Highly Accretive Acquisition of Performance

Designed Products Expands Product Portfolio, Strengthens

Profitability and Meaningfully Enhances Size of Company

Establishes a Powerhouse in Hardware Gaming

Accessories with Leadership Positions in Console Headsets and

Controllers, Amplified by Significant Financial Synergies

Announces Intent to Launch a Modified Dutch

Tender Offer to Repurchase up to $30 Million in Value of Its Common

Stock Between Range of $13.75 - $15.00 Per Share

Pro Forma Prospective Net Debt of 0.7X at

Transaction Closing Leaves Meaningful Financial Cushion to Fund

Additional Growth Initiatives and Capital Return Alternatives

Announces the Appointment of Cris Keirn as

Chief Executive Officer

Turtle Beach Board of Directors Increases to 9

Members to Include Cris Keirn and David Muscatel, Operating Partner

at Diversis Capital

Provides 2024 Financial Outlook and Summary for

Combined Company

Turtle Beach Corporation (Nasdaq: HEAR) (“Turtle Beach” or the

“Company”), a leading gaming accessories brand, announced today

that following the Company's establishment of a Value Enhancement

Committee in 2023, the Board of Directors (the “Board”) has

approved comprehensive and value-creative changes to its business,

capital allocation and senior leadership. In consultation with its

financial and legal advisors over the past year, the Company

considered a comprehensive range of strategic, operational and

financial alternatives on behalf of shareholders, including a full

sale of the Company, and following the completion of its review,

announced the following updates:

Strategic Acquisition of Performance

Designed Products (“PDP”)

Turtle Beach today announced the execution of definitive

agreements to acquire PDP, a leading gaming accessories provider at

an enterprise value for PDP of $118 million (the “Transaction”).

PDP is a privately held third-party gaming accessories leader that

designs and distributes aftermarket video game accessories,

including controllers, headsets, power cases, and other

accessories. The Transaction combines two leading gaming companies

with industry-leading teams, significant product momentum and

proven track records of delivering profitable growth. The

Transaction substantially grows the size of Turtle Beach. Bringing

PDP’s leading gaming controller category to Turtle Beach will

provide additional scale and create future development

opportunities. Furthermore, the Company provided the following

strategic rationale:

- The combined company anticipates total revenues of $390 to 410

million in the first full 12 months of ownership (Q2 2024 through

Q1 2025).

- The post-synergy Adjusted EBITDA of PDP is projected to be $22

to $28 million in the first full 12 months of ownership (Q2 2024

through Q1 2025) implying a post-synergy transaction multiple of

4.7x at the mid-point of estimated 2024 Adjusted EBITDA.

- Turtle Beach expects $10 to $12 million of anticipated annual

run-rate cost synergies for the transaction, with upside for

incremental revenue synergies, best practice sharing and further

cost synergies over time.

- Acquiring PDP at an attractive valuation multiple relative to

the trading multiples of peers implies potential significant upside

in market value for the combined company.

- Diversis Capital, a Los Angeles-based private equity firm and

PDP’s majority owner, will become the largest shareholder of Turtle

Beach with approximately 16% of the pro forma basic shares

outstanding prior to the expected modified Dutch Tender Offer and

will add one of its Senior Operating Partners, David Muscatel, to

the Turtle Beach Board.

Consideration for the Transaction consists of the issuance of

3.45 million shares of Turtle Beach's common stock and

approximately $79.9 million in cash. The Transaction is expected to

be immediately accretive to Turtle Beach shareholders on key

metrics including the Company’s growth prospects, strategic

positioning with retailers and customers, and financial

profile.

The Board of Directors of both Turtle Beach and PDP have

unanimously approved the Transaction and the Transaction was closed

immediately upon the execution of the definitive agreements.

Jefferies LLC acted as exclusive financial advisor and Dechert

LLP acted as legal counsel to Turtle Beach and O’Melveny &

Myers LLP acted as legal counsel to PDP in connection with the

transaction.

2024 Summary Financial

Outlook

Turtle Beach is pleased with its share gains experienced during

the holiday season, its ongoing cost improvement initiatives, and

its 2024 product portfolio, all of which continue to highlight the

meaningful, recent positive momentum on both the top and

bottom-line for the Company.

The acquisition of PDP adds significant financial benefits to

Turtle Beach that, in conjunction with synergies realized,

fundamentally transforms the financial profile of the Company.

Accordingly, the Company expects 2024 net revenues to be in the

range of $370 million to $380 million, with the growth driven

primarily by the acquisition of PDP and the expected

out-performance of the gaming markets in specific categories based

on the Company’s product plans for 2024. Additionally, in light of

the Company’s strong execution on its efficiency and profitability

initiatives, the Company expects pro forma combined Adjusted EBITDA

to be between $51 million and $54 million, which incorporates

approximately 9 months of operations from PDP.

