--12-31Q10001340476false00-0000000UnlimitedUnlimited000001340476drttf:BasicSubscriptionPrivilegeMember2024-03-310001340476srt:MaximumMemberus-gaap:PerformanceSharesMember2024-01-012024-03-310001340476country:US2023-01-012023-03-310001340476drttf:JanuaryMember2024-03-220001340476us-gaap:CostOfSalesMember2023-01-012023-03-310001340476drttf:MonteCarloValuationMethodMemberdrttf:PerformanceBasedRestrictedStockUnitsMember2021-01-012021-12-3100013404762022-01-012022-12-310001340476us-gaap:TransferredOverTimeMember2024-01-012024-03-310001340476drttf:DebtSettlementAgreementMemberdrttf:TwentyTwoNwFundLpMember2022-04-260001340476drttf:EquitySettledAwardsMember2023-01-012023-03-310001340476srt:MinimumMember2024-01-012024-03-310001340476drttf:LeasingFacilitiesMember2023-01-012023-12-310001340476us-gaap:OtherRestructuringMember2023-01-012023-03-310001340476us-gaap:AdditionalPaidInCapitalMember2023-12-310001340476drttf:AssetsHeldForSaleMember2023-03-310001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2021-11-152021-11-150001340476us-gaap:RestrictedStockUnitsRSUMember2023-12-310001340476srt:MaximumMemberdrttf:LitigationFundingAgreementMember2024-02-042024-02-040001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2024-01-012024-03-310001340476drttf:AssetsHeldForSaleMember2024-01-012024-03-3100013404762022-12-310001340476drttf:ShareAwardsMember2024-01-012024-03-310001340476drttf:PerformanceBasedRestrictedStockUnitsMember2024-01-012024-03-310001340476drttf:DebtSettlementAgreementMemberdrttf:TwentyTwoNwFundLpMember2023-03-310001340476us-gaap:AdditionalPaidInCapitalMember2024-03-310001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2021-01-250001340476us-gaap:LicenseMember2024-01-012024-03-310001340476us-gaap:RevolvingCreditFacilityMember2023-01-012023-09-300001340476drttf:DeferredShareUnitsMember2022-12-310001340476us-gaap:ProductMember2023-01-012023-03-3100013404762024-01-090001340476drttf:AssetsHeldForSaleMember2022-12-310001340476us-gaap:FacilityClosingMember2023-01-012023-03-310001340476us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001340476drttf:MonteCarloValuationMethodMemberdrttf:PerformanceBasedRestrictedStockUnitsMember2022-01-012022-12-310001340476drttf:InventoryAndPropertyPlantAndEquipmentMember2024-03-310001340476drttf:InventoryAndPropertyPlantAndEquipmentMember2023-12-310001340476drttf:LeasingFacilitiesMember2024-01-012024-03-310001340476us-gaap:ContractTerminationMember2023-12-3100013404762024-03-310001340476drttf:DebtSettlementAgreementMember2023-03-150001340476drttf:DeferredShareUnitsMemberdrttf:GrantedUnderThe2023LitpMember2023-12-310001340476us-gaap:CustomerConcentrationRiskMemberdrttf:SignificantCustomerMemberus-gaap:SalesRevenueNetMember2024-01-012024-03-310001340476us-gaap:OtherRestructuringMember2024-01-012024-03-310001340476us-gaap:RevolvingCreditFacilityMemberdrttf:CanadianDollarAdvancesMember2024-01-012024-03-3100013404762023-11-210001340476drttf:PerformanceBasedRestrictedStockUnitsMemberdrttf:TwoThousandTwentyTwoAndTwoThousandTwentyOnePerformanceBasedRestrictedStockUnitsMemberdrttf:ShareBasedCompensationAwardTrancheFourMember2024-01-012024-03-310001340476drttf:EducationMember2024-01-012024-03-310001340476us-gaap:PrimeRateMemberdrttf:RBCFacilitiesMember2024-01-012024-03-310001340476us-gaap:RetainedEarningsMember2023-01-012023-03-310001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2024-03-310001340476drttf:RestrictedStockUnitsTimeBasedMember2024-01-012024-03-310001340476us-gaap:RevolvingCreditFacilityMember2024-03-310001340476drttf:DeferredShareUnitsMember2023-12-310001340476country:CA2024-03-310001340476drttf:DeferredShareUnitsMember2024-01-012024-03-310001340476us-gaap:ServiceMember2023-01-012023-03-310001340476us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001340476us-gaap:PerformanceSharesMember2023-12-310001340476us-gaap:AdditionalPaidInCapitalMember2023-03-310001340476us-gaap:TransferredAtPointInTimeMember2024-01-012024-03-310001340476drttf:DeferredShareUnitsMember2023-01-012023-03-310001340476drttf:ProductAndTransportationRevenuesMember2023-01-012023-03-3100013404762024-01-012024-03-310001340476drttf:CommercialMember2023-01-012023-03-310001340476srt:ScenarioPreviouslyReportedMember2023-01-012023-03-310001340476us-gaap:PerformanceSharesMember2024-03-310001340476drttf:DebtSettlementAgreementMember2024-01-012024-03-310001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2021-11-150001340476drttf:RockHillFacilityTemporarySuspensionAndClosurMember2023-01-012023-03-310001340476us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001340476us-gaap:ShareBasedCompensationAwardTrancheOneMemberdrttf:PerformanceBasedRestrictedStockUnitsMemberdrttf:TwoThousandTwentyTwoAndTwoThousandTwentyOnePerformanceBasedRestrictedStockUnitsMember2024-01-012024-03-310001340476us-gaap:RetainedEarningsMember2024-03-310001340476country:US2024-01-012024-03-310001340476drttf:RestrictedStockUnitsTimeBasedMember2022-12-310001340476drttf:DeferredShareUnitsMember2024-03-310001340476us-gaap:AdditionalPaidInCapitalMember2022-12-310001340476srt:MedianMemberus-gaap:PerformanceSharesMember2024-01-012024-03-310001340476drttf:LeasingFacilitiesMember2023-12-310001340476us-gaap:CommonStockMember2022-12-310001340476drttf:AssetsHeldForSaleMember2023-01-012023-03-310001340476us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001340476us-gaap:AllOtherSegmentsMember2023-01-012023-03-310001340476us-gaap:CommonStockMember2024-01-012024-03-310001340476drttf:LicenseFeesFromDistributionPartnersMember2023-01-012023-03-310001340476drttf:ShareAwardsMember2023-01-012023-03-310001340476drttf:RestrictedStockUnitsTimeBasedMember2023-12-310001340476country:US2023-12-310001340476us-gaap:CommonStockMember2023-12-310001340476drttf:RBCFacilitiesMember2024-03-310001340476drttf:ProductAndTransportationRevenuesMember2024-01-012024-03-310001340476drttf:EquitySettledAwardsMember2024-01-012024-03-310001340476drttf:DecemberMember2024-03-310001340476us-gaap:ContractTerminationMember2024-01-012024-03-310001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2021-01-292021-01-290001340476drttf:PerformanceBasedRestrictedStockUnitsMemberdrttf:TwoThousandTwentyTwoPerformanceBasedRestrictedStockUnitsMember2023-03-012024-03-010001340476country:US2024-03-310001340476us-gaap:RetainedEarningsMember2023-12-310001340476drttf:LiborMemberdrttf:RBCFacilitiesMember2024-02-090001340476drttf:DecemberMember2024-02-150001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2023-01-012023-12-310001340476drttf:RestrictedStockUnitsTimeBasedMember2024-03-310001340476us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100013404762021-01-250001340476drttf:DebtSettlementAgreementMemberdrttf:TwentyTwoNwFundLpMember2023-03-152023-03-150001340476drttf:JanuaryMember2024-02-150001340476us-gaap:HealthCareMember2024-01-012024-03-310001340476drttf:PerformanceBasedRestrictedStockUnitsMemberdrttf:TwoThousandTwentyTwoAndTwoThousandTwentyOnePerformanceBasedRestrictedStockUnitsMemberdrttf:ShareBasedCompensationAwardTrancheFourMember2024-03-310001340476drttf:DeferredShareUnitsMemberdrttf:GrantedUnderThe2023LitpMember2024-03-310001340476us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001340476drttf:TwentyTwoNwFundLpMember2023-03-310001340476us-gaap:ContractTerminationMember2024-03-310001340476us-gaap:RevolvingCreditFacilityMemberdrttf:UsDollarAdvancesMember2024-03-310001340