UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-38631

CHEER HOLDING, INC.

22F, Block B, Xinhua

Technology Building,

No. 8 Tuofangying

South Road,

Jiuxianqiao, Chaoyang

District, Beijing, China 100016

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Explanatory Note

CHEER

HOLDING, INC. (the “Company”) is furnishing this Form 6-K to provide its six-month interim financial statements and

to incorporate such financial statements into the Company’s registration statements referenced below.

This

Form 6-K and Exhibits 99.1 and 99.2 attached hereto shall be deemed to be incorporated by reference into the Company’s registration

statements on Form S-8 (File No. 333-237788) and on Form F-3 (File No. 333-279221), to be a part thereof from the date on which this

report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

Exhibit Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

CHEER HOLDING, INC. |

| |

|

| |

By: |

/s/ Bing Zhang |

| |

Name: |

Bing Zhang |

| |

Title: |

Chief Executive Officer |

| |

|

| Dated: July 31, 2024 |

|

2

Exhibit 99.1

CHEER HOLDING, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(In U.S. dollars in thousands, except share

and per share data)

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 186,089 | | |

$ | 194,227 | |

| Restricted cash | |

| 291 | | |

| 298 | |

| Accounts receivable, net | |

| 79,818 | | |

| 81,170 | |

| Prepayment and other current assets, net | |

| 47,803 | | |

| 31,179 | |

| Total current assets | |

| 314,001 | | |

| 306,874 | |

| Property, plant and equipment, net | |

| 53 | | |

| 85 | |

| Intangible assets, net | |

| 18,176 | | |

| 20,255 | |

| Deferred tax assets | |

| 601 | | |

| 41 | |

| Unamortized produced content, net | |

| 16 | | |

| - | |

| Right-of-use assets | |

| 394 | | |

| 377 | |

| Total non-current assets | |

| 19,240 | | |

| 20,758 | |

| TOTAL ASSETS | |

$ | 333,241 | | |

$ | 327,632 | |

| | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term bank loans | |

$ | 6,880 | | |

$ | 4,216 | |

| Accounts payable | |

| 2,671 | | |

| 9,599 | |

| Contract liabilities | |

| 126 | | |

| 130 | |

| Accrued liabilities and other payables | |

| 3,881 | | |

| 3,764 | |

| Other taxes payable | |

| 31,774 | | |

| 28,178 | |

| Lease liabilities current | |

| 144 | | |

| 330 | |

| Total current liabilities | |

| 45,476 | | |

| 46,217 | |

| Long-term bank loan | |

| 1,376 | | |

| 1,408 | |

| Lease liabilities non-current | |

| 241 | | |

| - | |

| Total non-current liabilities | |

| 1,617 | | |

| 1,408 | |

| TOTAL LIABILITIES | |

$ | 47,093 | | |

$ | 47,625 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Ordinary shares (par value of $0.001 per share; 200,000,000 shares authorized as of June 30, 2024 and December 31, 2023; 10,285,568 and 10,070,012 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively) | |

$ | 10 | | |

$ | 10 | |

| Additional paid-in capital | |

| 106,795 | | |

| 106,215 | |

| Statutory reserve | |

| 1,411 | | |

| 1,411 | |

| Retained earnings | |

| 193,578 | | |

| 181,162 | |

| Accumulated other comprehensive loss | |

| (15,723 | ) | |

| (8,869 | ) |

| TOTAL CHEER HOLDING, INC SHAREHOLDERS’ EQUITY | |

| 286,071 | | |

| 279,929 | |

| Non-controlling interest | |

| 77 | | |

| 78 | |

| TOTAL EQUITY | |

| 286,148 | | |

| 280,007 | |

| TOTAL LIABILITIES AND EQUITY | |

$ | 333,241 | | |

$ | 327,632 | |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

CHEER HOLDING, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF INCOME AND

COMPREHENSIVE INCOME (LOSS)

(In U.S. dollars in thousands, except share

and per share data)

| | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenues | |

$ | 71,055 | | |

$ | 67,435 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Cost of revenues | |

| (18,885 | ) | |

| (16,946 | ) |

| Selling and marketing | |

| (37,559 | ) | |

| (38,870 | ) |

| General and administrative | |

| (1,611 | ) | |

| (2,266 | ) |

| Research and development | |

| (1,361 | ) | |

| (641 | ) |

| Total operating expenses | |

| (59,416 | ) | |

| (58,723 | ) |

| | |

| | | |

| | |

| Income from operations | |

| 11,639 | | |

| 8,712 | |

| | |

| | | |

| | |

| Other income (expenses): | |

| | | |

| | |

| Interest income, net | |

| 223 | | |

| 32 | |

| Change in fair value of warrant liability | |

| - | | |

| 79 | |

| Other (expense) income, net | |

| (23 | ) | |

| 13 | |

| Total other income | |

| 200 | | |

| 124 | |

| | |

| | | |

| | |

| Income before income tax | |

| 11,839 | | |

| 8,836 | |

| | |

| | | |

| | |

| Income tax benefits (expenses) | |

| 578 | | |

| (37 | ) |

| Net income | |

| 12,417 | | |

| 8,799 | |

| | |

| | | |

| | |

| Less: net gain attributable to non-controlling interest | |

| 1 | | |

| 52 | |

| Net income attributable to Cheer Holding. Inc’s shareholders | |

$ | 12,416 | | |

$ | 8,747 | |

| | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | |

| Unrealized foreign currency translation loss | |

| (6,856 | ) | |

| (8,907 | ) |

| Comprehensive income (loss) | |

| 5,561 | | |

| (108 | ) |

| Less: comprehensive loss attributable to non-controlling interests | |

| (1 | ) | |

| - | |

| Comprehensive income (loss) attributable to Cheer Holding. Inc’s shareholders | |

$ | 5,562 | | |

$ | (108 | ) |

| | |

| | | |

| | |

| Earnings per ordinary share | |

| | | |

| | |

Basic and Diluted | |

$ | 1.23 | | |

$ | 1.17 | |

| | |

| | | |

| | |

| Weighted average shares used in calculating earnings per ordinary share | |

| | | |

| | |

Basic and Diluted | |

| 10,058,846 | | |

| 7,507,504 | |

| |

* |

Retroactively restated to give effect to a share consolidation at a ratio of one-for-tenth ordinary shares effective on November 24, 2023 (Note 1). |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

CHEER HOLDING, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF CHANGES IN EQUITY