In the first full four quarters of operation (Q2 2024 through Q1

2025), the combined Company expects total net sales to be in the

range of $390 - $410 million and Adjusted EBITDA to be in the range

of $60 - $65 million.

Intends to Launch a Modified Dutch

Auction Tender Offer within One (1) Month

To drive further value for Turtle Beach shareholders, the

Company announced today that it intends to launch a modified “Dutch

Auction” Tender Offer (the “Tender Offer”) to purchase up to $30

million in value of its common stock (the “Common Stock”) at a

price per share not less than $13.75 per share and not greater than

$15.00 per share, less any applicable withholding taxes and without

interest, using available cash on hand and available borrowing

capacity. On March 12, 2024, the closing price of the Common Stock

was $11.03 per share, setting the low-end of the Tender Offer range

at a 25% premium to the most recent closing share price. The Tender

Offer is anticipated to commence on or about April 10, 2024 and is

expected to expire at 12 midnight, New York City time, at the end

of the day on or about May 10, 2024, unless extended or

terminated.

A modified "Dutch Auction" Tender Offer allows shareholders to

indicate how many shares of Common Stock and at what price within

the range described above they wish to tender their shares. Based

on the number of shares tendered and the prices specified by the

tendering shareholders, the Company will determine the lowest

per-share price that will enable it to acquire up to $30 million in

value of Common Stock.

The Company’s Board believes the modified “Dutch Auction” Tender

Offer structure is a mechanism that affords shareholders with an

opportunity to obtain liquidity with respect to all or a portion of

their shares, with less potential disruption to the share price and

the usual transaction costs inherent in open market purchases and

sales.

Executive Management and the Board of Directors of Turtle Beach

do not plan on participating in the tender offer.

Announcement of Chief Executive

Officer

The Company announced that Turtle Beach’s Board of Directors has

appointed Cris Keirn as Chief Executive Officer and to the Board of

Directors, effective immediately. The appointment concludes a

comprehensive CEO search process, launched by the Board in the

second quarter of 2023, with the mandate to appoint a highly

qualified leader with extensive product innovation, operational and

transformational experience, and capable of delivering strong

financial and operational results to drive future growth across the

business.

Mr. Keirn joined Turtle Beach in 2013 and has been a key

contributor in the transformation of Turtle Beach’s product

portfolios, including in his role as Vice-President of Business

Planning and Strategy prior to his executive role in sales. Mr.

Keirn has also led sales operations, customer care and market

analytics teams for the Company. Prior to joining Turtle Beach,

Cris held leadership positions over a 17-year span in multiple

divisions at Motorola across engineering, product management,

operations, quality and customer relations.

“I’m honored to work with the amazing team at Turtle Beach, now

including our new colleagues from PDP, as we continue to deliver

fantastic new products for gamers and value to our shareholders,”

said Keirn. “Working with our industry partners, and with the

combined expertise of our teams, we will drive a transformational

change to the company’s scale and execution with innovation and

expansion of our leadership positions across gaming accessory

categories.”

“After a comprehensive review of strategic actions and

significant engagement by the Board of Directors, I am excited

about the announcements made today that we believe will create

substantial value for Turtle Beach shareholders,” said Terry

Jimenez, Chairman of the Board of Directors and Chairman of the

Value Enhancement Committee. “Acquiring PDP, announcing a modified

Dutch auction tender offer, and appointing Cris Keirn as our next

CEO are significant outcomes that are a result of a thorough review

of our business opportunities ahead. We are pleased to welcome the

PDP team to Turtle Beach, and we look forward to benefiting from

our improved financial profile, gaming product portfolio and

industry-leading team. In addition, we are pleased to welcome both

Cris and Dave to our Board, both of whom are excellent additions.

We’re also excited to have Cris leading the business as CEO and

believe his industry expertise and leadership skills are critical

to advancing our strategy to drive growth across our gaming

accessories businesses and generate substantial profit. Ultimately,

each of these outcomes better position the Company for future

success and value creation for shareholders.”

Conference Call Details

Turtle Beach will host a conference call today, March 13, 2024,

at 5:00 p.m. ET / 2:00 p.m. PT to review the transaction, detail

its fourth quarter and full year 2023 earnings results and host a

question-and-answer session. A live webcast of the call will be

available on the “Events & Presentations” page of the Company’s

website at www.turtlebeachcorp.com. To access the call by phone,

please go to this link (registration link) and you will be provided

with dial-in details. To avoid delays, we encourage participants to

dial into the conference call 15 minutes ahead of the scheduled

start time. A replay of the webcast will also be available for a

limited time at www.turtlebeachcorp.com.

