false

0001472012

Immunome Inc.

0001472012

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported):

November 13, 2024

Immunome,

Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39580 |

|

77-0694340 |

(state or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification

No.) |

18702 N. Creek Parkway, Suite 100

Bothell, WA |

|

98011 |

| (Address of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (425)

939-7410

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange

on which registered |

| Common

Stock, $0.0001 par value per share |

|

IMNM |

|

The Nasdaq

Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02 | Results of

Operations and Financial Condition. |

On November 13, 2024, Immunome, Inc.

(the “Company”) announced its financial results for the third quarter ended September 30, 2024 and provided a business

update in the press release attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 2.02 of this Current

Report on Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section or Sections 11 and 12(a)(2) of

the Securities Act of 1933, as amended. The information shall not be deemed incorporated by reference into any other filing with the Securities

and Exchange Commission made by the Company, whether made before or after today’s date, regardless of any general incorporation

language in such filing, except as shall be expressly set forth by specific references in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 13, 2024 |

Immunome, Inc. |

| |

|

| |

By: |

/s/ Max Rosett |

| |

Name: |

Max Rosett |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Immunome

Reports Third Quarter 2024 Financial Results and Provides Business Update

11/13/2024

BOTHELL, Wash. –Immunome, Inc.

(Nasdaq: IMNM), a biotechnology company focused on the development of first-in-class and best-in-class targeted oncology therapies, today

announced financial results for the third quarter ended September 30, 2024, and provided a business update.

“Immunome continues to advance its pipeline,” said Clay

B. Siegall, Ph.D., President and Chief Executive Officer. “Topline data for the RINGSIDE Part B trial of AL102 is expected

in the second half of 2025, and IND submissions for IM-1021 and IM-3050 are on track.”

“Our discovery team is focused on discovering ADCs that effectively

pursue the novel targets we believe will define the next generation of transformative cancer therapies. In particular, the differentiated

profile of HC74, our proprietary TOP1 payload, offers exciting opportunities for portfolio expansion when combined with our large repertoire

of antibodies.”

Pipeline Highlights

Full enrollment for the Phase 3 RINGSIDE Part B study of AL102

for the treatment of desmoid tumors was completed in February 2024, and Immunome expects to report topline data for RINGSIDE Part B

in the second half of 2025. In parallel, Immunome is performing additional manufacturing and pharmacology work required to support

a new drug application filing for AL102.

Immunome also anticipates submitting INDs for IM-1021 and IM-3050

in the first quarter of 2025, as previously disclosed.

Third Quarter 2024 Financial Results

| · | As of September 30, 2024, cash, cash equivalents and marketable

securities totaled $240.1 million. Immunome’s current cash runway is expected to extend

into 2026. |

| · | Research and development expenses for the quarter ended September 30,

2024 were $37.2 million, including stock-based compensation costs of $1.8 million. |

| · | In-process research and development expenses for the quarter

ended September 30, 2024 were $6.7 million. These expenses were related to Immunome’s

business development activity. |

| · | General and administrative expenses for the quarter ended September 30,

2024 were $9.5 million, including stock-based compensation expense of $3.1 million. |

| · | Immunome reported a net loss of $47.1 million for the quarter

ended September 30, 2024. |

About Immunome, Inc.

Immunome is a clinical-stage targeted oncology company committed to

developing first-in-class and best-in-class targeted therapies designed to improve outcomes for cancer patients. We are advancing an

innovative portfolio of therapeutics, drawing on leadership that previously played key roles in the design, development and commercialization

of cutting-edge targeted cancer therapies, including antibody-drug conjugates (ADCs). In addition to a portfolio of discovery-stage ADCs,

our pipeline includes AL102, a gamma secretase inhibitor currently in a Phase 3 trial for treatment of desmoid tumors, as well as IM-1021,

a ROR1 ADC, and IM-3050, a FAP-targeted radioligand, both of which are the subject of INDs expected to be submitted in the first quarter

of 2025. For more information, visit www.immunome.com.

Cautionary Statement Regarding Forward-Looking Statements

Statements in this press release that are not purely historical in

nature are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We use

words such as “expects,” “believe,” “opportunities,” “anticipates” and similar expressions

to identify these forward-looking statements. These forward-looking statements include Immunome’s expected timing for providing

topline data for the Phase 3 RINGSIDE Part B trial; Immunome’s expected timing for filing an IND for IM-1021 and IM-3050;

Immunome’s expectation that it will commence clinical development of IM-1021 and IM-3050 in early 2025; the

potential of Immunome’s ADC targets to provide first-in-class or best-in-class potential; and other statements regarding

management’s intentions, plans, beliefs, expectations or forecasts for the future. These forward-looking statements are based on

Immunome’s current expectations and involve assumptions that may never materialize or may prove to be incorrect; consequently,

actual results may differ materially from those expressed or implied in the statements due to a number of factors, including the risk

that Immunome will not be able to realize the benefits of its strategic transactions; the risk that regulatory approvals for Immunome’s

programs and product candidates are not obtained, are delayed or are subject to unanticipated conditions; the risk that pre-clinical

data may not be predictive of clinical data; the risk that Immunome’s product candidates and development candidates fail to achieve

their intended endpoints; uncertainties related to Immunome’s capital requirements and Immunome’s expected cash runway; Immunome’s

ability to grow and successfully execute on its business plan; and other risks and uncertainties indicated from time to time described

in Immunome’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 12,

2024, in Immunome’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, being filed with the SEC

today, and in Immunome’s other filings with the SEC. Except as required by law, Immunome assumes no obligation and does not

intend to update any forward-looking statements included in this press release.

