00016808732024Q3falseDECEMBER 31http://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:shareshffg:segmenthffg:variableInterestEntityxbrli:purehffg:derivativehffg:termLoanhffg:propertyhffg:trusthffg:renewalPeriodhffg:leasehffg:installmenthffg:extension00016808732024-01-012024-09-300001680873us-gaap:CommonStockMember2024-01-012024-09-300001680873us-gaap:PreferredStockMember2024-01-012024-09-3000016808732024-11-0700016808732024-09-3000016808732023-12-310001680873us-gaap:NonrelatedPartyMember2024-09-300001680873us-gaap:NonrelatedPartyMember2023-12-310001680873us-gaap:RelatedPartyMember2024-09-300001680873us-gaap:RelatedPartyMember2023-12-310001680873us-gaap:SeriesAPreferredStockMember2024-09-300001680873us-gaap:SeriesAPreferredStockMember2023-12-310001680873hffg:ThirdPartiesMember2024-07-012024-09-300001680873hffg:ThirdPartiesMember2023-07-012023-09-300001680873hffg:ThirdPartiesMember2024-01-012024-09-300001680873hffg:ThirdPartiesMember2023-01-012023-09-300001680873hffg:RelatedPartiesMember2024-07-012024-09-300001680873hffg:RelatedPartiesMember2023-07-012023-09-300001680873hffg:RelatedPartiesMember2024-01-012024-09-300001680873hffg:RelatedPartiesMember2023-01-012023-09-3000016808732024-07-012024-09-3000016808732023-07-012023-09-3000016808732023-01-012023-09-3000016808732022-12-3100016808732023-09-300001680873us-gaap:CommonStockMember2022-12-310001680873us-gaap:TreasuryStockCommonMember2022-12-310001680873us-gaap:AdditionalPaidInCapitalMember2022-12-310001680873us-gaap:RetainedEarningsMember2022-12-310001680873us-gaap:ParentMember2022-12-310001680873us-gaap:NoncontrollingInterestMember2022-12-310001680873us-gaap:RetainedEarningsMember2023-01-012023-03-310001680873us-gaap:ParentMember2023-01-012023-03-310001680873us-gaap:NoncontrollingInterestMember2023-01-012023-03-3100016808732023-01-012023-03-310001680873us-gaap:CommonStockMember2023-01-012023-03-310001680873us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001680873us-gaap:CommonStockMember2023-03-310001680873us-gaap:TreasuryStockCommonMember2023-03-310001680873us-gaap:AdditionalPaidInCapitalMember2023-03-310001680873us-gaap:RetainedEarningsMember2023-03-310001680873us-gaap:ParentMember2023-03-310001680873us-gaap:NoncontrollingInterestMember2023-03-3100016808732023-03-310001680873us-gaap:RetainedEarningsMember2023-04-012023-06-300001680873us-gaap:ParentMember2023-04-012023-06-300001680873us-gaap:NoncontrollingInterestMember2023-04-012023-06-3000016808732023-04-012023-06-300001680873us-gaap:CommonStockMember2023-04-012023-06-300001680873us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001680873us-gaap:CommonStockMember2023-06-300001680873us-gaap:TreasuryStockCommonMember2023-06-300001680873us-gaap:AdditionalPaidInCapitalMember2023-06-300001680873us-gaap:RetainedEarningsMember2023-06-300001680873us-gaap:ParentMember2023-06-300001680873us-gaap:NoncontrollingInterestMember2023-06-3000016808732023-06-300001680873us-gaap:RetainedEarningsMember2023-07-012023-09-300001680873us-gaap:ParentMember2023-07-012023-09-300001680873us-gaap:NoncontrollingInterestMember2023-07-012023-09-300001680873us-gaap:CommonStockMember2023-07-012023-09-300001680873us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001680873us-gaap:CommonStockMember2023-09-300001680873us-gaap:TreasuryStockCommonMember2023-09-300001680873us-gaap:AdditionalPaidInCapitalMember2023-09-300001680873us-gaap:RetainedEarningsMember2023-09-300001680873us-gaap:ParentMember2023-09-300001680873us-gaap:NoncontrollingInterestMember2023-09-300001680873us-gaap:CommonStockMember2023-12-310001680873us-gaap:TreasuryStockCommonMember2023-12-310001680873us-gaap:AdditionalPaidInCapitalMember2023-12-310001680873us-gaap:RetainedEarningsMember2023-12-310001680873us-gaap:ParentMember2023-12-310001680873us-gaap:NoncontrollingInterestMember2023-12-310001680873us-gaap:RetainedEarningsMember2024-01-012024-03-310001680873us-gaap:ParentMember2024-01-012024-03-310001680873us-gaap:NoncontrollingInterestMember2024-01-012024-03-3100016808732024-01-012024-03-310001680873us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001680873us-gaap:CommonStockMember2024-03-310001680873us-gaap:TreasuryStockCommonMember2024-03-310001680873us-gaap:AdditionalPaidInCapitalMember2024-03-310001680873us-gaap:RetainedEarningsMember2024-03-310001680873us-gaap:ParentMember2024-03-310001680873us-gaap:NoncontrollingInterestMember2024-03-3100016808732024-03-310001680873us-gaap:RetainedEarningsMember2024-04-012024-06-300001680873us-gaap:ParentMember2024-04-012024-06-300001680873us-gaap:NoncontrollingInterestMember2024-04-012024-06-3000016808732024-04-012024-06-300001680873us-gaap:CommonStockMember2024-04-012024-06-300001680873us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001680873us-gaap:CommonStockMember2024-06-300001680873us-gaap:TreasuryStockCommonMember2024-06-300001680873us-gaap:AdditionalPaidInCapitalMember2024-06-300001680873us-gaap:RetainedEarningsMember2024-06-300001680873us-gaap:ParentMember2024-06-300001680873us-gaap:NoncontrollingInterestMember2024-06-3000016808732024-06-300001680873us-gaap:RetainedEarningsMember2024-07-012024-09-300001680873us-gaap:ParentMember2024-07-012024-09-300001680873us-gaap:NoncontrollingInterestMember2024-07-012024-09-300001680873us-gaap:CommonStockMember2024-07-012024-09-300001680873us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001680873us-gaap:CommonStockMember2024-09-300001680873us-gaap:TreasuryStockCommonMember2024-09-300001680873us-gaap:AdditionalPaidInCapitalMember2024-09-300001680873us-gaap:RetainedEarningsMember2024-09-300001680873us-gaap:ParentMember2024-09-300001680873us-gaap:NoncontrollingInterestMember2024-09-300001680873hffg:HFFIMember2024-09-300001680873hffg:HFFIMember2023-12-310001680873hffg:MINMember2024-09-300001680873hffg:MINMember2023-12-310001680873hffg:MSMember2024-09-300001680873hffg:MSMember2023-12-310001680873hffg:SeafoodMember2024-07-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:SeafoodMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001680873hffg:SeafoodMember2023-07-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:SeafoodMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300001680873hffg:SeafoodMember2024-01-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:SeafoodMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300001680873hffg:SeafoodMember2023-01-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:SeafoodMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001680873hffg:AsianSpecialtyMember2024-07-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:AsianSpecialtyMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001680873hffg:AsianSpecialtyMember2023-07-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:AsianSpecialtyMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300001680873hffg:AsianSpecialtyMember2024-01-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:AsianSpecialtyMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300001680873hffg:AsianSpecialtyMember2023-01-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:AsianSpecialtyMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001680873hffg:MeatAndPoultryMember2024-07-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:MeatAndPoultryMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001680873hffg:MeatAndPoultryMember2023-07-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:MeatAndPoultryMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300001680873hffg:MeatAndPoultryMember2024-01-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:MeatAndPoultryMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300001680873hffg:MeatAndPoultryMember2023-01-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:MeatAndPoultryMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001680873hffg:FreshProduceMember2024-07-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:FreshProduceMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001680873hffg:FreshProduceMember