Form 8-K - Current report

14 Agosto 2023 - 6:10AM

Edgar (US Regulatory)

false 0001563577 0001563577 2023-08-14 2023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 14, 2023

GALERA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-39114 |

|

46-1454898 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

45 Liberty Blvd #230

Malvern, PA 19355

(Address of principal executive offices) (Zip Code)

(610) 725-1500

(Registrant’s telephone number, include area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

GRTX |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

| Item 2.02. |

Results of Operations and Financial Condition. |

On August 14, 2023, Galera Therapeutics, Inc. announced its financial results for the quarter ended June 30, 2023. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1 attached hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly provided by specific reference in such a filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

Exhibit 99.1 relating to Item 2.02 shall be deemed to be furnished, and not filed:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

GALERA THERAPEUTICS, INC. |

|

|

|

|

| Date: August 14, 2023 |

|

|

|

By: |

|

/s/ J. Mel Sorensen, M.D. |

|

|

|

|

|

|

J. Mel Sorensen, M.D. |

|

|

|

|

|

|

President and Chief Executive Officer |

Exhibit 99.1

Galera Reports Second Quarter 2023 Financial Results and Recent Corporate Updates

Company received Complete Response Letter from FDA for avasopasem and intends to request Type A meeting with FDA to discuss potential next

steps

Cash runway extended into Q2 2024 in connection with reduction in workforce

FDA granted orphan drug designation to rucosopasem for the treatment of pancreatic cancer

Enrollment in GRECO trials with rucosopasem remains ongoing

MALVERN, Pa. – August 14, 2023 – Galera Therapeutics, Inc. (Nasdaq: GRTX), a clinical-stage biopharmaceutical company

focused on developing and commercializing a pipeline of novel, proprietary therapeutics that have the potential to transform radiotherapy in cancer, today announced financial results for the second quarter ended June 30, 2023, and provided

recent corporate updates.

“Following the FDA’s decision on the avasopasem NDA, we have taken decisive steps to extend our cash runway as we

seek a Type A meeting with the FDA to discuss the potential path forward for approval,” said Mel Sorensen, M.D., Galera’s President and CEO. “In parallel, enrollment continues in the ongoing GRECO trials of rucosopasem, our

anti-cancer candidate, as we investigate the novel compound’s potential to enhance stereotactic body (high daily dose) radiotherapy and extend the lives of patients with deadly cancers.”

Radiotherapy-Induced Severe Oral Mucositis (SOM)

| |

• |

|

In August 2023, the Company announced that the U.S. Food and Drug Administration (FDA) issued a Complete Response

Letter (CRL) for the New Drug Application (NDA) for avasopasem for radiotherapy-induced SOM in patients with head and neck cancer (HNC) undergoing standard-of-care

treatment. In the CRL, the FDA communicated that the results from the Phase 3 ROMAN trial together with the supporting data from the GT-201 trial are not sufficiently persuasive to establish substantial

evidence of avasopasem’s effectiveness and safety for reducing SOM in patients with HNC. FDA stated that results from an additional clinical trial will be required for resubmission. The Company intends to request a Type A meeting with the FDA

to understand the FDA’s rationale for its decision and discuss next steps to support an NDA resubmission seeking approval of avasopasem. |

Cisplatin-Related Chronic Kidney Disease

| |

• |

|

In June 2023, Galera presented an abstract featuring avasopasem, as part of the Head and Neck Cancer session at

the American Society of Clinical Oncology (ASCO) Annual Meeting, which took place June 2-6, 2023, in Chicago, IL. The abstract, titled “One-year reductions in

cisplatin-related chronic kidney disease (CKD) in patients with head and neck cancer (HNC) treated with avasopasem manganese: A prespecified analysis from the Phase 3 ROMAN trial,” noted significant improvements in preservation of kidney

function compared to placebo based on mean change in estimated Glomerular Filtration Rate, beginning by 3 months through one-year end of follow-up. Reductions in CKD

were consistent across cisplatin dosing schedules. |

Locally Advanced Pancreatic Cancer (LAPC)

| |

• |

|

Enrollment is ongoing in the randomized, placebo-controlled Phase 2b

GRECO-2 trial of rucosopasem in combination with SBRT in patients with LAPC. The primary endpoint of the trial is overall survival. Completion of enrollment continues to be anticipated in the first half of

2024, and topline data readout is expected by the end of 2024. |

| |

• |

|

In May 2023, the FDA granted Orphan Drug Designation for rucosopasem for the treatment of pancreatic cancer.

