false

0000749647

0000749647

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 7, 2024

Imunon,

Inc.

(Exact

name of registrant as specified in its Charter)

| Delaware |

|

001-15911 |

|

52-1256615 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 997

Lenox Drive, Suite 100, Lawrenceville, NJ |

|

08648-2311 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(609)

896-9100

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

IMNN |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

November 7, 2024, Imunon, Inc. issued a press release reporting its financial results for the quarter ended September 30, 2024. A copy

of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On

October 31, 2024, Imunon, Inc. announced it would hold a conference call on November 7, 2024 to discuss its financial results for the

quarter ended September 30, 2024 and provide a business update. The conference call will also be broadcast live on the internet at http://www.imunon.com.

The

information in this report, including the exhibit hereto, is being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections

11 and 12(a)(2) of the Securities Act of 1933, as amended. Such information shall not be incorporated by reference into any filing with

the Securities and Exchange Commission made by Imunon, Inc., whether made before or after the date hereof, regardless of any general

incorporation language in such filing.

The

press release contains forward-looking statements which involve certain risks and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. Please refer to the cautionary note in the press release regarding these

forward-looking statements.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

IMUNON

INC. |

| |

|

|

| Dated:

November 7, 2024 |

By: |

/s/

David Gaiero |

| |

|

David

Gaiero |

| |

|

Chief

Financial Officer |

Exhibit

99.1

IMUNON

Reports Third Quarter 2024 Financial Results and Provides Business Updates

Conference call today at 11:00 a.m. ET

LAWRENCEVILLE,

N.J., Nov. 7, 2024 – IMUNON, Inc. (NASDAQ: IMNN), a clinical-stage company in

late-stage development with its DNA-mediated immunotherapy, today reported financial results for the three and nine months ended

September 30, 2024. The Company also provided an update on its clinical development of IMNN-001 including progress toward commencing

a Phase 3 study in advanced ovarian cancer, and an update on IMNN-101, its seasonal COVID-19 booster candidate.

“The

third quarter was a period of important milestones and outstanding progress for IMUNON, driven largely by presentation of highly compelling

topline results from our OVATION 2 Study with IMNN-001 in advanced ovarian cancer,” said Stacy Lindborg, Ph.D., president and chief

executive officer of IMUNON. “In this study, treatment with IMNN-001 was associated with an overall survival improvement of 11.1

months compared to treatment with standard of care, and results were even stronger in the subset of patients who were also treated with

PARP inhibitors. Building on this momentum, we have been highly encouraged by the interest in these results among global leaders from

the medical and scientific communities. We have also engaged with the U.S. Food and Drug Administration to craft the design of our planned

registrational study and are preparing for an in-person End-of-Phase 2 meeting with the agency later this month. We remain on track to

begin our planned 500-patient pivotal Phase 3 study during the first quarter of 2025.”

“Tomorrow

afternoon we will be presenting new OVATION 2 data at the Society for Immunotherapy of Cancer 39th Annual Meeting. Our abstract

is being highlighted as a late-breaking acceptance, so compelling that it was accepted after the deadline. Given the strength of the

data, we are unsurprised with SITC’s decision to include our data for presentation. This is an exceptional opportunity to gain

further awareness for IMNN-001 and our trial results.”

“In

summary, IMUNON is extraordinarily well-positioned to address the unmet need in a deadly cancer while also playing an important role

in public health. We are justifiably excited about our prospects for patients and shareholders alike,” Dr. Lindborg concluded.

RECENT

DEVELOPMENTS

IMNN-001

Immunotherapy

Presenting

Additional Phase 2 data for IMNN-001 at SITC – On October 30, 2024 the Company announced the acceptance of a late-breaking

presentation featuring new clinical data from the Phase 2 OVATION 2 Study of IMNN-001 at the Society for Immunotherapy of Cancer (SITC)

39th Annual Meeting, being held in Houston, TX. The presentation, titled “Phase I/II study of Safety and Efficacy of

Intraperitoneal IMNN-001 with Neoadjuvant Chemotherapy of Paclitaxel and Carboplatin in Patients Newly Diagnosed with Advanced Epithelial

Ovarian Cancer,” will be made on Friday, November 8, 2024 from 12:15-1:45 p.m. and 5:30-7:30 p.m. CST by Jennifer Scalici, M.D.,

Professor, Division of Gynecological Oncology, Emory University School of Medicine and a principal investigator in the trial.