(In U.S. dollars in thousands, except share

and per share data)

| | |

Ordinary shares | | |

Additional

paid-in | | |

Retained | | |

Statutory | | |

Accumulated

other

comprehensive

(loss) | | |

Total

shareholders’ | | |

Non-

controlling | | |

Total | |

| | |

Shares* | | |

Amount | | |

capital | | |

earnings | | |

reserve | | |

gain | | |

equity | | |

interests | | |

Equity | |

| Balance as of December 31, 2022 | |

| 6,812,440 | | |

| 7 | | |

| 27,009 | | |

| 150,685 | | |

| 1,411 | | |

| (6,684 | ) | |

| 172,428 | | |

| 75 | | |

| 172,503 | |

| Contribution from shareholder | |

| - | | |

| - | | |

| 463 | | |

| - | | |

| - | | |

| - | | |

| 463 | | |

| - | | |

| 463 | |

| Issuance of shares through private placement | |

| 2,419,355 | | |

| 2 | | |

| 59,998 | | |

| - | | |

| - | | |

| - | | |

| 60,000 | | |

| - | | |

| 60,000 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| 8,747 | | |

| - | | |

| - | | |

| 8,747 | | |

| 52 | | |

| 8,799 | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (8,855 | ) | |

| (8,855 | ) | |

| (52 | ) | |

| (8,907 | ) |

| Balance as of June 30, 2023 | |

| 9,231,795 | | |

| 9 | | |

| 87,470 | | |

| 159,432 | | |

| 1,411 | | |

| (15,539 | ) | |

| 232,783 | | |

| 75 | | |

| 232,858 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as of December 31, 2023 | |

| 10,070,012 | | |

| 10 | | |

| 106,215 | | |

| 181,162 | | |

| 1,411 | | |

| (8,869 | ) | |

| 279,929 | | |

| 78 | | |

| 280,007 | |

| Withdrawal of contribution from shareholder | |

| - | | |

| - | | |

| (4 | ) | |

| - | | |

| - | | |

| - | | |

| (4 | ) | |

| - | | |

| (4 | ) |

| Share-based compensation to one employee** | |

| 231,909 | | |

| 0 | | |

| 584 | | |

| - | | |

| - | | |

| - | | |

| 584 | | |

| - | | |

| 584 | |

| Cancellation of shares due to roundup of fraction shares in share consolidation** | |

| (16,353 | ) | |

| 0 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net income | |

| - | | |

| - | | |

| - | | |

| 12,416 | | |

| - | | |

| - | | |

| 12,416 | | |

| 1 | | |

| 12,417 | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,854 | ) | |

| (6,854 | ) | |

| (2 | ) | |

| (6,856 | ) |

| Balance as of June 30, 2024 | |

| 10,285,568 | | |

| 10 | | |

| 106,795 | | |

| 193,578 | | |

| 1,411 | | |

| (15,723 | ) | |

| 286,071 | | |

| 77 | | |

| 286,148 | |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

CHEER HOLDING, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(In U.S. dollars in thousands)

| | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net cash (used in) provided by operating activities | |

| (6,741 | ) | |

| 27,179 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property, plant and equipment | |

| - | | |

| (4 | ) |

| Loans made to a third party | |

| - | | |

| (58 | ) |

| Net cash used in investing activities | |

| - | | |

| (62 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from issuance of ordinary shares in connection with a private placement | |

| - | | |

| 60,000 | |

| Proceeds from bank loans | |

| 7,071 | | |

| 2,598 | |

| Repayments of bank loans | |

| (4,242 | ) | |

| (4,041 | ) |

| Payment of loan origination fees | |

| (58 | ) | |

| (11 | ) |

| Borrowings from a related party | |

| 205 | | |

| 1,000 | |

| Contribution from shareholders | |

| - | | |

| 463 | |

| Withdrawal of contribution from shareholder | |

| (4 | ) | |

| - | |

| Net cash provided by financing activities | |

| 2,972 | | |

| 60,009 | |

| | |

| | | |

| | |

| Effect of exchange rate changes | |

| (4,376 | ) | |

| (5,167 | ) |

| | |

| | | |

| | |

| Net (decrease) increase in cash and cash equivalents | |

| (8,145 | ) | |

| 81,959 | |

| Cash and cash equivalents, at beginning of period | |

| 194,525 | | |

| 70,482 | |

| Cash and cash equivalents, at end of period | |

$ | 186,380 | | |

| 152,441 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |

| | | |

| | |

| Interests paid | |

$ | 199 | | |

$ | 77 | |

| Lease liabilities arising from obtaining right-of-use assets | |

$ | 466 | | |

$ | 202 | |

| Change in fair value of warrant liabilities | |

$ | - | | |

$ | (79 | ) |

RECONCILIATION OF CASH, CASH EQUIVALENTS AND

RESTRICTED CASH TO THE CONSOLIDATED BALANCE SHEETS

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Cash and cash equivalents | |

$ | 186,089 | | |

$ | 194,227 | |

| Restricted cash | |

| 291 | | |

| 298 | |

| | |

$ | 186,380 | | |

$ | 194,525 | |

The accompanying notes are an integral part of

these unaudited condensed consolidated financial statements.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

1. ORGANIZATION AND PRINCIPAL ACTIVITIES

Cheer Holding, Inc. (“CHR” or the

“Company”) is an exempted company incorporated on November 30, 2018, under the laws of the Cayman Islands. CHR through

its subsidiaries, the VIE and the VIE’s subsidiaries, provides advertisement and content production services and operate a leading

mobile and online advertising, media and entertainment business in China.

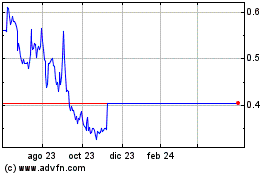

On November 1, 2023, the Company changed its legal

name from Glory Star New Media Group Holdings Limited. to Cheer Holding, Inc. In connection with the name change, the Company also changed

its trading symbol for tis ordinary shares from “GSMG” to “CHR”. The Company’s warrants continue to trade

under the ticker symbol “GSMGW”. Effective on November 9, 2023, the Company traded on open market under new name and trading

symbol.

On November 24, 2023, the Company effected a share

consolidation at a ratio of one-for-tenth (10) ordinary shares with a par value of US$0.0001 each in the Company’s issued and unissued

share capital into one ordinary share with a par value of US$0.001 (“the Share Consolidation”). Immediately following the

Share Consolidation, the authorized share capital of the Company to be US$20,200 divided into 20,000,000 ordinary shares of a par value

of US$0.001 each and 2,000,000 preferred shares of a par value of US$0.0001 each

As of June 30, 2024, the Company’s subsidiaries,

the VIEs and the VIE’s subsidiaries were as the following:

| | | Date of

incorporation | | Place of

incorporation | | Percentage of

legal/beneficial

ownership

by the

Company | | | Principal

activities |

| Subsidiaries: | | | | | | | | | |

Glory Star New Media Group HK Limited

(“Glory Star HK”) | | December 18, 2018 | | Hong Kong | | | 100 | % | | Holding |

Glory Star New Media (Beijing)

Technology Co., Ltd. (“WFOE”) | | March 13, 2019 | | PRC | | | 100 | % | | Holding |

| VIEs: | | | | | | | | | | |

Xing Cui Can International Media (Beijing)

Co., Ltd. (“Xing Cui Can”) | | September 7, 2016 | | PRC | | | 100 | % | | Holding |

Horgos Glory Star Media Co., Ltd.

(“Horgos”) | | November 1, 2016 | | PRC | | | 100 | % | | Holding |

| VIEs’ subsidiaries | | | | | | | | | | |

Glory Star Media (Beijing) Co., Ltd.

(“Glory Star Beijing”) | | December 9, 2016 | | PRC | | | 100 | % | | Provision of provides advertisement and content production services |

Leshare Star (Beijing) Technology Co., Ltd.

(“Beijing Leshare”) | | March 28, 2016 | | PRC | | | 100 | % | | Provision of provides advertisement and content production services |

Horgos Glary Prosperity Culture Co., Ltd.

