true

This Amendment No. 1 on Form 8-K/A amends the Current Report on Form 8-K filed on January 25, 2024 (the "Original 8-K"), to provide an updated version of the investor presentation furnished as Exhibit 99.1 thereto to update market size opportunity references and clarify the cost of an NDA filing for Apersure as set forth on slides 16, 17 and 28. The updated investor presentation is furnished as Exhibit 99.1 hereto and supersedes Exhibit 99.1 to the Original 8-K in its entirety. No other changes have been made to the Original 8-K or to Exhibit 99.1 furnished hereto.

0001682639

0001682639

2024-01-25

2024-01-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): January 25, 2024

EYENOVIA, INC.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-38365 |

|

47-1178401 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

295 Madison Avenue, Suite 2400, New York, NY

10017

(Address of Principal Executive Offices, and

Zip Code)

(833) 393-6684

Registrant’s Telephone Number, Including

Area Code

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

| (Title of each class) |

|

(Trading

Symbol) |

|

(Name of each exchange

on which registered) |

| Common stock, par value $0.0001 per share |

|

EYEN |

|

The Nasdaq Stock Market

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

EXPLANATORY NOTE

This Amendment No. 1 on Form 8-K/A amends the

Current Report on Form 8-K filed on January 25, 2024 (the “Original 8-K”), to provide an updated version of the investor presentation

furnished as Exhibit 99.1 thereto to update market size opportunity references and clarify the cost of an NDA filing for Apersure as set

forth on slides 16, 17 and 28. The updated investor presentation is furnished as Exhibit 99.1 hereto and supersedes Exhibit 99.1 to the

Original 8-K in its entirety. No other changes have been made to the Original 8-K or to Exhibit 99.1 furnished hereto.

| Item 7.01. | Regulation FD Disclosure. |

On January 25, 2024, Eyenovia

released an updated investor presentation, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

Eyenovia is developing topical

ophthalmic medications that utilize its novel, patented Optejet® drug-device dispensing platform to address large market indications

with significant unmet medical needs. Numerous studies have demonstrated the ability of the Optejet to achieve efficacy with up to 80%

less medication than traditional eye drops, resulting in increased local tolerability and decreased systemic exposure to both drug and

preservatives. The Optejet technology is protected by a comprehensive IP portfolio, with many claims in effect beyond 2031.

Complementing its Optejet

device, Eyenovia is developing its Optecare™ suite of digital applications which leverages the onboard programming and Bluetooth

technology in the Optejet to track usage and boost compliance through reminders sent to the patient, which may result in improved patient

outcomes. This also represents a potential additional revenue stream for eye doctors under a CPT code for “Remote Therapeutic Monitoring

Treatment Management Services.”

Eyenovia currently has one

commercial asset, Mydcombi for mydriasis (in-office and surgical pupil dilation), which is currently being launched commercially. Eyenovia

estimates this to be a $250 million market annually, and the updated investor presentation contains several testimonials from early adopters

of the technology. Mydcombi represents the first FDA approved drug in the Optejet, providing important validation of the technology.

Eyenovia in-licensed its second

asset, APP13007 for pain and inflammation following ocular surgery, from Formosa Pharmaceuticals in August of 2023. APP13007 has an FDA

PDUFA date of March 4, 2024. APP13007 utilizes Formosa’s APNT™ platform which reduces an active pharmaceutical ingredient’s

particle size with high uniformity and purity, ultimately enhancing bioavailability.

New clinical data in the updated

investor presentation demonstrates that 91% of APP13007-treated patients were pain free through day 15, as compared to 42% for placebo.

Similarly, 59% of APP13007-tretaed patients were free from inflammation (ACC Grade 0) through day 15, versus 16% for placebo. Importantly,

the clinical profile of APP13007 allows for 2x/day dosing in a market where most approved treatments require up to 4x/day dosing. APP13007

was well tolerated in clinical trials. Eyenovia plans to launch APP13007 in 2H 2024, if approved. This would allow the company to further

leverage its planned 10-person field sales force.

