UNITED

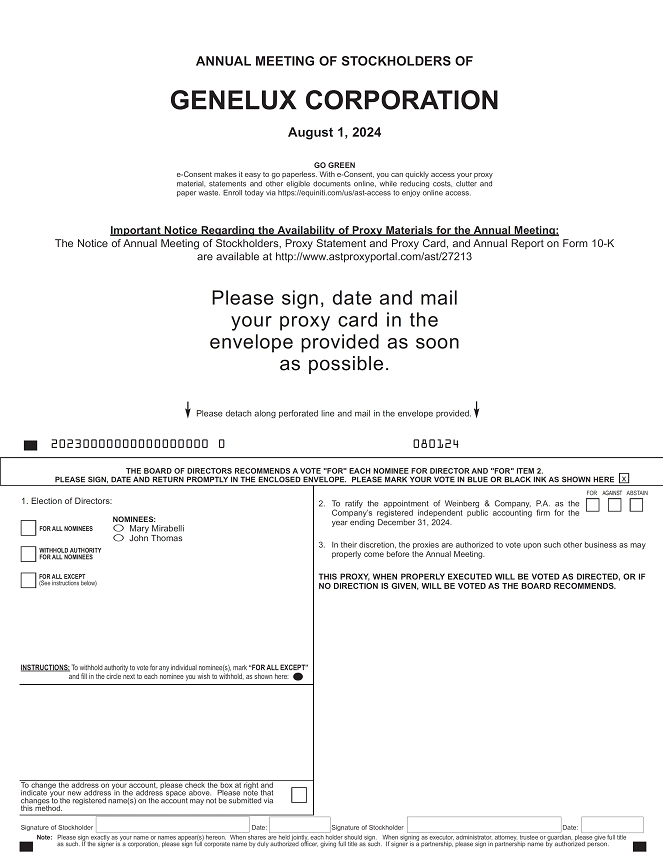

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment

No.__)

| Filed by the Registrant |

☒ |

| Filed by a party other than the Registrant |

☐ |

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under § 240.14a-12 |

GENELUX

CORPORATION

(Name

of Registrant as Specified In Its Charter)

Not

Applicable

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

|

☒

|

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act

Rules 14a-6(i)(1) and 0-11 |

GENELUX

CORPORATION

2625

Townsgate Road, Suite 230

Westlake

Village, California 91361

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

To

Be Held On August 1, 2024

At

10:00 a.m. Pacific Time

Dear

Stockholder:

You

are cordially invited to attend the 2024 Annual Meeting of Stockholders (including any adjournments,

continuations or postponements thereof, the “Annual Meeting”) of Genelux

Corporation, a Delaware corporation (the “Company”). The Annual Meeting will be held virtually on Thursday, August

1, 2024 at 10:00 a.m. Pacific Time via live webcast at https://web.lumiconnect.com/222451939. For additional instructions on how

to attend the Annual Meeting, please review the accompanying Proxy Statement for the Annual Meeting (the “Proxy Statement”).

The Annual Meeting will be held for the following purposes:

1.

To elect the two Class II directors named herein, each to hold office until the Company’s 2027 annual meeting of stockholders

and until their successors are duly elected and qualified, or until their earlier death, resignation

or removal.

2.

To ratify the appointment by the Audit Committee of the Board of Directors of Weinberg & Company, P.A. as the independent registered

public accounting firm of the Company for its fiscal year ending December 31, 2024.

3.

To conduct any other business properly brought before the Annual Meeting.

These

items of business are more fully described in the Proxy Statement. The Annual Meeting will be held virtually through a live webcast.

Stockholders of record at the close of business on June 3, 2024 and their proxy holders will be able to attend the Annual Meeting virtually,

submit questions, and vote during the live webcast by visiting https://web.lumiconnect.com/222451939 and entering the control

number included in your Notice of Internet Availability of Proxy Materials (“Notice

of Internet Availability”) or in the instructions that you received via email. Please

refer to the additional logistical details and recommendations in the Proxy Statement. You may log-in beginning at 10:00 a.m. Pacific

Time, on Thursday, August 1, 2024.

The

record date for the Annual Meeting is June 3, 2024. Only stockholders of record at the close of business on that date and their proxy

holders may vote at the meeting or any adjournment thereof. We are pleased to take advantage of Securities and Exchange Commission (“SEC”)

rules that allow us to provide this notice of annual meeting, the Proxy Statement and our

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 29, 2024 (our “Annual Report”)

online, with paper copies available free of charge upon request. On or about June 22, 2024, we will mail our Notice of Internet Availability

instead of a paper copy of our proxy materials.

Important

Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on Thursday, August 1, 2024 at 10:00

a.m. Pacific Time through a live webcast at

https://web.lumiconnect.com/222451939.

The

Proxy Statement and Annual Report are available at http://www.astproxyportal.com/ast/27213.

|

By

Order of the Board of Directors

|

|

| |

|

| /s/

Thomas Zindrick, J.D. |

|

| Thomas Zindrick, J.D. |

|

| President, Chief Executive Officer and Chairman |

|

Westlake

Village, California

June

14, 2024

You

are cordially invited to attend the Annual Meeting online. Whether or not you expect to attend the Annual Meeting, please complete, date,

sign and return the proxy card if one is mailed to you, or vote over the telephone or the internet as instructed in these materials,

as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote online

if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and

you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder. Please contact your broker,

bank or other nominee for information about specific requirements if you would like to vote your shares during the Annual Meeting.

GENELUX

CORPORATION

2625

Townsgate Road, Suite 230

Westlake

Village, California 91361

PROXY

STATEMENT

FOR

THE 2024 ANNUAL MEETING OF STOCKHOLDERS

To

Be Held On August 1, 2024

MEETING

AGENDA

Proposals |

|

Page |

|

Voting

Standard |

|

Board

Recommendation |

| Proposal

1: Election of Directors |

|

7 |

|

Plurality

of the votes of the shares present virtually, or represented by proxy, at the Annual Meeting and entitled to vote generally on the

election of directors |

|

“For”

each Class II director nominee named in the Proxy Statement |

| Proposal

2: Ratification of Independent Registered Public Accounting Firm |

|

17 |

|

Majority

of shares present virtually, or represented by proxy, at the Annual Meeting and entitled to vote on the subject matter |

|

“For” |

TABLE

OF CONTENTS

QUESTIONS

AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

What

are proxy materials?