2023-07-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:FreshProduceMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300001680873hffg:FreshProduceMember2024-01-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:FreshProduceMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300001680873hffg:FreshProduceMember2023-01-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:FreshProduceMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001680873hffg:PackagingAndOtherMember2024-07-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:PackagingAndOtherMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001680873hffg:PackagingAndOtherMember2023-07-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:PackagingAndOtherMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300001680873hffg:PackagingAndOtherMember2024-01-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:PackagingAndOtherMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300001680873hffg:PackagingAndOtherMember2023-01-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:PackagingAndOtherMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001680873hffg:CommodityProductMember2024-07-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:CommodityProductMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001680873hffg:CommodityProductMember2023-07-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:CommodityProductMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300001680873hffg:CommodityProductMember2024-01-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:CommodityProductMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300001680873hffg:CommodityProductMember2023-01-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberhffg:CommodityProductMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-07-012023-09-300001680873us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300001680873us-gaap:ProductConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001680873us-gaap:VehiclesMember2024-09-300001680873us-gaap:VehiclesMember2023-12-310001680873us-gaap:BuildingMember2024-09-300001680873us-gaap:BuildingMember2023-12-310001680873us-gaap:BuildingImprovementsMember2024-09-300001680873us-gaap:BuildingImprovementsMember2023-12-310001680873us-gaap:FurnitureAndFixturesMember2024-09-300001680873us-gaap:FurnitureAndFixturesMember2023-12-310001680873us-gaap:LandMember2024-09-300001680873us-gaap:LandMember2023-12-310001680873us-gaap:MachineryAndEquipmentMember2024-09-300001680873us-gaap:MachineryAndEquipmentMember2023-12-310001680873us-gaap:ConstructionInProgressMember2024-09-300001680873us-gaap:ConstructionInProgressMember2023-12-310001680873srt:MinimumMember2024-09-300001680873srt:MaximumMember2024-09-300001680873hffg:AsahiFoodIncMember2024-09-300001680873hffg:AsahiFoodIncMember2023-12-310001680873hffg:PtTamronAkuatikProdukIndustriMember2024-09-300001680873hffg:PtTamronAkuatikProdukIndustriMember2023-12-3100016808732024-01-012024-06-300001680873us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001680873us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001680873us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001680873us-gaap:FairValueMeasurementsRecurringMember2024-09-300001680873us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001680873us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001680873us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001680873us-gaap:FairValueMeasurementsRecurringMember2023-12-310001680873us-gaap:FairValueInputsLevel1Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel2Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel3Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2024-09-300001680873hffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel1Memberhffg:JPMorganMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel2Memberhffg:JPMorganMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel3Memberhffg:JPMorganMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873hffg:JPMorganMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel1Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel2Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel3Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873hffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel1Memberhffg:EastWestBankMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel2Memberhffg:EastWestBankMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel3Memberhffg:EastWestBankMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873hffg:EastWestBankMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2024-09-300001680873us-gaap:FairValueInputsLevel1Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel2Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel3Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2023-12-310001680873hffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel1Memberhffg:OtherFinanceInstitutionsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel2Memberhffg:OtherFinanceInstitutionsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel3Memberhffg:OtherFinanceInstitutionsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2023-12-310001680873hffg:OtherFinanceInstitutionsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:FixedRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel1Memberhffg:JPMorganMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel2Memberhffg:JPMorganMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel3Memberhffg:JPMorganMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873hffg:JPMorganMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel1Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel2Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel3Memberhffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873hffg:BankOfAmericaMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel1Memberhffg:EastWestBankMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel2Memberhffg:EastWestBankMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873us-gaap:FairValueInputsLevel3Memberhffg:EastWestBankMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-310001680873hffg:EastWestBankMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberhffg:VariableRateDebtMember2023-12-3100016808732023-01-012023-12-310001680873us-gaap:NoncompeteAgreementsMember2024-09-300001680873us-gaap:NoncompeteAgreementsMember2023-12-310001680873us-gaap:TradeNamesMember2024-09-300001680873us-gaap:TradeNamesMember2023-12-310001680873us-gaap:CustomerRelationshipsMember2024-09-300001680873us-gaap:CustomerRelationshipsMember2023-12-310001680873us-gaap:InterestRateSwapMember2019-08-200001680873us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2019-08-200001680873hffg:InterestRateSwapTwoMemberus-gaap:NondesignatedMember2019-08-2000016808732019-08-200001680873hffg:MortgageSecuredTermLoansMemberhffg:EastWestBankMember2019-08-202019-08-200001680873hffg:MortgageSecuredTermLoansMemberhffg:EastWestBankMember2019-08-200001680873us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2019-12-190001680873hffg:MortgageSecuredTermLoansMemberhffg:BankOfAmericaMember2021-12-192021-12-190001680873hffg:MortgageSecuredTermLoansMemberhffg:BankOfAmericaMember2019-12-190001680873us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-03-150001680873hffg:MortgageSecuredTermLoansMember2023-03-150001680873srt:MinimumMemberhffg:BankOfAmericaMember2024-09-300001680873srt:MaximumMemberhffg:BankOfAmericaMember2024-09-300001680873hffg:BankOfAmericaMember2024-09-300001680873hffg:BankOfAmericaMember2023-12-310001680873srt:MinimumMemberhffg:EastWestBankMember2024-09-300001680873srt:MaximumMemberhffg:EastWestBankMember2024-09-300001680873hffg:EastWestBankMember2024-09-300001680873hffg:EastWestBankMember2023-12-310001680873srt:MaximumMemberhffg:JPMorganMember2024-09-300001680873hffg:JPMorganMember2024-09-300001680873hffg:JPMorganMember2023-12-310001680873hffg:OtherFinanceCompaniesMember2024-09-300