Exceeds Earnings Expectations, Revenue In

Line Reiterates 2024 Cash Flow Forecast & Expectation

for YoY Revenue Growth

- Revenue of $423.4 million, in line with expectations.

- Net income and diluted EPS of $15.3 million and $0.21; adjusted

net income(1) and adjusted diluted EPS(1) of $16.5 million and

$0.22.

- Adjusted EBITDA(1) of $28.9 million, a 10.7% increase over Q1

2023.

Healthcare Services Group, Inc. (NASDAQ:HCSG) today reported

results for the three months ended March 31, 2024.

Ted Wahl, Chief Executive Officer, stated, “Our team delivered

strong first quarter results, building on our positive momentum in

2023. During the quarter, we managed adjusted cost of services

under 86% and continued to grow our new business and

manager-in-training pipelines. We remain confident that we will

deliver on our goal of year-over-year growth in 2024, with the

majority of those new business adds expected in the second half of

the year.”

Mr. Wahl continued, “On the cash collections front,

historically, the first quarter is our most challenging for cash

collections, especially on the heels of the fourth quarter, which

typically sees our strongest collections. The first quarter

seasonality is anticipated and accounted for in our cash flow

forecasting. However, what was unanticipated was the February

Change Healthcare cyberattack. The resulting disruption had a

far-reaching impact across the healthcare landscape and affected

the claims submissions and billing activities of long-term and

post-acute care providers, many of whom are HCSG customers. In

spite of these first quarter headwinds, anticipated or otherwise,

we achieved 95% cash collections and would have met our first

quarter cash flow forecast if not for the Change Healthcare issue.

While this event was disruptive during the quarter, we are

confident that the impact on our customers is temporary. We expect

to make up for any delays in cash collections in the months ahead,

which is why we’re reiterating our 2024 adjusted cash flow range of

$40.0 to $55.0 million.”

Mr. Wahl stated, “Industry fundamentals continue to trend

positively, with workforce availability continuing to improve,

occupancy at 79%, just under pre-pandemic levels, and CMS's

recently proposed 4.1% increase in Medicare rates for fiscal year

2025. On the regulatory front, CMS published its final minimum

staffing rule earlier this week. We believe it’s highly likely the

rule will not be implemented, or will undergo significant revision

during the extended phase in period, especially given the

inevitability of litigation and potential for legislation or

administration change.”

Mr. Wahl concluded, “As we round the turn of what has been a

prolonged recovery for the industry, the Company’s underlying

fundamentals are stronger than ever. We remain focused on executing

on our strategic priorities to drive growth and deliver meaningful

shareholder value in the year ahead.”

First Quarter Highlights

GAAP

Adjusted(1)

Revenue

$423.4

$423.4

Cost of services

$358.9

$357.3

Selling, general and administrative

$46.9

$42.8

Earnings per share

$0.21

$0.22

Cash flows used in operating

activities

$26.0

$9.2

- Revenue was $423.4 million, in line with the Company’s

expectations of $420.0 million to $430.0 million. The Company

estimates Q2 revenue in the range of $420.0 million to $430.0

million.

- Housekeeping & laundry and dining & nutrition segment

revenues were $190.5 million and $232.9 million, respectively.

- Housekeeping & laundry and dining & nutrition segment

margins were 9.7% and 7.6%, respectively.

- Cost of services was $358.9 million; adjusted cost of services

was $357.3 million, or 84.4%. The Company’s goal is to continue to

manage adjusted cost of services in the 86% range.

- SG&A was $46.9 million; adjusted SG&A was $42.8

million, or 10.1%. The Company’s goal continues to be achieving

adjusted SG&A in the 8.5% to 9.5% range.

- Diluted EPS was $0.21 per share; adjusted diluted EPS was $0.22

per share.

Balance Sheet and Liquidity

The Company’s primary sources of liquidity are cash and cash

equivalents, its revolving credit facility, and cash flow from

operating activities. As of the end of the first quarter, the

Company had a current ratio of 2.8 to 1, cash and marketable

securities of $129.6 million, and a $500.0 million credit facility,

which expires in November 2027. Additionally, Q1 cash flow and

adjusted cash flow used in operations were $26.0 million and $9.2

million, respectively. The Company reiterated its 2024 adjusted

cash flow from operations range of $40.0 million to $55.0

million.

Conference Call and Upcoming

Events

The Company will be attending and participating in the following

conferences:

- 2024 RBC Capital Markets Global Healthcare Conference being

held on May 14, 2024 at the InterContinental Barclay NY

- Benchmark’s 2024 Healthcare House Call Virtual Conference,

taking place on May 21, 2024

- The UBS Healthcare Services Cape Cod Summit on June 5, 2024 at

Chatham Bars Inn in Chatham, MA

- Baird’s 2024 Global Consumer, Technology & Services

Conference on June 6, 2024 at the InterContinental Barclay NY

The Company will host a conference call on Wednesday, April 24,

2024, at 8:30 a.m. Eastern Time to discuss its results for the

three months ended March 31, 2024. The call may be accessed via

phone at 1 (888) 330-3451, Conference ID: 4431380. The call will be

simultaneously webcast under the “Events & Presentations”

section of the Investor Relations page on the Company’s website,

www.hcsg.com. A replay of the webcast will also be available on the

website for one year following the date of the earnings call.