The

proxy materials are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Genelux

Corporation, a Delaware corporation (“Genelux,” the “Company,” “we” or “us”), for use

at our 2024 Annual Meeting of Stockholders (including any adjournments, continuations or postponements

thereof, the “Annual Meeting”) to be held on Thursday, August 1, 2024 at 10:00 a.m. Pacific Time via live webcast

by accessing https://web.lumiconnect.com/222451939 in advance of the meeting, completing the online registration, which requires

that you provide the control number included on your Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”),

proxy card, or voting instruction form, and following any instructions you subsequently receive via e-mail.

The

proxy materials include the Notice of Internet Availability, this Proxy Statement for the Annual Meeting (this “Proxy Statement”),

our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (“fiscal year 2023”), filed with the Securities

and Exchange Commission (“SEC”) on March 29, 2024 (our “Annual Report”), and the proxy card or, for shares held

in street name (held for your account by a broker, bank or other nominee), a voting instruction form, for the Annual Meeting. As a stockholder,

you are invited to attend the Annual Meeting virtually and are requested to vote on the items of business described in this Proxy Statement.

This Proxy Statement includes information that we are required to provide to you under SEC rules and is designed to assist you in voting

your shares.

Pursuant

to the “notice and access” rules adopted by the SEC, we have elected to provide access to our proxy materials to our stockholders

via the internet. Accordingly, on or about June 22, 2024, we will mail a Notice of Internet Availability to stockholders entitled to

vote at the Annual Meeting containing instructions on how to access the proxy materials and how to vote. Please follow the instructions

on the Notice of Internet Availability for requesting paper or e-mail copies of our proxy materials. In addition, stockholders of record

may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis for future stockholder

meetings. We believe electronic delivery will expedite the receipt of the proxy materials and will help lower the costs of our proxy

materials. Please note that, while our proxy materials are available at the website referenced in the Notice of Internet Availability

and on our website, no information contained on either website is incorporated by reference into or considered to be a part of this document.

Will

I receive any other proxy materials by mail?

We

may send you a proxy card, along with a second Notice, after 10 calendar days have passed since

our first mailing of the Notice of Internet Availability.

How

do I attend and ask questions during the Annual Meeting?

The

Annual Meeting will be held virtually on Thursday, August 1, 2024 at 10:00 a.m. Pacific Time via live webcast at https://web.lumiconnect.com/222451939.

We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:30 a.m. Pacific Time, and you

should allow reasonable time for the check-in procedures.

You

are entitled to attend the Annual Meeting if you were a stockholder as of the close of business on June 3, 2024 (the “Record Date”)

or hold a valid proxy for the Annual Meeting. As part of the registration process, you must enter the control number located on your

Notice of Internet Availability, proxy card or voting instruction form. If you are a beneficial owner of shares registered in the name

of a broker, bank or other nominee, you should contact your broker, bank or other nominee to receive a control number in order to join

the meeting.

You

may submit a question up to one hour in advance of the meeting at http://www.astproxyportal.com/ast/27213 after logging in with

the control number shown on your Notice of Internet Availability, proxy card or voting instruction form. If you wish to submit a question

on the day of the Annual Meeting, beginning at 10:00 a.m. Pacific Time on Thursday, August 1, 2024, you may log into the virtual meeting

platform at https://web.lumiconnect.com/222451939, and follow the instructions there. Our Annual Meeting will be governed by our

Rules of Conduct and Procedures, which will be made available to stockholders on the Annual Meeting’s live webcast on the day of

the Annual Meeting and will address the ability of stockholders to ask questions during the meeting, including rules on permissible topics,

and rules for how questions and comments will be recognized and disclosed to meeting participants.

Whether

or not you participate in the Annual Meeting, it is important that you vote your shares.

What

if I cannot find my Control Number?

Please

note that if you do not have your control number and you are a registered stockholder, you will

be able to login as a guest. To view the meeting webcast visit https://web.lumiconnect.com/222451939 and

register as a guest. If you login as a guest, you will not be able to vote your shares or ask questions during the Annual Meeting.

If

you are a beneficial owner (that is, you hold your shares in an account at a bank, broker or other nominee), you will need to contact

that bank, broker or other nominee to obtain your control number prior to the Annual Meeting.

Will

a list of record stockholders as of the Record Date be available?

For

the 10 days ending the day prior to the Annual Meeting, a list of our record stockholders as of the close of business on the

Record Date will be available for examination by any stockholder of record for any purpose germane to the Annual Meeting at

2625 Townsgate Road, Suite 230, Westlake Village, California 91361.

Where

can we get technical assistance?

If

you have difficulty accessing the meeting, please refer to the technical support telephone number posted on the virtual meeting website

login page, where technicians will be available to help you.

Who

can vote at the Annual Meeting?

Only

stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. On the Record Date,

there were 34,351,967 shares of common stock outstanding and entitled to vote.

Stockholder

of Record: Shares Registered in Your Name

If

on the Record Date your shares were registered directly in your name with Genelux’s transfer agent, Equiniti Trust Company, LLC,

then you are a stockholder of record. As a stockholder of record, you may vote online at the Annual Meeting or vote by proxy.

Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the proxy card that may be mailed to you or

vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial

Owner: Shares Registered in the Name of a Broker or Bank

If

on the Record Date your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization,

then you are the beneficial owner of shares held in “street name” and the Notice of Internet Availability should be forwarded

to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting

at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the

shares in your account. You are also invited to attend the Annual Meeting. You must follow the instructions provided by your brokerage

firm, bank, or other similar organization for your bank, broker or other stockholder of record to vote your shares per your instructions.

Alternatively, many brokers and banks provide the means to grant proxies or otherwise instruct them to vote your shares by telephone

and via the Internet, including by providing you with a control number via email or on your Notice of Internet Availability or your voting

instruction form. If your shares are held in an account with a broker, bank or other stockholder of record providing such a service,

you may instruct them to vote your shares by telephone (by calling the number provided in the proxy materials) or over the internet as

instructed by your broker, bank or other stockholder of record. If you did not receive a control number via email or on your Notice of

Internet Availability or voting instruction form, and you wish to vote prior to or at the virtual Annual Meeting, you must follow the

instructions from your broker, bank or other stockholder of record, including any requirement to obtain a valid legal proxy. Many brokers,

banks and other stockholders of record allow a beneficial owner to obtain a valid legal proxy either online or by mail, and we recommend

that you contact your broker, bank or other stockholder of record to do so.

On

what matters am I voting?

There

are two matters scheduled for a vote at the Annual Meeting:

| ● | Proposal

1: To elect the Class II directors named herein, each to hold office until the Company’s

2027 annual meeting of stockholders and until their

successor is duly elected and qualified, or until their earlier death, resignation or removal;

and |

| ● | Proposal

2: To ratify the appointment by the Audit Committee of the Board (the “Audit Committee”)

of Weinberg & Company, P.A. as the independent registered public accounting firm of the

Company for its fiscal year ending December 31, 2024. |

What

if another matter is properly brought before the meeting?

