Intuit Launches QuickBooks Sole Trader: Simplified Financial Management for the UK’s 3.1 million One-Person Businesses

07 Noviembre 2024 - 4:00AM

Business Wire

AI-powered business solution manages

transactions, enables accounting on-the-go, automates tax

preparation, and facilitates accountant and bookkeeper

collaboration

Intuit Inc. (Nasdaq: INTU), the global financial technology

platform that makes Intuit TurboTax, Credit Karma, QuickBooks, and

Mailchimp, announced the UK launch of QuickBooks Sole Trader, a

powerful cloud-based tax and accounts solution, with built-in AI

automation, designed specifically for sole traders, including

landlords with single property income and those in construction,

with annual income under £90,000. This solution is powered by

Intuit's business platform that helps customers increase revenue

and improve profitability.

Most one-person, or first-time, business owners want to run and

grow their business with less work and more confidence in their

financial decisions. They have a desire to reduce administration

time, stay on top of their taxes, and seek clarity on their

financial position. QuickBooks Sole Trader allows customers to

manage receipts, mileage, expenses, bank transactions and invoices

in one place, or via the mobile App, for a holistic view of their

finances, whilst simplifying income tax preparation.

The impending introduction of Making Tax Digital (MTD) for

Income Tax mandates that those earning over £50,000 annually keep

digital records beginning April 2026, with those earning over

£30,000 following suit in April 2027. In last weeks’ Autumn Budget,

the UK government further deepened its commitment to MTD for Income

Tax, by extending it to an additional cohort of sole traders and

landlords with income over £20,000 by the end of this Parliament.

Over 2.8 million sole traders and landlords are set to be affected

by MTD for Income Tax. QuickBooks Sole Trader ensures digital

accounting is administered in line with the new HMRC rules and uses

AI automation to streamline digital record keeping by mapping bank

transactions and expenses to tax categories, and generating income

tax estimates.

Nick Williams, Product Director at Intuit QuickBooks says, “Sole

traders are amongst the largest community that do not use

accounting software, yet they must create an accurate income tax

self assessment every year and prepare for MTD, which will involve

quarterly submissions. QuickBooks has been helping small and medium

businesses prepare for MTD since 2018 and our new Sole Trader

offering provides clear value for both individuals and their

accounting professionals, helping them work together to meet tax

obligations, manage money, save time, and grow.”

QuickBooks Sole Trader includes a suite of time-saving tools for

first-time, and existing, software users, delivering a done-for-you

experience:

- AI-Driven Automation: automatically separates personal

and business bank transactions, categorises business and personal

expenses, and estimates income tax whilst connecting multiple bank

accounts.

- Mobile & Cloud Access: manage receipts, track

mileage, and create invoices on-the-go using the QuickBooks mobile

app, available on iOS and Android. With omni-channel support

including email and chat, users can stay connected and receive help

when needed, ensuring smooth operations wherever they are.

- Built for Sole Traders: designed to meet the needs of

sole traders, including construction industry CIS

capabilities for subcontractors and support for managing

property income for single property owner landlords. The platform

simplifies construction industry deductions and property income

management while offering a scalable platform for growth.

- MTD for Income Tax Ready (coming soon): stay ahead of

tax changes and prepare for quarterly submissions and year-end tax

filing, through HMRC recognised software.

- Accountant Collaboration: connect QuickBooks Sole Trader

with an accounting professional at no extra charge, to ensure

accuracy and receive professional support. Accounting professionals

can extract data and reconcile it for accounts production through

QuickBooks Online Accountant.

- Built for Growth: the platform features a simple user

interface keeping the complexity of bookkeeping hidden, but making

it visible for accounting professionals. This ensures that sole

traders can easily navigate the system, while the sophisticated

QuickBooks Online backend allows businesses to effortlessly scale

and integrate additional capabilities on Intuit’s business platform

as they grow.

Emma Longley, owner of ECL Coaching, a Kent-based leadership

coaching consultancy, comments: “I was looking for software to help

set up my business. This is my first foray into being self

employed. I know nothing about accountancy and have never used any

software of this kind before. Money was coming in so I was trying

to keep track of everything in a spreadsheet, but I didn’t know how

to organise it. I recently commissioned an accountant, so I wanted

to find a system that they could access easily too. QuickBooks Sole

Trader has helped me organise and get into good habits. It’s

simple, straightforward and easy to use, connects with my personal

and business bank accounts and gives me prompts suggesting how

transactions should be categorised. I love that it’s modern AI

technology, but with a really easy display and built-in guidance,

that will grow with me.”

While QuickBooks Self-Employed has supported one-person

businesses since its launch in 2015, QuickBooks Sole Trader builds

on the expertise gained from serving these customers, with elevated

features that add flexibility and productivity tools designed to

solve a wider set of problems. QuickBooks Sole Trader is part of

the QuickBooks Online platform, which offers a seamless way for

customers to access other offerings from the QuickBooks ecosystem

to meet their growing needs. QuickBooks Sole Trader is available

from today for UK customers.

For more information visit our website.

Disclaimer:

"This information is intended to outline our general product

direction, but represents no obligation and should not be relied on

in making a purchasing decision. Additional terms, conditions and

fees may apply with certain features and functionality. Eligibility

criteria may apply. Product offers, features, and functionality are

subject to change without notice."

About Intuit

Intuit is the global financial technology platform that powers

prosperity for the people and communities we serve. With

approximately 100 million customers worldwide using TurboTax,

Credit Karma, QuickBooks and Mailchimp, we believe that everyone

should have the opportunity to prosper. We never stop working to

find new, innovative ways to make that possible. Please visit us at

Intuit.com and find us on social for the latest information about

Intuit and our products and services.

Intuit Limited registered in England (Company No.: 2679414)

Registered address and principal place of business: 5th Floor

Cardinal Place, 80 Victoria Street, London, SW1E 5JL, England.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107540413/en/

For more information, contact quickbooks@edelman.com

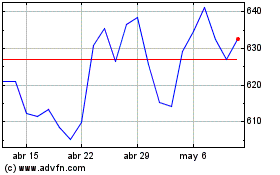

Intuit (NASDAQ:INTU)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

Intuit (NASDAQ:INTU)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025