001680873hffg:OtherFinanceCompaniesMember2023-12-310001680873hffg:MortgageSecuredTermLoansMemberhffg:BankOfAmericaMember2024-01-012024-09-300001680873hffg:AssetsHeldBySubsidiariesMemberhffg:JPMorganMember2024-09-300001680873hffg:AssetsHeldBySubsidiariesMemberhffg:JPMorganMember2023-12-310001680873hffg:JPMorganMemberhffg:ThirdAmendedCreditAgreementMemberhffg:MortgageSecuredTermLoansMember2024-09-300001680873hffg:JPMorganMemberhffg:SecondAmendedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2024-09-300001680873hffg:JPMorganMemberhffg:SecondAmendedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-03-312022-03-310001680873hffg:JPMorganMemberhffg:SecondAmendedCreditAgreementMemberus-gaap:BridgeLoanMember2024-07-150001680873hffg:HFFoodsMemberhffg:ShareholderMember2024-09-300001680873hffg:HFFoodsMemberhffg:Mr.ZhouMinNiMr.NiFormerCoChiefExecutiveOfficerVariousTrustsMember2024-09-300001680873us-gaap:RelatedPartyMemberhffg:AsahiFoodIncMember2024-07-012024-09-300001680873us-gaap:RelatedPartyMemberhffg:AsahiFoodIncMember2023-07-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:AsahiFoodIncMember2024-01-012024-09-300001680873us-gaap:RelatedPartyMemberhffg:AsahiFoodIncMember2023-01-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:BestFoodServicesLlcMember2024-07-012024-09-300001680873us-gaap:RelatedPartyMemberhffg:BestFoodServicesLlcMember2023-07-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:BestFoodServicesLlcMember2024-01-012024-09-300001680873us-gaap:RelatedPartyMemberhffg:BestFoodServicesLlcMember2023-01-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:EnsonGroupIncMember2023-07-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:EnsonGroupIncMember2023-01-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:OceanPacificSeafoodGroupMember2024-07-012024-09-300001680873us-gaap:RelatedPartyMemberhffg:OceanPacificSeafoodGroupMember2023-07-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:OceanPacificSeafoodGroupMember2024-01-012024-09-300001680873us-gaap:RelatedPartyMemberhffg:OceanPacificSeafoodGroupMember2023-01-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:OtherRelatedPartiesMember2024-07-012024-09-300001680873us-gaap:RelatedPartyMemberhffg:OtherRelatedPartiesMember2023-07-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:OtherRelatedPartiesMember2024-01-012024-09-300001680873us-gaap:RelatedPartyMemberhffg:OtherRelatedPartiesMember2023-01-012023-09-300001680873us-gaap:RelatedPartyMember2024-07-012024-09-300001680873us-gaap:RelatedPartyMember2023-07-012023-09-300001680873us-gaap:RelatedPartyMember2024-01-012024-09-300001680873us-gaap:RelatedPartyMember2023-01-012023-09-300001680873hffg:BestFoodServicesLlcMember2023-12-310001680873hffg:BestFoodServicesLlcMember2024-09-300001680873hffg:ABCTradingLlcMemberus-gaap:SalesMember2024-07-012024-09-300001680873hffg:ABCTradingLlcMemberus-gaap:SalesMember2023-07-012023-09-300001680873hffg:ABCTradingLlcMemberus-gaap:SalesMember2024-01-012024-09-300001680873hffg:ABCTradingLlcMemberus-gaap:SalesMember2023-01-012023-09-300001680873hffg:AsahiFoodIncMemberus-gaap:SalesMember2024-07-012024-09-300001680873hffg:AsahiFoodIncMemberus-gaap:SalesMember2023-07-012023-09-300001680873hffg:AsahiFoodIncMemberus-gaap:SalesMember2024-01-012024-09-300001680873hffg:AsahiFoodIncMemberus-gaap:SalesMember2023-01-012023-09-300001680873hffg:BestFoodServicesLlcMemberus-gaap:SalesMember2024-07-012024-09-300001680873hffg:BestFoodServicesLlcMemberus-gaap:SalesMember2023-07-012023-09-300001680873hffg:BestFoodServicesLlcMemberus-gaap:SalesMember2024-01-012024-09-300001680873hffg:BestFoodServicesLlcMemberus-gaap:SalesMember2023-01-012023-09-300001680873hffg:EagleFoodServiceLLCMemberus-gaap:SalesMember2024-07-012024-09-300001680873hffg:EagleFoodServiceLLCMemberus-gaap:SalesMember2023-07-012023-09-300001680873hffg:EagleFoodServiceLLCMemberus-gaap:SalesMember2024-01-012024-09-300001680873hffg:EagleFoodServiceLLCMemberus-gaap:SalesMember2023-01-012023-09-300001680873hffg:FirstChoiceSeafoodIncMemberus-gaap:SalesMember2024-07-012024-09-300001680873hffg:FirstChoiceSeafoodIncMemberus-gaap:SalesMember2023-07-012023-09-300001680873hffg:FirstChoiceSeafoodIncMemberus-gaap:SalesMember2024-01-012024-09-300001680873hffg:FirstChoiceSeafoodIncMemberus-gaap:SalesMember2023-01-012023-09-300001680873hffg:FortuneOneFoodsIncMemberus-gaap:SalesMember2024-07-012024-09-300001680873hffg:FortuneOneFoodsIncMemberus-gaap:SalesMember2023-07-012023-09-300001680873hffg:FortuneOneFoodsIncMemberus-gaap:SalesMember2024-01-012024-09-300001680873hffg:FortuneOneFoodsIncMemberus-gaap:SalesMember2023-01-012023-09-300001680873hffg:NFMemberus-gaap:SalesMember2024-07-012024-09-300001680873hffg:NFMemberus-gaap:SalesMember2023-07-012023-09-300001680873hffg:NFMemberus-gaap:SalesMember2024-01-012024-09-300001680873hffg:NFMemberus-gaap:SalesMember2023-01-012023-09-300001680873hffg:UnionFoodLLCMemberus-gaap:SalesMember2024-07-012024-09-300001680873hffg:UnionFoodLLCMemberus-gaap:SalesMember2023-07-012023-09-300001680873hffg:UnionFoodLLCMemberus-gaap:SalesMember2024-01-012024-09-300001680873hffg:UnionFoodLLCMemberus-gaap:SalesMember2023-01-012023-09-300001680873us-gaap:SalesMember2024-07-012024-09-300001680873us-gaap:SalesMember2023-07-012023-09-300001680873us-gaap:SalesMember2024-01-012024-09-300001680873us-gaap:SalesMember2023-01-012023-09-300001680873hffg:KirnlandMemberus-gaap:BuildingMember2021-02-280001680873hffg:KirnlandMemberus-gaap:BuildingMember2024-07-012024-09-300001680873hffg:KirnlandMemberus-gaap:BuildingMember2023-07-012023-09-300001680873hffg:KirnlandMemberus-gaap:BuildingMember2024-01-012024-09-300001680873hffg:KirnlandMemberus-gaap:BuildingMember2023-01-012023-09-300001680873hffg:AsahiFoodIncMemberus-gaap:BuildingMember2021-02-280001680873hffg:AsahiFoodIncMemberus-gaap:BuildingMember2024-07-012024-09-300001680873hffg:AsahiFoodIncMemberus-gaap:BuildingMember2023-07-012023-09-300001680873hffg:AsahiFoodIncMemberus-gaap:BuildingMember2024-01-012024-09-300001680873hffg:AsahiFoodIncMemberus-gaap:BuildingMember2023-01-012023-09-300001680873us-gaap:RelatedPartyMemberhffg:ABCTradingLlcMember2024-09-300001680873us-gaap:RelatedPartyMemberhffg:ABCTradingLlcMember2023-12-310001680873us-gaap:RelatedPartyMemberhffg:AsahiFoodIncMember2024-09-300001680873us-gaap:RelatedPartyMemberhffg:AsahiFoodIncMember2023-12-310001680873us-gaap:RelatedPartyMemberhffg:BestFoodServicesLlcMember2024-09-300001680873us-gaap:RelatedPartyMemberhffg:BestFoodServicesLlcMember2023-12-310001680873us-gaap:RelatedPartyMemberhffg:EnsonSeafoodGAIncMember2023-12-310001680873us-gaap:RelatedPartyMemberhffg:FortuneOneFoodsIncMember2024-09-300001680873us-gaap:RelatedPartyMemberhffg:FortuneOneFoodsIncMember2023-12-310001680873us-gaap:RelatedPartyMemberhffg:UnionFoodLLCMember2024-09-300001680873us-gaap:RelatedPartyMemberhffg:UnionFoodLLCMember2023-12-310001680873hffg:EnsonSeafoodGAIncMember2024-09-300001680873us-gaap:RelatedPartyMemberhffg:OtherRelatedPartiesMember2024-09-300001680873us-gaap:RelatedPartyMemberhffg:OtherRelatedPartiesMember2023-12-310001680873us-gaap:RestrictedStockUnitsRSUMember2024-09-300001680873us-gaap:PerformanceSharesMember2024-09-300001680873hffg:LeaseFifthAvenueManhattanNewYorkMember2024-01-012024-09-300001680873hffg:LeaseFor273FifthAvenueManhattanNewYorkMember2024-09-300001680873hffg:LeaseFor275FifthAvenueManhattanNewYorkMember2024-09-300001680873hffg:LeaseFifthAvenueManhattanNewYorkMember2024-07-012024-09-300001680873hffg:LeaseFifthAvenueManhattanNewYorkMember2024-09-300001680873srt:MinimumMember2021-02-102021-02-1000016808732024-03-012024-03-310001680873hffg:AnHeartAndMinshengCaseMember2023-10-250001680873hffg:AnHeartAndMinshengCaseMember2024-01-012024-09-300001680873hffg:A275FifthAvenueNewYorkNewYorkMember2024-04-302024-04-300001680873hffg:A4795InnovativeWayPowderSpringsGeorgiaMember2024-09-300001680873hffg:A4795InnovativeWayPowderSpringsGeorgiaMember2024-09-302024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________________