The

Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought

before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote such proxy in accordance with the

recommendation of our management on such matters, including any matters dealing with the conduct of the Annual Meeting. This discretionary

authority is granted when you sign the form of proxy.

How

do I vote?

For

Proposal 1, you may either vote “For” the nominees to the Board or you

may “Withhold” your vote for any

nominee that you specify. For the other matter to be voted on, you may vote “For”

or “Against” or abstain from voting.

The

procedures for voting are as follows:

Stockholder

of Record: Shares Registered in Your Name

If

you are a stockholder of record, you may vote online at the Annual Meeting, vote by proxy over the telephone, vote by proxy through the

internet, or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you

plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting

and vote at the Annual Meeting even if you have already voted by proxy. In such case and if you vote at the Annual Meeting, your previously

submitted proxy will be disregarded since votes will not be double counted

| ● | To

vote online during the Annual Meeting, if you are a stockholder of record as

of the Record Date, follow the instructions at https://web.lumiconnect.com/222451939.

You will need to enter the control number found on your Notice of Internet Availability

or notice you receive or in the email sending you the Proxy Statement. |

| ● | To

vote online prior to the Annual Meeting (until 11:59 p.m. Pacific Time on July

31, 2024), you may vote via the Internet at www.voteproxy.com; by telephone;

or by completing and returning your proxy card or voting instruction form, as described below. |

| ● | To

vote using the proxy card, simply complete, sign and date the proxy card that may be delivered

and return it promptly in the envelope provided. If you return your signed proxy card to

us before the Annual Meeting, we will vote your shares as you direct. |

| ● | To

vote over the telephone, please call toll free 1-800-776-9437 (1-201-299-4446 for international

caller). Your telephone vote must be received by 11:59 p.m. Pacific Time on July 31, 2024

to be counted. |

| ● | To

vote through the internet prior to the Annual Meeting, go to www.voteproxy.com and follow

the instructions to complete an electronic proxy. You will be asked to provide the company

number and control number from the Notice of Internet Availability. Your internet vote must

be received by 11:59 p.m. Pacific Time on July 31, 2024 to be counted. |

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, you should have received a notice

containing voting instructions from that organization rather than from Genelux. You must follow the voting instructions in the notice

to ensure that your vote is counted. Alternatively, many brokers and banks provide the means to grant proxies or otherwise instruct them

to vote your shares by telephone or over the internet as instructed by your broker, bank or other nominee. To vote at the Annual Meeting,

you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other nominee

included with these proxy materials, or contact that organization to request a proxy form.

Internet

proxy voting is provided to allow you to vote your shares online, with procedures designed

to ensure the authenticity and correctness of your proxy vote instructions. However, please

be aware that you must bear any costs associated with your internet access, such as usage

charges from internet access providers and telephone companies.

How

many votes do I have?

On

each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

If

I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions,

what happens?

If

you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or online at the Annual

Meeting, your shares will not be voted.

If

you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable,

“For” the election of the nominees for director and “For”

the ratification of the appointment by the Audit Committee of Weinberg & Company, P.A. as the independent registered public accounting

firm of the Company for the fiscal year ending December 31, 2024. If any other matter is properly presented at the Annual Meeting, your

proxyholder (one of the individuals named on your proxy card) will vote your shares using that individual’s best judgment, including

any matters dealing with the conduct of the Annual Meeting.

If

I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If

you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares,

your broker, bank or other agent may still be able to vote your shares in its discretion. Under the rules of the New York Stock Exchange

(“NYSE”), brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote

your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with

respect to “non-routine” matters. In this regard, Proposal 1 is considered to be “non-routine,” meaning that

your broker may not vote your shares on this proposal in the absence of your voting instructions. Proposal 2 is considered to be a “routine”

matter, meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker

in its discretion on Proposal 2.

If

you are a beneficial owner of shares held in street name, and you do not plan to attend

the Annual Meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions

to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Who

is paying for this proxy solicitation?

We

will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit

proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation

for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial

owners.

What

does it mean if I receive more than one Notice of Internet Availability?

If

you receive more than one Notice of Internet Availability, your shares may be registered in more than one name or in different accounts.

Please follow the voting instructions on the Notices of Internet Availability to ensure that all of your shares are voted.

Can

I change my vote after submitting my proxy?

Stockholder

of Record: Shares Registered in Your Name

Yes.

You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may

revoke your proxy in any one of the following ways:

| ● | You

may submit another properly completed proxy card with a later date. |

| ● | You

may grant a subsequent proxy by telephone or through the internet. |

| ● | You

may send a timely written notice that you are revoking your proxy to Genelux’s Corporate

Secretary at 2625 Townsgate Road, Suite 230, Westlake Village, California 91361, Attn: Corporate

Secretary. Such notice will be considered timely if it is received at the indicated address

by the close of business on the business day preceding the date of the Annual Meeting. |

| ● | You

may attend the Annual Meeting and vote virtually. Simply attending the Annual Meeting will

not, by itself, revoke your proxy. |

Your

most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other nominee.

When

are stockholder proposals and director nominations due for next year’s annual meeting?

To

be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by February 22, 2025, to

2625 Townsgate Road, Suite 230, Westlake Village, California 91361, Attn: Corporate Secretary. If you wish to submit a proposal (including

a director nomination) at the meeting that is not to be included in next year’s proxy materials, you must do so between April 3,

2025 and May 3, 2025. However, if our 2025 annual

meeting of stockholders is not held between July 1, 2025 and September 1, 2025, written notice of the proposal (including a director

nomination) must be received (A) not earlier than the close of business on the 120th day prior to the 2025 annual meeting of stockholders,

and (B) not later than the close of business on the later of the 90th day prior to the 2025 annual meeting of stockholders or the 10th

day following the day on which public announcement of the date of such meeting is first made. You are also advised to review the

Company’s Amended and Restated Bylaws (our “Bylaws”), which contain additional requirements about advance notice of

stockholder proposals and director nominations.

In

order for stockholders to give timely notice of director nominations at next year’s annual meeting for inclusion on a universal

proxy card under Rule 14a-19 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), notice must be submitted

by the same deadline as described above under the advance notice procedures set forth in our Bylaws and must also include the information

in the notice required by our Bylaws and by Rule 14a-19(b)(2) and Rule 14a-19(b)(3) of the Exchange Act.

How

are votes counted?

