false

0001438231

0001438231

2024-11-14

2024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2024

DIGIMARC CORPORATION

(Exact name of registrant as specified in its charter)

|

Oregon

|

001-34108

|

26-2828185

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File No.)

|

(IRS Employer

Identification No.)

|

8500 SW Creekside Place, Beaverton Oregon 97008

(Address of principal executive offices) (Zip Code)

(503) 469-4800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.001 Par Value Per Share

|

|

DMRC

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition

|

On November 14, 2024, Digimarc Corporation issued a press release announcing its financial results for the quarter ended September 30, 2024. The full text of the press release is attached hereto as Exhibit 99.1.

Attached hereto as Exhibit 99.2 is the script from the Company’s conference call on November 14, 2024 announcing its financial results for the quarter ended September 30, 2024, as posted on the Company’s website at https://www.digimarc.com/investors/quarterly-earnings.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits

|

ExhibitNo.

|

|

Description

|

| |

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 14, 2024

| |

|

By:

|

|

/s/ Charles Beck

|

| |

|

|

|

Charles Beck

|

| |

|

|

|

Chief Financial Officer and Treasurer

|

Exhibit 99.1

Digimarc Reports Third Quarter 2024 Financial Results

Beaverton, Ore. – November 14, 2024 – Digimarc Corporation (NASDAQ: DMRC) reported financial results for the third quarter ended September 30, 2024.

“Looking forward, Q3 was the most significant quarter I have witnessed since I joined the company,” said Digimarc CEO Riley McCormack. “We made significant progress on things underway and opened new areas of opportunity we previously didn’t believe addressable in the near term. Looking back, we acknowledge Q3 revenue doesn’t reflect the reality just described. The gap between what lies ahead and what lies behind has never been this large and we look forward to providing additional information to bridge that gap as soon as reasonably possible.”

Third Quarter Financial Results

Annual recurring revenue(1) as of September 30, 2024 decreased to $18.7 million compared to $19.6 million as of September 30, 2023. The $0.9 million decrease reflects a $5.8 million decrease due to the delayed timing in the anticipated renewal of a commercial contract, partially offset by new annual recurring revenue from entry into new commercial subscription contracts and increased subscription fees on existing commercial contracts.

Subscription revenue for the third quarter of 2024 increased to $5.3 million compared to $4.8 million for the third quarter of 2023, primarily reflecting higher subscription revenue from new and existing commercial contracts, partially offset by the delayed timing in the anticipated renewal of a commercial contract.

Service revenue for the third quarter of 2024 remained flat, compared to the third quarter of 2023, primarily reflecting higher service revenue from HolyGrail recycling projects, partially offset by lower service revenue from the Central Banks.

Total revenue for the third quarter of 2024 increased to $9.4 million compared to $9.0 million for the third quarter of 2023.

Gross profit margin for the third quarter of 2024 increased to 62% compared to 58% for the third quarter of 2023. Excluding amortization expense on acquired intangible assets, subscription gross profit margin increased to 86% from 85% and service gross profit margin increased to 61% from 54% for the third quarter of 2024 compared to the third quarter of 2023.

Non-GAAP gross profit margin for the third quarter of 2024 increased to 78% compared to 76% for the third quarter of 2023.

Operating expenses for the third quarter of 2024 increased to $17.3 million compared to $16.4 million for the third quarter of 2023, primarily reflecting $0.6 million of cash severance costs and $0.4 million of lower labor costs allocated to cost of revenue due to the amount and mix of billable labor hours incurred.

Non-GAAP operating expenses for the third quarter of 2024 increased to $14.1 million compared to $13.2 million for the third quarter of 2023.

Net loss for the third quarter of 2024 was $10.8 million or ($0.50) per share compared to $10.7 million or ($0.53) per share for the third quarter of 2023.

Non-GAAP net loss for the third quarter of 2024 was $6.1 million or ($0.29) per share compared to $5.9 million or ($0.29) per share for the third quarter of 2023.

At September 30, 2024, cash, cash equivalents and marketable securities totaled $33.7 million compared to $27.2 million at December 31, 2023.

(1) Annual Recurring Revenue (ARR) is a company performance metric calculated as the aggregation of annualized subscription fees from all of our commercial contracts as of the measurement date.