FORM 10-Q

(Mark one)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________________ to _______________________.

Commission File Number: 001-38180

__________________________________________________________________________

HF FOODS GROUP INC.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 81-2717873 (I.R.S. Employer Identification No.) |

|

6325 South Rainbow Boulevard, Suite 420, Las Vegas, NV 89118 |

| (Address of principal executive offices) (Zip Code) |

(888) 905-0988

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | HFFG | Nasdaq Capital Market |

| Preferred Share Purchase Rights | N/A | Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 7, 2024, the registrant had 52,737,650 shares of common stock outstanding.

HF Foods Group Inc. and Subsidiaries

Form 10-Q for the Quarter Ended September 30, 2024

Table of Contents

| | | | | | | | |

| Description | Page |

| |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | |

| |

PART I. FINANCIAL INFORMATION

ITEM 1. Financial Statements.

HF Foods Group Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash | $ | 11,445 | | | $ | 15,232 | |

Accounts receivable, net of allowances of $2,077 and $2,119 | 51,728 | | | 47,524 | |

| Accounts receivable - related parties | 226 | | | 308 | |

| Inventories | 119,508 | | | 105,618 | |

| Prepaid expenses and other current assets | 10,012 | | | 10,145 | |

| TOTAL CURRENT ASSETS | 192,919 | | | 178,827 | |

| Property and equipment, net | 146,073 | | | 133,136 | |

| Operating lease right-of-use assets | 14,981 | | | 12,714 | |

| Long-term investments | 2,374 | | | 2,388 | |

| Customer relationships, net | 139,257 | | | 147,181 | |

| Trademarks, trade names and other intangibles, net | 26,339 | | | 30,625 | |

| Goodwill | 85,118 | | | 85,118 | |

| | | |

| Other long-term assets | 5,689 | | | 6,531 | |

| TOTAL ASSETS | $ | 612,750 | | | $ | 596,520 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Checks issued not presented for payment | $ | 12,018 | | | $ | 4,494 | |

| Line of credit | 66,911 | | | 58,564 | |

| Accounts payable | 51,566 | | | 51,617 | |

| Accounts payable - related parties | 74 | | | 397 | |

| Current portion of long-term debt, net | 5,410 | | | 5,450 | |

| Current portion of obligations under finance leases | 3,301 | | | 1,749 | |

| Current portion of obligations under operating leases | 4,147 | | | 3,706 | |

| Accrued expenses and other liabilities | 19,684 | | | 17,287 | |

| TOTAL CURRENT LIABILITIES | 163,111 | | | 143,264 | |

| Long-term debt, net of current portion | 104,658 | | | 108,711 | |

| | | |

| Obligations under finance leases, non-current | 17,726 | | | 11,229 | |

| Obligations under operating leases, non-current | 11,180 | | | 9,414 | |

| Deferred tax liabilities | 27,853 | | | 29,028 | |

| Other long-term liabilities | 2,612 | | | 6,891 | |

| TOTAL LIABILITIES | 327,140 | | | 308,537 | |

COMMITMENTS AND CONTINGENCIES (Note 13) | | | |

| SHAREHOLDERS’ EQUITY: | | | |

Series A Participating Preferred Stock, par value $0.001; 100,000 shares authorized, no shares issued and outstanding | — | | | — | |

Preferred Stock, $0.001 par value; 1,000,000 shares authorized; no shares issued and outstanding | — | | | — | |

Common Stock, $0.0001 par value; 100,000,000 shares authorized; 54,734,585 and 54,153,391 shares issued and 52,737,162 and 52,155,968 shares outstanding as of September 30, 2024 and December 31, 2023, respectively | 5 | | | 5 | |

Treasury stock, at cost; 1,997,423 shares as of September 30, 2024 and December 31, 2023 | (7,750) | | | (7,750) | |

| Additional paid-in capital | 604,110 | | | 603,094 | |

| Accumulated deficit | (313,305) | | | (308,688) | |

| TOTAL SHAREHOLDERS’ EQUITY ATTRIBUTABLE TO HF FOODS GROUP INC. | 283,060 | | | 286,661 | |

| Noncontrolling interests | 2,550 | | | 1,322 | |

| TOTAL SHAREHOLDERS’ EQUITY | 285,610 | | | 287,983 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 612,750 | | | $ | 596,520 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

1

HF Foods Group Inc. and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 | | |

| Net revenue - third parties | $ | 297,619 | | | $ | 280,635 | | | $ | 893,786 | | | $ | 862,561 | | | |

| Net revenue - related parties | 770 | | | 818 | | | 2,599 | | | 5,059 | | | |

| TOTAL NET REVENUE | 298,389 | | | 281,453 | | | 896,385 | | | 867,620 | | | |

| | | | | | | | | |

| Cost of revenue - third parties | 247,528 | | | 229,772 | | | 740,969 | | | 710,953 | | | |

| Cost of revenue - related parties | 698 | | | 756 | | | 2,377 | | | 4,904 | | | |

| TOTAL COST OF REVENUE | 248,226 | | | 230,528 | | | 743,346 | | | 715,857 | | | |

| | | | | | | | | |

| GROSS PROFIT | 50,163 | | | 50,925 | | | 153,039 | | | 151,763 | | | |

| | | | | | | | | |

| Distribution, selling and administrative expenses | 49,652 | | | 48,841 | | | 149,988 | | | 154,013 | | | |

| | | | | | | | | |

| INCOME (LOSS) FROM OPERATIONS | 511 | | | 2,084 | | | 3,051 | | | (2,250) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Interest expense | 2,644 | | | 2,715 | | | 8,597 | | | 8,430 | | | |

| Other (income) expense, net | (332) | | | (490) | | | 3,040 | | | (845) | | | |

| Change in fair value of interest rate swap contracts | 3,290 | | | (1,984) | | | 959 | | | (2,094) | | | |

| Lease guarantee income | — | | | (95) | | | (5,548) | | | (305) | | | |

| | | | | | | | | |

| | | | | | | | | |

| (LOSS) INCOME BEFORE INCOME TAXES | (5,091) | | | 1,938 | | | (3,997) | | | (7,436) | | | |

| | | | | | | | | |

| Income tax (benefit) expense | (1,254) | | | (36) | | | 164 | | | (2,053) | | | |

| NET (LOSS) INCOME AND COMPREHENSIVE (LOSS) INCOME | (3,837) | | | 1,974 | | | (4,161) | | | (5,383) | | | |

| | | | | | | | | |

| Less: net income (loss) attributable to noncontrolling interests | 103 | | | 90 | | | 456 | | | (484) | | | |

| NET (LOSS) INCOME AND COMPREHENSIVE (LOSS) INCOME ATTRIBUTABLE TO HF FOODS GROUP INC. | $ | (3,940) | | | $ | 1,884 | | | $ | (4,617) | | | $ | (4,899) | | | |

| | | | | | | | | |

| (LOSS) EARNINGS PER COMMON SHARE - BASIC | $ | (0.07) | | | $ | 0.03 | | | $ | (0.09) | | | $ | (0.09) | | | |

| (LOSS) EARNINGS PER COMMON SHARE - DILUTED | $ | (0.07) | | | $ | 0.03 | | | $ | (0.09) | | | $ | (0.09) | | | |

| WEIGHTED AVERAGE SHARES - BASIC | 52,726,683 | | | 54,142,396 | | | 52,490,321 | | | 54,005,010 | | | |

| WEIGHTED AVERAGE SHARES - DILUTED | 52,726,683 | | | 54,513,314 | | | 52,490,321 | | | 54,005,010 | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