Votes

will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for Proposal 1 (the proposal

to elect the Class II directors named herein), votes “For,” “Withhold”

and, if applicable, broker non-votes; and, for Proposal 2 (the proposal to ratify the appointment by the Audit Committee of Weinberg

& Company, P.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2024), votes “For”

and “Against,” abstentions and, if applicable, broker non-votes. “Withhold”

votes will have no effect on Proposal 1. Abstentions will be counted towards the vote total for Proposal 2 and will have the same effect

as “Against” votes. Broker non-votes will be counted towards the presence

of a quorum for either proposal but will not be counted towards the vote total for either proposal.

What

are “broker non-votes”?

As

discussed above, when a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or

other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine” under NYSE

rules, the broker, bank or other such agent cannot vote the shares. When there is at least one “routine” matter that the

broker, bank or other securities intermediary votes on, the shares that are un-voted on “non-routine” matters are counted

as “broker non-votes.” Proposal 1 is considered to be “non-routine” and we therefore expect broker non-votes

to exist in connection with this proposal. Proposal 2 is a “routine” matter and we therefore expect brokers, banks or other

securities intermediaries to vote on this proposal.

As

a reminder, if you are a beneficial owner of shares held in street name, in order to ensure

your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by

the deadline provided in the materials you receive from your broker, bank or other agent.

How

many votes are needed to approve each proposal?

The

following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes:

Proposal

Number |

|

Proposal

Description |

|

Vote

Required for Approval |

|

Voting

Options |

|

Effect

of

Abstentions or Withhold Votes, as applicable |

|

Effect

of

Broker Non-Votes |

|

Board

Recommendation |

| 1 |

|

Election

of Directors |

|

Plurality

of the votes of shares present virtually, or represented by proxy, at the Annual Meeting and entitled to vote generally on the election

of directors. |

|

“For”

or “Withhold” |

|

No

Effect |

|

No

effect |

|

“For”

all nominees |

| 2 |

|

Ratification

of Independent Registered Public Accounting Firm |

|

Majority

of shares present virtually, or represented by proxy, at the Annual Meeting and entitled to vote on the subject

matter. |

|

“For,”

“Against,” or “Abstain” |

|

Against |

|

Not

applicable(1) |

|

“For” |

| (1) |

This proposal is considered

to be a “routine” matter under applicable NYSE rules. Accordingly, if you hold your shares in street name and do not provide

voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary

authority under NYSE rules to vote your shares on this proposal. |

What

is the quorum requirement?

A

quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of

the voting power of the outstanding shares of capital stock entitled to vote are present at the Annual Meeting virtually or represented

by proxy. On the Record Date, there were 34,351,967 shares outstanding and entitled to vote. Thus, the holders of 17,175,984 shares

must be present virtually or represented by proxy at the Annual Meeting to have a quorum.

Your

shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or

other nominee) or if you vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

If there is no quorum, the chair of the Annual Meeting or the holders of a majority of shares present at the meeting virtually or represented

by proxy may adjourn the Annual Meeting to another date.

How

can I find out the results of the voting at the Annual Meeting?

Preliminary

voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form

8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time

to file a Current Report on Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary

results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Proposal

1

Election of Directors

Genelux’s

Board is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each

class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A

director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall

serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

The

Board currently has five authorized members. The Class II directors, Mary Mirabelli and Dr. John Thomas, have been recommended for election

to the Board as Class II directors by the Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”).

If elected at the Annual Meeting, Ms. Mirabelli and Dr. Thomas would serve until our 2027 annual meeting of stockholders and until their

successor is duly elected and qualified, or until their earlier death, resignation or removal.

It is the Company’s policy to encourage directors and nominees for director to attend the Annual Meeting.

Directors

are elected by a plurality of the votes of the holders of shares present virtually or represented by proxy and entitled to vote on the

election of directors. Accordingly, the nominees receiving the highest number of “For”

votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, “For”

the election of the nominees named below. If a nominee becomes unavailable for election as a result of an unexpected occurrence, shares

that would have been voted for the nominee will instead be voted for the election of a substitute nominee proposed by the Company. The

nominees for election have agreed to serve if elected. The Company’s management has no reason to believe that any of the nominees

will be unable to serve.

The

Nominating Committee seeks to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge,

financial expertise and high-level management experience necessary to oversee and direct the Company’s business. To that end, the

Nominating Committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the

goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound

business judgment and other qualities that the Nominating Committee views as critical to the effective functioning of the Board. The

brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience,

qualifications, attributes or skills of each director or nominee that led the Nominating Committee to recommend that that nominee should

continue to serve on the Board. However, each of the members of the Nominating Committee may have a variety of reasons why he or she

believes a particular person would be an appropriate nominee for the Board, and these views may differ from the views of other members.

The

table below provides certain information regarding our current directors and nominees for director as of the Record Date.

| Nominee/Director

Name |

|

Age |

|

Position |

|

Director

Since |

|

Year

Current

Term

Expires |

|

Current

Director

Class |

| Nominees

for Class II Directors: |

|

|

|

|

|

|

|

|

|

|

| Mary

Mirabelli |

|

67 |

|

Director |

|

2021 |

|

2024 |

|

II |

| John

Thomas, Ph.D. |

|

66 |

|

Director |

|

2002 |

|

2024 |

|

II |

| Continuing

Directors: |

|

|

|

|

|

|

|

|

|

|

| James

L. Tyree |

|

71 |

|

Lead

Independent Director |

|

2012 |

|

2025 |

|

III |

| Thomas

Zindrick, J.D. |

|

65 |

|

President,

Chief Executive Officer and Chairman |

|

2021 |

|

2025 |

|

III |

| John

Smither |

|

71 |

|

Director |

|

2023 |

|

2026 |

|

I |

The

following is a brief biography of the nominees and each director whose term will continue after the Annual Meeting.

Nominees

for Election for a Three-year Term Expiring at the 2027 Annual Meeting

Mary

Mirabelli, 67, has served as a member of our Board since June 2021. Ms. Mirabelli served as the senior vice president

at the Healthcare Finance Management Association from April 2018 to December 2023. Previously, Ms. Mirabelli has served as the Vice President

of Global Healthcare Services at Hewlett Packard Enterprise Company from June 2014 to April 2018. Ms. Mirabelli served as a senior executive

at Hospital Corporation of America from 2010 to 2014. Ms. Mirabelli holds a B.S. in occupational therapy from University of Illinois

at Urbana-Champaign and a MiM from Northwestern University’s Kellogg Graduate School of Management.

We

believe Ms. Mirabelli’s extensive experience managing and leading companies within the healthcare industry qualify her to serve

on our Board.