In addition, Eyenovia recently

announced that it has re-acquired the development rights to MicroPine (precision dosed atropine spray) from Bausch+Lomb, which is currently

in Phase 3 for pediatric myopia. Myopia, which typically begins in early childhood, is characterized by an elongation of the eye, resulting

in significant vision loss and even blindness if not treated. It is estimated that myopia affects 25 million children in the U.S. alone,

with five million of those believed to be at high risk. The Review of Myopia Management states this equates to a $1.8 billion annual market

opportunity in the U.S., with a similar opportunity in China. With myopia, treatment compliance is particularly important to slow disease

progression, early indications from use of Eyenovia’s Optecare remote therapeutic monitoring suggest enhanced dosing compliance

as compared to historical treatments without such monitoring.

In terms of remaining development

steps for MicroPine, Eyenovia is planning to meet with FDA to discuss possible changes to the Phase 3 CHAPERONE clinical trial protocol

to expedite development, including a possible interim analysis of data from ~300 patients in late 2024. If positive and statistically

significant, Eyenovia plans to meet with FDA again with the goal of submitting an NDA in 2H 2026. If positive but not statistically significant,

Eyenovia will continue the trial until the original enrollment target of 420 patients reaches the study endpoint. Under that scenario,

the Company would plan to file an NDA in 2H 2027.

Longer term, the Company sees

potential applications for the Optejet in glaucoma (annual U.S. market opportunity of $2.7 billion), acute dry eye ($236 million), chronic

dry eye ($2.1 billion) and eye hydration.

Eyenovia’s updated investor

presentation is also available for download under “Events and Presentations” in the “Investors” section of the

Company’s website, www.eyenovia.com.

The information contained

in this Item 7.01, including Exhibit 99.1, is being “furnished” and shall not be deemed “filed” for purposes of

Section 18 of the Exchange Act, or otherwise subject to the liability of that Section or Sections 11 and 12(a)(2) of the Securities Act.

The information contained in this Item 7.01, including Exhibit 99.1, shall not be incorporated by reference into any registration statement

or other document pursuant to the Securities Act or into any filing or other document pursuant to the Exchange Act, except as otherwise

expressly stated in any such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EYENOVIA, INC. |

| |

|

| Date: January 31, 2024 |

/s/ John Gandolfo |

| |

John Gandolfo |

| |

Chief Financial Officer |

Exhibit 99.1

January 2024 We Are the Optejet® Company Developing and commercializing ophthalmic drug - device therapeutics with Optecare Ρ services in large markets with high unmet needs EYEN - COM - V2 - 0021

Forward - looking Statements Except for historical information, all the statements, expectations and assumptions contained in this presentation are forwar d - l ooking statements. Forward - looking statements include, but are not limited to, statements that express our intentions, beliefs, expecta tions, strategies, predictions or any other statements relating to our future activities or other future events or conditions, inclu din g estimated market opportunities for our product candidates and platform technology. These statements are based on current expectations, est imates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of fut ure performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and re sul ts may, and in some cases are likely to, differ materially from what is expressed or forecasted in the forward - looking statements due to num erous factors discussed from time to time in documents which we file with the U.S. Securities and Exchange Commission. In addition, such statements could be affected by risks and uncertainties related to, among other things: risks of our clinic al trials, including, but not limited to, the costs, design, initiation and enrollment, timing, progress and results of such trials; the timing of, an d our ability to submit applications for, obtaining and maintaining regulatory approvals for our product candidates; the potential advantages of our product candidates and platform technology and the potential for approval of APP13007 ; the rate and degree of market acceptance and clinical utility of our product candidates; our estimates regarding the potential market opportunity for our product candidates; relia nce on third parties to develop and commercialize our product candidates; the risk of defects in, or returns of, our products; the ability of us and our partners to timely develop, implement and maintain manufacturing, commercialization and marketing capabilities and strategies fo r our product candidates; intellectual property risks; changes in legal, regulatory, legislative and geopolitical environments in t he markets in which we operate and the impact of these changes on our ability to obtain regulatory approval for our products; and our competitive po sition. Any forward - looking statements speak only as of the date on which they are made, and except as may be required under applicable securities laws, Eyenovia does not undertake any obligation to update any forward - looking statements. 2