(“Glary Prosperity”) | | December 14, 2017 | | PRC | | | 51 | % | | Provision of provides advertisement and content production services |

Horgos Glary Prosperity Culture Co., Ltd,

Beijing Branch (“Glary Prosperity BJ”) | | May 8, 2018 | | PRC | | | 51 | % | | Provision of provides advertisement and content production services |

Glory Star (Horgos) Media Technology Co., Ltd

(“Horgos Technology”) | | September 9, 2020 | | PRC | | | 100 | % | | Provision of provides advertisement and content production services |

| * | On March 17, 2023, we wrote off Shenzhen Leshare Investment

Co.,Ltd. due to business adjustment. For the six months ended June 30, 2023, we recognized minimal gain arising from the writing off

and recorded in the account of “other income, net” in the consolidated statements of income and comprehensive income. |

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

The unaudited condensed consolidated financial

statements have been prepared in accordance with the rules and regulations of the Security and Exchange Commission and accounting principles

generally accepted in the United States of America (“U.S. GAAP”) for interim financial reporting. Certain information and

footnote disclosures normally included in financial statements prepared in conformity with U.S. GAAP have been condensed or omitted pursuant

to such rules and regulations. Accordingly, these statements should be read in conjunction with the Company’s audited consolidated

financial statements for the year ended December 31, 2023 filed on March 14, 2024.

In the opinion of the management, the accompanying

unaudited condensed consolidated financial statements reflect all normal recurring adjustments, which are necessary for a fair presentation

of financial results for the interim periods presented. The Group believes that the disclosures are adequate to make the information presented

not misleading. The accompanying unaudited condensed consolidated financial statements have been prepared using the same accounting policies

as used in the preparation of the Company’s consolidated financial statements for the year ended December 31, 2023. The results

of operations for the six months ended June 30, 2024 and 2023 are not necessarily indicative of the results for the full years.

Financial statement amounts and balances

of the VIEs and the VIEs’ subsidiaries

Total assets and liabilities presented on the

Company’s unaudited condensed consolidated balance sheets and revenue, expense, net income presented on the Company’s unaudited

condensed consolidated statements of income as well as the cash flow from operating, investing and financing activities presented on the

unaudited condensed consolidated statements of cash flows are substantially the financial position, operation and cash flow of the VIEs

and the VIEs’ subsidiaries. CHR has not provided any financial support to the VIEs and the VIEs’ subsidiaries for the six

months ended June 30, 2024 and 2023. The following financial statements amounts and balances of the VIEs and the VIEs’ subsidiaries

were included in the unaudited condensed consolidated financial statements as of June 30, 2024 and December 31, 2023, and for the six

months ended June 30, 2024 and 2023:

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Total assets | |

$ | 329,768 | | |

$ | 324,019 | |

| Total liabilities | |

$ | 142,935 | | |

$ | 146,188 | |

| | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Total revenues | |

$ | 71,055 | | |

$ | 67,437 | |

| Net income | |

$ | 13,463 | | |

$ | 10,004 | |

| | |

| | | |

| | |

| Net cash (used in) provided by operating activities | |

$ | (6,247 | ) | |

$ | 24,796 | |

| Net cash used in investing activities | |

$ | - | | |

$ | (61 | ) |

| Net cash provided by financing activities | |

$ | 2,829 | | |

$ | 60,385 | |

The VIEs and the VIEs’ subsidiaries contributed

100% and 100% of the consolidated revenues for the six months ended June 30, 2024 and 2023. As of June 30, 2024 and December 31, 2023,

the VIEs and the VIEs’ subsidiaries accounted for an aggregate of 99.0% and 98.9%, respectively, of the consolidated total assets,

and 94.6% and 95.0%, respectively, of the consolidated total liabilities.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Financial statement amounts and balances

of the VIEs and the VIEs’ subsidiaries (cont.)

There are no terms in any arrangements, considering

both explicit arrangements and implicit variable interests that require the Company or its subsidiaries to provide financial support

to the VIEs. However, the Company has provided and will continue to provide financial support to the VIEs considering the business requirements

of the VIEs, as well as the Company’s own business objectives in the future.

There are no assets held in the VIEs and the VIEs’

subsidiaries that can be used only to settle obligations of the VIEs and the VIEs’ subsidiaries, except for registered capital and

the PRC statutory reserves. As the VIEs and the VIEs’ subsidiaries are incorporated as a limited liability company under the PRC

Company Law, creditors of the VIEs and the VIEs’ subsidiaries do not have recourse to the general credit of the Company for any

of the liabilities of the VIEs and the VIEs’ subsidiaries. Relevant PRC laws and regulations restrict the VIEs and the VIEs’

subsidiaries from transferring a portion of their net assets, equivalent to the balance of its statutory reserve and its share capital,

to the Company in the form of loans and advances or cash dividends.

Accounts Receivable, net

On January 1, 2023, the Company adopted Accounting

Standards Update (“ASU”) No. 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on

Financial Instruments (“ASU 2016-13”), using the modified retrospective transition method. ASU 2016-13 replaces the existing

incurred loss impairment model with an expected loss methodology, which will result in more timely recognition of credit losses. Upon

adoption, the Company changed the impairment model to utilize a forward-looking current expected credit losses (CECL) model in place of

the incurred loss methodology for financial instruments measured at amortized cost and receivables resulting from the application of ASC

606, including contract assets. The adoption of the guidance had no impact on the allowance for credit losses for accounts receivable.

The Company maintains an allowance for credit

losses and records the allowance for credit losses as an offset to accounts receivable and the estimated credit losses charged to the

allowance is classified as “General and administrative expenses” in the unaudited condensed consolidated statements of income

and comprehensive income. The Company assesses collectability by reviewing accounts receivable on an individual basis because the Company

had limited customers and each of them has difference characteristics, primarily based on business line and geographical area. In determining

the amount of the allowance for credit losses, the Company considers historical collectability based on past due status, the age of the

balances, credit quality of the Company’s customers based on ongoing credit evaluations, current economic conditions, reasonable

and supportable forecasts of future economic conditions, and other factors that may affect the Company’s ability to collect from

customers. Delinquent account balances are written-off against the allowance for doubtful accounts after management has determined that

the likelihood of collection is not probable.

Unamortized produced content

Produced content includes direct production costs,

production overhead and acquisition costs and is stated at the lower of unamortized cost or estimated fair value. Produced content also

includes cash expenditures made to enter into arrangements with third parties to co-produce certain of its productions.

The Company uses the individual-film-forecast-computation

method and amortizes the produced content based on the ratio of current period actual revenue (numerator) to estimated remaining unrecognized

ultimate revenue as of the beginning of the fiscal year (denominator) in accordance with ASC 926. Ultimate revenue estimates for the produced

content are periodically reviewed and adjustments, if any, will result in prospective changes to amortization rates. When estimates of

total revenues and other events or changes in circumstances indicate that a film or television series has a fair value that is less than

its unamortized cost, a loss is recognized currently for the amount by which the unamortized cost exceeds the film or television series’

fair value. For the six months ended June 30, 2024 and 2023, $13,020 and $10,617 were amortized to the cost of sales, respectively. For

the six months ended June 30, 2024 and 2023, the Company provided impairment of $nil and $21 against unamortized production cost, respectively.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Accounts payable

Accounts payable represent liabilities for goods

and services provided to the Company prior to the end of financial period which are unpaid. They are classified as current liabilities

if payment is due within one year or less (or in the normal operating cycle of the business if longer). Otherwise, they are presented

as non-current liabilities.

