UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

__________________________________________

Filed by the Registrant Filed by a party other than the Registrant

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

| |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ | Definitive Proxy Statement |

| |

☒ | Definitive Additional Materials |

| |

☐ | Soliciting Material under §240.14a-12 |

Groupon, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: |

| |

| (2) Aggregate number of securities to which transaction applies: |

| |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) Proposed maximum aggregate value of transaction: |

| |

| (5) Total fee paid: |

| |

☐ | Fee previously paid with preliminary materials. |

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amounts Previously Paid |

| |

| (2) Form, Schedule or Registration Statement No.: |

| |

| (3) Filing Party: |

| |

| (4) Date Filed: |

EXPLANATORY NOTE

This Supplement Number 1 to Schedule 14A (“Supplement 1”) is being filed by Groupon, Inc. (the “Company”) to supplement its definitive proxy statement for the Company’s annual meeting of stockholders to be held on June 12, 2024 (the “Annual Meeting”), which was filed with the U.S. Securities and Exchange Commission (“SEC”) on April 29, 2024 (the “Proxy Statement”), in order to provide updated information about Dusan Senkypl and updated disclosure under the heading “New Plan Benefits under the 2011 Incentive Plan.” Except as specifically provided herein in this Supplement 1, Supplement 1 does not otherwise modify or update any other disclosures presented in the Proxy Statement. In addition, this Supplement 1 does not reflect any other events occurring after the date of the Proxy Statement or modify or update disclosures that may have been affected by subsequent events.

SUPPLEMENTAL DISCLOSURE DATED MAY 23, 2024

REGARDING DUSAN SENKYPL AND NEW PLAN BENEFITS IN CONNECTION WITH THE

SHARE INCREASE AMENDMENT

THIS SUPPLEMENT 1 SHOULD BE READ TOGETHER WITH THE PROXY STATEMENT

On April 29, 2024, the Company filed the Proxy Statement with the SEC relating to the Annual Meeting.

On May 7, 2024, the Company announced that its Board of Directors (the “Board”) appointed Dusan Senkypl as permanent Chief Executive Officer of the Company. Further information associated with the appointment described in this Supplement 1 is available in the Company’s Current Report on Form 8-K filed with the SEC on May 7, 2024.

Additionally, included in the Proxy Statement is a proposal to increase the number of shares of Company common stock approved for issuance under the Company’s 2011 Incentive Plan, as amended (the “2011 Incentive Plan”), by 7,000,000 shares (the “Share Increase Amendment”).

The Company is furnishing this Supplement 1 to provide updated disclosure regarding Dusan Senkypl’s new role as well as “New Plan Benefits under the 2011 Incentive Plan” in connection with the Share Increase Amendment resulting from conditional performance share unit (“PSU”) awards made following the Proxy Statement’s filing and under the previously disclosed performance-based equity program (the “2024 PSU Program”) to Dusan Senkypl, the Company’s Chief Executive Officer, Jiri Ponrt, the Company’s Chief Financial Officer, and the Company’s executive team.

Supplemental Disclosure to Proxy Statement

Dusan Senkypl

The section titled “Board of Director Biographies” on page 4 of the Proxy Statement contains information regarding Mr. Senkypl’s biography and related information. Such information is revised as follows to reflect Mr. Senkypl’s appointment to Chief Executive Officer:

| | | | | |

Dusan Senkypl Age 48 Director and Chief Executive Officer

| Experience •Groupon Director (2022-present) (originally appointed pursuant to the terms of a Cooperation Agreement, dated as of June 13, 2022); Interim Chief Executive Officer (March 2023-May 2024); Chief Executive Officer (May 2024-present) •Partner of Pale Fire Capital SE (“PFC”), the Company’s largest stockholder, and a private equity investment group that invests in e-commerce companies both in Europe and worldwide, since January 2017, where he also served as a director from November 2019 to April 2021, and has served as chairman of the board of directors (April 2021-present) •Director at Aukro s.r.o., the largest Czech online marketplace (2019-present) •Director and chairman of the board of directors at Rouvy, SE, a global indoor cycling app competing with Zwift Inc. (2021-present) •Founder and chief executive officer of NetBrokers Holding (“NBH”), which became the largest insurance and finance marketplace in the Czech Republic and Slovakia (2014-2018) •Co-founder, chief executive officer and director, ePojisteni.cz, an insurance technology company (2009-2019)

Skills & Qualifications •Technology / E-commerce •International •Public Investment / Portfolio Management

Mr. Senkypl brings to the Board significant e-commerce leadership experience gained from leadership positions at several e-commerce, Internet and technology companies.

|

|

New Plan Benefits under the 2011 Incentive Plan

On May 6, 2024, Mr. Ponrt executed a Performance Share Unit Award Agreement awarding him 522,731 PSUs, and on May 7, 2024, Mr. Senkypl executed a Performance Share Unit Award Agreement awarding him 1,393,948 PSUs.