3 • Designed to address issues with ease - of - use and dosing precision • Delivers efficacy while improving tolerability and reducing side effects 1 • Digital Optecare Œ capabilities 2 Optejet ® with microdose array print technology • Patented digital device platform technology • Unique, class - leading drug products • High - value product pipeline addressing areas of significant medical and market need • Multi - faceted business model with revenue from direct sales and licensing agreements Eyenovia (NASDAQ:EYEN) is the Optejet® Company 1. Wirta DL, Walters TR, Flynn WJ, Rathi S, Ianchulev T. Mydriasis with micro - array print touch - free tropicamide - phenylephrine f ixed combination MIST: pooled randomized Phase III trials. Ther Deliv. 2021 Mar;12(3):201 - 214. 2. Optecare is Eyenovia’s suite of digital compliance and adherence capabilities

4 Today’s Eyedropper Bottle Designed for manufacturing ease, not patient use Over the past 125 years, changes in eyedropper design have done little to improve the usability of topical ophthalmic medications 1800’s Glass Pipette 1900’s Glass Pipette with Bulb and Separate Vial Today Integrated Bottle with Dropper Tip 1. S urvey conducted in January 2023 with 100 people (19 - 65+ Age Range, Mean Age = 51YO) who regularly take eye drop medications. Respondents were asked to rank common drug forms from easiest to most difficult to administer on a 0 - 10 scale (0 meaning no difficulty, 10 meaning extremely difficult). Of the 11 medication types ra nked, eye drops were the third most difficult behind suppositories and eye ointments. The topical ointments were ranked the easiest to administer with an average score of 1.1, and suppositories ranked the most d iff icult with a score of 6.48. Eye drops received an average score of 4.6. In a recent survey conducted by J. Reckner and Associates, consumers reported that taking eye drops was among the most difficult ways to self - administer medication 1

5 Introducing the Optejet ® Optejet® with replaceable drug cartridge Spray nozzle with 109 laser - drilled ports Shutter Activation button Ergonomic design Proprietary, pre - filled drug cartridge manufactured by Eyenovia Optejet is a drug - device combination product manufactured with a sterile - filled, replaceable drug cartridge and equipped with Optecare Œ (connected care) capabilities

6 Ergonomic Design to Improve Usability Horizontal delivery, push - button dosing and no protruding tip Eye Dropper Bottle administration requires head - tilting, squeezing, and reliance on gravity Eye Dropper Bottle tips can touch the patient’s eye surface and medication can drip down their face Optejet administration can be done horizontally with the push of a button Optejet has a recessed nozzle, protected by a shutter when not in use to prevent cross - contamination

7 Laboratory - Proven Cartridge Thoroughly Tested to Demonstrate Sterile Drug Delivery RESULTS: Using the 1x10 6 microbial growth challenge protocol, Optejet met the passing criteria. • All test units did not show growth for the 28 - day simulated use • All positive control units showed growth • All negative control units did not show growth Whitcomb, J. & Lam, P. (2023, October 11 - 14). Demonstration of Microbial Integrity for a Multi - Dose Ophthalmic Spray Drug Device. American Academy of Optometry, New Orleans, LA, United States.

8 The Optejet Delivers 80% Less Drug Volume Than Eye Droppers Sufficient for efficacy while improving benefits from reducing excessive exposure to both drugs and preservatives 1,2 1 Wirta D. et al, Presentation at 2019 ASCRS meeting | 2 Ianchulev T. et al, Therapeutic Delivery 2018 | 3 Hamrah , P. et al. Cytotoxicity Evaluation for BAK - preserved Latanoprost Delivered By Drop vs. Microdose Array Print Technology. ARVO 2023 poster. New Orleans, LA | 4 The impact of precision spray dosing of netarsudil 0.02% can be seen when compared to a single drop of the same drug. Improves Local Tolerability and Decreases Systemic Exposure 4 Minimizes Excessive Drug Exposure to Ocular Tissues 3 When tolerability is poor, patients are very likely to discontinue their medication or put pressure on the ophthalmologist to change their treatment 5 3 4