Accounts payable are initially recognized at fair

value, and subsequently carried at amortized cost using the effective interest method.

Contract liabilities

Contract liabilities amounted to $126 and $130

at June 30, 2024 and December 31, 2023, respectively, which represent advance payment received from our customers for goods or services

that had not yet been provided.

The Company will recognize the advances as revenue

when it has transferred control of the goods or services to which the advances relate, and has no obligation under the contract to transfer

additional goods or services.

Revenue Recognition

The Company early adopted the new revenue standard

Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers, on January 1, 2017. The core principle

of this new revenue standard is that a company should recognize revenue to depict the transfer of promised goods or services to customers

in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. The

following five steps are applied to achieve that core principle:

| |

● |

Step 1: Identify the contract with the customer |

| |

● |

Step 2: Identify the performance obligations in the contract |

| |

● |

Step 3: Determine the transaction price |

| |

● |

Step 4: Allocate the transaction price to the performance obligations in the contract |

| |

● |

Step 5: Recognize revenue when the company satisfies a performance obligation |

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Revenue Recognition (cont.)

The Company mainly offers and generates revenue

from the copyright licensing of self-produced content, advertising and customized content production and others. Revenue recognition policies

are discussed as follows:

Copyright revenue

The Company self produces or coproduces TV series

featuring lifestyle, culture and fashion, and licenses the copyright of the TV series on an episode basis to the customer for broadcast

over a period of time. Generally, the Company signs a contract with a customer which requires the Company to deliver a series of episodes

that are substantially the same and that have the same pattern of transfer to the customer. Accordingly, the delivery of the series of

episodes is defined as the only performance obligation in the contract.

For the TV series produced solely by the Company,

the Company satisfies its performance obligation over time by measuring the progress toward the delivery of the entire series of episodes

which is made available to the licensee for exhibition after the license period has begun. Therefore, the copyright revenue in a contract

is recognized over time based on the progress of the number of episodes delivered.

The Company also coproduces TV series with other

producers and licenses the copyright to third-party video broadcast platforms for broadcast. For TV series produced by the Company with

co-producers, the Company satisfies its performance obligations over time by the delivery of the entire series of episodes to the customer,

and requires the customer to pay consideration based on the number and the unit price of valid subsequent views of the TV series that

occur on a broadcast platform. Therefore, the copyright revenue is recognized when the later of the valid subsequent view occurs or the

performance obligation relating to the delivery of a number of episodes has been satisfied.

Advertising revenue

The Company generates revenue from sales of various

forms of advertising on its TV series and streaming content by way of 1) advertisement displays, or 2) the integration of promotion activities

in TV series and content to be broadcast. Advertising contracts are signed to establish the different contract prices for different advertising

scenarios, consistent with the advertising period. The Company enters into advertising contracts directly with the advertisers or the

third-party advertising agencies that represent advertisers.

For the contracts that involve the third-party

advertising agencies, the Company is principal as the Company is responsible for fulfilling the promise of providing advertising services

and has the discretion in establishing the price for the specified advertisement. Under a framework contract, the Company receives separate

purchase orders from advertising agencies before the broadcast. Accordingly, each purchase order is identified as a separate performance

obligation, containing a bundle of advertisements that are substantially the same and that have the same pattern of transfer to the customer.

Where collectability is reasonably assured, revenue is recognized monthly over the service period of the purchase order.

For contracts signed directly with the advertisers,

the Company commits to display a series of advertisements which are substantially the same or similar in content and transfer pattern,

and the display of the whole series of advertisements is identified as the single performance obligation under the contract. The Company

satisfies its performance obligations over time by measuring the progress toward the display of the whole series of advertisements in

a contract, and advertising revenue is recognized over time based on the number of advertisements displayed.

Payment terms and conditions vary by contract

types, and terms typically include a requirement for payment within a period from 6 to 9 months. Both direct advertisers and third-party

advertising agencies are generally billed at the end of the display period and require the Company to issue VAT invoices in order to make

their payments.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Revenue Recognition (cont.)

Customized content production revenue

The Company produces customized short streaming

videos according to its customers’ requirement, and earns fixed fees based on delivery. Revenue is recognized upon the delivery

of short streaming videos.

CHEERS E-mall marketplace service revenue

The Company through CHEERS E-mall, an online e-commerce

platform, enables third-party merchants to sell their products to consumers in China. The Company charges fees for platform services to

merchants for sales transactions completed on the Cheer E-Mall including but not limited to products displaying, promotion and transaction

settlement services. The Company does not take control of the products provided by the merchants at any point in the time during the transactions

and does not have latitude over pricing of the merchandise. Transaction services fee is determined as the difference between the platform

sales price and the settlement price with the merchants. CHEERS E-mall marketplace service revenue is recognized at a point of time when

the Company’s performance obligation to provide marketplace services to the merchants are determined to have been completed under

each sales transaction upon the consumers confirming the receipts of goods. Payments for services are generally received before deliveries.

The Company provides coupons to consumers at our

own discretion as incentives to promote CHEERS E-mall marketplace with validity usually around or less than one week, which can only be

used in future purchases of eligible merchandise offered on CHEERS E-mall to reduce purchase price that are not specific to any merchant.

Consumers are not customers of the Company, therefore incentives offered to consumers are not considered consideration payable to customers.

As the consumers are required to make future purchases of the merchants’ merchandise to redeem these coupons, the Company does not

accrue any expense for coupons when granted and recognizes the amounts of redeemed coupons as marketing expenses when future purchases

are made.

Other Revenues

Other revenue primarily consists of copyrights

trading of purchased and produced TV-series and the sales of products on Taobao platform. For copyright licensing of purchased and produced

TV-series, the Company recognize revenue on net basis at a point of time upon the delivery of master tape and authorization of broadcasting

right. For sales of product, the company recognize revenue upon the transfer of products according to the fixed price and production amount

in sales orders.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Revenue Recognition (cont.)

The following table identifies the disaggregation

of our revenue for the six months ended June 30, 2024 and 2023, respectively:

| | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Category of Revenue: | |

| | |

| |

| Advertising revenue | |

$ | 70,855 | | |

$ | 64,863 | |

| Copyrights revenue | |

| - | | |

| 2,451 | |

| CHEERS e-Mall marketplace service revenue | |

| 120 | | |

| 110 | |

| Other revenue | |

| 80 | | |

| 11 | |

| Total | |

$ | 71,055 | | |

$ | 67,435 | |

| Timing of Revenue Recognition: | |

| | | |

| | |

| Services transferred over time | |

$ | 70,855 | | |

$ | 67,314 | |

| Services transferred at a point in time | |

| 120 | | |

| 110 | |

| Goods transferred at a point in time | |

| 80 | | |

| 11 | |

| Total | |

$ | 71,055 | | |

$ | 67,435 | |

The Company applied a practical expedient to expense

costs as incurred for costs to obtain a contract with a customer when the amortization period would have been one year or less. The Company

does not have any significant incremental costs of obtaining contracts with customers incurred and/or costs incurred in fulfilling contracts

with customers within the scope of ASC Topic 606, that shall be recognized as an asset and amortized to expenses in a pattern that matches

the timing of the revenue recognition of the related contract.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Concentration and Credit Risk

Financial instruments that potentially subject

the Company to concentrations of credit risk are cash and cash equivalents, and accounts receivable arising from its normal business activities.

