Expensify Pays Down All Debt and Announces Share Repurchase

09 Septiembre 2024 - 9:15AM

Business Wire

The company announced it has paid off all debts

($22.6 million) and completed a buyback of 645,938 shares.

Expensify, Inc. (Nasdaq: EXFY), a payments superapp that helps

individuals and businesses around the world simplify the way they

manage money across expenses, corporate cards and bills, announced

today that the company paid down the balance of its revolving line

of credit ($15 million), paid off the mortgage on its headquarters

in downtown Portland, OR, ($7.6 million) and repurchased 645,938

shares of its Class A common stock from its founder.

The company still retains access to $24 million in a revolving

line of credit if needed, but has otherwise cleared the debt from

its balance sheets. Additionally, rather than refinance its

mortgage which was scheduled to come due in the third quarter of

2024, the company has paid it off.

The 645,938 Class A common stock shares were purchased at an

average price of $2.34, reflecting the weighted average price over

a three-day period ending August 27, 2024. The shares will be

retired. The Company’s share repurchases are designed to offset

dilution from stock issuances and reduce share count over time.

Expensify CFO, Ryan Schaffer, said, “We are happy with the

continued progress our business has made since this time last year.

The cost cutting efforts we initiated have had a great impact on

the health of our business. The end of our multi-year product

revamp journey is within sight, we returned to positive cash flows

for the past two quarters, we’ve eliminated our debt, and continued

to repurchase shares. We are excited for the future of the company

and the product we’re bringing to market.”

Please see the company’s 8-K disclosures at our investor website

for more information on these transactions:

https://investors.expensify.com/

Forward-Looking

Statements

Forward-looking statements in this press release, which are not

historical facts, are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1955. These

statements include statements regarding our intended share

repurchases and expected shareholder benefits; expected funding

through cash generated from operations; and our expected future

free cash flow generation and credit facility restrictions. As a

result, our actual results, performance or achievements may differ

materially from those expressed or implied by these forward-looking

statements. In some cases, you can identify forward-looking

statements because they contain words such as “may,” “will,”

“shall,” “should,” “expects,” “plans,” “anticipates,” “could,”

“intends,” “target,” “projects,” “contemplates,” “believes,”

“estimates,” “predicts,” “potential,” “goal,” “objective,” “seeks,”

or “continue” or the negative of these words or other similar terms

or expressions that concern our expectations, strategy, plans, or

intentions. Such forward-looking statements are necessarily based

upon estimates and assumptions that, while considered reasonable by

us and our management, are inherently uncertain. Factors that may

cause actual results to differ materially from current expectations

include, but are not limited to: our expectations regarding our

financial performance and future operating performance; our ability

to attract and retain members, expand usage of our platform, sell

subscriptions to our platform and convert individuals and

organizations into paying customers; the timing and success of new

features, integrations, capabilities and enhancements by us, or by

competitors to their products, or any other changes in the

competitive landscape of our market; the amount and timing of

operating expenses and capital expenditures that we may incur to

maintain and expand our business and operations to remain

competitive; the sufficiency of our cash, cash equivalents and

investments to meet our liquidity needs and permit future share

buybacks; our ability to make required payments under and to comply

with the various requirements of our current and future

indebtedness; our ability to effectively manage our exposure to

fluctuations in foreign currency exchange rates; the economic,

political and social impact of, and uncertainty relating to, the

COVID-19 pandemic; the war in Ukraine and escalating geopolitical

tensions as a result of Russia's invasion of Ukraine; the increased

expenses associated with being a public company; the size of our

addressable markets, market share and market trends; anticipated

trends, developments and challenges in our industry, business and

the highly competitive markets in which we operate; our

expectations regarding our income tax liabilities and the adequacy

of our reserves; our ability to effectively manage our growth and

expand our infrastructure and maintain our corporate culture; our

ability to identify, recruit and retain skilled personnel,

including key members of senior management; the safety,

affordability and convenience of our platform and our offerings;

our ability to successfully defend litigation brought against us;

our ability to successfully identify, manage and integrate any

existing and potential acquisitions of businesses, talent,

technologies or intellectual property; general economic conditions

in either domestic or international markets, including the societal

and economic impact of the COVID-19 pandemic, and geopolitical

uncertainty and instability; our protections against security

breaches, technical difficulties, or interruptions to our platform;

our ability to maintain, protect and enhance our intellectual

property; and other risks discussed in our filings with the SEC.

All forward-looking statements attributable to us or persons acting

on our behalf are expressly qualified in their entirety by the

cautionary statements set forth above. We caution you not to place

undue reliance on any forward-looking statements, which are made

only as of the date of this press release. We do not undertake or

assume any obligation to update publicly any of these

forward-looking statements to reflect actual results, new

information or future events, changes in assumptions or changes in

other factors affecting forward-looking statements, except to the

extent required by applicable law. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect to those or other

forward-looking statements.

About Expensify

Expensify helps more than 15 million people around the world

track expenses, reimburse employees, manage corporate cards, send

invoices, pay bills, and book travel. All in one app. So whether

you're working for yourself, running a small business, managing a

team, or overseeing the finances of a global enterprise, let

Expensify handle your spend so you can stay focused on success.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909647375/en/

Nick Tooker, investors@expensify.com

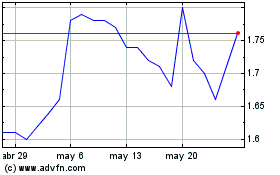

Expensify (NASDAQ:EXFY)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

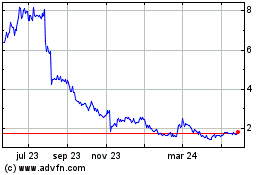

Expensify (NASDAQ:EXFY)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024