9 Optejet Digital Technology is Optecare Ρ The Optejet ® is capable of automatically tracking usage OPTECARE: Multiple Benefits for All Stakeholders PATIENT • Reminders to take medicine • Ability to track compliance progress • Opportunity for brand - specific encouragement • May be monetized through App subscription service PHYSICIAN • Ability for quicker action with more accurate data • Opportunity for billing: CPT Code (98980) for monthly check of compliance data PAYER • Cost savings: Less likely to have patient on second medication if compliance is the issue • Better outcomes: Compliance with drug therapy shown to slow disease progression 1 1 Shu YH et al. Topical Medication Adherence and Visual Field Progression in Open - angle Glaucoma. J Glaucoma 2021

10 Broad Intellectual Property Portfolio • Key claims covered with multiple patents – 16 US Patents Issued; 1 pending – 95 foreign issued; 32 pending – Many in effect beyond 2031 • Clinical data and regulatory approval adds another layer of IP

11 Spray nozzle with 109 laser - drilled ports Mist button Proprietary, pre - filled and replaceable drug cartridge containing tropicamide and phenylephrine Fill button Base Unit with rechargeable battery Cartridge Base Proprietary, pre - filled drug cartridge manufactured by Eyenovia MydCombi Ρ The First FDA - Approved Product with Optejet ® Technology

12 The Office - Based and Surgical Pupil Dilation Market $250 Million Opportunity 1 in the United States 1. $200M annual sales of pharmaceutical mydriatic products used during 108M office - based exams ($2 * 100M) + $50M of single bott le mydriatic agents used cataract replacement surgery ($12.5 x 4M) ● The leading pupil dilation drugs are tropicamide and phenylephrine, both used individually and together and delivered as eye drops ● There are approximately 108 million office - based dilations performed annually in the United States ● The current process suffers from a number of shortfalls: ○ - Multiple eyedrops are usually needed ○ - Patient discomfort and avoidance ○ - Time - consuming administration and slow recovery to “normal” ○ - Cross - contamination risk

13 First and only FDA approved ophthalmic spray for mydriasis • Two Phase 3 clinical trials evaluated the efficacy of MYDCOMBI for achievement of mydriasis. • MYDCOMBI was statistically superior to tropicamide administered alone and phenylephrine administered alone. • Nearly all (94%) subject eyes achieved clinically significant effect by achieving pupil diameter of ≥ 6 mm at 35 - minute post - dose compared to 78% of eyes administered tropicamide alone and 1.6% of eyes administered phenylephrine alone. • Clinically effective mydriasis was observed as quickly as 20 minutes. MydCombi Ρ MydCombi Tropicamide Phenylephrine Placebo

14 MydCombi Ρ Speed and simplicity with each spray 1 Indication: MYDCOMBI (tropicamide 1% and phenylephrine HCl 2.5%) ophthalmic spray is indicated to induce mydriasis for routin e d iagnostic procedures and in conditions where short term pupil dilation is desired. IMPORTANT SAFETY INFORMATION. CONTRAINDICATIONS: Known hypersensitivity to any component of the formulation. WARNINGS AND PRECAUTIONS. FOR TOPICAL OPHTHALMIC USE. NOT FOR INJECTION. This preparation may cause CNS disturbances which may be dangerous in pediatric pa tie nts. The possibility of psychotic reaction and behavioral disturbance due to hypersensitivity to anticholinergic drugs should be considered. Mydriatics may produce a transient elevati on of intraocular pressure. Significant elevations in blood pressure have been reported. Caution in patients with elevated blood pressure. Rebound miosis has been reported one day after installa tio n. Remove contact lenses before using. DRUG INTERACTIONS. Atropine - like Drugs: May exaggerate the adrenergic pressor response. Cholinergic Agonists and Ophthalmic Cholinesterase Inhibito rs: May interfere with the antihypertensive action of carbachol, pilocarpine, or ophthalmic cholinesterase inhibitors. Potent Inhalation Anesthetic Agents: May potentiate cardiovascular depr ess ant effects of some inhalation anesthetic agents. ADVERSE REACTIONS. Most common ocular adverse reactions include transient blurred vision, reduced visual acuity, photophobia, superficial puncta te keratitis, and mild eye discomfort. Increased intraocular pressure has been reported following the use of mydriatics. Systemic adverse reactions including dryness of the m out h, tachycardia, headache, allergic reactions, nausea, vomiting, pallor, central nervous system disturbances and muscle rigidity have been reported with the use of tropicamide. To report SUS PEC TED ADVERSE REACTIONS, contact Eyenovia, Inc. At 1 - 833 - 393 - 6684 or FDA at 1 - 800 - FDA - 1088 ( www.fda.gov / medwatch ) www.mydcombi.com for FULL PRESCRIBING INFORMATION The only FDA approved fixed - dose combination of the leading pupil dilating drugs Quickly achieves clinically necessary dilation and reliable time to resolution 1 Well tolerated. In clinical studies 97% of patients reported zero side effects 1 Online ordering will be available on EyenoviaRx.com 1. Wirta DL, Walters TR, Flynn WJ, Rathi S, Ianchulev T. Mydriasis with micro - array print touch - free tropicamide - phenylephrine fixed combination MIST: pooled randomized Phase III tr ials. Ther Deliv . 2021 Mar;12(3):201 - 214.