476us-gaap:RestrictedStockUnitsRSUMember2023-03-310001340476drttf:SharesRestatedMember2023-01-012023-03-310001340476us-gaap:RestrictedStockUnitsRSUMember2024-03-310001340476drttf:RangeOfExercisePricesForOutstandingShareOptionsFiveMember2024-03-310001340476drttf:TwoThousandTwentyOnePerformanceBasedRestrictedStockUnitsMemberdrttf:PerformanceBasedRestrictedStockUnitsMember2023-03-012024-03-010001340476drttf:CashSettledAwardsMember2023-01-012023-03-310001340476us-gaap:RestrictedStockUnitsRSUMember2022-12-3100013404762023-03-310001340476us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001340476drttf:DebtSettlementAgreementMemberdrttf:DecemberMember2024-03-310001340476us-gaap:RevolvingCreditFacilityMember2024-01-012024-03-310001340476drttf:RangeOfExercisePricesForOutstandingShareOptionsSevenMember2024-01-012024-03-310001340476us-gaap:ShareBasedCompensationAwardTrancheTwoMemberdrttf:PerformanceBasedRestrictedStockUnitsMemberdrttf:TwoThousandTwentyTwoAndTwoThousandTwentyOnePerformanceBasedRestrictedStockUnitsMember2024-01-012024-03-310001340476us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001340476srt:MinimumMemberus-gaap:PerformanceSharesMember2024-01-012024-03-310001340476us-gaap:RetainedEarningsMember2023-03-310001340476drttf:RangeOfExercisePricesForOutstandingShareOptionsSevenMember2024-03-310001340476us-gaap:ServiceMember2024-01-012024-03-310001340476us-gaap:GovernmentContractMember2024-01-012024-03-310001340476drttf:SharesRestatedMember2024-01-012024-03-310001340476us-gaap:PerformanceSharesMember2024-01-012024-03-310001340476us-gaap:RevolvingCreditFacilityMemberdrttf:CanadianDollarAdvancesMember2024-03-310001340476country:CA2023-12-310001340476drttf:ProductOneMember2024-01-012024-03-310001340476drttf:CommercialMember2024-01-012024-03-310001340476us-gaap:LicenseMember2023-01-012023-03-310001340476drttf:AdditionalSubscriptionPrivilegeMember2024-03-310001340476us-gaap:FacilityClosingMember2024-01-012024-03-310001340476country:CA2023-01-012023-03-3100013404762023-12-3100013404762023-01-012023-03-310001340476drttf:PerformanceBasedRestrictedStockUnitsMemberdrttf:TwoThousandTwentyTwoAndTwoThousandTwentyOnePerformanceBasedRestrictedStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-03-310001340476drttf:AssetsHeldForSaleMember2023-12-310001340476us-gaap:GovernmentContractMember2023-01-012023-03-310001340476us-gaap:CommonStockMember2024-03-310001340476drttf:RBCFacilitiesMember2023-12-310001340476drttf:JanuaryMemberdrttf:DebtSettlementAgreementMember2023-12-310001340476us-gaap:CustomerConcentrationRiskMemberdrttf:SignificantCustomerMemberus-gaap:AccountsReceivableMember2024-01-012024-03-310001340476drttf:DeferredShareUnitsMember2023-03-310001340476us-gaap:TransferredOverTimeMember2023-01-012023-03-310001340476drttf:CanadianDollarAdvancesMember2024-03-310001340476us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-03-310001340476us-gaap:CommonStockMember2023-01-012023-03-310001340476drttf:UsDollarAdvancesMember2024-03-310001340476us-gaap:EmployeeStockOptionMember2024-03-310001340476drttf:RangeOfExercisePricesForOutstandingShareOptionsFiveMember2024-01-012024-03-310001340476drttf:LeasingFacilitiesMember2024-03-310001340476us-gaap:OtherRestructuringMember2023-01-012023-12-310001340476drttf:RestrictedStockUnitsTimeBasedMember2023-01-012023-03-310001340476us-gaap:EmployeeStockOptionMember2023-03-310001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2023-12-3100013404762021-01-252021-01-2500013404762024-01-092024-01-090001340476drttf:EducationMember2023-01-012023-03-310001340476drttf:LicenseFeesFromDistributionPartnersMember2024-01-012024-03-3100013404762024-04-300001340476drttf:DebtSettlementAgreementMemberdrttf:DecemberMember2023-12-310001340476drttf:DecemberMember2024-03-220001340476drttf:AssetsHeldForSaleMember2024-03-310001340476us-gaap:ContractTerminationMember2023-01-012023-03-310001340476drttf:DecemberMember2024-02-152024-02-150001340476us-gaap:RevolvingCreditFacilityMember2021-02-120001340476drttf:PerformanceBasedRestrictedStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberdrttf:TwoThousandTwentyTwoAndTwoThousandTwentyOnePerformanceBasedRestrictedStockUnitsMember2024-01-012024-03-3100013404762023-05-310001340476srt:MaximumMember2024-01-012024-03-310001340476drttf:RockHillFacilityTemporarySuspensionAndClosurMember2024-01-012024-03-310001340476us-gaap:PerformanceSharesMember2023-07-012023-09-300001340476us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001340476drttf:JanuaryMember2024-02-152024-02-150001340476drttf:CashSettledAwardsMember2024-01-012024-03-310001340476us-gaap:HealthCareMember2023-01-012023-03-310001340476us-gaap:TransferredAtPointInTimeMember2023-01-012023-03-310001340476us-gaap:RetainedEarningsMember2022-12-310001340476drttf:TransportationMember2023-01-012023-03-310001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2021-01-252021-01-250001340476drttf:PerformanceBasedRestrictedStockUnitsMember2023-01-012023-03-310001340476us-gaap:PrimeRateMemberdrttf:RBCFacilitiesMember2024-02-092024-02-090001340476country:CA2024-01-012024-03-310001340476us-gaap:EmployeeStockOptionMember2022-12-310001340476drttf:LeasingFacilitiesMember2022-12-310001340476us-gaap:ShareBasedCompensationAwardTrancheOneMemberdrttf:PerformanceBasedRestrictedStockUnitsMemberdrttf:TwoThousandTwentyTwoAndTwoThousandTwentyOnePerformanceBasedRestrictedStockUnitsMember2024-03-310001340476us-gaap:StockOptionMember2024-01-012024-03-310001340476drttf:TransportationMember2024-01-012024-03-310001340476us-gaap:EmployeeStockOptionMember2023-12-310001340476us-gaap:ShareBasedCompensationAwardTrancheTwoMemberdrttf:PerformanceBasedRestrictedStockUnitsMemberdrttf:TwoThousandTwentyTwoAndTwoThousandTwentyOnePerformanceBasedRestrictedStockUnitsMember2024-03-310001340476drttf:ProductOneMember2023-01-012023-03-310001340476us-gaap:CostOfSalesMember2024-01-012024-03-310001340476us-gaap:RetainedEarningsMember2024-01-012024-03-310001340476drttf:JanuaryMemberdrttf:DebtSettlementAgreementMember2024-03-310001340476drttf:LiborMemberdrttf:RBCFacilitiesMember2023-02-090001340476us-gaap:ComprehensiveIncomeMember2024-01-012024-03-310001340476us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001340476drttf:RestrictedStockUnitsTimeBasedMember2023-03-310001340476drttf:TwentyTwoNwFundLpMember2023-01-012023-03-310001340476drttf:ConvertibleUnsecuredSubordinatedDebenturesMember2022-12-310001340476us-gaap:ComprehensiveIncomeMember2023-01-012023-03-310001340476us-gaap:AllOtherSegmentsMember2024-01-012024-03-310001340476us-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2024-03-3100013404762023-12-120001340476us-gaap:RelatedPartyMember2024-03-3100013404762023-11-212023-11-2100013404762023-01-012023-12-310001340476drttf:JanuaryMember2024-03-310001340476us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001340476drttf:RBCFacilitiesMember2023-02-090001340476us-gaap:ProductMember2024-01-012024-03-310001340476us-gaap:ConvertibleDebtMember2024-01-012024-03-310001340476us-gaap:StockOptionMember2023-01-012023-03-310001340476us-gaap:CommonStockMember2023-03-310001340476us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001340476us-gaap:RevolvingCreditFacilityMemberus-gaap:PrimeRateMember2024-01-012024-03-31xbrli:puredrttf:Countryxbrli:sharesiso4217:CADxbrli:sharesdrttf:Segmentiso4217:CADdrttf:Daysiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

