Dime Community Bancshares, Inc. (the “Company”) (NASDAQ:

DCOM), the parent company of Dime Community Bank (the “Bank”),

today announced that the pricing of its offering of $65,000,000 of

its 9.000% fixed-to-floating rate subordinated notes due 2034 (the

“Notes”) in a registered public offering (the “Offering”). The

Company has granted the underwriters a 30-day option to purchase up

to an additional $9,750,000 aggregate principal amount of the Notes

to cover over-allotments, if any.

The Notes will initially bear interest at 9.000%

per annum, with interest payable quarterly in arrears, commencing

on the issue date, to, but excluding, July 15, 2029. Commencing

July 15, 2029, the interest rate on the Notes will reset quarterly

to a floating rate per annum equal to a benchmark rate that is

expected to be Three-Month Term SOFR (which is defined in the

Notes) plus 495.1 basis points, with interest payable quarterly in

arrears. The Company may redeem the Notes, in whole or in part, on

and after July 15, 2029, at a price equal to 100% of the principal

amount of the Notes being redeemed plus accrued and unpaid

interest. The Notes will mature on July 15, 2034 if they are not

earlier redeemed.

The Company expects to close the transaction,

subject to customary conditions, on or about June 28, 2024. The

Notes are intended to qualify as Tier 2 capital for regulatory

purposes.

The Notes are expected to be listed on the

Nasdaq Stock Market® within 30 days of the original issue date

under the trading symbol “DCOMG”.

The Company intends to use the net proceeds of

the Offering for general corporate purposes, including supporting

organic growth initiatives, and to support the Company and Bank’s

regulatory capital ratios.

Raymond James & Associates, Inc. and Keefe,

Bruyette & Woods, A Stifel Company are acting as joint

book-running managers for the Offering. D.A. Davidson & Co. and

Piper Sandler are acting as co-managers for the Offering.

This press release is neither an offer to sell

nor a solicitation of an offer to purchase any securities of the

Company. There will be no sale of securities in any jurisdiction in

which such an offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such jurisdiction. Any offer to sell or solicitation of an offer to

purchase securities of the Company will be made only pursuant to a

prospectus supplement and prospectus filed with the U.S. Securities

and Exchange Commission (the “SEC”). The Company has filed a

registration statement (including a prospectus) (File No.

333-264390) and a preliminary prospectus supplement with the SEC

for the Offering to which this press release relates. Before making

an investment decision, you should read the prospectus and

preliminary prospectus supplement and other documents that the

Company has filed with the SEC for additional information about the

Company and the Offering.

Copies of the preliminary prospectus supplement

and the accompanying base prospectus relating to the Offering can

be obtained without charge by visiting the SEC’s website at

www.sec.gov, or by emailing Raymond James & Associates, Inc. at

prospectus@raymondjames.com or by emailing Keefe, Bruyette &

Woods, A Stifel Company, at SyndProspectus@stifel.com.

About the Company

Dime Community Bancshares, Inc. is the holding

company for Dime Community Bank, a New York State-chartered trust

company with over $13.5 billion in assets and the number one

deposit market share among community banks on Greater Long

Island(1).

(1) Aggregate deposit market

share for Kings, Queens, Nassau & Suffolk counties for

community banks less than $20 billion in assets.

Forward-Looking Statements

This news release contains a number of

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

These statements may be identified by use of words such as

“annualized,” “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “seek,” “likely,” “may,” “outlook,”

“plan,” “potential,” “predict,” “project,” “should,” “will,”

“would” and similar terms and phrases, including references to

assumptions.

Forward-looking statements are based upon

various assumptions and analyses made by the Company in light of

management’s experience and its perception of historical trends,

current conditions and expected future developments, as well as

other factors it believes are appropriate under the circumstances.

These statements are not guarantees of future performance and are

subject to risks, uncertainties, and other factors (many of which

are beyond the Company’s control) that could cause actual

conditions or results to differ materially from those expressed or

implied by such forward-looking statements. Accordingly, you should

not place undue reliance on such statements. Factors that could

affect our results include, without limitation, the following:

increases in competitive pressure among financial institutions or

from non-financial institutions; inflation and fluctuation in

market interest rates, which may affect demand for our products,

interest margins and the fair value of financial instruments;

changes in deposit flows, loan demand or real estate values;

changes in the quality and composition of the Company’s loan or

investment portfolios or unanticipated or significant increases in

loan losses; changes in accounting principles, policies or

guidelines; changes in corporate and/or individual income tax laws

or policies; general socio-economic conditions or events, including

conditions caused by public health emergencies, international

conflict, inflation, and recessionary pressures, either nationally

or locally in some or all areas in which the Company conducts

business, or conditions in the securities markets or the banking

industry; legislation, regulatory or policy changes; technological

changes; failures or breaches of information technology security

systems; success or consummation of new business initiatives or the

integration of an acquired entities may be more difficult or

expensive than the Company anticipates; and litigation or other

matters before regulatory agencies.

For discussion of these and other risks that may

cause actual results to differ from expectations, please refer to

the sections entitled “Forward-Looking Statements” and “Risk

Factors” in the Company’s most recent Annual Report on Form 10-K

and subsequent updates set forth in the Company’s Quarterly Reports

on Form 10-Q and Current Reports on Form 8-K.

Dime Community Bancshares,

Inc.Investor Relations Contact:Avinash ReddySenior

Executive Vice President — Chief Financial OfficerPhone:

718-782-6200; Ext. 5909Email: avinash.reddy@dime.com

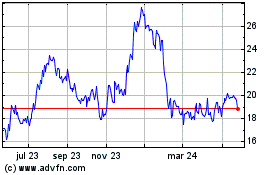

Dime Community Bancshares (NASDAQ:DCOM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

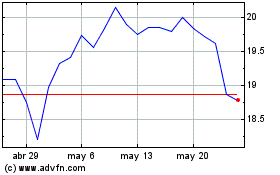

Dime Community Bancshares (NASDAQ:DCOM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024