15 Testimonials “My staff and the patients love the technology. MydCombi provides good dilation without the burning associated with in - office dilation.” Edward Rubinchik , MD SmartEyeCare - NY “MydCombi is a no brainer. Patients tolerated the medication better due to the Optejet device, and it saves our technicians work up time vs. using three eye drops.” Ed Yung, MD Pacific Eye Institute - CA “MydCombi is easier to use for patients with difficult eye anatomies than eye drops. There’s no chance of contamination as MydCombi doesn’t touch the patients' eyes.” Krystina Feliciano, Ophthalmic Tech New York Eye Surgery Center “Patients are dilating faster and get back to normal faster. It’s easy to use by my technicians.” Aleksandra Wianecka , OD Vision Source Signature Eyecare - NY “MydCombi has been a fantastic addition to our office in the age of streamlined medicine and has been welcomed by our patients.” Nathan Radcliffe, MD New York Eye Surgery Center “MydCombi is easy to handle, and the effectiveness is similar to eye drops with patients experiencing more comfort when instilled.” Dan Tran, MD Coastal Vision Medical Group - CA

16 Late - Stage Development Pipeline 1. IQVIA Estimates of Ophthalmic Topical Steroid and Steroid Combinations Market 2023 2. Richard Edlow , O. (2020) The Myopia Management Market, Review of Myopia Management. Available at: https://reviewofmm.com/the - myopia - managemen t - market/ 3. Eyenovia Estimates Product Indication Targeted Product Differentiation United States Addressable Market Next Milestone PROPRIETARY APP13007 Post surgical pain and inflammation 2x day dosing in a market dominated by 4x day dosing $700M 1 PDUFA March 2024 MicroPine Pediatric Progressive Myopia Optejet: Ease of use, less systemic exposure, Optecare Πservice $1.8B 2 Planned Ph3 Interim Analysis Q4 2024 Apersure Presbyopia Optejet: Ease of use, convenience, low side effect incidence $850M 3 $4 million NDA fee on hold pending improvement in presbyopia market

17 APP13007 (Clobetasol Propionate Nanosuspension 0.05%, BID) An Important Advancement in Ocular Post - Surgical Pain and Inflammation Control FDA PDUFA date March 2024 • Short and mid - term revenue opportunity ($700 M market) 1 • Synergistic commercialization with MydCombi’s sales force 2024 Post - ocular surgery treatment 2027 • Potential acute dry eye product in the Optejet ($236 M market) 2 Dry eye treatment 1. IQVIA Estimates of Ophthalmic Topical Steroid and Steroid Combinations Market 2023 2. Eyenovia Estimates chronic dry eye is 90% and acute is 10% of total dry eye market of $2.36B (North America Dry Eye Syndro me Market – Industry Trends and Forecast to 2030) Data Bridge Market Research. Available at: https://www.databridgemarketresearch.com/reports/north - america - dry - eye - syndrome - market#:~:text=Data%20Bridge%20Mar ket%20Research%20analyzes,indicates%20that%20the%20market%20value.