Conference Call

Digimarc will hold a conference call today (Thursday, November 14, 2024) to discuss these financial results and to provide a business update. CEO Riley McCormack, CFO Charles Beck, and CLO George Karamanos will host the call starting at 5:00 p.m. Eastern time (2:00 p.m. Pacific time). A question and answer session will follow management’s prepared remarks.

The conference call will be broadcast live and available for replay here and in the investor section of the company’s website. The conference call script will also be posted to the company’s website shortly before the call.

For those who wish to call in via telephone to ask a question, please dial the number below at least five minutes before the scheduled start time:

Toll Free number: 877-407-0832

International number: 201-689-8433

Conference ID number: 13743904

Company Contact:

Charles Beck

Chief Financial Officer

Charles.Beck@digimarc.com

+1 503-469-4721

###

About Digimarc

Digimarc Corporation (NASDAQ: DMRC) is the pioneer and global leader in digital watermarking technologies. For nearly 30 years, Digimarc innovations and intellectual property in digital watermarking have been deployed at massive scale for the identification and the authentication of physical and digital items. A notable example of this is our partnership with a consortium of the world’s central banks to deter counterfeiting of global currency. Digimarc is also instrumental in supporting global industry standards efforts spanning both the physical and digital worlds. In 2023, Digimarc was named to the Fortune 2023 Change the World list and honored as a 2023 Fast Company World Changing Ideas finalist. Learn more at Digimarc.com.

Forward-Looking Statements

Except for historical information contained in this release, the matters described in this release contain various “forward-looking statements.” These forward-looking statements include statements identified by terminology such as “will,” “should,” “expects,” “estimates,” “predicts” and “continue” or other derivations of these or other comparable terms. These forward-looking statements are statements of management’s opinion and are subject to various assumptions, risks, uncertainties and changes in circumstances. Actual results may vary materially from those expressed or implied from the statements in this release as a result of changes in economic, business and regulatory factors, including, without limitation, the terms and timing of anticipated contract renewals. More detailed information about risk factors that may affect actual results are outlined in the company’s Form 10-K for the year ended December 31, 2023, and in subsequent periodic reports filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date of this release. Except as required by law, Digimarc undertakes no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this release.

Non-GAAP Financial Measures

This release contains the following non-GAAP financial measures: Non-GAAP gross profit, Non-GAAP gross profit margin, Non-GAAP operating expenses, Non-GAAP net loss, and Non-GAAP loss per share (diluted). See below for a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure. These non-GAAP financial measures are an important measure of our operating performance because they allow management, investors and analysts to evaluate and assess our core operating results from period-to-period after removing non-cash and non-recurring activities that affect comparability. Our management uses these non-GAAP financial measures in evaluating its financial and operational decision making and as a means to evaluate period-to-period comparisons.

Digimarc believes that providing these non-GAAP financial measures, together with the reconciliation to GAAP, helps management and investors make comparisons between us and other companies. In making any comparisons to other companies, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measures and the corresponding GAAP measures provided by each company under applicable SEC rules. These non-GAAP financial measures are not measurements of financial performance or liquidity under GAAP. In order to facilitate a clear understanding of its consolidated historical operating results, investors should examine Digimarc’s non-GAAP financial measures in conjunction with its historical GAAP financial information, and investors should not consider non-GAAP financial measures in isolation or as substitutes for performance measures calculated in accordance with GAAP. Non-GAAP financial measures should be viewed as supplemental to, and should not be considered as alternatives to, GAAP financial measures. Non-GAAP financial measures may not be indicative of the historical operating results of the Company nor are they intended to be predictive of potential future results.

Digimarc Corporation

Consolidated Income Statement Information

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription

|

|

$ |

5,252 |

|

|

$ |

4,811 |

|

|

$ |

17,394 |

|

|

$ |

13,374 |

|

|

Service

|

|

|

4,191 |

|

|

|

4,183 |

|

|

|

12,366 |

|

|

|

12,193 |

|

|

Total revenue

|

|

|

9,443 |

|

|

|

8,994 |

|

|

|

29,760 |

|

|

|

25,567 |

|

|

Cost of revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription (1)

|

|

|

735 |

|

|

|

698 |

|

|

|

2,205 |

|

|

|

2,264 |

|

|

Service (1)