John

Thomas, Ph.D., 66, has served as a member of our Board since September 2002. Dr. Thomas served as our first Chief Financial

Officer from 2002 to 2004. Dr. Thomas has been the Dean of the School of Business and Management at La Sierra University since 1999.

Dr. Thomas has served on the board of ICON Business Bank since 2023 and is the audit committee chair. Dr. Thomas has served on the boards

of directors of KSGN Good News Radio since January 2004, Loma Linda Broadcasting Network International since January 2009 and ADRA International

as a member of the finance committee since September 2015. He previously served as a member of the board of directors of the Family Service

Association from 1992 to 2018. Dr. Thomas holds an M.B.A. in finance from Loma Linda University and in marketing from Symbiosis Institute

of Management Studies, as well as an M.A. in international political economy and a Ph.D. in political economy from Claremont Graduate

University.

We

believe that Dr. Thomas’s extensive training, expertise and experience in finance, qualifies him to serve on our Board.

The

Board of Directors Recommends

A

Vote “For” each Named Nominee.

Directors

Continuing in Office Until the 2025 Annual Meeting

James

L. Tyree, 71, has served as a member of our Board since May 2012 and as our Lead Independent Director since July 2021.

Mr. Tyree previously served as Chairman of the Board from 2014 to 2021 and has had a distinguished career in health care spanning more

than forty years. His accomplishments are well recognized as an investor, operating executive, and entrepreneur. Mr. Tyree is the co-founder,

Chairman, and managing partner of Tyree & D’Angelo Partners, a private equity investment firm. Prior to founding Tyree

& D’Angelo Partners, Mr. Tyree held numerous executive positions at Abbott Laboratories (“Abbott”) including (but

not limited too) Executive Vice President Global Pharmaceuticals and Sr. Vice President Global Nutrition. In these positions Mr. Tyree

reported to the Chairman and Chief Executive Officer. During the period beginning 1997 until his retirement in 2012, Mr. Tyree was a

significant contributor to Abbott’s most defining endeavors. Mr. Tyree was the strategic and tactical driver involved of every

major M&A transaction executed by the company including the acquisitions of BASF Pharmaceuticals, KOS Pharmaceuticals, Solvay Pharmaceuticals,

and Piramal Health Solutions. He was also responsible for the restructuring of Takeda Abbott Pharmaceuticals, Abbott’s highly successful

joint venture with Takeda Chemicals of Japan. During this time period, Abbott was named as the top deal maker in the industry by The

Deal. In 2010 Fortune named Abbott as the most admired company in the pharmaceutical sector. Prior to joining Abbott, Mr. Tyree was the

President of Sugen, Inc., a biotechnology company focused in oncology. Mr. Tyree led the company’s initial public offering in 1994

and subsequently shaped the company to make it an attractive acquisition target. The company was acquired by Pharmacia in 1997. Earlier

in his career, Mr. Tyree held management positions at Bristol-Myers Squibb, Pfizer, and Abbott. Over his entire career, he is a four-time

expatriate having lived and worked six and a half years in Latin America and seven years in Japan. Mr. Tyree has served and an independent

director of Genelux, SonarMed, Innoviva, Chemocentryx, and Assertio. Mr. Tyree earned bachelor degrees in psychology and forensic studies,

and a master’s degree in business administration from Indiana University.

We

believe that Mr. Tyree’s extensive experience in biotechnology and pharmaceuticals, qualifies him to serve on our Board.

Thomas

Zindrick, J.D., 65, has served as our President, Chief Executive Officer and a member of our Board since May 2014 and

as our Chair since July 2021. Currently, he serves as Executive Chair of Aeromics, Inc., a clinical-stage pharmaceutical company developing

products for the treatment of ischemic stroke, since August 2018. Mr. Zindrick served as Chief Executive Officer of Amitech Therapeutic

Solutions, Inc., from March 2012 to May 2014. From 1993 to 2009, Mr. Zindrick was at Amgen Inc. (“Amgen”), where he held

positions of increasing responsibility, including Vice President Associate General Counsel from 2001 to 2004 and again from 2008 to 2009.

At Amgen, from 2004 to 2008, Mr. Zindrick served as Chief Compliance Officer. Prior to joining Amgen, Mr. Zindrick was an attorney at

The Dow Chemical Company. Mr. Zindrick served on the board of directors of Amitech Therapeutic Solutions, Inc. from October 2011 to February

2021 and DNX Biopharmaceuticals, Inc. from November 2014 to March 2020. Mr. Zindrick received his J.D. from the University of Illinois

College of Law and a B.A. in biology from North Central College in Naperville, Illinois.

We

believe Mr. Zindrick’s extensive experience managing and leading companies within the pharmaceutical and biotechnology industries

qualify him to serve on our Board.

Director

Continuing in Office Until the 2026 Annual Meeting

John

Smither, 71, has served as a member of the Board since September 2023. From August 2023 to April 2024 Mr. Smither served

as the Interim Chief Financial Officer of Arcutis Biotherapeutics, Inc. (“Arcutis”) from August 2023 and from May 2019 to

May 2021 served as the Chief Financial Officer of Arcutis, where he was responsible for all financial aspects of Arcutis including leading

Arcutis’s successful initial public offering and four follow-on financings. Previously, Mr. Smither was the Chief Financial Officer

at Sienna Biopharmaceutics from January 2016 to April 2017, and again from April 2018 to March 2019. Mr. Smither also served as the Interim

Chief Financial Officer at Kite Pharma, a Gilead Company, from November 2017 through April 2018, and was the chief financial officer

of Unity Biotechnology from January 2016 to July 2017. He also served as chief financial officer at Kythera Biopharmaceuticals (“Kythera”),

where he was responsible for all financial activities during early clinical stage development through approval and launch, led private

fundraising rounds, prepared Kythera for its successful initial public offering in October 2012, and oversaw its acquisition by Allergan

plc for approximately $2.1 billion. At Amgen, Mr. Smither held several financial positions of increasing responsibility, including vice

president of finance and administration for Amgen’s European operations in 28 countries, and served as Executive Director of Corporate

Accounting. In January 2023, Mr. Smither was appointed to the board of NewAmsterdam Pharma and has served as the chair of its audit committee

since January 2022 and also serves on its compensation committee. From January 2022 to December 2023, Mr. Smither has served as a member

of the board of directors of Applied Molecular Transport Inc., as chair of its audit committee, and as a member of its compensation committee.