18 Technology Enables APP13007’s Compelling Profile The Post - surgical Pain and Inflammation Market Was Valued at $200m in 2022 - High uniformity and purity in particle size - Improved stability - Improved dispersion properties - Improved bioavailability Patented APNT nanolization provides many benefits in topical ophthalmic drug development* * https://www.formosapharma.com/technology/

19 * Korenfeld ASCRS Presentation 2023 | A Phase 3 Study of APP13007 (Clobetasol Propionate Ophthalmic Nanosuspension 0.05%) to Treat Inflammation and Pain after Cata rac t Surgery 0% 33% 59% 0% 12% 16% 0% 20% 40% 60% 80% POD1 POD8 POD15 INFLAMMATION % of subjects with ACC Grade=0 Sustained to Day 15 51% of subjects in the clinical study experienced significant pain, with over half requiring rescue from placebo vs 4% with APP13007. 0% 77% 82% 91% 0% 44% 43% 42% 0% 20% 40% 60% 80% 100% POD1 POD4 POD8 POD15 PAIN % of Subjects Pain Free Sustained to Day 15 APP13007 Placebo APP13007 Placebo Rapid and Sustained Ocular Pain Relief and Clearance of Inflammation

20 When it Comes to Post - Surgical Pain and Inflammation Management Efficacy and Twice - a - Day Dosing Matter Most 1. J. Reckner and Associates survey conducted August 2023 with 100 Ophthalmologists performing at least 10 ocular surgeries p er week. Respondents were asked to consider the description of the product mentioned with the following description: “There is a new corticosteroid that may be available next year. This new steroid would be dosed twice - dai ly post - ocular surgery by patients. In clinical trials, it has shown to be very effective in reducing inflammation and pain and well tolerated with a low (<2%) incidence of IOP spikes over a 14 - day usage period.” What part of this description is most important to you? Preferred posology for post - cataract surgery: Antibiotic, NSAID and steroid once in the morning and evening 1 Post - Surgical Steroid Posology Dexamethasone 4x daily Difluprednate 4x daily Flurometholone 4x daily Loteprednol 2x - 4x daily Prednisolone 2x - 4x daily APP13007 2x daily https://pi.bausch.com/globalassets/pdf/PackageInserts/Pharma/Rx - Generics/Dexamethasone - Sodium - Phosphate - A - 9100202 - 9100302.pdf https:// www.accessdata.fda.gov / drugsatfda_docs /label/2008/022212lbl.pdf https:// www.accessdata.fda.gov / drugsatfda_docs /label/2013/016851s063lbl.pdf https:// www.accessdata.fda.gov / drugsatfda_docs /label/2012/202872lbl.pdf https:// www.accessdata.fda.gov / drugsatfda_docs /label/2017/017011s047lbl.pdf

21 All Adverse Events ≥ 2.0% APP13007 (N=181) Placebo (N=197) Adverse Events n (%) # of Events n (%) # of Events Subjects with ≥ 1 Ocular Adverse Event 29 (16.0%) 33 34 (17.3%) 50 Anterior chamber inflammation 7 (3.9%) 7 3 (1.5%) 3 Corneal oedema 3 (1.7%) 3 10 (5.1%) 10 * Korenfeld ASCRS Presentation 2023 | A Phase 3 Study of APP13007 (Clobetasol Propionate Ophthalmic Nanosuspension 0.05%) to Treat Inflam ma tion and Pain after Cataract Surgery In the Clinical Trial CPN - 301, Over 99% of Patients in the Treatment Group Experienced No Incidents of Elevated IOP > 21mmHg*

