Turtle Beach Corporation (Nasdaq: HEAR) (“Turtle Beach” or the

“Company”), a leading gaming accessories brand, today reported

financial results for the fourth quarter and full year ended

December 31, 2023.

Fourth Quarter Summary vs. Year-Ago

Quarter:

- Net revenue was $99.5 million, a decrease of 1.3% compared to

$100.9 million a year ago;

- Net income was $8.6 million, or $0.47 per diluted share,

compared to net loss of $23.2 million, or $1.40 per diluted share,

a year ago;

- Adjusted EBITDA improved to $14.0 million compared to $1.0

million a year ago.

2023 Full-Year Summary vs.

2022:

- Net revenue was $258.1 million, an increase of 7.5% compared to

$240.2 million a year ago;

- Net loss was $17.7 million, or $1.03 per diluted share,

compared to $59.5 million, or $3.62 per diluted share, a year

ago;

- Adjusted EBITDA improved to $6.5 million compared to an

Adjusted EBITDA loss of $29.9 million a year ago.

Management Commentary

“Turtle Beach’s resilience and adaptability have elevated our

leadership position across gaming accessories,” said Cris Keirn,

Chief Executive Officer, Turtle Beach Corporation. “Our 2023 full

year net revenue increased by 7.5% year-over-year as a result of

significant share gains across multiple categories and geographies,

including our core business of console gaming headsets. With

post-pandemic transitional effects to gaming markets and our

business now behind us, we are looking forward to a strong era of

exciting new products and growth.

“We continued to execute against our strategic pillars and

ongoing cost management initiatives, which drove margin

improvements ahead of our expectations. These initiatives,

including portfolio optimization, SKU rationalization, and

platformed product development, come into full effect in 2024. We

look forward to realizing these benefits with dramatically improved

business performance and a 2024 portfolio that will showcase

groundbreaking product launches across key categories. We

anticipate that these new products, along with our continued focus

on multiple cost management initiatives, will result in significant

improvements in Turtle Beach’s performance in 2024.

“We are incredibly optimistic about our 2024 prospects given our

progress against optimizing the business for the future, our growth

prospects in all our gaming categories driven by fantastic new

product launches, and our focus on significantly increasing

profitability. In addition, today we separately announced the

highly accretive acquisition of PDP to significantly diversify our

leadership position in gaming accessories, strengthen profitability

and meaningfully enhance scale. We view this as a transformational

change for the company and our growth prospects have never been

stronger.

“Additionally, as part of our 2024 strategy, we will be

consolidating all PC products, including mice, keyboards and

headsets, under our best-selling Turtle Beach Brand. Over the last

few years, we’ve demonstrated the power of our brand through our

successful entries into other accessories categories, and we expect

our customers and portfolio of PC products to benefit from this

consolidation. We will continue to drive growth and build on our

innovative expansion of gaming categories and products while

maintaining our leadership in gaming headsets. With our highly

accretive acquisition of PDP and continued category expansion for

Turtle Beach products, we expect revenue contribution outside of

console gaming headsets to exceed 40% of total revenues in 2024. We

believe Turtle Beach is poised for significant value creation in

2024 and beyond.”

Fourth Quarter 2023 Financial

Results

Net revenue in the fourth quarter of 2023 was $99.5 million, a

decrease of 1% compared to $100.9 million a year ago, driven

primarily by a softer than expected console gaming headset market,

but returned to growth in late December. Additionally, the slight

decline was driven by higher promotional spend than anticipated due

to the softer than expected console gaming headset market.

Gross margin in the fourth quarter of 2023 increased to 32.0%,

the highest level in the past seven quarters, compared to 19.8% a

year ago. This increase was driven primarily by lower freight costs

and promotional spend. In the fourth quarter of 2022, the Company

recorded a $4.5 million incremental inventory provision related to

the pandemic driven supply chain challenges. Excluding this

provision, the fourth quarter of 2022 adjusted gross margin was

24.3% resulting in an expansion of 770 basis points after this

normalization.