From March 2018 to September 2023, Mr. Smither has served as a member of the board of directors of eFFECTOR Therapeutics Inc. and its

predecessor entity, as chair of its audit committee, and as a member of its nominating and corporate governance committee. Additionally,

from December 2013 to May 2020, Mr. Smither served as a member of the board of directors of Achaogen, Inc., as chair of its audit committee,

and as a member of its compensation committee. Mr. Smither began his career at Ernst & Young, where he was audit partner and held

a certification as a Certified Public Accountant (inactive). He holds a B.S. in accounting, with honors, from California State University

at Los Angeles.

We

believe Mr. Smither’s extensive experience as a chief financial officer and service on the boards of directors of other biotechnology

and pharmaceutical companies qualifies him to serve on our Board.

Information

regarding the Board of Directors and corporate governance

Independence

of the Board of Directors

Under

the listing rules of The Nasdaq Stock Market LLC (“Nasdaq”), a majority of the

members of our Board must qualify as “independent,” as affirmatively determined by our Board. In addition, the rules of Nasdaq

require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate

governance committees be independent. Under the rules of the Nasdaq, a director will only qualify as an “independent director”

if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the

exercise of independent judgment in carrying out the responsibilities of a director. Compensation Committee members must not have a relationship

with us that is material to the director’s ability to be independent from management in connection with the duties of a Compensation

Committee member. Additionally, Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the

Exchange Act. To be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other

than in his or her capacity as a member of the audit committee of the board of directors or any other board committee, accept, directly

or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or be an affiliated

person of the listed company or any of its subsidiaries The Board consults with the Company’s counsel to ensure that the Board’s

determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,”

including those set forth in pertinent Nasdaq listing rules, as in effect from time to time.

Consistent

with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his

or her family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that

each of Ms. Mirabelli, Dr. Thomas, Mr. Tyree and Mr. Smither, representing four of our five directors, is an independent director within

the meaning of the applicable Nasdaq listing rules. In making this determination, the Board found that none of these directors or nominees

for director had a material or other disqualifying relationship with the Company.

Board

Diversity

While

we do not have a formal diversity policy in place, our Nominating Committee monitors the mix of skills and experience of its directors

to help ensure it has the necessary tools to perform its oversight function effectively. The Board fully appreciates the value of a diversity

of viewpoints, background and experiences as important to the selection of directors to enhance the Board’s cognitive diversity

and quality of dialogue in the boardroom.

We

believe that our current directors possess diverse professional experiences, skills and backgrounds, in addition to, among other characteristics,

high standards of personal and professional ethics and valuable knowledge of our business and our industry.

Below

is our Nasdaq Board Diversity Matrix for the fiscal year 2024. Last year’s Board Diversity Matrix is available in our definitive

proxy statement filed with the SEC on July 20, 2023. The following Board Diversity Matrix provides certain self-identified personal demographics

of our directors.

| Board

Diversity Matrix (As of June 3, 2024) |

| Total Number

of Directors | |

5 | |

| | |

| Female | | |

| Male | | |

| Non- Binary | | |

| Did

Not Disclose Gender | |

| Part I: Gender Identity | |

| | | |

| | | |

| | | |

| | |

| Directors | |

| 1 | | |

| 4 | | |

| - | | |

| - | |

| Part II: Demographic Background | |

| | | |

| | | |

| | | |

| | |

| African American or Black | |

| - | | |

| - | | |

| - | | |

| - | |

| Alaskan Native or Native American | |

| - | | |

| - | | |

| - | | |

| - | |

| Asian | |

| - | | |

| 1 | | |

| - | | |

| - | |

| Hispanic or Latinx | |

| - | | |

| - | | |

| - | | |

| - | |

| Native Hawaiian or Pacific Islander | |

| - | | |

| - | | |

| - | | |

| - | |

| White | |

| 1 | | |

| 3 | | |

| - | | |

| - | |

| Two or More Races or Ethnicities | |

| - | | |

| - | | |

| - | | |

| - | |

| LGBTQ+ | |

| - | |

| Did Not Disclose Demographic Background | |

| - | |

Board

Leadership Structure

The

Company’s Board is currently chaired by the President and Chief Executive Officer of the Company, Mr. Zindrick. Mr. Tyree serves

as lead independent director.

The

Company believes that combining the positions of Chief Executive Officer and Chairman helps to ensure that the Board and management act

with a common purpose. In the Company’s view, separating the positions of Chief Executive Officer and Chairman has the potential

to give rise to divided leadership, which could interfere with good decision-making or weaken the Company’s ability to develop

and implement strategy. Instead, the Company believes that combining the positions of Chief Executive Officer and Chairman provides a

single, clear chain of command to execute the Company’s strategic initiatives and business plans. In addition, the Company believes

that a combined Chief Executive Officer/Chairman is well positioned to act as a bridge between management and the Board, facilitating

the regular flow of information. The Company also believes that it is advantageous to have a Chairman with an extensive history with

and knowledge of the Company (as is the case with the Company’s Chief Executive Officer).

Because

Mr. Zindrick has

served and continues to serve in both these roles, our Board appointed Mr. Tyree as the lead independent director to help reinforce

the independence of the Board as a whole. The position of lead independent director has been structured to serve as an effective balance

to a combined Chief Executive Officer/Chairman: the lead independent director is empowered to, among other duties and responsibilities,

approve agendas and meeting schedules for regular Board meetings, preside over Board meetings in the absence of the Chair, preside over

and establish the agendas for meetings of the independent directors, act as liaison between the Chair and the independent directors,

approve information sent to the Board, preside over any portions of Board meetings at which the evaluation or compensation of the Chief

Executive Officer is presented or discussed and, as appropriate upon request, act as a liaison to stockholders. In addition, it is the

responsibility of the lead independent director to coordinate between the Board and management with regard to the determination and implementation

of responses to any problematic risk management issues. As a result, the Company believes that the lead independent director can help

ensure the effective independent functioning of the Board in its oversight responsibilities. In addition, the Company believes that the

lead independent director is well positioned to build a consensus among directors and to serve as a conduit between the other independent

directors and the Chairman, for example, by facilitating the inclusion on meeting agendas of matters of concern to the independent directors.

In light of the Chief Executive Officer’s extensive history with and knowledge of the Company, and because the Board’s lead

independent director is empowered to play a significant role in the Board’s leadership and in reinforcing the independence of the

Board, the Company believes that it is advantageous for the Company to combine the positions of Chief Executive Officer and Chairman.

Role

of the Board in Risk Oversight

One

of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management

committee, but rather administers this oversight function directly through the Board, as a whole, as well as through various standing

committees of our Board that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for

monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company.