The Company places its cash and cash equivalents in what it believes to be credit-worthy financial institutions.

The Company’s operations are carried out

in the PRC. Accordingly, our business, financial condition, and results of operations may be influenced by the political, economic, and

legal environment in the PRC, and by the general state of the economy of the PRC. Our operations in the PRC are subject to specific

considerations and significant risks not typically associated with companies in North America. The Company’s results may be adversely

affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and

remittance abroad, and rates and methods of taxation, among other things. Financial instruments which potentially subject us to concentrations

of credit risk consist principally of cash and cash equivalent. All of our cash is maintained with state-owned banks, commercial banks

or third-party service provider certified by the People’s bank of China, such as Alipay, within the PRC. Per PRC regulations,

the maximum insured bank deposit amount is RMB500 (approximately $69) for each financial institution. The Company’s total unprotected

cash held in bank amounted to approximately $185,968 and $194,081 as of June 30, 2024 and December 31, 2023, respectively. The Company

has not experienced any losses in such accounts and believes the Company is not exposed to any risks on our cash held in bank accounts.

Accounts receivable are typically unsecured and

derived from revenue earned from customers, thereby exposed to credit risk. The risk is mitigated by the Company’s assessment of

its customers’ creditworthiness and its ongoing monitoring of outstanding balances.

The Company’s sales are made to customers

that are located primarily in China. The Company has a concentration of its revenues and receivables with specific customers. For the

six months ended June 30, 2024, five customers accounted for 27.0%, 21.4%, 14.2%, 14.0% and 13.6% of the Company’s total revenue,

respectively. For the six months ended June 30, 2023, four customers accounted for 20%, 19%, 17% and 13% of the Company’s total

revenue, respectively.

As of June 30, 2024, six customers accounted

for 28%,27%,12%,12%,11%and 10% of the net accounts receivable balance, respectively. As of December 31, 2023, six customers accounted

for 23%, 16%, 15% 14% 12% and 11% of the net accounts receivable balance, respectively.

As

of June 30, 2024, three vendors accounted for 41%,31% and 10% of the accounts payable, respectively. As of December 31, 2023, four vendors

accounted for 50%, 21%, 12% and 11% of the accounts payable, respectively.

Foreign Currency Translation

The reporting currency of the Company is the U.S.

dollar (“USD”). The functional currency of subsidiaries, VIEs and VIEs’ subsidiaries located in China is the Chinese

Renminbi (“RMB”). For the entities whose functional currency is the RMB, result of operations and cash flows are translated

at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period,

and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements

of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments

resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive

income/loss. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing

on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currency at the

exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on

transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont.)

Concentration and Credit Risk (cont.)

All of the Company’s revenue and expense

transactions are transacted in the functional currency of the operating subsidiaries. The Company does not enter into any material transaction

in foreign currencies. Transaction gains or losses have not had, and are not expected to have, a material effect on the results of operations

of the Company.

The unaudited condensed consolidated balance sheet

amounts, with the exception of equity, at June 30, 2024 and December 31, 2023 were translated at RMB 7.2672 to $1.00 and at RMB 7.0999

to $1.00, respectively. Equity accounts were stated at their historical rates. The average translation rates applied to unaudited condensed

consolidated statements of income and cash flows for the six months ended June 30, 2024 and 2023 were RMB 7.0716 to $1.00 and RMB 6.9283

to $1.00, respectively.

Recent Accounting Pronouncements

In December 2023, the FASB issued ASU 2023-09,

which is an update to Topic 740, Income Taxes. The amendments in this update related to the rate reconciliation and income taxes paid

disclosures improve the transparency of income tax disclosures by requiring (1) adding disclosures of pretax income (or loss) and income

tax expense (or benefit) to be consistent with U.S. Securities and Exchange Commission (SEC) Regulation S-X 210.4-08(h), Rules of General

Application—General Notes to Financial Statements: Income Tax Expense, and (2) removing disclosures that no longer are considered

cost beneficial or relevant. For public business entities, the amendments in this Update are effective for annual periods beginning after

December 15, 2024. For entities other than public business entities, the amendments are effective for annual periods beginning after December

15, 2025. Early adoption is permitted for annual financial statements that have not yet been issued or made available for issuance. The

amendments in this Update should be applied on a prospective basis. Retrospective application is permitted.

In October 2023, the FASB issued ASU 2023-06,

Disclosure Improvements — codification amendments in response to SEC’s disclosure Update and Simplification initiative which

amend the disclosure or presentation requirements of codification subtopic 230-10 Statement of Cash Flows—Overall, 250-10 Accounting

Changes and Error Corrections— Overall, 260-10 Earnings Per Share— Overall, 270-10 Interim Reporting— Overall, 440-10

Commitments—Overall, 470-10 Debt—Overall, 505-10 Equity—Overall, 815-10 Derivatives and Hedging—Overall, 860-30

Transfers and Servicing—Secured Borrowing and Collateral, 932-235 Extractive Activities— Oil and Gas—Notes to Financial

Statements, 946-20 Financial Services— Investment Companies— Investment Company Activities, and 974-10 Real Estate—Real

Estate Investment Trusts—Overall. The amendments represent changes to clarify or improve disclosure and presentation requirements

of above subtopics. Many of the amendments allow users to more easily compare entities subject to the SEC’s existing disclosures

with those entities that were not previously subject to the SEC’s requirements. Also, the amendments align the requirements in

the Codification with the SEC’s regulations. For entities subject to existing SEC disclosure requirements or those that must provide

financial statements to the SEC for securities purposes without contractual transfer restrictions, the effective date aligns with the

date when the SEC removes the related disclosure from Regulation S-X or Regulation S-K. Early adoption is not allowed. For all other

entities, the amendments will be effective two years later from the date of the SEC’s removal.

In March 2023, the FASB issued new accounting

guidance, ASU 2023-01, for leasehold improvements associated with common control leases, which is effective for fiscal years beginning

after December 15, 2023, including interim periods within those fiscal years. Early adoption is permitted for both interim and annual

financial statements that have not yet been made available for issuance. The new guidance introduced two issues: terms and conditions

to be considered with leases between related parties under common control and accounting for leasehold improvements. The goals for the

new issues are to reduce the cost associated with implementing and applying Topic 842 and to promote diversity in practice by entities

within the scope when applying lease accounting requirements.

