F5, Inc. (NASDAQ: FFIV) today announced financial results for

its fourth quarter and fiscal year ended September 30, 2024.

“Our fourth quarter revenue of $747 million reflects 6% growth

year over year and includes a 19% increase in software revenue from

the fourth quarter of fiscal year 2023,” said François Locoh-Donou,

F5’s President and CEO. “In fiscal year 2024, despite a challenging

macro backdrop to the start of the year, we achieved revenue at the

high end of our guidance, surpassed our software growth

expectations, and maintained rigorous operational discipline,

culminating in double-digit earnings per share growth for the

year.”

“Our results speak to the power of our portfolio and innovation,

the strength of our operating model, and the resilience of our

business,” continued Locoh-Donou. “In a relatively short period of

time, we have substantially reshaped F5 from a hardware-centric,

single-product company into a security and software leader in

today’s hybrid multicloud world. Our transformation has redefined

F5’s role beyond the data center, increasing our value to

customers, diversifying our revenue, and expanding our total

addressable market.”

Fourth Quarter Performance Summary

Fourth quarter fiscal year 2024 revenue totaled $747 million,

compared with $707 million in the fourth quarter of fiscal year

2023. Software revenue of $228 million grew 19% from the year-ago

period. Systems revenue of $130 million represented a decline of 3%

from the prior year. Global services revenue of $388 million grew

2% from the year-ago period.

GAAP gross profit for the fourth quarter of fiscal year 2024 was

$603 million, representing GAAP gross margin of 80.8%. This

compares with GAAP gross profit of $566 million in the year-ago

period, which represented GAAP gross margin of 80.1%. Non-GAAP

gross profit for the fourth quarter of fiscal year 2024 was $619

million, representing non-GAAP gross margin of 83.0%. This compares

with non-GAAP gross profit of $585 million in the year-ago period,

which represented non-GAAP gross margin of 82.7%.

GAAP operating profit for the fourth quarter was $191 million,

representing GAAP operating margin of 25.6%. This compares with

GAAP operating profit of $172 million in the year-ago period, which

represented GAAP operating margin of 24.3%. Non-GAAP operating

profit for the period was $257 million, representing non-GAAP

operating margin of 34.4%. This compares to non-GAAP operating

profit of $240 million in the year-ago period, which represented

non-GAAP operating margin of 33.9%.

GAAP net income for the fourth quarter of fiscal year 2024 was

$165 million, or $2.80 per diluted share compared to $152 million,

or $2.55 per diluted share, in the fourth quarter of fiscal year

2023. Non-GAAP net income for the fourth quarter of fiscal year

2024 was $217 million, or $3.67 per diluted share, compared to $209

million, or $3.50 per diluted share, in the fourth quarter of

fiscal year 2023.

Fiscal Year 2024 Performance Summary

Fiscal year 2024 revenue totaled $2.82 billion, compared with

$2.81 billion in fiscal year 2023. Software revenue of $735 million

grew 11% from the year-ago period. Systems revenue of $537 million

represented a decline of 20% from the prior year. Global services

revenue of $1.54 billion grew 4% from the year-ago period.

GAAP gross profit for the fiscal year 2024 was $2.26 billion,

representing GAAP gross margin of 80.2%. This compares with GAAP

gross profit of $2.22 billion in the year-ago period, which

represented GAAP gross margin of 78.9%. Non-GAAP gross profit for

fiscal year 2024 was $2.33 billion, representing non-GAAP gross

margin of 82.8%. This compares with non-GAAP gross profit of $2.29

billion in the year-ago period, which represented non-GAAP gross

margin of 81.5%.

GAAP operating profit for fiscal year 2024 was $659 million,

representing GAAP operating margin of 23.4%. This compares with

GAAP operating profit of $473 million in the year-ago period, which

represented GAAP operating margin of 16.8%. Non-GAAP operating

profit for the period was $946 million, representing non-GAAP

operating margin of 33.6%. This compares to non-GAAP operating

profit of $850 million in the year-ago period, which represented

non-GAAP operating margin of 30.2%.