|

|

|

1,638 |

|

|

|

1,938 |

|

|

|

5,138 |

|

|

|

5,621 |

|

|

Amortization expense on acquired intangible assets

|

|

|

1,173 |

|

|

|

1,135 |

|

|

|

3,445 |

|

|

|

3,346 |

|

|

Total cost of revenue

|

|

|

3,546 |

|

|

|

3,771 |

|

|

|

10,788 |

|

|

|

11,231 |

|

|

Gross profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription (1)

|

|

|

4,517 |

|

|

|

4,113 |

|

|

|

15,189 |

|

|

|

11,110 |

|

|

Service (1)

|

|

|

2,553 |

|

|

|

2,245 |

|

|

|

7,228 |

|

|

|

6,572 |

|

|

Amortization expense on acquired intangible assets

|

|

|

(1,173 |

) |

|

|

(1,135 |

) |

|

|

(3,445 |

) |

|

|

(3,346 |

) |

|

Total gross profit

|

|

|

5,897 |

|

|

|

5,223 |

|

|

|

18,972 |

|

|

|

14,336 |

|

|

Gross profit margin:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription (1)

|

|

|

86 |

% |

|

|

85 |

% |

|

|

87 |

% |

|

|

83 |

% |

|

Service (1)

|

|

|

61 |

% |

|

|

54 |

% |

|

|

58 |

% |

|

|

54 |

% |

|

Total

|

|

|

62 |

% |

|

|

58 |

% |

|

|

64 |

% |

|

|

56 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

5,637 |

|

|

|

5,366 |

|

|

|

16,789 |

|

|

|

16,770 |

|

|

Research, development and engineering

|

|

|

6,488 |

|

|

|

6,308 |

|

|

|

19,873 |

|

|

|

20,295 |

|

|

General and administrative

|

|

|

4,861 |

|

|

|

4,433 |

|

|

|

13,695 |

|

|

|

13,412 |

|

|

Amortization expense on acquired intangible assets

|

|

|

280 |

|

|

|

272 |

|

|

|

823 |

|

|

|

800 |

|

|

Impairment of lease right of use assets and leasehold improvements

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

250 |

|

|

Total operating expenses

|

|

|

17,266 |

|

|

|

16,379 |

|

|

|

51,180 |

|

|

|

51,527 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(11,369 |

) |

|

|

(11,156 |

) |

|

|

(32,208 |

) |

|

|

(37,191 |

) |

|

Other income, net

|

|

|

617 |

|

|

|

478 |

|

|

|

1,868 |

|

|

|

1,870 |

|

|

Loss before income taxes

|

|

|

(10,752 |

) |

|

|

(10,678 |

) |

|

|

(30,340 |

) |

|

|

(35,321 |

) |

|

Provision for income taxes

|

|

|

(2 |

) |

|

|

(45 |

) |

|

|

(22 |

) |

|

|

(65 |

) |

|

Net loss

|

|

$ |

(10,754 |

) |

|

$ |

(10,723 |

) |

|

$ |

(30,362 |

) |

|

$ |

(35,386 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share — basic

|

|

$ |

(0.50 |

) |

|

$ |

(0.53 |

) |

|

$ |

(1.43 |

) |

|

$ |

(1.76 |

) |

|

Loss per share — diluted

|

|

$ |

(0.50 |

) |

|

$ |

(0.53 |

) |

|

$ |

(1.43 |

) |

|

$ |

(1.76 |

) |

|

Weighted average shares outstanding — basic

|

|

|

21,435 |

|

|

|

20,217 |

|

|

|

21,187 |

|

|

|

20,158 |

|

|

Weighted average shares outstanding — diluted

|

|

|

21,435 |

|

|

|

20,217 |

|

|

|

21,187 |

|

|

|

20,158 |

|

(1) Cost of revenue, Gross profit and Gross profit margin for Subscription and Service excludes amortization expense on acquired intangible assets.