or

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-39061

DIRTT ENVIRONMENTAL SOLUTIONS LTD.

(Exact name of registrant as specified in its charter)

|

|

|

Alberta, Canada (State or other jurisdiction of incorporation or organization) |

|

N/A (IRS Employer Identification No.) |

|

|

|

7303 30th Street S.E. Calgary, Alberta, Canada (Address of principal executive offices) |

|

T2C 1N6 (Zip code) |

(Registrant’s telephone number, including area code): (403) 723-5000

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

Accelerated filer |

|

☐ |

|

|

|

|

|

|

Non-accelerated filer |

|

☒ |

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The registrant had 191,880,226 common shares outstanding as of April 30, 2024.

DIRTT ENVIRONMENTAL SOLUTIONS LTD.

FORM 10-Q

FOR THE QUARTER ENDED MARCH 31, 2024

TABLE OF CONTENTS

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 (this “Quarterly Report”) are “forward-looking statements” within the meaning of “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and “forward-looking information” within the meaning of applicable Canadian securities laws. All statements, other than statements of historical fact included in this Quarterly Report, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this Quarterly Report, the words “anticipate,” “believe,” “expect,” “estimate,” “intend,” “plan,” “project,” “outlook,” “may,” “will,” “should,” “would,” “could,” “can,” “continue,” the negatives thereof, variations thereon and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Forward-looking statements are based on certain estimates, beliefs, expectations and assumptions made in light of management’s experience and perception of historical trends, current conditions and expected future developments, as well as other factors that may be appropriate.

Forward-looking statements necessarily involve unknown risks and uncertainties, which could cause actual results or outcomes to differ materially from those contained in, or expressed or implied by such statements. Due to the risks, uncertainties and assumptions inherent in forward-looking information, you should not place undue reliance on forward-looking statements. Factors that could have a material adverse effect on our business, financial condition, results of operations and growth prospects can be found in the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (the “SEC”) and applicable securities commissions or similar regulatory authorities in Canada on February 21, 2024 (the “Annual Report on Form 10-K”), and in this Quarterly Report under “Part II, Item 1A. Risk Factors.” These factors include, but are not limited to, the following:

•general economic and business conditions in the jurisdictions in which we operate;

•our ability to implement our strategic plan, including realization of benefits from certain cost-optimization initiatives undertaken since 2022 and into 2024, and the ability of our board of directors (“Board of Directors”) to successfully implement its transformation plan;

•inflation and material fluctuations of commodity prices, including raw materials, and our ability to set prices for our products that satisfactorily adjust for inflation and fluctuations in commodity prices;

•volatility of our share price and potentially limited liquidity for U.S. investors due to our common shares being quoted on the “OTC Pink Tier”;

•the availability of capital or financing on acceptable terms, or at all, which may impact our liquidity and impair our ability to make investments in the business;

•turnover of our key executives and difficulties in recruiting or retaining key employees;

•our history of negative cash flow from operating activities;

•our ability to generate sufficient revenue to achieve and sustain profitability and positive cash flows;

•our ability to attract, train and retain qualified hourly labor on a timely basis to increase overall productive capacity in our manufacturing facilities to enable us to capture rising demand in the construction industry;

•our ability to achieve and manage growth effectively;

•competition in the interior construction industry;

•our two largest shareholders are able to exercise a significant amount of control over the Company due to their significant ownership of our common shares, and their interests may conflict with or differ from the interests of our other shareholders;

•competitive behaviors by our co-founders and former executives;

•the condition and changing trends of the overall construction industry;

•our reliance on the network of Construction Partners (as defined herein) for sales, marketing and installation of our solutions;

•our ability to introduce new designs, solutions and technology and gain client and market acceptance;

•defects in our designing and manufacturing software and warranty and product liability claims brought against us;

•the effectiveness of our manufacturing processes and our success in implementing improvements to those processes;

•the effectiveness of certain elements of our administrative systems and the need for investment in those systems;

•shortages of supplies of certain key components and materials or disruption in supplies due to global events;

•global economic, political and social conditions affecting financial markets, such as the war in Ukraine and the Israel-Hamas war;

•our exposure to currency exchange rates, tax rates, interest rates and other fluctuations, including those resulting from changes in laws or administrative practice;

•legal and regulatory proceedings brought against us;

•infringement on our patents and other intellectual property and our ability to protect and enforce our intellectual property rights, including certain intellectual property rights that are jointly owned with a third party;

•cyber-attacks and other security breaches of our information and technology systems;

•damage to our information technology and software systems;

•our requirements to comply with applicable environmental, health, safety and other laws;

•the impact of increasing attention to environmental, social and governance (ESG) matters on our business, including potentially incurring additional expenses implementing Canadian, U.S. and other regulations requiring additional disclosures regarding GHG emissions and/or broader ESG-related factors;

•periodic fluctuations in our results of operations and financial conditions;

•the effect of being governed by the corporate laws of a foreign country, including the difficulty of enforcing civil liabilities against directors and officers residing in a foreign country;

•the availability and treatment of government subsidies (including any current or future requirements to repay or return such subsidies); and

•future mergers, acquisitions, agreements, consolidations or other corporate transactions we may engage in.

These risks are not exhaustive. Because of these risks and other uncertainties, our actual results, performance or achievement, or industry results, may be materially different from the anticipated or estimated results discussed in the forward-looking statements in this Quarterly Report. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors nor can we assess the effects of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or expressed or implied by, any forward-looking statements. Our past results of operations are not necessarily indicative of our future results. You should not place undue reliance on any forward-looking statements, which represent our beliefs, assumptions and estimates only as of the dates on which they were made, as predictions of future events. We undertake no obligation to update these forward-looking statements, even though circumstances may change in the future, except as required under applicable securities laws. We qualify all of our forward-looking statements by these cautionary statements.