(1) Adjusted results are non-GAAP financial measures and exclude

the impact of certain items. See the tables within "Reconciliations

of Non-GAAP Financial Measures" for more information.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This release and any schedules incorporated by reference into it

may contain forward-looking statements within the meaning of

federal securities laws, which are not historical facts but rather

are based on current expectations, estimates and projections about

our business and industry, and our beliefs and assumptions. Words

such as “believes,” “anticipates,” “plans,” “expects,” “estimates,”

“will,” “goal,” and similar expressions are intended to identify

forward-looking statements. The inclusion of forward-looking

statements should not be regarded as a representation by us that

any of our plans will be achieved. We undertake no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise. Such

forward-looking information is also subject to various risks and

uncertainties. Such risks and uncertainties include, but are not

limited to, risks arising from our providing services to the

healthcare industry and primarily providers of long-term care; the

impact of and future effects of the COVID-19 pandemic or other

potential pandemics; having a significant portion of our

consolidated revenues contributed by one customer during the three

months ended March 31, 2024; credit and collection risks associated

with the healthcare industry; the impact of bank failures; our

claims experience related to workers’ compensation and general

liability insurance (including any litigation claims, enforcement

actions, regulatory actions and investigations arising from

personal injury and loss of life related to COVID-19); the effects

of changes in, or interpretations of laws and regulations governing

the healthcare industry, our workforce and services provided,

including state and local regulations pertaining to the taxability

of our services and other labor-related matters such as minimum

wage increases; the Company's expectations with respect to selling,

general, and administrative expense; and the risk factors described

in Part I of our Form 10-K for the fiscal year ended December 31,

2023 under “Government Regulation of Customers,” “Service

Agreements and Collections,” and “Competition” and under Item 1A.

“Risk Factors” in such Form 10-K.

These factors, in addition to delays in payments from customers

and/or customers in bankruptcy, have resulted in, and could

continue to result in, significant additional bad debts in the near

future. Additionally, our operating results would be adversely

affected by continued inflation particularly if increases in the

costs of labor and labor-related costs, materials, supplies and

equipment used in performing services (including the impact of

potential tariffs and COVID-19) cannot be passed on to our

customers.

In addition, we believe that to improve our financial

performance we must continue to obtain service agreements with new

customers, retain and provide new services to existing customers,

achieve modest price increases on current service agreements with

existing customers and/or maintain internal cost reduction

strategies at our various operational levels. Furthermore, we

believe that our ability to sustain the internal development of

managerial personnel is an important factor impacting future

operating results and the successful execution of our projected

growth strategies. There can be no assurance that we will be

successful in that regard.

USE OF NON-GAAP FINANCIAL INFORMATION

To supplement HCSG’s consolidated financial information, which

are prepared in accordance with generally accepted accounting

principles in the United States of America (“GAAP”), the Company

believes that certain non-GAAP financial measures are useful in

evaluating operating performance and comparing such performance to

other companies.

The Company is presenting adjusted cost of services provided,

adjusted selling, general and administrative expense, adjusted net

income, adjusted diluted earnings per share, adjusted cash flows

(used in) provided by operations, earnings before interest, taxes,

depreciation and amortization (“EBITDA"), and EBITDA excluding

items impacting comparability ("Adjusted EBITDA"). We cannot

provide a reconciliation of forward-looking non-GAAP measures to

GAAP due to the inherent difficulty in forecasting and quantifying

certain amounts that are necessary for such reconciliation. The

presentation of non-GAAP financial measures is not meant to be

considered in isolation or as a substitute for financial statements

prepared in accordance with GAAP.

HEALTHCARE SERVICES GROUP,

INC.

CONSOLIDATED STATEMENTS OF

INCOME

(Unaudited)

(in thousands, except per

share data)

For the Three Months

Ended

March 31,

2024

2023

Revenue

$

423,433

$

417,230

Operating costs and expenses:

Costs of services

358,911

362,379

Selling, general and administrative

46,911

40,047

Income from operations

17,611

14,804

Other income (expense), net

3,703

1,351

Income before income taxes

21,314

16,155

Income tax provision

6,005

4,484

Net income

$

15,309

$

11,671

Basic earnings per common share

$

0.21

$

0.16

Diluted earnings per common share

$

0.21

$

0.16

Basic weighted average number of common

shares outstanding

73,926

74,497

Diluted weighted average number of common

shares outstanding

74,055

74,518

HEALTHCARE SERVICES GROUP,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands)

March 31, 2024

December 31, 2023

Cash and cash equivalents

$

29,288

$

54,330

Restricted cash equivalents

24,695

—

Marketable securities, at fair value

75,618

93,131

Accounts and notes receivable, net

407,140

383,509

Other current assets

43,673

40,726

Total current assets

580,414

571,696

Property and equipment, net

29,190

28,774

Notes receivable — long-term, net

23,287

24,832

Goodwill

75,529

75,529

Other intangible assets, net

11,456

12,127

Deferred compensation funding

44,269

40,812

Other assets

39,735

36,882

Total assets

$

803,880

$

790,652

Accrued insurance claims — current

$

23,138

$

22,681

Other current liabilities

186,237

194,247

Total current liabilities

209,375

216,928

Accrued insurance claims — long-term

62,796

61,697

Deferred compensation liability —

long-term

44,271

41,186

Lease liability — long-term

10,590

11,235

Other long term liabilities

2,267

2,990

Stockholders' equity

474,581

456,616

Total liabilities and stockholders'

equity

$

803,880

$

790,652

HEALTHCARE SERVICES GROUP,

INC.

