Increases Share Repurchase Authorization to

$55 Million to Honor Continued Commitment to Return Capital to

Shareholders

Share Repurchase Authorization Replaces

Previously Announced Tender Offer Given Underlying Shares Are Now

Trading 11% Above Previously Communicated Top End of Proposed

Tender Offer Range

Board of Directors Will Continue to

Aggressively Assess Mechanisms to Create Shareholder Value

Leading gaming accessory maker Turtle Beach Corporation (Nasdaq:

HEAR) (“Turtle Beach” or the “Company”) announced today its Board

of Directors has modified its previously communicated near-term

return of capital plan to shareholders, given the overwhelmingly

positive reaction to the Company’s recent transformational

acquisition of Performance Designed Products (“PDP”) and the strong

underlying trading price of the Company’s shares.

With today’s announcement, the Board of Directors (the “Board”)

no longer intends to launch the previously announced modified

“Dutch auction” Tender Offer (the “Tender Offer”) to purchase up to

$30 million of its common stock (the “Common Stock”) at a price per

share not less than $13.75 per share and not greater than $15.00

per share. Since the acquisition of PDP and the intent to launch

the Tender Offer was announced on March 13, 2024, the average

trading price of the Company’s shares has surpassed the highest end

of the Tender Offer range indicated, with the most recent closing

price of the shares 11-21% above the range, and the Board believes

the proposed Tender Offer would only receive limited participation.

The Board has determined that launching a tender offer estimated to

receive only limited participation would not achieve the Company’s

objectives while at the same time creating significant and unneeded

costs for the Company that are not in the best interests of

investors.

In its continued effort to evaluate capital allocation

priorities, the Board has determined that the best course of action

to continue to return capital to shareholders is to increase the

Company’s share repurchase program by $30 million. Under the

revised share repurchase authorization, the Company is authorized

to acquire up to a total of $55 million of shares of its common

stock, including the $8.4 million already acquired under the

program, at its discretion from time to time in the open market, or

in block purchases or privately negotiated transactions, subject to

compliance with the applicable restrictions in the Company’s debt

agreements. The current balance remaining for the repurchase

program, including today’s increased authorization, is $46.6

million.

Terry Jimenez, Chairman of the Board, states: “The Board of

Directors is excited about the future of the Company and we are

encouraged by the positive response of our investors to the

significant changes underway at Turtle Beach. On behalf of the

Board, we look forward to meaningful value creation opportunities

for the Company and its shareholders. Increasing our share

repurchase program is confirmation of the confidence the Board has

in the Company’s cash generation outlook, expanded earnings power,

and continued operational excellence.”

The Company expects to announce further details regarding the

stock repurchase authorization in connection with the issuance of

its first quarter 2024 earnings in May.

The amount and timing of specific repurchases are subject to

market conditions, applicable legal requirements and other factors.

Turtle Beach intends to fund the share repurchases using cash from

operations or short-term borrowings and may suspend or discontinue

repurchases at any time.

About Turtle Beach

Corporation

Turtle Beach Corporation (the “Company”)

(www.turtlebeachcorp.com) is one of the world’s leading gaming

accessory providers. The Company’s namesake Turtle Beach brand

(www.turtlebeach.com) is known for designing best-selling gaming

headsets, top-rated game controllers, award-winning PC gaming

peripherals, and groundbreaking gaming simulation accessories.

Innovation, first-to-market features, a broad range of products for

all types of gamers, and top-rated customer support have made

Turtle Beach a fan-favorite brand and the market leader in console

gaming audio for over a decade. Turtle Beach Corporation acquired

Performance Designed Products (www.pdp.com) in 2024. Turtle Beach’s

shares are traded on the Nasdaq Exchange under the symbol:

HEAR.

Cautionary Note on Forward-Looking

Statements

This press release includes forward-looking information and

statements within the meaning of the federal securities laws.

Except for historical information contained in this release,

statements in this release may constitute forward-looking

statements regarding assumptions, projections, expectations,

targets, intentions or beliefs about future events. Statements

containing the words “may,” “could,” “would,” “should,” “believe,”

“expect,” “anticipate,” “plan,” “estimate,” “target,” “goal,”

“project,” “intend” and similar expressions, or the negatives

thereof, constitute forward-looking statements. Forward-looking

statements involve known and unknown risks and uncertainties, which

could cause actual results to differ materially from those

contained in any forward-looking statement. The inclusion of such

information should not be regarded as a representation by the

Company, or any person, that the objectives of the Company will be

achieved. Forward-looking statements are based on management’s

current beliefs and expectations, as well as assumptions made by,

and information currently available to, management.

While the Company believes that its expectations are based upon

reasonable assumptions, there can be no assurances that its goals

and strategy will be realized. Numerous factors, including risks

and uncertainties, may affect actual results and may cause results

to differ materially from those expressed in forward-looking

statements made by the Company or on its behalf. Some of these

factors include, but are not limited to, risks related to

inflationary pressures, optimizing our product portfolio, reducing

our cost of goods and operating expenses, reductions in logistic

and supply chain challenges and costs, the substantial

uncertainties inherent in the acceptance of existing and future

products, the difficulty of commercializing and protecting new

technology, the impact of competitive products and pricing,

including promotional credits and discounts, general business and

economic conditions, risks associated with the future direction or

governance of the Company, risks associated with the expansion of

our business, including the integration of any businesses we

acquire and the integration of such businesses within our internal

control over financial reporting and operations, our indebtedness,

liquidity, and other factors discussed in our public filings,

including the risk factors included in the Company’s most recent

Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and the

Company’s other periodic reports filed with the Securities and

Exchange Commission. Except as required by applicable law,

including the securities laws of the United States and the rules

and regulations of the Securities and Exchange Commission, the

Company is under no obligation to publicly update or revise any

forward-looking statement after the date of this release whether as

a result of new information, future developments or otherwise.

All trademarks are the property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240409551246/en/

MacLean Marshall Sr. Director, Public Relations

& Brand Communications Turtle Beach

Corporation 858.914.5093

maclean.marshall@turtlebeach.com

Investor Information:

Alex Thompson Gateway Group 949.574.3860

hear@gateway-grp.com

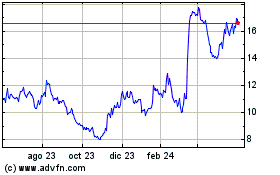

Turtle Beach (NASDAQ:HEAR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

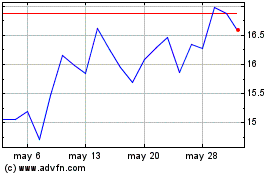

Turtle Beach (NASDAQ:HEAR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025