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

DIRTT Environmental Solutions Ltd.

Interim Condensed Consolidated Balance Sheets

(Unaudited – Stated in thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

As at March 31, |

|

|

As at December 31, |

|

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

38,989 |

|

|

|

24,744 |

|

Restricted cash |

|

|

241 |

|

|

|

355 |

|

Trade and accrued receivables, net of expected credit losses of

$0.1 million at March 31, 2024 and at December 31, 2023 |

|

|

15,782 |

|

|

|

15,787 |

|

Other receivables |

|

|

476 |

|

|

|

484 |

|

Inventory |

|

|

15,669 |

|

|

|

16,577 |

|

Prepaids and other current assets |

|

|

2,426 |

|

|

|

4,023 |

|

Assets held for sale |

|

|

- |

|

|

|

1,555 |

|

Total Current Assets |

|

|

73,583 |

|

|

|

63,525 |

|

Property, plant and equipment, net |

|

|

23,801 |

|

|

|

25,077 |

|

Capitalized software, net |

|

|

2,700 |

|

|

|

2,450 |

|

Operating lease right-of-use assets, net |

|

|

28,442 |

|

|

|

29,813 |

|

Other assets |

|

|

3,442 |

|

|

|

3,452 |

|

Total Assets |

|

|

131,968 |

|

|

|

124,317 |

|

LIABILITIES |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

15,360 |

|

|

|

19,880 |

|

Other liabilities |

|

|

2,906 |

|

|

|

2,482 |

|

Customer deposits and deferred revenue |

|

|

3,080 |

|

|

|

5,290 |

|

Current portion of long-term debt and accrued interest |

|

|

675 |

|

|

|

841 |

|

Current portion of lease liabilities |

|

|

5,449 |

|

|

|

5,255 |

|

Total Current Liabilities |

|

|

27,470 |

|

|

|

33,748 |

|

Long-term debt |

|

|

46,125 |

|

|

|

55,267 |

|

Long-term lease liabilities |

|

|

26,957 |

|

|

|

28,201 |

|

Total Liabilities |

|

|

100,552 |

|

|

|

117,216 |

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Common shares, unlimited authorized without par value, 191,880,226 issued and outstanding at March 31, 2024 and 105,377,667 issued and outstanding at December 31, 2023 |

|

|

218,294 |

|

|

|

196,128 |

|

Additional paid-in capital |

|

|

7,355 |

|

|

|

7,954 |

|

Accumulated other comprehensive loss |

|

|

(16,422 |

) |

|

|

(16,125 |

) |

Accumulated deficit |

|

|

(177,811 |

) |

|

|

(180,856 |

) |

Total Shareholders’ Equity |

|

|

31,416 |

|

|

|

7,101 |

|

Total Liabilities and Shareholders’ Equity |

|

|

131,968 |

|

|

|

124,317 |

|

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

DIRTT Environmental Solutions Ltd.

Interim Condensed Consolidated Statement of Operations

(Unaudited - Stated in thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Product revenue |

|

|

39,039 |

|

|

|

35,476 |

|

Service revenue |

|

|

1,808 |

|

|

|

1,232 |

|

Total revenue |

|

|

40,847 |

|

|

|

36,708 |

|

|

|

|

|

|

|

|

Product cost of sales |

|

|

24,992 |

|

|

|

27,423 |

|

Service cost of sales |

|

|

1,207 |

|

|

|

603 |

|

Total cost of sales |

|

|

26,199 |

|

|

|

28,026 |

|

Gross profit |

|

|

14,648 |

|

|

|

8,682 |

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

Sales and marketing |

|

|

5,920 |

|

|

|

5,515 |

|

General and administrative |

|

|

4,566 |

|

|

|

5,833 |

|

Operations support |

|

|

1,775 |

|

|

|

1,990 |

|

Technology and development |

|

|

1,251 |

|

|

|

1,539 |

|

Stock-based compensation |

|

|

675 |

|

|

|

796 |

|

Reorganization |

|

|

138 |

|

|

|

1,071 |

|

Impairment charge on Rock Hill Facility |

|

|

530 |

|

|

|

- |

|

Related party expense |

|

|

- |

|

|

|

2,056 |

|

Total operating expenses |

|

|

14,855 |

|

|

|

18,800 |

|

|

|

|

|

|

|

|

Operating loss |

|

|

(207 |

) |

|

|

(10,118 |

) |

Government subsidies |

|

|

- |

|

|

|

148 |

|

Gain on extinguishment of convertible debt |

|

|

2,931 |

|

|

|

- |

|

Foreign exchange gain (loss) |

|

|

919 |

|

|

|

(261 |

) |

Interest income |

|

|

489 |

|

|

|

4 |

|

Interest expense |

|

|

(1,054 |

) |

|

|

(1,207 |

) |

|

|

|

3,285 |

|

|

|

(1,316 |

) |

Net income (loss) before tax |

|

|

3,078 |

|

|

|

(11,434 |

) |

Income taxes |

|

|

|

|

|

|

Current and deferred income tax expense |

|

|

33 |

|

|

|

- |

|

|

|

|

33 |

|

|

|

- |

|

Net income (loss) after tax |

|

|

3,045 |

|

|

|

(11,434 |

) |

|

|

|

|

|

|

|

Net income (loss) per share |

|

|

|

|

|

|

Net income (loss) per share - basic |

|

|

0.02 |

|

|

|

(0.10 |

) |

Net income (loss) per share - diluted |

|

|

0.01 |

|

|

|

(0.10 |

) |

|

|

|

|

|

|

|

Weighted average number of shares outstanding (in thousands) |

|

|

|

|

|

|

Basic |

|

|

183,668 |

|

|

|

111,702 |

|

Diluted |

|

|

288,479 |

|

|

|

111,702 |

|

Interim Condensed Consolidated Statement of Comprehensive Income (Loss)

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Net income (loss) for the period |

|

|

3,045 |

|

|

|

(11,434 |

) |

|

Exchange differences on translation of foreign operations |

|

|

(297 |

) |

|

|

273 |

|

|

Comprehensive income (loss) for the period |

|

|

2,748 |

|

|

|

(11,161 |

) |

|

Total revenue for the three months ended March 31, 2024 includes $nil revenue earned from related parties and $nil related party expenses ($0.3 million and $2.1 million for the three months ended March 31, 2023, respectively). Refer to Note 16.

Interest expense for the three months ended March 31, 2024 includes $0.4 million earned by a related party ($nil for the three months ended March 31, 2023). Refer to Note 16.

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

DIRTT Environmental Solutions Ltd.