22 • Begins in early childhood, with genetic link 1 • Elongation of the eye with morbidity and vision problems 2 • Urgent need for FDA - approved drug therapies to slow myopia progression Affects ~25M children in the US alone, with ~5M considered to have high myopia risk 3 1 Jones LA, Sinnott LT, Mutti DO, Mitchell GL, Moeschberger ML, Zadnik K. Parental history of myopia, sports and outdoor activities, and future myopia. Invest Ophthalmol Vis Sci. 2007 Aug;48(8):3524 - 32. 2 Eye and Contact Lens. 2004; 30 3 Theophanous C. Myopia Prevalence and Risk Factors in Children. Clinical Ophthalmology. December 2018. U.S. Census Bureau, Cur re nt Population Survey, Annual Social and Economic Supplement, 2019. Progressive Myopia is a Global Epidemic That Can Lead to Vision Loss and Blindness if Not Controlled Progression of Myopic Maculopathy

23 Treatment Options and Medical Need Drugs in Clinical Trials ● Atropine eyedrops have been observed to slow myopia progression in children 3 ● Multiple companies (Sydnexis, Vyluma, and Ocumension) are in clinical trials using atropine drops ranging in concentrations from 0.01% to 0.03%. These trials are expected to be completed from 2024 - 2027 ● Eyenovia’s MicroPine ophthalmic spray is in trial evaluating atropine sulfate solution concentrations at 0.1%, and 0.01%. MicroPine delivers ~8µL of drug horizontally and can track adherence. Eyenovia’s trial is expected to be completed in 2029 Adherence to therapies is a primary determinant of treatment success. Extensive review of the literature reveals that in developed countries adherence to therapies averages 50%. 3 Optejet Designed to Address Unmet Needs ● Increased Tolerability • Lower Drug Exposure ● Ease of Use • Optejet has been used for nearly 5,000 patient months in children ● Enhanced Compliance • Connected - care allows for monitoring of patient use and discussion with healthcare provider ● Enhanced Safety • Lower systemic exposure 1. Optometry and Vision Science94(6):638 - 646, June 2017 2. Int J Health Sci (Qassim). 2013 Nov;7(3):291 - 9. doi : 10.12816/0006057 3. Chia A, Chua WH, Cheung YB, et al. Atropine for the treatment of childhood Myopia: Safety and efficacy of 0.5%, 0.1%, and 0.0 1% doses (Atropine for the Treatment of Myopia 2). Ophthalmology 2012;119:347 - 354 4. Oman Med J. 2011 May;26(3):155 - 9. doi : 10.5001/omj.2011.38 Approved Devices ● Soft ( MiSight ) and Hard (Ortho - K) contact lenses are used to correct nearsightedness and slow the progression of myopia in children Over 75% of optometrists, however, feel that using contact lenses in patients under 10 years of age is not appropriate. Microbial keratitis being a serious concern for contact lens wearers . 1 ● Stellest Specialty Glasses are also used to correct vision and slow axial elongation A 2012 study showed that two thirds of children did not comply with wearing their vision correcting spectacles due to various reasons (Dislike, Lost/Broken, Feel Unnecessary, Teasing) 2

24 The Pediatric Progressive Myopia Market is Valued at $1.8B in the US and Similarly in China Currently under investigation, not FDA approved

25 Optecare Ρ Designed to Improve Treatment Adherence • Precision - dosed atropine spray developed specifically for children • Easy, daily use by children 1 • Lower drug volume exposure to enhance comfort and minimize systemic exposure • Can communicate with smart devices to track treatment adherence and provide family reminders • Compliance data shows promise compared with historical treatments 1 Data on file with Eyenovia. 2 Naito 2018: Naito T, Yoshikawa K, Namiguchi K, Mizoue S, Shiraishi A, et al. (2018) Comparison of success rates in eye drop instillation between sitting position and supine position. PLOS ONE 13 (9): e0204363. Patel 1995: Patel SC, Spaeth GL. Compliance in patients prescribed eyedrops for glaucoma. Ophthalmic Surg. 1995 May - Ju n;26(3):233 - 6. Winfield, 1990: Winfield AJ, Jessiman D, Williams A, Esakowitz L. A study of the causes of non - compliance by patients prescribed eyedrops. Br J Ophthalmol . 1990 Aug;74(8):477 - 80. 3. Matsui, 1997: Matsui DM. Drug compliance in pediatrics. Clinical and research issues. Pediatr Clin North Am. 1997 Feb;44(1):1 - 14. 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 5 10 15 20 25 Six - Month Daily Treatment Compliance 28 Children Age 6 – 13 YO 1 Subject number Correctly Administered Doses / Total Potential Doses Average of compliance rates from published ophthalmic studies 2 Average of compliance rates from published pediatric studies 3