Other accounting standards that have been issued

or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial

statements upon adoption. The Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated

to its consolidated financial condition, results of operations, cash flows or disclosures.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

3. ACCOUNTS RECEIVABLE, NET

As of June 30, 2024 and December 31, 2023, accounts

receivable consisted of the following:

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Accounts receivable | |

$ | 80,624 | | |

$ | 81,990 | |

| Less: allowance for expected credit losses | |

| (806 | ) | |

| (820 | ) |

| Accounts receivables, net | |

$ | 79,818 | | |

$ | 81,170 | |

For the six months ended June 30, 2024 and 2023,

the movement of allowance for expected credit losses is as the following:

| | |

June 30, 2024 | | |

June 30, 2023 | |

| Opening balance | |

$ | 820 | | |

$ | 1,006 | |

| Provision of allowance for expected credit losses | |

| 5 | | |

| 1,111 | |

| Writing off allowance for expected credit losses | |

| - | | |

| (1,374 | ) |

| Foreign exchange adjustment | |

| (19 | ) | |

| (27 | ) |

| Ending balance | |

$ | 806 | | |

$ | 716 | |

4. PREPAYMENT AND OTHER CURRENT ASSETS

As of June 30, 2024 and December 31, 2023, prepayment

and other current and non-current assets consisted of the following:

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Advances to vendors | |

$ | 49,883 | | |

$ | 33,295 | |

| Staff advance | |

| 85 | | |

| 98 | |

| Others | |

| 40 | | |

| 43 | |

| Subtotal | |

$ | 50,008 | | |

$ | 33,436 | |

| Less: allowance for expected credit losses | |

| (2,205 | ) | |

| (2,257 | ) |

| Prepayment and other assets, net | |

| 47,803 | | |

| 31,179 | |

For the six months ended June 30, 2024 and 2023,

the Company did not provide allowance against the advances to vendors.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

5. PROPERTY, PLANT AND EQUIPMENT, NET

As of June 30, 2024 and December 31, 2023, property,

plant and equipment consisted of the following:

| | |

June 30, 2024 | | |

December 31,

2023 | |

| Electronic equipment | |

$ | 770 | | |

$ | 820 | |

| Office equipment and furniture | |

| 68 | | |

| 70 | |

| Leasehold improvement | |

| 178 | | |

| 182 | |

| | |

| 1,016 | | |

| 1,072 | |

| Less: accumulated depreciation | |

| (963 | ) | |

| (987 | ) |

| | |

$ | 53 | | |

$ | 85 | |

For the six months ended June 30, 2024 and 2023,

depreciation expense amounted to $30 and $45, respectively.

6. INTANGIBLE ASSETS, NET

As of June 30, 2024 and December 31, 2023, intangible

assets consisted of the following:

| | |

June 30, 2024 | | |

December 31,

2023 | |

| Electronic equipment | |

$ | 29,492 | | |

$ | 30,187 | |

| Less: accumulated depreciation | |

| (11,316 | ) | |

| (9,932 | ) |

| | |

$ | 18,176 | | |

$ | 20,255 | |

The balance of intangible assets mainly represents

software related to CHEERS App, primarily consisting of e-mall, online game, video media library and data warehouse modules, etc., CheerCar

App, NFT App and Cheer Chat App, which were acquired externally tailored to the Company’s requirements and is amortized straight-line

over 7 years in accordance with the way the Company estimates to generate economic benefits from such software.

For the six months ended June 30, 2024 and 2023,

amortization expense amounted to $1,657 and $1,538, respectively. The following is a schedule, by periods, of amortization amount of intangible

asset as of June 30, 2024:

| For the six months ending December 31, 2024 | |

$ | 1,613 | |

| For the year ending December 31, 2025 | |

| 3,226 | |

| For the year ending December 31, 2026 | |

| 3,226 | |

| For the year ending December 31, 2027 | |

| 3,226 | |

| Thereafter | |

| 6,885 | |

| Total | |

$ | 18,176 | |

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

7. ACCRUED LIABILITIES AND OTHER PAYABLES

As of June 30, 2024 and December 31, 2023, accrued

liabilities and other payables consisted of the following:

| | |

June 30, 2024 | | |

December 31,

2023 | |

| Payroll payables | |

$ | 1,155 | | |

$ | 1,233 | |

| Other payables | |

| 2,726 | | |

| 2,531 | |

| | |

$ | 3,881 | | |

$ | 3,764 | |

8. OTHER TAXES PAYABLE

As of June 30, 2024 and December 31, 2023, other

taxes payable consisted of the following:

| | |

June 30, 2024 | | |

December 31,

2023 | |

| VAT payable | |

$ | 26,190 | | |

$ | 22,916 | |

| Income tax payable | |

| 2,399 | | |

| 2,455 | |

| Business tax payable | |

| 3,182 | | |

| 2,791 | |

| Others | |

| 3 | | |

| 16 | |

| | |

$ | 31,774 | | |

$ | 28,178 | |

9. BANK LOANS, CURRENT AND NON CURRENT

Bank loans represent the amounts due to various

banks that are due within and over one year. As of June 30, 2024 and December 31, 2023, bank loans consisted of the following:

| | |

June 30, 2024 | | |

December 31,

2023 | |

| Short-term bank loans: | |

| | | |

| | |

| Loan from Xiamen International Bank | |

$ | 2,752 | | |

$ | 2,113 | |

| Loan from China Citic Bank | |

| 2,752 | | |

| - | |

| Loan from Huaxia Bank | |

| 1,376 | | |

| - | |

| Loan from China Merchants Bank | |

| - | | |

| 2,103 | |

| | |

| 6,880 | | |

| 4,216 | |

| Long-term bank loans: | |

| | | |

| | |

| Loan from China Construction Bank | |

| 1,376 | | |

| 1,408 | |

| | |

$ | 1,376 | | |

$ | 1,408 | |

Short-term bank loans

For

the six months ended June 30, 2024, the Company entered into loan agreements with three banks, pursuant to the Company borrowed an aggregate

of $7,071 from the banks with maturity dates due in August 2024 through March 2025. The loan bore per annum interest rates ranging

between 3.20% and 5.50%. For the six months ended June 30, 2024, the Company also repaid an aggregate of $4,808 to two banks.

For

the six months ended June 30, 2023, the Company entered into loan agreements with two banks, pursuant to the Company borrowed an aggregate

of $2,598 from the banks with maturity dates due in November 2023 through February 2024. The loan bore interest rates ranging between

4.5% and 6%. For the six months ended June 30, 2023, the Company also repaid an aggregate of $4,041 to four banks.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

9. BANK LOANS, CURRENT AND NON CURRENT (cont.)

Long-term bank loans

For the year ended December 31, 2023, the Company

entered into loan agreements with one bank, pursuant to the Company borrowed a three-year bank borrowing of $1,412 from the banks

with maturity date due in September 2026. The loan bore an interest rates of 3.95% per annum.

Guarantee information

As of June 30, 2024, the guarantee information

for bank borrowings were as below:

The loans from Xiamen International Bank were

guaranteed by Horgos, and Mr. Zhang Bing, the Chairman of the Company’s board of directors.

The loan from China Citic Bank was guaranteed

by Horgos and Mr. Zhang Bing.

The

loan from Huaxia Bank was guaranteed by Mr. Zhangbin, and Beijing Zhongguancun Sci-tech Financing Guarantee Co., Ltd, for whom a counter

guarantee was provided by Horgos and Mr. Zhang Bing.

10. LEASES

The Company leases offices space under non-cancelable

operating leases, with terms ranging from two to threee years. The Company considers those renewal or termination options that are reasonably

certain to be exercised in the determination of the lease term and initial measurement of right of use assets and lease liabilities. Lease

expense for lease payment is recognized on a straight-line basis over the lease term. Leases with initial term of 12 months or less are

not recorded on the balance sheet.

The Company determines whether a contract is or

contains a lease at inception of the contract and whether that lease meets the classification criteria of a finance or operating lease.

When available, the Company uses the rate implicit in the lease to discount lease payments to present value; however, most of the Company’s

leases do not provide a readily determinable implicit rate. Therefore, the Company discount lease payments based on an estimate of its

incremental borrowing rate.

The Company’s lease agreements do not contain

any material residual value guarantees or material restrictive covenants.