Operating expenses in the fourth quarter of 2023 were $23.4

million compared to $28.1 million a year ago. Fourth quarter

recurring operating expenses declined approximately 12.6% year over

year, primarily driven by continued proactive expense

management.

Net income in the fourth quarter of 2023 was $8.6 million, or

$0.47 per diluted share, compared to net loss of $23.2 million, or

$1.40 per diluted share, in the year-ago quarter. The weighted

average diluted share count for the fourth quarter of 2023 was 18.4

million compared to 16.6 million in the year-ago quarter.

Adjusted EBITDA (as defined below in “Non-GAAP Financial

Measures”) in the fourth quarter of 2023 improved to $14.0 million,

compared to $1.0 million in the year-ago period. The adjusted

EBITDA improvement of $12.9 million for the quarter was due to

gross margin expansion and operating expense reductions.

2023 Financial Results

Net revenue in 2023 was $258.1 million, an increase of 7.5%

compared to $240.2 million a year ago, driven by market share gains

and new product launches.

Gross margin in 2023 increased to 29.3%, compared to 20.5% a

year ago. This increase was driven primarily by lower freight and

logistics costs as the elevated freight rates driven by the

pandemic normalized. In 2022, the Company recorded a $9.8 million

incremental inventory provision related to the pandemic driven

supply chain challenges. Excluding this provision, 2022 adjusted

gross margin was 24.6%.

Operating expenses in 2023 were $91.9 million compared to $100.7

million a year ago. Full year 2023 recurring operating expenses

declined approximately 10.6% year over year, primarily driven by

continued proactive expense management.

Net loss in 2023 was $17.7 million, or $1.03 per diluted share,

compared to $59.5 million, or $3.62 per diluted share, in the

year-ago quarter. The weighted average diluted share count for 2023

was 17.1 million compared to 16.5 million in the year-ago

quarter.

Adjusted EBITDA (as defined below in “Non-GAAP Financial

Measures”) in 2023 improved to $6.5 million, compared to adjusted

EBITDA loss of $29.9 million in the year-ago period.

Balance Sheet and Cash Flow

Summary

At December 31, 2023, the Company had $18.7 million of cash and

no outstanding borrowings on its revolver. This compares to $11.4

million of cash and $19.1 million outstanding on its revolver at

December 31, 2022. This is a $26.4 million improvement in the

Company’s net cash position versus a year ago. Inventories at

December 31, 2023 were $44.0 million compared to $71.3 million at

December 31, 2022. Cash flow from operations for the twelve months

ended December 31, 2023 was $27.0 million, a $68.9 million

improvement year over year.

Outlook

Turtle Beach separately announced today, among other strategic

items, the acquisition of PDP, adding significant financial

benefits to Turtle Beach that, in conjunction with synergies

realized, fundamentally transforms the financial profile of the

Company.

Accordingly, the Company expects 2024 net revenues to be in the

range of $370 million to $380 million, with the growth driven

primarily by the acquisition of PDP and the expected

out-performance of the gaming markets in specific categories based

on the Company’s product plans for 2024. Additionally, in light of

the Company’s strong execution on its efficiency and profitability

initiatives, the Company expects pro forma combined Adjusted EBITDA

to be between $51 million and $54 million, which incorporates

approximately 9 months of operations from PDP.

The Company further reiterates its long-term goals of a 10%+

revenue CAGR, a mid-30’s gross margin percentage, and is now

focused on low to mid-teens percentage for Adjusted EBITDA

margins.

Value Enhancement Committee

Review

The Company today issued a separate press release announcing the

outcome of the Board’s Value Enhancement Committee review, which

can be found at https://corp.turtlebeach.com/press-releases/.

With respect to the Company's adjusted EBITDA outlook, a

reconciliation to its net income (loss) outlook for the same

periods has not been provided because of the variability,

complexity, and lack of visibility with respect to certain

reconciling items between adjusted EBITDA and net income (loss),

including other income (expense), provision for income taxes and

stock-based compensation. These items cannot be reasonably and

accurately predicted without the investment of undue time, cost and

other resources and, accordingly, a reconciliation of the Company’s

adjusted EBITDA outlook to its net income (loss) outlook for such

periods is not provided. These reconciling items could be material

to the Company’s actual results for such periods.