RECONCILIATIONS OF NON-GAAP

FINANCIAL MEASURES

(Unaudited)

Reconciliation of GAAP costs of

services provided to adjusted cost of services (in

thousands)

For the Three Months

Ended

March 31,

2024

2023

GAAP costs of services provided

$

358,911

$

362,379

Bad debt expense adjustments(1)

1,644

4,035

Adjusted cost of services

$

357,267

$

358,344

Adjusted costs of services as a percentage

of Adjusted revenues

84.4

%

85.9

%

Reconciliation of GAAP selling, general

and administrative ("SG&A") to adjusted SG&A (in

thousands)

For the Three Months

Ended

March 31,

2024

2023

GAAP SG&A

$

46,911

$

40,047

(Gain)/loss on deferred compensation in

SG&A(2)

4,100

1,546

Adjusted SG&A

$

42,811

$

38,501

Adjusted SG&A as a percentage of

adjusted revenues

10.1

%

9.2

%

Reconciliation of GAAP net income to

adjusted net income (in thousands) and earnings per share to

adjusted diluted earnings per share

For the Three Months

Ended

March 31,

2024

2023

GAAP net income

$

15,309

$

11,671

(Gain)/loss on deferred compensation,

net

(10

)

44

Bad debt expense adjustments(1)

1,644

4,035

Tax effect of adjustments(3)

(460

)

(1,132

)

Adjusted net income

$

16,483

$

14,618

Adjusted net income as a percentage of

adjusted revenues

3.9

%

3.5

%

GAAP diluted earnings per share

$

0.21

$

0.16

Adjusted diluted earnings per

share

$

0.22

$

0.20

Weighted-average shares outstanding -

diluted

74,055

74,518

Reconciliation of GAAP net income to

EBITDA and adjusted EBITDA (in thousands)

For the Three Months

Ended

March 31,

2024

2023

GAAP net income

$

15,309

$

11,671

Income tax provision

6,005

4,484

Interest, net

(48

)

102

Depreciation and amortization(4)

3,531

3,720

EBITDA

$

24,797

$

19,977

Share-based compensation

2,484

2,058

(Gain)/loss on deferred compensation,

net

(10

)

44

Bad debt expense adjustments(1)

1,644

4,035

Adjusted EBITDA

$

28,915

$

26,114

Adjusted EBITDA as a percentage of

adjusted revenue

6.8

%

6.3

%

Reconciliation of GAAP cash flows used

in operations to adjusted cash flows provided by (used in)

operations (in thousands)

For the Three Months

Ended

March 31,

2024

2023

GAAP cash flows used in

operations

$

(26,033

)

$

(16,290

)

Accrued payroll(5)

16,815

21,167

Adjusted cash flows (used in) provided

by operating activities

$

(9,218

)

$

4,877

(1)

The bad debt expense adjustment reflects

the difference between GAAP bad debt expense (CECL) and historical

write-offs as a percentage of adjusted revenues, both of which are

based on the same seven year look-back period.

(2)

Represents the changes in fair market

value on deferred compensation investments. The impact of

offsetting investment portfolio gains are included in the “Other

(expense) income, net” caption on the Consolidated Statements on

Income (Loss).

(3)

The tax impact of adjustments is

calculated using a 28% effective tax rate.

(4)

Includes right-of-use asset depreciation

of $1.8 million for the three months ended March 31, 2024 and $1.2

million for the three months ended March 31, 2023.

(5)

The accrued payroll adjustment reflects

changes in accrued payroll for the three months ended March 31,

2024 and 2023. The Company processes payroll on set weekly and

bi-weekly schedules, and the timing of payments may result in

operating cash flow increases or decreases which are not indicative

of the Company’s quarterly cash flow performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424139086/en/

Theodore Wahl President and Chief Executive Officer

Matthew J. McKee Chief Communications Officer

215-639-4274 investor-relations@hcsgcorp.com

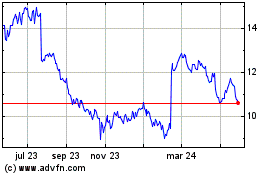

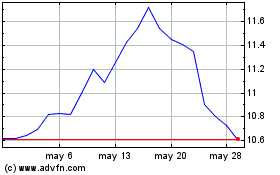

Healthcare Services (NASDAQ:HCSG)

Gráfica de Acción Histórica

De Mar 2025 a Mar 2025

Healthcare Services (NASDAQ:HCSG)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025