false

0000749647

0000749647

2024-10-02

2024-10-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 2, 2024

IMUNON,

INC.

(Exact

name of registrant as specified in its Charter)

| Delaware |

|

001-15911 |

|

52-1256615 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 997

Lenox Drive, Suite 100, Lawrenceville, NJ |

|

08648-2311 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(609)

896-9100

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

IMNN |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

October 4, 2024, the Board of Directors of Imunon, Inc. (the “Company”) appointed Susan Eylward (age 45) as General Counsel

and Corporate Secretary.

Prior

to her position with the Company, Ms. Eylward served as Senior Counsel at Science 37, Inc. (formerly Nasdaq: SNCE), a solutions organization

focused on decentralized clinical trials, from January of 2022 through April of 2024, where she was responsible for a variety of complex

legal matters, including, among others, corporate governance, securities compliance, executive compensation, and acquisitions. Prior

to that, Ms. Eylward served as corporate counsel and Vice President at the Allstate Corporation (NYSE: ALL) during 2021, at National

General Holdings Corp. (formerly Nasdaq: NGHC) from September of 2014 through December of 2020, and at Tower Group International, Ltd.

(formerly Nasdaq: TWGP) from May of 2009 through September of 2014, and at each of the foregoing, she had responsibility for various

corporate legal matters including governance, securities law, alternative investments and transactions. From 2004 through 2009, Ms. Eylward

practiced law at Dewey & LeBoeuf LLP, where she represented public and private companies for equity and debt offerings, as well as

mergers and acquisitions. Ms. Eylward received a Juris Doctor from New York Law School and a Bachelor of Arts in Accounting from Boston

College.

In

connection with her appointment as General Counsel and Corporate Secretary, on October 2, 2024, Ms. Eylward entered into an offer letter

of employment with the Company, with her employment effective as of October 7, 2024. Pursuant to the offer letter, the Company will pay

Ms. Eylward an initial salary of $340,000 and Ms. Eylward will be eligible to receive a target annual performance bonus of 30% of her

annual base salary. As an inducement to Ms. Eylward’s employment, on October 7, 2024, the Company agreed to issue Ms. Eylward an

option to purchase 50,000 shares of the Company’s common stock (the “Inducement Options”). The Inducement Options have

(i) a 10-year term, (ii) an exercise price per share equal to the closing price of the Company’s common stock as reported by Nasdaq

on October 7, 2024, and (iii) a four-year vesting schedule, with 25% of the shares subject to the option vesting on the first anniversary

of the grant date and the remaining underlying shares vesting annually until fully vested on the fourth anniversary of the grant date,

subject to Ms. Eylward’s continued service with the Company through each applicable vesting date. The Inducement Options are being

granted outside the Company’s 2018 Stock Incentive Plan as an inducement material to Ms. Eylward’s entry into employment

with the Company in accordance with Nasdaq Listing Rule 5635(c)(4).

The

foregoing summary of the offer letter does not purport to be complete and is qualified in its entirety by reference to the full text

of the offer letter, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated herein by reference

as if fully set forth herein.

There

are no arrangements or understandings between Ms. Eylward and any other persons pursuant to which she was appointed as General Counsel

and Corporate Secretary of the Company. There are no family relationships between Ms. Eylward and any director or executive officer of

the Company, and she has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a)

of Regulation S-K.

Item

7.01. Regulation FD Disclosure.

A

copy of the press release issued by the Company, dated October 7, 2024, relating to the inducement grant made to Ms. Eylward is attached

hereto as Exhibit 99.1 to this Form 8-K.

The

information under this Item 7.01 and the press release attached to this Form 8-K as Exhibit 99.1 shall be deemed to be “furnished”

and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

IMUNON,

INC. |

| |

|

|

| Dated:

October 7, 2024 |

By: |

/s/

David Gaiero |

| |

|

David

Gaiero |

| |

|

Chief

Financial Officer |

Exhibit 10.1

Exhibit

99.1

IMUNON

Reports Inducement Grant Under NASDAQ Listing Rule 5635(c)(4)

LAWRENCEVILLE,

N.J. (October 7, 2024) – IMUNON, Inc. (NASDAQ: IMNN) (the “Company”), a clinical-stage company in late-stage development

with its DNA-mediated immunotherapy, today announced that the Compensation Committee of the Company’s Board of Directors approved

the grant of (i) inducement stock options to purchase a total of 60,000 shares of the Company’s common stock to one individual

hired by Imunon during the fourth quarter of 2024 and (ii) inducement stock options to purchase a total of 50,000 shares of common stock

to Susan Eylward, hired by Imunon as General Counsel and Secretary effective October 7, 2024 (collectively, the “Inducement Option

Grants”). The Inducement Option Grants were approved in accordance with Nasdaq Listing Rule 5635(c)(4) and were made on October

7, 2024, as a material inducement to each employee’s entry into employment with the Company.