Digimarc Corporation

Reconciliation of GAAP to Non-GAAP Financial Measures

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

GAAP gross profit

|

|

$ |

5,897 |

|

|

$ |

5,223 |

|

|

$ |

18,972 |

|

|

$ |

14,336 |

|

|

Amortization of acquired intangible assets

|

|

|

1,173 |

|

|

|

1,135 |

|

|

|

3,445 |

|

|

|

3,346 |

|

|

Amortization and write-off of other intangible assets

|

|

|

136 |

|

|

|

143 |

|

|

|

410 |

|

|

|

433 |

|

|

Stock-based compensation

|

|

|

154 |

|

|

|

310 |

|

|

|

563 |

|

|

|

866 |

|

|

Non-GAAP gross profit

|

|

$ |

7,360 |

|

|

$ |

6,811 |

|

|

$ |

23,390 |

|

|

$ |

18,981 |

|

|

Non-GAAP gross profit margin

|

|

|

78 |

% |

|

|

76 |

% |

|

|

79 |

% |

|

|

74 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating expenses

|

|

$ |

17,266 |

|

|

$ |

16,379 |

|

|

$ |

51,180 |

|

|

$ |

51,527 |

|

|

Depreciation and write-off of property and equipment

|

|

|

(179 |

) |

|

|

(223 |

) |

|

|

(570 |

) |

|

|

(911 |

) |

|

Amortization of acquired intangible assets

|

|

|

(280 |

) |

|

|

(272 |

) |

|

|

(823 |

) |

|

|

(800 |

) |

|

Amortization and write-off of other intangible assets

|

|

|

(77 |

) |

|

|

(228 |

) |

|

|

(241 |

) |

|

|

(276 |

) |

|

Amortization of lease right of use assets under operating leases

|

|

|

(90 |

) |

|

|

(94 |

) |

|

|

(263 |

) |

|

|

(426 |

) |

|

Stock-based compensation

|

|

|

(2,548 |

) |

|

|

(2,382 |

) |

|

|

(7,376 |

) |

|

|

(7,280 |

) |

|

Impairment of lease right of use assets and leasehold improvements

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(250 |

) |

|

Non-GAAP operating expenses

|

|

$ |

14,092 |

|

|

$ |

13,180 |

|

|

$ |

41,907 |

|

|

$ |

41,584 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss

|

|

$ |

(10,754 |

) |

|

$ |

(10,723 |

) |

|

$ |

(30,362 |

) |

|

$ |

(35,386 |

) |

|

Total adjustments to gross profit

|

|

|

1,463 |

|

|

|

1,588 |

|

|

|

4,418 |

|

|

|

4,645 |

|

|

Total adjustments to operating expenses

|

|

|

3,174 |

|

|

|

3,199 |

|

|

|

9,273 |

|

|

|

9,943 |

|

|

Non-GAAP net loss

|

|

$ |

(6,117 |

) |

|

$ |

(5,936 |

) |

|

$ |

(16,671 |

) |

|

$ |

(20,798 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP loss per share (diluted)

|

|

$ |

(0.50 |

) |

|

$ |

(0.53 |

) |

|

$ |

(1.43 |

) |

|

$ |

(1.76 |

) |

|

Non-GAAP net loss

|

|

$ |

(6,117 |

) |

|

$ |

(5,936 |

) |

|

$ |

(16,671 |

) |

|

$ |

(20,798 |

) |

|

Non-GAAP loss per share (diluted)

|

|

$ |

(0.29 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.79 |

) |

|

$ |

(1.03 |

) |

Digimarc Corporation

Consolidated Balance Sheet Information

(in thousands)

(Unaudited)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents (1)

|

|

$ |

25,560 |

|

|

$ |

21,456 |

|

|

Marketable securities (1)

|

|

|

8,126 |

|

|

|

5,726 |

|

|

Trade accounts receivable, net

|

|

|

6,965 |

|

|

|

5,813 |

|

|

Other current assets

|

|

|

4,143 |

|

|

|

4,085 |

|

|

Total current assets

|

|

|

44,794 |

|

|

|

37,080 |

|

|

Property and equipment, net

|

|

|

1,159 |

|

|

|

1,570 |

|

|

Intangibles, net

|

|

|

24,834 |

|

|

|

28,458 |

|

|

Goodwill

|

|

|

9,030 |

|

|

|

8,641 |

|

|

Lease right of use assets

|

|

|

3,754 |

|

|

|

4,017 |

|

|

Other assets

|

|

|

1,453 |

|

|

|

786 |

|

|

Total assets

|

|

$ |

85,024 |

|

|

$ |

80,552 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and other accrued liabilities