Our Audit Committee has the responsibility to consider and discuss our major risks, including financial risk exposures and cybersecurity

risks, and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the

process by which risk assessment and management is undertaken. The Audit Committee reviews cybersecurity risk, as part of its review

of our cybersecurity framework, measures, tools, and compliance, on at least an annual basis. The Audit Committee also monitors compliance

with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating Committee

monitors the effectiveness of our corporate governance practices, including whether they are successful in preventing illegal or improper

liability-creating conduct. The Compensation Committee of our Board (“Compensation Committee”) assesses and monitors whether

any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Commitment

to Corporate Responsibility

As

a company focused on developing a pipeline of next-generation oncolytic viral immunotherapies for patients suffering from aggressive

and/or difficult-to-treat solid tumor types, we strive to identify ways to enhance and deliver on our commitment to patients, the medical

community, our employees, our investors and our other stakeholders. Accordingly, we recognize the intersection between environmental,

social and governance practices and these objectives. Given this, in 2023 we focused on the following areas:

Environmental

Impact. We are cognizant of the impact we have on our broader environment and have supported several green measures in an effort

to reduce our carbon footprint, including reducing air travel, allowing our employees to work remotely, providing reusable dishes and

cutlery to employees, making available electric car chargers at several of our offices, facilitating paperless operations for our clinical

trials, expanding the use of electronic investigator files, eConsent forms and digital logs. Further, as we expand and grow, we are committed

to doing so in an environmentally responsible way, and will endeavor to improve efficiencies and minimize our carbon footprint wherever

practicable.

Social

Impact. Our future performance depends significantly upon the continued service of our key scientific, technical and senior management

personnel and our continued ability to attract and retain highly skilled employees. We provide our employees with competitive compensation,

development programs that enable continued learning and growth and a robust employment package that promotes employee well-being. In

addition to salaries, these programs include potential annual discretionary bonuses, stock option and restricted stock unit awards, a

401(k) plan, ESPP plan, healthcare and insurance benefits, flexible spending accounts, paid time off, family leave and flexible work

schedules, among other benefits. We are committed to patients and to the communities in which we operate.

Diversity

and Inclusion. We strive to invest in and create ongoing opportunities for employee development in a diverse and inclusive environment

in which each team member plays a unique and vital role. We currently have one female director (representing 20% of our directors) and

one Asian director (representing 20% of our directors). We believe that a diverse workforce not only positively impacts our performance

and strengthens our culture, but also cultivates an essential pipeline of experienced leaders for management. Hiring for diversity of

skills, background and perspective continues to be an area of focus as we grow.

Ethics

and Corporate Governance. We aspire, and expect our suppliers, to maintain the highest standards of business conduct and ethics.

All of our employees, officers and directors are required to adhere to the Genelux Corporation Code of Conduct (the “Code of Conduct”),

which provides, among other things, that all of our employees, officers and directors must maintain the highest standards of business

conduct and ethics and conduct internal and external affairs in an honest and ethical manner.

Meetings

of the Board of Directors

The

Board met 11 times during the last fiscal year. Each Board member attended 75% or more of the aggregate number of meetings of the Board

and the committees on which he or she served that were held during the portion of the last fiscal year for which he or she was a director

or committee member. Although we do not have a formal policy regarding attendance by Board members at annual meetings of stockholders,

we encourage our directors to attend such meetings. All of the Board members attended the 2023 annual meeting.

As

required under applicable Nasdaq listing rules, in fiscal year 2023, the Company’s independent directors met 11 times in regularly

scheduled executive sessions at which only independent directors were present.

Information

Regarding Committees of the Board of Directors

The

Board has three committees: the Audit Committee, the Compensation Committee and the Nominating Committee. The following table provides

membership and meeting information for fiscal year 2023 for each of the Board committees:

| Name | |

Audit | | |

Compensation | | |

Nominating

and Corporate Governance | |

| Ms. Mary Mirabelli | |

| X | | |

| X | | |

| X* | |

| Dr. John Thomas | |

| X* | | |

| X | | |

| X | |

| Mr. James L. Tyree | |

| | | |

| | | |

| | |

| Mr. John Smither | |

| X | | |

| X* | | |

| X | |

| Mr. Thomas Zindrick, J.D. | |

| | | |

| | | |

| | |

| Total meetings in fiscal year

2023 | |

| 6 | | |

| 4 | | |

| 7 | |

Below

is a description of each committee of the Board. The Board has determined that each member of each committee meets the applicable Nasdaq

rules and regulations regarding “independence” and each member is free of any relationship that would impair his or her individual

exercise of independent judgment with regard to the Company.

Audit

Committee

The

Audit Committee was established by the Board in accordance with Section 3(a)(58)(A) of the Exchange Act to oversee the Company’s

corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee

performs several functions.

The

principal duties and responsibilities of our Audit Committee include, among other things:

| ● | evaluating

the performance of and assessing the qualifications of the independent auditors; |

| ● | determining

and approving the engagement of the independent auditors; |

| ● | determining

whether to retain or terminate the existing independent auditors or to appoint and engage

new independent auditors; |

| ● | reviewing

and approving the retention of the independent auditors to perform any proposed permissible

non-audit services; |

| ● | monitoring

the rotation of partners of the independent auditors on the Company’s audit engagement

team as required by law; |

| ● | reviewing

and approving or rejecting transactions between the Company and any related persons; |

| ● | conferring

with management and the independent auditors regarding the effectiveness of internal control

over financial reporting; |

| ● | establishing

procedures, as required under applicable law, for the receipt, retention and treatment of

complaints received by the Company regarding accounting, internal accounting controls or

auditing matters and the confidential and anonymous submission by employees of concerns regarding

questionable accounting or auditing matters, including Critical Audit Matters (CAMs); |

| ● | overseeing

the Company’s information technology risk exposures, including cybersecurity, data

privacy and data security; and |

| ● | meeting

to review the Company’s annual audited financial statements and quarterly financial

statements with management and the independent auditor, including a review of the Company’s

disclosures under “Management’s Discussion and Analysis of Financial Condition

and Results of Operations.” |

The

Audit Committee is composed of three directors: Ms. Mirabelli, Mr. Smither and Dr. Thomas, who serves as the committee’s chair.

The Audit Committee met six times during fiscal year 2023. The Board has adopted a written Audit Committee charter that is available

to stockholders on the Company’s website at https://investors.genelux.com/corporate-governance/documents-charters.

The

Board reviews the Nasdaq listing rules definition of independence for Audit Committee members on an annual basis and has determined that

all members of the Audit Committee are independent (as independence is currently defined in Nasdaq Listing Rule 5605(c)(2)(A)(i) and

(ii) and Rule 10A-3(b)(1) of the Exchange Act).