|

Non-Small Cell Lung Cancer (NSCLC)

| |

• |

|

Enrollment is ongoing in the randomized, placebo-controlled Phase 2 stage of the

GRECO-1 trial of rucosopasem in combination with SBRT in patients with NSCLC. Completion of enrollment continues to be anticipated in the second half of 2023, and topline data readout is expected in the second

half of 2024. |

General Corporate Updates

| |

• |

|

In connection with the CRL announcement, on August 9, 2023, the Company further announced it will focus

resources on defining the path forward for avasopasem, progressing the ongoing clinical trials for rucosopasem, and concurrently evaluating strategic alternatives, including partnering, for the continued development of avasopasem and rucosopasem. As

a result, the Company reduced its workforce by approximately 70%. The plan includes a wind-down of commercial readiness efforts and headcount reductions across several departments. |

Second Quarter 2023 Financial Highlights

| |

• |

|

Research and development expenses were $7.6 million in the second quarter of 2023, compared to

$6.6 million for the same period in 2022. The increase was primarily attributable to an increase in rucosopasem development costs, partially offset by a decrease in avasopasem development costs. |

| |

• |

|

General and administrative expenses were $9.2 million in the second quarter of 2023, compared to

$5.3 million for the same period in 2022. The increase was primarily attributable to avasopasem commercial preparations. |

| |

• |

|

Galera reported a net loss of $(20.7) million, or $(0.48) per share, for the second quarter of 2023, compared to

a net loss of $(14.6) million, or $(0.54) per share, for the same period in 2022. |

| |

• |

|

As of June 30, 2023, Galera had cash, cash equivalents and short-term investments of $38.8 million.

Galera expects that its existing cash, cash equivalents and short-term investments, taking into account the implementation of the reduction in workforce announced in August 2023, will enable Galera to fund its operating expenses and capital

expenditure requirements into the second quarter of 2024. |

About Galera Therapeutics

Galera Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing and commercializing a pipeline of novel, proprietary therapeutic

candidates that have the potential to transform radiotherapy in cancer. Galera’s selective dismutase mimetic product candidate avasopasem manganese (avasopasem) is being developed for radiation-induced toxicities. The FDA has granted Fast Track

and Breakthrough Therapy designations to avasopasem for the reduction of severe oral mucositis induced by radiotherapy. The Company’s second product candidate, rucosopasem manganese (rucosopasem), is in clinical-stage development to augment the

anti-cancer efficacy of stereotactic body radiation therapy in patients with non-small cell lung cancer and locally advanced pancreatic cancer. Rucosopasem was granted Orphan Drug Designation by the FDA for

the treatment of pancreatic cancer. Galera is headquartered in Malvern, PA.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in

this press release that do not relate to matters of historical fact should be considered forward-looking statements, including without limitation statements regarding: the expectations surrounding the continued advancement of Galera’s product

pipeline; the potential safety and efficacy of Galera’s product candidates and their regulatory and clinical development; the Company’s intention to request and hold a Type A meeting with the FDA in order to understand the FDA’s

rationale for its decision and discuss next steps to support an NDA resubmission seeking approval of avasopasem; the Company’s ability to resubmit the NDA; the Company’s plans to take actions, and the potential for those actions, to extend

its cash runway; the Company’s intention to pursue strategic alternatives; the expectations surrounding the progress of the randomized, placebo-controlled Phase 2b GRECO-2 trial of rucosopasem in

combination with stereotactic body radiation therapy (SBRT) in patients with LAPC and the timing of completion of enrollment of the trial and topline data readout therefrom; the expectations surrounding the randomized, placebo-controlled Phase 2

stage of the GRECO-1 trial of rucosopasem in combination with SBRT in patients with NSCLC and the timing of completion of enrollment of the trial and topline data readout therefrom; the expected financial and

operational impacts of Galera’s recent reduction in force; Galera’s ability to fund its operating expenses and capital expenditures into the second quarter of 2024; and Galera’s ability to achieve its goal of transforming radiotherapy

in cancer treatment with its selective dismutase mimetics. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties

and other important factors that may cause Galera’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including,

but not limited to, the following: Galera’s limited operating history; anticipating continued losses for the foreseeable future; substantial doubt regarding Galera’s ability to continue as a going concern; needing substantial funding and

