Seamless AI-Powered Solutions and Consumer

Platform Innovations Deliver Unparalleled Ease, Confidence and

Faster Refunds

Intuit Inc. (Nasdaq: INTU), the global financial technology

platform that makes Intuit TurboTax, Credit Karma, QuickBooks, and

Mailchimp, today announced its tax platform offerings for personal

and small business filers. New innovations and seamless

integrations across Intuit’s AI-driven expert platform deliver an

accurate and personalized "done-for-you" tax filing experience with

speed, guaranteeing maximum refunds faster. Extending its efforts

to empower taxpayers beyond tax season, Intuit now also helps

customers make smart money decisions year round for an even better

tax outcome next year.

“Receiving a tax refund is a pivotal moment in the financial

lives of millions of Americans each year, so we’re laser focused on

eliminating the work and worry of tax filing, delivering the best

‘done-for-you’ tax prep experience on the market that puts maximum

refunds guaranteed into customers' pockets faster,” said Executive

Vice President and General Manager of Intuit's Consumer Group, Mark

Notarainni. “With our connected consumer platform we go even

further, empowering customers across Credit Karma and TurboTax with

year-round insights and personalized recommendations, so we can

help our customers navigate their financial journey beyond tax

season.”

Intuit's AI-Powered TurboTax Experts Deliver Personalized,

Transparent Tax Prep in Just 2 Hours

The assisted tax preparation method is plagued with inefficiency

for tax filers and tax preparers. It is time-consuming, manual, and

expensive, with little price transparency. Intuit’s AI-driven

expert network delivers full service, assisted tax prep with a live

tax expert in a modern, tech-enhanced, and convenient experience

from start to finish.

Now filers can have their tax year 2024 taxes prepared for them

in as little as two hours. Through Intuit’s AI-driven expert

network, customers are connected virtually with a qualified tax

expert with experience in their tax situation and complexity,

directly through TurboTax, the Credit Karma app, or QuickBooks

Online. Whether filing personal or small business taxes, Intuit

customers can get their taxes done for them with confidence knowing

that TurboTax experts have the power of Intuit’s AI platform at

their fingertips flagging the highest deductions, credits, and

accuracy along the way.

With approval from customers, Intuit’s AI algorithms analyze

customer information to quickly match them with the best-suited

TurboTax expert from its nationwide network of 12,000 experts,

including CPAs, EAs, and tax attorneys. Once matched, TurboTax’s

tax document import and upload capabilities make sharing tax data

with their experts a breeze, dramatically improving speed,

accuracy, and ultimately providing customers with access to their

money quickly. A new real-time progress tracker within the TurboTax

iOS mobile app makes it easy for customers to go about their day,

easily following their expert's progress. The tracker indicates

when the tax expert has questions, progressed, or is done,

eliminating the uncertainty that comes with traditional tax prep

methods. Upfront and transparent pricing ensures there are no

surprise fees.

Only through TurboTax Live Assisted can customers who choose to

prepare their own taxes also connect with experts on-demand via

phone, video call, or chat to gain the confidence they need.

TurboTax Live Assisted is also the only tax filing solution on the

market that provides customers an expert final review at no added

cost, ensuring 100 percent accuracy and maximum refund

guaranteed.

With a nationwide network of personal and small business tax

experts who have on average 12 years of experience each, Intuit is

putting expertise in the pockets of its customers, giving them the

knowledge they need to make smart money decisions.

Intuit’s AI-Driven Platform Delivers ‘Done-For-You’

Taxes

For millions of Americans, the tax refund, averaging over

$3,000, represents the largest paycheck of the year.1 Getting fast

access to those funds can be critical. However, preparing taxes can

be stressful and confusing, and filers can waste unnecessary time

manually entering information from their tax forms, which can lead

to unintended mistakes, or answering questions that aren’t relevant

to their situation. For those who choose to file their tax year

2024 taxes on their own, TurboTax, built on Intuit’s AI-driven

expert platform, offers a personalized, fast, and

confidence-inspiring tax preparation and filing experience with

built-in guidance, and faster access to their refunds.

TurboTax’s industry-leading tax document auto-fill capabilities

offer broad support of tax document import, upload, and photo

capture. Customers have multiple methods to automatically enter

their data, including simple document import from more than 350

financial institutions. Intuit’s AI platform then auto-fills the

majority of tax returns, minimizing manual data entry, and enabling

a truly "done-for-you" tax filing experience. Continuing to build

on the previously announced Intuit Assist, customers receive

thorough and personalized explanations throughout the filing

process, ensuring customers understand the “why” behind the

numbers, adding to their confidence that their taxes are done

right. While automated workflows anticipate the filer’s needs,

serving up real-time accuracy checks as customers complete their

return.