Conference Call Details

In conjunction with this announcement, Turtle Beach will host a

conference call at 5:00 p.m. ET / 2:00 p.m. PT with the Company’s

Chief Executive Officer, Cris Keirn, and CFO, John Hanson. A live

webcast of the call will be available on the “Events &

Presentations” page of the Company’s website at

www.corp.turtlebeach.com. To access the call by phone, please go to

this link (registration link) and you will be provided with dial in

details. To avoid delays, we encourage participants to dial into

the conference call 15-minutes ahead of the scheduled start time. A

replay of the webcast will also be available for a limited time at

www.corp.turtlebeach.com.

Non-GAAP Financial

Measures

In addition to its reported results, the Company has included in

this earnings release certain financial metrics, including adjusted

EBITDA, that the Securities and Exchange Commission define as

“non-GAAP financial measures.” Management believes that such

non-GAAP financial measures, when read in conjunction with the

Company's reported results, can provide useful supplemental

information for investors analyzing period-to-period comparisons of

the Company's results. Non-GAAP financial measures are not an

alternative to the Company’s GAAP financial results and may not be

calculated in the same manner as similar measures presented by

other companies. “Adjusted EBITDA” is defined by the Company as net

income (loss) before interest, taxes, depreciation and

amortization, stock-based compensation (non-cash), and certain

non-recurring special items that we believe are not representative

of core operations, as further described in Table 4. These non-GAAP

financial measures are presented because management uses non-GAAP

financial measures to evaluate the Company’s operating performance,

to perform financial planning, and to determine incentive

compensation. Therefore, the Company believes that the presentation

of non-GAAP financial measures provides useful supplementary

information to, and facilitates additional analysis by, investors.

The non-GAAP financial measures included herein exclude items that

management does not believe reflect the Company’s core operating

performance because such items are inherently unusual,

non-operating, unpredictable, non-recurring, or non-cash. See a

reconciliation of GAAP results to Adjusted EBITDA included as Table

4 below for each of the three and twelve months ended December 31,

2022 and December 31, 2023.

About Turtle Beach

Corporation

Turtle Beach Corporation (the “Company”)

(www.turtlebeachcorp.com) is one of the world’s leading gaming

accessory providers. The Company’s namesake Turtle Beach brand

(www.turtlebeach.com) is known for designing best-selling gaming

headsets, PC gaming products, top-rated game controllers, and

groundbreaking gaming simulation accessories. Innovation,

first-to-market features, a broad range of products for all types

of gamers, and top-rated customer support have made Turtle Beach a

fan-favorite brand and the market leader in console gaming audio

for over a decade. Turtle Beach’s shares are traded on the Nasdaq

Exchange under the symbol: HEAR.

Cautionary Note on Forward-Looking

Statements

This press release includes forward-looking information and

statements within the meaning of the federal securities laws.

Except for historical information contained in this release,

statements in this release may constitute forward-looking

statements regarding assumptions, projections, expectations,

targets, intentions or beliefs about future events. Statements

containing the words “may,” “could,” “would,” “should,” “believe,”

“expect,” “anticipate,” “plan,” “estimate,” “target,” “goal,”

“project,” “intend” and similar expressions, or the negatives

thereof, constitute forward-looking statements. Forward-looking

statements are only predictions and are not guarantees of

performance. Forward-looking statements involve known and unknown

risks and uncertainties, which could cause actual results to differ

materially from those contained in any forward-looking statement.

The inclusion of such information should not be regarded as a

representation by the Company, or any person, that the objectives

of the Company will be achieved. Forward-looking statements are

based on management’s current beliefs and expectations, as well as

assumptions made by, and information currently available to,

management.