Interim Condensed Consolidated Statement of Changes in Shareholders’ Equity

(Unaudited – Stated in thousands of U.S. dollars, except for share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

Number of |

|

|

|

|

|

Additional |

|

|

other |

|

|

|

|

|

Total |

|

|

Common |

|

|

Common |

|

|

paid-in |

|

|

comprehensive |

|

|

Accumulated |

|

|

shareholders’ |

|

|

shares |

|

|

shares |

|

|

capital |

|

|

loss |

|

|

deficit |

|

|

equity |

|

As at December 31, 2022 |

|

97,882,844 |

|

|

|

191,347 |

|

|

|

9,023 |

|

|

|

(16,106 |

) |

|

|

(166,272 |

) |

|

|

17,992 |

|

Stock-based compensation |

|

- |

|

|

|

- |

|

|

|

452 |

|

|

|

- |

|

|

|

- |

|

|

|

452 |

|

Issued on vesting of RSUs and Share Awards |

|

659,473 |

|

|

|

1,256 |

|

|

|

(1,256 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

RSUs and Share Awards withheld to settle employee tax obligations |

|

- |

|

|

|

- |

|

|

|

(26 |

) |

|

|

- |

|

|

|

- |

|

|

|

(26 |

) |

Issued for employee share purchase plan |

|

322,408 |

|

|

|

128 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

128 |

|

Foreign currency translation adjustment |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

273 |

|

|

|

- |

|

|

|

273 |

|

Net loss for the period |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(11,434 |

) |

|

|

(11,434 |

) |

As at March 31, 2023 |

|

98,864,725 |

|

|

|

192,731 |

|

|

|

8,193 |

|

|

|

(15,833 |

) |

|

|

(177,706 |

) |

|

|

7,385 |

|

As at December 31, 2023 |

|

105,377,667 |

|

|

|

196,128 |

|

|

|

7,954 |

|

|

|

(16,125 |

) |

|

|

(180,856 |

) |

|

|

7,101 |

|

Stock-based compensation |

|

- |

|

|

|

- |

|

|

|

248 |

|

|

|

- |

|

|

|

- |

|

|

|

248 |

|

Issued on vesting of RSUs and Share Awards |

|

521,253 |

|

|

|

771 |

|

|

|

(771 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

Issued on Rights Offering |

|

85,714,285 |

|

|

|

21,273 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

21,273 |

|

Issued for employee share purchase plan |

|

267,021 |

|

|

|

122 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

122 |

|

RSUs and Share Awards withheld to settle employee tax obligations |

|

- |

|

|

|

- |

|

|

|

(76 |

) |

|

|

- |

|

|

|

- |

|

|

|

(76 |

) |

Foreign currency translation adjustment |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(297 |

) |

|

|

- |

|

|

|

(297 |

) |

Net income for the period |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

3,045 |

|

|

|

3,045 |

|

As at March 31, 2024 |

|

191,880,226 |

|

|

|

218,294 |

|

|

|

7,355 |

|

|

|

(16,422 |

) |

|

|

(177,811 |

) |

|

|

31,416 |

|

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

DIRTT Environmental Solutions Ltd.

Interim Condensed Consolidated Statement of Cash Flows

(Unaudited – Stated in thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income (loss) for the period |

|

|

3,045 |

|

|

|

(11,434 |

) |

Adjustments: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,534 |

|

|

|

2,675 |

|

Impairment charge on Rock Hill Facility |

|

|

530 |

|

|

|

- |

|

Stock-based compensation |

|

|

675 |

|

|

|

796 |

|

Foreign exchange loss (gain) |

|

|

(978 |

) |

|

|

346 |

|

Gain on extinguishment of convertible debt |

|

|

(2,931 |

) |

|

|

- |

|

Accretion of convertible debentures |

|

|

180 |

|

|

|

164 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Trade and accrued receivables |

|

|

(34 |

) |

|

|

2,111 |

|

Other receivables |

|

|

(3 |

) |

|

|

4,732 |

|

Inventory |

|

|

597 |

|

|

|

1,299 |

|

Prepaid and other assets, current and long term |

|

|

1,437 |

|

|

|

391 |

|

Accounts payable and accrued liabilities |

|

|

(4,072 |

) |

|

|

(3,299 |

) |

Other liabilities |

|

|

- |

|

|

|

2,056 |

|

Customer deposits and deferred revenue |

|

|

(2,202 |

) |

|

|

(1,020 |

) |

Current portion of long-term debt and accrued interest |

|

|

(152 |

) |

|

|

(56 |

) |

Lease liabilities |

|

|

331 |

|

|

|

251 |

|

Net cash flows used in operating activities |

|

|

(2,043 |

) |

|

|

(988 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of property, plant and equipment, net of accounts

payable changes |

|

|

(344 |

) |

|

|

(371 |

) |

Capitalized software development expenditures |

|

|

(442 |

) |

|

|

(532 |

) |

Other asset expenditures |

|

|

(79 |

) |

|

|

(106 |

) |

Recovery of software development expenditures |

|

|

121 |

|

|

|

26 |

|

Proceeds on sale of assets held for sale |

|

|

1,025 |

|

|

|

- |

|

Net cash flows provided by (used in) investing activities |

|

|

281 |

|

|

|

(983 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Repayment of long-term debt |

|

|

(5,074 |

) |

|

|

(642 |

) |

Net proceeds received from rights offering |

|

|

21,273 |

|

|

|

- |

|

Employee tax payments on vesting of RSUs |

|

|

(76 |

) |

|

|

(26 |

) |

Net cash flows provided by (used in) financing activities |

|

|

16,123 |

|

|

|

(668 |

) |

Effect of foreign exchange on cash, cash equivalents and

restricted cash |

|

|

(230 |

) |

|

|

(36 |

) |

Net increase (decrease) in cash, cash equivalents and

restricted cash |

|

|

14,131 |

|

|

|

(2,675 |

) |

Cash, cash equivalents and restricted cash, beginning of year |

|

|

25,099 |

|

|

|

14,239 |

|

Cash, cash equivalents and restricted cash, end of period |

|

|

39,230 |

|

|

|

11,564 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Interest paid |

|

|

(1,005 |

) |

|

|

(1,072 |

) |

Income taxes received |

|

|

- |

|

|

|

5 |

|

|

|

|

|

|

|

|

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets. |

|

|

|

As At March 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash and cash equivalents |

|

|

38,989 |

|

|

|

8,146 |

|

Restricted cash |

|

|

241 |

|

|

|

3,418 |

|

Total cash, cash equivalents and restricted cash |

|

|

39,230 |

|

|

|

11,564 |

|

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

DIRTT Environmental Solutions Ltd.

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

(Amounts in thousands of U.S. dollars unless otherwise stated)

1. GENERAL INFORMATION

DIRTT Environmental Solutions Ltd. and its subsidiary (“DIRTT”, the “Company”, “we” or “our”) is a leader in industrialized construction. DIRTT's system of physical products and digital tools empowers organizations, together with construction and design leaders, to build high-performing, adaptable, interior environments. Operating in the workplace, healthcare, education, and public sector markets, DIRTT’s system provides total design freedom, and greater certainty in cost, schedule, and outcomes.

DIRTT’s proprietary design integration software, ICE® (“ICE” or “ICE software”), translates the vision of architects and designers into a 3D model that also acts as manufacturing information. ICE is also licensed to unrelated companies and construction partners of the Company (“Construction Partners”), including Armstrong World Industries, Inc. (“AWI”), which owns a 50% interest in the rights, title and interests in certain intellectual property rights in a portion of the ICE software that is used by AWI.

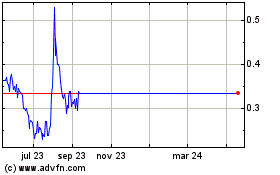

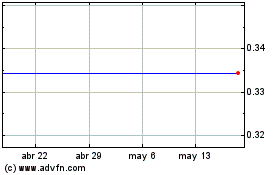

DIRTT is incorporated under the laws of the province of Alberta, Canada. Its headquarters is located at 7303 – 30th Street S.E., Calgary, AB, Canada T2C 1N6 and its registered office is located at 4500, 855 – 2nd Street S.W., Calgary, AB, Canada T2P 4K7. DIRTT’s common shares trade on the Toronto Stock Exchange under the symbol “DRT”. Effective October 12, 2023, DIRTT’s common shares ceased to trade on the Nasdaq Capital Market. DIRTT’s common shares are quoted on the OTC Markets on the “OTC Pink Tier” under the symbol “DRTTF.”