Imunon

Ovarian Cancer R&D Day – On September 18, 2024 the company held an Ovarian Cancer R&D Day in New York City that included

presentations from executive management and a panel of renowned leaders in research and patient care including:

| |

●

|

Sid

Kerkar, M.D., T cell biology review editor, Frontiers in Immunology. Dr. Kerkar discussed the important role of interleukin-12

(IL-12) in treating cancer. |

| |

|

|

| |

●

|

William

Bradley, M.D., Professor, Obstetrics and Gynecology, Gynecologic Oncology, Medical College of Wisconsin. Dr. Bradley discussed the

safety and efficacy of IMNN-001. |

| |

|

|

| |

●

|

L.J.

Wei, Ph.D., Professor of Biostatistics, Harvard T.H. Chan School of Public Health. Dr. Wei discussed the opportunity to combine progression-free

survival (PFS) and overall survival (OS) to provide a clinically interpretable evaluation of the IMNN-001 treatment effect. |

| |

|

|

| |

● |

Amir

Jazaeri, M.D., Vice Chair for Clinical Research, Director, Gynecologic Cancer Immunotherapy Program, Department of Gynecologic Oncology

and Reproductive Medicine, University of Texas MD Anderson Cancer Center. Dr. Jazaeri discussed the ongoing Phase 1/2 study of IMNN-001

in combination with bevacizumab in advanced ovarian cancer, for which he serves as principal investigator, including the importance

of minimal residual disease and early translational insights. |

| |

|

|

| |

●

|

Premal

Thaker, M.D., Interim Chief of Gynecologic Oncology, David & Lynn Mutch Distinguished Professor of Obstetrics & Gynecology,

Director of Gynecologic Oncology Clinical Research, Washington University School of Medicine, and the OVATION 2 Study Chair. Dr.

Thaker discussed the OVATION 2 topline results and their clinical significance. |

Positive

topline results from the OVATION 2 Study in advanced ovarian cancer – On July 30, 2024, the Company announced topline results

from the study that provide strong further validation of the potential safety and efficacy of IMNN-001 in the treatment of advanced ovarian

cancer. Highlights from patients treated with IMNN-001 plus standard of care in a first-line treatment setting included:

| |

● |

An

11.1 month increase in median OS compared with standard of care alone in the intent-to-treat (ITT) population. |

| |

|

|

| |

● |

A

hazard ratio in the ITT population of 0.74, which represents a 35% improvement in survival. |

| |

● |

Among

the approximately 90% of trial participants who received at least 20% of specified treatments per-protocol in both study arms, patients

in the IMNN-001 arm had a 15.7 month increase in median OS, representing a further extension of life with a hazard ratio of 0.64,

a 56% improvement in survival. |

| |

|

|

| |

● |

For

the nearly 40% of trial participants treated with a poly ADP-ribose polymerase (PARP) inhibitor, the hazard ratio decreased further

to 0.41, with median OS in the IMNN-001 treatment arm not yet reached at the time of database lock, compared with median OS of 37.1

months in the standard-of-care treatment arm. |

The

PFS results, the trial’s primary endpoint, support the OS results with:

| |

● |

A

three-month improvement in PFS compared with standard of care alone. |

| |

|

|

| |

● |

A

hazard ratio in the ITT population of 0.79, indicating a 27% improvement in delaying progression for the IMNN-001 treatment arm. |

CORPORATE

DEVELOPMENTS

Raised

gross proceeds of $10 million in a registered direct financing – On July 30, 2024, the Company entered into a Securities Purchase

Agreement with certain institutional and accredited investors, pursuant to which the Company issued, in a registered direct offering,

an aggregate of 5,000,000 shares of the Company’s common stock at an offering price of $2.00 per share for gross proceeds of $10.0

million. In a concurrent private placement (together with the registered direct offering) and also pursuant to the Securities Purchase

Agreement, the Company issued to the Purchasers unregistered warrants to purchase shares of common stock. The warrants have an exercise

price of $2.00 per share and became exercisable immediately after the issuance for a term of five and one-half years following the date

of issuance. The closing of the registered direct offering occurred on August 1, 2024.

Additions

to leadership team to ensure operational excellence and support future plans – On October 7, 2024, Susan Eylward was named

General Counsel and Corporate Secretary. She was most recently Senior Counsel at Science 37, Inc., a solutions organization focused on

decentralized clinical trials, where she was responsible for a variety of complex legal matters, including corporate governance, securities

compliance, executive compensation and acquisitions.

Kristin

Longobardi was named Senior Vice President of Operations, bringing more than two decades of experience in enhancing business processes

and operations across the biotech and pharmaceutical sectors. Previously, she served as Vice President of R&D Quality, Operations

and Performance at Biogen. Her expertise in portfolio management, financial planning and operational excellence will be pivotal in driving

IMUNON’s operational frameworks toward supporting ambitious company growth.