GAAP net income for fiscal year 2024 was $567 million, or $9.55

per diluted share compared to $395 million, or $6.55 per diluted

share, in fiscal year 2023. Non-GAAP net income for fiscal year

2024 was $794 million, or $13.37 per diluted share, compared to

$705 million, or $11.70 per diluted share, in fiscal year 2023.

Performance Summary Tables

GAAP Measures Non-GAAP Measures ($ in millions except

EPS)

Q4 FY2024 Q4 FY2023 FY2024 FY2023

($ in millions except EPS)

Q4 FY2024 Q4 FY2023

FY2024 FY2023 Revenue

$

747

$

707

$

2,816

$

2,813

Gross profit

$

603

$

566

$

2,258

$

2,220

Gross profit

$

619

$

585

$

2,332

$

2,293

Gross margin

80.8%

80.1%

80.2%

78.9%

Gross margin

83.0%

82.7%

82.8%

81.5%

Operating profit

$

191

$

172

$

659

$

473

Operating profit

$

257

$

240

$

946

$

850

Operating margin

25.6%

24.3%

23.4%

16.8%

Operating margin

34.4%

33.9%

33.6%

30.2%

Net income

$

165

$

152

$

567

$

395

Net income

$

217

$

209

$

794

$

705

EPS

$

2.80

$

2.55

$

9.55

$

6.55

EPS

$

3.67

$

3.50

$

13.37

$

11.70

A reconciliation of GAAP to non-GAAP measures is included in the

attached Consolidated Income Statements. Additional information

about non-GAAP financial information is included in this

release.

Business Outlook

For fiscal year 2025, F5 expects to deliver total revenue growth

of 4% to 5%, and non-GAAP earnings per share growth of 5% to 7%

over fiscal year 2024. On a tax-neutral basis, the midpoint of F5’s

fiscal year 2025 non-GAAP earnings per share guidance reflects 10%

growth year over year.

For the first quarter of fiscal year 2025, F5 expects to deliver

revenue in the range of $705 million to $725 million, with non-GAAP

earnings in the range of $3.29 to $3.41 per diluted share.

$1 Billion Authorized for Share Repurchases

F5 also announced today that its Board of Directors has

authorized an additional $1 billion for its common stock repurchase

program. This new authorization is incremental to the $422 million

remaining in the existing program.

All forward-looking non-GAAP measures included in the Company’s

business outlook exclude estimates for amortization of intangible

assets, share-based compensation expenses, significant effects of

tax legislation and judicial or administrative interpretation of

tax regulations (including the impact of income tax reform),

non-recurring income tax adjustments, valuation allowance on

deferred tax assets, and the income tax effect of non-GAAP

exclusions, and do not include the impact of any future

acquisitions or divestitures, acquisition-related charges and

write-downs, restructuring charges, facility exit costs, or other

non-recurring charges that may occur in the period. F5 is unable to

provide a reconciliation of non-GAAP earnings guidance measures to

corresponding U.S. generally accepted accounting principles or GAAP

measures on a forward-looking basis without unreasonable effort due

to the overall high variability and low visibility of most of the

foregoing items that have been excluded. Material changes to any

one of these items could have a significant effect on our guidance

and future GAAP results. Certain exclusions, such as amortization

of intangible assets and share-based compensation expenses, are

generally incurred each quarter, but the amounts have historically

varied and may continue to vary significantly from quarter to

quarter.

Live Webcast and Conference Call

F5 will host a live webcast to review its financial results and

outlook today, October 28, 2024, at 4:30 pm ET. The live webcast is

accessible from the investor relations page of F5.com. To

participate in the live call via telephone in the U.S. and Canada,

dial +1 (877) 407-0312. Outside the U.S. and Canada, dial +1 (201)

389-0899. Please call at least five minutes prior to the call start

time. The webcast replay will be archived on the investor relations

portion of F5’s website.