Each

member of the Audit Committee can read and understand fundamental financial statements in accordance with applicable requirements. In

arriving at these determinations, the Board has examined each Audit Committee member’s scope of experience and the nature of their

employment.

The

Board has also determined that Dr. Thomas qualifies as an “audit committee financial expert” within the meaning of Item 407(d)(5)

of Regulation S-K. The Board made a qualitative assessment of Dr. Thomas’s level of knowledge and experience based on a number

of factors, including his formal education and experience as a chief financial officer for public reporting companies.

Report

of the Audit Committee of the Board of Directors*

The

Audit Committee has reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2023

with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters

required to be discussed under the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and

the Securities and Exchange Commission. The Audit Committee has also received the written disclosures and the letter from the independent

registered public accounting firm required by applicable requirements of the PCAOB regarding the independent registered public accounting

firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public

accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board that

the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Dr.

John Thomas (Chair)

Ms. Mary Mirabelli

Mr. John Smither

*

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be

incorporated by reference in any of our filings under the Exchange Act or the Securities Act of 1933, as amended, whether made before

or after the date hereof and irrespective of any general incorporation language in any such filing.

Compensation

Committee

The

Compensation Committee is currently composed of three directors: Ms. Mirabelli, Dr. Thomas and Mr. Smither, who serves as the committee’s

chair. All members of the Compensation Committee are independent (as independence is currently defined in Nasdaq Listing Rule 5605(d)(2))

and a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act. The Compensation Committee met

four times during fiscal year 2023. The Board has adopted a written Compensation Committee charter that is available to stockholders

on the Company’s website at https://investors.genelux.com/corporate-governance/documents-charters.

The

Compensation Committee acts on behalf of the Board to review, modify, approve, make recommendations to the Board regarding and oversee

the Company’s compensation strategy, policies, plans and programs, including:

| ● | establishing

corporate and individual performance objectives relevant to the compensation of the Company’s

executive officers, directors and other senior management and evaluating performance in light

of these stated objectives; |

| ● | reviewing

and approving the compensation and other terms of employment or service, including severance

and change-in-control arrangements, of the Company’s Chief Executive Officer and the

other executive officers and directors; and |

| ● | establishing

policies with respect to the Company’s equity compensation plans, pension and profit-sharing

plans, deferred compensation plans and other similar plan and programs. |

Compensation

Committee Processes and Procedures

Typically,

the Compensation Committee meets at least quarterly and with greater frequency if necessary. The agenda for each meeting is usually developed

by the Chair of the Compensation Committee, in consultation with the Chief Executive Officer. The Compensation Committee meets regularly

in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants

may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or

to otherwise participate in Compensation Committee meetings. The Chief Executive Officer does not participate in, and is not present

during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives.

The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel

of the Company. In addition, under its charter, the Compensation Committee has the authority to obtain, at the expense of the Company,

advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external

resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee

has direct responsibility for the oversight of the work of any consultants or advisers engaged for the purpose of advising the Compensation

Committee. In particular, the Compensation Committee has the sole authority to retain, in its sole discretion, compensation consultants

to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable

fees and other retention terms. Under its charter, the Compensation Committee may select, or receive advice from, a compensation consultant,

legal counsel or other adviser to the Compensation Committee, other than in-house legal counsel and certain other types of advisers,

only after taking into consideration six factors, prescribed by the SEC and Nasdaq, that bear upon the adviser’s independence;

however, there is no requirement that any adviser be independent.

During

the past fiscal year, after taking into consideration the six factors prescribed by the SEC and Nasdaq described above, the Compensation

Committee engaged PayGovernance as its compensation consultant. The Compensation Committee requested that PayGovernance:

| ● | evaluate

the efficacy of the Company’s existing compensation strategy and practices in supporting

and reinforcing the Company’s long-term strategic goals; and |

| ● | assist

in refining the Company’s compensation strategy and in developing and implementing

an executive compensation program to execute that strategy. |

As

part of its engagement, PayGovernance was requested by the Compensation Committee to develop a comparative group of companies and to

perform analyses of competitive performance and compensation levels for that group and provide an overall assessment of the Company’s

executive compensation programs in comparison to executive compensation programs at selected publicly traded peer companies. At the request

of the Compensation Committee, in 2023, PayGovernance also conducted individual interviews with members of the Compensation Committee

and senior management to learn more about the Company’s business operations and strategy, key performance metrics and strategic

goals, as well as the labor markets in which the Company competes. PayGovernance ultimately developed recommendations for our 2023 compensation

program that were presented to the Compensation Committee for its consideration. Following an active dialogue with PayGovernance, the

Compensation Committee approved the recommendations of PayGovernance.

Historically,

the Compensation Committee has made most of the significant adjustments to annual compensation, determined bonus and equity awards and

established new performance objectives at one or more meetings held during the fourth quarter of the year. However, the Compensation

Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level

strategic issues, such as the efficacy of the Company’s compensation strategy, potential modifications to that strategy and new

trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process

comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current

year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations

submitted to the Compensation Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of

his performance is conducted by the Compensation Committee, which determines any adjustments to his compensation as well as awards to

be granted. For all executives and directors as part of its deliberations, the Compensation Committee may review and consider, as appropriate,

materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the

total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information,

company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels and

recommendations of the Compensation Committee’s compensation consultant, including analyses of executive and director compensation

paid at other companies identified by the consultant.

Nominating

and Corporate Governance Committee

The

Nominating Committee is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company (consistent

with criteria approved by the Board), reviewing and evaluating incumbent directors, selecting or recommending to the Board for selection

candidates for election to the Board, making recommendations to the Board regarding the membership of the committees of the Board, assessing

the performance of the Board, and developing a set of corporate governance principles for the Company.

The

Nominating Committee is composed of three directors: Dr. Thomas, Mr. Smither and Ms. Mirabelli, who serves as the committee’s chair.

All members of the Nominating Committee are independent (as independence is currently defined in Nasdaq Listing Rule 5605(a)(2)). The

Nominating Committee met seven times during fiscal year 2023. The Board has adopted a written Nominating Committee charter that is available

to stockholders on the Company’s website at https://investors.genelux.com/corporate-governance/documents-charters.

The

Nominating Committee believes that candidates for director should have certain minimum qualifications, including the ability to read

and understand basic financial statements and having the highest personal integrity and ethics. The Nominating Committee also intends

to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient

time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business

judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the

Nominating Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed

in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders.

In conducting this assessment, the Nominating Committee typically considers diversity (including gender, racial and ethnic diversity),

age, skills and such other factors as it deems appropriate, given the current needs of the Board and the Company, to maintain a balance

of knowledge, experience and capability.

The