First Trust Advisors L.P. Announces Distribution for Exchange-Traded Fund

10 Junio 2013 - 3:24PM

Business Wire

First Trust Advisors L.P. (“FTA”) announces the declaration of

the regular quarterly distribution for First Trust NASDAQ® Clean

Edge® Smart Grid Infrastructure Index Fund, an exchange-traded fund

advised by FTA.

The following dates apply to today’s distribution

declarations:

Expected Ex-Dividend Date:

June 11, 2013 Record Date: June 13, 2013

Payable Date: June 28, 2013

Ordinary Income

INDEX EXCHANGE-TRADED FUND

Per Share

Ticker

Exchange

Fund Name

Frequency

Amount

First Trust Exchange-Traded Fund

II

GRID NASDAQ First Trust NASDAQ® Clean Edge® Smart Grid

Infrastructure Index Fund

Quarterly

$0.3904

First Trust Advisors L.P., the Fund’s investment advisor, along

with its affiliate First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $70 billion

as of May 31, 2013, through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds and separate managed

accounts.

You should consider the investment objectives, risks, charges

and expenses of the Fund before investing. The prospectus for the

Fund contains this and other important information and are

available free of charge by calling toll-free at 1-800-621-1675 or

visiting www.ftportfolios.com. A prospectus should be

read carefully before investing.

Past performance is no assurance of future results. Principal

Risk Factors: The Fund’s shares will change in value, and you could

lose money by investing in the Fund. An investment in the Fund

involves risk similar to those of investing in any fund of equity

securities traded on exchanges. The risks of investing in the Fund

are spelled out in its prospectus, shareholder report, and other

regulatory filings.

The Fund may invest in small capitalization and mid

capitalization companies. Such companies may experience greater

price volatility than larger, more established companies. The Fund

may be concentrated in securities of companies in a certain sector

or industry which subjects the Fund to additional risks, including

limited diversification. The Fund invests in foreign securities and

may be subject to additional risks not associated with domestic

securities. An index ETF seeks investment results that correspond

generally to the price and yield of an index. You should anticipate

that the value of the Fund’s shares will decline, more or less, in

correlation with any decline in the value of the index. The Fund’s

return may not match the return of the index. Unlike the Fund, the

index does not actually hold a portfolio of securities and

therefore does not incur the expenses incurred by the Fund.

The Fund is also subject to replication management risk,

non-diversification risk, industrials sector risk, smart grid risk,

non U.S. securities risk, depository receipts risk, currency risk

and securities lending risk.

Investors buying or selling Fund shares on the secondary market

may incur brokerage commissions. Investors who sell Fund shares may

receive less than the share’s net asset value. Unlike shares of

open-end mutual funds, investors are generally not able to purchase

Fund shares directly from the Fund and individual shares are not

redeemable. However, specified large blocks of shares called

“creation units” can be purchased from, or redeemed to, the

Fund.

First Trust Advisors L.P.Press Inquiries: Jane Doyle,

630-765-8775Analyst Inquiries: Eric Anderson, 630-517-7676Broker

Inquiries: Ryan Issakainen, 630-765-8689

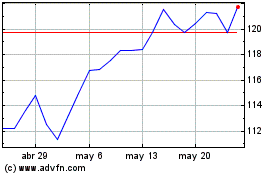

First Trust NASDAQ Clean... (NASDAQ:GRID)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

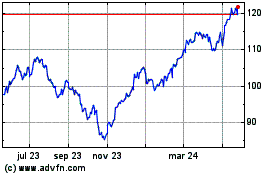

First Trust NASDAQ Clean... (NASDAQ:GRID)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024