HF Foods Group Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 | | |

| Cash flows from operating activities: | | | | | |

| Net loss | $ | (4,161) | | | $ | (5,383) | | | |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | | | | | |

| Depreciation and amortization expense | 19,932 | | | 19,551 | | | |

| | | | | |

| | | | | |

| Asset impairment charges | — | | | 1,200 | | | |

| | | | | |

| Provision for credit losses | (40) | | | 56 | | | |

| Deferred tax benefit | (1,175) | | | (2,467) | | | |

| | | | | |

| Change in fair value of interest rate swap contracts | 959 | | | (2,094) | | | |

| Stock-based compensation | 1,961 | | | 2,605 | | | |

| | | | | |

| Non-cash lease expense | 2,955 | | | 2,668 | | | |

| Lease guarantee income | (5,548) | | | (305) | | | |

| Other non-cash expense | 522 | | | 168 | | | |

| Changes in operating assets and liabilities: | | | | | |

| Accounts receivable | (4,105) | | | 997 | | | |

| Accounts receivable - related parties | 23 | | | (115) | | | |

| Inventories | (13,890) | | | 4,349 | | | |

| | | | | |

| | | | | |

| Prepaid expenses and other current assets | 133 | | | (14,074) | | | |

| | | | | |

| Other long-term assets | 734 | | | (2,878) | | | |

| Accounts payable | (658) | | | 22,618 | | | |

| Accounts payable - related parties | (323) | | | (1,039) | | | |

| Operating lease liabilities | (3,015) | | | (2,511) | | | |

| Accrued expenses and other liabilities | 2,397 | | | (2,722) | | | |

| Net cash (used in) provided by operating activities | (3,299) | | | 20,624 | | | |

| Cash flows from investing activities: | | | | | |

| | | | | |

| Purchase of property and equipment | (9,435) | | | (3,495) | | | |

| | | | | |

| Proceeds from sale of property and equipment | 12 | | | 900 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash used in investing activities | (9,423) | | | (2,595) | | | |

| Cash flows from financing activities: | | | | | |

| Payments for tax withholding related to vested stock awards | (173) | | | — | | | |

| Checks issued not presented for payment | 7,524 | | | (15,058) | | | |

| Proceeds from line of credit | 1,120,318 | | | 891,510 | | | |

| Repayment of line of credit | (1,112,012) | | | (896,959) | | | |

| | | | | |

| Repayment of long-term debt | (4,125) | | | (4,653) | | | |

| | | | | |

| Repayment of obligations under finance leases | (2,597) | | | (1,974) | | | |

| | | | | |

| | | | | |

| Cash distribution to shareholders | — | | | (884) | | | |

| Net cash provided by (used in) financing activities | 8,935 | | | (28,018) | | | |

| Net decrease in cash | (3,787) | | | (9,989) | | | |

| Cash at beginning of the period | 15,232 | | | 24,289 | | | |

| Cash at end of the period | $ | 11,445 | | | $ | 14,300 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Supplemental disclosure of non-cash investing and financing activities: | | | | | |

| Right-of-use assets obtained in exchange for operating lease liabilities | $ | 5,222 | | | $ | 1,024 | | | |

| Property acquired in exchange for finance leases | 10,646 | | | 1,285 | | | |

| | | | | |

| Dissolution of noncontrolling interests | 772 | | | — | | | |

| Capital expenditures included in accounts payable | 607 | | | — | | | |

| Note receivable related to property and equipment sales | — | | | 300 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

HF Foods Group Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Shareholders' Equity

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Accumulated Deficit | | Total Shareholders’

Equity Attributable to

HF Foods Group Inc. | | Noncontrolling

Interests | | Total

Shareholders’

Equity |

| Shares | | Amount | |

Shares | | Amount | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance at January 1, 2023 | 53,813,777 | | | $ | 5 | | | — | | | $ | — | | | $ | 598,322 | | | $ | (306,514) | | | $ | 291,813 | | | $ | 4,436 | | | $ | 296,249 | |

| Net (loss) income | — | | | — | | | — | | | — | | | — | | | (5,933) | | | (5,933) | | | 136 | | | (5,797) | |

| Issuance of common stock pursuant to equity compensation plan | 37,847 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Shares withheld for tax withholdings on vested awards | (7,132) | | | — | | | — | | | — | | | (34) | | | — | | | (34) | | | — | | | (34) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 1,096 | | | — | | | 1,096 | | | — | | | 1,096 | |

| Balance at March 31, 2023 | 53,844,492 | | | $ | 5 | | | — | | | $ | — | | | $ | 599,384 | | | $ | (312,447) | | | $ | 286,942 | | | $ | 4,572 | | | $ | 291,514 | |

| Net loss | — | | | — | | | — | | | — | | | | | (850) | | | (850) | | | (710) | | | (1,560) | |

| | | | | | | | | | | | | | | | | |

| Issuance of common stock pursuant to equity compensation plan | 269,113 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Shares withheld for tax withholdings on vested awards | (27,441) | | | — | | | — | | | — | | | (106) | | | — | | | (106) | | | — | | | (106) | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 752 | | | — | | | 752 | | | — | | | 752 | |

| Balance at June 30, 2023 | 54,086,164 | | | $ | 5 | | | — | | | $ | — | | | $ | 600,030 | | | $ | (313,297) | | | $ | 286,738 | | | $ | 3,862 | | | $ | 290,600 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 1,884 | | | 1,884 | | | 90 | | | 1,974 | |

| Issuance of common stock pursuant to equity compensation plan | 84,196 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Shares withheld for tax withholdings on vested awards | (17,457) | | | — | | | — | | | — | | | (91) | | | — | | | (91) | | | — | | | (91) | |

| Distribution to shareholders | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (884) | | | (884) | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 757 | | | — | | | 757 | | | — | | | 757 | |

| Balance at September 30, 2023 | 54,152,903 | | | $ | 5 | | | — | | | — | | | $ | 600,696 | | | $ | (311,413) | | | $ | 289,288 | | | $ | 3,068 | | | $ | 292,356 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Treasury Stock | | Additional

Paid-in

Capital | | Accumulated Deficit | | Total Shareholders’

Equity Attributable to

HF Foods Group Inc. | | Noncontrolling

Interests | | Total

Shareholders’

Equity |

| Shares | | Amount | |

Shares | | Amount | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance at January 1, 2024 | 54,153,391 | | | $ | 5 | | | 1,997,423 | | | $ | (7,750) | | | $ | 603,094 | | | $ | (308,688) | | | $ | 286,661 | | | $ | 1,322 | | | $ | 287,983 | |

| Net (loss) income | — | | | — | | | — | | | — | | | — | | | (694) | | | (694) | | | 135 | | | (559) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 738 | | | — | | | 738 | | | — | | | 738 | |

| Balance at March 31, 2024 | 54,153,391 | | | $ | 5 | | | 1,997,423 | | | $ | (7,750) | | | $ | 603,832 | | | $ | (309,382) | | | $ | 286,705 | | | $ | 1,457 | | | $ | 288,162 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 17 | | | 17 | | | 218 | | | 235 | |

| Issuance of common stock pursuant to equity compensation plan | 555,181 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Shares withheld for tax withholdings on vested awards | (40,403) | | | — | | | — | | | — | | | (128) | | | — | | | (128) | | | — | | | (128) | |

| Dissolution of noncontrolling interests | — | | | — | | | — | | | — | | | (772) | | | — | | | (772) | | | 772 | | | — | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 522 | | | — | | | 522 | | | — | | | 522 | |

| Balance at June 30, 2024 | 54,668,169 | | | $ | 5 | | | 1,997,423 | | | $ | (7,750) | | | $ | 603,454 | | | $ | (309,365) | | | $ | 286,344 | | | $ | 2,447 | | | $ | 288,791 | |

| Net (loss) income | — | | | — | | | — | | | — | | | — | | | (3,940) | | | (3,940) | | | 103 | | | (3,837) | |

| Issuance of common stock pursuant to equity compensation plan | 82,713 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Shares withheld for tax withholdings on vested awards | (16,297) | | | — | | | — | | | — | | | (45) | | | — | | | (45) | | | — | | | (45) | |

| | | | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 701 | | | — | | | 701 | | | — | | | 701 | |

| Balance at September 30, 2024 | 54,734,585 | | | $ | 5 | | | 1,997,423 | | | $ | (7,750) | | | $ | 604,110 | | | $ | (313,305) | | | $ | 283,060 | | | $ | 2,550 | | | $ | 285,610 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

HF Foods Group Inc. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Note 1 - Organization and Description of Business

Organization and General

HF Foods Group Inc. and subsidiaries (collectively “HF Foods” or the “Company”) is an Asian foodservice distributor that markets and distributes fresh produce, seafood, frozen and dry food, and non-food products to primarily Asian restaurants and other foodservice customers throughout the United States. The Company's business consists of one operating segment, which is also its one reportable segment: HF Foods, which operates solely in the United States. The Company's customer base consists primarily of Asian restaurants, and it provides sales and service support to customers who mainly converse in Mandarin or Chinese dialects.

