest sale price of our common stock on the business

day on which we initiate the purchase and (ii) the average of the three lowest closing sale prices of our common stock during the 10

consecutive business day period immediately preceding the business day on which we initiate the purchase. The purchase price per share

will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other

similar transaction occurring during the business days used to compute such price. Lincoln Park may not assign or transfer its rights

and obligations under the Purchase Agreement.

Under

applicable rules of The Nasdaq Stock Market, in no event may we issue or sell to Lincoln Park under the Purchase Agreement more than

19.99% of the shares of our common stock outstanding immediately prior to the execution of the Purchase Agreement (which is 1,711,172

shares based on 8,555,864 shares outstanding immediately prior to the execution of the Purchase Agreement), unless (i) we obtain stockholder

approval to issue shares of common stock in excess of the Exchange Cap or (ii) the average price per share of all applicable sales of

our common stock to Lincoln Park under the Purchase Agreement equals or exceeds $3.59 (which represents the lower of (A) the official

closing price of our common stock on Nasdaq immediately preceding the signing of the Purchase Agreement and (B) the average official

closing price of our common stock on Nasdaq for the five consecutive trading days ending on the trading day immediately preceding the

date of the Purchase Agreement), such that issuances and sales of our common stock to Lincoln Park under the Purchase Agreement would

not be subject to the Exchange Cap under applicable Nasdaq rules. In any event, the Purchase Agreement specifically provides that we

may not issue or sell any shares of our common stock under the Purchase Agreement if such issuance or sale would breach any applicable

Nasdaq rules.

The

Purchase Agreement also prohibits us from directing Lincoln Park to purchase any shares of common stock if those shares, when aggregated

with all other shares of our common stock then beneficially owned by Lincoln Park and its affiliates, would result in Lincoln Park exceeding

the Beneficial Ownership Cap.

On

October 21, 2024, the day we entered into the Purchase Agreement, we issued the Commitment Shares to Lincoln Park in consideration for

its commitment to purchase shares of our common stock under the Purchase Agreement.

Purchase

of Shares Under the Purchase Agreement

On

or after the Commencement, from time to time, at our sole discretion, on any business day selected by us on which the closing sale price

of the common stock is not below $0.50 per share, we may direct Lincoln Park to purchase shares of our common stock in amounts up to

30,000 shares on any single business day as a Regular Purchase; provided that such share limit increases to up to 35,000 shares if the

closing sale price of our common stock is not below $5.00 per share on the business day on which we initiate the purchase, and

to up to 40,000 shares if the closing sale price of our common stock is not below $7.50 per share on the business day on which we initiate

the purchase. We refer to such share amount limitation in this prospectus as the “Regular Purchase Share Limit.” In any

case, Lincoln Park’s maximum commitment in any single Regular Purchase may not exceed $500,000. The Regular Purchase Share

Limit is subject to proportionate adjustment in the event of a reorganization, recapitalization, non-cash dividend, stock split, reverse

stock split, or other similar transaction; provided, that if, after giving effect to such full proportionate adjustment, the adjusted

Regular Purchase Share Limit would preclude us from requiring Lincoln Park to purchase common stock at an aggregate purchase price equal

to or greater than $50,000 in any single Regular Purchase, then the Regular Purchase Share Limit will not be fully adjusted, but rather

the Regular Purchase Share Limit for such Regular Purchase shall be adjusted as specified in the Purchase Agreement, such that, after

giving effect to such adjustment, the Regular Purchase Share Limit will be equal to (or as close as can be derived from such adjustment

without exceeding) $50,000.

