In Mature Cloud Market, Cost Optimization is Top Enterprise Priority: ISG Study

22 Julio 2024 - 11:03AM

Business Wire

Survey of global cloud decision-makers finds

more than 50 percent of applications now in the cloud, more than

double the rate of 2022

With more than half of business-critical enterprise applications

now in the cloud, new survey research from leading global

technology research and advisory firm Information Services Group

(ISG) (Nasdaq: III) finds enterprises are even more focused on cost

savings and leveraging the cloud for AI.

The ISG Market Lens™ Cloud Managed Services Study interviewed

250 business leaders responsible for cloud decision-making

worldwide about their cloud priorities, plans and performance, and

found cloud maturity has doubled in the past two years. More than

50 percent of application categories are in the cloud in 2024,

compared with 23 percent in 2022, and cost optimization has become

a top strategic motivator for enterprise cloud services.

Thirty-four percent of respondents to the 2024 study cite cost

optimization of their cloud portfolio as a top priority, compared

with 19 percent who said cost was a key driver of cloud adoption in

2022. Cloud services spending now accounts for 17 percent of IT

budgets, the study found.

“Cloud priorities have expanded since our 2022 cloud study, when

flexibility and scalability were key priorities alongside cost,”

said Michael Dornan, principal analyst and co-author of the study.

“Cost optimization is now a clear priority, as enterprises want to

ensure that their spending is maximized for business success and

accelerating investments in AI.”

Cloud services performance, security and data accessibility are

also top enterprise cloud priorities and are the most common

service-level agreements (SLAs) between enterprises and providers

in their cloud provider ecosystem. Of those SLAs, 54 percent of

enterprises rate security as very good or excellent, closely

followed by service availability at 50 percent.

In contrast, fewer than 20 percent of survey respondents rate

their provider’s cost management highly. Delivery against business

value metrics, migration timelines and innovation also score

poorly, suggesting that while enterprise technology needs are

largely met, business needs are often not.

Data from the second-quarter 2024 ISG Index™ found the number of

AI-related projects increased about 60 percent in the trailing 12

months. AI projects now account for about 2.5 percent of revenue

among the top 10 service providers. That share could rise to 5 or

10 percent over time as proofs-of-concept lead to projects that can

scale.

“AI is playing a growing role in cloud strategies, with 26

percent of survey respondents saying empowering cloud applications

with AI capabilities is a top-three priority,” said Alex Bakker,

ISG Distinguished Analyst and co-author of the study. “In 2024,

enterprises are focused on utilizing cloud-based AI modules and

expanding cloud service provision to quickly leverage the benefits

of AI. In the longer term, demand for AI is expected to drive

growth in cloud spending across all categories, including private

cloud."

The ISG Market Lens Study also showed the proportion of survey

respondents who say they have business applications they can "lift

and shift" to the cloud has doubled since 2022 to 27 percent, while

the proportion re-writing applications from scratch has fallen to

19 percent, reflecting previous application enhancements that

prioritized future cloud migration. Fifty percent of respondents

expect to move future applications to the cloud with minimal

changes, leaving the architecture unchanged.

“IT leaders and the business leaders they support often differ

on their preferred approaches to cloud migration,” Bakker said.

“Business decision-makers want speed and are less likely to rewrite

applications, but our study found 57 percent of IT decision-makers

anticipate and prefer to rearchitect applications during migration.

Our study suggests CIOs will need to persuade business leaders

their preferred migration approach generates value for the bottom

line.”

The ISG Market Lens Cloud Managed Services Study was conducted

globally in globally in April and May 2024, and surveyed 250

executives with decision making responsibility for cloud business

and technology strategy.

ISG Market Lens buyer behavior studies combine findings from

surveys of senior-level global executives with expert ISG research

and analysis on market trends and strategic business initiatives.

Past studies explored a range of topics, including business process

outsourcing, digital sustainability,

AI, application development and maintenance, cost optimization,

cybersecurity, global capability

centers, network

modernization, banking and the future

workplace.

Contact ISG for more information on ISG Market Lens

research.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading

global technology research and advisory firm. A trusted business

partner to more than 900 clients, including more than 75 of the

world’s top 100 enterprises, ISG is committed to helping

corporations, public sector organizations, and service and

technology providers achieve operational excellence and faster

growth. The firm specializes in digital transformation services,

including AI and automation, cloud and data analytics; sourcing

advisory; managed governance and risk services; network carrier

services; strategy and operations design; change management; market

intelligence and technology research and analysis. Founded in 2006,

and based in Stamford, Conn., ISG employs more than 1,600

digital-ready professionals operating in more than 20 countries—a

global team known for its innovative thinking, market influence,

deep industry and technology expertise, and world-class research

and analytical capabilities based on the industry’s most

comprehensive marketplace data. For more information, visit

www.isg-one.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240722455823/en/

Will Thoretz, ISG +1 203 517 3119 will.thoretz@isg-one.com

Julianna Sheridan, Matter Communications for ISG +1 978 518 4520

isg@matternow.com

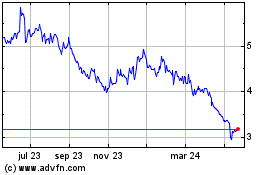

Information Services (NASDAQ:III)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

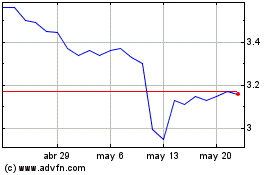

Information Services (NASDAQ:III)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024