Note 2 - Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) and applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) regarding interim financial reporting. All adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included.

The condensed consolidated financial statements and related financial information should be read in conjunction with the audited consolidated financial statements and the related notes thereto that are included in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 26, 2024 (the “2023 Annual Report”). There have been no material changes to the Company’s significant accounting policies as compared to the significant accounting policies described in the 2023 Annual Report.

All significant intercompany balances and transactions have been eliminated in consolidation. For consolidated entities where we own or are exposed to less than 100% of the economics, the Company records net income (loss) attributable to noncontrolling interest in its condensed consolidated statements of operations and comprehensive loss equal to the percentage of the economic or ownership interest retained in such entity by the respective noncontrolling party.

Variable Interest Entities

GAAP provides guidance on the identification of a variable interest entity (“VIE”) and financial reporting for an entity over which control is achieved through means other than voting interests. The Company evaluates each of its interests in an entity to determine whether or not the investee is a VIE and, if so, whether the Company is the primary beneficiary of such VIE. In determining whether the Company is the primary beneficiary, the Company considers if the Company (1) has power to direct the activities that most significantly affect the economic performance of the VIE, and (2) has the obligation to absorb losses or the right to receive the economic benefits of the VIE that could be potentially significant to the VIE. If deemed the primary beneficiary, the Company consolidates the VIE.

The Company previously disclosed one VIE, AnHeart, Inc. (“AnHeart”), for which the Company was not the primary beneficiary and therefore did not consolidate. Effective April 30, 2024, the Company assumed the lease for which AnHeart was a lessee and the Company was a guarantor, and as such, it no longer recognizes AnHeart as a VIE as of September 30, 2024. See Note 13 - Commitments and Contingencies for additional information on AnHeart.

Noncontrolling Interests

GAAP requires that noncontrolling interests in subsidiaries and affiliates be reported in the equity section of the Company’s condensed consolidated balance sheets. In addition, the amounts attributable to the net income (loss) of those noncontrolling interests are reported separately in the condensed consolidated statements of operations and comprehensive loss.

As of September 30, 2024 and December 31, 2023, noncontrolling interest equity consisted of the following:

| | | | | | | | | | | | | | | | | | | | |

| ($ in thousands) | | Ownership of noncontrolling interest at September 30, 2024 | | September 30, 2024 | | December 31, 2023 |

HF Foods Industrial, LLC ("HFFI")(a) | | N/A | | $ | — | | | $ | (759) | |

| Min Food, Inc. | | 39.75% | | 2,184 | | | 1,715 | |

| Monterey Food Service, LLC | | 35.00% | | 366 | | | 366 | |

| Total | | | | $ | 2,550 | | | $ | 1,322 | |

_______________

(a)During the nine months ended September 30, 2024, upon dissolution of HFFI, the Company assumed HFFI’s remaining assets and liabilities. In accordance with ASC Topic 810 (“ASC 810”), Consolidation, changes in a parent’s ownership interest while the parent retains its controlling financial interest in its subsidiary shall be accounted for as equity transactions. No gain or loss was recognized. As a result of this transaction, noncontrolling interest of $(0.8) million was reclassified to additional paid-in capital on the condensed consolidated balance sheets.

Uses of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenue and expenses during each reporting period. Actual results could differ from those estimates. Significant accounting estimates reflected in the Company’s condensed consolidated financial statements include, but are not limited to, inventory reserves, impairment of long-lived assets, impairment of goodwill, and the purchase price allocation and fair value of assets and liabilities acquired with respect to business combinations.

Recent Accounting Pronouncements

In November 2024, the FASB issued Accounting Standards Update (ASU) 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses. The guidance requires additional disclosure of certain amounts included in the expense captions presented on the Statement of Operations as well as disclosures about selling expenses. This guidance is effective on a prospective basis, with the option for retrospective application, for annual periods beginning after December 15, 2026 and interim reporting periods beginning after December 15, 2027. The Company is in the process of assessing the impact the adoption of this guidance will have on the Company’s financial statement disclosures.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which requires enhanced disclosures about segment expenses on an annual and interim basis. This standard is effective for the Company’s consolidated financial statements for the year ending December 31, 2024 and for interim periods beginning in 2025. The impact of the adoption of this ASU is not expected to have a material effect on the Company’s financial position, or operations, however, the Company is currently evaluating the impact of this standard on its disclosures to the consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which requires public entities to disclose specific categories in its annual effective tax rate reconciliation and disaggregated information about significant reconciling items by jurisdiction and by nature. This guidance also requires entities to disclose their income tax payments (net of refunds) to international, federal, and state and local jurisdictions. This guidance is effective for fiscal years beginning after December 15, 2024, and requires prospective application with the option to apply it retrospectively. Early adoption is permitted. The Company is currently evaluating the impact of this guidance on the consolidated financial statements and disclosures.

Note 3 - Revenue

The following table presents the Company's net revenue disaggregated by principal product categories:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| ($ in thousands) | | 2024 | | 2023 | | 2024 | | 2023 | | |

| Seafood | | $ | 98,826 | | | 33 | % | | $ | 87,475 | | | 31 | % | | $ | 292,751 | | | 33 | % | | $ | 271,748 | | | 32 | % | | | | |

| Asian Specialty | | 74,269 | | | 25 | % | | 74,384 | | | 26 | % | | 231,971 | | | 26 | % | | 228,545 | | | 26 | % | | | | |

| Meat and Poultry | | 64,538 | | | 21 | % | | 54,787 | | | 19 | % | | 186,080 | | | 21 | % | | 162,848 | | | 19 | % | | | | |

| Produce | | 31,670 | | | 11 | % | | 29,578 | | | 11 | % | | 95,924 | | | 10 | % | | 93,425 | | | 11 | % | | | | |

| Packaging and Other | | 15,797 | | | 5 | % | | 17,342 | | | 6 | % | | 47,816 | | | 5 | % | | 54,775 | | | 6 | % | | | | |

| Commodity | | 13,289 | | | 5 | % | | 17,887 | | | 7 | % | | 41,843 | | | 5 | % | | 56,279 | | | 6 | % | | | | |

| Total | | $ | 298,389 | | | 100 | % | | $ | 281,453 | | | 100 | % | | $ | 896,385 | | | 100 | % | | $ | 867,620 | | | 100 | % | | | | |

Note 4 - Balance Sheet Components

Accounts receivable, net consisted of the following:

| | | | | | | | | | | |

| (In thousands) | September 30, 2024 | | December 31, 2023 |

| Accounts receivable | $ | 53,805 | | | $ | 49,643 | |

| Less: allowance for expected credit losses | (2,077) | | | (2,119) | |

| Accounts receivable, net | $ | 51,728 | | | $ | 47,524 | |

Movement of allowance for expected credit losses was as follows:

| | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| (In thousands) | 2024 | | 2023 | | | | |

| Beginning balance | $ | 2,119 | | | $ | 1,442 | | | | | |

| | | | | | | |

| (Decrease) increase in provision for expected credit losses | (40) | | | 56 | | | | | |

| Bad debt write-offs | (2) | | | (24) | | | | | |

| Ending balance | $ | 2,077 | | | $ | 1,474 | | | | | |

Prepaid expenses and other current assets consisted of the following:

| | | | | | | | | | | |

| (In thousands) | September 30, 2024 | | December 31, 2023 |

| Prepaid expenses | $ | 4,531 | | | $ | 4,591 | |

| Advances to suppliers | 3,698 | | | 3,340 | |

| Other current assets | 1,783 | | | 2,214 | |

| Prepaid expenses and other current assets | $ | 10,012 | | | $ | 10,145 | |

Property and equipment, net consisted of the following:

| | | | | | | | | | | |

| (In thousands) | September 30, 2024 | | December 31, 2023 |

Automobiles(1) | $ | 47,859 | | | $ | 37,256 | |

Buildings(2) | 63,045 | | | 63,045 | |

| Building improvements | 22,677 | | | 22,014 | |

| Furniture and fixtures | 419 | | | 474 | |

| Land | 49,929 | | | 49,929 | |

| Machinery and equipment | 13,232 | | | 11,532 | |

| Construction in progress | 7,981 | | | 1,391 | |

| Subtotal | 205,142 | | | 185,641 | |

| Less: accumulated depreciation | (59,069) | | | (52,505) | |

| Property and equipment, net | $ | 146,073 | | | $ | 133,136 | |

_________________

(1) The cost and accumulated depreciation of property and equipment related to finance leases was $32.4 million and $13.1 million at September 30, 2024 and $22.2 million and $10.3 million at December 31, 2023, which primarily relates to Automobiles. During the nine months ended September 30, 2024, the Company entered into finance leases for automobiles which mature in 4 to 6 years and have a weighted average discount rate of 6.6%. The total future minimum lease payments under finance leases as of September 30, 2024 is $31.5 million. As of September 30, 2024, the Company had additional automobile leases that had not yet commenced which totaled $16.2 million in future minimum lease payments.

(2) The Company entered into a finance lease on September 30, 2024 for a new Atlanta, GA based distribution center which will commence during 2025 and totaled $15.8 million in future minimum lease payments over 10 years.

Depreciation expense was $2.6 million and $2.4 million for the three months ended September 30, 2024 and 2023, respectively. Depreciation expense was $7.7 million and $7.3 million for the nine months ended September 30, 2024 and 2023, respectively. During the nine months ended September 30, 2023, the Company impaired machinery and recognized impairment expense of $1.2 million in distribution, selling and administrative expense in the condensed consolidated statements of operations and comprehensive income.

Long-term investments consisted of the following:

| | | | | | | | | | | | | | | | | |

| (In thousands) | Ownership as of September 30,

2024 | | September 30, 2024 | | December 31, 2023 |

| Asahi Food, Inc. ("Asahi") | 49% | | $ | 574 | | | $ | 588 | |

| Pt. Tamron Akuatik Produk Industri ("Tamron") | 12% | | 1,800 | | | 1,800 | |

| Total long-term investments | | | $ | 2,374 | | | $ | 2,388 | |

The investment in Tamron is accounted for using the measurement alternative under Accounting Standards Codification (“ASC”) Topic 321 Investments—Equity Securities, which is measured at cost, less any impairment, plus or minus changes resulting from observable price changes in orderly transactions for identical or similar investments, if any. The investment in Asahi is accounted for under the equity method due to the fact that the Company has significant influence but does not exercise control over this investee. The Company determined there was no impairment as of September 30, 2024 for these investments.

Accrued expenses and other liabilities consisted of the following:

| | | | | | | | | | | | | | |

| (In thousands) | | September 30, 2024 | | December 31, 2023 |

| Accrued compensation | | $ | 6,090 | | | $ | 7,941 | |

| Accrued professional fees | | 854 | | | 1,353 | |

| | | | |

| Accrued interest and fees | | 1,089 | | | 1,276 | |

| Self-insurance liability | | 2,999 | | | 1,723 | |

| Other | | 8,652 | | | 4,994 | |

| Total accrued expenses and other liabilities | | $ | 19,684 | | | $ | 17,287 | |

Note 5 - Fair Value Measurements

The following table presents the Company's hierarchy for its assets and liabilities measured at fair value on a recurring basis as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

| Quoted Prices in Active Markets for Identical Assets | | Significant Other Observable Inputs | | Significant Unobservable Inputs | | | | Quoted Prices in Active Markets for Identical Assets | | Significant Other Observable Inputs | | Significant Unobservable Inputs | | |

| (In thousands) |

| Assets: | | | | | | | | | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 304 | | | $ | — | | | $ | 304 | | | $ | — | | | $ | 412 | | | $ | — | | | $ | 412 | |

| | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 2,452 | | | $ | — | | | $ | 2,452 | | | $ | — | | | $ | 1,601 | | | $ | — | | | $ | 1,601 | |

| | | | | | | | | | | | | | | |

The Company follows the provisions of ASC Topic 820 Fair Value Measurement which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

•Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

•Level 2 - Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data.

•Level 3 - Inputs are unobservable inputs which reflect the reporting entity’s own assumptions about what assumptions market participants would use in pricing the asset or liability based on the best available information.

Any transfers of assets or liabilities between Level 1, Level 2, and Level 3 of the fair value hierarchy will be recognized at the end of the reporting period in which the transfer occurs. There were no transfers between fair value levels in any of the periods presented herein.

The carrying amounts reported in the condensed consolidated balance sheets for cash, accounts receivable, other current assets, accounts payable, checks issued not presented for payment and accrued expenses and other liabilities approximate their fair value based on the short-term maturity of these instruments.

See Note 7 - Derivative Financial Instruments for additional information regarding the Company’s interest rate swaps.

Carrying Value and Estimated Fair Value of Outstanding Debt - The following table presents the carrying value and estimated fair value of the Company’s outstanding debt as described in Note 8 - Debt, including the current portion, as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value Measurements | | | |

| (In thousands) | | Level 1 | | Level 2 | | Level 3 | | Carrying Value | |

| September 30, 2024 | | |

| Fixed rate debt: | | | | | | | | | |

| | | | | | | | | |

| Bank of America | | $ | — | | | $ | — | | | $ | 116 | | | $ | 126 | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Variable rate debt: | | | | | | | | | |

| JPMorgan Chase | | $ | — | | | $ | 102,294 | | | $ | — | | | $ | 102,294 | | |

| Bank of America | | $ | — | | | $ | 2,090 | | | $ | — | | | $ | 2,090 | | |

| East West Bank | | $ | — | | | $ | 5,558 | | | $ | — | | | $ | 5,558 | | |

| | | | | | | | | |

| December 31, 2023 | | | | | | | | | |

| Fixed rate debt: | | | | | | | | | |

| | | | | | | | | |

| Bank of America | | $ | — | | | $ | — | | | $ | 151 | | | $ | 169 | | |

| | | | | | | | | |

| | | | | | | | | |

| Other finance institutions | | $ | — | | | $ | — | | | $ | 43 | | | $ | 45 | | |

| Variable rate debt: | | | | | | | | | |

| JPMorgan Chase | | $ | — | | | $ | 106,079 | | | $ | — | | | $ | 106,079 | | |

| Bank of America | | $ | — | | | $ | 2,193 | | | $ | — | | | $ | 2,193 | | |

| East West Bank | | $ | — | | | $ | 5,675 | | | $ | — | | | $ | 5,675 | | |

The carrying value of the variable rate debt approximates its fair value because of the variability of interest rates associated with these instruments. For the Company's fixed rate debt, the fair values were estimated using discounted cash flow analyses, based on the current incremental borrowing rates for similar types of borrowing arrangements.

See Note 8 - Debt for additional information regarding the Company's debt.

Nonrecurring Fair Values

The Company measures fair value of certain assets on a nonrecurring basis when events or changes in circumstances indicate that the carrying value of the assets may not be recoverable. No adjustments to fair value from the write-down of asset values due to impairment were made during the three and nine months ended September 30, 2024 and 2023.

There were no assets carried at nonrecurring fair value at September 30, 2024 and December 31, 2023.

Note 6 - Goodwill and Acquired Intangible Assets

Goodwill

There is only one reporting unit at September 30, 2024 and December, 31, 2023. The Company tests goodwill for impairment at least annually, as of December 31, or whenever events or changes in circumstances indicated goodwill might be impaired.