While the Company believes that its expectations are based upon

reasonable assumptions, there can be no assurances that its goals

and strategy will be realized. Numerous factors, including risks

and uncertainties, may affect actual results and may cause results

to differ materially from those expressed in forward-looking

statements made by the Company or on its behalf. Some of these

factors include, but are not limited to, risks related to general

business and economic conditions, inflationary pressures, the

impact of competitive products and pricing, including promotional

credits and discounts, optimizing our product portfolio, the

substantial uncertainties inherent in the acceptance of existing

and future products, our dependence on third parties to manufacture

and transport our products, reductions in logistic and supply chain

challenges and costs, reducing our cost of goods and operating

expenses, the difficulty of commercializing and protecting new

technology, risks associated with the future direction or

governance of the Company, risks associated with the expansion of

our business, including the integration of PDP and any other

businesses we acquire and the integration of such businesses within

our internal control over financial reporting and operations, our

indebtedness, liquidity, and other factors discussed in our public

filings, including the risk factors included in the Company’s most

recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q,

and the Company’s other periodic reports filed with the Securities

and Exchange Commission. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the Securities and Exchange Commission, the

Company is under no obligation to publicly update or revise any

forward-looking statement after the date of this release whether as

a result of new information, future developments or otherwise.

All trademarks are the property of their respective owners.

Turtle Beach

Corporation

Condensed Consolidated

Statements of Operations

(in thousands, except per-share

data)

(unaudited)

Table 1.

Three Months Ended

Twelve Months Ended

December 31,

December 31,

December 31,

December 31,

2023

2022

2023

2022

Net revenue

$

99,538

$

100,900

$

258,122

$

240,166

Cost of revenue

67,734

80,882

182,618

190,979

Gross profit

31,804

20,018

75,504

49,187

Operating expenses:

Selling and marketing

13,032

14,124

43,489

47,090

Research and development

4,467

4,335

17,137

19,123

General and administrative

5,946

7,785

31,321

32,558

Goodwill and other intangible asset

impairment

-

1,896

-

1,896

Total operating expenses

23,445

28,140

91,947

100,667

Operating income (loss)

8,359

(8,122

)

(16,443

)

(51,480

)

Interest expense

251

577

504

1,220

Other non-operating expense (income),

net

(405

)

(2,330

)

394

1,753

Income (loss) before income tax

8,513

(6,369

)

(17,341

)

(54,453

)

Income tax expense benefit

(39

)

16,864

338

5,093

Net income (loss)

$

8,552

$

(23,233

)

$

(17,679

)

$

(59,546

)

Net income (loss) per share

Basic

$

0.49

$

(1.40

)

$

(1.03

)

$

(3.62

)

Diluted

$

0.47

$

(1.40

)

$

(1.03

)

$

(3.62

)

Weighted average number of shares:

Basic

17,449

16,562

17,135

16,450

Diluted

18,383

16,562

17,135

16,450

Turtle Beach

Corporation

Condensed Consolidated Balance

Sheets

(in thousands, except par value

and share amounts)

Table 2.

December 31,

December 31,

2023

2022

(unaudited)

ASSETS

(in thousands, except par value

and share amounts)

Current Assets:

Cash

$

18,726

$

11,396

Accounts receivable, net

54,390

43,336

Inventories

44,019

71,252

Prepaid expenses and other current

assets

7,720

9,196

Total Current Assets

124,855

135,180

Property and equipment, net

4,824

6,362

Goodwill

10,686

10,686

Intangible assets, net

1,734

2,612

Other assets

7,868

8,547

Total Assets

$

149,967

$

163,387

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current Liabilities:

Revolving credit facility

$

—

$

19,053

Accounts payable

26,908

19,846

Other current liabilities

29,424

25,433

Total Current Liabilities

56,332

64,332

Income tax payable

1,546

2,076

Other liabilities

7,012

8,038

Total Liabilities

64,890

74,446

Commitments and Contingencies

Stockholders’ Equity

Common stock, $0.001 par value -

25,000,000 shares authorized; 17,531,702 and 16,569,173 shares

issued and outstanding as of December 31, 2023 and 2022,

respectively

18

17

Additional paid-in capital

220,185

206,916

Accumulated deficit

(134,277

)

(116,598

)

Accumulated other comprehensive loss

(849

)

(1,394

)

Total Stockholders’ Equity

85,077

88,941

Total Liabilities and Stockholders’

Equity

$

149,967

$

163,387

Turtle Beach

Corporation

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(unaudited)

Table 3.