Forward Looking Statements

This press release contains forward-looking statements

including, among other things, F5’s position as a security and

software leader in today’s multicloud world, F5’s role beyond the

data center, F5’s value to customers, , the Company’s future

financial performance including revenue, earnings growth, future

customer demand, and the performance and benefits of the Company's

products. These, and other statements that are not historical

facts, are forward-looking statements. These forward-looking

statements are subject to the safe harbor provisions created by the

Private Securities Litigation Reform Act of 1995. Actual results

could differ materially from those projected in the forward-looking

statements as a result of certain risk factors. Such

forward-looking statements involve risks and uncertainties, as well

as assumptions and other factors that, if they do not fully

materialize or prove correct, could cause the actual results,

performance or achievements of the Company, or industry results, to

be materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors include, but are not limited to: customer

acceptance of offerings; continued disruptions to the global supply

chain resulting in inability to source required parts for F5’s

products or the ability to only do so at greatly increased prices

thereby impacting our revenues and/or margins; global economic

conditions and uncertainties in the geopolitical environment;

overall information technology spending; F5’s ability to

successfully integrate acquired businesses’ products with F5

technologies; the ability of F5’s sales professionals and

distribution partners to sell new solutions and service offerings;

the timely development, introduction and acceptance of additional

new products and features by F5 or its competitors; competitive

factors, including but not limited to pricing pressures, industry

consolidation, entry of new competitors into F5’s markets, and new

product and marketing initiatives by our competitors; increased

sales discounts; the business impact of the acquisitions and

potential adverse reactions or changes to business or employee

relationships, including those resulting from the announcement of

completion of acquisitions; uncertain global economic conditions

which may result in reduced customer demand for our products and

services and changes in customer payment patterns; litigation

involving patents, intellectual property, shareholder and other

matters, and governmental investigations; potential security flaws

in the Company’s networks, products or services; cybersecurity

attacks on its networks, products or services; natural catastrophic

events; a pandemic or epidemic; F5’s ability to sustain, develop

and effectively utilize distribution relationships; F5’s ability to

attract, train and retain qualified product development, marketing,

sales, professional services and customer support personnel; F5’s

ability to expand in international markets; the unpredictability of

F5’s sales cycle; the ability of F5 to execute on its share

repurchase program including the timing of any repurchases; future

prices of F5’s common stock; and other risks and uncertainties

described more fully in our documents filed with or furnished to

the Securities and Exchange Commission, including our most recent

reports on Form 10-K and Form 10-Q and current reports on Form 8-K

and other documents that we may file or furnish from time to time,

which could cause actual results to vary from expectations. The

financial information contained in this release should be read in

conjunction with the consolidated financial statements and notes

thereto included in F5’s most recent reports on Forms 10-Q and 10-K

as each may be amended from time to time. All forward-looking

statements in this press release are based on information available

as of the date hereof and qualified in their entirety by this

cautionary statement. F5 assumes no obligation to revise or update

these forward-looking statements.

GAAP to non-GAAP Reconciliation

F5’s management evaluates and makes operating decisions using

various operating measures. These measures are generally based on

the revenues of its products, services operations, and certain

costs of those operations, such as cost of revenues, research and

development, sales and marketing and general and administrative

expenses. One such measure is GAAP net income excluding, as

applicable, stock-based compensation, amortization, and impairment

of purchased intangible assets, facility-exit costs,

acquisition-related charges, net of taxes, restructuring charges,

and certain non-recurring tax expenses and benefits, which is a

non-GAAP financial measure under Section 101 of Regulation G under

the Securities Exchange Act of 1934, as amended. This measure of

non-GAAP net income is adjusted by the amount of additional taxes

or tax benefit that the Company would accrue if it used non-GAAP

results instead of GAAP results to calculate the Company’s tax

liability.

The non-GAAP adjustments, and F5's basis for excluding them from

non-GAAP financial measures, are outlined below:

Stock-based compensation. Stock-based compensation consists of

expense for stock options, restricted stock, and employee stock

purchases through the Company’s Employee Stock Purchase Plan.

Although stock-based compensation is an important aspect of the

compensation of F5’s employees and executives, management believes

it is useful to exclude stock-based compensation expenses to better

understand the long-term performance of the Company’s core business

and to facilitate comparison of the Company’s results to those of

peer companies.

Amortization and impairment of purchased intangible assets.