The Company performed a quantitative goodwill impairment assessment as of December 31, 2023, as a result of the Company’s results of operations during 2023 compared to previous forecasts, combined with the level of the Company’s stock price. The fair value of the reporting unit was determined using an average of the income approach, comparable public company analysis, and comparable acquisitions analysis. The annual goodwill impairment test in 2023 resulted in an estimated fair value that exceeded carrying value by approximately 10% at December 31, 2023, and therefore, the Company concluded no impairment was required to be recorded during the year ended December 31, 2023.

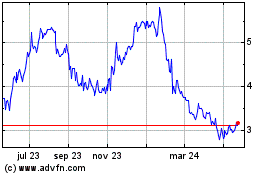

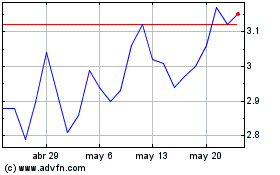

As of September 30, 2024, the Company concluded that a triggering event occurred due to a sustained decline in the Company’s stock price since December 31, 2023, which required interim testing for goodwill impairment in accordance with ASC 350. Accordingly, the Company performed a quantitative assessment as of September 30, 2024. The fair value of the reporting unit was determined using an average of the income approach, comparable public company analysis, and comparable acquisitions analysis. The fair value of the reporting unit exceeded the carrying value by approximately 1%, and therefore the Company concluded no impairment was required to be recorded during the period.

In calculating the fair value of the reporting unit, the Company considered the resulting implied enterprise value control premium compared to recent control premiums paid in the industry, and also considered the lack of liquidity in its common stock. The Company’s common stock is fairly thinly traded, with a higher level of internal stockholders than its peers, and no major analyst coverage. As a result, the implied value from the traded stock price is based on limited investment public interest. The Company determined that the implied control premium was reasonable in light of these recent comparable transactions and considering the lack of liquidity in its common stock, which corroborates the Company’s fair value estimate.

The most critical assumptions in determining fair value using the income approach were projections of future cash flows such as forecasted revenue growth rates, gross profit margins, distribution, selling and administrative expense levels, and the discount rate. The market approaches were primarily impacted by an enterprise value multiple of EBITDA.

A significant change in these assumptions or a further sustained decline in the Company’s stock price could result in potential goodwill impairment in the future, and such impairment could be material.

Goodwill was $85.1 million as of September 30, 2024 and December 31, 2023.

Acquired Intangible Assets

The components of the intangible assets are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| (In thousands) | | Gross

Carrying

Amount | | Accumulated

Amortization | | Net

Carrying

Amount | | Gross

Carrying

Amount | | Accumulated

Amortization | | Net

Carrying

Amount |

| Non-competition agreement | | $ | 3,892 | | | $ | (3,400) | | | $ | 492 | | | $ | 3,892 | | | $ | (2,429) | | | $ | 1,463 | |

| Trademarks and trade names | | 44,207 | | | (18,360) | | | 25,847 | | | 44,207 | | | (15,045) | | | 29,162 | |

| Customer relationships | | 185,266 | | | (46,009) | | | 139,257 | | | 185,266 | | | (38,085) | | | 147,181 | |

| Total | | $ | 233,365 | | | $ | (67,769) | | | $ | 165,596 | | | $ | 233,365 | | | $ | (55,559) | | | $ | 177,806 | |

Amortization expense for acquired intangible assets was $4.1 million for the three months ended September 30, 2024 and 2023. Amortization expense for acquired intangible assets was $12.2 million for the nine months ended September 30, 2024 and 2023.

Note 7 - Derivative Financial Instruments

Derivative Instruments

The Company utilizes interest rate swaps ("IRS") for the sole purpose of mitigating interest rate fluctuation risk associated with floating rate debt instruments (as defined in Note 8 - Debt). The Company does not use any other derivative financial instruments for trading or speculative purposes.

On August 20, 2019, HF Foods entered into two IRS contracts with East West Bank (the "EWB IRS") for initial notional amounts of $1.1 million and $2.6 million, respectively. On April 20, 2023, the Company amended the corresponding mortgage term loans, which pegged the two mortgage term loans to 1-month Term SOFR (Secured Overnight Financing Rate) + 2.29% per annum for the remaining duration of the term loans. The amended EWB IRS contracts fixed the two term loans at 4.23% per annum until maturity in September 2029.

On December 19, 2019, HF Foods entered into an IRS contract with Bank of America (the "BOA IRS") for an initial notional amount of $2.7 million in conjunction with a newly contracted mortgage term loan of corresponding amount. On December 19, 2021, the Company entered into the Second Amendment to Loan Agreement, which pegged the mortgage term loan to Term SOFR + 2.5%. The BOA IRS was modified accordingly to fix the SOFR based loan to approximately 4.50%. The term loan and corresponding BOA IRS contract mature in December 2029.

On March 15, 2023, the Company entered into an amortizing IRS contract with JPMorgan Chase for an initial notional amount of $120.0 million, effective from March 1, 2023 and expiring in March 2028, as a means to partially hedge its existing floating rate loans exposure. Pursuant to the agreement, the Company will pay the swap counterparty a fixed rate of 4.11% in exchange for floating payments based on Term SOFR.

The Company evaluated the aforementioned IRS contracts currently in place and did not designate those as cash flow hedges. Hence, the fair value changes of these IRS contracts are accounted for and recognized as a change in fair value of interest rate swap contracts in the condensed consolidated statements of operations and comprehensive income (loss).

As of September 30, 2024, the Company determined that the fair values of the IRS contracts were $0.3 million in an asset position and $2.5 million in a liability position. As of December 31, 2023, the fair values of the IRS contracts were $0.4 million in an asset position and $1.6 million in a liability position. The Company includes these in other long-term assets and other long-term liabilities, respectively, on the consolidated balance sheets. In determining fair value, the Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible, as well as consider counterparty credit risk in its assessment of fair value. The inputs used to determine the fair value of the IRS are classified as Level 2 on the fair value hierarchy.

Note 8 - Debt

Long-term debt at September 30, 2024 and December 31, 2023 is summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in thousands) | | | | | | |

| Bank Name | | Maturity | | Interest Rate at September 30, 2024 | | September 30, 2024 | | December 31, 2023 |

Bank of America (a) | | October 2026 - December 2029 | | 4.34% - 7.95% | | $ | 2,216 | | | $ | 2,362 | |

East West Bank (b) | | August 2027 - September 2029 | | 7.46% - 8.50% | | 5,558 | | | 5,675 | |

| | | | | | | | |

JPMorgan Chase (c) | | January 2030 | | 7.18% | | 102,520 | | | 106,337 | |

Other finance institutions (d) | | July 2024 | | N/A | | — | | | 45 | |

| Total debt, principal amount | | | | | | 110,294 | | | 114,419 | |

| Less: debt issuance costs | | | | | | (226) | | | (258) | |

| Total debt, carrying value | | | | | | 110,068 | | | 114,161 | |

| Less: current portion | | | | | | (5,410) | | | (5,450) | |

| Long-term debt | | | | | | $ | 104,658 | | | $ | 108,711 | |

_______________

(a)Loan balance consists of real estate term loan and equipment term loan, collateralized by one real property and specific equipment. The real estate term loan is pegged to TERM SOFR + 2.5%.

(b)Real estate term loans with East West Bank are collateralized by three real properties. Balloon payments of $2.2 million and $3.4 million are due at maturity in 2027 and 2029, respectively.

(c)Real estate term loan with a principal balance of $102.5 million as of September 30, 2024 and $106.3 million as of December 31, 2023 is secured by assets held by the Company and has a maturity date of January 2030.

(d)Secured by vehicles.

The terms of the various loan agreements related to long-term bank borrowings require the Company to comply with certain financial covenants, including, but not limited to, a fixed charge coverage ratio and effective tangible net worth. As of September 30, 2024, the Company was in compliance with its covenants.

Credit Facility

The outstanding principal balance on the line of credit as of September 30, 2024 was $66.9 million and outstanding letters of credit amounted to $5.8 million leaving access to approximately $27.3 million in additional funds through our $100.0 million line of credit, subject to a borrowing base calculation.