Supplemental balance sheet information related to operating lease was

as follows:

| | |

June 30, 2024 | | |

December 31,

2023 | |

| Right-of-use assets | |

| 394 | | |

| 377 | |

| | |

| | | |

| | |

| Lease liabilities current | |

| 144 | | |

| 330 | |

| Lease liabilities non-current | |

| 241 | | |

| - | |

| | |

$ | 385 | | |

$ | 330 | |

The weighted average remaining lease terms and

discount rates for the operating lease were as follows as of June 30, 2024:

| Remaining lease term and discount rate: | | | |

| Weighted average remaining lease term (years) | | | 2.58 | |

| Weighted average discount rate | | | 5.55 | % |

For the six months ended June 30, 2024 and 2023,

the Company incurred total operating lease expenses of $99 and $202, respectively.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

10. LEASES (cont.)

The following is a schedule of maturities of lease liabilities as of

June 30, 2024:

| For the six months ending December 31, 2024 | |

$ | 77 | |

| For the year ending December 31, 2025 | |

| 167 | |

| For the year ending December 31, 2026 | |

| 167 | |

| Total lease payments | |

| 411 | |

| Less: imputed interest | |

| (26 | ) |

| Present value of lease liabilities | |

$ | 385 | |

11. RELATED PARTY TRANSACTIONS

For the six months ended June 30, 2024 and 2023,

the Company did not enter into related party arrangements with any related parties. As of June 30, 2024 and December 31, 2023, the Company

had no balances due from or due to related parties.

12. INCOME TAXES

The Company evaluates the level of authority for

each uncertain tax position (including the potential application of interest and penalties) based on the technical merits, and measures

the unrecognized benefits associated with the tax positions. For the six months ended June 30, 2024 and 2023, the Company had no unrecognized

tax benefits. Due to uncertainties surrounding future utilization, the Company estimates there will not be sufficient future income to

realize the deferred tax assets arising from net operating losses for the VIEs and the VIEs’ subsidiaries. The Company maintains

a full valuation allowance on its net deferred tax assets arising from net operating losses as of June 30, 2024 and December 31, 2023.

As

of June 30, 2024 and December 31, 2023, the Company had deferred tax assets of $601 and $41, respectively, arising from net operating

assets by loss-making subsidiaries and allowance of accounts receivable.

The Company does not anticipate any significant

increase to its liability for unrecognized tax benefit within the next 12 months. The Company will classify interest and penalties related

to income tax matters, if any, in income tax expense.

For the six months ended June 30, 2024 and 2023,

the Company had income tax benefits (expenses) as the following table:

| | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Current income tax expenses | |

$ | - | | |

$ | - | |

| Deferred income tax benefits (expense) | |

| 578 | | |

| (37 | ) |

| | |

$ | 578 | | |

$ | (37 | ) |

Uncertain tax positions

The Company accounts for uncertainty in income

taxes using a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax position for

recognition by determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained

on audit, including resolution of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the

largest amount that is more than 50% likely of being realized upon settlement. Interest and penalties related to uncertain tax positions

are recognized and recorded as necessary in the provision for income taxes. The Company is subject to income taxes in the PRC. According

to the PRC Tax Administration and Collection Law, the statute of limitations is three years if the underpayment of taxes is due to computational

errors made by the taxpayer or the withholding agent. The statute of limitations is extended to five years under special circumstances,

where the underpayment of taxes is more than RMB 100. In the case of transfer pricing issues, the statute of limitation is ten years.

There is no statute of limitation in the case of tax evasion. There were no uncertain tax positions as of June 30, 2024 and the Company

does not believe that its unrecognized tax benefits will change over the next twelve months.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

13. SHARE-BASED COMPENSATION TO EMPLOYEES

On June 26, 2024, the Company granted 231,909

ordinary shares to an employee as compensation expenses. The ordinary shares were fully vest upon grant. For the six months ended June

30, 2024, the Company recognized share-based compensation expenses of $584 in the account of “general and administrative expenses”.

As of June 30, 2024, there are no unrecognized compensation expense.

For

the six months ended June 30, 2023, the Company did not grant share-based compensation to employees and the Company did not

recognize share-based compensation expenses.

14. EQUITY

Preferred Shares

The Company is authorized to issue 2,000,000 preferred

shares with a par value of $0.0001 per share with such designation, rights and preferences as may be determined from time to time by the

Company’s Board of Directors. At June 30, 2024 and December 31, 2023, there were no preferred shares issued or outstanding.

Ordinary Shares

The Company is authorized to issue 200,000,000

ordinary shares with a par value of $0.0001 per share. Holders of the ordinary shares are entitled to one vote for each share.

On May 9, 2023, the Company closed private

placements with two (2) accredited investors (the “Investors”). The Company issued an aggregate of 2,419,355 ordinary shares

(after giving effect to share consolidation effected in November 2023) of the Company, par value $0.001, at a price per share of $15.5

for gross proceeds of $60,000,000.

On November 24, 2023, the Company effected a share

consolidation at a ratio of one-for-tenth (10) ordinary shares with a par value of US$0.0001 each in the Company’s issued and unissued

share capital into one ordinary share with a par value of US$0.001 (“the Share Consolidation”). Immediately following the

Share Consolidation, the authorized share capital of the Company to be US$20,200 divided into 20,000,000 ordinary shares of a par value

of US$0.001 each and 2,000,000 preferred shares of a par value of US$0.0001 each. The Company believed that it was appropriate to reflect

the transactions on a retroactive basis pursuant to ASC 260, Earnings Per Share. The Company has retroactively adjusted all share

and per share data for all periods presented.

On September 5, 2023, the Company closed

private placements with two (2) accredited investors (the “Investors”). The Company issued an aggregate of 806,451 ordinary

shares (after giving effect to share consolidation effected in November 2023) of the Company, par value $0.001, at a price per share of

$24.8 (after giving effect to share consolidation effected in November 2023) for gross proceeds of $20,000,000.

In December 2023, the Company issued additional

31,766 ordinary shares subject to roundup of fractional shares arising from Share Consolidation. In January 2024, the Company further

canceled 16,353 ordinary shares subject to roundup of fractional shares arising from Share Consolidation

On

June 26, 2024, the Company granted 231,909 ordinary shares to an employee as compensation expenses.

As of June 30, 2024 and December 31, 2023, there

were 10,301,921 and 10,070,012 ordinary shares (after giving effect to share consolidation effected in November 2023) issued and outstanding,

respectively.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

14. EQUITY (cont.)

Public Warrants

Pursuant to the Initial Public Offering, TKK sold

2,500,000 Units (after giving effect to share consolidation effected in November 2023) at a purchase price of $100.00 per Unit (after

giving effect to share consolidation effected in November 2023), inclusive of 300,000 Units (after giving effect to share consolidation

effected in November 2023) sold to the underwriters on August 22, 2018 upon the underwriters’ election to partially exercise their

over-allotment option. Each Unit consists of one ordinary share, one warrant (“Public Warrant”) and one right (“Public

Right”). Each Public Warrant entitles the holder to purchase one-half of one ordinary share at an exercise price of $115.00 per

whole share. Each Public Right entitles the holder to receive one-tenth of one ordinary share at the closing of a Business Combination.