2. BASIS OF PRESENTATION

The accompanying unaudited interim condensed consolidated financial statements (the “Financial Statements”) have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X and, accordingly, the Financial Statements do not include all of the information and notes required by accounting principles generally accepted in the United States for complete financial statements. In the opinion of the Company, the Financial Statements contain all adjustments necessary, consisting of only normal recurring adjustments, for a fair statement of its financial position as of March 31, 2024, and its results of operations and cash flows for the three months ended March 31, 2024 and 2023. The condensed balance sheet at December 31, 2023, was derived from audited annual financial statements but does not contain all of the footnote disclosures from the annual financial statements. These Financial Statements should be read in conjunction with the audited consolidated financial statements as of December 31, 2023 and 2022 and for each of the three years in the period ended December 31, 2023 included in the Annual Report on Form 10-K of the Company as filed with the SEC and applicable securities commission or similar regulatory authorities in Canada.

In these Financial Statements, unless otherwise indicated, all dollar amounts are expressed in United States (“U.S.”) dollars. DIRTT’s financial results are consolidated in Canadian dollars, the Company’s functional currency, and the Company has adopted the U.S. dollar as its reporting currency. All references to US$ or $ are to U.S. dollars and references to C$ are to Canadian dollars.

Principles of consolidation

The Financial Statements include the accounts of DIRTT Environmental Solutions Ltd. and its subsidiary. All intercompany balances, income and expenses, unrealized gains and losses and dividends resulting from intercompany transactions have been eliminated on consolidation.

Basis of measurement

These Financial Statements have been prepared on the historical cost convention except for certain financial instruments, assets held for sale and certain components of stock-based compensation that are measured at fair value. Historical cost is generally based on the fair value of the consideration given in exchange for assets. The Company’s quarterly tax provision is based upon an estimated annual effective tax rate.

Seasonality

Sales of the Company’s products are driven by consumer and industrial demand for interior construction solutions. The timing of customers’ construction projects can be influenced by a number of factors including the prevailing economic climate and weather.

3. ADOPTION OF NEW AND REVISED ACCOUNTING STANDARDS

On December 14, 2023, the FASB issued Accounting Standards Update No. 2023-09, “Improvements to Income Tax Disclosures” (“ASU 2023-09”) further disaggregated information on an entity’s tax rate reconciliation and income taxes paid. The amendments in ASU 2023-09 are effective for fiscal years beginning after December 15, 2024, on a prospective basis with an option of retrospective application. The Company is evaluating the impact of the adoption of this standard.

Although there are several other new accounting standards issued or proposed by the FASB, which the Company has adopted or will adopt, as applicable, the Company does not believe any of these accounting pronouncements has had or will have a material impact on its Financial Statements.

4. REORGANIZATION AND ASSETS HELD FOR SALE

Workforce Reductions

During the three months ended March 31, 2023, a review of our costs resulted in the decision to eliminate a number of salaried positions. These actions resulted in the Company incurring certain one-time termination costs. There were no restructuring costs associated with workforce reductions in the three months ended March 31, 2024.

Temporary Suspension of Operations and Subsequent Closure at Rock Hill, South Carolina (the “Rock Hill Facility”)

On August 23, 2022, we announced the temporary suspension of operations at our Rock Hill Facility, shifting related manufacturing to our Calgary manufacturing facility. Costs associated with this idle facility, included in cost of sales, were $0.5 million for the three month period ended March 31, 2024 (2023 – $0.4 million).

On September 27, 2023, the Company decided to permanently close the Rock Hill Facility. Certain assets, including manufacturing equipment, which met held-for-sale criteria at that time were reclassified from property, plant and equipment. During the three months ended March 31, 2024, $1.0 million of the assets held for sale were sold. At March 31, 2024, we determined to reduce the assets held for sale balance from $0.5 million to $nil, resulting in a $0.5 million impairment charge for the quarter. While we will continue to pursue a sale of the assets, we were not able to determine the likelihood of recoverability based on the current market interest in the equipment.

|

|

|

|

|

|

|

|

|

|

|

As at March 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets held for sale, opening |

|

|

1,555 |

|

|

|

- |

|

Proceeds from sale of assets held for sale |

|

|

(1,025 |

) |

|

|

- |

|

Impairment charge on reassessment |

|

|

(530 |

) |

|

|

- |

|

Assets held for sale, ending |

|

|

- |

|

|

|

- |

|

For the three months ended March 31, 2024, reorganization costs incurred relate to the above mentioned initiatives:

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Termination benefits |

|

|

- |

|

|

|

700 |

|

Phoenix facility closure |

|

|

- |

|

|

|

43 |

|

Rock Hill Facility temporary suspension and closure of operations |

|

|

126 |

|

|

|

- |

|

Other costs |

|

|

12 |

|

|

|

328 |

|

Total reorganization costs |

|

|

138 |

|

|

|

1,071 |

|

|

|

|

|

|

Reorganization costs in accounts payable and accrued liabilities at January 1, 2023 |

|

|

2,277 |

|

Reorganization expense |

|

|

3,009 |

|

Reorganization costs paid |

|

|

(4,690 |

) |

Reorganization costs in accounts payable and accrued liabilities at December 31, 2023 |

|

|

596 |

|

Reorganization expense |

|

|

138 |

|

Reorganization costs paid |

|

|

(438 |

) |

Reorganization costs in accounts payable and accrued liabilities at March 31, 2024 |

|

|

296 |

|

Of the $0.3 million reorganization costs in accounts payable and accrued liabilities (December 31, 2023 – $0.6 million), $0.2 million relates to termination benefits (December 31, 2023 – $0.5 million) and $0.1 million relates to other reorganization costs (December 31, 2023 – $0.1 million).

5. GAIN ON EXTINGUISHMENT OF CONVERTIBLE DEBENTURES

On February 15, 2024, the Company commenced a substantial issuer bid and tender offer (the “Issuer Bid”) pursuant to which the Company offered to repurchase for cancellation: (i) up to C$6.0 million principal amount of its issued and outstanding January Debentures (as defined in Note 8) at a purchase price of C$720 per C$1,000 principal amount of January Debentures, and (ii) up to C$9.0 million principal amount of its issued and outstanding December Debentures (as defined in Note 8), at a purchase price of C$600 per C$1,000 principal amount of December Debentures.

C$4.7 million ($3.5 million) aggregate principal amount of the January Debentures and C$5.8 million ($4.3 million) aggregate principal amount of December Debentures were validly deposited and not withdrawn at the expiration of the Issuer Bid on March 22, 2024, representing approximately 11.66% of the January Debentures and 16.50% of the December Debentures issued and outstanding at that time. The Company took up all the Debentures (as defined in Note 8) tendered pursuant to the Issuer Bid for aggregate consideration of C$7.0 million ($5.2 million) (comprised of C$6.9 million ($5.1 million) repayment on principal and interest of C$0.1 million ($0.1 million)).

In accordance with GAAP, it was determined that the C$6.9 million ($5.1 million) repayment on principal triggered an extinguishment of debt. The gain on extinguishment of C$3.9 million ($2.9 million) was calculated as the difference between the repayment and the net carrying value of the extinguished principal less unamortized issuance costs of C$0.4 million ($0.2 million) (refer to Note 8).

6. TRADE AND ACCRUED RECEIVABLES

Accounts receivable are recorded at the invoiced amount, do not require collateral and typically do not bear interest. The Company estimates an allowance for credit losses using the lifetime expected credit loss at each measurement date, taking into account historical credit loss experience as well as forward-looking information, in order to establish rates for each class of financial receivable with similar risk characteristics. Adjustments to this estimate are recognized in the consolidated statement of operations.