|

|

$ |

5,973 |

|

|

$ |

6,672 |

|

|

Deferred revenue

|

|

|

3,409 |

|

|

|

5,853 |

|

|

Total current liabilities

|

|

|

9,382 |

|

|

|

12,525 |

|

|

Long-term lease liabilities

|

|

|

5,418 |

|

|

|

5,994 |

|

|

Other long-term liabilities

|

|

|

64 |

|

|

|

106 |

|

|

Total liabilities

|

|

|

14,864 |

|

|

|

18,625 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

50 |

|

|

|

50 |

|

|

Common stock

|

|

|

21 |

|

|

|

20 |

|

|

Additional paid-in capital

|

|

|

413,480 |

|

|

|

376,189 |

|

|

Accumulated deficit

|

|

|

(342,130 |

) |

|

|

(311,768 |

) |

|

Accumulated other comprehensive loss

|

|

|

(1,261 |

) |

|

|

(2,564 |

) |

|

Total shareholders’ equity

|

|

|

70,160 |

|

|

|

61,927 |

|

|

Total liabilities and shareholders’ equity

|

|

$ |

85,024 |

|

|

$ |

80,552 |

|

(1) Aggregate cash, cash equivalents, and marketable securities was $33.7 million and $27.2 million at September 30, 2024 and December 31, 2023, respectively.

Digimarc Corporation

Consolidated Cash Flow Information

(in thousands)

(Unaudited)

| |

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(30,362 |

) |

|

$ |

(35,386 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and write-off of property and equipment

|

|

|

570 |

|

|

|

911 |

|

|

Amortization of acquired intangible assets

|

|

|

4,268 |

|

|

|

4,146 |

|

|

Amortization and write-off of other intangible assets

|

|

|

651 |

|

|

|

709 |

|

|

Amortization of lease right of use assets under operating leases

|

|

|

263 |

|

|

|

426 |

|

|

Stock-based compensation

|

|

|

7,939 |

|

|

|

8,146 |

|

|

Impairment of lease right of use assets and leasehold improvements

|

|

|

— |

|

|

|

250 |

|

|

Increase (decrease) in allowance for doubtful accounts

|

|

|

96 |

|

|

|

— |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Trade accounts receivable

|

|

|

(1,321 |

) |

|

|

(1,581 |

) |

|

Other current assets

|

|

|

(9 |

) |

|

|

1,688 |

|

|

Other assets

|

|

|

(582 |

) |

|

|

279 |

|

|

Accounts payable and other accrued liabilities

|

|

|

(816 |

) |

|

|

299 |

|

|

Deferred revenue

|

|

|

(2,448 |

) |

|

|

3,298 |

|

|

Lease liability and other long-term liabilities

|

|

|

(586 |

) |

|

|

136 |

|

|

Net cash provided by (used in) operating activities

|

|

|

(22,337 |

) |

|

|

(16,679 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(199 |

) |

|

|

(208 |

) |

|

Capitalized patent costs

|

|

|

(313 |

) |

|

|

(295 |

) |

|

Proceeds from maturities of marketable securities

|

|

|

16,978 |

|

|

|

26,696 |

|

|

Purchases of marketable securities

|

|

|

(19,376 |

) |

|

|

(8,664 |

) |

|

Net cash provided by (used in) investing activities

|

|

|

(2,910 |

) |

|

|

17,529 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Issuance of common stock, net of issuance costs

|

|

|

32,218 |

|

|

|

— |

|

|

Purchase of common stock

|

|

|

(2,890 |

) |

|

|

(2,036 |

) |

|

Repayment of loans

|

|

|

(35 |

) |

|

|

(33 |

) |

|

Net cash provided by (used in) financing activities

|

|

|

29,293 |

|

|

|

(2,069 |

) |

|

Effect of exchange rate on cash

|

|

|

58 |

|

|

|

(44 |

) |

|

Net increase (decrease) in cash and cash equivalents (2)

|

|

$ |

4,104 |

|

|

$ |

(1,263 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities at beginning of period

|

|

|

27,182 |

|

|

|

52,542 |

|

|

Cash, cash equivalents and marketable securities at end of period

|

|

|

33,686 |

|

|

|

33,331 |

|

|

(2) Net (decrease) increase in cash, cash equivalents and marketable securities

|

|

$ |

6,504 |

|

|

$ |

(19,211 |

) |

###

Exhibit 99.2

Digimarc Corporation (DMRC) Conference Call

Third Quarter 2024 Financial Results

November 14, 2024

Welcome [George Karamanos]