Year Ended

December 31, 2023

December 31, 2022

CASH FLOWS FROM OPERATING ACTIVITIES

$

27,044

$

(41,846

)

CASH FLOWS FROM INVESTING ACTIVITIES

(2,159

)

(3,549

)

CASH FLOWS FROM FINANCING ACTIVITIES

Borrowings on revolving credit

facilities

210,210

91,945

Repayment of revolving credit

facilities

(229,263

)

(72,892

)

Proceeds from exercise of stock options

and warrants

2,261

653

Repurchase of common stock

(974

)

-

Debt financing costs

(80

)

-

Net cash provided by (used for) financing

activities

(17,846

)

19,706

Effect of exchange rate changes on

cash

291

(635

)

Net decrease in cash

7,330

(26,324

)

Cash - beginning of period

11,396

37,720

Cash - end of period

$

18,726

$

11,396

Turtle Beach

Corporation

GAAP to Adjusted EBITDA

Reconciliation

(in thousands)

Table 4.

Three Months Ended

Year Ended

December 31,

December 31,

2023

2022

2023

2022

(in thousands)

Net income (loss)

$

8,552

$

(23,233

)

$

(17,679

)

$

(59,546

)

Interest expense

251

577

504

1,220

Depreciation and amortization

1,166

1,352

4,839

5,816

Stock-based compensation (1)

3,429

2,209

11,983

7,984

Income tax expense

(39

)

16,864

338

5,093

Impairment charge (2)

—

1,896

—

1,896

Restructuring expense (3)

(43

)

—

1,061

556

CEO transition related costs (4)

—

—

2,874

—

Business transaction expense (5)

653

—

653

—

Proxy contest and other (6)

(15

)

1,372

1,921

7,092

Adjusted EBITDA

$

13,954

$

1,037

$

6,494

$

(29,889

)

(1) Increase in stock-based compensation

in the year ended December 31, 2023 over the comparable prior year

period primarily driven by $4.0 million dollar charge related to

accelerated vesting of equities associated with the separation of

our former CEO.

(2) Impairment charge includes costs

related to impairment of intangible assets.

(3) Restructuring charges are expenses

that are paid in connection with reorganization of our operations.

These costs primarily include severance and related benefits.

(4) CEO transition related expense

includes one-time costs associated with the separation of its

former CEO. Such costs included severance, bonus, medical benefits

and the tax impact of accelerated vesting of stock-based

compensation.

(5) Business transaction expense includes

one-time costs we incurred in connection with acquisitions

including professional fees such as legal and accounting along with

other certain integration related costs of the acquisitions.

(6) Proxy contest and other primarily

includes (one-time legal, other professional fees, as well as

employee retention costs associated with proxy challenges presented

by certain shareholder activists.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240313431086/en/

MacLean Marshall Sr. Director, Public Relations

& Brand Communications Turtle Beach

Corporation 858.914.5093

maclean.marshall@turtlebeach.com

Investor Information:

Alex Thompson Gateway Group 949.574.3860

hear@gateway-grp.com

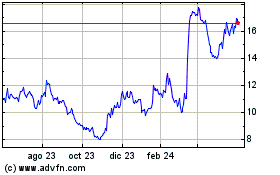

Turtle Beach (NASDAQ:HEAR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

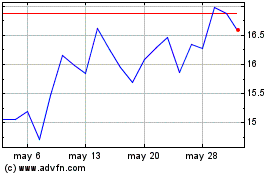

Turtle Beach (NASDAQ:HEAR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025