Purchased intangible assets are amortized over their estimated

useful lives, and generally cannot be changed or influenced by

management after the acquisition. On a non-recurring basis, when

certain events or circumstances are present, management may also be

required to write down the carrying value of its purchased

intangible assets and recognize impairment charges. Management does

not believe these charges accurately reflect the performance of the

Company’s ongoing operations; therefore, they are not considered by

management in making operating decisions. However, investors should

note that the use of intangible assets contributed to F5’s revenues

earned during the periods presented and will contribute to F5’s

future period revenues as well.

Facility-exit costs. F5 has incurred certain non-recurring

right-of-use asset impairment charges, and other related recurring

costs in connection with the exit of its leased facilities. These

charges are not representative of the ongoing activity or costs to

the business. As a result, these charges are being excluded to

provide investors with a more comparable measure of costs

associated with ongoing operations.

Acquisition-related charges, net. F5 does not acquire businesses

on a predictable cycle and the terms and scope of each transaction

can vary significantly and are unique to each transaction. F5

excludes acquisition-related charges from its non-GAAP financial

measures to provide a useful comparison of the Company’s operating

results to prior periods and to its peer companies.

Acquisition-related charges consist of planning, execution and

integration costs incurred directly as a result of an

acquisition.

Restructuring charges. F5 has incurred restructuring charges

that are included in its GAAP financial statements, primarily

related to workforce reductions and costs associated with exiting

facility-lease commitments. F5 excludes these items from its

non-GAAP financial measures when evaluating its continuing business

performance as such items vary significantly based on the magnitude

of the restructuring action and do not reflect expected future

operating expenses. In addition, these charges do not necessarily

provide meaningful insight into the fundamentals of current or past

operations of its business.

Management believes that non-GAAP net income per share provides

useful supplemental information to management and investors

regarding the performance of the Company’s core business operations

and facilitates comparisons to the Company’s historical operating

results. Although F5’s management finds this non-GAAP measure to be

useful in evaluating the performance of the core business,

management’s reliance on this measure is limited because items

excluded from such measures could have a material effect on F5’s

earnings and earnings per share calculated in accordance with GAAP.

Therefore, F5’s management will use its non-GAAP earnings and

earnings per share measures, in conjunction with GAAP earnings and

earnings per share measures, to address these limitations when

evaluating the performance of the Company’s core business.

Investors should consider these non-GAAP measures in addition to,

and not as a substitute for, financial performance measures in

accordance with GAAP.

F5 believes that presenting its non-GAAP measures of earnings

and earnings per share provides investors with an additional tool

for evaluating the performance of the Company’s core business and

is used by management in its own evaluation of the Company’s

performance. Investors are encouraged to look at GAAP results as

the best measure of financial performance. However, while the GAAP

results are more complete, the Company provides investors these

supplemental measures since, with reconciliation to GAAP, it may

provide additional insight into the Company’s operational

performance and financial results.

For reconciliation of these non-GAAP financial measures to the

most directly comparable GAAP financial measures, please see the

section in our attached Condensed Consolidated Income Statements

entitled “Non-GAAP Financial Measures.”

About F5

F5 is a multicloud application security and delivery company

committed to bringing a better digital world to life. F5

partners with the world’s largest, most advanced organizations to

secure every app — on premises, in the cloud, or at the edge. F5

enables businesses to continuously stay ahead of threats while

delivering exceptional, secure digital experiences for their

customers. For more information, go to f5.com. (NASDAQ: FFIV)

You can also follow @F5 on X (Twitter) or visit us on LinkedIn

and Facebook for more information about F5, its partners, and

technologies. F5 is a trademark, service mark, or tradename of F5,

Inc., in the U.S. and other countries. All other product and

company names herein may be trademarks of their respective

owners.

SOURCE: F5, Inc.