Non-GAAP Financial

Measures

In addition to its reported results, the Company has included in

this release certain financial metrics, including adjusted EBITDA,

that the Securities and Exchange Commission define as “non-GAAP

financial measures.” Management believes that such non-GAAP

financial measures, when read in conjunction with the Company's

reported results, can provide useful supplemental information for

investors analyzing period-to-period comparisons of the Company's

results. Non-GAAP financial measures are not an alternative to the

Company’s GAAP financial results and may not be calculated in the

same manner as similar measures presented by other companies.

“Adjusted EBITDA” is defined by the Company as net income (loss)

before interest, taxes, depreciation and amortization, stock-based

compensation (non-cash), and certain non-recurring special items

that we believe are not representative of core operations, as

further described in Table 4 of our Full Year 2023 Earnings

Release. These non-GAAP financial measures are presented because

management uses non-GAAP financial measures to evaluate the

Company’s operating performance, to perform financial planning, and

to determine incentive compensation. Therefore, the Company

believes that the presentation of non-GAAP financial measures

provides useful supplementary information to, and facilitates

additional analysis by, investors. The non-GAAP financial measures

included herein exclude items that management does not believe

reflect the Company’s core operating performance because such items

are inherently unusual, non-operating, unpredictable,

non-recurring, or non-cash. See a reconciliation of GAAP results to

Adjusted EBITDA included as Table 4 in our Full Year 2023 Earnings

Release for each of the three and twelve months ended December 31,

2022 and December 31, 2023.

About Turtle Beach

Corporation

Turtle Beach Corporation (the “Company”)

(www.turtlebeachcorp.com) is one of the world’s leading gaming

accessory providers. The Company’s namesake Turtle Beach brand

(www.turtlebeach.com) is known for designing best-selling gaming

headsets, PC gaming products, top-rated game controllers, and

groundbreaking gaming simulation accessories. Innovation,

first-to-market features, a broad range of products for all types

of gamers, and top-rated customer support have made Turtle Beach a

fan-favorite brand and the market leader in console gaming audio

for over a decade. Turtle Beach’s shares are traded on the Nasdaq

Exchange under the symbol: HEAR.

Cautionary Note on Forward-Looking

Statements

This press release includes forward-looking information and

statements within the meaning of the federal securities laws.

Except for historical information contained in this release,

statements in this release may constitute forward-looking

statements regarding assumptions, projections, expectations,

targets, intentions or beliefs about future events. Statements

containing the words “may,” “could,” “would,” “should,” “believe,”

“expect,” “anticipate,” “plan,” “estimate,” “target,” “goal,”

“project,” “intend” and similar expressions, or the negatives

thereof, constitute forward-looking statements. Forward-looking

statements involve known and unknown risks and uncertainties, which

could cause actual results to differ materially from those

contained in any forward-looking statement. The inclusion of such

information should not be regarded as a representation by the

Company, or any person, that the objectives of the Company will be

achieved. Forward-looking statements are based on management’s

current beliefs and expectations, as well as assumptions made by,

and information currently available to, management.

While the Company believes that its expectations are based upon

reasonable assumptions, there can be no assurances that its goals

and strategy will be realized. Numerous factors, including risks

and uncertainties, may affect actual results and may cause results

to differ materially from those expressed in forward-looking

statements made by the Company or on its behalf. Some of these

factors include, but are not limited to, risks related to

inflationary pressures, optimizing our product portfolio, reducing

our cost of goods and operating expenses, reductions in logistic

and supply chain challenges and costs, the substantial

uncertainties inherent in the acceptance of existing and future

products, the difficulty of commercializing and protecting new

technology, the impact of competitive products and pricing,

including promotional credits and discounts, general business and

economic conditions, risks associated with the future direction or

governance of the Company, risks associated with the expansion of

our business, including the integration of any businesses we

acquire and the integration of such businesses within our internal

control over financial reporting and operations, our indebtedness,

liquidity, and other factors discussed in our public filings,

including the risk factors included in the Company’s most recent

Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and the

Company’s other periodic reports filed with the Securities and

Exchange Commission. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the Securities and Exchange Commission, the

Company is under no obligation to publicly update or revise any

forward-looking statement after the date of this release whether as

a result of new information, future developments or otherwise.

All trademarks are the property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240313363647/en/

MacLean Marshall Sr. Director, Public Relations

& Brand Communications Turtle Beach

Corporation 858.914.5093

maclean.marshall@turtlebeach.com

Investor Information:

Alex Thompson Gateway Group 949.574.3860

hear@gateway-grp.com

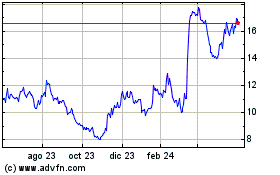

Turtle Beach (NASDAQ:HEAR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

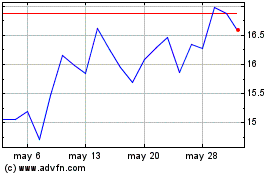

Turtle Beach (NASDAQ:HEAR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025