In order to manage and assess our risk, management maintains credit policies that include regular review of credit limits of individual receivables and systematic monitoring of aging of trade receivables and the financial well-being of our customers. In addition, we acquired trade credit insurance effective April 1, 2020. At March 31, 2024, approximately 97% of our trade accounts receivable are insured, relating to accounts receivable from counterparties deemed creditworthy by the insurer and excluding accounts receivable from government entities.

Our trade balances are spread over a broad Construction Partner base, which is geographically dispersed. For the three months ended March 31, 2024, one Construction Partner accounted for greater than 10% of revenue (one Construction Partner for the three months ended March 31, 2023). In addition, and where possible, we collect a 50% deposit on sales, excluding government and certain other clients.

The Company’s aged receivables were as follows:

|

|

|

|

|

|

|

|

|

|

|

As at |

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Current |

|

|

13,297 |

|

|

|

12,070 |

|

Overdue |

|

|

2,585 |

|

|

|

3,818 |

|

|

|

|

15,882 |

|

|

|

15,888 |

|

Less: expected credit losses |

|

|

(100 |

) |

|

|

(101 |

) |

|

|

|

15,782 |

|

|

|

15,787 |

|

No adjustment to our expected credit losses of $0.1 million was required for the three months ended March 31, 2024. Receivables are generally considered to be past due when over 60 days old, unless there is a separate payment arrangement in place for the collection of the receivable.

On February 4, 2024, the Company entered into a Litigation Funding Agreement with a third party for the funding of up to $4.0 million of litigation costs in respect of specific claims against Falkbuilt, Inc., Falkbuilt Ltd. and Henderson. In return, the Company has agreed to pay from any proceeds received from the settlement of such claims, a reimbursement of funded amounts plus diligence and underwriting costs, plus a multiple of such funded amount based on certain milestones. As part of this agreement, the Company is subject to a general security arrangement over its assets.

7. OTHER LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

As at, |

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Warranty provisions (1) |

|

|

866 |

|

|

|

873 |

|

DSU liability |

|

|

1,486 |

|

|

|

1,086 |

|

Income taxes payable |

|

|

321 |

|

|

|

289 |

|

Sublease deposits |

|

|

183 |

|

|

|

184 |

|

Other provisions |

|

|

50 |

|

|

|

50 |

|

Other liabilities |

|

|

2,906 |

|

|

|

2,482 |

|

(1)The following table presents a reconciliation of the warranty provision balance:

|

|

|

|

|

|

|

|

|

|

|

As at, |

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

As at January 1 |

|

|

873 |

|

|

|

1,278 |

|

Additions to warranty provision |

|

|

205 |

|

|

|

1,208 |

|

Payments related to warranties |

|

|

(212 |

) |

|

|

(1,613 |

) |

|

|

|

866 |

|

|

|

873 |

|

8. LONG-TERM DEBT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revolving

Credit Facility |

|

|

Leasing

Facilities |

|

|

Convertible

Debentures |

|

|

Total Debt |

|

Balance on January 1, 2023 |

|

|

- |

|

|

|

11,812 |

|

|

|

53,623 |

|

|

|

65,435 |

|

Accretion of issue costs |

|

|

- |

|

|

|

- |

|

|

|

698 |

|

|

|

698 |

|

Accrued interest |

|

|

- |

|

|

|

526 |

|

|

|

3,411 |

|

|

|

3,937 |

|

Interest payments |

|

|

- |

|

|

|

(526 |

) |

|

|

(3,451 |

) |

|

|

(3,977 |

) |

Principal repayments |

|

|

- |

|

|

|

(11,579 |

) |

|

|

- |

|

|

|

(11,579 |

) |

Exchange differences |

|

|

- |

|

|

|

251 |

|

|

|

1,343 |

|

|

|

1,594 |

|

Balance at December 31, 2023 |

|

|

- |

|

|

|

484 |

|

|

|

55,624 |

|

|

|

56,108 |

|

Current portion of long-term debt and accrued interest |

|

|

- |

|

|

|

79 |

|

|

|

762 |

|

|

|

841 |

|

Long-term debt |

|

|

- |

|

|

|

405 |

|

|

|

54,862 |

|

|

|

55,267 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance on January 1, 2024 |

|

|

- |

|

|

|

484 |

|

|

|

55,624 |

|

|

|

56,108 |

|

Accretion of issue costs |

|

|

- |

|

|

|

- |

|

|

|

180 |

|

|

|

180 |

|

Accrued interest |

|

|

- |

|

|

|

9 |

|

|

|

843 |

|

|

|

852 |

|

Interest payments |

|

|

- |

|

|

|

(9 |

) |

|

|

(996 |

) |

|

|

(1,005 |

) |

Principal repayments |

|

|

- |

|

|

|

(19 |

) |

|

|

(5,055 |

) |

|

|

(5,074 |

) |

Gain on extinguishment |

|

|

- |

|

|

|

- |

|

|

|

(2,931 |

) |

|

|

(2,931 |

) |

Exchange differences |

|

|

- |

|

|

|

(11 |

) |

|

|

(1,319 |

) |

|

|

(1,330 |

) |

Balance at March 31, 2024 |

|

|

- |

|

|

|

454 |

|

|

|

46,346 |

|

|

|

46,800 |

|

Current portion of long-term debt and accrued interest |

|

|

- |

|

|

|

78 |

|

|

|

597 |

|

|

|

675 |

|

Long-term debt |

|

|

- |

|

|

|

376 |

|

|

|

45,749 |

|

|

|

46,125 |

|

Revolving Credit Facility

On February 12, 2021, the Company entered into a loan agreement governing a C$25.0 million senior secured revolving credit facility with the Royal Bank of Canada (“RBC”), as lender (the “RBC Facility”). Under the RBC Facility, the Company was able to borrow up to a maximum of 90% of investment grade or insured accounts receivable plus 85% of eligible accounts receivable plus the lesser of (i) 75% of the book value of eligible inventory and (ii) 85% of the net orderly liquidation value of eligible inventory less any reserves for potential prior ranking claims (the “Borrowing Base”). Interest was calculated at the Canadian or U.S. prime rate plus 30 basis points or at the Canadian Dollar Offered Rate or LIBOR plus 155 basis points. Under the RBC Facility, if the “Aggregate Excess Availability,” (defined as the Borrowing Base less any loan advances or letters of credit or guarantee and if undrawn including unrestricted cash), was less than C$5.0 million, the Company is subject to a fixed charge coverage ratio (“FCCR”) covenant of 1.10:1 on a trailing twelve-month basis. Additionally, if the FCCR had been below 1.10:1 for the three immediately preceding months, the Company was required to maintain a reserve account equal to the aggregate of one year of payments on outstanding loans on the Leasing Facilities (defined below). Should an event of default have occurred or the Aggregate Excess Availability been less than C$6.25 million for five consecutive business days, the Company would have entered a cash dominion period whereby the Company’s bank accounts would have been blocked by RBC and daily balances would have offset any borrowings and any remaining amounts made available to the Company.

On February 9, 2023, the Company extended the RBC Facility (the “Extended RBC Facility”). The Extended RBC Facility had a borrowing base of C$15 million and a one-year term. Interest was calculated as at the Canadian or U.S. prime rate plus 75 basis points or the Canadian Dollar Offered Rate or Term Secured Overnight Financing Rate (“Term SOFR”) plus 200 basis points plus the Term SOFR Adjustment (as defined in the amended loan agreement governing the Extended RBC Facility). Under the Extended RBC Facility, if the trailing twelve month FCCR was not above 1.25 for three consecutive months, a cash balance equivalent to one-year’s worth of Leasing Facilities payments was required to be maintained. Effective October 2023, inventory was scoped out of the Borrowing Base.