The

purchase price per share for the shares that may be sold to Lincoln Park in any Regular Purchase will be the lesser of:

| ● | the

lowest sale price of our common stock on the business day on which we initiate the purchase;

or |

| ● | the

arithmetic average of the three lowest closing sale prices for our common stock during the

10-consecutive-business-day period immediately preceding the business day on which we initiate

the purchase. |

In

addition to Regular Purchases, on any business day on which we have properly submitted a notice directing Lincoln Park to purchase the

then applicable Regular Purchase Share Limit and properly delivered all the shares purchased in all prior purchases under the Purchase

Agreement, we may direct Lincoln Park to purchase an additional amount of shares of our common stock, which we refer to as an “Accelerated

Purchase,” not to exceed the lesser of:

| ● | 30%

of the total volume of shares of our common stock traded during the Accelerated Purchase

Period (as defined in the Purchase Agreement); and |

| ● | three

times the number of shares of common stock purchased pursuant to the corresponding Regular

Purchase. |

We

may also direct Lincoln Park, by notice delivered before 1:00 p.m. Eastern time on a business day on which an Accelerated Purchase has

been completed and all of the shares to be purchased thereunder (and under the corresponding Regular Purchase) have been properly delivered

to Lincoln Park in accordance with the Purchase Agreement prior to such time on such business day, to purchase an additional amount of

shares of our common stock, which we refer to as an Additional Accelerated Purchase, of up to the lesser of:

| ● | 30%

of the total volume of shares of our common stock traded during the Additional Accelerated

Purchase Period (as defined in the Purchase Agreement); and |

| ● | three

times the number of shares of common stock purchased pursuant to the corresponding Regular

Purchase. |

We

may, in our sole discretion, submit multiple Additional Accelerated Purchase notices to Lincoln Park on a single Accelerated Purchase

date, provided that all prior Accelerated Purchases and Additional Accelerated Purchases (including those that have occurred earlier

on the same day) have been completed and all of the shares to be purchased thereunder (and under the corresponding Regular Purchase)

have been properly delivered to Lincoln Park in accordance with the Purchase Agreement.

The

purchase price per share for each Accelerated Purchase and each Additional Accelerated Purchase will be equal to 95% of the lesser of:

| ● | the

volume weighted average price of our common stock during the applicable Accelerated Purchase

Period or Additional Accelerated Purchase Period; and |

| ● | the

closing sale price of our common stock on the applicable Accelerated Purchase date. |

In

the case of any Regular Purchase, Accelerated Purchase and Additional Accelerated Purchase, the purchase price per share will be equitably

adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction

occurring during the business days used to compute such price.

Other

than as described above, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the

timing and amount of any sales of our common stock to Lincoln Park.

Suspension

Events

Suspension

Events under the Purchase Agreement include,

among others, the following:

| ● | a

lapse in the effectiveness of the registration statement of which this prospectus forms a

party for any reason (including, without limitation, the issuance of a stop order or similar

order) or any required prospectus is unavailable for the resale by Lincoln Park of the shares

of our common stock offered hereby and such lapse or unavailability continues for a period

of 10 consecutive business days or for more than an aggregate of 30 business days in any

365-day period, subject to certain exceptions described in the Purchase Agreement; |

| ● | the

suspension of our common stock from trading on The Nasdaq Capital Market (or such other nationally

recognized market or exchange on which our common stock may be listed or traded) for a period

of one business day; |

| ● | the

delisting of our common stock from The Nasdaq Capital Market, unless our common stock is

immediately thereafter trading or quoted on the New York Stock Exchange, The Nasdaq Global

Market, The Nasdaq Global Select Market, the NYSE American, the NYSE Arca, the OTCQX Best

Market or the OTCQB Venture Market operated by OTC Markets Group, Inc. (or any nationally

recognized successor to any of the foregoing); |

| ● | the

failure by our transfer agent to issue to Lincoln Park the shares purchased by Lincoln Park

under the Purchase Agreement within two business days after the applicable date on which

Lincoln Park is entitled to receive such shares; |

| | | |

| ● | any

breach by us of any of our representations, warranties or covenants in the Purchase Agreement

or Registration Rights Agreement if such breach would reasonably be expected to have a Material