The

Inducement Option Grants have an exercise price per share equal to the closing price of Imunon’s common stock as reported by Nasdaq

on October 7, 2024. The Inducement Option Grants have a 10-year term and a four-year vesting schedule, with 25% of the shares subject

to the option vesting on the first anniversary of the grant date and the remaining underlying shares vesting annually such that they

will be fully vested on the fourth anniversary of the grant date, subject to the applicable employee’s continued service with Imunon

through each applicable vesting date.

About

IMUNON

IMUNON

is a clinical-stage biotechnology company focused on advancing a portfolio of innovative treatments that harness the body’s natural

mechanisms to generate safe, effective and durable responses across a broad array of human diseases, constituting a differentiating approach

from conventional therapies. IMUNON is developing its non-viral DNA technology across its modalities. The first modality, TheraPlas®,

is developed for the coding of cytokines and other therapeutic proteins in the treatment of solid tumors where an immunological approach

is deemed promising. The second modality, PlaCCine®, is developed for the delivery of DNA-coded viral antigens that can

elicit a strong immunological response.

The

Company’s lead clinical program, IMNN-001, is a DNA-based immunotherapy for the localized treatment of advanced ovarian cancer

that has completed Phase 2 development. IMNN-001 works by instructing the body to produce safe and durable levels of powerful cancer-fighting

molecules, such as interleukin-12 and interferon gamma, at the tumor site. Additionally, the Company has entered a first-in-human study

of its COVID-19 booster vaccine (IMNN-101). IMUNON will continue to leverage these modalities and to advance the technological frontier

of plasmid DNA to better serve patients with difficult-to-treat conditions. For more information, please visit www.imunon.com.

Forward-Looking

Statements

IMUNON

wishes to inform readers that forward-looking statements in this news release are made pursuant to the “safe harbor” provisions

of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including, but not

limited to, statements regarding the Company’s plans and expectations with respect to its business, are forward-looking statements.

We generally identify forward-looking statements by using words such as “may,” “will,” “expect,”

“plan,” “anticipate,” “estimate,” “intend” and similar expressions (as well as other

words or expressions referencing future events, conditions or circumstances). Readers are cautioned that such forward-looking statements

involve risks and uncertainties including, without limitation, uncertainties relating to unforeseen changes in the course of research

and development activities and in clinical trials, including the fact that interim results are not necessarily indicative of final results;

the uncertainties of and difficulties in analyzing interim clinical data; the significant expense, time and risk of failure of conducting

clinical trials; the need for IMUNON to evaluate its future development plans; possible actions by customers, suppliers, competitors

or regulatory authorities; and other risks detailed from time to time in IMUNON’s filings with the Securities and Exchange Commission.

IMUNON assumes no obligation, except to the extent required by law, to update or supplement forward-looking statements that become untrue

because of subsequent events, new information or otherwise.

Contacts:

| IMUNON |

|

LHA

Investor Relations |

| David

Gaiero |

|

Kim

Sutton Golodetz |

| 978-376-6352 |

|

212-838-3777 |

| dgaiero@imunon.com |

|

kgolodetz@lhai.com |

#

# #

v3.24.3

Cover

|

Oct. 02, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 02, 2024

|

| Entity File Number |

001-15911

|

| Entity Registrant Name |

IMUNON,

INC.

|

| Entity Central Index Key |

0000749647

|

| Entity Tax Identification Number |

52-1256615

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

997

Lenox Drive

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Lawrenceville

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08648-2311

|

| City Area Code |

(609)

|

| Local Phone Number |

896-9100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.01 per share

|

| Trading Symbol |

IMNN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

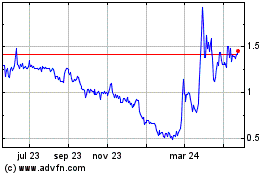

Imunon (NASDAQ:IMNN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

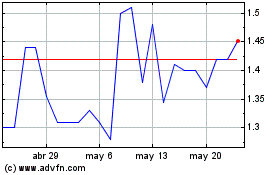

Imunon (NASDAQ:IMNN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024