Welcome to our Q3 conference call. Riley McCormack, our CEO, and Charles Beck, our CFO, are with me on the call. On the call today, we will provide a business update and discuss Q3 financial results. This will be followed by a question and answer forum. We have posted our prepared remarks in the investor relations section of our website and will archive this webcast there.

Safe Harbor Statement

Before we begin, let me remind everyone that today's discussion contains forward-looking statements that have risks and uncertainties. Please refer to our press release for more information on the specific risk factors that could cause actual results to differ materially.

Riley will now provide a business update.

Business Update [Riley McCormack]

Thank you, George, and hello everyone.

Looking forward, Q3 was the most significant quarter I have witnessed since I joined the company. Invention and market development are the twin pillars upon which all future opportunities are built. In both of these critical areas, we not only made significant progress on things underway, we also opened new areas of opportunity we previously didn’t believe addressable in the near term.

Looking back, we acknowledge Q3 revenue doesn’t reflect the reality just described. The gap between what lies ahead and what lies behind has never been this large. As noted in the 10-Q that we published today, our third quarter results were impacted by the delayed renewal of a commercial contract. The financial component of this deal is meaningful, as it represents a significant upsell. The strategic component will prove transformational, not only to our company but also to the massive industry it will revolutionize.

In fact, it is exactly this broad industry impact that has led to this deal taking longer to close than all involved originally believed. Trading time-to-close for strategic scope is an outcome I unequivocally support. We run our business to maximize long-term value, and we expect our current path to do exactly that. In addition, our decision to invest a large amount of company resources in Q3 to support this deal versus other opportunities is another decision behind which I unequivocally stand, even knowing as we do now that the expenditure of those resources wouldn’t fall in the same quarter in which the deal was signed.

Because of the transformational nature of this deal from both a financial and strategic perspective, if it closes before our next scheduled call as we currently believe is likely, we will hold an interim call. On any such call, we will provide more details on this specific deal as well as a more complete discussion on what lies ahead, providing the context we know we owe you as to why we believe the gap between looking forward and looking backward has never been this large. For reasons that will be clear, our ability to provide the full picture today is impacted by our inability to discuss the specifics of this deal. Instead of providing a partial picture by discussing the other important developments I noted earlier, I will reserve the rest of my prepared remarks for this interim call.

I will now turn the call over to Charles to discuss our Q3 financial results.

Financial Results [Charles Beck]

Thank you, Riley, and hello everyone.

I normally begin my discussion of our financial results by providing a snapshot of our key financial metrics because I believe this overview provides useful context ahead of discussing each metric in turn. As a result of the significance of the delayed contract Riley just referenced, today I am going to forgo providing that snapshot because Q3 results are not a true representation of the state of our business.

In addition to having an outsized impact on ending ARR1, the delay in resigning resulted in no revenue being recognized nor any cash collected from this contract during Q3. By significantly impacting some of our most important financial metrics, this delay means quarterly financial results are not reflective of our expected go-forward performance, even before considering this contract renewal is expected to include a large upsell.

Ending ARR was $18.7 million compared to $19.6 million at the end of September last year. ARR decreased $900 thousand, which reflects a $5.8 million decrease due to the delayed contract I just referenced, as the original contract has expired and is therefore excluded from ending ARR. The decrease in ARR from this contract was partially offset by net new additions to ARR. While some companies include forecasted renewals in their ARR metric, we take a more conservative approach by only including contracts that are booked in ARR.

Total revenue for the quarter was $9.4 million, an increase of $500 thousand or 5% from $9.0 million in Q3 last year.

Subscription revenue, which accounted for 56% of total revenue for the quarter, grew 9% from $4.8 million to $5.3 million year-over-year. The increase reflects subscription revenue recognized on new customer contracts as well as upsells on existing customer contracts, offset by no revenue being recognized from the impacted contract as I mentioned earlier. Subscription revenue growth would have been significantly higher if the delayed contract had closed within Q3 as originally expected.