Seamless integrations across TurboTax and Credit Karma, and

TurboTax and QuickBooks, eliminate the need for customers to juggle

multiple financial apps. New this year, year-round personalized tax

insights and suggestions ensure Credit Karma customers get the best

tax outcome on their life events throughout the year. These

integrations, combined with Intuit’s AI-driven document import and

auto-fill technology further streamlines data entry for Intuit

customers across its platform.

TurboTax continues to offer its faster refund solutions.

Customers can get their refund with speed through Intuit’s Up To 5

Days Early2 with Credit Karma Money3. And with its online Refund

Advance loan,4 approved customers can get up to $4,000 into a

Credit Karma Money account in as little as 60 seconds after IRS

acceptance of their tax filing,5 with $0 loan fees, 0% APR, and no

credit score impact.6

Intuit's Consumer Platform Helps Customers Make Smart Money

Decisions at Tax Time and Beyond

Seamlessly connecting TurboTax and Credit Karma, Intuit's

consumer platform empowers customers to make smarter money

decisions at tax time and beyond. Starting this January, Credit

Karma members will receive personalized tax-impacting insights

throughout the year, ensuring they get the best possible tax

outcome when the time comes to file their taxes directly within the

app’s powered-by-TurboTax experience. For instance, customers with

mortgages might receive a mortgage interest deduction insight that

conveys the estimated figure they can deduct from the interest

they've paid on their home loan.

Directly within the Credit Karma app, Intuit’s AI platform will

automatically organize tax documents, transfer relevant data, and

auto-fill a majority of the customer’s return, eliminating manual

entry and reducing accidental customer typos. After they’ve

completed filing, Credit Karma members are able to optimize their

money and take advantage of financial opportunities.

Intuit’s consumer platform delivers a truly personalized,

‘done-for-you’ financial experience, empowering customers to make

smart money decisions, take steps to improve their financial health

year-round, and achieve their best tax outcome, guaranteed.

Pricing and Availability

Tax year 2024 TurboTax products are available today, Dec. 5,

2024, in English and Spanish at www.TurboTax.com, the Apple App

Store, and Google Play Store. QuickBooks tax products are also

available today at QuickBooks.com. Credit Karma tax filing products

will be available via the Credit Karma app in English this Jan.

2025 and timed to the start date for individual tax returns.

TurboTax Business Tax Live Assisted and Live Full Service

offerings are for small businesses, including S-corps, LLCs, and

partnerships, and are available in English today and in Spanish in

Feb. 2025. For a limited time, business tax filers receive 20% off

personal taxes filed with TurboTax, and those who do not have a

QuickBooks account will be offered a 30-day QuickBooks Online trial

(starting in Jan. 2025).

About Intuit

Intuit is the global financial technology platform that powers

prosperity for the people and communities we serve. With

approximately 100 million customers worldwide using products such

as TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe

that everyone should have the opportunity to prosper. We never stop

working to find new, innovative ways to make that possible. Please

visit us at Intuit.com and find us on social for the latest

information about Intuit and our products and services.

Disclaimer details:

1 $3,004 is the average refund amount American taxpayers

received in the 2024 filing season based on IRS data as of October

18, 2024.

2 Up To 5 Days Early with Credit Karma Money: To be

eligible, you don’t need to file your taxes with a particular tax

prep service. However, you will not be eligible if you choose to

pay your tax preparation fee using your federal tax refund or

choose to take a Refund Advance loan. 5-day early program may

change or discontinue at any time. Up to 5 days early access to

your federal tax refund is compared to standard tax refund

electronic deposit and is dependent on and subject to IRS

submitting refund information to the bank before release date. IRS

may not submit refund information early.

3 Banking services provided by MVB Bank, Inc., Member FDIC.

Maximum balance and transfer limits apply. A maximum of 6

withdrawals per monthly savings statement cycle may apply.

4 Refund Advance is a loan issued by First Century Bank, N.A. or

WebBank, neither of which are affiliated with MVB Bank, Inc.,

Member FDIC. Refund Advance loans issued by First Century Bank,

N.A., are facilitated by Intuit TT Offerings Inc. (NMLS # 1889291),

a subsidiary of Intuit Inc. Refund Advance loans issued by WebBank

are facilitated by Intuit Financing Inc. (NMLS#1136148), a

subsidiary of Intuit Inc. Terms apply. Learn more here:

https://turbotax.intuit.com/refund-advance.

5 IRS accepts returns starting late-Jan. Acceptance times vary.

Most customers receive funds within 15 minutes of acceptance.

6 Refund Advance and 5 Day Early Program not to be combined.

See guarantee details at turbotax.intuit.com/guarantees/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205349870/en/

Intuit TurboTax contact: Karen Nolan Karen_Nolan@intuit.com

PR Agency, Hunter PR contact: Becky Brand

bbrand@hunterpr.com

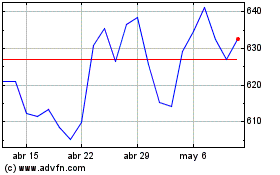

Intuit (NASDAQ:INTU)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Intuit (NASDAQ:INTU)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024