THIRD

QUARTER FINANCIAL RESULTS

The

Company had $10.3 million in cash, investments and accrued interest receivable as of September 30, 2024. The Company believes it has

sufficient capital resources to fund its operations into the third quarter of 2025.

Research

and development expenses were $3.3 million for the third quarter of 2024, compared with $2.0 million for the third quarter of 2023. General

and administrative expenses were $1.7 million for the third quarter of 2024, compared with $1.9 million for the third quarter of 2023.

Net

loss was $4.9 million, or $0.34 per share, for the third quarter of 2024, compared with a net loss of $3.5 million, or $0.37 per share,

for the third quarter of 2023.

YEAR-TO-DATE

FINANCIAL RESULTS

Research

and development expenses were $9.4 million for the nine months ended September 30, 2024, compared with $7.7 million for the nine months

ended September 30, 2023. General and administrative expenses were $5.6 million for the nine months ended September 30, 2024, compared

with $7.3 million for nine months ended September 30, 2023.

Year-to-date

net loss was $14.6 million, or $1.39 per share, compared with a net loss of $14.6 million, or $1.64 per share, for the same period of

2023.

Conference

Call and Webcast

The

Company is hosting a conference call at 11:00 a.m. ET today to provide a business update, discuss third quarter 2024 financial results

and answer questions. To participate in the call, please dial 833-816-1132 (Toll-Free/North America) or 412-317-0711 (International/Toll)

and ask for the IMUNON third quarter 2024 earnings call. A live webcast of the call will be available here.

The

call will be archived for replay until November 21, 2024. The replay can be accessed at 877-344-7529 (U.S. Toll-Free), 855-669-9658 (Canada

Toll-Free) or 412-317-0088 (International Toll), using the replay access code 10193110. A webcast of the call will be available here

for 90 days.

About

IMUNON

IMUNON

is a clinical-stage biotechnology company focused on advancing a portfolio of innovative treatments that harness the body’s natural

mechanisms to generate safe, effective and durable responses across a broad array of human diseases, constituting a differentiating approach

from conventional therapies. IMUNON is developing its non-viral DNA technology across its modalities. The first modality, TheraPlas®,

is developed for the gene-based delivery of cytokines and other therapeutic proteins in the treatment of solid tumors where an immunological

approach is deemed promising. The second modality, PlaCCine®, is developed for the gene delivery of viral antigens that can elicit

a strong immunological response.

The

Company’s lead clinical program, IMNN-001, is a DNA-based immunotherapy for the localized treatment of advanced ovarian cancer

that has completed Phase 2 development. IMNN-001 works by instructing the body to produce safe and durable levels of powerful cancer-fighting

molecules, such as interleukin-12 and interferon gamma, at the tumor site. Additionally, the Company has entered a first-in-human study

of its COVID-19 booster vaccine (IMNN-101). IMUNON will continue to leverage these modalities and to advance the technological frontier

of plasmid DNA to better serve patients with difficult-to-treat conditions, and to further strengthen IMUNON’s balance sheet through

attractive business development opportunities. For more information, please visit www.imunon.com.

Forward-Looking

Statements

IMUNON

wishes to inform readers that forward-looking statements in this news release are made pursuant to the “safe harbor” provisions

of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including, but not

limited to, statements regarding the timing for commencement of a Phase 3 trial of IMNN-001, the timing and outcome of the Company’s

End-of-Phase 2 meeting with the FDA, the timing and enrollment of the Company’s clinical trials, the potential of any therapies

developed by the Company to fulfill unmet medical needs, the market potential for the Company’s products, if approved, the potential

efficacy and safety profile of our product candidates, and the Company’s plans and expectations with respect to its development

programs more generally, are forward-looking statements. We generally identify forward-looking statements by using words such as “may,”

“will,” “expect,” “plan,” “anticipate,” “estimate,” “intend”

and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances). Readers are cautioned

that such forward-looking statements involve risks and uncertainties including, without limitation, uncertainties relating to unforeseen

changes in the course of research and development activities and in clinical trials, including the fact that interim results are not

necessarily indicative of final results; the uncertainties of and difficulties in analyzing interim clinical data; the significant expense,

time and risk of failure of conducting clinical trials; the need for IMUNON to evaluate its future development plans; possible actions

by customers, suppliers, competitors or regulatory authorities; and other risks detailed from time to time in IMUNON’s filings

with the Securities and Exchange Commission. IMUNON assumes no obligation, except to the extent required by law, to update or supplement

forward-looking statements that become untrue because of subsequent events, new information or otherwise.