Service revenue was flat at $4.2 million year-over-year, reflecting higher commercial service revenue from HolyGrail recycling projects partially offset by lower government service revenue due to timing.

Subscription gross profit margin2 improved slightly to 86% in Q3 this year, compared to 85% in Q3 last year and 89% in the prior quarter. The sequential drop in subscription gross profit margin is due to the absorption of fixed costs over a lower subscription revenue number. This metric would have been significantly higher on both a year-over-year and sequential basis if the aforementioned contract had closed in Q3.

Service gross profit margin improved from 54% in Q3 last year to 61% in Q3 this year, reflecting a favorable change in labor mix. We expect to generate mid-50 percent service gross profit margins on a normalized basis, with some fluctuation quarter to quarter.

Operating expenses for the quarter were $17.3 million compared to $16.4 million in Q3 last year, an increase of 5%. Included in Q3 operating expenses this quarter was $600 thousand of one-time cash severance costs for organizational changes made during the quarter to better align our operations. Additionally, operating expenses were $400 thousand higher due to lower labor costs allocated to cost of revenue due to the amount and mix of billable labor hours incurred during the quarter. Total expenses, which exclude the impact of allocations, were flat year-over-year when removing the $600 thousand of one-time severance costs.

Non-GAAP operating expenses, which exclude non-cash and non-recurring items, were $14.1 million for the quarter, up 7% compared to $13.2 million in Q3 last year. The increase in non-GAAP operating expenses closely mirrors the increase in GAAP operating expenses that I just explained, and like total GAAP expenses, total non-GAAP expenses were flat when excluding one-time severance costs and the impact of allocations.

Net loss per share for the quarter was 50 cents versus 53 cents in Q3 last year. Non-GAAP net loss per share was 29 cents in both periods.

We ended the quarter with $33.7 million in cash and short-term investments.

Free cash flow3 usage was $7.3 million for the quarter, compared to $400 thousand in Q3 last year. The variation year-over-year is primarily due to the timing of cash receipts from the contract we have been referencing throughout our prepared remarks. If this contract, as currently drafted, had been executed and paid within the third quarter, free cash flow would have been positive in Q3.

While we are working diligently to finalize this contract in Q4, the receipt of payment will lag contract execution by standard payment terms. Even if we do not receive payment from this contract before the end of the year, we expect Q4 free cash flow usage to be significantly improved from Q3. If we do receive payment before the end of the year, we expect Q4 free cash flow to be significantly positive.

For further discussion of our financial results, and risks and prospects for our business, please see our Form 10-Q that has been filed with the SEC.

I will now turn the call back over to Riley for final remarks.

1 Annual Recurring Revenue (ARR) is a company performance metric calculated as the aggregation of annualized subscription fees from all of our commercial contracts as of the measurement date.

2 Subscription gross profit margin excludes amortization expense on acquired intangible assets.

3 Free cash flow includes cash used in operating activities, the purchase of property and equipment and capitalized patent costs.

Final Remarks [Riley McCormack]

Thanks Charles. I will keep my closing remarks as brief as my opening remarks. Q3 was the most significant quarter I have witnessed since I joined the company. What lies ahead looks much different than what can be seen in any lagging indicator. We look forward to closing this gap as soon as we are able. We will now open the call up to questions.

v3.24.3

Document And Entity Information

|

Nov. 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

DIGIMARC CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 14, 2024

|

| Entity, Incorporation, State or Country Code |

OR

|

| Entity, File Number |

001-34108

|

| Entity, Tax Identification Number |

26-2828185

|

| Entity, Address, Address Line One |

8500 SW Creekside Place

|

| Entity, Address, City or Town |

Beaverton

|

| Entity, Address, State or Province |

OR

|

| Entity, Address, Postal Zip Code |

97008

|

| City Area Code |

503

|

| Local Phone Number |

469-4800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

DMRC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001438231

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

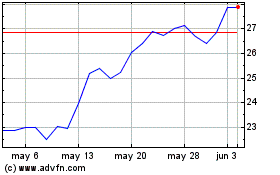

Digimarc (NASDAQ:DMRC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Digimarc (NASDAQ:DMRC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024