On February 9, 2024, the Company extended the Extended RBC Facility (the “Second Extended RBC Facility”). The Second Extended RBC Facility is subject to the borrowing base calculation to a maximum of C$15 million and a one-year term. Interest is calculated at the Canadian or U.S. prime rate plus 75 basis points or at the Canadian Dollar Offered Rate or Adjusted Term CORRA or Term SOFR plus the Term SOFR Adjustment, in each case plus 200 basis points. At March 31, 2024, available borrowings are C$10.1 million ($8.5 million) (December 31, 2023 – C$13.6 million ($10.3 million) of available borrowings), calculated in the same manner as the RBC Facility described above, of which no amounts have been drawn. The Second Extended RBC Facility removed the three-month FCCR

covenant, which resulted in the release of $0.1 million of restricted cash during the first quarter of 2024 (the Company had $0.4 million restricted cash as at December 31, 2023).

Leasing Facilities

The Company has a C$5.0 million equipment leasing facility in Canada (the “Canada Leasing Facility”) of which C$4.4 million ($3.4 million) has been drawn and C$3.8 million ($2.9 million) has been repaid, and a $14.0 million equipment leasing facility in the United States (the “U.S. Leasing Facility” and, together with the Canada Leasing Facility, the “Leasing Facilities”) with RBC, of which $13.3 million has been drawn and repaid. The Canada Leasing Facility has a seven-year term and bears interest at 4.25%. Refer to Note 4 on the decision to permanently close the Rock Hill Facility. As part of this decision, the Company fully settled the $7.8 million principal balance of the U.S. Leasing Facility in the fourth quarter of 2023. The U.S. Leasing Facility is no longer available to be drawn on.

The Company did not make any draws on the Canadian Leasing Facilities during the first quarter of 2024 (2023 – $nil). The associated financial liabilities are shown on the consolidated balance sheet in the current portion of long-term debt and accrued interest and long-term debt.

Convertible Debentures

On January 25, 2021, the Company completed a C$35.0 million ($27.5 million) bought-deal financing of convertible unsecured subordinated debentures with a syndicate of underwriters (the “January Debentures”). On January 29, 2021, the Company issued a further C$5.25 million ($4.1 million) of the January Debentures under the terms of an overallotment option granted to the underwriters. The January Debentures will mature and be repayable on January 31, 2026 (the “January Debentures Maturity Date”) and accrue interest at the rate of 6.00% per annum payable semi-annually in arrears on the last day of January and July of each year commencing on July 31, 2021 until the January Debentures Maturity Date. Interest and principal are payable in cash or shares at the option of the Company. The January Debentures will be convertible into common shares of DIRTT, at the option of the holder, at any time prior to the close of business on the business day prior to the earlier of the January Debentures Maturity Date and the date specified by the Company for redemption of the January Debentures. Costs of the transaction were approximately C$2.7 million, including the underwriters’ commission. As a result of the Rights Offering (as defined herein) (refer to Note 14), the conversion price of the January Debentures was adjusted to C$4.03 per common share representing a conversion rate of 248.1390 common shares per C$1,000 principal amount. On March 22, 2024, the Company completed the Issuer Bid in which the Company repurchased for cancellation C$4.7 million ($3.5 million) of the principal balance of the January Debentures, and paid C$0.04 million ($0.03 million) of the interest payable on such January Debentures (refer to Note 5). As at March 31, 2024, C$35.6 million ($26.3 million) principal amount of the January Debentures was outstanding of which C$18.9 million ($13.9 million) was held by a related party (refer to Note 16).

On December 1, 2021, the Company completed a C$35.0 million ($27.4 million) bought-deal financing of convertible unsecured subordinated debentures with a syndicate of underwriters (the “December Debentures” and, together with the January Debentures, the “Debentures”). These December Debentures will mature and be repayable on December 31, 2026 (the “December Debentures Maturity Date”) and accrue interest at the rate of 6.25% per annum payable semi-annually in arrears on the last day of June and December of each year commencing on June 30, 2022 until the December Debentures Maturity Date. Interest and principal are payable in cash or shares at the option of the Company. The December Debentures will be convertible into common shares of DIRTT, at the option of the holder, at any time prior to the close of business on the business day prior to the earlier of the December Debentures Maturity Date and the date specified by the Company for redemption of the December Debentures. Costs of the transaction were approximately C$2.3 million, including the underwriters’ commission. As a result of the Rights Offering (refer to Note 14), the conversion price of the December Debentures was adjusted to C$3.64 per common share representing a conversion rate of 274.7253 common shares per C$1,000 principal amount. On March 22, 2024, the Company completed the Issuer Bid in which the Company repurchased for cancellation C$5.8 million ($4.3 million) of the principal balance of the December Debentures and paid C$0.08 million ($0.06 million) of the interest payable on such December Debentures (refer to Note 5). As at March 31, 2024, C$29.2 million ($21.5 million) principal amount of the December Debentures was outstanding of which C$13.6 million ($10.0 million) was held by a related party (refer to Note 16).

9. STOCK-BASED COMPENSATION

In May 2020, shareholders approved the DIRTT Environmental Solutions Long Term Incentive Plan (the “2020 LTIP”). The 2020 LTIP replaced the predecessor incentive plans, being the Performance Share Unit Plan (“PSU Plan”) and the Amended and Restated Stock Option Plan (“Stock Option Plan”). Following the approval of the 2020 LTIP, no further awards will be made under either the Stock Option Plan or the PSU Plan, but both remain in place to govern the terms of any awards that were granted pursuant to such plans and remain outstanding.

In May 2023, shareholders approved the DIRTT Environmental Solutions Ltd. Amended and Restated Long-Term Incentive Plan (the “2023 LTIP”) at the annual and special meeting of shareholders. The 2023 LTIP gives the Company the ability to award options, share appreciation rights, restricted share units, deferred share units, restricted shares, dividend equivalent rights, and other share-based awards and cash awards to eligible employees, officers, consultants and directors of the Company and its affiliates. In accordance with the 2023 LTIP, the sum of (i) 12,350,000 common shares plus (ii) the number of common shares subject to stock options previously granted under the Company’s Amended and Restated Incentive Stock Option Plan (the “Stock Option Plan”) that, following May 30, 2023, expire or are cancelled or terminated without having been exercised in full, have been reserved for issuance under the 2023 LTIP. Upon vesting of certain LTIP awards, the Company may withhold and sell shares as a means of meeting DIRTT’s tax withholding requirements in respect of the withholding tax remittances required in respect of award holders. To the extent the fair value of the withheld shares upon vesting exceeds the grant date fair value of the instrument, the excess amount is credited to retained earnings or deficit.

Deferred share units (“DSUs”) have historically been granted to non-employee directors under the Deferred Share Unit Plan for Non-Employee Directors (as amended and restated, the “DSU Plan”) and settleable only in cash. The 2023 LTIP gives the Company the ability to settle DSUs in either cash or common shares, while consolidating future share-based awards under a single plan. The terms of the DSU Plan are otherwise materially unchanged as incorporated into the 2023 LTIP. Effective May 30, 2023, no new awards will be made under the DSU Plan, but awards previously granted under the DSU Plan will continue to be governed by the DSU Plan. DSUs are settled following cessation of services with the Company.

Stock-based compensation expense

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Equity-settled awards |

|

|

493 |

|

|

|

644 |

|

Cash-settled awards |

|

|

182 |

|