Contacts:

| Media |

Investors |

| CG

Life |

ICR

Healthcare |

| Jenna

Urban |

Peter

Vozzo |

| 212-253-8881 |

443-213-0505 |

| jurban@cglife.com |

peter.vozzo@westwicke.com |

(Tables

to Follow)

IMUNON,

Inc.

Condensed

Statements of Operations

(in

thousands except per share amounts)

| | |

Three Months Ended

September

30, | | |

Nine

Months Ended September

30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 3,293 | | |

$ | 1,981 | | |

$ | 9,407 | | |

$ | 7,735 | |

| General and administrative | |

| 1,668 | | |

| 1,923 | | |

| 5,579 | | |

| 7,328 | |

| Total operating expenses | |

| 4,961 | | |

| 3,904 | | |

| 14,986 | | |

| 15,063 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (4,961 | ) | |

| (3,904 | ) | |

| (14,986 | ) | |

| (15,063 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Investment income | |

| 116 | | |

| 427 | | |

| 423 | | |

| 962 | |

| Interest expense | |

| - | | |

| - | | |

| - | | |

| (197 | ) |

| Loss on debt extinguishment | |

| - | | |

| - | | |

| - | | |

| (329 | ) |

| Total other (expense) income, net | |

| 116 | | |

| 427 | | |

| 423 | | |

| 436 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (4,845 | ) | |

$ | (3,477 | ) | |

$ | (14,563 | ) | |

$ | (14,627 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.34 | ) | |

$ | (0.37 | ) | |

$ | (1.39 | ) | |

$ | (1.64 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 14,445 | | |

| 9,377 | | |

| 10,503 | | |

| 8,926 | |

IMUNON,

Inc.

Selected

Balance Sheet Information

(in

thousands)

| | |

September 30,

2024 | | |

December

31,

2023 | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 10,312 | | |

$ | 5,839 | |

| Investment securities and interest receivable | |

| - | | |

| 9,857 | |

| Advances, deposits and other current assets | |

| 2,220 | | |

| 2,545 | |

| Total current assets | |

| 12,532 | | |

| 18,241 | |

| | |

| | | |

| | |

| Property and equipment | |

| 564 | | |

| 752 | |

| | |

| | | |

| | |

| Other assets | |

| | | |

| | |

| Deferred tax asset | |

| - | | |

| 1,280 | |

| Operating lease right-of-use assets, net | |

| 1,245 | | |

| 1,595 | |

| Deposits and other assets | |

| 50 | | |

| 50 | |

| Total other assets | |

| 1,295 | | |

| 2,925 | |

| Total assets | |

$ | 14,391 | | |

$ | 21,918 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable – trade accrued liabilities | |

$ | 2,360 | | |

$ | 3,515 | |

| Other accrued liabilities | |

| 2,573 | | |

| 3,391 | |

| Operating lease liabilities – current portion | |

| 509 | | |

| 485 | |

| Total current liabilities | |

| 5,442 | | |

| 7,391 | |

| | |

| | | |

| | |

| Operating lease liabilities – non-current portion | |

| 758 | | |

| 1,139 | |

| Total liabilities | |

| 6,200 | | |

| 8,530 | |

| Stockholders’ equity | |

| | | |

| | |

| Common stock | |

| 145 | | |

| 94 | |

| Additional paid-in capital | |

| 410,877 | | |

| 401,501 | |

| Accumulated other comprehensive gain (loss) | |

| - | | |

| 61 | |

| Accumulated deficit | |

| (402,746 | ) | |

| (388,183 | ) |

| | |

| 8,276 | | |

| 13,473 | |

| Less: Treasury stock | |

| (85 | ) | |

| (85 | ) |

| Total stockholders’ equity | |

| 8,191 | | |

| 13,388 | |

| Total liabilities and stockholders’ equity | |

$ | 14,391 | | |

$ | 21,918 | |

#

# #

v3.24.3

Cover

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity File Number |

001-15911

|

| Entity Registrant Name |

Imunon,

Inc.

|

| Entity Central Index Key |

0000749647

|

| Entity Tax Identification Number |

52-1256615

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

997

Lenox Drive

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Lawrenceville

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08648-2311

|

| City Area Code |

(609)

|

| Local Phone Number |

896-9100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.01 per share

|

| Trading Symbol |

IMNN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

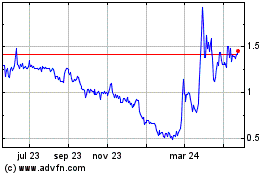

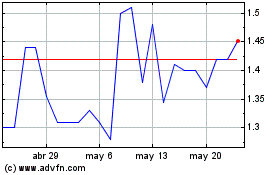

Imunon (NASDAQ:IMNN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Imunon (NASDAQ:IMNN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024