Public Warrants may only be exercised for a whole

number of shares. No fractional ordinary shares will be issued upon exercise of the Public Warrants. The Public Warrants will become exercisable

on the later of (a) the completion of a Business Combination and (b) 12 months from the closing of the Initial Public Offering. No Public

Warrants will be exercisable for cash unless the Company has an effective and current registration statement covering the ordinary shares

issuable upon exercise of the Public Warrants and a current prospectus relating to such ordinary shares. Notwithstanding the foregoing,

if a registration statement covering the ordinary shares issuable upon the exercise of the Public Warrants is not effective within 90

days from the consummation of a Business Combination, the holders may, until such time as there is an effective registration statement

and during any period when the Company shall have failed to maintain an effective registration statement, exercise the Public Warrants

on a cashless basis pursuant to an available exemption from registration under the Securities Act. If an exemption from registration is

not available, holders will not be able to exercise their Public Warrants on a cashless basis. The Public Warrants will expire five years

from the consummation of a Business Combination or earlier upon redemption or liquidation.

The Company may redeem the Public Warrants:

| |

● |

in whole and not in part; |

| | ● | at a price of $0.01 per warrant; |

| |

● |

at any time while the Public Warrants are exercisable; |

| | ● | upon no less than 30 days’ prior written notice of redemption to each Public Warrant holder; |

| | ● | if, and only if, the reported last sale price of the Company’s ordinary shares equals or exceeds $18.00 per share, for any 20 trading days within a 30 trading day period ending on the third business day prior to the notice of redemption to the warrant holders; and |

| |

● |

if, and only if, there is a current registration statement in effect with respect to the ordinary shares underlying such warrants at the time of redemption and for the entire 30-day trading period referred to above and continuing each day thereafter until the date of redemption. |

If the Company calls the Public Warrants for redemption,

management will have the option to require all holders that wish to exercise the Public Warrants to do so on a “cashless basis,”

as described in the warrant agreement.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

14. EQUITY (cont.)

Public Warrants (cont.)

The exercise price and number of ordinary shares

issuable upon exercise of the warrants may be adjusted in certain circumstances including in the event of a capitalization of shares,

extraordinary dividend or recapitalization, reorganization, merger or consolidation. However, the warrants will not be adjusted for issuances

of ordinary shares at a price below their exercise price or issuance of potential extension warrants in connection with an extension of

the period of time for the Company to complete a Business Combination. Additionally, in no event will the Company be required to net cash

settle the warrants. If the Company is unable to complete a Business Combination within the Combination Period and the Company liquidates

the funds held in the Trust Account, holders of warrants will not receive any of such funds with respect to their warrants, nor will they

receive any distribution from the Company’s assets held outside of the Trust Account with the respect to such warrants. Accordingly,

the warrants may expire worthless.

As of June 30, 2024 and December 31, 2023, the

Company had 2,500,000 of public warrants outstanding (after giving effect to share consolidation effected in November 2023).

Rights

Each holder of a Public Right will automatically

receive one-tenth (1/10) of an ordinary share upon consummation of a Business Combination, even if the holder of a Public Right converted

all ordinary shares held by him, her or it in connection with a Business Combination or an amendment to the Company’s Amended and

Restated Memorandum and Articles of Association with respect to its pre-business combination activities. Upon the closing of the Business

Combination, the Company issued 250,433 shares (after giving effect to share consolidation effected in November 2023) in connection with

an exchange of Public Rights.

Statutory reserve

Horgos, Beijing Glory Star, Beijing Leshare, Shenzhen

Leshare, Glary Prosperity, Horgos Technology and Xing Cui Can operate in the PRC, are required to reserve 10% of their net profit after

income tax, as determined in accordance with the PRC accounting rules and regulations. Appropriation to the statutory reserve by the Company

is based on profit arrived at under PRC accounting standards for business enterprises for each year. The profit arrived at must be set

off against any accumulated losses sustained by the Company in prior years, before allocation is made to the statutory reserve. Appropriation

to the statutory reserve must be made before distribution of dividends to shareholders. The appropriation is required until the statutory

reserve reaches 50% of the registered capital. This statutory reserve is not distributable in the form of cash dividends.

Non-controlling interest

As of June 30, 2024 and December 31, 2023, the

Company’s non-controlling interest represented 49% equity interest of Horgos Glary Prosperity.

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

15. PRIVATE PLACEMENT WARRANTS

Simultaneously with the closing of the Initial

Public Offering, Symphony Holdings Limited (“Symphony”) purchased an aggregate of 1,180,000 Private Placement Warrants (after

giving effect to share consolidation effected in November 2023) at $5.00 per Private Placement Warrant for an aggregate purchase price

of $5,900. On August 22, 2018, TKK consummated the sale of an additional 120,000 Private Placement Warrants at a price of $5.00 per Private

Placement Warrant, generating gross proceeds of $600. Each Private Placement Warrant is exercisable to purchase one-half of one ordinary

share at an exercise price of $115.00 per whole share.

The Private Placement Warrants are identical to

the Public Warrants underlying the Units sold in the Initial Public Offering, except that the Private Placement Warrants (i) are not redeemable

by the Company and (ii) may be exercised for cash or on a cashless basis, so long as they are held by the initial purchaser or any of

its permitted transferees. If the Private Placement Warrants are held by holders other than the initial purchasers or any of their permitted

transferees, the Private Placement Warrants will be redeemable by the Company and exercisable by the holders on the same basis as the

Public Warrants. In addition, the Private Placement Warrants may not be transferable, assignable or salable until the consummation of

a Business Combination, subject to certain limited exceptions.

As of June 30, 2024 and December 31, 2023, the

Company had 1,300,000 of private placement warrants outstanding. The warrant liability related to such private placement warrants was

remeasured to its fair value at each reporting period. The change in fair value was recognized in the unaudited condensed consolidated

statements of income. The change in fair value of the warrant liability was as follows:

| | |

Warrant Liability | |

| Estimated fair value at December 31, 2022 | |

$ | 86 | |

| Change in estimated fair value | |

| (79 | ) |

| Estimated fair value at June 30, 2023 | |

$ | 7 | |

| | |

| | |

| Estimated fair value at December 31, 2023 | |

$ | - | |

| Change in estimated fair value | |

| - | |

| Estimated fair value at June 30, 2024 | |

$ | - | |

The fair value of the private warrants was estimated

using the binomial option valuation model. The application of the binomial option valuation model requires the use of a number of inputs

and significant assumptions including volatility. Significant judgment is required in determining the expected volatility of the common

share. Due to the limited history of trading of the Company’s common share, the Company determined expected volatility based on

a peer group of publicly traded companies. The following reflects the inputs and assumptions used:

| | | For the Six Months Ended

June 30, | |

| | | 2024 | | | 2023 | |

| Category of Revenue: | | | | | | |

| Stock price | | $ | 2.6 | | | $ | 4.9 | |

| Exercise price | | $ | 115.00 | | | $ | 115.00 | |

| Risk-free interest rate | | | 5.33 | % | | | 4.87 | % |

| Expected term (in years) | | | 0.62 | | | | 1.63 | |

| Expected dividend yield | | | - | | | | - | |

| Expected volatility | | | 94.0 | % | | | 97.1 | % |

CHEER HOLDING, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(In U.S. dollars in thousands, except share

and per share data)

16. SEGMENT INFORMATION

In accordance with ASC 280, Segment Reporting,

operating segments are defined as components of an enterprise about which separate financial information is available that is evaluated

regularly by the chief operating decision maker (“CODM”), or decision making group, in deciding how to allocate resources