The Compensation Committee of the Board also approved PSU awards for the Company’s executive team in the aggregate amount of approximately 1.9 million shares of common stock (together with the PSUs awarded to Messrs. Ponrt and Senkypl, the “Contingent Awards”). Each of these executives has executed or will execute a Performance Share Unit Award Agreement. The Contingent Awards have an award date of May 1, 2024, and they are subject to stockholder approval of the Share Increase Amendment at the Annual Meeting.

The section entitled “New Plan Benefits under the 2011 Incentive Plan” on page 67 of the Proxy Statement is updated to include the below information:

| | | | | | | | |

Name and Position | Dollar Value | Number of Shares(3) |

Dusan Senkypl, Chief Executive Officer | $11,500,071(1) | 1,393,948 |

Kedar Desphpande, former Chief Executive Officer | N/A | N/A |

Jiri Ponrt, Chief Financial Officer | $4,312,531(1) | 522,731 |

Damien Schmitz, former Chief Financial Officer | N/A | N/A |

Dane Drobny, former Chief Administrative Officer, General Counsel, and Corporate Secretary | N/A | N/A |

Executive Group | $15,812,602(1) | 1,916,679 |

Non-Executive Director Group | $608,333(2) | N/A |

Non-Executive Officer Employee Group | $16,128,866(1) | 1,955,014 |

(1) The amount reflected is the preliminary aggregate fair value estimate of each Contingent Award, determined utilizing a Monte Carlo pricing model as of the May 1, 2024 award date, with the following assumptions:

| | | | | | | | |

Assumption | | Value |

| Expected Volatility (3 Year Historical) | | 92.8% |

| Risk-free Interest Rate | | 4.7% |

| Dividend Yield | | 0.0% |

| Expected Term | | 3 Years |

| Length of Performance Period | | 3 Years |

•Our “Expected Volatility” is based on Groupon’s 3-year historical volatility over the expected term.

•The “Risk-Free Interest Rate” that we use is based on the United States Treasury yield in effect on the award date for zero coupon United States Treasury notes with maturities equal to a 3-year expected term.

•We do not currently issue dividends; therefore, a 0.00% “Dividend Yield” has been used to simulate the ending value of our stock delivered.

•The “Expected Term” is based on the time period from the valuation date (here, the award date) to the end of the performance period.

These assumptions may not be representative of the assumptions that would apply at the time the Share Increase Amendment is approved by stockholders, and which would consequently be used in calculating the actual aggregate fair value for purposes of ASC Topic 718. An increase in the assumed values for the expected volatility and risk-free interest rate, and/or the trading price of our common stock (assuming all other assumptions remain constant) will generally result in a higher value than the preliminary aggregate fair value estimate of the Contingent Awards reported in this table. A decrease in the assumed values for the expected volatility, expected term and risk-free interest rate, and/or the trading price of our common stock (assuming all other assumptions remain constant) will generally result in a lower value than the preliminary aggregate fair value estimate of the Contingent Awards reported in this table.

(2) The amount disclosed is equal to the total dollar value of all annual stock grants to be issued to our non-employee directors following the Annual Meeting, including the total dollar value of any portion of the annual cash retainer that any non-employee director elected to defer into an award of deferred stock units. Share figures will be determined by dividing the dollar value by the closing share price on the date of the Annual Meeting (rounded to the nearest share).

(3) Because Mr. Deshpande, Mr. Schmitz, and Mr. Drobny are all former named executive officers that separated or resigned from the Company in 2023, none of them are eligible for any PSU awards under the 2011 Incentive Plan.

Except as described above, this Supplement 1 does not modify, amend, supplement or otherwise affect the Proxy Statement. This Supplement 1 should be read together with the Proxy Statement. If you have already returned your proxy card or voting instruction form, or voted by other means, you do not need to take any action unless you wish to change your vote. If you wish to change your vote on any proposal, you may submit a new proxy card or take other action as described in the Proxy Statement.

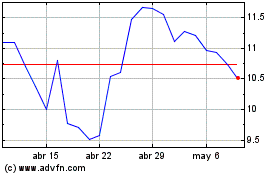

Groupon (NASDAQ:GRPN)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Groupon (NASDAQ:GRPN)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024