Investor Contact:

Max Rosett

Chief Financial Officer

investors@immunome.com

Immunome, Inc.

Consolidated

Balance Sheets

(Unaudited;

In thousands)

| | |

September 30, 2024 | | |

December 31, 2023 | | |

Delta | |

| Assets | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 155,568 | | |

$ | 98,679 | | |

| 56,889 | |

| Marketable securities | |

| 84,562 | | |

| 39,463 | | |

| 45,099 | |

| Prepaid expenses and other current assets | |

| 3,910 | | |

| 6,561 | | |

| (2,651 | ) |

| Total current assets | |

| 244,040 | | |

| 144,703 | | |

| 99,337 | |

| Property and equipment, net | |

| 7,172 | | |

| 2,073 | | |

| 5,099 | |

| Operating right-of-use assets | |

| 2,388 | | |

| 1,564 | | |

| 824 | |

| Restricted cash | |

| 100 | | |

| 100 | | |

| — | |

| Other long-term assets | |

| 3,198 | | |

| 100 | | |

| 3,098 | |

| Total assets | |

$ | 256,898 | | |

$ | 148,540 | | |

| 108,358 | |

| Liabilities and stockholders’ equity | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Accounts payable | |

$ | 3,518 | | |

$ | 3,311 | | |

| 207 | |

| Accrued expenses and other current liabilities | |

| 26,331 | | |

| 8,025 | | |

| 18,306 | |

| Deferred revenue, current | |

| 9,679 | | |

| 10,493 | | |

| (814 | ) |

| Total current liabilities | |

| 39,528 | | |

| 21,829 | | |

| 17,699 | |

| Deferred revenue, non-current | |

| — | | |

| 5,489 | | |

| (5,489 | ) |

| Operating lease liabilities, net of current portion | |

| 2,464 | | |

| 1,340 | | |

| 1,124 | |

| Total liabilities | |

| 41,992 | | |

| 28,658 | | |

| 13,334 | |

| Stockholders’ equity: | |

| | | |

| | | |

| | |

| Preferred stock | |

| — | | |

| — | | |

| — | |

| Common stock | |

| 6 | | |

| 4 | | |

| 2 | |

| Additional paid-in capital | |

| 650,351 | | |

| 342,663 | | |

| 307,688 | |

| Accumulated other comprehensive income | |

| 70 | | |

| 22 | | |

| 48 | |

| Accumulated deficit | |

| (435,521 | ) | |

| (222,807 | ) | |

| (212,714 | ) |

| Total stockholders’ equity | |

| 214,906 | | |

| 119,882 | | |

| 95,024 | |

| Total liabilities and stockholders’ equity | |

$ | 256,898 | | |

$ | 148,540 | | |

| 108,358 | |

Immunome, Inc.

Consolidated

Statements of Operations

(Unaudited;

In thousands, except share and per share amounts)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Collaboration revenue | |

$ | 2,910 | | |

$ | 3,565 | | |

$ | 6,303 | | |

$ | 10,192 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| In-process research and development | |

| 6,706 | | |

| — | | |

| 124,972 | | |

| — | |

| Research and development(1) | |

| 37,200 | | |

| 3,823 | | |

| 81,652 | | |

| 13,452 | |

| General and administrative(1) | |

| 9,526 | | |

| 4,375 | | |

| 22,509 | | |

| 11,617 | |

| Total operating expenses | |

| 53,432 | | |

| 8,198 | | |

| 229,133 | | |

| 25,069 | |

| Loss from operations | |

| (50,522 | ) | |

| (4,633 | ) | |

| (222,830 | ) | |

| (14,877 | ) |

| Interest income | |

| 3,422 | | |

| 288 | | |

| 10,116 | | |

| 705 | |

| Net loss | |

$ | (47,100 | ) | |

$ | (4,345 | ) | |

$ | (212,714 | ) | |

$ | (14,172 | ) |

| Net loss per share, basic and diluted | |

$ | (0.78 | ) | |

$ | (0.36 | ) | |

$ | (3.72 | ) | |

$ | (1.16 | ) |

| Weighted-average shares outstanding, basic and diluted | |

| 60,205,327 | | |

| 12,202,335 | | |

| 57,239,668 | | |

| 12,194,277 | |

| Comprehensive loss | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (47,100 | ) | |

$ | (4,345 | ) | |

$ | (212,714 | ) | |

$ | (14,172 | ) |

| Unrealized loss on marketable securities | |

| 68 | | |

| — | | |

| 48 | | |

| — | |

| Comprehensive loss | |

$ | (47,032 | ) | |

$ | (4,345 | ) | |

$ | (212,666 | ) | |

$ | (14,172 | ) |

(1) Amounts include non-cash stock based compensation as follows

(in thousands):

| | |

Three Months Ended September 30, | | |

Nine

Months Ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Research and development | |

$ | 1,820 | | |

$ | 466 | | |

$ | 3,244 | | |

$ | 1,323 | |

| General and administrative | |

| 3,072 | | |

| 617 | | |

| 7,034 | | |

| 2,017 | |

| Total share-based compensation expense | |

$ | 4,892 | | |

$ | 1,083 | | |

$ | 10,278 | | |

$ | 3,340 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

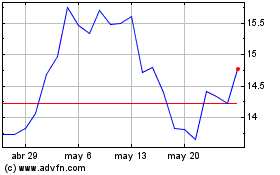

Immunome (NASDAQ:IMNM)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Immunome (NASDAQ:IMNM)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025