the ability to raise capital; Galera’s dependence on avasopasem manganese (GC4419); uncertainties inherent in the conduct of clinical trials; difficulties or delays enrolling patients in clinical trials; the FDA’s acceptance of data from

clinical trials outside the United States; undesirable side effects from Galera’s product candidates; risks relating to the regulatory approval process; failure to capitalize on more profitable product candidates or indications; ability to

receive or maintain Breakthrough Therapy Designation or Fast Track Designation for product candidates; failure to obtain regulatory approval of

product candidates in the United States or other jurisdictions; ongoing regulatory obligations and continued regulatory review; risks related to commercialization; risks related to competition;

ability to retain key employees; risks related to intellectual property; inability to maintain collaborations or the failure of these collaborations; Galera’s reliance on third parties; the possibility of system failures or security breaches;

liability related to the privacy of health information obtained from clinical trials and product liability lawsuits; unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives; environmental, health and

safety laws and regulations; Galera’s recent reduction in force undertaken to significantly reduce our ongoing operating expenses may not result in our intended outcomes and may yield unintended consequences and additional costs; Galera may not

be able to enter into any desired strategic alternative or partnership on a timely basis, on acceptable terms, or at all; if Galera is unable to secure additional funding or enter into any desired strategic alternative or partnership, it may need to

cease operations; the impact of the COVID-19 pandemic on Galera’s business and operations, including preclinical studies and clinical trials, and general economic conditions; risks related to ownership of

Galera’s common stock; and significant costs as a result of operating as a public company. These and other important factors discussed under the caption “Risk Factors” in Galera’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (SEC) and Galera’s other filings with the SEC could cause actual results to differ materially from those

indicated by the forward-looking statements made in this press release. Any forward-looking statements speak only as of the date of this press release and are based on information available to Galera as of the date of this release, and Galera

assumes no obligation to, and does not intend to, update any forward-looking statements, whether as a result of new information, future events or otherwise.

Galera Therapeutics, Inc.

Consolidated Statements of Operations

(unaudited, in thousands except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

$ |

7,561 |

|

|

$ |

6,636 |

|

|

$ |

14,833 |

|

|

$ |

14,743 |

|

| General and administrative |

|

|

9,246 |

|

|

|

5,293 |

|

|

|

15,855 |

|

|

|

10,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(16,807 |

) |

|

|

(11,929 |

) |

|

|

(30,688 |

) |

|

|

(25,083 |

) |

| Other income (expense), net |

|

|

(3,905 |

) |

|

|

(2,629 |

) |

|

|

(7,734 |

) |

|

|

(4,918 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(20,712 |

) |

|

$ |

(14,558 |

) |

|

$ |

(38,422 |

) |

|

$ |

(30,001 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share of common stock, basic and diluted |

|

$ |

(0.48 |

) |

|

$ |

(0.54 |

) |

|

$ |

(0.98 |

) |

|

$ |

(1.12 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding, basic and diluted |

|

|

42,916,962 |

|

|

|

26,821,303 |

|

|

|

39,077,876 |

|

|

|

26,785,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Galera Therapeutics, Inc.

Selected Consolidated Balance Sheet Data

(unaudited, in thousands)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2023 |

|

|

December 31,

2022 |

|

| Cash, cash equivalents, and short-term investments |

|

$ |

38,755 |

|

|

$ |

31,597 |

|

| Total assets |

|

|

48,276 |

|

|

|

44,036 |

|

| Total current liabilities |

|

|

13,622 |

|

|

|

13,379 |

|

| Total liabilities |

|

|

163,275 |

|

|

|

153,217 |

|

| Total stockholders’ deficit |

|

|

(114,999 |

) |

|

|

(109,181 |

) |

###

Investor Contacts:

Christopher Degnan

Galera Therapeutics, Inc.

610-725-1500

cdegnan@galeratx.com

William Windham

Solebury Strategic Communications

646-378-2946

wwindham@soleburystrat.com

Media Contact:

Timothy Biba

Solebury Strategic Communications

646-378-2927

tbiba@soleburystrat.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

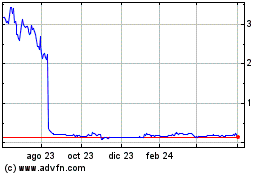

Galera Therapeutics (NASDAQ:GRTX)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

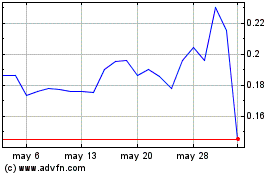

Galera Therapeutics (NASDAQ:GRTX)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025