26 MicroPine Planned Development Timeline 4Q 2024 2026 2027 2028 2025 I f Positive But Not Yet Statistically Significant, Continue Study Until 420 Patients Reach Endpoint File NDA File NDA If Positive and Statistically Significant, Meet with FDA to Potentially Stop Enrollment and Submit Data Output from Interim Analysis of ~300 Patients

27 Eyenovia: 2024 Key Events Q1 National MydCombi Launch APP13007 PDUFA Early March Q2 Q3 Q4 MydCombi ΠPost - Marketing Study Results MydCombi ΠGen - 2 Planned FDA Meeting National APP13007 Launch (Pending Approval) MicroPine Planned FDA Meeting

28 Additional Large - Market Opportunities 1. Estimates from IQVIA Sales Data | 2. Eyenovia Estimates chronic dry eye is 90% and acute is 10% of total dry eye market of $2 .36B (North America Dry Eye Syndrome Market РIndustry Trends and Forecast to 2030) Data Bridge Market Research. Available at: https://www.databridgemarketresearch.com/reports/north - america - dry - eye - syndrome - market#:~:text=Data%20Bridge%20Mar ket%20Research%20analyzes,indicates%20that%20the%20market%20value. Target Market Targeted Product Differentiation United States Addressable Market POTENTIAL Glaucoma Optejet: Optecare Πservice, Ease of use, Low side effect incidence $2.7B 1 Acute Dry Eye Optejet: New drug class, Ease of use, Fast onset $236M 2 Chronic Dry Eye Optejet: New MOA, Ease of use, Fast onset $2.1B 2 Eye Hydration Optejet Device Registration

29 Financial Snapshot (September 2023) Nasdaq: EYEN Common Shares Outstanding 42.9M Equity Grants Outstanding Under Stock Plans 5.3M Warrants 13.2M Fully Diluted Shares 61.4M Cash $20.7M Debt $14.1M

30 Experienced Leadership Team Bren Kern Chief Operating Officer Michael Rowe Chief Executive Officer John Gandolfo Chief Financial Officer Norbert Lowe VP, Commercial Operations Greg Bennett VP, Clinical Program Strategy and Development Malini Batheja , PhD VP, Pharm R&D and CMC Regulatory Enrico Brambilla VP, Device R&D and Engineering Lauren Gidden VP, Quality and Regulatory Affairs Rob Richardson VP, Manufacturing

v3.24.0.1

Cover

|

Jan. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

This Amendment No. 1 on Form 8-K/A amends the Current Report on Form 8-K filed on January 25, 2024 (the "Original 8-K"), to provide an updated version of the investor presentation furnished as Exhibit 99.1 thereto to update market size opportunity references and clarify the cost of an NDA filing for Apersure as set forth on slides 16, 17 and 28. The updated investor presentation is furnished as Exhibit 99.1 hereto and supersedes Exhibit 99.1 to the Original 8-K in its entirety. No other changes have been made to the Original 8-K or to Exhibit 99.1 furnished hereto.

|

| Document Period End Date |

Jan. 25, 2024

|

| Entity File Number |

001-38365

|

| Entity Registrant Name |

EYENOVIA, INC.

|

| Entity Central Index Key |

0001682639

|

| Entity Tax Identification Number |

47-1178401

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

295 Madison Avenue

|

| Entity Address, Address Line Two |

Suite 2400

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

833

|

| Local Phone Number |

393-6684

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

EYEN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

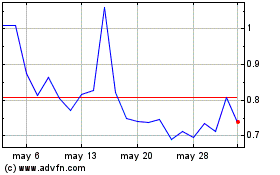

Eyenovia (NASDAQ:EYEN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Eyenovia (NASDAQ:EYEN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024