F5, Inc Consolidated Balance Sheets (unaudited, in

thousands)

September 30,

September 30,

2024

2023

Assets Current assets Cash and cash equivalents

$

1,074,602

$

797,163

Short-term investments

-

6,160

Accounts receivable, net of allowances of $4,585 and $3,561

389,024

454,832

Inventories

76,378

35,874

Other current assets

569,467

554,744

Total current assets

2,109,471

1,848,773

Property and equipment, net

150,943

170,422

Operating lease right-of-use assets

178,180

195,471

Long-term investments

8,580

5,068

Deferred tax assets

365,951

295,308

Goodwill

2,312,362

2,288,678

Other assets, net

487,517

444,613

Total assets

$

5,613,004

$

5,248,333

Liabilities and Shareholders’ Equity Current

liabilities Accounts payable

$

67,894

$

63,315

Accrued liabilities

300,076

282,890

Deferred revenue

1,121,683

1,126,576

Total current liabilities

1,489,653

1,472,781

Deferred tax liabilities

7,179

4,637

Deferred revenue, long-term

676,276

648,545

Operating lease liabilities, long-term

215,785

239,565

Other long-term liabilities

94,733

82,573

Total long-term liabilities

993,973

975,320

Commitments and contingencies Shareholders’ equity

Preferred stock, no par value; 10,000 shares authorized, no shares

outstanding

-

-

Common stock, no par value; 200,000 shares authorized, 58,094 and

59,207 shares issued and outstanding

5,889

24,399

Accumulated other comprehensive loss

(20,912

)

(23,221

)

Retained earnings

3,144,401

2,799,054

Total shareholders' equity

3,129,378

2,800,232

Total liabilities and shareholders' equity

$

5,613,004

$

5,248,333

F5, Inc. Consolidated Income Statements

(unaudited, in thousands, except per share amounts)

Three Months Ended

Years Ended

September 30,

September 30,

2024

2023

2024

2023

Net revenues Products

$

358,285

$

325,324

$

1,272,795

$

1,334,638

Services

388,389

381,650

1,543,325

1,478,531

Total

746,674

706,974

2,816,120

2,813,169

Cost of net revenues (1)(2)(3)(4) Products

87,403

88,602

336,237

375,192

Services

56,317

52,362

221,410

218,116

Total

143,720

140,964

557,647

593,308

Gross profit

602,954

566,010

2,258,473

2,219,861

Operating expenses (1)(2)(3)(4) Sales and marketing

217,002

204,832

832,279

878,215

Research and development

123,951

127,834

490,120

540,285

General and administrative

70,976

61,603

268,828

263,405

Restructuring charges

-

-

8,655

65,388

Total

411,929

394,269

1,599,882

1,747,293

Income from operations

191,025

171,741

658,591

472,568

Other income, net

12,489

3,085

36,874

13,420

Income before income taxes

203,514

174,826

695,465

485,988

Provision for income taxes

38,218

22,692

128,687

91,040

Net income

$

165,296

$

152,134

$

566,778

$

394,948

Net income per share - basic

$

2.83

$

2.57

$

9.65

$

6.59

Weighted average shares - basic

58,384

59,245

58,720

59,909

Net income per share - diluted

$

2.80

$

2.55

$

9.55

$

6.55

Weighted average shares - diluted

59,056

59,699

59,359

60,270

Non-GAAP Financial Measures Net income

as reported

$

165,296

$

152,134

$

566,778

$

394,948

Stock-based compensation expense

53,759

53,265

219,108

236,650

Amortization and impairment of purchased intangible assets

10,144

14,304

51,331

53,434

Facility-exit costs

1,439

1,560

3,509

6,626

Acquisiton-related charges

505

(1,073

)

4,352

15,036

Restructuring charges

-

-

8,655

65,388

Tax effects related to above items

(14,204

)

(11,421

)

(60,065

)

(66,758

)

Net income excluding stock-based compensation expense, amortization

and impairment of purchased intangible assets, facility-exit costs,

acquisition-related charges, restructuring charges, net of tax

effects (non-GAAP) - diluted

$

216,939

$

208,769

$

793,668

$

705,324

Net income per share excluding stock-based compensation

expense, amortization and impairment of purchased intangible

assets, facility-exit costs, acquisition-related charges,

restructuring charges, net of tax effects (non-GAAP) - diluted

$

3.67

$

3.50

$

13.37

$

11.70

Weighted average shares - diluted

59,056

59,699

59,359

60,270

(1) Includes stock-based compensation expense as follows:

