First Trust Advisors L.P. (“First

Trust”) today announced the anticipated launch of the First Trust

NASDAQ® Clean Edge® Smart Grid Infrastructure Index Fund. This

exchange-traded fund (ETF) is expected to begin trading on November

17 on The NASDAQ® Stock Market under the ticker symbol (GRID). This

ETF seeks investment results that correspond generally to the price

and yield (before the fund’s fees and expenses) of an equity index

called the NASDAQ OMX® Clean Edge® Smart Grid Infrastructure

IndexSM. The Index is designed to act as a transparent and liquid

benchmark for the grid and energy infrastructure sector.

"With a growing demand for electricity

and the increasingly inefficient infrastructure, the current power

grid is unable to keep up with 21st century technology," according

to Ryan Issakainen, Vice President and ETF Analyst at First Trust.

"There's a growing movement towards a next generation power grid -

Smart Grid. Electricity is one of the largest and most

capital-intensive sectors in our economy and we are tremendously

excited about the potential that an investment in this industry

represents."

The Index includes companies that are

primarily engaged and involved in electric grid, electric meters

and devices, networks, energy storage and management, and enabling

software used by the smart grid infrastructure sector. First Trust

will be the investment advisor for the ETF.

About

The Clean Edge®

Smart Grid Infrastructure Index

Fund

The Index is a modified-market

capitalization weighted index that includes companies that are

primarily engaged and involved in electric grid, electric meters

and devices, networks, energy storage and management, and

industry-related software. The index is jointly owned by the NASDAQ

OMX Group, Inc. and Clean Edge, Inc. The index is administered by

NASDAQ OMX Group, Inc.

About

First Trust Advisors L.P.

Based in Wheaton, Illinois, First Trust

Advisors L.P., and its affiliate First Trust Portfolios L.P., are

privately-held companies which provide a variety of investment

services, including asset management, financial advisory services,

and municipal and corporate investment banking, with collective

assets under management or supervision of over $24 billion as of

October 30, 2009 through closed-end funds, unit investment trusts,

mutual funds, separate managed accounts and exchange-traded

funds.

For more information, please visit

www.ftportfolios.com.

Principal Risk Factors

The information in the prospectus is not

complete and may be changed. We may not sell these securities until

the registration statement filed with the Securities and Exchange

Commission is effective. The prospectus is not an offer to sell

these securities and is not soliciting an offer to buy these

securities in any state where the offer or sale is not

permitted.

An investor should consider the

fund’s investment objectives, risks, charges and expenses carefully

before investing. Contact First Trust Portfolios L.P. at

1-800-621-1675 or visit www.ftportfolios.com to

obtain a prospectus or summary prospectus which contains this and

other information about the fund. The prospectus or summary

prospectus should be read carefully before investing.

An investor could lose money by

investing in the Fund. An investment in the Fund is not a deposit

of a bank and is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other governmental agency.

MARKET RISK. Market risk is the

risk that a particular stock owned by the Fund, Shares of the Fund

or stocks in general may fall in value. Shares are subject to

market fluctuations caused by such factors as economic, political,

regulatory or market developments, changes in interest rates and

perceived trends in stock prices. Overall stock values could

decline generally or could underperform other investments.

NON-CORRELATION RISK. The Fund’s

return may not match the return of the Index for a number of

reasons. For example, the Fund incurs operating expenses not

applicable to the Index, and may incur costs in buying and selling

securities, especially when rebalancing the Fund’s portfolio

holdings to reflect changes in the composition of the Index. In

addition, the Fund’s portfolio holdings may not exactly replicate

the securities included in the Index or the ratios between the

securities included in the Index.

REPLICATION MANAGEMENT RISK. The

Fund is exposed to additional market risk due to its policy of

investing principally in the securities included in the Index. As a

result of this policy, securities held by the Fund will generally

not be bought or sold in response to market fluctuations and the

Fund will be concentrated in smart grid companies. Therefore, the

Fund will generally not sell a stock because the stock’s issuer is

in financial trouble, unless that stock is removed or is

anticipated to be removed from the Index.

NON-DIVERSIFICATION RISK. The

Fund is classified as “non-diversified” under the Investment

Company Act of 1940, as amended (the “1940 Act”). As a result, the

Fund is only limited as to the percentage of its assets which may

be invested in the securities of any one issuer by the

diversification requirements imposed by the Internal Revenue Code

of 1986, as amended (the “Code”). The Fund may invest a relatively

high percentage of its assets in a limited number of issuers.

SMART GRID RISK. The Fund will be

concentrated in smart grid companies. Smart grid companies can be

negatively affected by high costs of research and development, high

capital requirements for implementation, uncertain government

regulations and input, limited ability of industrial and utility

companies to quickly transform their businesses in order to

implement new technologies and uncertainty of the ability of new

products to penetrate established industries. Smart grid companies

are often reliant upon contracts with government and commercial

customers which may expire from time to time. Such companies are

also affected by the general business conditions within the

industrial, utility, information technology and telecommunications

sectors and the overall global economy.

NON-U.S. SECURITIES RISK. The

Fund invests in securities of non-U.S. issuers. Such securities are

subject to higher volatility than securities of domestic issuers

due to possible adverse political, social or economic developments;

restrictions on foreign investment or exchange of securities; lack

of liquidity; excessive taxation; government seizure of assets;

different legal or accounting standards; and less government

supervision and regulation of exchanges in foreign countries.

CURRENCY RISK. Because the Fund’s

NAV is determined on the basis of U.S. dollars, an investor may

lose money if the local currency of a foreign market depreciates

against the U.S. dollar, even if the local currency value of a

Fund’s holdings goes up.

NASDAQ®, NASDAQ OMX®, and Clean Edge®

are the registered trademarks (the “Marks”) of The NASDAQ OMX

Group, Inc. (“NASDAQ OMX”) and Clean Edge, Inc. (“Clean Edge”)

respectively. NASDAQ OMX® and Clean Edge® are, collectively with

their affiliates, the “Corporations”. The Marks are licensed for

use by First Trust Advisors L.P. The Fund has not been passed on by

the Corporations as to its legality or suitability. The Fund is not

issued, endorsed, sold or promoted by the Corporations. The Fund

should not be construed in any way as investment advice by the

Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO

LIABILITY WITH RESPECT TO THE FUND.

Not FDIC Insured • Not Bank Guaranteed •

May Lose Value

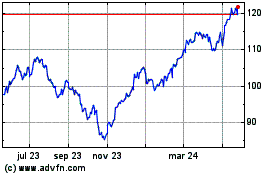

First Trust NASDAQ Clean... (NASDAQ:GRID)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

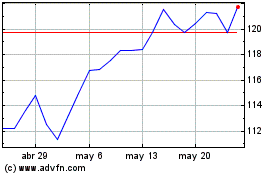

First Trust NASDAQ Clean... (NASDAQ:GRID)

Gráfica de Acción Histórica

De May 2023 a May 2024