Cost of net revenues

$

7,089

$

7,142

$

29,409

$

29,658

Sales and marketing

20,720

21,307

84,520

96,478

Research and development

13,981

15,888

60,264

69,416

General and administrative

11,969

8,928

44,915

41,098

$

53,759

$

53,265

$

219,108

$

236,650

(2) Includes amortization and impairment of purchased

intangible assets as follows: Cost of net revenues

$

9,283

$

11,234

$

43,848

$

42,136

Sales and marketing

717

2,788

6,749

10,239

Research and development

93

63

375

63

General and administrative

51

219

359

996

$

10,144

$

14,304

$

51,331

$

53,434

(3) Includes facility-exit costs as follows: Cost of net

revenues

$

141

$

152

$

372

$

653

Sales and marketing

451

505

1,442

2,135

Research and development

515

545

478

2,265

General and administrative

332

358

1,217

1,573

$

1,439

$

1,560

$

3,509

$

6,626

(4) Includes acquisition-related charges as follows: Cost of

net revenues

$

-

$

32

$

20

$

244

Sales and marketing

-

155

72

2,668

Research and development

500

(1,296

)

1,328

4,035

General and administrative

5

36

2,932

8,089

$

505

$

(1,073

)

$

4,352

$

15,036

F5, Inc. Consolidated Statements of Cash Flows

(unaudited, in thousands)

Years Ended

September 30,

2024

2023

Operating activities Net income

$

566,778

$

394,948

Adjustments to reconcile net income to net cash provided by

operating activities: Stock-based compensation

219,108

236,650

Depreciation and amortization

106,991

112,702

Non-cash operating lease costs

33,041

38,528

Deferred income taxes

(68,523

)

(108,521

)

Impairment of assets

-

3,455

Other

(962

)

1,372

Changes in operating assets and liabilities (excluding effects of

the acquisition of businesses): Accounts receivable

63,953

16,704

Inventories

(40,504

)

32,491

Other current assets

(14,038

)

(64,959

)

Other assets

(91,964

)

16,591

Accounts payable and accrued liabilities

40,368

(63,100

)

Deferred revenue

22,838

81,741

Lease liabilities

(44,667

)

(45,193

)

Net cash provided by operating activities

792,419

653,409

Investing activities Purchases of investments

(2,100

)

(1,789

)

Maturities of investments

6,237

111,330

Sales of investments

-

16,085

Acquisition of businesses, net of cash acquired

(32,939

)

(35,049

)

Purchases of property and equipment

(30,412

)

(54,184

)

Net cash (used in) provided by investing activities

(59,214

)

36,393

Financing activities Proceeds from the exercise of

stock options and purchases of stock under employee stock purchase

plan

55,079

59,959

Payments for repurchase of common stock, including excise taxes

paid

(500,558

)

(350,049

)

Payments on term debt agreement

-

(350,000

)

Taxes paid related to net share settlement of equity awards

(11,523

)

(13,209

)

Net cash used in financing activities

(457,002

)

(653,299

)

Net increase in cash, cash equivalents and restricted cash

276,203

36,503

Effect of exchange rate changes on cash, cash equivalents and

restricted cash

1,302

2,125

Cash, cash equivalents and restricted cash, beginning of period

800,835

762,207

Cash, cash equivalents and restricted cash, end of period

$

1,078,340

$

800,835

Supplemental disclosures of cash flow information

Cash paid for taxes, net of refunds

$

181,635

$

191,569

Cash paid for amounts included in the measurement of lease

liabilities

53,346

52,893

Cash paid for interest on long-term debt

-

2,970

Supplemental disclosures of non-cash activities Right-of-use

assets obtained in exchange for lease obligations

$

12,927

$

10,544

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028710777/en/

Investors Suzanne DuLong +1 (206) 272-7049 s.dulong@f5.com

Media Rob Gruening +1 (206) 272-6208 r.gruening@f5.comm

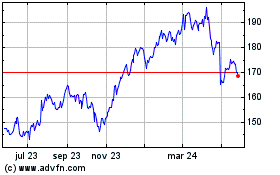

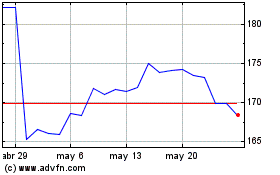

F5 (NASDAQ:FFIV)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

F5 (NASDAQ:FFIV)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024